UNIT 5: AUDITOR’S RESPONSIBILITY

Key unit competence: To be able to exhibit auditor’s responsibilities

Introductory activity

A case study

KARAMBIZI is an auditor who was appointed in PHILMAX Ltd Company.

The company wanted to set terms of working framework for a new auditor.

The management of the company wishes to know how to define generalduties and legal professional responsibilities of an auditor.

Question

1. Highlight three duties of an auditor

2. What do you think are reasons that may lead to auditor’s liabilities?3. What do you think can be auditor’s liabilities in relation to third parties?

5.1. Legal responsibilities and duties of an auditor

Learning activity 5.1

An auditor has been recruited in a company to help it secure operations,

especially related to financial and procedural management operations.

1. What do you think are main duties of an auditor in a company?

2. What do you think are reasons which can make an auditor liable tothe company?

5.1.1. Legal responsibilities of an auditor

Under the company’sAact, an auditor may be liable to the following parties:

• The client to whom he/she owes the primary duty of care;

• Third parties who have not privacy of contract but have relied on his/heropinion to arrive at a decision.

In general, the auditor’s liability may arise due to:

– Breach of contract;

– His/her failure to discover material misstatement due to fraud;

– His/her failure to discover material misstatement due to error;– Carelessness or dishonesty.

The liability of an auditor may arise in the following capacities:

• In his/her capacity as an auditor in private audits;• In his/her capacity as an auditor as a statutory audit.

a) Liabilities of an Auditor under Private Audits

In such audits, the auditor’s liabilities depend on the agreement between the

auditor and the client. It is for that reason that an auditor insists that the agreementbe in writing clearly, defining his/her duties, powers and responsibilities.

The auditor cannot be held liable for losses incurred as aresult of reliance on

parts of the accounts not covered in the auditing agreement. The auditor’s

liabilities are limited to the areas specified in the scope. In order to minimize his/

her liabilities, the auditor must:

• Be diligent and honest to reduce negligence;

• Should never sign a balance sheet he/she doesn’t believe to be correct;

• Use disclaimers on his/her report to minimize liabilities resulting fromhis/her report.

In assessing the auditor’s liabilities under private audit, the following should be

assessed:

• That he/she was actually negligent with reference to the agreement;

• That out of negligence, the client suffered loss;

• That a person who has explicit contractual obligation with him/her hassuffered the loss defined by the contract.

Note: Under private audits, the auditor must include a caveat and disclaimer to

his/her report to the effect that it should not be used by any party to make any

decision as the client may have limited his/her scope in the audit and that was

liable to obtain all information which he/she considered as necessary to makean opinion

b) Liabilities of an Auditor under Statutory Audits (Company’s Act)

Under the Company’s Act, auditors’ liabilities cannot be limited by any

agreement. The Act defines his/her duties, powers and responsibilities. Under

the Company’s Act, the auditors’ liabilities can arise out of:

• Civil law• Criminal law

Civil liability of the Auditor: These liabilities arise out of negligence. Under civil

law, the auditor has the duty to care about the following:

• The client (in contract)• Third parties whether he/she has contractual obligations or not.

The client (in contract)

The auditor due to this must exercise care and diligence in the performance of

his/her duties. Even though negligence is proved against the auditor, there is no

liability for negligence unless it can also be proved that the client also incurred

loss out that negligence i.e. in case of third party liability. In order to sue the

auditor successfully, the client must prove:

• The auditor was negligent;

• That out of the auditor’s negligence, a client suffered a financial loss;• That the financial loss is qualified and material.

Auditors’ liabilities to Third parties

He/she can be liable to the third parties under the following conditions:

• Where the party has suffered a financial loss as a result or by relying on

the report made by the auditor;

• Where it can be proved that the auditor did not use his/her professional

skills and judgement during the audits;

• Where the auditor made report aware that such a report should be

used by the third parties to make investment decisions;

• Where the auditor didn’t attach the disclaimer on his/her report that

such a report was not included to be relied upon by third parties;

• Where it can be proved that actually the third parties relied on the

report;

• Where the parties can prove that no external factors whatever influenced

their decision but just the audit report;• Where the third parties were not warned not to rely on the audit report.

Auditors’ liabilities to Third parties

He/she can be liable to the third parties under the following conditions:

• Where the party has suffered a financial loss as a result or by relying on

the report made by the auditor;

• Where it can be proved that the auditor did not use his/her professional

skills and judgement during the audits;

• Where the auditor made report aware that such a report should be

used by the third parties to make investment decisions;

• Where the auditor didn’t attach the disclaimer on his/her report that

such a report was not included to be relied upon by third parties;

• Where it can be proved that actually the third parties relied on the

report;

• Where the parties can prove that no external factors whatever influenced

their decision but just the audit report;• Where the third parties were not warned not to rely on the audit report.

5.1.2. Duties of an auditor

• Duty to make a report to shareholders or owners and duty to statethe following in his/her report

– Whether in his/her opinion, he/she has received all information andexplanations necessary for his/her opinion.

– Whether in his/her opinion, the trading, profit and loss account exhibitsthe true and fair view of the profits or loss of the period.

– Whether in his/her opinion, the balance sheet is properly drawn andexhibits a true and fair view of the company’s financial position.

– Whether proper books of accounts have been kept properly by the

company and returns received from company’s branches not visited byhim/her.

• Duty to call for information

– Whether loans have been properly secured except lands and building.

– Whether securities have been sold below the purchase price.

– Whether personal expenses have been debited to the profit and loss

account and if so to debit the personal accounts of the employeesconcerned.

• Duty to assist in investigations

The auditor assists in carrying out investigation and provides support in

investigation to the investigators but only if financial matters are provided onhis/her working purpose.

• Auditor’s responsibilities in relation to fraud

With the prospectus, an auditor has to be extra careful in approving any kind of

information because if there is a misleading information, which can cause the

loss to the company and third parties, they can hold him/her liable for damages.The auditor can relieve himself/herself of such liabilities under the following:

– If he/she withdraws his/her consent in writing before such prospectushas been registered and circulated for the public use;

– That after registration of prospectus and before the allotment of

shares, he/she is knowing the misleading statement in the prospectus,withdrawn his/her consent and gives a public notice to this effect;

– That it was important to give such statement and that he/she has

reasonable grounds, which he/she can substantiate e.g. letters ofrepresentation for proving that the statement was true.

In general, the auditor’s liabilities to the third parties and client give arise toclaims against the auditor on such grounds as:

– Failure to detect embezzlement by employees;

– Negligence on the part of the auditor or his/her staff;

– Improper accounts procedures, which may lead to fraud;

– Errors in the financial statement he/she is reporting on.

In order to minimize his/her liabilities to the third parties and the client whilecompiling his/her report, an auditor should:

– Enter into agreement with his/her client that another person should notuse his/her report;

– Include a disclaimer in his/her report to the effect that any party to makeany decision not included.

• Criminal liabilities of an Auditor

Arise when an auditor commits an act, which constitutes a crime. This includes

wrongful performance of a statutory duty or breach of statutory obligation. The

liquidator or receiver can sue an auditor as an officer of a company especially

during receivership or liquidation during the course of winding up a company if

he/she made wrong statement to them. In order to hold the auditor liable, thefollowing should be proved:

– That the auditor made a statement that proved false in material facts;

– That the auditor wilfully made a statement, which was actually falseknowing it;

– That the statement made was in any report, prospectus, balance sheet,

certificate or any other document, which under the company Act, theauditor is required to authenticate;

– That the auditor made a statement as a statutory officer of the company

In general, an auditor can be held liable under the companies Act for criminalacts under the following circumstances:

– If he/she fails to disclose material facts in the financial statements,

knowing that they are material and that such non-disclosure will makethe statement misleading;

– If the auditor does not use reasonable care and skills during the courseof his/her audit;

– If the auditor wilfully contravenes any provisions of the act which under

normal circumstances is supposed to follow during the course of his/herauditing e.g. If he/she fails to request returns from the branches;

– If he/she destroys secrets ,mutilates vouchers, documents books ofaccounts, certificates with the aim to destroy someone’s opinion;

– If he/she falsifies or is privy to falsification of any document, prospectus,

books of accounts or vouchers of the company with to deceive ordefraud;

– If he/she knows that, a material has been omitted in the report orfinancial statements and does not reveal such fact.

Note: The main auditor cannot hold the liabilities of branch auditors.

– To certify statutory report in order to assure the owners about the

number of shares allocated to promoters and whether such issue wasconducted properly.

– Duty to certify the profit and loss account in the prospectus.

– Duty to certify the profit and loss accounts when managing agentsresign, balance sheet and funds flow statement.

Other duties

– Whether loans are properly secured and not at terms prejudicial to theinterest of the shareholders.

– Whether transactions conducted by the company are not prejudicial tothe interest of the shareholders.

– Whether securities have been sold at the price, lower than cost.

Application activity 5.1

1. Identify how an auditor can minimise his/her liabilities in regards tohis/her audit responsibilities.

2. Develop a guideline showing how the auditor’s liabilities under privateaudit should be assessed.

5.2. Errors and frauds

Learning activity 5.2

A company found out some errors in the records of financial documents and

wanted to resort to auditor’s services to help the organisation in trackingerrors.

1. What types of errors the auditor may discover in the company’sfinancial records?

2. What are the procedures the auditor will apply to discover errors andfrauds?

5.2.1. Types of errors and frauds

a) Errors

Definition of error: an error is an unintentional misstatement in the financialstatements, including the omission of an amount or a disclosure.

Errors detected/ disclosed by the Trial Balance

The purpose of the T/B is to check the accuracy and validity of the books. Itspecifically detects the following errors:

• Single entry i.e. failing to complete double entry. e.g. cash sales wheresales A/C is credited but cash A/C not posted.

• Overcast (over debit or over credit of accounts) or undercast (undercredit or under debit of accounts).

• Two credits or two debits on the same side without the correspondingentries.

• Transfiguration or transposition i.e. changing figures by mistakeswhen posting e.g FRW 58, 000 as FRW 85,000.

• Summation or addition error e.g. if the total is FRW 40,000 and youtotal FRW 50, 000.

Errors not detected/disclosed by the trial balance

• Errors of original entry

These errors originate from source documents e.g. invoices, vouchers, receipts,

bank-paying sleep etc. These errors are carried throughout the accounting

process i.e. from the journal to the ledger to the trial balance and eventually tothe final accounts.

For example: goods were sold on credit for FRW 95,000, but was recorded inthe sales invoice as FRW 59, 000 and the same figure is journalized.

• Errors of Omission

These are errors of omitting transactions from all books of accounts. If a

transaction occurs and is not recorded anywhere, the T/B cannot detect such

an error. If for example goods were bought for cash of FRW 65,000 and entrieswere not made in the cash and purchases account.

• Errors of commission

These errors are committed when an entry is made on wrong person’s account

or account title but the double entry properly effected. For instance, goods

worth FRW 400,000 were sold to Jane on credit but Joan’s account was

debited instead of the correct account of Jane. The sales account being properlycredited.

• Errors of Principle

These are making entries on wrong classes or types of accounts. For instance,

if a capital expenditure for say purchase of a motor vehicle is made, and it is

debited to the purchases account instead of the correct motor vehicle account.

Or if an old fixed asset was disposed off and the proceeds from this disposal orsale is entered in the sales account

• Compensating errors

These errors cancel out in the trial balance. They are cancelled because the

error on one side of the T/B is compensated by a similar error on the other side

of the trial balance. For instance, if an item that appears on the debit side of theT/B

E.g, Purchases is overcast by FRW280,000 and by coincidence another account

that appear on the credit side of the trial balance says the sales account was

also overcast by FRW 280,000. These errors will neutralize each other and theTB will agree as if no error was made.

• Errors of complete reversal entries

These are committed when entries are made on wrong sides of the accounts. For

instance, if wages totaling FRW 3,500,000 were paid cash and the bookkeeperdebits the cash account and credits the wages account.

Material error is an error, which has a big effect on the accounting transactions

and has effect on the financial statements of a business. To help you decide

whether a particular item/transaction is material, you may consider looking atthe following:

– The effect on an individual financial statement as well as the whole set of

financial statements.

– The percentage of the possible error: for profit and loss account items,

we usually calculate the percentage with reference to the profit before

interest and tax figure. For Balance Sheet items, we usually calculate the

percentage with reference to the total share capital and reserves or the

total fixed assets. As a rule, an error less than 5% would be regarded as

immaterial.

– Recurring or non-recurring error: recurring errors must be investigated no

matter how small the percentage is. Recurring errors imply that there is a

problem with the accounting system, which should be followed up.

– Statutory requirement: In general, if an error does not seriously affect the

accounts users’ decisions, we do not worry about this minor mistake.

However, in the context of law, sometimes there is no room for the

materiality concept. For example, if the Companies Act requires that a

particular item must be disclosed in financial statements, it must be doneeven if the amount is only Frw1.

Immaterial error

Immaterial error is when an item is immaterial, we do not need to worry about itfor both qualitative and quantitative aspects.

Trial balance checking

• Check casts of the trial balance, lists of debtors and creditors.

• Establish the mount of difference.

• Check balances from personal and impersonal ledger into the trial

balance.

• While checking the balances, care must be taken to ensure that theclosing balances are correctly entered in the right column.

Short cut method

• Look for an item of half that amount which might have been entered onthe wrong side.

• If the difference is divisible by nine, it may mean an error of transpositionof figures (69 written as 96 or 86 written as 68, etc).

• If the difference is a round sum, it is probable that the mistake has beenmade in totals of trial balance or carry forward of its figures.

• If the difference is of large amount, it is advisable to compare the trial

balance with that of the previous year, in order to ascertain whether the

figures under the different heads of account are very near the same asthose of previous year.

Extensive checking

• Ascertain that all opening balances have been correctly brought forward

in the current year’s books.

• Check casts, cross casts and carry-forward the various books of

original entries and ledgers.

• If the ledgers are self-balancing, the work would be restricted to

checking the balances, postings and casts of only that ledger the trial

balance of which does not agree..

• The postings from the various subsidiary books should then be checked

into the impersonal ledger.

• The journal and subsidiary books should be scrutinized to see that the

total debits and credits of each entry tally and there were no un-tickeditems.

Measures to prevent errors

– Employ a strong internal control system and efficient internal check

system.

– Award employees reasonable salaries according to their qualifications

and experience. to reduce chance ofcommitting errors and raise theirmorale to work.

– Employment of qualified staff to prevent errors of principle.

– Institute an internal audit department where possible.

– Encourage clerks/staff to take their annual leave periodically so that their

work. Performance can be assessed in their absence and any errors they

had made revealed.

– Encourage inter-department transfers and rotation of duties at a surprise

moment so as to cut down the continuity of an error.

– There should a close supervision of duties; particularly in sensitive areas

of the business e.g. cash receipts and payments.

– Use specific reviews of what has taken place in any one given area.

– Use machines to record transactions e.g. adding machines, check-writing machines, etc.

– Management should insist on referees when engaging employeesespecially the accounting staff.

b) Fraud

Definition of fraud: fraud is an intentional misrepresentation of financial

information by one or more individuals among the management, employees or

third party collaboration in order to defraud the business on financial resourcesand assets. Example:

• Manipulation, falsification and alteration of record and document.

• Misappropriation of assets usually for personal use e.g. cash.

Types of the frauds

• Embezzlement of cash

This is the defalcation or misappropriation of moneyin, which you are responsible

in a business intentionally.

Cash may be misappropriated by:

– Omitting to enter any cash which has been received;

– Entering fewer amount than what has been actually received;

– Making fictitious entries on the payment side of the cashbook;

– Entering much amount on the payment side of the cashbook than whatactually has been paid.

• Misappropriation of goods

Misappropriation of goods is undersood as a cas where any may intentionallymisappropriate business goods for his/her personal use.

• Fraudulent manipulation of accounts

It is committed by directors or managers with a purpose of showing more profits

than what actually they are.This can be done to:

– Get a higher commission on profits;

– Ensure efficiency and smooth running of the business to shareholders;

– Obtain loans from financial institutions;– Attract more investors to join the business;

Showing less profits than what actually they are in order:

– To purchase shares in the market at a lower price;

– To reduce or avoid the payment of income tax;

– To give a wrong impression about the success of the business tocompetitors.

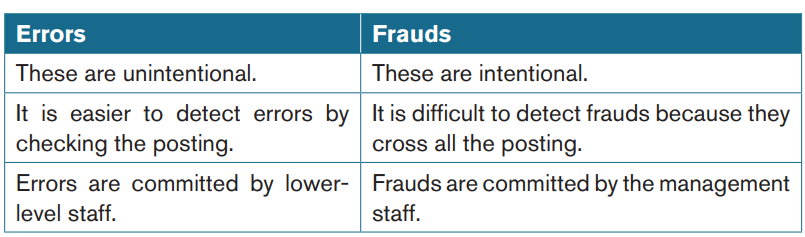

Difference between errors and frauds

Procedures of detecting errors and frauds

• Control of source documents

– Examination of documents that support a recorded transaction oramount.

– The direction of testing must be from the recorded item to thesupporting document.

– Tests existence or occurrence.

• Document tracing (from supporting document to recorded item)

– Primary test for unrecorded items and therefore tests thecompleteness assertion.

– The direction of testing must be from the supporting document to therecorded item.

Physical observation

– Auditor witnesses the physical activities of the client.

– Differs from physical examination because physical examinationcounts assets, while observation focuses on client activities.

• Direct confirmation

The receipt of a written or oral response from an independent third party

Auditor has client request that the third party respond directly to the auditor.

Positive Confirmations asks for response even if balance is correct. Negative

Confirmations asks for a response only if balance is incorrect. Examples: Banks– Confirm checking account and loan balances

• Analytical examination

Audits studies relationships among data. Unusual fluctuations occur when

significant difference are not expected but do exist or when significant

differences are expected but do not exist. Analytical examination is requiredduring the planning and completion phases on all audits.

• Examination of the annual accounts

This involves the review of the financial information by the auditor

5.2.2. Auditor’s responsibilities in relation to fraud

ISA 240 the auditor’s responsibility to consider fraud in an audit of financial

statements, states quite clearly in paragraph 240.13 that the primary responsibility

for the prevention and detection of fraud rests with the management and those

charged with governance of the entity. It is their responsibility to establish a

control environment to assist in achieving the orderly and efficient conduct of the

entity’s operations. It is up to them to put a strong emphasis on fraud prevention.

The auditor does not have a specific responsibility to prevent or detect fraud,

but he must consider whether it has caused a material misstatement in thefinancial statements.

Application activity 5.2

1. Establish measures an organisation should use in order to preventerrors

2. What are justifications clients could provide as proof for liablity of anauditor ?

Skills lab activity 5

In their learning teams, students will be shared the school accountinginformation system and documents, be requested to identify errors.

End unit 5 assessment

1. Define the following terms:

a) Error

b) Fraud

2. Describe the auditor’s liabilities towards the third parties.

3. Describe five (5) types of errors in audit

4. Describe the duties of an auditor

5. What are the types of frauds?

6. What are auditor’s responsibilities in relation to fraud?

7. What kinds of measures are to be put in place to prevent errors?

8. Describe the procedures, which can be used to detect errors andfraud