UNIT3: RECEIVING ITEMS AND ENTERING

Key unit competence: Prepare the bill by entering all goods/

services received on the appropriate dateusing QUICKBOOKS

Introductory Activity

Any business activity is intended to make a profit; this requires the sales of goods

or services. Somme businesses purchase goods and resale them without any

transformation. Other businesses transform raw material into finished goods.

For any business, goods or items received from different vendors have to be

recorded with reference to the vendor bills for payment process.

On the other side, other goods or services are sold to customers. For correcting

payment, the invoices are issued and sent to the customers. Payment in all

means are allowed and always recorded in appropriate books of account.

Required:

1) Discuss the purchase and sales of business goods and services2) Enter the business items, vendors and customers in the QuickBooks

3.1. Receiving items

Learning Activity 3.1.

NEW LIFE restaurant started it activities in January 2022. It provides services to

a number of customers in the village. Its owner explained to the new accountant

that the business record includes both services and products especially in

case of recording items received and entering the bills.

Assume that you are the new accountant of NEW LIFE restaurant,

• How will differentiate services from products

• Suggest the characteristics of list of items that will be recoded in yoursystem

3.1.1. Enter the vendor’s name

In the context of accounts payable, a vendor is a person or business that supplies

goods or services to the company. Another term for vendor is supplier. The term

vendor can also be used to mean any seller of goods.

To create a vender name in QuickBooks, Follow these steps:

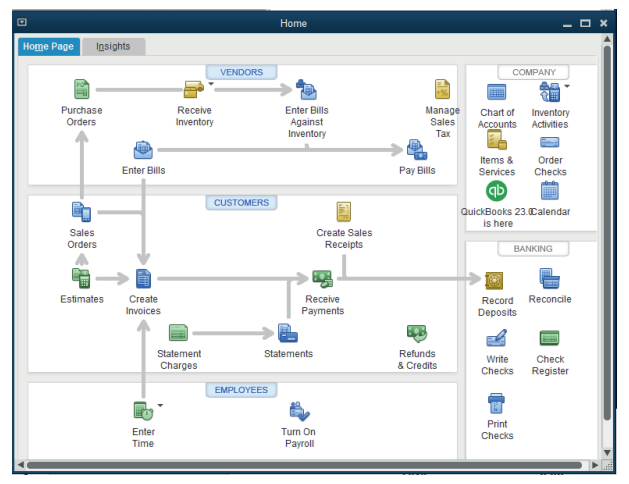

Click on vendor icon on QuickBooks Home page for finding and clicking onVENDOR.

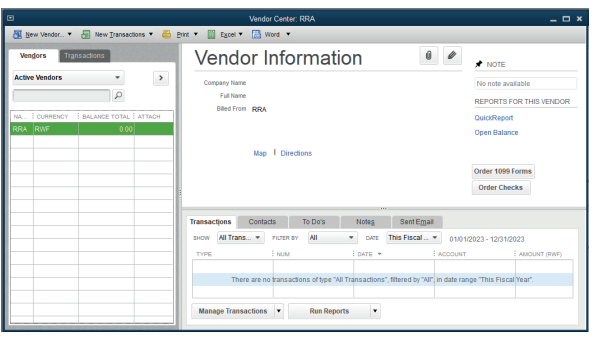

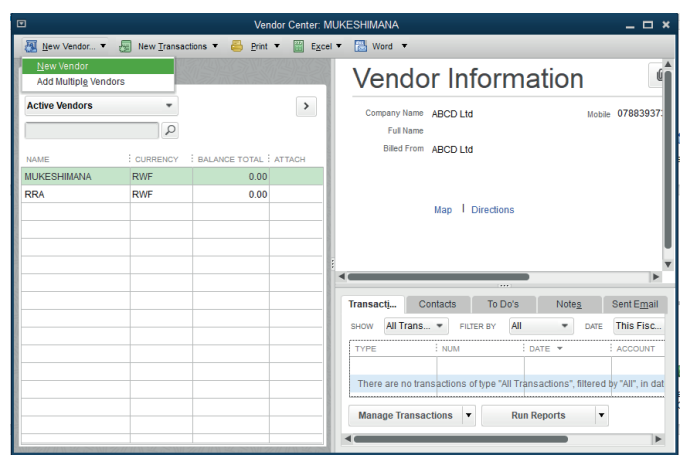

A click on VENDOR will give the following window and the user click automatically

on New Vendor

A click on New vendor will allow to the user to get a field to fill the new vendor

names address and all other identification and OK

3.1.2. Enter the item list

In QuickBooks, items are the products and services a business buys and sells.

Users enter and track items in QuickBooks so they can quickly add them toinvoices and other sales forms. Items appear as lines on sales forms.

Each unique item gets a line with its name, description, quantity, and cost per

item. Items allow you to use Quantity, to track cost and/or price and even for

that same one thing as both.

When the user chooses to use Items in QuickBooks, the items entered will be

linked to specific accounts. These accounts are visible by looking at the “Chart

of Accounts” in QuickBooks interface. If you have multiple items that need to

be attached to a single job, it is possible to do so with QuickBooks. Simply link

the item to the appropriate account when you enter it in. Then all of the items for

that job will be visible when you run a report.

Example

Cooperative DUTERIMBERE is operating in NYAMIRAMA market. It uses to

buy and sell agricultural products including rice, beans, maize, and sorghum.

To make the list of these items in QuickBooks will be done through the processbelow:

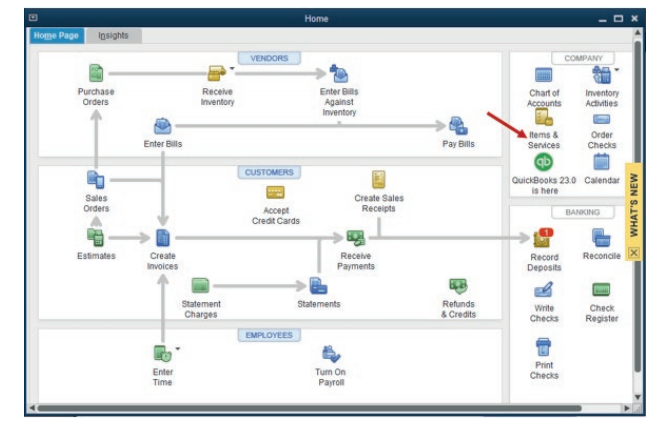

Click on item list &services at the right side of home page of QuickBooks

Figure 3.1 Items and Services icon usage

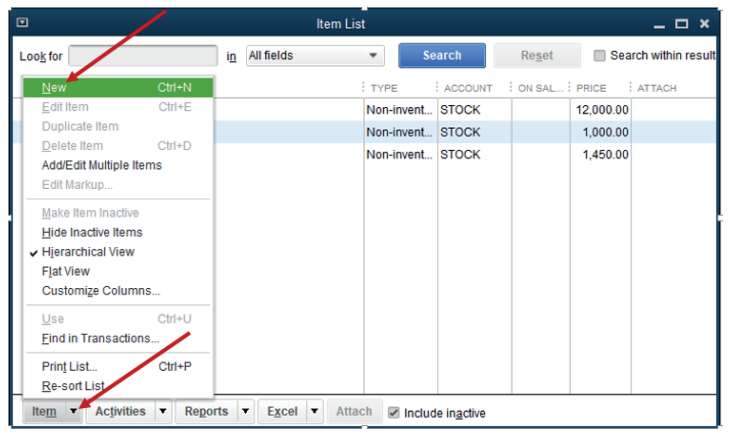

The items list appears as follow with an option to add new item by clicking onitem menu at the left bottom command of items list window and New.

Figure 3.2 Creation of new Item on the list

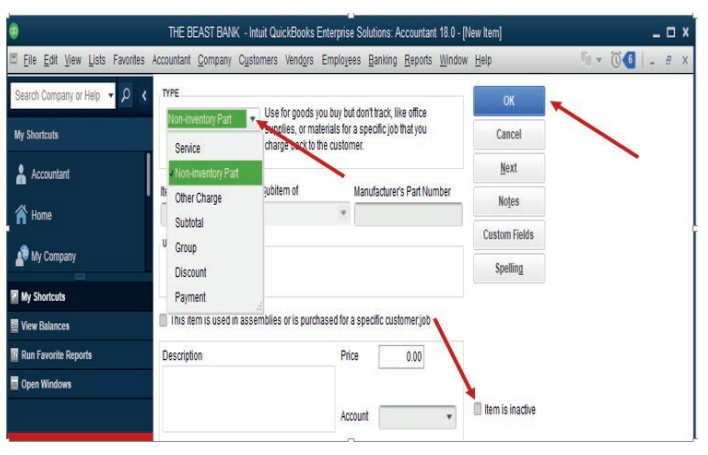

Choose whether it is an item list of products or services. Here under, it is a list

of products (Non inventory part), item number, there is also an option to add the

item name in description field and the price per unit, then the account related tothe item. Before clicking Ok, make sure the item is active.

Figure 3.3 Type of products or Services activation

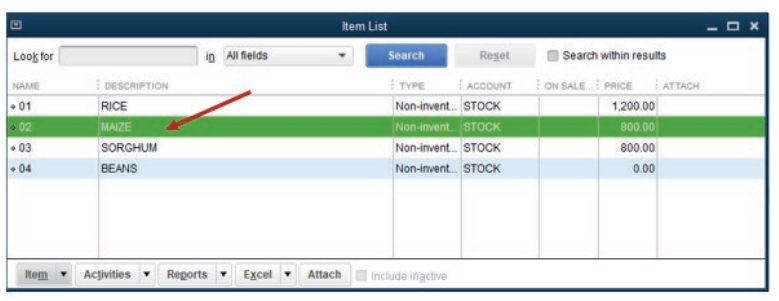

The item list is created and the QuickBooks displays it as here under:

Figure 3.4 List of created items

These items should be either linked to the vendors or the customers as the

cooperative buy and sell them. If some items are linked to the customers, it

means that the cooperative sells the by cash or cheques and on credit basis.

The credit sales are always associated with the debtors (Account receivable),and it is necessary to enter the bill for payment.

Application Activity 3.1.

The following transactions have been extracted from the books of

DUKUNDANE Ltd:

1/6/2015: Starting the business with 5,000,000 FRW cash and 10,000,000

FRW at bank

4/6/2015: purchase of tables and Chairs on credit valued at 12,000,000

FRW, from TUYISENGE

6/6/2015: Sales of goods by cash valued at 7,000,000 FRW

8/6/2016: Remaining goods returned to TUYISENGE

10/6/2016: Payment to TUYISENGE by cheque

• Enter the vendor name• Record the received items

3.2. Enter bill

Learning Activity 3.2.

If purchase transaction is concluded on credit basis, both the seller and the

keep the invoice that details goods or services purchased and sold so that

the transaction should be recorded in business system. How do you thingQuickBooks is used to enter the bill?

Learning Activity 3.2.

The word “bill” designates an accounting document that outlines the amount

a customer has to pay for a product or service that is purchased. It is also

considered as a payment reminder. A bill is issued before the payment is sent,

and it is used one-time and immediately

A bill is an invoice that one of business suppliers will give to the business,

and which, sooner or later, business will have to pay. It might also hear as a‘purchase invoice’ or a ‘supplier invoice.

3.2.1. The steps of entering the bills

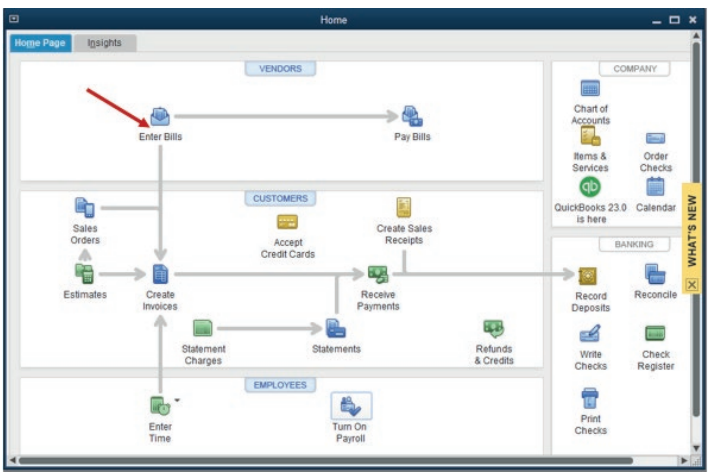

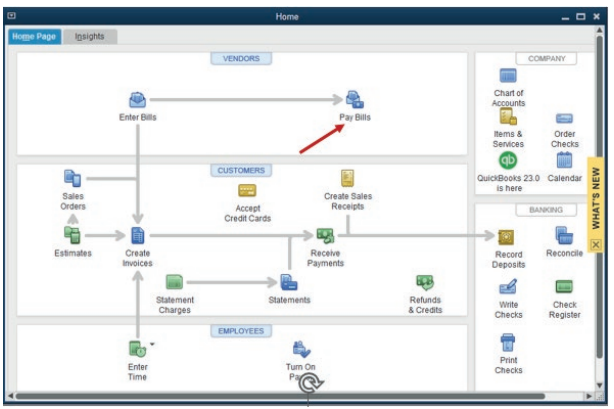

For interring the bill, follow the process below:Start by clicking on Enter Bills tool on the QuickBooks home page.

Figure 3.5 Start entering the bill

The bill menu that will give the option to select the vendor to whom the bill is

from. In case there is no vendor list or a there is a need to record a bill from a

new vendor, the user can add new.

3.2.2. Choose the Vendor and the Items relating to the vendorto be paid

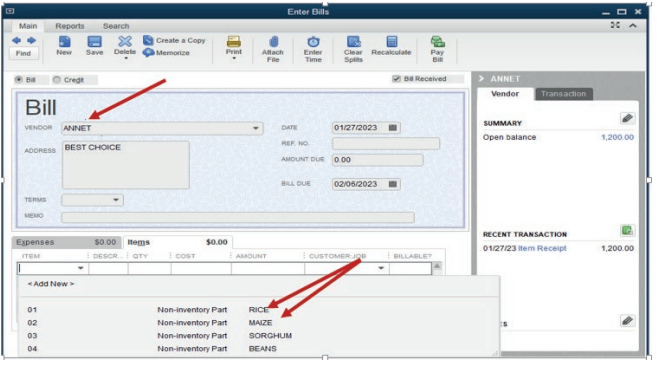

Figure 3.6 Add the vendor name

Assume that the bill is from vendor Annet. Annet is selected. It is time to additems supplied by Annet.

Figure 3.7 selection of items relating to the vendor

Select the item. If there is a missing item on the list, add it through

Add new then Save&Close or Save &New in case Annet’s bill consists of more

than one item. For our case, Annet’s bill consists of rice and maize.

3.2.3. Pay the bill for received items

The business uses to purchase goods or services from different vendors. Being

either credit purchase or cash, the transaction is concluded when the paymentis over. For the above-mentioned case, the bill as paid as follow:

Figure 3.8. Starting Bill Payment process

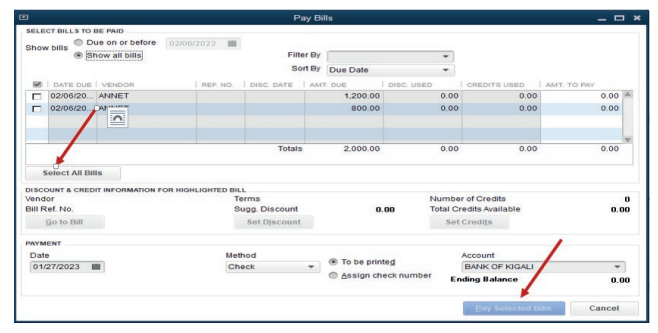

Annet’s bill will automatically appear, but any total amount will be available on

the bill until all bills are selected. Here under, bills are no selected and Payselected bill is inactive.

Figure 3.9. Selection of items to be paid

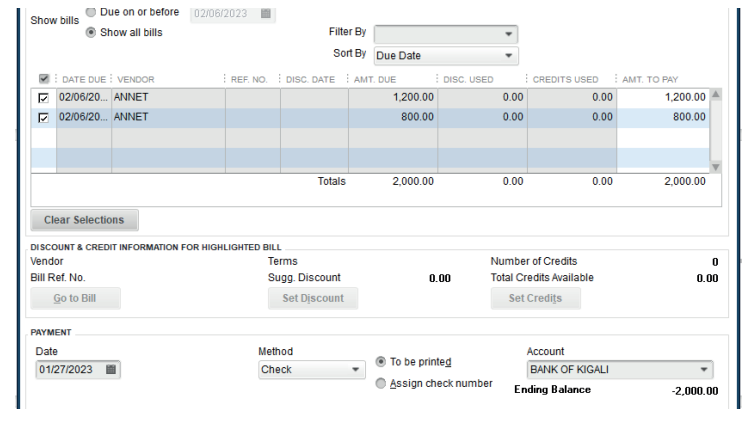

This is Annet’s bill after selecting all bills:

Figure 3.10 Selection of all Bill to be paid

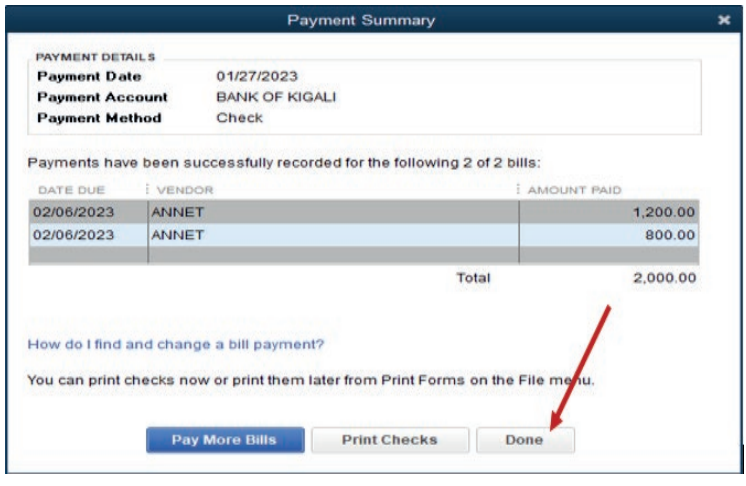

The total amount to pay is 2,000 FRW. There is no discount and the payment

mode is by cheque. It is time to click on Pay selected Bills. A proof of paymentappears as follow:

Figure 3.11. Proof of Payment

Click on Print checks if it is necessary to give a hard copy cheque to payee orClick on done for ending the process.

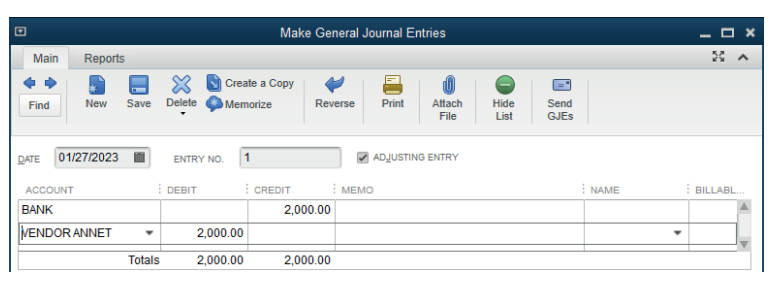

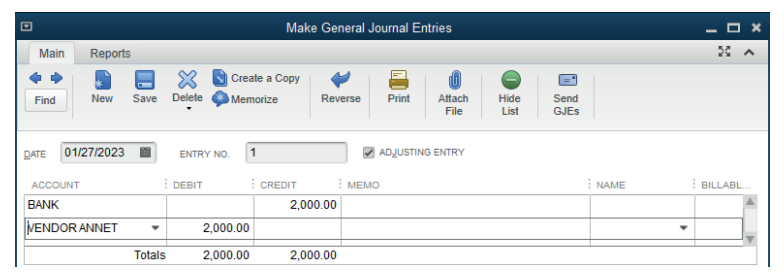

3.2.4. Recording the bills payment

If the payment to the vendor should be done either by cash, bank or cards.

To record the payment, the general journal is used by debiting the vendor’saccount and crediting the source of payment. (Cash, card or bank account.)

3.2.4. Recording the bills payment

If the payment to the vendor should be done either by cash, bank or cards.

To record the payment, the general journal is used by debiting the vendor’saccount and crediting the source of payment. (Cash, card or bank account.)

End of Unit Assessment

1. Differentiate:

a) Vendor from a customer

b) Order from invoice

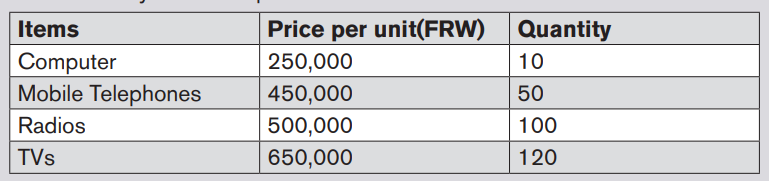

2. Mrs. Alex, the owner of BEST ELECTRONIC Ltd stated the business inJanuary 2020. He purchases the items bellow:

SAMSUNG 250 is Alexis’ supplier of computer and telephones while RWIZA

Ltd supplies Computers and TVs. Vision 2050 is a customer of both Radios

and TVs. You are hired as an accountant of BEST ALECTRONCS and the

company uses QuickBooks in preparation of its reports.

Required:

1) Create the list of items

2) Enter the vendors

3) Prepare the bills for received items4) Record the payments to the vendors