UNIT1: INTRODUCTION TO QUICKBOOKS

Key unit competence: Create company profile in QUICKBOOKSsoftware

Introductory Activity

In today’s business environment, most financial accounting systems have

been computerized and automated in such a way that papers are not needed

or needed less and less. Mr NGOGA Frank is an accountant in ABC Ltd.

His day to day activities is to identify and record, classify, summarize, analyze

and interpret financial transactions of the company in a significant manner

and in terms of money, transactions and events which are in part of financial

character, and interpret the related results. Mr NGOGA Frank uses a manual

book keeping accounting system. This causes him a low performance in

terms of providing timely financial information to the different users for rational

decisions. To overcome this, the owner is suggesting to shift from manual book

keeping system to computerized accounting system.

a) Advise him on accounting software that can be used by the company.

b) Do you think the software will help them to handle the challenges?Explain.

1.1 General overview on QuickBooks

Activity 1.1

Holly city Technology Ltd has a paper-based database and wants to have a

computerized one to use to keep all its customers, suppliers and third parties’

data. Every day Director of Holly city technology Ltd faces different challenges

of properly keeping customer’s data because of the system they use which isa paper based database and Microsoft Excel program.

By analyzing this scenario answer the following questions:

a. Advise him on the software the company can use for solving the above

challengesb. Differentiate a paper-based database from a computerized database

QuickBooks is one of the most popular accounting software for small

businesses. Moving from manual bookkeeping or spreadsheets have grown

into many problems, difficulties, obstacles and businesses need a better option

compared to other current software.

QuickBooks can be a good choice for small and medium businesses. It is best

known for its bookkeeping software; it offers a range of accounting and financesolutions for small businesses.

1.1.1. Key concepts

a. Accounting: Accounting is a process of identifying and recording,

classifying, summarizing, analyzing and interpreting financial transactions

of an entity for a certain financial period.

b. Accounting cycle: Accounting cycle refers to a series of steps followed

by companies to systematically process financial information from source

documents to the preparation of financial statements on a monthly,

quarterly, and/or annual basis. The collective process of recording,

processing, classifying and summarizing the business transactions in

financial statements is known as accounting cycle.

c. Manual Bookkeeping: This is a way of recording business activity

transactions without using a computer system with specialized accounting

software. In this way, transactions are registered by hand in accounting

books, using a written ledger of transactions, physical records, pads of

paper and books.

d. Computerized accounting: Computerized accounting system is an

accounting information system that processes the financial transactions

and events as per Generally Accepted Accounting Principles (GAAP) toproduce reports as per user requirements

1.1.2. Use of QuickBooks software in accounting records

QuickBooks provides a number of ready to use templates that business

owners can use to create invoices, spreadsheets, charts and business plan.

QuickBooks makes it easy to customize the look and feel of those documents.

QuickBooks allows the user to look at and manage purchases, sales, andexpenses in one spot.

Additionally, QuickBooks helps businesses in the following ways:

• QuickBooks like other accounting is important in digitalization of

accounting data

• Simplifies and automates data entry. For example, a point-of-sale

terminal may actually become a data entry device so that sales are

automatically “booked” into the accounting system as they occur

• Frequently divide the accounting process into modules related to

functional areas such as sales/collection, purchasing/payment, and

others.

• Is “user-friendly” by providing data entry blanks that are easily understood

in relation to the underlying transactions.

• Minimize key-stokes by using “pick lists,” automatic call-up functions,

and auto-complete type technology.

• Is built on data-base logic, allowing transaction data to be sorted and

processed based on any query structure. For example, producing an

income statement for July; providing a listing of sales to Customer

• Provide up-to-date data that may be accessed by key business decision

makers.

• Are capable of producing numerous specialized reports in addition tothe key financial statements

Application Activity 1.1

1. Define the following Terms:

a) Manual Bookkeeping

b) Computerized accounting

c) Accounting cycle2. Discuss the importance of QuickBooks

1.2. Installation of QUICKBOOKS software

Learning Activity 1.2

Holly city Technology Ltd accountant Uwimbabazi bought a laptop which

doesn’t have any accounting software

1. Demonstrate and outline the procedure will be used by Uwimbabazi forhaving QuickBooks in her computer.

Installation (or setup) of software is the act of making the program ready

for execution. Installation refers to the particular configuration of a software or

hardware with a view to making it usable with the computer. A soft or digital

copy of the piece of software (program) is needed to install it. There are different

processes of installing a piece of software (program).

Because the process varies for each program and each computer, programs

(including operating systems) often come with an installer, a specialized program

responsible for doing whatever is needed for the installation. Installation may be

part of a larger software deployment process.

Installation typically involves code (program) being copied/generated from

the installation files to new files on the local computer for easier access by

the operating system, creating necessary directories, registering environment

variables, providing separate program for un-installation etc. Because code is

generally copied/generated in multiple locations, uninstallation usually involvesmore than just erasing the program folder.

Common operations performed during QuickBooks software

installation include:

• Making sure that necessary system requirements are met

• Checking for existing versions of the software

• Creating or updating program files and folders

• Adding configuration data such as configuration files, Windows

registry entries or environment variables

• Making the software accessible to the user, for instance by creating

links, shortcuts or bookmarks

• Configuring components that run automatically, such as Windows

services

• Performing product activation• Updating the software versions

Steps of installing QuickBooks Software

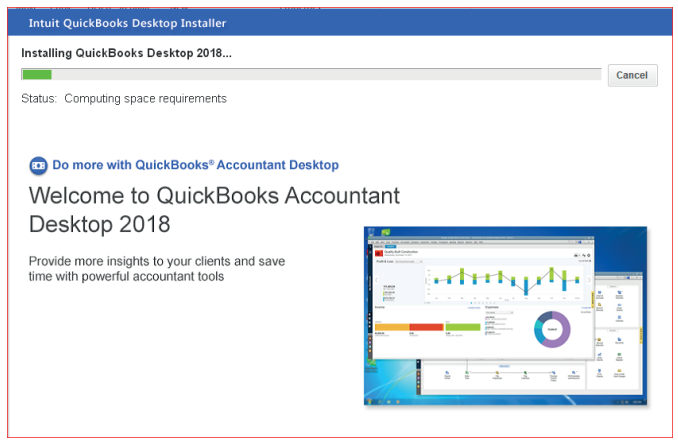

The following are the steps to install a QuickBooks software in a computer:Step 1. Open QuickBooks set up icon, then the following window appear:

Figure 1.1. QuickBooks Install Shield wizard

Step 2: In the Welcome Window that appeared click on NEXT and get thefollowing:

Figure 1.2. Welcome to QuickBooks Interface

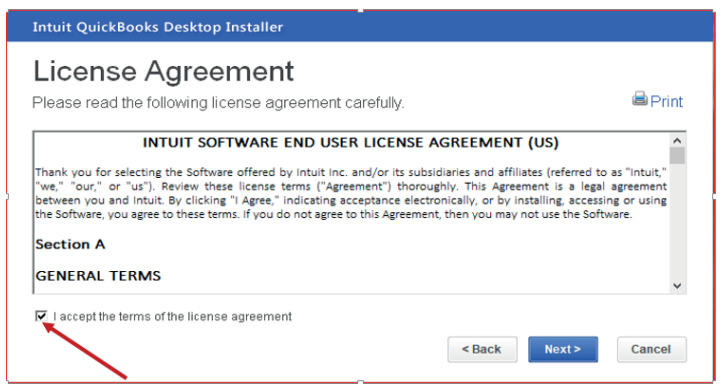

Step 3: Tick on “I accept the terms of the license agreement” and click onNext

Figure 1.3 QuickBooks License Agreement Interface

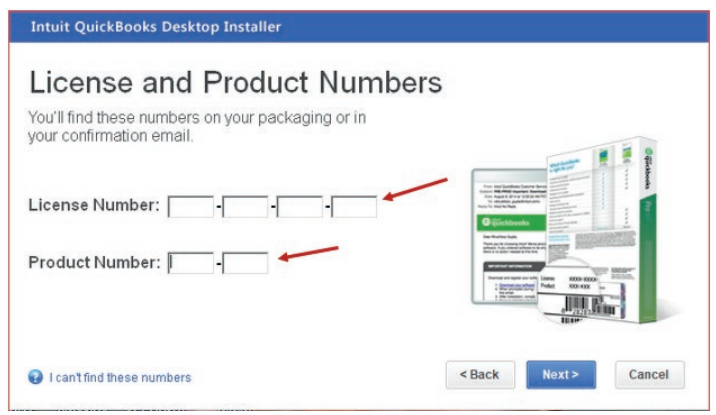

Step4: After accepting the terms and conditions of QuickBooks license,

activate the QuickBooks Desktop by filling the license and product numberin their field.

Figure 1.4 Field reserved for License Number and Product Number

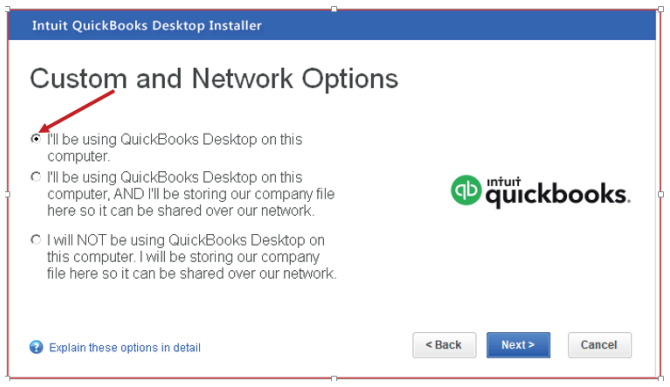

After click on Next then the following window of custom and network optionswill appear.

Figure 1.5 Interface used for selecting where QuickBooks Desktop will be used

Step 5: Select whether you will use QuickBooks Desktop on this computer

(which is the recommended option). Then click on Next. One of the three

options is chosen depending on how QuickBooks will be used.

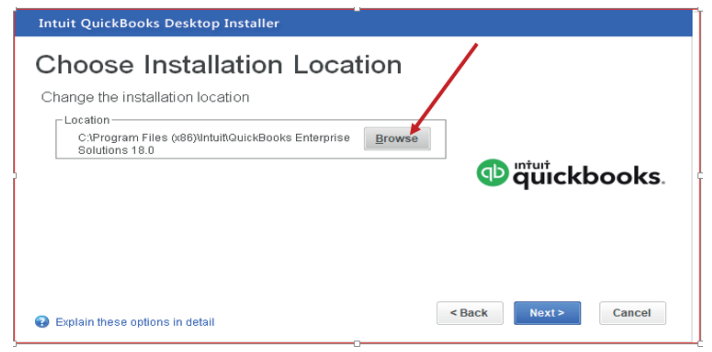

Step 6: Choose installation Location

Click on browse to select the installation location. By default, QuickBooks files

are saved in local disk C\Program Files (x86) \Intuit\QuickBooks Enterprise

solutions. But the user can locate it in other locations like on desktop or localdisk D.

Figure 1.6 Location of QuickBooks Software

Click on install and wait for installation process

Figure 1.7 Interface with QuickBooks installation Progress

Application Activity 1.2

Assume you have got a job of being an accountant of five-star hotel

and the hotel wants to start using QuickBooks accounting software in

their accounting records. Even if the hotel manager has already bought

QuickBooks software, it is not yet installed in their computers. You are

therefore asked to help them to install it.

1. What are the steps will you follow to install QuickBooks in computer?

2. Install the QuickBooks software in one computer in the schoolcomputer lab

1.3. Creating company profile in QuickBooks

Learning Activity 1.3

ABADAHIGWA COOPERATIVE needs to use QuickBooks in its day to

day accounting records. It is necessary to ha a full complete profile of thecompany to ensure an easy and clear records of transactions.

• Suggest to the cooperative the main component of the

company profile

• Use your own example to show to the cooperative an exampleof a full complete company profile

A company profile or company file is where the user stores company financial

records in QuickBooks. Therefore, it is the first thing to do in QuickBooks. You

can create a company file from scratch or convert records previously kept in a

small-business accounting program. It is a tool to use for analyzing the financialsituation of companies.

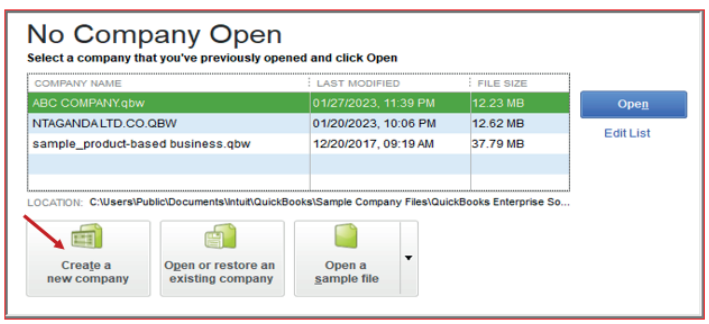

To create a company profile, follow this procedure:

• Click on the QuickBooks Home page• Click on create new company:

Figure 1.8 Creation of new company

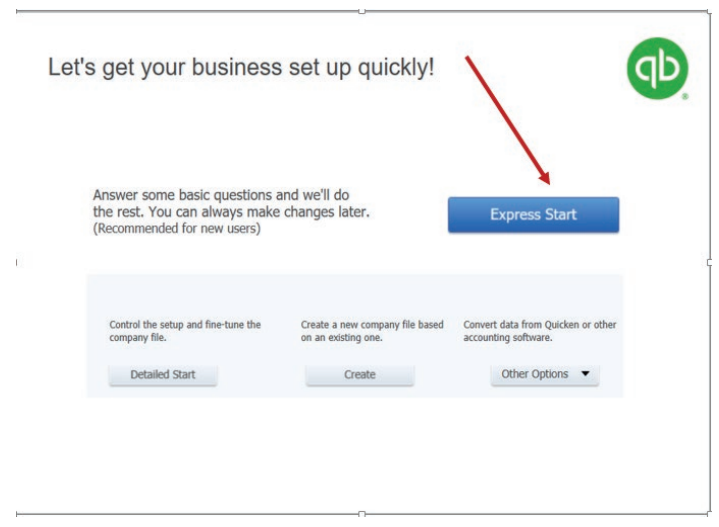

• Clicking on Expressing Start

Figure 1.9 The beginning of Easy setup of company identification

After clicking on Expressing Start, an easy setup of company profile interviewstarts.

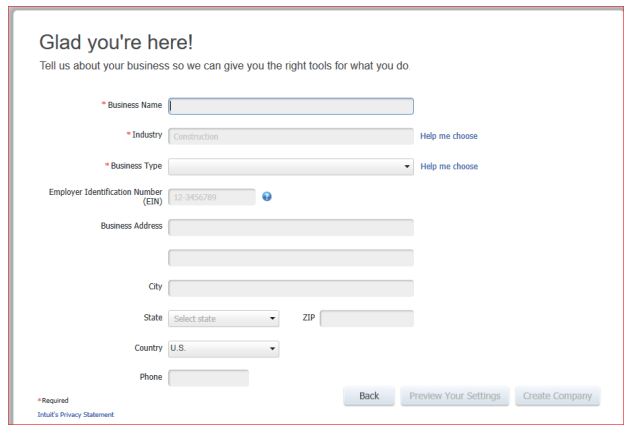

• Complete the easy setup of company profile interview:

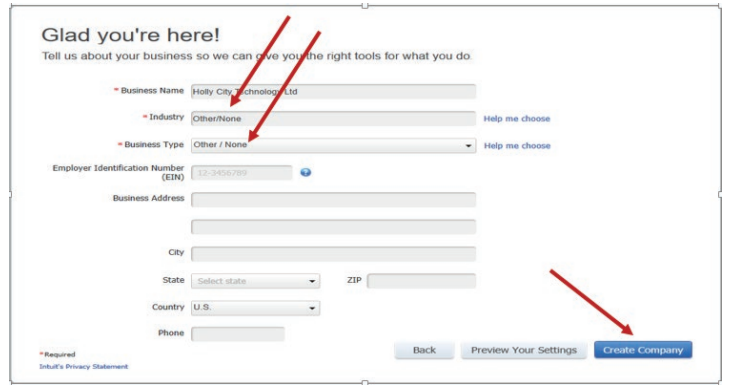

Figure 1.10 Business information interface

• Fill the business name

• For the industry, click on help me to choose so that the default chart

of accounts should not appear in the company charts of company.• Select other/none

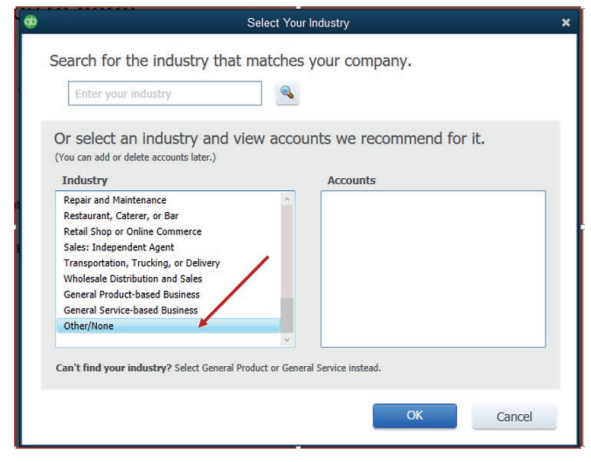

Figure 1.11 interface with a list of industry types

The selection of Other/None allows the user to have a free field of charts of

account so that he can set the appropriate charts of account according to the

transactions he will be recording.

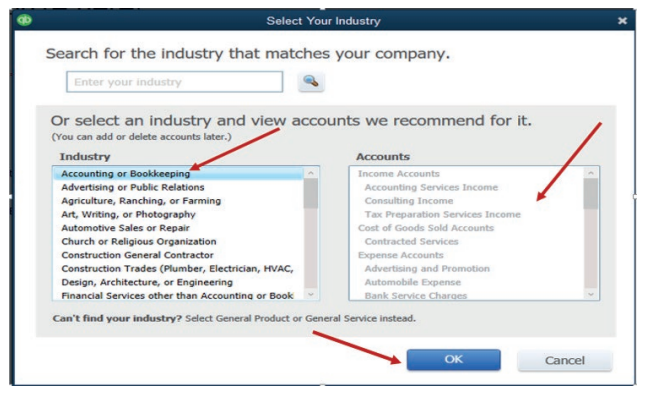

If the user selects the Accounting or bookkeeping on the field of Industry,

the default account relating to the selected industry will appear in the chart of

accounts including the ones the user does not want.

The field of Business Type should be filled according to the user’s choice. If

the user needs to continue by setting his own charts of account, he can selectOther / None. Then OK

Figure 1.12 Details of company information

Note: For Employer Identification Number use the format xxx-xx-xxxx (Three

digits- Two digits-four digits).• After filling all fields click on Create the Company

Then wait for the company creation process until the following window appear

Figure 1.13 Interface for adding Business People, Product or Services

In the above window the user adds people to do business with, product or

services sold by the company and bank accounts. Otherwise, the user may skipto start Working tab.

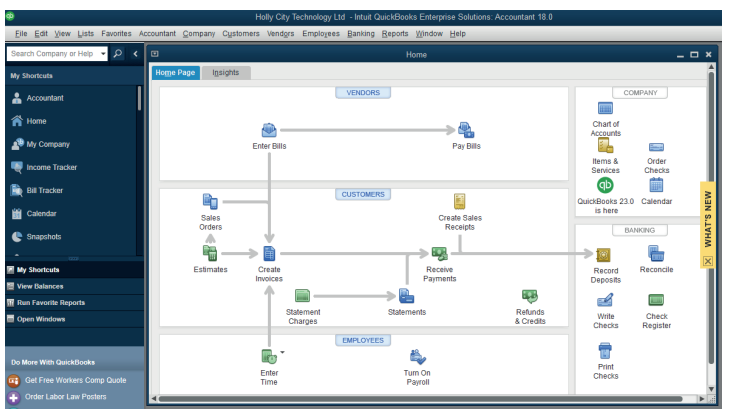

Then the QuickBooks Home Page interface appears as follows:

Figure 1.14 QuickBooks Home Page interface

The menu bar has fourteen menus namely: File, Edit, View, Lists, Favorites,

Accountant, Company, Customers, Vendors, Employees, Banking, Reports,Window and Help.

Application Activity 1.3

BWIZA Ltd is a small sole trade business of purchasing and selling of

Eggplants. It is located in NDUBA Sector, GASABO District KIGALI CITY

(Tel +250788567012-722567012; P.O Box 1123 Kigali).

BWIZA Ltd is facing serious problems related to the use of manual accounting,it decided to use QuickBooks. Create accompany profile for BWIZA Ltd.

1.4. Customization of company preference

Learning Activity 1.4

If the QuickBooks user wants to customize company preferences in QuickBooks

to fit his personal style and business needs he can do it with the help of

QuickBooks preferences as long as references permit the users to choose

how they want QuickBooks to manage things or to set own preferences.

• What should be the examples preferences that the user can

customize?• In which process it could be done?

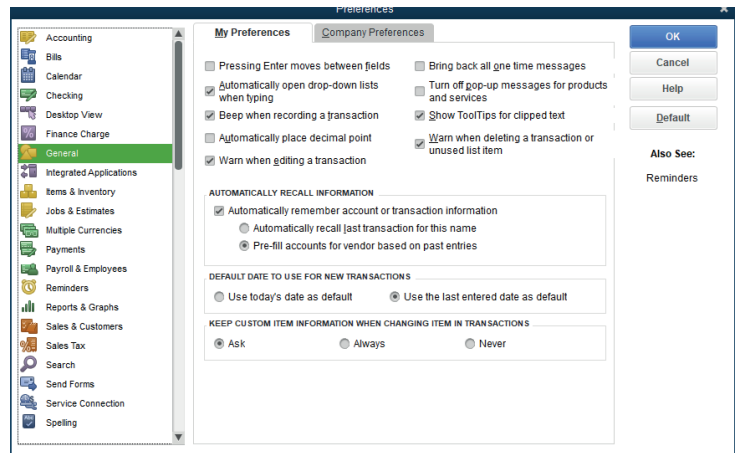

Preferences allow you as the user to decide how you want QuickBooks to

handle things or set personal or company preferences.

Examples of preferences that the user can customize:

– Age from due date: The overdue days appears on the invoice,

statement or bill, that start from the due date that

– Age from transaction date: The overdue days start on the creation

date of the invoice, statement or the date of when bill receiving.

– Format: If you click this button, then this button will open the Report

Format Preferences window which authorizes you to customize Header

or Footer & Fonts and Numbers on QuickBooks reports. You can modify

the appearance of the report.

– Reports: Show items by defining how reports display the name of the

items.

– Reports: If you need to display account numbers in your reports, click

Name and Description or Name only.

– The Classify button: With the help of this button, you can reclassifyaccounts for the Statement of Cash Flows report

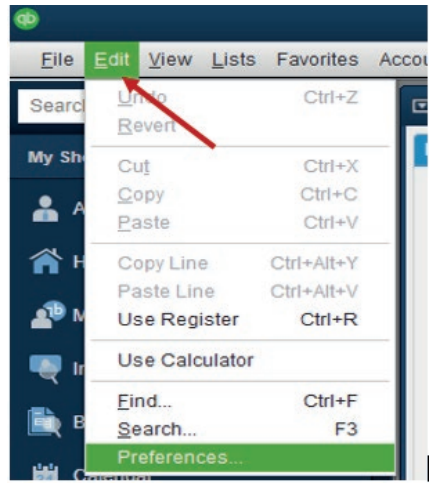

Preferences can be found by going to the top of the main QuickBooks Home

page and click on Edit and then preferences. Click on Edit Menu, on theQuickBooks Home page and find the following window:

A click on Preferences gives to the user the wide option to customize either his

preferences or Company Preferences.

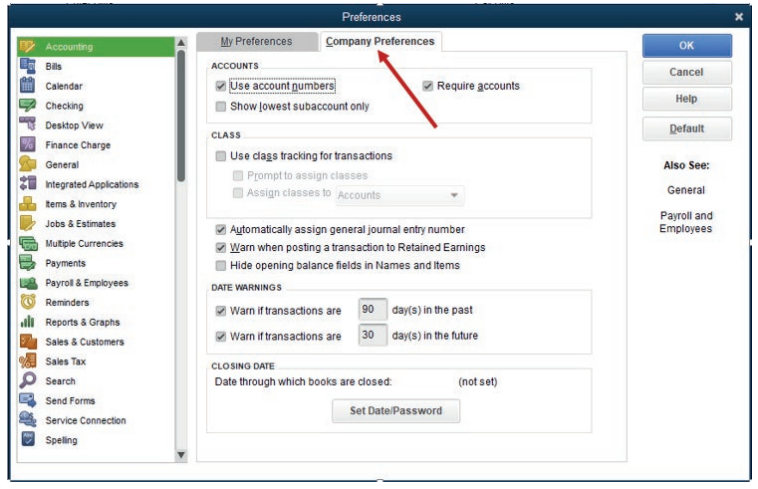

For example: If the user needs to customize the use of numbers on the

accounts, he/she must follow these steps:1. Click on Accounting

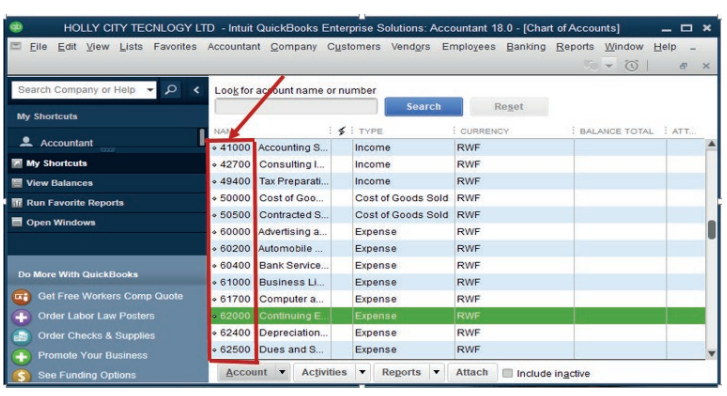

• Click on Company preference and tick on Use Account Numbers

and OK

• After clicking OK, check the accounts and see the numbers on the

accounts

Application Activity 1.3

1. What is the meaning of customization of company preferences?

2. Give the examples of preferences that the QuickBooks user can

customize to suit its work.

3. Present a preferences window where on My Preferences, Payroll &Employees, Only Online Payroll and Last Name are selected.

End of Unit Assessment

1. Define the Installation of software

2. List the common operations performed during QuickBooks software

installation

3. MUTARA ENTERPRISE is a small sole trade business of manufacturing

of furniture items. It is located in KAGEYO Sector, Gatsibo District

in Eastern Province (Tel +250788567012-722567012; P.O Box

1123 Gatsibo). MUTARA ENTERPRISE Shop is well known for its

services performed in Society that attracts customers.

• Use the information above to create a company profile.

• Customize the charts of accounts so that they appear withrelevant codes numbers