UNIT 4: AUDITOR’S REQUIREMENTS

Key unit competence: To be able to describe the auditor’s requirements

Introductory activity

Observe the above image then answer the following questions:

1. Why is it necessary for an auditor to have rights during the audit

work?

2. What can happen to the auditor who does not perform well some of

his/ her duties?

3. How do we call the specific characteristics that can allow someone

to be an auditor?

4. How do we call the specific characteristics that can’t allow someoneto be an auditor?

4.1. Qualifications and disqualifications of an auditor

Learning activity 4.1

Observe the image above then answer the following questions:

1. What do you think those people are discussing about ?

2. Is it possible that the Board of Directors can select the manager’s

wife as an auditor of the company? If Yes or No, explain.

3. What can happen if the Board of Directors decide to select the

manager’s wife?

4. Are there any sanctions to the auditor who accepts the appointmentafter knowing that he/she is not eligible?

4.1.1. Qualifications of an auditor

A person to be appointed as an auditor of a company is required to hold some

specific qualifications. These qualifications are given in company’s Act of thecountry.

This section answers the following question: “Who can be an auditor”? Thefollowing are his/her qualifications and requirements:

• To be a member of one or more of the professional bodies which is

specified in the first column of the accountants for example ICPAR,ICPAK, ICPAU and ACCA;

• Anyone authorized by the registrar of companies to do so (Should be aholder of a degree in accounting and have been in auditing environment);

• Must have passed a final exam of CPA, ACCA, CA;

• Must ensure that he/she has adherence to professional ethics;

• Must have a post-graduate experience in an auditing environment ofnot less than two years;

• Must be holding a practicing certificate given by the ProfessionalAccountancy body like ICPAR, ICPAU, ACCA, and ICPAK.

4.1.2. Disqualifications of an auditor

This refers to the question of who cannot be an auditor. The following are parties

who cannot be auditors:

• An officer or servant of the company-which means that an employee of

a company cannot perform his/her own audit;

• A person who is partner or who is in employment of an officer of the

company being audited;

• A person who was the director, employee or any other officer of the

company to be audited, during three preceding years;

• The spouse or any other relative of a director of the company;

• Persons who are disqualified as auditors of the company’s subsidiary

or holding company or a subsidiary of a company’s holding company;

• Body corporate -These are in form of limited companies. These cannot

be auditors because of the following reasons;

– These have limited liabilities status and if allowed to be auditors,

this will expose the client to limited liabilities, which may ultimately

lead to heavy losses.

– Limited companies cannot express personal opinion, yet the

Companies Act requires that the audit report contain an opinion

paragraph (personal opinion) which millions of shareholders-owners

of a limited company cannot express.

• A person who is indebted to the company for quite large sum of money

or has given guarantee or security in connection with indebtness to anyparty who received or got such indebt ness;

• Directors, shareholders, managing agents, secretaries and treasures ofthe company;

• A person who is holding more than 5% of the company’s authorizedshare capital.

Application activity 4.1

SCENARIO

KBC is a limited company that sells rice and sugar, MUGABO is the General

Manager engaged by shareholders. KBC Ltd has shareholders in the whole

country, and some of them don’t have enough time to look at the performance

of their business. After Covid-19 pandemic period some shareholders didn’t

receive their dividends due to the loss reported by the managment and

was disclosed in the financial stements of the company for the period for

the perioded ended 31December 2020. They had doubt that the financial

statements were manipulated by the management. They decided to appoint

an external auditor and requested MUGABO to look for a qualified auditor

who can help them to know what had happened. MUGABO appointed his

nephew TOTO as an external auditor. He perfomed the audit of the company

and confirmed the same loss.

Required:Specify the basis for disqualifications of an auditor.

4.2. Rights and removal of an auditor

Learning activity 4.2

Observe the above image then answer the following questions:

1. Is it necessary that an auditor must have specific rights? If Yes or No,

explain.

2. What can happen if the client refuses to give to the auditor some of

his/her rights?

3. What can happen to an auditor who does’nt perform well some ofhis/her duties?

4.2.1. Rights and duties of an auditor

a) Rights of auditors

The auditors must have certain rights to enable them to carry out their duties

effectively. The principal rights auditors should have, excepting those dealingwith resignation or removal, are set out below:

• Right to access to the books of accounts of the organization at alltimes

– The auditor has a right to access to those books, which may bekept in the business and elsewhere.

– Right to receive returns submitted by the branch office to headoffice.

“Books” will include books of accounts, statutory books (Memorandum, and

articles), statistical books, costing books, minute books and all vouchers ofwhatever nature.

• Right to request and receive

The auditor has the right to request and receive from officers of the company

such information and explanations as they consider as necessary for theperformance of their duties.

• Right to receive a notice of 21 days to attend the Annual GeneralMeeting

The auditor has the right to receive a notice of 21 days to attend the Annual

General Meeting or Extra-Ordinary Annual General Meeting regardless of

whether accounts are discussed at the same annual general meeting, but can

only speak at this annual general meeting if the accounts are subjected todiscussion.

• Rights to make a statement at the Annual General Meeting

The statement must be to do with accounts under discussion, and is bound

to answer only those questions concerning the accounts if there pass through

the Chairman of the annual general meeting. He/she has the right to correct

wrong statements given by directors to do with accounts. He/she cannot cover

omissions in the report through his/her statements at the annual general meetingin exercising this right.

• Right to be indemnified

He/she can be indemnified out of the company’s assets against any liabilities

incurred by him/her defending his/her name if this was tarnished by the companyin any manner.

• Right to visit the company’s branches

The statutory auditor has a right to visit the company’s branches provided if

these have no qualified auditor. During this visit, he/she has a right to over all

books of accounts and vouchers of the same branch and has a right to accessto returns (the returns the same branch has submitted to the head office).

• Rights to take legal and technical advice

The auditor has a right to obtain advice from such experts as engineers, lawyers,

solicitors and valuers. However, this advice must be interpreted from the

auditor’s own understanding of the prevailing circumstances in order to arriveat an opinion.

• Right to Remuneration

The auditor has the right to receive his/her fees provided after the completionof the audit work.

His/her work or if dismissed unlawfully during the course of the year, he/she hasa right to the full year’s fees.

• Remuneration of an auditor

– If appointed by directors, they will fix his/her fees and expenses.

– If appointed by the Registrar, he/she fixes his/her remuneration in liaison

with Directors.

– If appointed by shareholders, the same fix his/her fees or can delegate

the powers to the Directors.

– A retiring auditor who is automatically re-appointed at the AGM,

unless a resolution is passes re-fixing his/her fees is entitled the same

remuneration as in the previous periods.

– If the auditor is required to do any other work other than his/her normal

work, e.g. to prepare tax return, he/she is entitled to extra remuneration

for that.

– If an auditor is removed in the way prejudicial to his/her interest, e.g.

unlawfully, he/she is entitled to a full year fees.

– Any sum paid in respect of expenses to the auditor is part of his/herremuneration and should be reflected in the P&L Account.

• Right to sign the Auditor Report

An auditor or one partner in the firm of the auditors has a right to sign an audit

report or authenticate any documents which the companies Act requires the

auditor to sign e.g. a prospectus, engagement letter; interim report for payment

of interim dividends, bankers reference to do with the company’s financialstrength, a report of the company’s affairs when the management are resigning.

• Rights in relation to written resolutions

A right to receive a copy of any written resolution proposed.

• Right to be heard at any general meeting

On any part of the business of that meeting, that concerns them as auditors.

If auditors have not received all the information and explanations they consider

necessary, they should state this fact in their audit report.

The companies Act make it an offence for a company’s officer knowingly or

recklessly to make a statement in any form to an auditor which:

– Conveys or purports to convey any information or explanation required

by the auditor; and– Is misleading, false or deceptive in a material particular.

b) Duties of an auditor

The auditors are required to report on every balance sheet (statement of financial

position) and profit and loss account (statement of comprehensive income) laidbefore the company in general meeting.

The auditor must consider the following:

• Compliance with legislation;

• Truth and fairness of accounts;

• Adequate accounting record and returns;

• Agreement of account to records;

• Consistency of other information;• Director’s benefits.

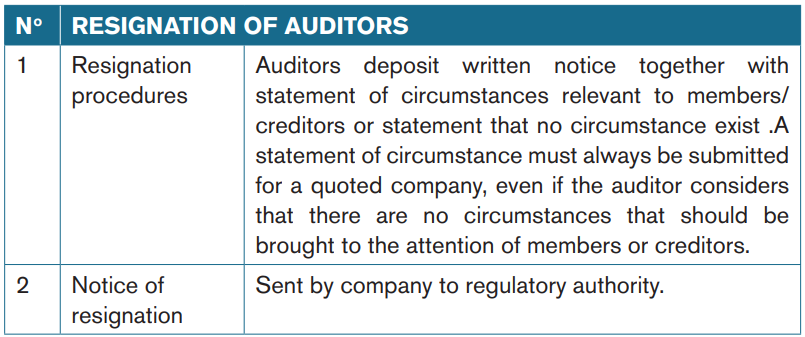

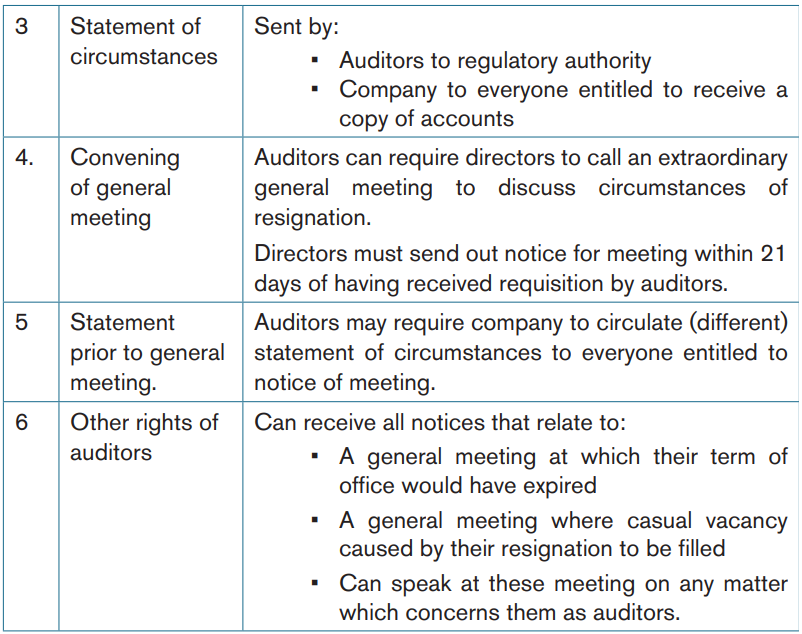

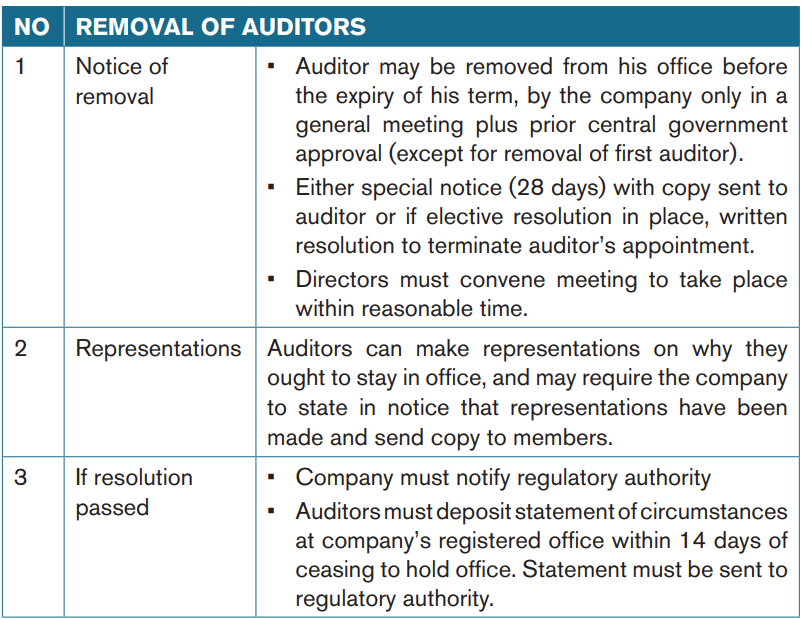

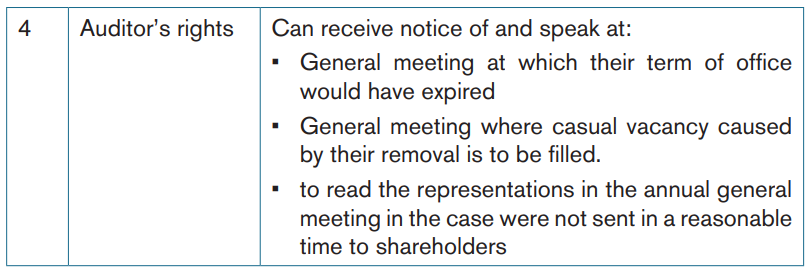

4.2.2. Resignation and removal of an auditor

Companies Act places a requirement on auditors to notify the appropriate audit

authority in certain circumstances on leaving office.

If it is a major audit (quoted company or major public interest company), thenotification must be given whenever an auditor ceases to hold office.

If it is not a major audit, the notification is only required if the auditor is leavingbefore the end of his term of office.

The appropriate audit authority is:

• Secretary of state or delegated body (such as the Rwanda professionaloversight board) if a major audit;

• Recognised supervisory body (e.g. ICPAR) for other audits.

Notice must inform the appropriate audit authority that the auditor has ceased

to hold office and be accompanied by a statement of circumstances or nocircumstances.

Application activity 4.2

1. A company’s auditor can be removed before expiry of his/her term by

one of the following:

A. Shareholders

B. Board of directors

C. Central government

D. State government

E. A and B are correct answers

F. All of the above

2. Remuneration of a company’s auditor is fixed by one of the following :

A. Shareholders

B. Board of directors

C. Central government

D. Appointing authorityF. All of the above

3. Which among the following is not a duty of the auditor:

A. Checking errors and frauds

B. Correcting errors and frauds

C. Vouching with original documents

D. Preparing final accountsE. No one of the above.

4. The duties of internal auditor are defined /given by :

A. Companies Act

B. Company low board

C. Management

D. A and C are correct answersE. All of the above

Skills lab activity 4

With the help of a teacher, students should be required to identify therights of an auditor and their applications.

End unit 4 assessment

1. While conducting the audit of a limited liability company for the year ended 31st March 2021, the auditor wanted to refer to the minute books. The management refused to provide the minute books to the auditor.

Required:

Specify one of the rights of the auditor.

2. Mugabo Ltd was formed on 1st August 2021 to manufacture

computers, the directors are unsure to their responsibilities and

the nature of their relationship with the external auditors. The audit

partner has asked you to visit the client and explain to the directors

more about the fundamental aspect of the accountability of thecompany and their relationship with the auditors.

Required:

What the auditors’ rights under the companies Act?