UNIT4: SALES AND RECEIVABLES

Key unit competence: Apply the rules of cash, cheques, credit

sales and account receivable transactionsin QUICKBOOKS

Introductory Activity

The management committee of MUTARA ENTERPRISE is experiencing a

low level of return on its investment. It decided to use QuickBooks software

especially while dealing with sales of its products. MUTARA ENTERPRISE

customers are allowed to pay by all means (Cash, cheque and cards). Some

other customers use to pay after a certain period as they buy on credit.

NTAGANDA is the accountant and wants you to assist him in recording both

(credit and cash/bank), sale transactions.

Show him the way appropriate record of credit and cash/bank transaction in

QuickBooks to improve the company current situation and start to get a highlevel of return on investment.

4.1 Credit sales transactions

Learning Activity 3.2.

DUFATANYE SOTRE is engaged in sales of fruit and vegetables in KIMISAGARA

market. The customers in the morning purchase on credit for paying in the

evening after selling.

• Advise the DUFATANYE SOTRE on the ways of recording its daily

sales

• If they DUFATANYE SOTRE needs to use QuickBooks in recording,explain to its accountant the steps of creating a sales invoice

The term “credit sales” refers to a transfer of ownership of goods and services

to a customer in which the amount owed will be paid at a later date. In other

words, credit sales are those purchases made by the customers who do notrender payment in full at the time of purchase.

Credit sales are a type of sales in which companies sell goods to the customer

on credit based on the credibility of customers. It gives the customer time to

make the payment after selling the purchased goods and does not require them

to invest their own money into a business. It helps small businesses, especially

those that do not have enough capital. At the same, it helps big companies also

because it attracts customers.

A credit sales transaction affects two accounts: Debtor (account receivables)

which is debited as it is a current asset and the sales account which is creditedas it is an income.

4.1.1. Record a credit sale

In QuickBooks, a credit sales transaction is recorded as here under:

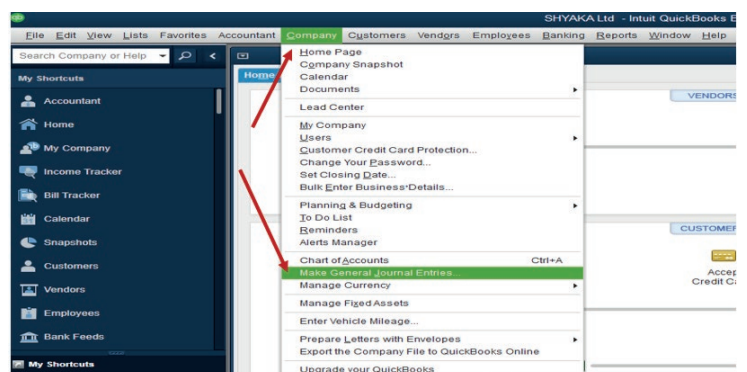

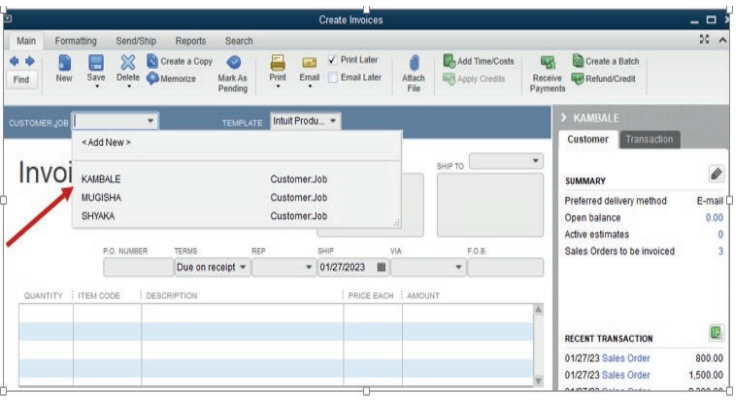

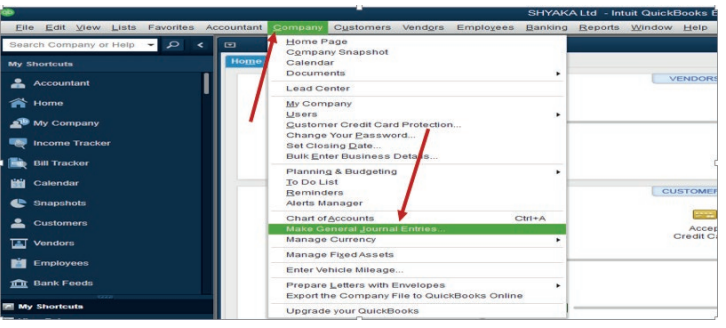

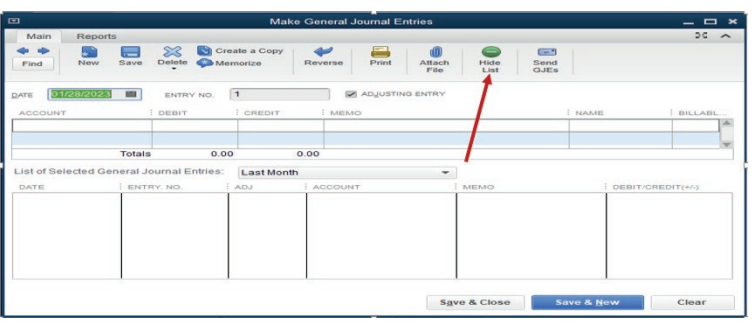

Step 1. Click on company menu on QuickBooks home page, then select MakeGeneral Journal Entries

Figure 4.1 General Journal Entries selection

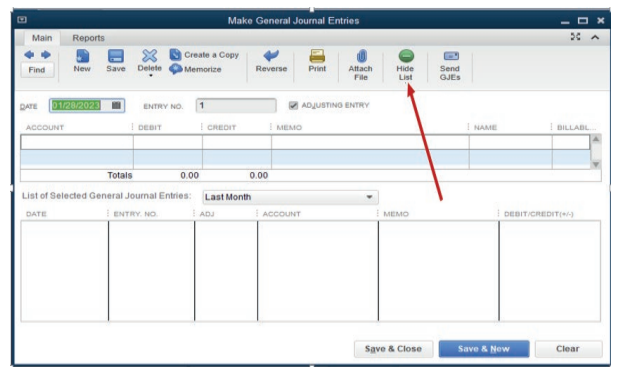

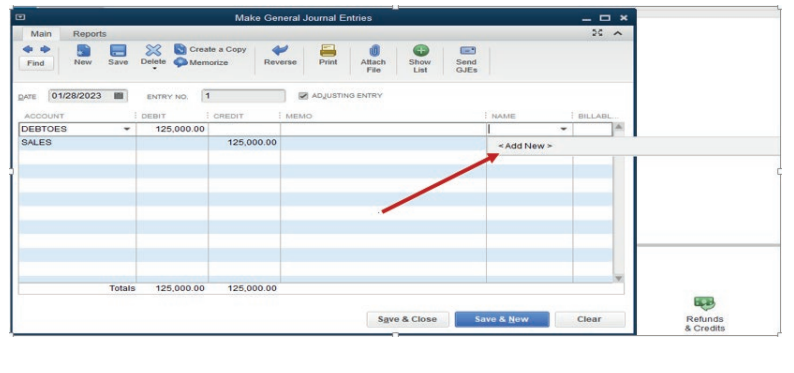

Step2. Complete the general journal

Figure 4.2 Option of hiding list of selected General Journal Entries

The first part of the window is for double entry and the bottom part shows the

number of transactions concluded. For having a clear space for recording, the

bottom part should be hidden by clicking Hide List

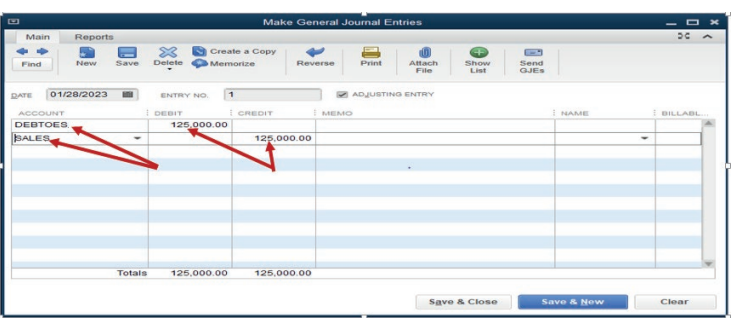

Example: SHYAKA Ltd started its business activities in January 2022. During

January the sales transactions concluded with all of its debtors is valued at

FRW 125,000. To record this transaction in the general journal, of course the

debtors and sales account are already created in the chart of account. If not

QuickBooks gives an option to add new account while recording.

Debit debtors: 125,000Credit sales: 125,000

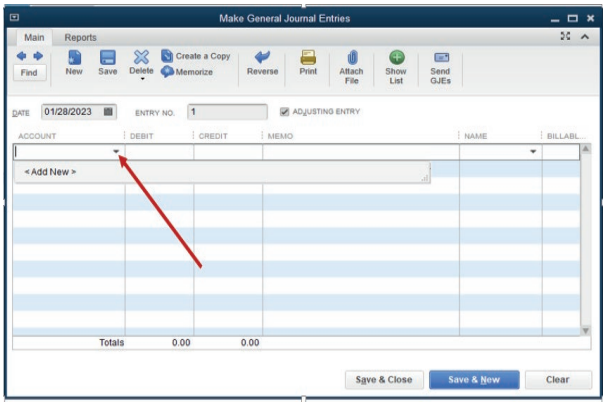

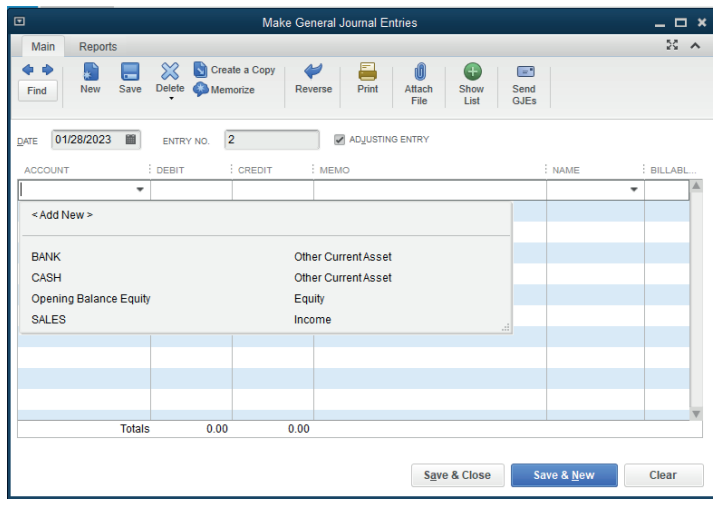

Figure 4.3 Empty General Journal Entries

As there is no debtors and sales accounts created in chart of account, we

can add them by the normal way of account creation, account type, continue,

account name then Save&Close or Save&New. Through this, a debtor

account is created and debited with FRW 125,000. Sales account is createdand credited with the equivalent amount.

Figure 4.4 .Records of credit sales

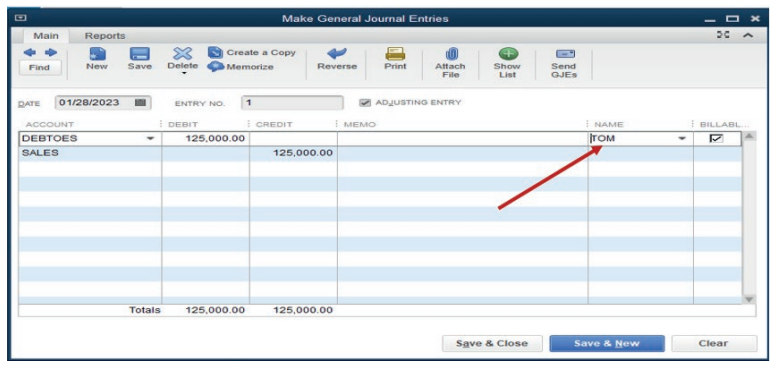

In case there is specific customer name, it can be added on the name columnfor clarifying who is the debtor.

Figure 4.5 created Field for adding customer name

If we click on Add New QuickBooks provides field to add customer name.

Figure 4.6 recording a sale transaction

A sale transaction is recorded, then Save &Close

4.1.2. Creating a sales (customer) invoice

A Customer invoice is an accounting document sent by seller of goods/services

to a buyer. It records services rendered, items provided, the amount owed by

the customer, and how they can make payment.

Invoices create legally binding agreements between business and buyers,

especially for larger purchases. This type of customer invoice is created based

on a sales order, which includes order lines and item numbers.

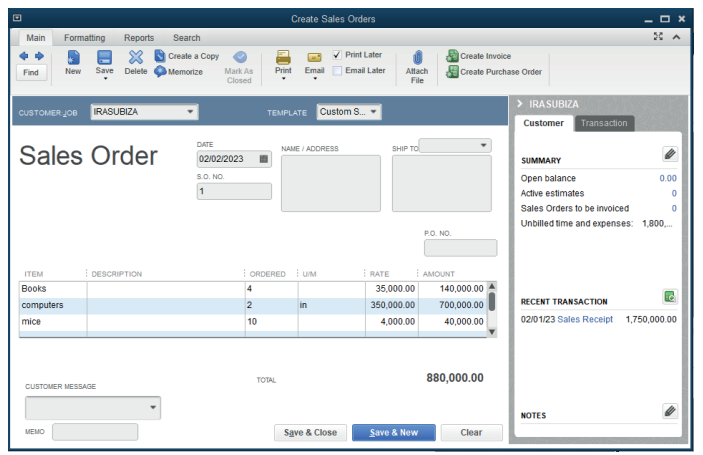

Sales order

This is a document hold by the business from its customer ordering the business

to supply determined goods or services.

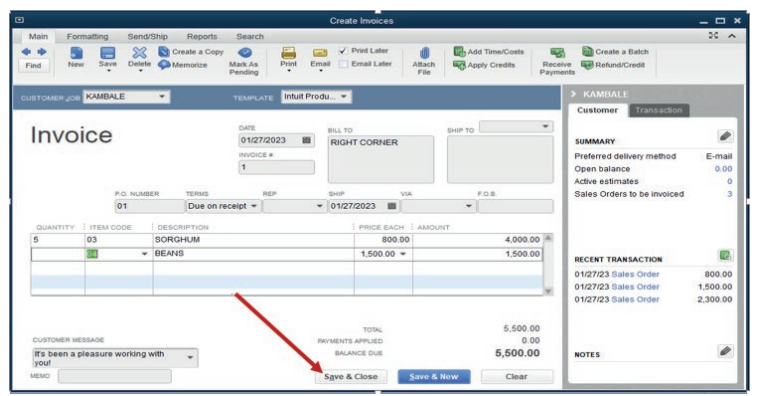

For our case, the cooperative has on order from a customer KAMBALE whoordered two items: Beans and sorghum.

Figure 3.13 Sales order Document

It is a responsibility of the business to create an invoice to its customer for

detailing goods or services that the customer ordered, the business is to deliver

(or delivered) for getting customer know exactly how much she/he owes the

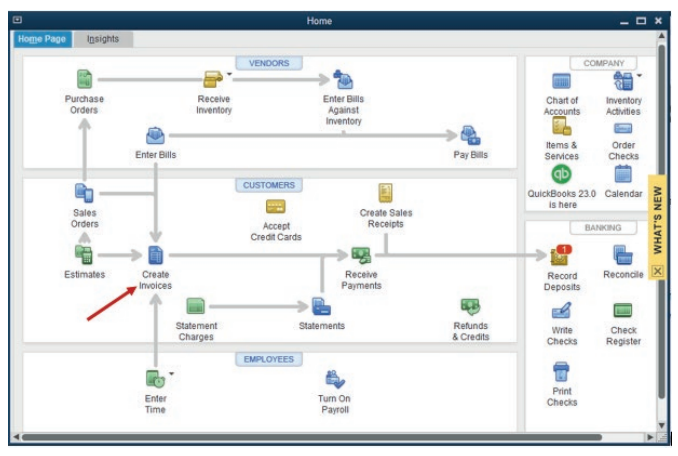

business. The invoice is created through this process by starting on QuickBooks

home page,Click on Create Invoice

Figure 3.14 icon used in invoice creation

Then a customer invoice window appears as below:

Figure 3.15 list of invoices created

The invoice goes to customer KAMBALE. So, the user selects KAMBALE from

the list of customers. The invoice consists the following:

The invoice number

Terms of payment

Date and details of goods supplied.Click Save &Close.

Figure 3.16 Saving an invoice created

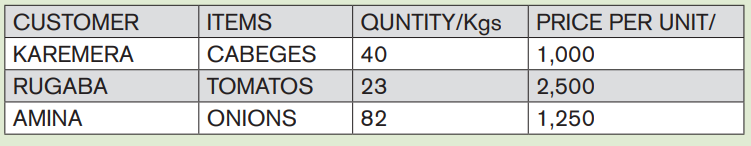

Application Activity 4.1.

1. Define a transaction

2. What is a credit sales?

3. Record the transaction below and display the sales invoice to thecustomer KAREMERA

Learning Activity 4.2.

The financial success of a business depends on selling goods or services

to customers, or clients. The more goods or services sold, the more income

the business makes. There are a number of different ways that customers

pay for goods and services sold to them. Sometimes payment is received

immediately and sometimes payment is received later. In the trading

Industry, customers or clients pay for goods and services and the like. These

transactions require the use of cash. Cash means the form of payment the

customer uses such as notes and coins, checks, debit or credit cards and

cheques.

1. Discuss the cash transaction effects on business account2. How this transaction is recorded in QuickBooks?

4.2. Cash/ cheque sales transactions

A cash sale is a business transaction in which the buyer pays for goods or

services at the time of the purchase. In a cash sale, payment is immediate. How

the buyer pays doesn’t matter, as long as there is a transfer of monies. It can

be: Cash: The buyer counts the bills and coins and hands it over to the seller. It

can be the cheque or payment cards for transferring money from the customer

account to the seller’s account.

A cash sales transaction affects two accounts: Cash /bank which is debited asit is a current asset and the sales account which is credited as it is an income.

4.2.1. Record a cash sale

In QuickBooks, a cash sales transaction is recorded as here under:

Step 1. Click on company menu on QuickBooks home page, then select MakeGeneral Journal Entries.

Figure 4.10 Make General Journal Entries

Step2. Complete the general journal

Figure 4.11. General journal to use for recording

The first part of the window is for double entry and the bottom part shows the

number of transactions concluded. For having a clear field for recording, thebottom part should be hidden by clicking Hide List

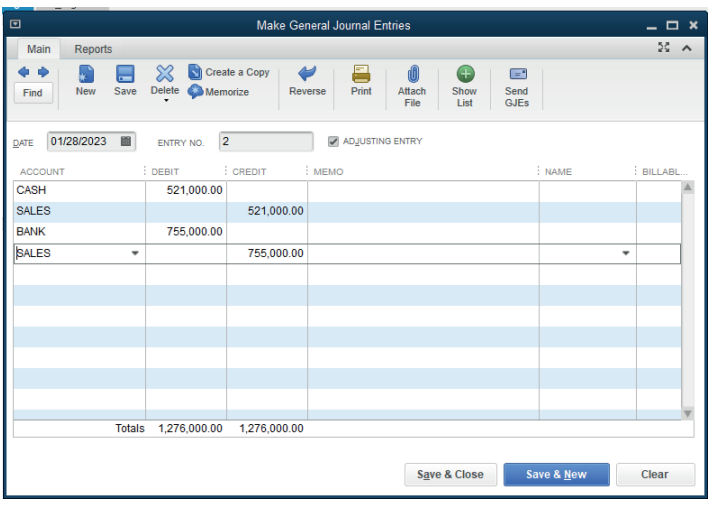

Example:

SHYAKA Ltd started its business activities in January 2022. During January the

cash and cheques sales transactions concluded with all of its clients are valued

at FRW 521,000 and FRW 755,000 respectively.

To record this transaction in the general journal, of course the cash, bank and

sales account are already created in the chart of account. If not QuickBooks

gives an option to add new account while recording. Here all the accounts arecreated in chart of account.

Figure 4.12.Option to record a sales by cheque and by cash

The next step is to debit the account to be debited and credit the account to be

credited respecting the rule of double entry. It means:

Debit Cash account 521,000

Credit Sales account 521000

Debit Bank account 775,000Credit Sales account 755,000

Figure 4.13. Sales by cash and by cheque record

A sale transaction is recorded, then Save &Close

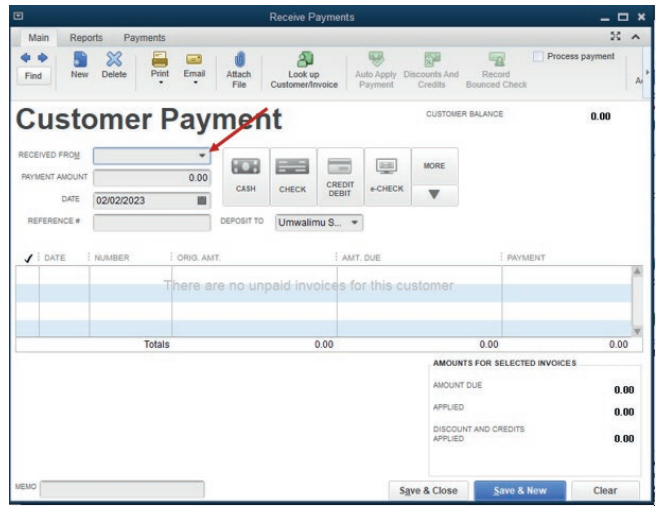

4.2.2. Receiving the payment

This occurs when a payment is received from a customer for goods or services

supplied. The customer who received the invoice has the option to sign a cheque

and send it to the business. He can also deposit cash on business account and

submit the bank deposit slip to the business or pay cash in hand to the business

premises.

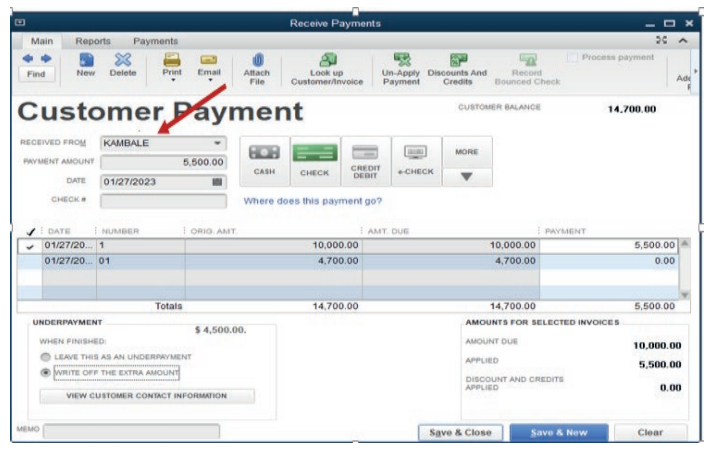

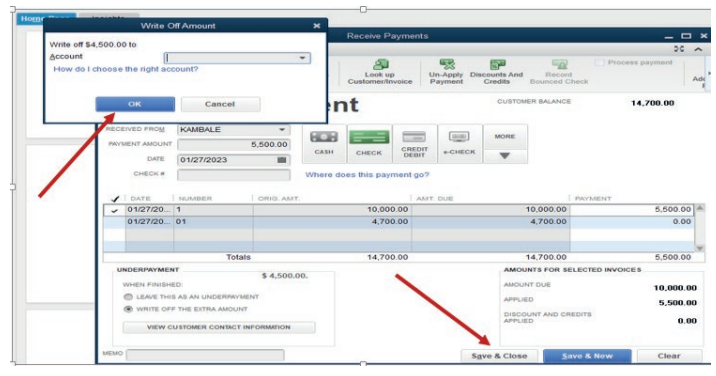

For our case, KAMBALE paid by cheque. To process this in QuickBooks, click

on Receiving Payment on QuickBooks home page for getting the followingwindow.

Figure 3.17 Selecting customer paid

This gives the option to enter the customer’s name where the payment is from,

the amount to receive, and after this, check whether the amount is equivalentwith the invoice. If yes, Click on Save & close

Figure 3.18. save a payment of customers

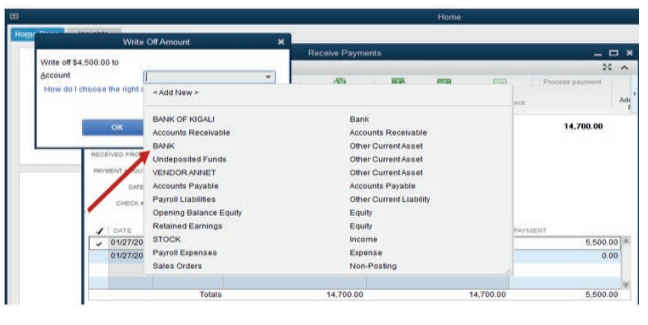

Save & close leads to the step of confirming the account to which the paymentgoes.

Figure 3.19. Selection of receiving account

Select the account from the list

Figure 3.20 Confirmation of receiving Account

Because the payment is done by cheque, the account is Bank. Then OK.

Figure 3.21. The receiving account is Bank

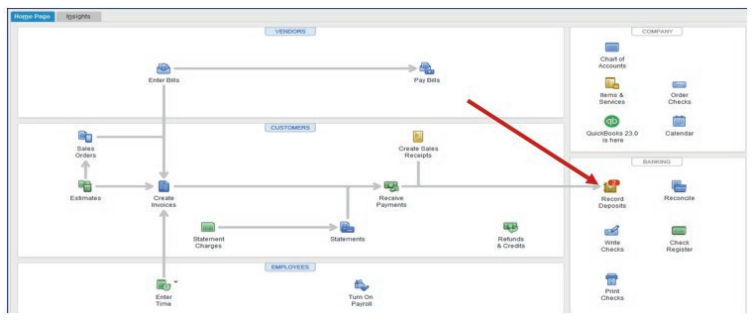

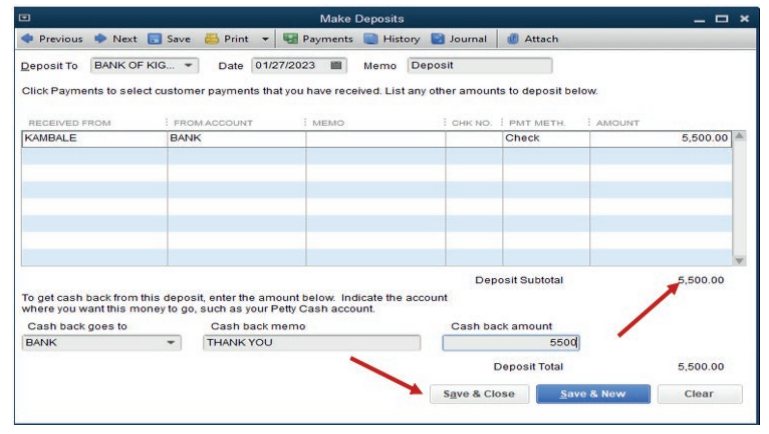

4.2.3. Recording the payment

Cash or cheque payment from customers must be recorded in business books

accounts. QuickBooks recognizes any unrecorded payment and the notificationis shown on its home page as below:

Figure 3.22. QuickBooks Home Page deposit notification

Once we click on notification, the below window showing the date, type of

transaction, payment method, the names of customer who is paying and totalamount paid appears. Click Save & Close

Figure 3.23. Cash Deposit slip

4.2.4. Sales receipt

A sales receipt is a transaction record that the seller issues at the time of sale

to verify the provided product or service and the amount the buyer paid. It is a

proof of payment. It is written by the selling business to its customer when the

payment against goods or services provided is over.

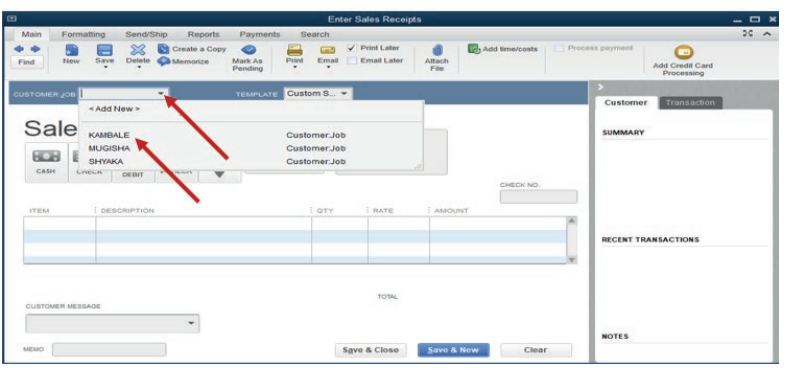

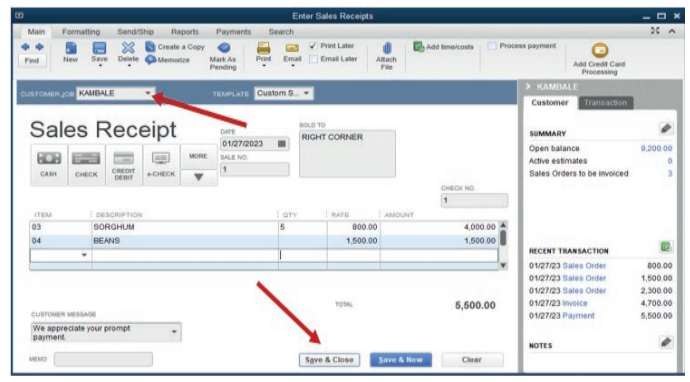

In QuickBooks, a sales receipt is created as following:

Clicking on Create Sales Receipt tool on QuickBooks home page and gettingthe below window:

Figure 3.24. creation of sales receipt

From this, KAMBALE is a customer to whom a receipt belongs. So the user

has to add the items and quantity that the customer is paying for, customer

message if necessary, cheque number… Once the below window appears andthere is an exact amount as is per invoice, click save & close

Figure 3.25. selection of the concerned customer

Application Activity 4.2.

1. Make a clear difference between sales and cash transactions

2. During the month of December 2022, B2C Co. Ltd concluded the

following sales transactions:

Sales on credit to; Teddy: FRW45, 740, Moise: FRW 347,600, Allen: FRW

245,000

Required:

• Record the abov e transactions in the journal of B2C Co. Ltd• Prepare the sales receipt.

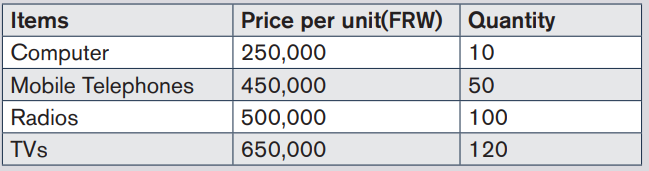

End of Unit Assessment

1. Differentiate:

a) Vendor from a customer

b) Order from invoice

2. Mrs. Alex, the owner of BEST ELECTRONIC Ltd stated the business inJanuary 2020. He purchases the items below:

SAMSUNG 250 is Alexis’ supplier of computer and telephones while

RWIZA Ltd supplies Computers and TVs. Vision 2050 is a customer

of both Radios and TVs. You are hired as an accountant of BEST

ALECTRONCS and the company uses QuickBooks in preparation ofits reports.

Required:

3. Create the list of items

4. Enter the vendors and customers

5. Prepare the bills for received items

6. Record the payments to the vendors

7. Prepare the order on behalf of customer, invoice and receive payment8. Record the payment from the customer