UNIT2: CREATION OF ACCOUNTS

Key unit competence: Create charts of accounts inQUICKBOOKS

Introductory Activity

MAREBE Ltd, a sole trading company uses QUICKBOOKS accounting

software in recording its daily financial transactions. The following are items

that the company is engaged in supplying: Computers, printers, projectors,

photocopying machines and TVs. During the month of January 2023, the

transactions below took place:

1. Starting the business with capital. A part of it at bank and the remaining

amount in Cash

2. Purchase of goods by cash

3. Bought goods on credit from Yvan.

4. Sales of goods on credit to MUSOZO

5. Cash sales.

6. Sales by cheque.

7. Returning goods to Yvan

8. Payment of accountant salary by cheque

9. MUSOZO returned goods to

10. Cash payment from Yvan for the total amount due from him. A discount

of 2% is received.

Required:

a) What are the type of accounts in which the transactions above

appear?b) List the whole accounts involved in the case study.

2.1. Creating charts of account names

Learning Activity 2.1

1. What is the meaning of charts of account?2. List the 2 uses of chart of account in accounting process

A Chart of Accounts is a list of financial accounts set up, usually use by

an accountant, an organization, and available for use by the bookkeeper for

recording transactions in the organization’s general ledger.

In QuickBooks, Chart of Accounts is a list of all the accounts that QuickBooks

uses to track financial information. These accounts are used to categorize your

transactions on everything from sales forms to reports to tax forms.

The Chart of Account allows to break down all the transactions that a business

made during a specific period into different subcategories.

By separating out the revenue, liabilities, assets, and business expenditures, a

chart of accounts enables to gain insight into the effectiveness of different areasof a business.

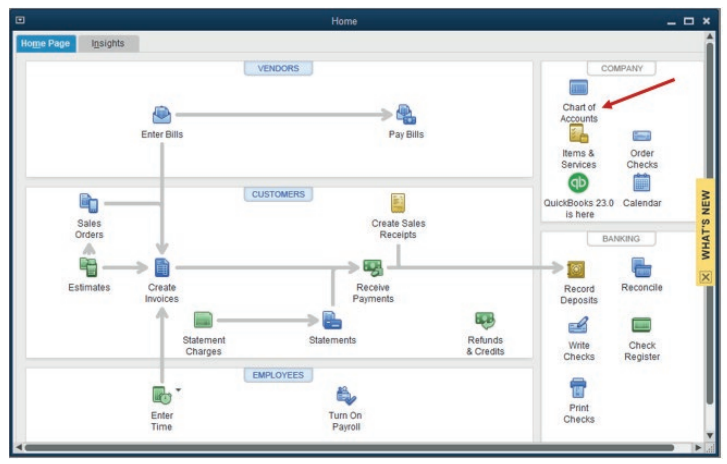

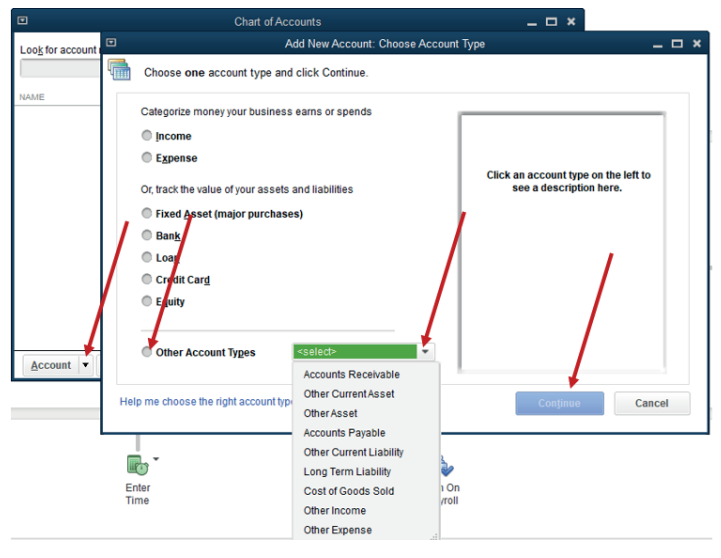

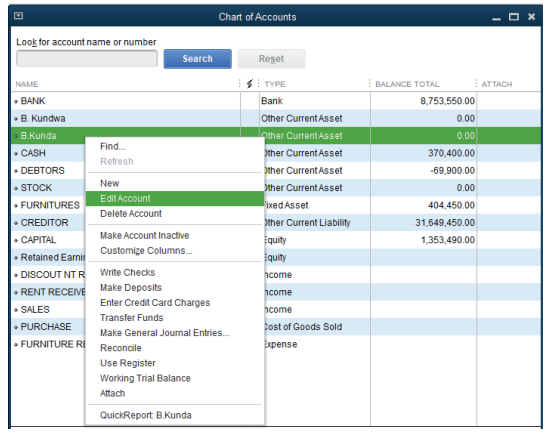

The following are the steps for creating Charts of Account in QuickBooks:• In the QuickBooks Home page, click on Charts of accounts

Figure 2.1 First step of Chart of Accounts Creation

If the option Other /None was chosen in setting company profile, on business

type select industry, the charts of account windows appear empty and this gives

a free space to the company account as you want.

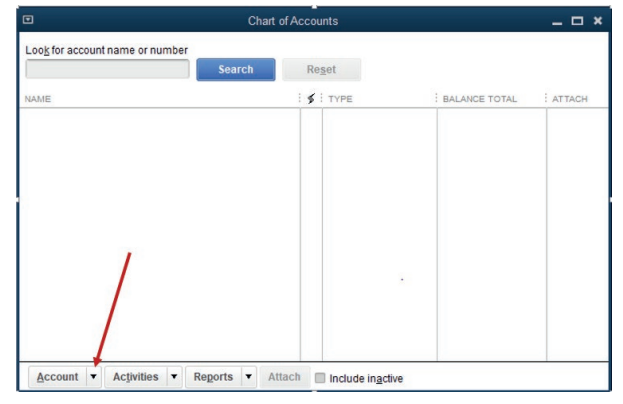

It also gives the option to create a New Account by Clicking on Account asillustrated in the windows below:

Figure 2.2 Option of Creating New Chart of Account

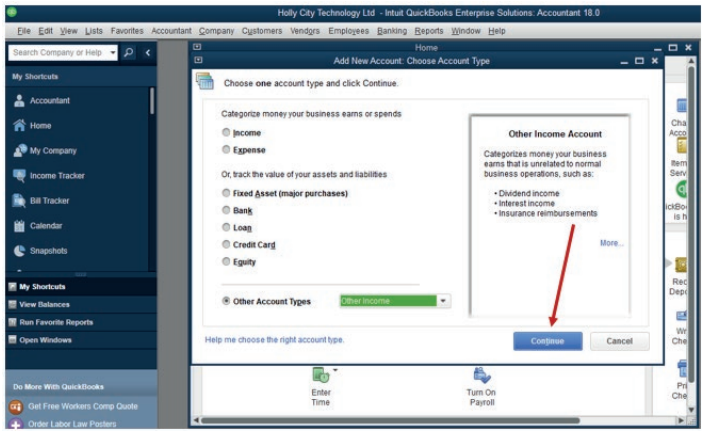

• Click on Account and New

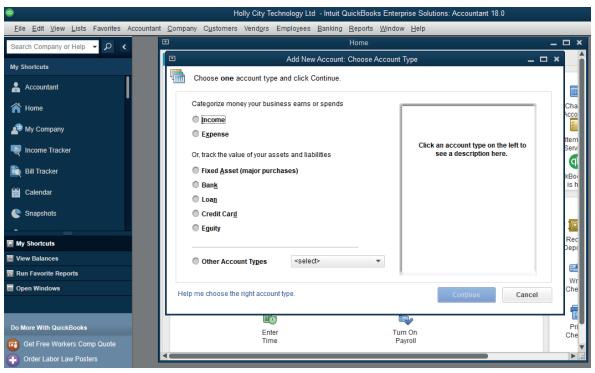

• Choose the type of account from the window below and click onContinue.

The types of account can be Income, Expenses, Equity, Liabilities, Assets,Bank, Loan, Credit cards, Other types of account.

Figure 2.3 Selection of Account Type

Depending on the nature of transaction, the user can select the type of accountthat can be affected by the double entry recording.

Example 1:

1. Starting the business with capital. A part of it at bank and the

remaining amount in cash.

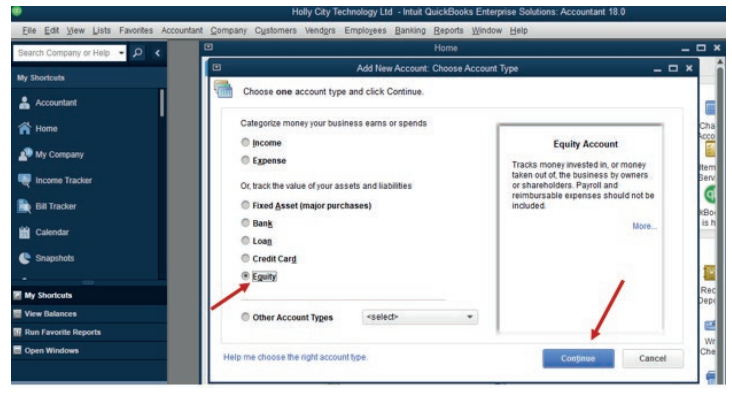

This transaction affects Capital, bank and cash accounts. To create capital

account, classify it in equity type by ticking the Equity radio button, write the

name of account which is CAPITAL and click Continue. Follow the same

process for bank and cash account.

Some accounts have Sub Accounts. The user has to make sure that each

account created falls under the account type and Sub Account in which it

belongs to.

Create Sub-accounts QuickBooks lets the user create sub-accounts of other

accounts. This lets you track the details on about the account in more details

than a regular account offers. To add sub-accounts, do the following:

1. Go to the Chart of Accounts

2. Choose the account you want to make a sub-account and click the down

arrow next to Choose Edit account.

3. Edit the account and select the checkbox labeled Is sub-account.4. Choose the main account that it will be a sub-account of.

Figure 2.4 Equity Account is selected.

If there are other account found that do not fall into these types, there is an

option to search from Other Account Types which gives the types of accountbelow:

Figure 2.5 Selection of Account Type.

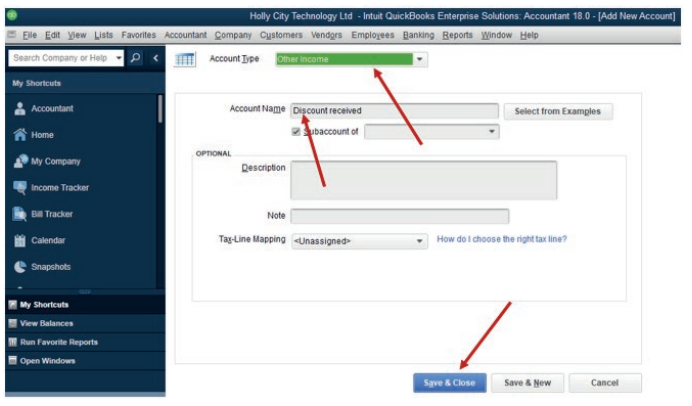

Example 2:

1. Discount received.

This transaction affects Discount received and creditor (account payable)

account.

These two accounts do not fall in the first account types. To create Chart of

Account, follow this procedure:

• From Other Account Type, select Other Income as account type

of discount received and Other Current Liability Account type forcreditor (account payable) then click Continue.

Figure 2.6 Interface of additional Income Account

Discount received is an Income type of account, Sub Account of Other income.

Creditor is an account payable type of account (Creditors), Sub Account of

Other current liabilities

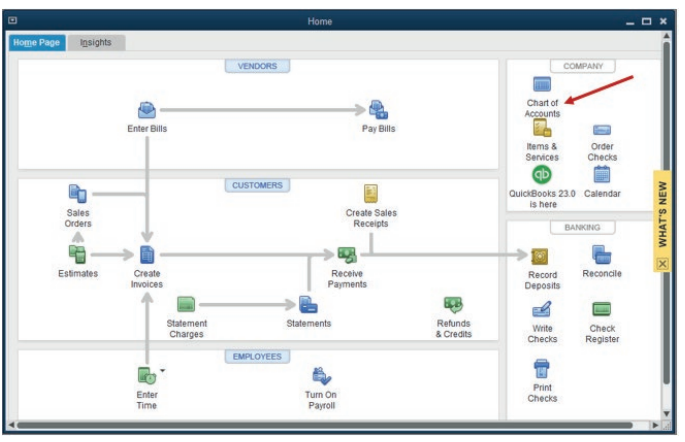

• The other income account type appears then Account name field is

filled.

If it is the last account created, click Save & Close. But if there are moreaccount to add, click Save & New.

Figure 2.7 Saving New account type and New Account Name.

• Click Save & New.

Application Activity 1.3

1. Match the accounts with their corresponding account types

2. The transactions below have been extracted from the books of

BWAIZA CO.

a) Starting the business with cash in hand

b) Bought office equipment by cash

c) Purchase of goods by cash

d) Sales of goods by cheque

e) Credit sales to AKALIZA Queen

Prepare the charts of account

2.2. Changing the account namesLearning Activity 2.2

The QuickBooks user creates the Charts of Accounts for the business. It

may happen that some of the accounts created seem to be not necessary

or are duplicated.

• What can you do if you are a QuickBooks user and you find a

situation like that?

• What do you think will be the dangers of keeping the unnecessaryaccounts in the business file?

If the user finds that some chats of account name have to be changed, he can

do the following:• Click on Charts of Account on QuickBooks Home page

The list of account appears, and the user make a right click on the account

whose name is to be changed

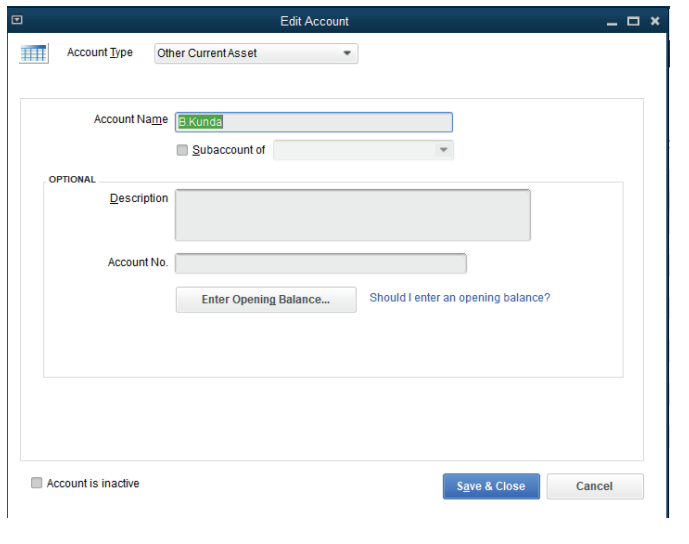

The user will find the following windows and the account name to be changed

appears as here below with an option to fill the other names, account type, subaccount if any and opening balance.

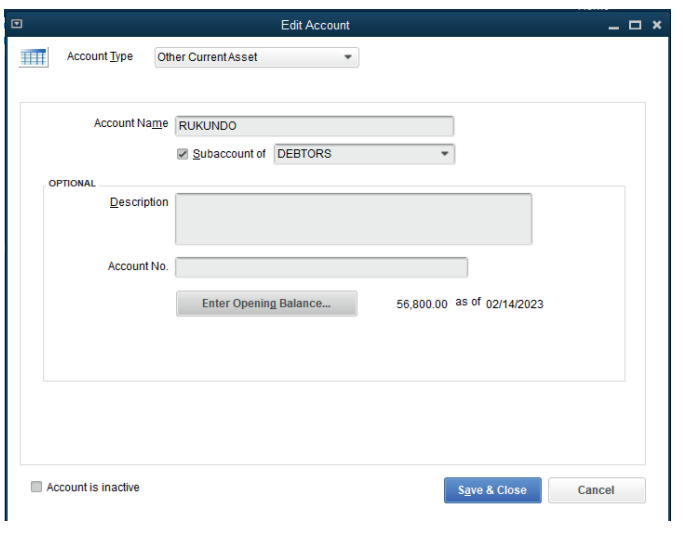

In the window above B.Kunda is changed and it is replaced by Rukundo, the

sub account and opening balance is added. It finally appears as in the followingwindow:

• Click on Save & Close.

Application activity 2.2.

MUKAMURIGO, the accountant of MARANATHA CHURCH uses QuickBooks

in her daily activities. In the beginning, she created the following charts of

accounts: Cash, Bank, Sales< Capital, Purchase<, CUSTOMERS, Rent,

Purchase2, Stock and William. She finally finds that some of the accounts

are duplicated and William account is not necessary.

Replace the duplicated accounts by salary account and change Williamaccount in to Willy Account

2.3. Deleting and making inactive unnecessary accounts

Learning activity 2.3.

The following transactions have been extracted from the file of MUGEMANA

TRADING Ltd

a) Capital: cash and bank

b) Purchase of goods on credit from supplier

c) Sales of goods by cash

d) Returning defective goods to Martin

e) Payment to martin the remaining amount by cheque. 2.5 % Cash

discount received

Below are the charts of accounts prepared by the former accountant:

– Cash

– Bank

– Purchase salary expenses

– Bank overdraft

– Drawings account

– Payables

You are hired as a new accountant. Do you agree that all of these accountsare necessary? If not, remove the unnecessary accounts.

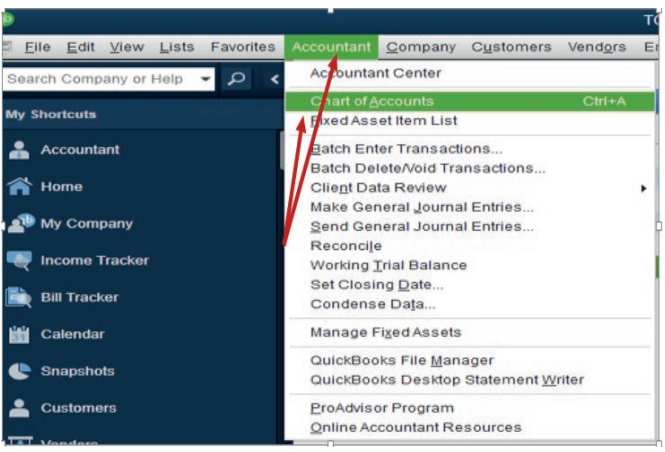

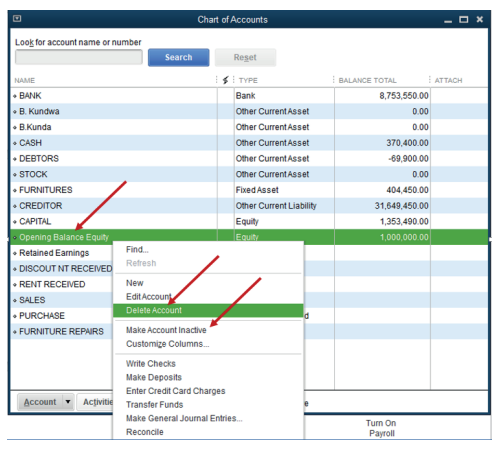

To delete an account, the following steps have to be done:

1. Click on Accountant on menu bar2. Click on Charts of Account

Figure 2.9. Search for an account

3. Find the account to be deleted

4. Here, opening balance Equity account is not necessary. Right click onthe account to delete or to make it inactive

Figure 2.9 Deleting or making Account Inactive unnecessary account.

Delete an account or Click on Make Account Inactive

Once an account is made inactive. It will no longer appear in list of charts of

account.

• Click OK when asked if the user wants to delete or to make an account

inactive.

Once you delete an account, it will be removed in the Chart of Accounts.

The good thing is, you can filter the COA page to include inactive or deletedaccounts.

Application Activity 2.3.

1. What are two reasons for deleting or making an account inactive?

2. Illustrate the process through which an account is deleted.

3. The following transactions have been extracted from the books of

Ganza Ltd:

a. 1/6/2020: Starting the business cash in hand

b. 4/6/2020: purchase of goods on credit from Kundwa

c. 6/6/2020: Sales of goods by cheque

The list of accounts below has been found in charts of account:

– Discount received

– Sales

– Account receivable

– Capital

– Bank

– Cash

– PurchaseRequired: Delete the unnecessary accounts if any.

2.4. Adjustment of account

Learning Activity 2.4.

The accountant of FRESH JUICE Ltd prepared the end of the year final

accounts before adjusting company accounts. During the next period,

the auditors advised her to deal with some accruals and prepayments for

reporting true and fair information.

What are the business account to be adjusted before preparing end ofperiod reports?

At the end of the accounting period, business account has to be adjusted

before preparing the financial statements. Account adjustments, also known

as adjusting entries, are entries that are made in the general journal at the end

of an accounting period to bring account balances up-to-date. Unlike entries

made to the general journal that are a result of business transactions, accountadjustments are a result of internal events.

2.4.1. Assets

Due to various reasons, the business fixed assets loose value through the years.

It is called depreciation. Before preparing the statement of financial position of

any business entity, the accumulated depreciation of any fixed asset must be

subtracted from its original cost so that the net value to report in balance sheet

will be true and fair.

The debtors are also business current asset that are adjusted in case of bad and

doubtful debts. Therefore, the business/firm should write the debtors account

off from the accounts and thus it becomes an expense that should be charged

in the profit & loss account. In practice a firm may also be unable to collect all

the amounts due from debtors. This is because a section of the debtors will nothonor their obligations.

2.4.2. Expenses A.

Accrued Expenses

An accrued expense is an expense that is payable or due for payment but has

not yet been paid during that period. An accrued expense should be charged in

the P&L account and shown in the balance sheet as a current liability. In quick

books, it is a liability account and it is recorded as follow:

Debit: expense account or P&L account

Credit: accrued expenseExample: Accrued salary: 10000Rwf

Figure 2.10 Record of accrued expense

It means that the accrued salary is added on the current salary of the period.

Therefore, it is charger on P&L account and it will appear in balance sheet under

a current liability

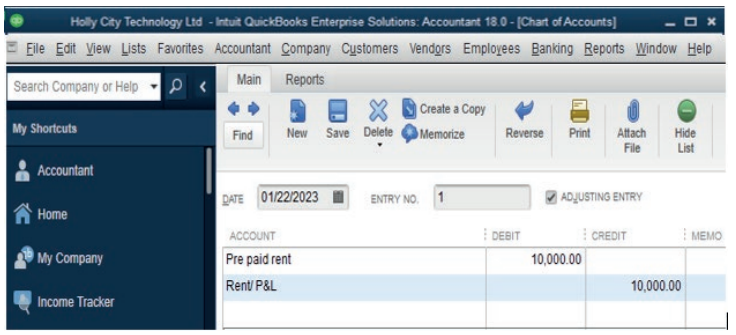

B. Prepaid Expenses

A prepaid expense is an expense that is not payable but cash has already been

paid. A prepaid expense should not be charged in the P&L a/c but should be

carried forward to the next financial period and should be shown in the balance

sheet as a current asset. In QuickBooks, prepaid expense is another current

asset account and recorded as follow:

Debit a prepaid expense account

Credit the expense for decreasing its valueExample: Prepaid rent: FRW 10,000

Figure 2.11. Record of prepaid expenses

2.4.3. Income

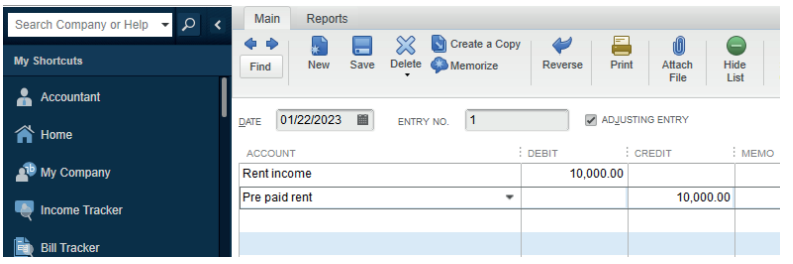

A. Prepaid Income

This is income that is not yet due but cash has been received for it. This happen

when an income is payable in advance it can be called also the Unearned

revenue. e.g. Rent payable 3 months in advance. A prepaid income should not

be reported in the current financial period but should be carried forward and

reported in the period it relates to as a current liability. In quick books, prepaid

income is another current liability account and it is recorded as follow:

Debit the other income in P&L accountCredit the prepaid income account

Figure 2.13. Record of prepaid Income

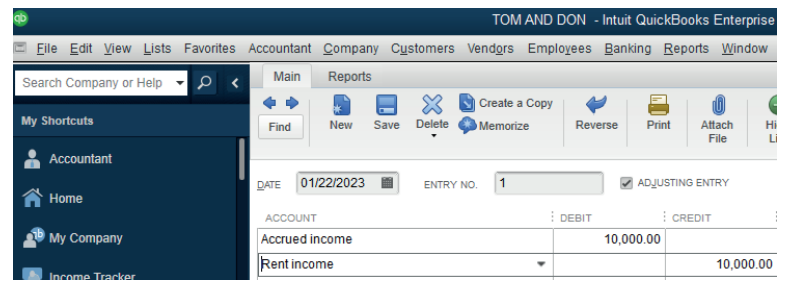

B. Accrued Income

This is income that relates to the current year but cash has not yet been received.

An accrued income should be reported in the profit & loss account and the

same income will be shown in the balance sheet as a current asset. In quick

books, it is another current asset account and it is recorded as follows:

Debit accrued income

Credit the P&L account on that income accountExample: Accrued rent income of FRW 10,000

Figure 2.14 Record of accrued income

The assets (fixed and current) and liabilities are the quick books accounts that

have to be adjusted depending on business transactions that are taking placeduring the period.

Application Activity 2.4.

1. True or false

a) Prepaid expense is a current liability account

b) Accrued income should be shown in the balance sheet as a current

liability.

c) A prepaid income should reported in the period it relates to as a

current liability.

2. The adjusting entry that reduces the balance in prepaid insurance will

also include which of the following:

a) A credit to cash

b) A credit to insurance expense

c) A debit to insurance expense

3. KALISA owns and operates a dry cleaner. The following occurred

during the period of January:

a) Prepaid rent for January and February

b) Purchase of insurance in January that will six months

c) Paid salary of his assistant for the last two monthsRequired: Prepare the chart accounts for the above information.

2.5. Owner withdrawals and investments

Activity 2.5

Mrs. Agatha is a sole trader in GAKENKE District. She invested her money in

auditing and consultancy activities. For getting the capital she used to save

for 5 years and finally she got FRW 6,000,000 which she deposited at

bank. During the first month of activities, she withdrawn FRW 120,000 from

business bank account for private use.

• You are to advise her on the chart of account she can create for

recording the transactions in quick books

• Show her the process she will pass through to keep the transactionin the system.

2.5.1 Owners investments

Owner investment, also called contributed capital, is the amount of assets that

the owner puts into the company. In other words, this is the amount of money

or other assets that the owner contributes to the business either to start it or to

keep it running.

In quick books, an owner’s capital account is the equity account listed in

the balance sheet of a business. It represents the net ownership interests of

investors in a business

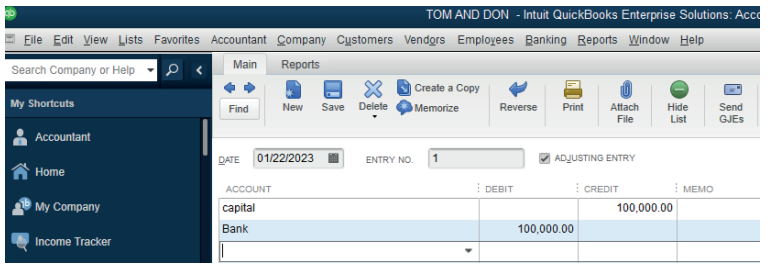

How to Record an owner’s investment in Quick books?

For recording owner’s initial investments (capital),

Capital account is debited

Cash /Bank account is credited

In case of re-investment for keeping the business running, the same entry will

be done or

Debit the Capital accountCredit any source of re-investment

Figure 2. 15 owner’s investment record

2.5.2. Owners’ withdrawals

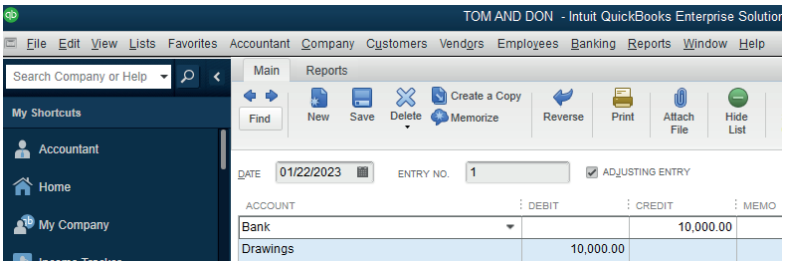

“Owner Withdrawals,” or “Owner Draws,” in quick books is a contra-equity

account. This means that it is reported in the equity section of the balance sheet,

but its normal balance is the opposite of a regular equity account. Because a

normal equity account has a credit balance, the withdrawal account has a debitbalance.

Withdrawal of any amount in cash or kind from the enterprise for personal use

by the proprietor is termed as Drawings. The Drawings account will be debited

and the cash or goods withdrawn will be credited.Example: Cash withdrawn from bank for personal use: 10,000Rwf

Figure 2.16 Drawings record

Application Activity 2.5.

1. Define the following concepts:

• Investment

• Owners’ equity

• Drawings

2. How can this transaction be recorded using quick books:Drawings of goods valued at 10,000RFW

2.6. Transfer of net income to the owner’s capital account.

Learning Activity 2.6.

BIGIRIMANA is the owner of BEST ELECTRONIC TRADING Ltd. He started

this company with the capital acquired from his saving with the loan got from

BANK OF KIGALI. During the year of business operations, he concluded

some transactions including drawings. At the end of the year, he prepared the

statement of profit or loss which shown that the business has a net income of

7,500,000Rwf.

Required:

• What do you thing is the drawings?

• Assume that you are BIGIRIMANA, what can you do with this netincome for the year?

2.6.1. Net income

Net income refers to the amount an individual or business makes after deducting

costs, allowances and taxes. In commerce, net income is what the business has

left over after all expenses, including salary and wages, cost of goods or raw

material and taxes. Net income shows how much money a company is making

after subtracting all expenses. It can also be referred to as “net profit” or “the

bottom line.”

As part of the closing entry process, the net income is moved into retained

earnings on the balance sheet. The assumption is that all income from the

company in one year is held onto for future use. Any funds that are not heldonto incur an expense that reduces net income.

2.6.2. Owners’ capital account

A capital account is used in accounting to record individual ownership rights

of the owners of a company. The capital account is recorded on the balance

sheet and is composed of the following items: Owner’s capital contributions

made when creating the company or following the creation, as required by the

business.

Basically, the owner’s capital account represents the net assets of the company.

It’s the amount of money left over after the company sells all of its assets and

pays off all of its creditors. This remaining amount of money is what the owner

actually owns or networth.

Owner’s capital account is one of the accounts of equity type of account

which consists of:

Capital

Less: Drawings

Add: Profit in case of positive net income of business or

Less Loss in case of negative net income of the business

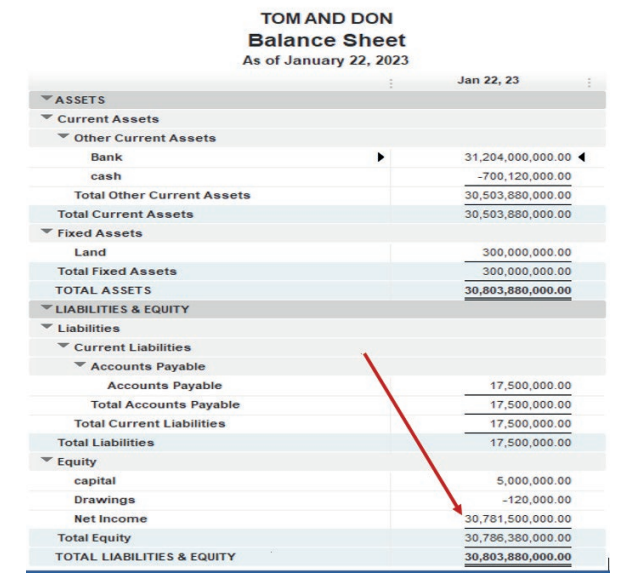

Quick books software will transfer the net income (profit or loss) of the business

for the period from the trading, profit or loss account to the statement of financial

position (balance sheet) automatically in its equity section.

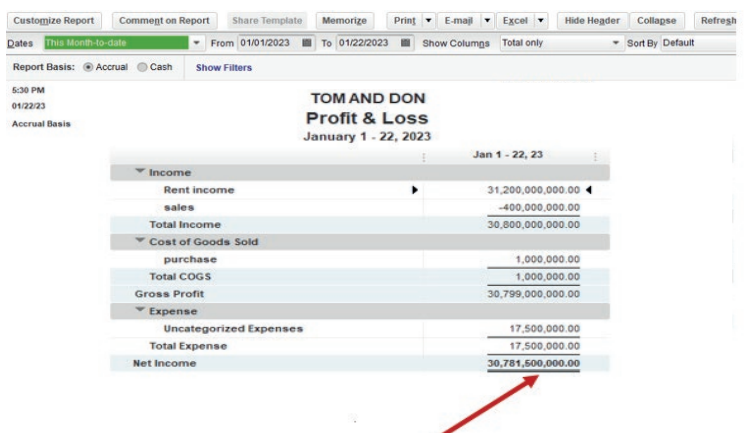

Example:

Here under, TOM AND DON business Net Income of the period is FRW30,781,500.

Figure 2.17 Net income to be transferred in balance sheet

This Net Income is transferred to the equity section of TOM AND DON Balancesheet as shown here under:

Figure 2.18 use Net Income in Balance sheet

Application Activity 2.6.

1. Define the following concepts:

a) Net income

b) Owners’ capital

2. BLESSED WORK LTD is a small sole trade business of purchasing

and selling of electronics items. It is located in MUHIMA sector,

NYARUGENGE District in KIGALI CITY (Tel +2507884324 -234712;

P.O Box 1213 Kigali. The owner decides to hire you knowing that you are

skilled in computerized accounting for preparing financial statements on

time.

The following past information is provided:

a. On 1st February, 2020: Starting business with RWF 10,000,000cash

and RWF 50,000,000 at bank.

b. 2nd February, 2020: Receiving a loan from Bk of RWF 70,000,000

8th February, 2020: Bought furniture for RWF 12,000,000 and paying

by cheque

c. 10th February, 2020: Purchasing goods on credit from TU` for RWF

4,000,000, cash purchase of FRW 2,500,000 and FRW 1,500,000 by

cheque.

d. 11th February, 2020: credit sales to KANYENGOGA for RWF 3,600,000,

cash sales of FRW 4,350,000 and sales by cheque of FRW 8,500,000.

e. Returns to TUBYIHERERANE FRW 500,000

f. Cash drawings: FRW100,000

g. 12th February, 2020: Paid rent of FRW 450,000 by cheque

12th February, 2020: FRW 1,750,000 Paid

to TUBYIHERERANE by cash. A discount of 7.5% is received.

h. 12th February, KANYENGOGA paid FRW 723,500 by cheque. A

discount of FWR 27,500 is allowed to him.

i. KANYENGOGA retuned goods valued at FRW245,000

j. 15th February, the following transactions took place:

a) Paid wages by cash of 250,500 FRW

b) The insurance is paid by cheque 740,000 FRW

c) Rent received by cheque is 90,450FRWShow the income statement transferred in the balance sheet.

End of Unit Assessment

1. MUGENI has the following items in her balance sheet as on 30 June

2021. Capital FRW 41,800, Creditors FRW 3,200, Fixtures FRW

7,000, Motor Vehicles FRW 8,400, Stock of goods FRW 9,900,

Debtors FRW 6,560, Cash at bank FRW 12,900 and Cash in hand

FRW 240

During the first week of July 2021 the below transactions took place:

b) He bought extra stock of goods FRW 1,540 on credit.

c) One of the debtors paid him FRW 560 in cash.

d) He bought extra fixture by cheque FRW 2,000.Prepare the charts of account