UNIT 13: AUDIT JUDGEMENT

Key unit competence: To be able to form an audit judgement

Introductory activity

Auditors are required to plan and conduct the audit in conformity

withIinternational Standards on Auditing. The standards require an auditor

to plan and conduct the audit accordingly and provide the appropriate audit

opinion on the audited financial statements.

The auditors may issue unqualified or qualified opinion. In the process of

deciding on the appropriate audit opinion, there are cases where an auditor

is obliged to make judgements. Making the appropriate judgements depends

on the auditor’s experience and skills. This calls for an auditor to perform

the audit of financial statements and make proper judgments with view of

forming an audit opinion.

1. In what circumstances do you think the auditor can make judgements?

13.1. Form of audit judgement

Learning activity 13.1

Look at the image above and answer the following questions:

1. What do you see on the above image?

2. When and why an auditor needs to make judgement.

13.1.1. Overall review of financial statement

a. The meaning of audit judgement

Audit judgement can be defined as any decision or evaluation made by an

auditor, which influences or governs the process and outcome of an audit of

financial statements.

b. Financial statements and related disclosures refer to a company’s

financial statements and notes to the financial statements as presented in

accordance with Generally Accepted Accounting Principles (GAAP)

c. Review of financial statements

Auditors must perform and document an overall review of the financial statements

before reaching an opinion. This review should include a review of accounting

policies and a review for consistency and reasonableness.

The auditors will have a draft set of financial statements which should be

supported by appropriate and sufficient audit evidence when the bulk of the

substantive procedures have been carried out. At the beginning of the end of

the audit process, it is usual for the auditors to undertake an overall review of

the financial statement.

Compliance with accounting regulations/policies

The auditors should consider whether:

• The information presented in the financial statements is in accordance

with local/national statutory requirements

• The accounting policies employed are in accordance with accounting

standards, properly disclosed, consistently applied and appropriate to

the entity.

When examining the accounting policies, auditors should consider:

• Policies commonly adopted in particular industries

• Policies for which there is substantial authoritative support

• Whether any departures from applicable accounting standards are

necessary for the financial statements to give a true and faire view

• Whether the financial statements reflect the substance of the underlying

transactions and not merely their form.

Review for consistency and reasonableness

• The auditors should consider whether the financial statements are

consistent with their knowledge of the entity’s business and with the

results of other audit procedures, and the manner of disclosure is fair. The

principal considerations are as follows: whether the financial statements

adequately reflect the information and explanations previously obtained

and conclusions previously reached during the course of the audit.

• Whether it reveals any new factors which may affect the presentation

of, or disclosure in, the financial statements.

• Whether analytical procedures applied when completing the audit,

such as comparing the information in the financial statements with

other pertinent data, produce results which assist in arriving at the

overall conclusion as to whether the financial statements as a whole

are consistent with the knowledge of the entity’s business.

• Whether the presentation adopted in the financial statements may have

been unduly influenced by the director’s desire to present matters in a

favourable or unfavourable light.

• The potential impact on the financial statements of the aggregate of

uncorrected misstatements (including those arising from bias in making

accounting estimates) identified during the course of the audit and the

preceding period’s audit, if any.

Analytical procedures

Analytical review procedures are used as part of the overall review procedures at

the end of an audit, but key factors which should be reviewed include: important

accounting ratios, variances and variations caused by industry or economic

factors.

The auditors would also discuss business matters with the directors, such

as changes in the sales mix, price rises, wages increases, and see if the

directors’ comments about such matters made sense of the figures in the

financial statements.

For example: if a director said that everyone had received a pay increase of 3%,

this would make sense of small rise in wages cost although no new staff had

been hired. The auditors would verify this explanation by looking to see if the

payroll reflects this 3% rise.

The auditors also assess if there are any areas in the financial statements which

are significantly different from the previous financial statements and obtain

explanations from these. At this stage, the auditor is concerned whether the

financial statements are internally consistent, so predictable relationships in

particular will be important.

ISA 700 states that forming an opinion as to whether the financial statements

give a true and fair view involves evaluating the fair presentation of the financial

statements.

The auditor must consider:

• Whether the financial statements (after any adjustments as a result of

the audit process) are consistent with the auditor’s understanding of

the entity and its environment

• The overall presentation, structure and content of the financial

statements

• Whether the financial statements, including disclosures in the notes,

faithfully represent the underlying transactions and events.

Analytical procedures performed at or near the end of the audit help corroborate

conclusions formed during the audit and assist in arriving at the overall

conclusions regarding fair presentations.

13.1.2. Events after the end of the period

The auditors should consider the effect of subsequent events on the financial

statements, up to the date the financial statements are signed

a) Subsequent events

Subsequent events are events occurring between the date of the financial

statements and the date of the auditor’s report, and facts that become known

to the auditor after the date of the auditor’s report. (ISA 560).

Subsequent events include:

• Events occurring between the end of the reporting period and the date

of the auditor’s report

• Facts discovered after the date of the auditor’s report

b) Events after the reporting period

Events after the reporting period deal with the treatment in financial statements

of events, both favourable and unfavourable, occurring after the period-end.

There are two types of events:

Adjusting events: are those that provide further evidence of conditions that

existed at the end of reporting period

Non-adjusting events: are those that are indicative of conditions that arose

after the end of the report period.

Events occurring up to the date of the auditor’s report ISA 560.6

The auditor shall perform procedures designed to obtain sufficient appropriate

audit evidence that all events occurring between the date of the financial

statements and the date of the auditor’s report that require adjustment of, or

disclosure in, the financial statements have been identified.

These procedures should be applied to any matters examined during the audit

which may be susceptible to change after the period end. They are in addition

to tests on specific transactions after the date of the financial statements, e.g.

cut-off tests.

Depending on the auditor’s risk assessment, procedures may involve the review

or testing of accounting records or transactions occurring between the date of

the financial statements and the auditor’s report.

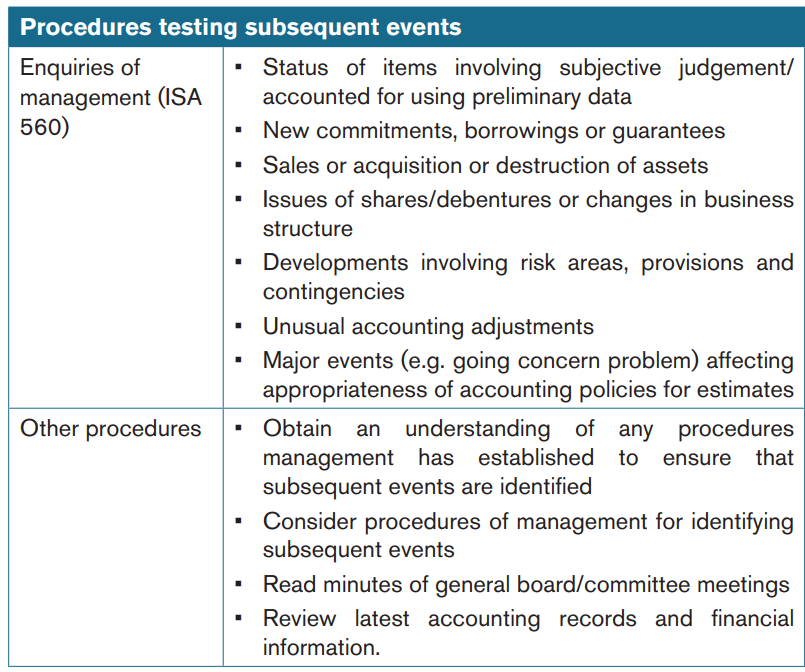

The ISA lists procedures to identify subsequent events which may require

adjustments or disclosures. They should be performed as near as possible to

the date of the auditor’s report. (ISA 560.7)

Reviews and updates of these procedures may be required, depending on the

length of the time between the procedures and the signing of the auditor’s

report and the susceptibility of the items to change over time.

ISA 560.8

If the auditor identifies events that require adjustment of, or disclosure in, the

financial statements the auditor shall determine whether each such event is

appropriately reflected in those financial statements in accordance with the

applicable financial reporting framework.

The ISA also requires the auditor to obtain written representations confirming

that all subsequent events have been adjusted or disclosed.

ISA 560.9

The auditor shall request management and, where appropriate, those charged

with governance, to provide a written representation that all events occurring

subsequent to the date of the financial statements and for which the applicable

financial reporting framework requires adjustment or disclosure have been

adjusted or disclosure.

13.1.3. Going concern

The auditor should communicate to the audit committee, when applicable, the

following matters relating to the auditor’s evaluation of the company’s ability to

continue as a going concern:

• If the auditor believes there is substantial doubt about the company’s

ability to continue as a going concern for a reasonable period of time, the

conditions and events that the auditor identified that, when considered

in the aggregate, indicate that there is substantial doubt.

• If the auditor concludes, after consideration of management plans, that

substantial doubt about the company’s ability to continue as a going

concern is alleviated, the basis for the auditor’s conclusion, including

elements the auditor identified within management’s plans that are

significant to overcoming the adverse effects of the conditions and

events.

• If the auditor concludes, after consideration of management’s plans,

that substantial doubt about the company’s ability to continue as a

going concern for a reasonable period of time remains:

– The effects, if any, on the financial statements and the

adequacy of the related disclosure; and– The effects on the auditor’s report.

Factors considered when management make an assessment on going

• The degree of uncertainty about the events or conditions being

assessed increases significantly the further into the future theassessment is made.

• Judgements are made on the basis of the information available at thetime.

• Judgements are affected by the size and complicity of the entity, the

nature and condition of the business and the degree to which it isaffected by external factors.

The examples of possible indicators of going concern problems are as follows:Financial indications

• Net liabilities or net current liability position where the company has

more liabilities than assets

• The company needs borrowing facilities which have not been agreed

• Relying too heavily on short-term borrowing

• Major debt repayment falling due where the company will need to

borrow again if it can

• Major restructuring of debt – this may indicate difficulties in repaying

the debt which in turn may indicate going concern issues.

• Indications that creditors want to call in loans

• Negative operating cash flows in budgets or financial statements

• Major losses or cash flow problems which have arisen since the

reporting date

• The company stopped paying dividends or falling behind in paying them

• Inability to pay suppliers’ invoices (payables) on due dates

• Inability to comply with terms of loan agreements

• Reduction in normal terms of trade credit by suppliers

• Change from credit to cash-on-delivery transactions with suppliers

• Inability to obtain financing for essential new product development or

other essential investments• Substantial sales of non-current assets not intended to be replaced

Operating indications

• Loss of key management without replacement

• Loss of key staff without replacement• Loss of a major market, franchises, licence, or principal supplier

• Labour difficulties or shortages of important supplies as this would

prevent the company from carrying out its business and eventually its

ability to remain in business

• Fundamental changes in market or technology

• Excessive dependence on a few product lines where the market is

depressed• Technical developments which render a key product obsolete

Other indications

• Non-compliance with capital or other statutory requirements

• Pending legal proceedings against the entity that may, if successful,

result in judgements that could not be met

• Changes in legislation or government policy

• Issues which involve a range of possible outcomes so wide that an

unfavourable result could affect the appropriateness of the goingconcern basis

The significance of such indications can often be mitigated/reduced by other

factors.

• The effect of an entity being unable to make its normal debt repayments

may be counterbalanced by management’s plans to maintain adequate

cash flows by alternative means, such as by disposal of assets,

rescheduling of loan repayments, or obtaining additional capital.

• The loss of a principal supplier may be mitigated by the availability of asuitable alternative source of supply.

13.1.4. Written representations

a) The meaning of key concepts

• Written representation

Written representations are written statements by management, provided to theauditor, to confirm certain matters or to support other audit evidence.

• Management

Management can be defined as the person (s) with executive responsibility forthe conduct of the entity’s operations.

b) Acknowledgement by Management of their responsibilitiesThe auditor shall request management to provide a written representation that:

• It has provided the auditor with all relevant information and access asagreed in the terms of the audit engagement; and

• All transactions have been recorded and are reflected in the financialstatements.

Audit evidence obtained during the audit that management has fulfilled the

responsibilities is not sufficient without obtaining confirmation from managementthat it believes that it has fulfilled those responsibilities.

For example, the auditor could not conclude that management has provided the

auditor with all relevant information agreed in the terms of the audit engagement

without asking it whether, and receiving confirmation that, such information hasbeen provided.

c) Representations by management as audit evidence

The auditor should obtain written representations from management on matters

material to the financial statements when other audit evidence cannot reasonably

be expected to exist. It may be necessary to inform management of the auditor’sunderstanding of materiality.

The possibility of misunderstandings between the auditor and management is

reduced when oral representations are confirmed by management in writing.The auditor should obtain written representations from management that:

– It acknowledges its responsibility for the design and implementation ofinternal control to prevent and detect error; and

– It believes the effects of those uncorrected financial misstatements

aggregated by the auditor during the audit are immaterial to thefinancial statements taken as a whole.

During the course of an audit, management makes many representations to

the auditor, either unsolicited or in response to specific inquiries. When such

representations relate to matters which are material to the financial statements,the auditor will need to:

– Seek corroborative audit evidence from sources inside or outside theentity,

– Evaluate whether the representations made by management appearreasonable and consistent with other audit evidence obtained and

– Consider whether the individuals making the representations can be

expected to be well informed on the particular matters.

Representations by management cannot be a substitute for other audit evidence

that the auditor could reasonably expect to be available. If the auditor is unable

to obtain sufficient appropriate audit evidence regarding a matter which has a

material effect on the financial statements and such audit evidence is expected

to be available, this will constitute a limitation in the scope of the audit, even if arepresentation has been received on the matter.

In certain instances, audit evidence other than that obtained by performing

inquiry may not be reasonably expected to be available; therefore the auditorobtains a written representation by management.

If a representation by management is contradicted by other audit evidence, the

auditor should investigate the circumstances and, when necessary, reconsiderthe reliability of other representations made by management.

ISA 580 lists a number of other ISAs which require specific writtenrepresentations. These include the following:

• The effect of uncorrected misstatements is immaterial, both individual

and in aggregate

• All known actual possible litigation and claims have been disclosed

• Whether assumption used in making accounting estimates are

reasonable

• All subsequent events requiring adjustment or disclosure have been

adjusted for or disclosed• Future actions and feasibility of plans relating to going concern issues.

Documentation of written Representations by Management

The auditor would ordinarily include, in audit working papers, evidence of

management’s representations in the form of a summary of oral discussionswith management or written representations from management.

A written representation is ordinarily more reliable audit evidence than an oralrepresentation and can take the form of:

• A representation letter from management,

• A letter from the auditor outlining the auditor’s understanding of

management’s representations, duly acknowledged and confirmed by

management,

• Relevant minutes of meetings of the board of directors or similar body

or a signed copy of the financial statements.

Basic elements of a representation letter

A representation letter should:

• Be addressed to the auditors

• Contain specified information

• Be appropriately dated and signed by the management. It wouldordinarily be dated the same date as the auditor’s report.

Actions if management refuse to provide representations

If management does not provide one or more of the requested writtenrepresentations the auditor shall:

• Discuss the matters with management;

• Re-evaluate the integrity of management and evaluate the effect that

this may have on the reliability of representations and audit evidence ingeneral; and

• Take appropriate actions, including determining the possible effect onthe opinion in the auditor’s report;

In these circumstances, the auditors should consider whether it is appropriateto rely on other representations made by management during the audit.

13.1.5. Completion

a) Summarising uncorrected misstatements

Misstatement is a difference between the amounts, classification, presentation,

or disclosure of a reported financial statement item and the amount, classification,

presentation, or disclosure that is required for the item to be in accordance with

the applicable financial reporting framework, and can arise either from error orfraud. (IFAC, 2016)

The auditor should consider the cumulative effect of uncorrected misstatements.

The summary of uncorrected misstatements will not only list misstatements

from the current year, but also those in the previous year(s). This will allow

uncorrected misstatements to be highlighted which are reversals of uncorrected

misstatements in the previous year, such as in the valuation of closing/opening

inventory. Cumulative uncorrected misstatements may also be shown, which

have increased from year to year. It is normal to show both the statement of

financial position and the statement of profit or loss and other comprehensiveincome effect, as in the example given here.

b) Evaluating the effect of misstatements

Misstatements, including omissions are considered to be material if they,

individual or in the aggregate, could reasonably be expected to influence the

decisions of users taken on the basis of the financial statements.

The concept materiality is applied by the auditor both in planning and performing

the audit, and in evaluating the effect of identified misstatements on the audit

and of uncorrected misstatements, if any, on the financial statements and informing the opinion in the auditor’s report.

The aggregate of uncorrected misstatements comprises:

• Specific misstatements identified by the auditors, including the net

effect of uncorrected identified during the audit of the previous periodif they affect the current period’s financial statements;

• Their best estimate of other misstatements which cannot bequantified specifically (ie .projected errors).

If the auditors consider that the aggregate of misstatements may be material, they

must consider reducing audit risk by extending audit procedures or requesting

management to adjust the financial statements (which management may wishto do anyway).

If management refuses to correct some or all of the misstatements communicated

by the auditor, the auditor shall obtain an understanding of management’s

reasons for not making the corrections and shall take that understanding into

account when evaluating whether the financial statements as a whole are freefrom material misstatement.

The auditor shall request a written representation from management and, where

appropriate, those charged with governance whether they believe the effects of

uncorrected misstatements are immaterial, individually and in aggregate, to thefinancial statements as a whole.

If the aggregate of the uncorrected misstatements that the auditors have

identified approaches the materiality level, the auditors should consider

whether it is likely that undetected misstatements, when taken with aggregated

uncorrected misstatements, could exceed the materiality level. Thus, as

aggregate uncorrected misstatements approach the materiality level the auditorsshould consider reducing the risk by:

– Performing additional audit procedures;

– Requesting management to adjust the financial statements foridentified misstatements.

The schedule will be used by the audit manager and partner to decide whether

the client should be requested to make adjustments to the financial statementsto correct the errors.

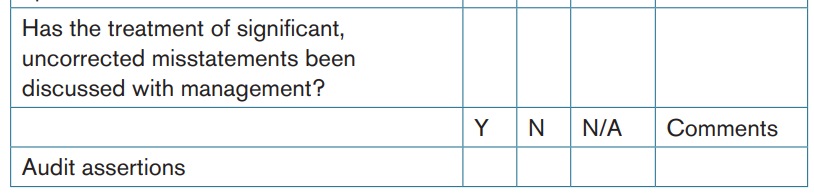

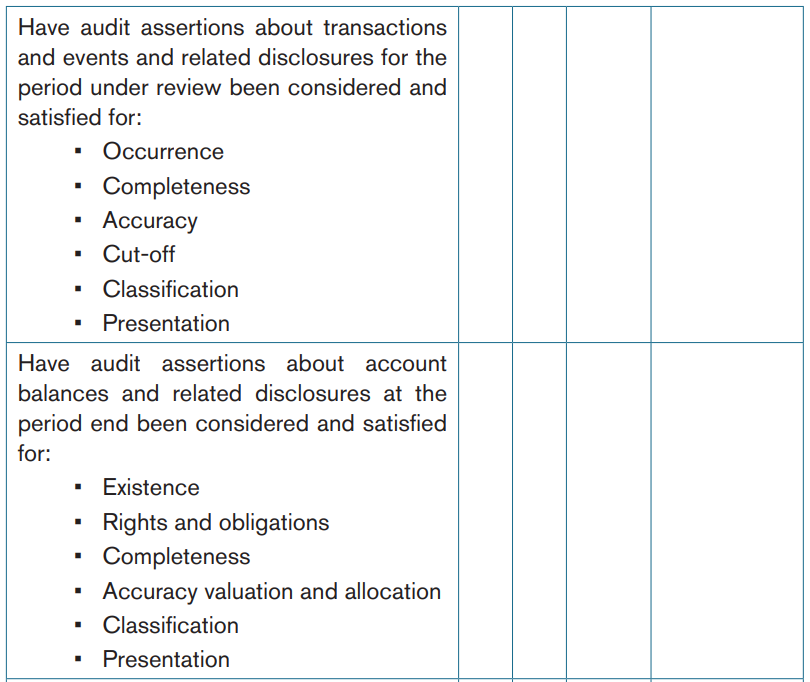

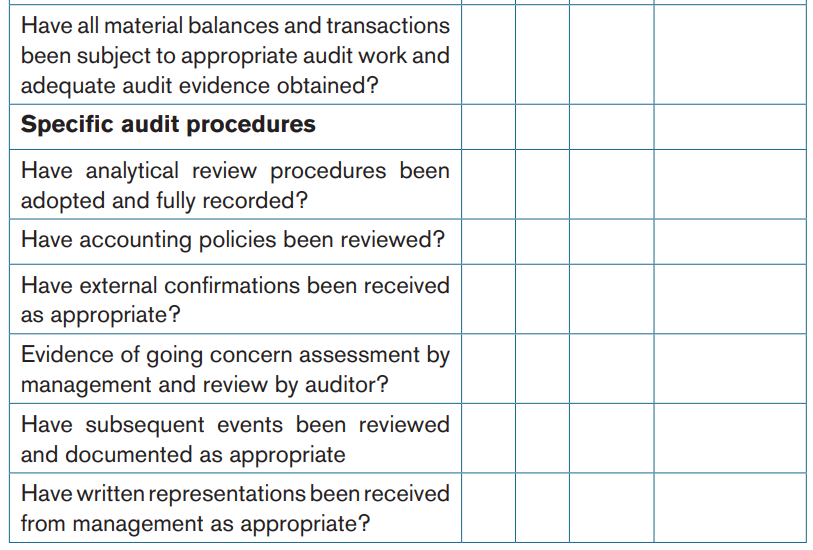

c) Completion checklists

Audit firms frequently use checklists (which must be signed off) to ensure that

all final procedures have been carried out, all material amounts are supportedby sufficient appropriate evidence, and so forth.

For example, extracts from an audit checklist might contain the following points:

Application activity 13.1

Questions

1. What are the principal considerations in a review of the financialstatements for consistency and reasonableness?

2. In certain instances, audit evidences other than that obtained by

performing inquiry may not be reasonably expected to be available.

Therefore the auditor obtains a written representation frommanagement.

Identify the actions that be taken by the auditor if the managementrefuse to provide the representation.

Skills lab activity 13

In their learning team, with guidance of a teacher, students will formulateaudit judgement.

End unit 13 assessment

1. Identify the main purposes of a representation letter and how far can

auditors rely on the audit evidence it provides?

2. What matters should auditors consider when examining accounting

policies?

3. What are the two types of subsequent events?

4. What are the consequences regarding the realisation of assets and

liabilities if the going concern basis of accounting is not appropriate?

5. Which of the following statements concerning written representations

is true?

a. Written representations are appropriate evidence when evidence

the auditors expected to be available is unavailable.

b. If written representations given do not agree with other evidence,

auditors should not trust any other representations made by

management during the course of the audit.

c. The representation letter must not be dated after the auditor’s

report.

d. The representation letter must contain a list of all materialadjustments to the final financial statements.