UNIT 12: PROCEDURES IN AUDIT OF FINANCIAL STATEMENTS

Key unit competence: To be able to demonstrate working knowledge in

respect of performance of audit procedures

Introductory activity

UMURAVA Ltd Company is a textile industry with the purpose of selling

its products in Rwanda and outside. As part of corporate governance,

shareholders are supposed to make follow up of the performance of their

company. They often appoint the management and auditor. The auditor is

appointed by the shareholders during the annual meeting.

The main responsibility of the auditor is to audit the financial statements of

the company and ascertain whether the financial statements are prepared

in all material respects and free from material misstatement due to errors

and fraud. The auditor should also review/ carry out an assessment on the

internal control. Thereafter, the auditor should issue the audit report on

financial statements and on internal controls (Management letter).

1. What do you think could be the purpose of the audit?2. What are the auditable elements of the financial statements?

12.1. Substantive procedures

Learning activity 12.1

1. What do you think the person in picture above could be doing?

2. What do you think would be roles/tasks of the auditor during theaudit of a financial statement?

12.1.1 The nature of substantive procedures

Substantive procedures are audit procedures designed to detect material

misstatements at the assertion level. They consist of tests of details (i.e.

testing classes of transactions, accounts balances and disclosures) and as

well substantive analytical procedures (i.e. where the auditor develops his/herexpectations and reconcile it with balances shown in the financial statements.

a) Substantive procedures

Substantive audit procedures (tests of details), the auditor inspects transactions

and balances taken on sample basis. The auditor is required to establish the

audit procedures and carryout audit. Detailed audit tests are performed todetect any material misstatement due to errors or fraud.

b) Analytical procedures

Analytical procedures are also another form of substantive procedures.

• The analytical procedures involve comparison with:

– Similar information for prior periods;

– Anticipated results of the entity, from budgets or forecasts;– Predictions prepared by the auditor’s Industry information.

• The consideration of the relationship between financial information and

relevant non-financial information.

• The consideration also of the relationship between elements of financial

information that are expected to conform to a predicted pattern based

on the entity’s experience, such as the relationship of gross profit to

sales.

• Ratio analysis can be a useful technique when carrying out analyticalprocedures.

12.1.2. Financial statement assertions

Financial statement assertions are the representations by management, explicit

or otherwise, that are embodied in the financial statements, as used by the

auditor to consider the different types of potential misstatements that may occur.

Audit tests are therefore designed and performed to obtain the appropriate and

sufficient audit evidences about the financial statements assertions. Assertions

relate to:

• Classes of transactions,

• Accounts balances

• Disclosures

a) Assertions about classes of transactions and events and disclosures(related to Income statement)

• Occurrence: transactions and events that have been recorded or

disclosed have occurred, and such transactions and events pertain tothe entity.

• Completeness: all transactions and events that should have been

recorded have been recorded, and all related disclosures that shouldhave been included in the financial statements have been included.

• Accuracy: amounts and other data relating to recorded transactions

and events have been recorded appropriately, and related disclosureshave been appropriately measured and described.

• Cut-off: transactions and events have been recorded in the correctreporting period.

• Classification: transactions and events have been recorded in theproper accounts.

• Presentation: transactions and events are appropriately aggregated or

disaggregated and are clearly described, and related disclosures are

relevant and understandable in the context of the requirements of theapplicable financial reporting framework.

b) Assertions about account balances and related disclosures (relatedfinancial position)

• Existence: assets, liabilities and equity interests exist.

• Rights and obligations: the entity holds or controls the rights to assets,and liabilities are the obligations of the entity.

• Completeness: all assets,aliabilities and equity interests that should

have been recorded have been recorded, and all related disclosures

that should have been included in the financial statements have beenincluded.

• Accuracy, valuation and allocation: assets, liabilities and equity

interests have been included in the financial statements at appropriate

amounts and any resulting valuation or allocation adjustments have

been appropriately recorded, and related disclosures have beenappropriately measured and described.

• Classification: assets, liabilities and equity interests have beenrecorded in the proper accounts.

• Presentation: assets, liabilities and equity interests are appropriately

aggregated or disaggregated and clearly described, and related

disclosures are relevant and understandable in the context of therequirements of the applicable financial reporting framework.

12.1. Methods of obtaining audit evidences

During the audit, the auditor has to collect sufficient and appropriate evidences

to support his or her conclusion. The audit evidences are collected in thefollowing ways;

• Inspection: inspection involves examining records or documents,

whether internal or external, in paper form, electronic form, or othermedia, or a physical examination of an asset.

• Observation: observation consists of looking at a process or procedure

being performed by others. For example: is where an auditor can attendinventory counts.

• External confirmation: an external confirmation represents audit

evidence obtained by the auditor as a direct written response to theauditor from a third party.

• Recalculation: recalculation consists of checking the mathematical

accuracy of documents or records. Recalculation may be performedmanually or electronically.

• Reperformance: reperformance involves the auditor’s independent

execution of procedures or controls that were originally performed aspart of the entity’s internal control.

• Analytical procedures: analytical procedures consist of evaluations of

financial information through analysis of plausible relationships among

both financial and non-financial data. Analytical procedures also look

at identified fluctuations or relationships that are inconsistent with fromthe expected values.

• Inquiry: inquiry consists of seeking information of knowledgeable

persons, both financial and non-financial, within the entity or outside

the entity. Inquiry is used extensively throughout the audit in addition to

other audit procedures. Inquiries may range from formal written inquiriesto informal oral inquiries.

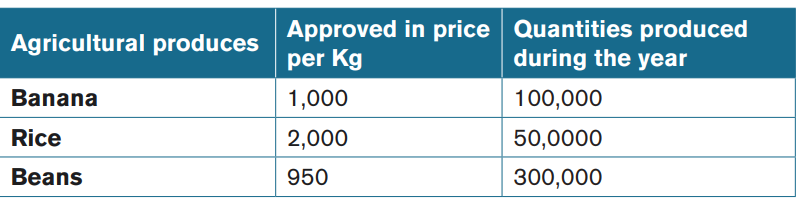

Exercise on analytical procedures

The audit XY Company is a company that is involved in sale of its agricultural

produces. The company planned to obtain sales revenue amounting to FRW

300,000,000 for sales during the year. The table below indicates different

agricultural produces, quantities produced and their respective prices. You

are required to audit the above revenue amount disclosed in XY Company’sfinancial statements for the period ended 31 Dec 2021.

As an auditor of XY Company, establish how can carry out your substantive

audit procedures and conclude on the revenue amount indicated above.

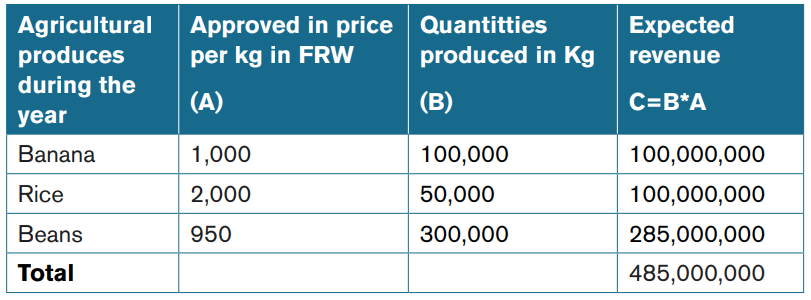

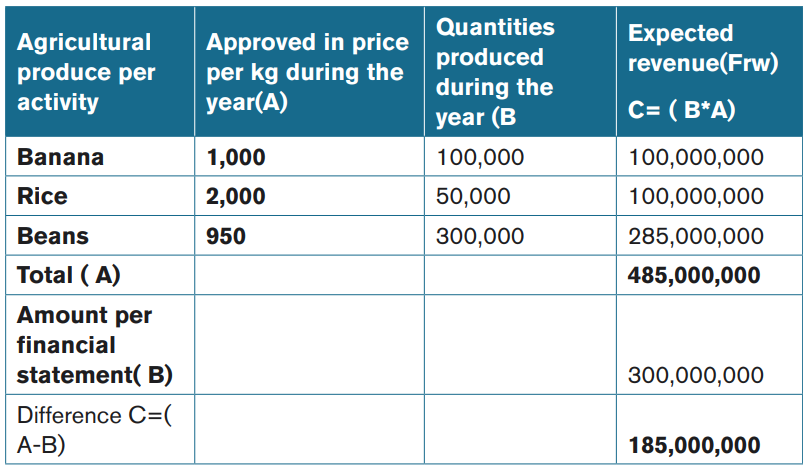

Following the considering the information shared to the auditor, it easy for the

audit to conclude on revenue amount by conducting substantive analyticalprocedures. The auditor can perform the following:

Step 1Identify the quantities sold and their approved/ market prices

Step 2Develop the expectation(s)

Step 3

Asses the relationship between computed amount and the amount reported inthe financial statements.

Step 4 seek explanations from the management for the above difference of

185,000,000FRW obtained.

Note

In case it is justified/supported, conclude it by ignoring the difference

If not justified, consider it as a reportable issue and include in the audit report.

Application activity 12.1

1. You have been tasked by your Auditor Manager to carry out the audit

of expense amounting FRW 100,000,000 included in the financial

statements of AB Ltd for the period ended 31 December 2020.

Demonstrate how you will collect the audit evidences during the auditof this expenditure of AB Ltd.

2. MK Ltd is a company that buys milk from the Milk collectors for the

consumption of its staff. Every month, the company collects 50,000

litres at a price of FRW 500 per Littre. MK reported the expense of FRW

45,000,000. You are assigned by your audit partners to quickly audit

the expense related to milk consumed during the year. Establish the

three audit procedures you will perform to conclude on milk expenseincluded in MK Ltd for the period ended 31 December 2020.

12.2. Analytical procedures

Learning activity 12.2

1. What are the materials/ items shown in the above picture?

2. What do you think could be their purposes?

3. What are the activities being done by the people shown in the abovepicture?

12.2.1. Using analytical procedures

One of the objectives of ISA 520 is that relevant and reliable audit evidence are

obtained when using substantive analytical procedures. The primary purpose of

substantive analytical procedures is to obtain assurance, in combination with

other audit testing (such as tests of controls and substantive tests of details),with respect to financial statements assertions for one or more auditable areas.

Substantive analytical procedures are generally more applicable to large volumesof transactions that tend to be more predictable over time.

The application of substantive analytical procedures is based on the expectation

that relationships among data exist and continue in the absence of knownconditions to the contrary.

To derive the most benefit from substantive analytical procedures, the auditor

should perform substantive analytical procedures before other substantive tests

because results of substantive analytical procedures often impact the nature

and extent of detailed testing. Substantive analytical procedures might direct

attention to areas of increased risk, and the assurance obtained from effective

substantive analytical procedures will reduce the amount of assurance neededfrom other tests.

12.2.2.The nature of analytical procedures

Analytical procedures involve the analysis of the relationships such as between

items of financial data to identify consistency and predicted patterns or

significant fluctuations, unexpected relationships and results of investigationsthereof. Analytical procedures are used throughout the audit process as follows:

a) Preliminary analytical review-risk assessment (Compliance withISA 315)

Preliminary analytical reviews are performed to obtain an understanding of

the business and its environment (e.g. financial performance relative to prior

years and relevant industry and comparison groups), to help assess the risk of

material misstatement in order to determine the nature, timing and extent of auditprocedures, i.e to help the auditor develop the audit strategy and programme.

b) Substantive analytical procedures

Analytical procedures are used as substantive procedures when the auditor

considers that the use of analytical procedures can be more effective or efficient

than tests of details in reducing the risk of material misstatements at the assertionlevel to an acceptably low level.

c) Final analytical review (Compliance with ISA 520)

Analytical procedures are performed as an overall review of the financial

statements at the end of the audit to assess whether they are consistent with

the auditor’s understanding of the entity. Final analytical procedures are not

conducted to obtain additional substantive assurance. If irregularities are found,

risk assessment should be performed again to consider any additional auditprocedures deemed necessary.

12.2.3. Analytical procedures in substantive testing

Performing analytical procedures involve the following four steps:

• Develop an expectation of account balance or ratio

• To determine the amount of difference from expectation that can be

accepted without investigation.

• Comparison of company’s account balance or ratio with the expected.

• Investigate and evaluate significant ratio or difference from theexpectation

Substantive analytical procedures are used for accounts balances or classes of

transactions where it is possible to develop an expected value for the recorded

amount or ratio. It should be however, noted that analytical procedures tend

to be appropriate for large volumes of predictable transactions (for example,wages and salaries).

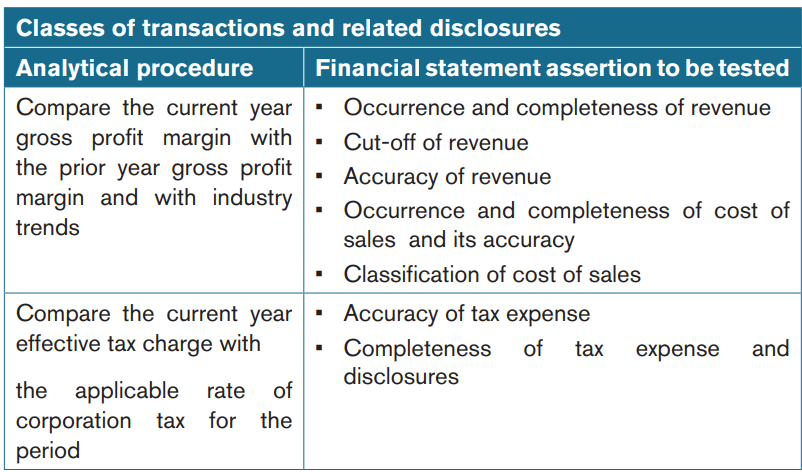

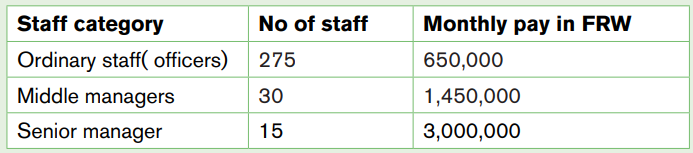

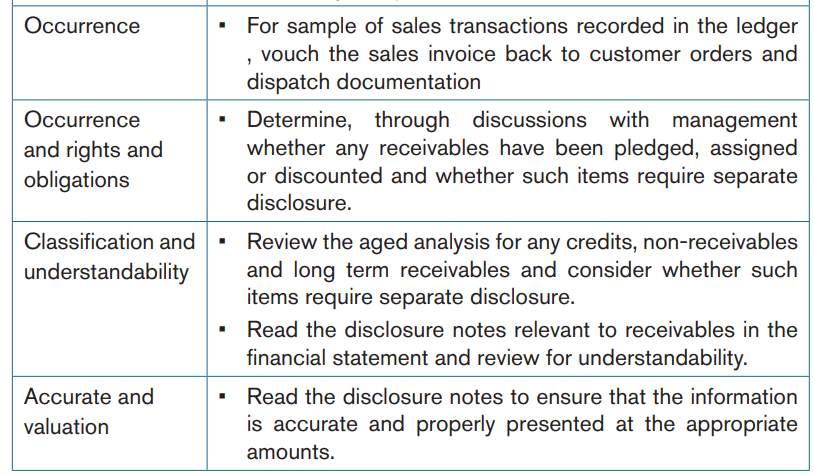

Analytical procedures can be designed to test several assertions at the sametime. Some examples are shown in the table below:

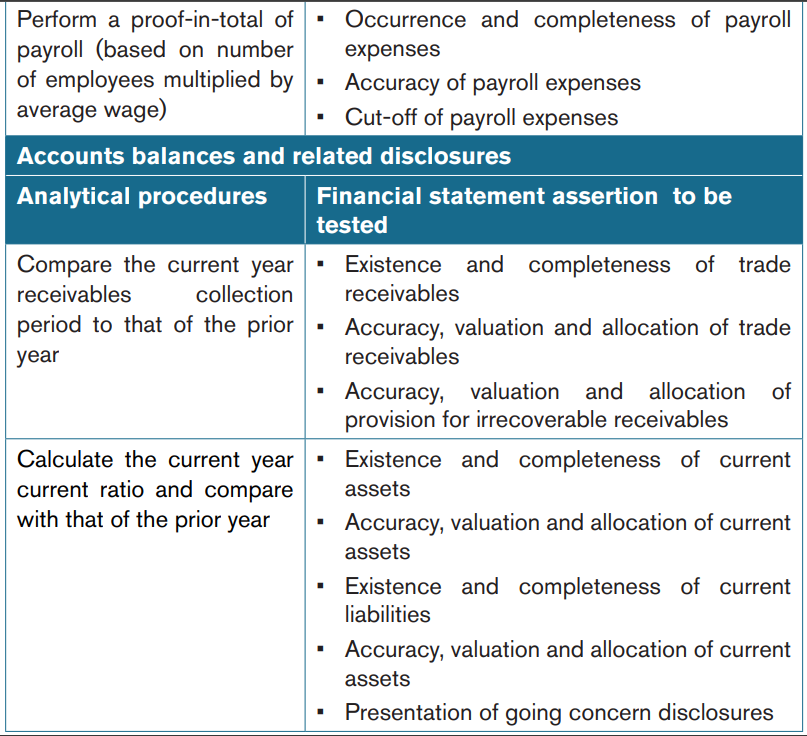

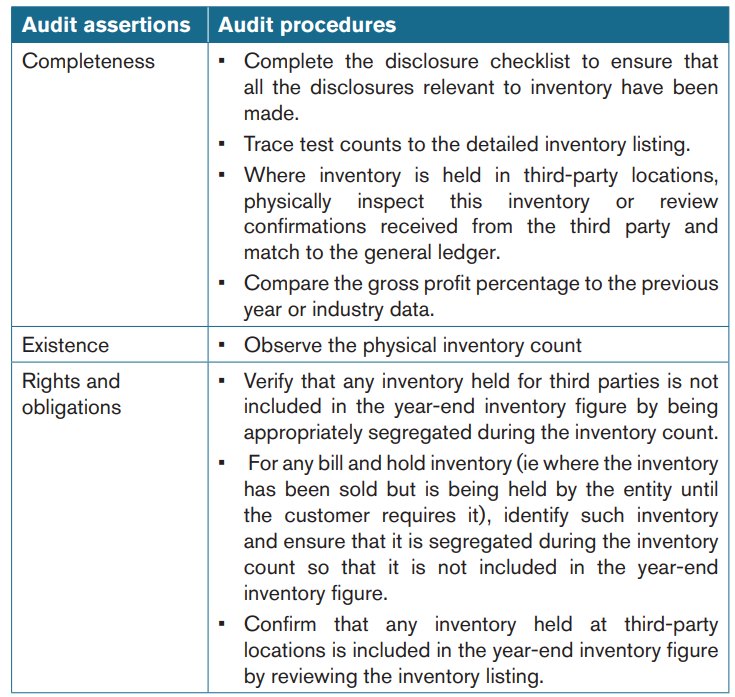

Gasaka secondary school has 331 students. As per the schools’ standards

procedures, each student is required to consume FRW 4750. The school

calendar of 2022 had 37 weeks/the year. The financial statement for the year

ended 31 December indicated expenditure of FRW 325,000,000 on students’

consumptions. Use analytical procedures to audit the above expenditurereported in Gasaka secondary school for the period ended 30 June 2022.

Answer:

Step 1

• Obtain the school register and confirm whether the number of students

existed throughout the academic year

• Obtain the approved school standards operating procedures/ guidelinesdetermining amount to be consumed by each student on daily basis.

Step 2• Develop the expectations

Step 3

• Obtain explanation(s) on the difference of FRW 82,212,750

• Asses/analyze the reasons or justifications provided

In response to the difference, the management reviewed their records and

noted that 67 were not available at some of days, hence form the basis for thedifference above (67*4750* 259).

Step 4

Conclusion, the auditor concludes that the amount repported is appropriate(completeness and accurate and cut off)

1. Investigation of fluctuations and relationships

In planning the analytical procedures as a substantive test, the auditor should

consider the amount of difference from the expectation that can be accepted

without further investigation. This consideration is influenced primarily by

materiality and should be consistent with the level of assurance desired from the

procedures. Determination of this amount involves considering the possibility

that a combination of misstatements in the specific accounts balances, or class

of transactions, or other balances or classes could aggregate to an unacceptableamount.

The auditor should evaluate significant unexpected differences. Reconsidering

the methods and factors used in developing the expectation, the inquiry of

management may assist the auditor in this regard.Management responses should ordinarily be agreed with other evidential matter.

In those cases, when an explanation for the difference cannot be obtained, the

auditor should obtain sufficient evidence about the assertion by performing

other audit procedures to satisfy himself/herself as to whether the difference is

a likely misstatement. In designing such other procedures, the auditor should

consider that unexplained differences may indicate an increased risk of materialmisstatement.

Application activity 12.2

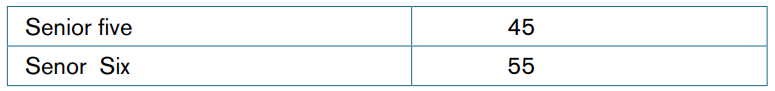

BC ltd company employs staff of different levels. The table below shows

their levels and salaries per month. You have been appointed by audit

supervisor to audit the expense related to salary disclosed in the financial

statements for BC Ltd company. Note that the financial statements for BC

Ltd company for the year ended 31 Dec 2019 under audit show the expenseof FRW 115,000,000.

Demonstrate the audit procedure you should perform during the audit of

the salary expense included in BC Ltd company financial statements for theperiod ended 30 December 2019.

12.3. Audit procedures for some elements of financialstatements

Learning activity 12.3

1. What do you think the person in the picture doing?

2. What is the purpose of the tool he has?

12.3.1. Inventory

The valuation and disclosure rules for inventory are laid down in IAS 2. Inventory

should be valued at the lower of cost and net realisable value.

Cost is defined by IAS 2 as comprising all costs of purchase and other costs

incurred in bringing inventory to its present location and condition. Net realisable

value is the estimated selling price in the ordinary course of business, less the

estimated cost of completion and the estimated costs necessary to make thesale.

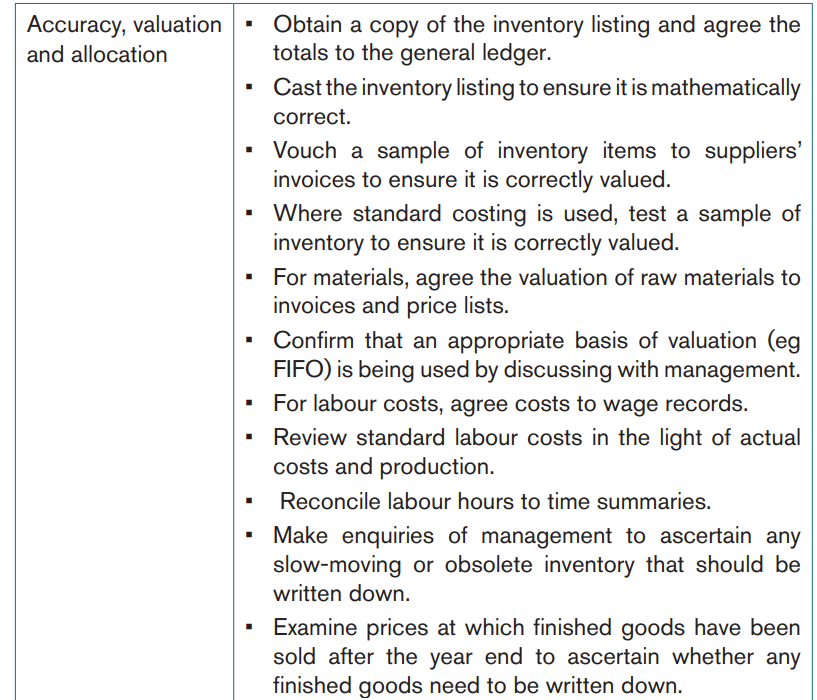

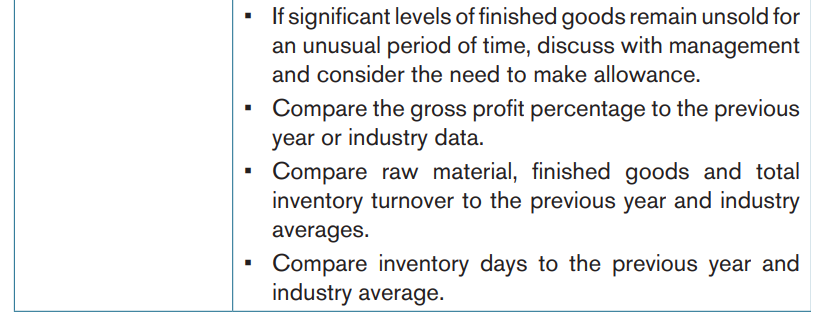

a) Audit procedures of inventory

The following procedures should be performed during the audit of inventorybalance disclosed in the financial statements.

• The physical inventory count

Physical inventory count procedures are vital, as they provide evidence which

cannot be obtained elsewhere or at any other time about the quantities andconditions of inventories and work-in-progress.

ISA 501 Audit evidence – specific considerations for selected items provides

guidance for auditors on attending the physical inventory count to obtain

evidence regarding the existence and condition of inventory. It states that where

inventory is material, auditors shall obtain sufficient appropriate audit evidence

regarding its existence and condition by attending the physical inventory count(unless this is impracticable) to do the following:

• Evaluate management’s instructions and procedures for recording and

controlling the result of the physical inventory count

• Observe the performance of the count procedures

• Inspect the inventory• Perform test counts

When observing inventory count, the auditor should also consider the following:

• Observe whether the client’s staff are following instructions, as this will

help to ensure the count is complete and accurate.

• Perform test counts to ensure procedures and internal controls are

working properly, and to gain evidence over existence and completeness

of inventory.

• Ensure that the procedures for identifying damaged, obsolete and

slow-moving inventory operate properly; the auditors should obtain

information about the inventory’s condition, age, and usage and, in the

case of work-in-progress, its stage of completion to ensure that it is

later valued appropriately.

• Confirm that inventory held on behalf of third parties is separately

identified and accounted for so that inventory is not overstated.

• Conclude whether the count has been properly carried out and is

sufficiently reliable as a basis for determining the existence of inventories.

• Consider whether any amendment is necessary to subsequent audit

procedures.

• Gain an overall impression of the levels and values of inventories held

so that the auditors may, in due course, judge whether the figure forinventory appearing in the financial statements is reasonable.

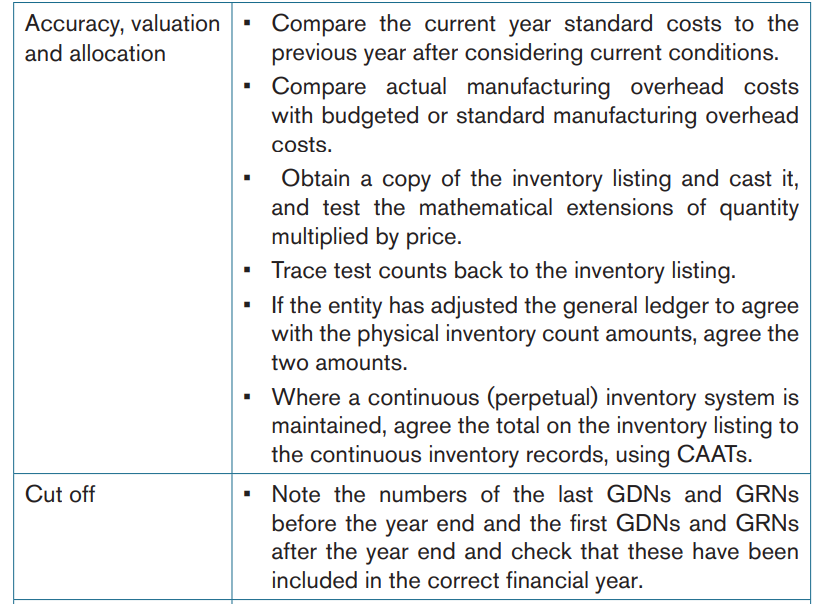

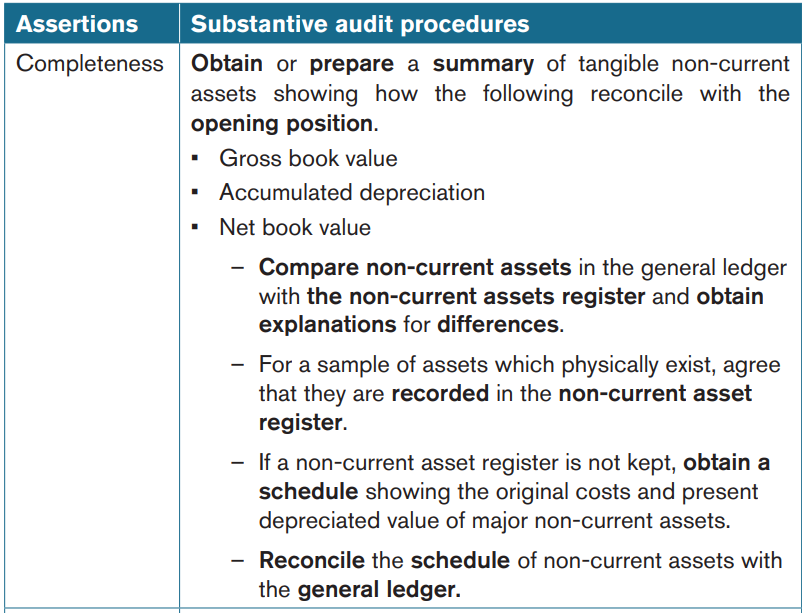

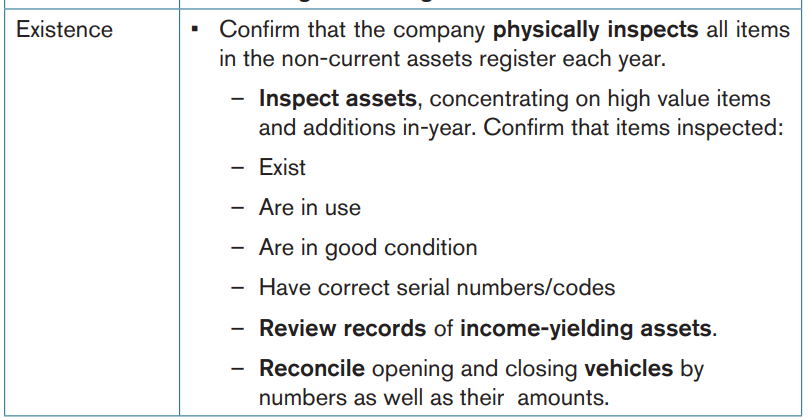

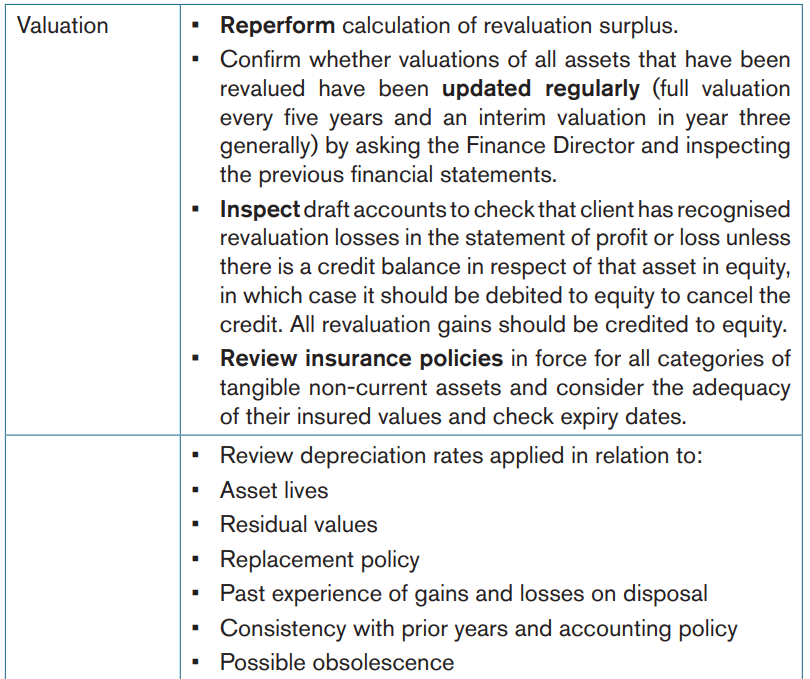

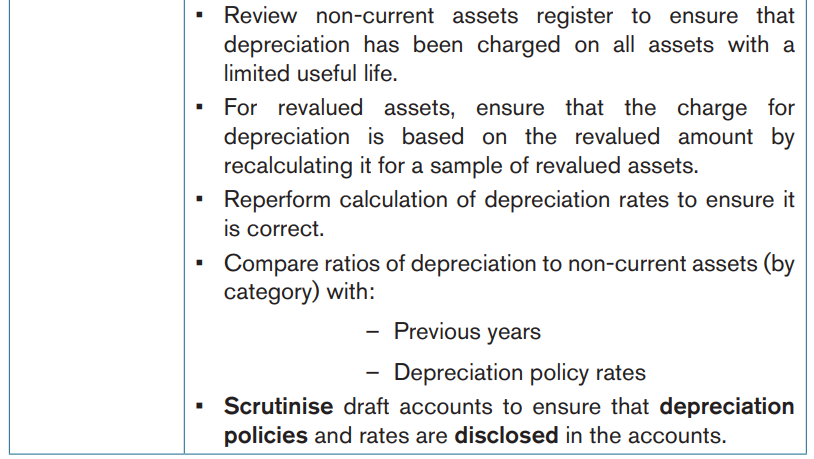

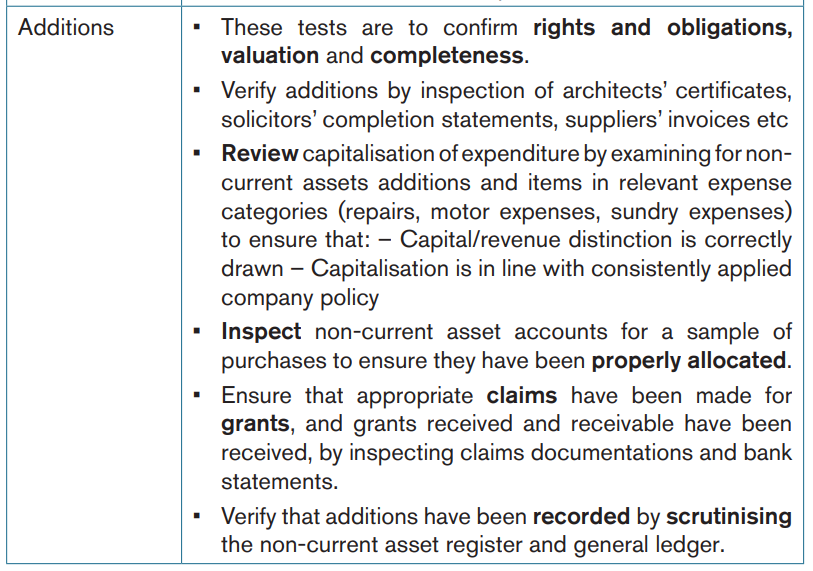

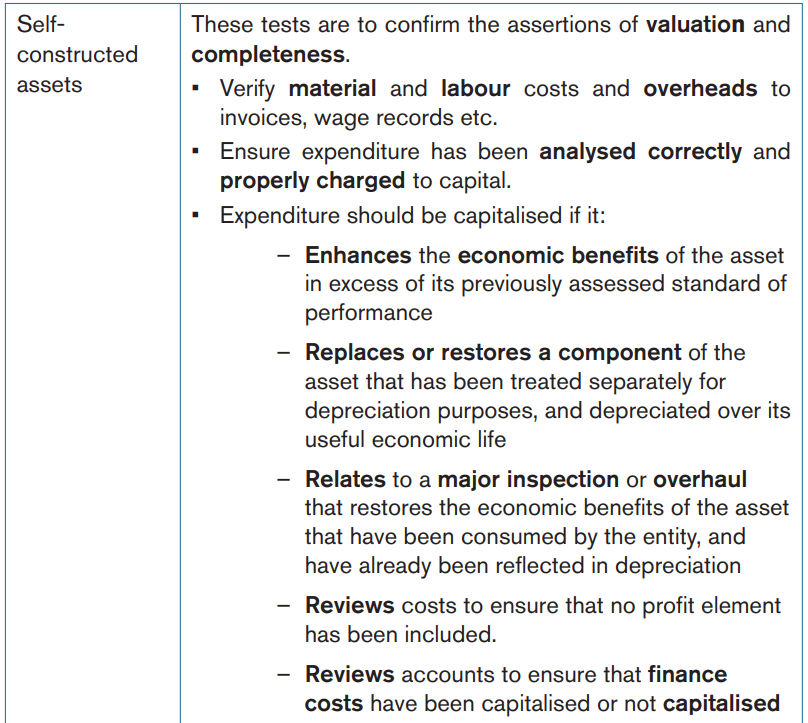

12.3.2.Non- current assets

a) The audit procedures of Property Plant and Equipment (PPE)

The following are some of the substantive audit procedures for non-currentassets.

Substantive audit procedures for Intangible non-current assets

Key assertions for intangible non-current assets are existence and valuation.

Auditor has to apply different audit procedures during the audit of Intangible

non-current assets. The following are the substantive procedures that shouldbe performed by the auditors.

1. Audit procedures for good will

• Agree the consideration to sales agreement by inspection.

• Consider whether asset valuation is reasonable.

• Agree that the calculation is correct by recalculation.

• Review the impairment review and discuss with management.

• Ensure valuation of goodwill is reasonable / there has been noimpairment not adjusted through discussion with management.

2. Research and development (R&D) costs

• Confirm that capitalized development costs conform to IAS 38 criteria

by inspecting details of projects and discussions with technicalmanagers.

• Confirm feasibility and viability by inspection of budgets.

• Recalculate amortization’s calculation to ensure it commences withproduction / is reasonable.

• Inspect invoices to verify expenditure incurred on R&D projects.

3. Other intangible assets

• Agree purchased intangibles to purchase documentation agreementby inspection.

• Inspect specialist valuation of intangibles and ensure it is reasonable.

• Review amortization calculations and ensure they are correct byrecalculation.

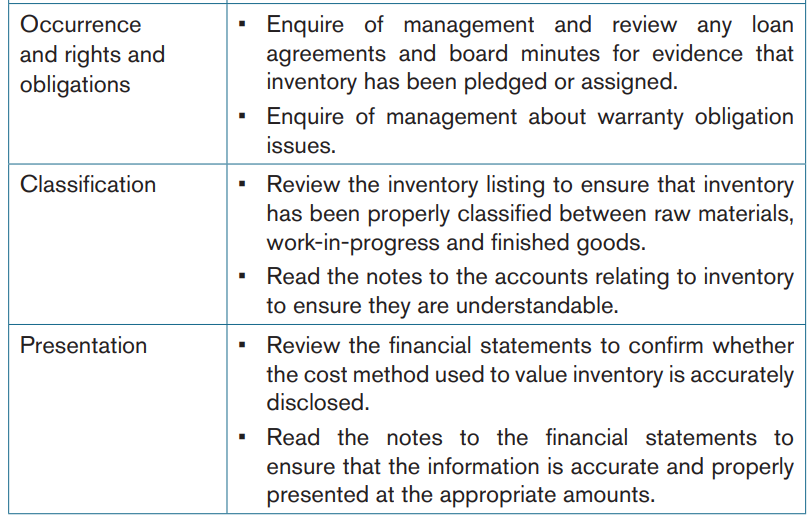

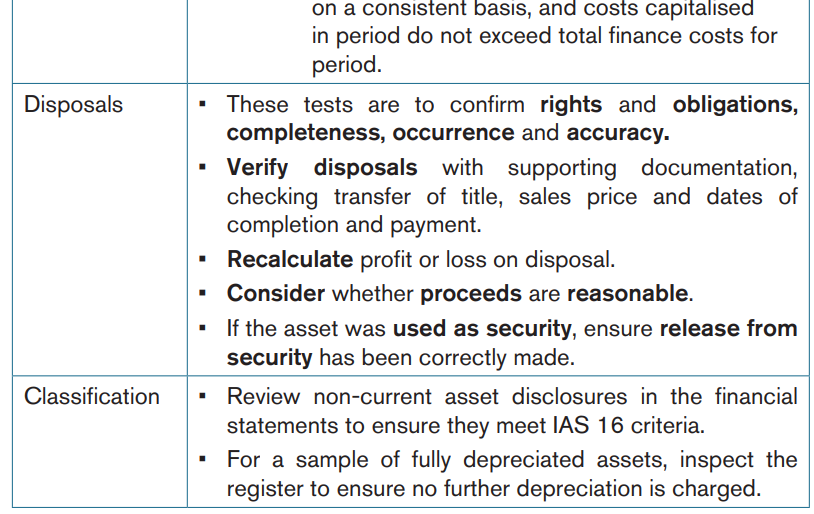

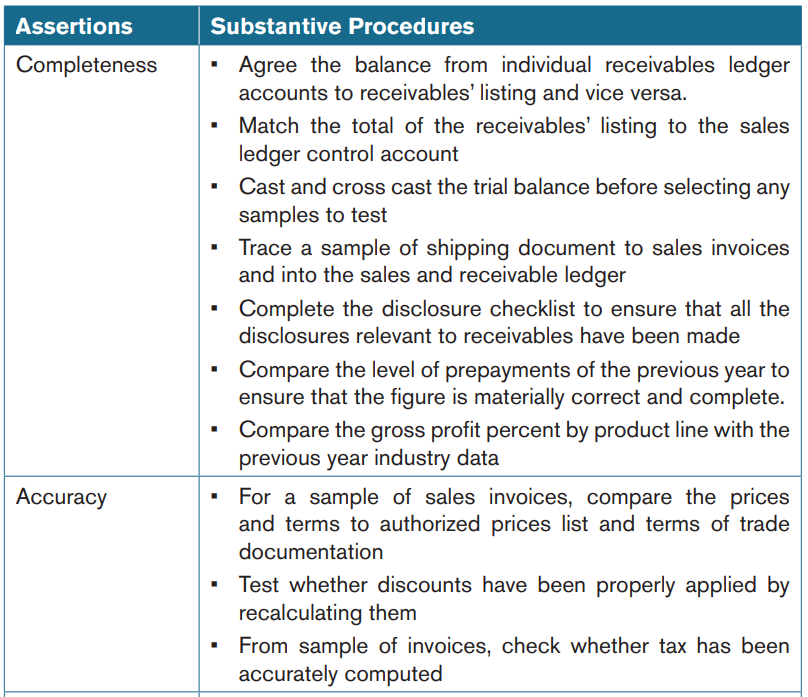

12.3.3. Substantive audit procedures for Account Receivables

Receivables are usually audited using a combination of test of details and

analytical procedures. The audit of receivable is important as this is likely to be

a material area. A combination of analytical procedures and tests of details areused, with sales also being tested in conjunction with trade receivables.

Existence, completeness and valuation are the key assertions relating to the

audit of receivables. Receivables are often tested in conjunction with sales. Thekey assertions for sales are occurrence, completeness and accuracy.

The following are the audit procedures that can be performed during the auditof receivables:

Note that part of the substantive audit procedures, the auditor should always

endeavour to request for confirmation for all financial position balances (thoseincluded in the sample) from third parties ie debtors, creditors and banks.

Part of the audit procedures, the auditor need to request confirmation from theconcerned debtors.

a) Receivables confirmation

ISA 505 states that when it is reasonable to expect customers to respond,

the auditor should ordinarily plan to obtain direct confirmation of receivables

to individual entries in an account balance. Verification of trade receivables by

direct confirmation the normal means of providing audit evidence to satisfy the

objective of checking whether customers exist and owe bonafide amounts tothe company (existence and rights and obligation).

b) Two methods of confirmation

• Positive

A positive external confirmation requests the confirming party to reply to the

auditor in all cases, either by indicating the confirming party’s agreement withthe given information, or by asking the confirming party to provide information.

• Negative

Negative confirmation provides less persuasive audit evidence than positive

confirmation. Accordingly, the auditor shall not use negative confirmation

requests as the sole substantive audit procedure to address an assessed risk

of material misstatement at the assertion level unless all of the following arepresent:

• The auditor has assessed the risk of material misstatement as low

and has obtained sufficient appropriate audit evidence regarding the

operating effectiveness of controls relevant to the assertion;

• The population of items subject to negative confirmation procedures

comprises a large number of small, homogeneous account balances,

transactions or conditions;

• A very low exception rate is expected; and

• The auditor is not aware of circumstances or conditions that would

cause recipients of negative confirmation requests to disregard suchrequests.

12.3.4. Cash and bank Balances

a) Bank balances

The following are key procedures the auditor should consider during the audit

of bank balances. During the audit of bank balances, the auditor has to test theassertions of completeness, valuation, existence, cut-off and presentation.

The auditor shall perform the following audit procedures:

• Obtain standard bank confirmations from each bank with which theclient conducted business during the audit period.

• Reperform arithmetic of bank reconciliation.

• Trace cheques shown as outstanding from the bank reconciliation

to the cash book prior to the year end and to the after-date bank

statements and obtain explanations for any large or unusual itemsnot cleared at the time of the audit.

• Compare cash book(s) and bank statements in detail for the last

month of the year, and match items outstanding at the reconciliationdate to bank statements.

• Review bank reconciliation previous to the year-end bank reconciliation

and test whether all items are cleared in the last period or takenforward to the year-end bank reconciliation.

• Obtain satisfactory explanations for all items in the cash book for

which there are no corresponding entries in the bank statement andvice versa by discussion with finance staff.

• Verify contra items appearing in the cash books or bank statementswith original entry.

• Verify by inspecting paying-in slips that unclear banking is paid inprior to the year end.

• Examine all lodgments in respect of which payment has been refused

by the bank; ensure that they are cleared on representation or that other

appropriate steps have been taken to effect recovery of the amountdue.

• Verify balances per the cash book according to the bank reconciliationby inspecting cash book, bank statements and general ledger.

• Verify the bank balances with reply to standard bank letter and withthe bank statements.

• Inspect the cash book and bank statements before and after the year

end for exceptional entries or transfers which have a material effecton the balance shown to be in-hand.

• Identify whether any accounts are secured on the assets of thecompany by discussion with management.

Consider whether there is a legal right of set-off of overdrafts againstpositive bank balances.

• Determine whether the bank accounts are subject to any restrictionsby enquiries with management.

• Review draft accounts to ensure that disclosures for bank are completeand accurate and in accordance with accounting standards.

b) Cash balances

Cash balances/floats are often individually immaterial but they may require some

audit emphasis because of the opportunities for fraud that could exist whereinternal control is weak.

The auditor will be very much concerned whether the cash exists, is complete,

and belongs to the company (rights and obligations) and is also stated at thecorrect value.

The following are some of the substantive audit procedures the auditor has to

perform:

• Count all cash balances and agree to petty cash book or other record

kept.

• Count all cash at same time and ensure all work is done in presence

of staff.

• Obtain a certificate of cash in hand from staff member.

• Enquire about IOUs or cheques cashed.

• Confirm balances are in agreement with the accounts.

• In addition, check whether the IOUs and un-cashed cheques havesubsequently been cleared timely.

12.3.5. Liabilities

Liabilities are classified into:

• Accounts payables and accruals

• Non-current Liabilities

• Capital and• Reserve

During the audit of these balances, the auditor should consider the nature and

transactions that effect each balance. Below are audit procedures for each ofthe balances of the above highlighted balances:

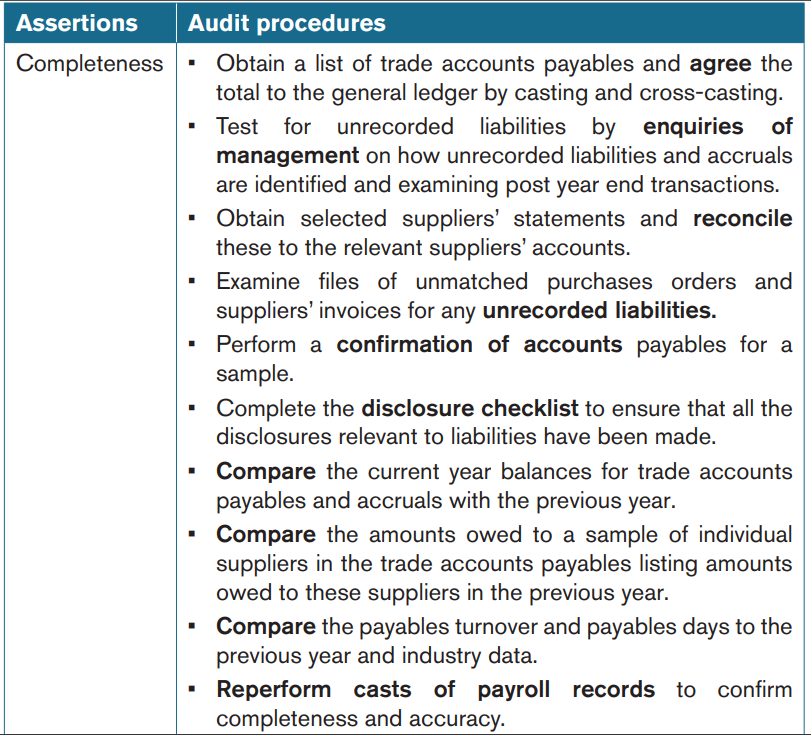

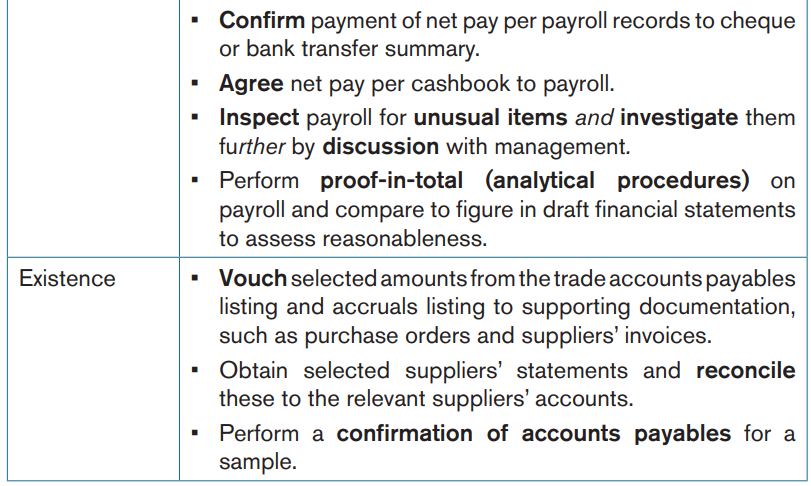

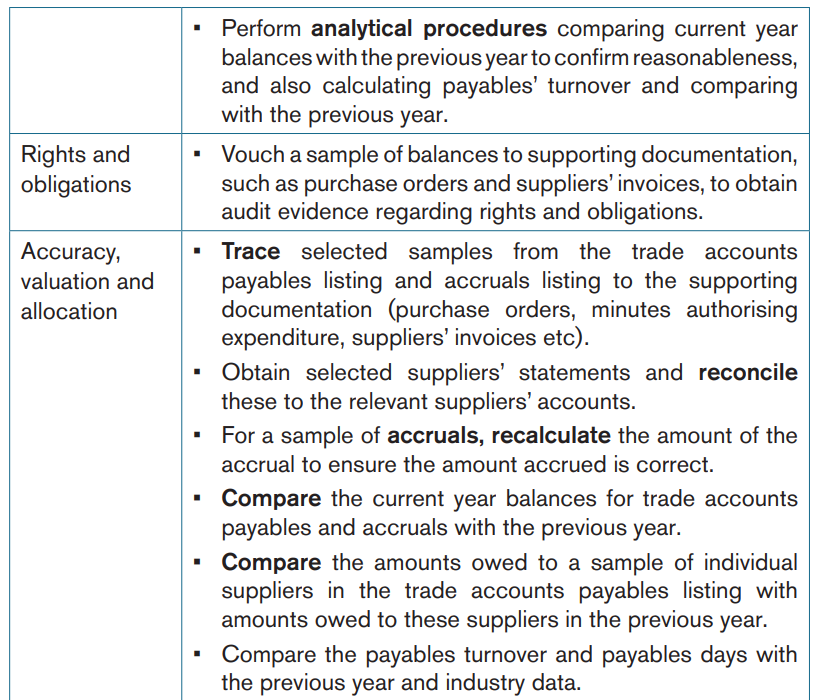

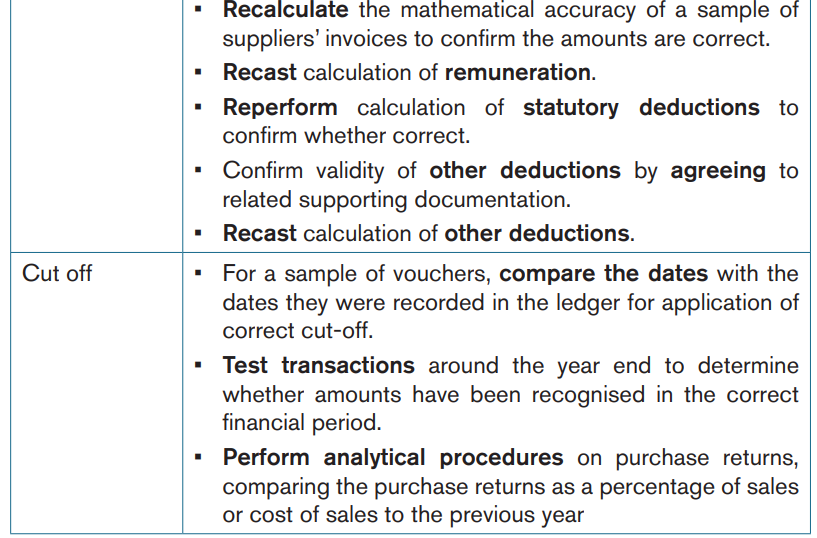

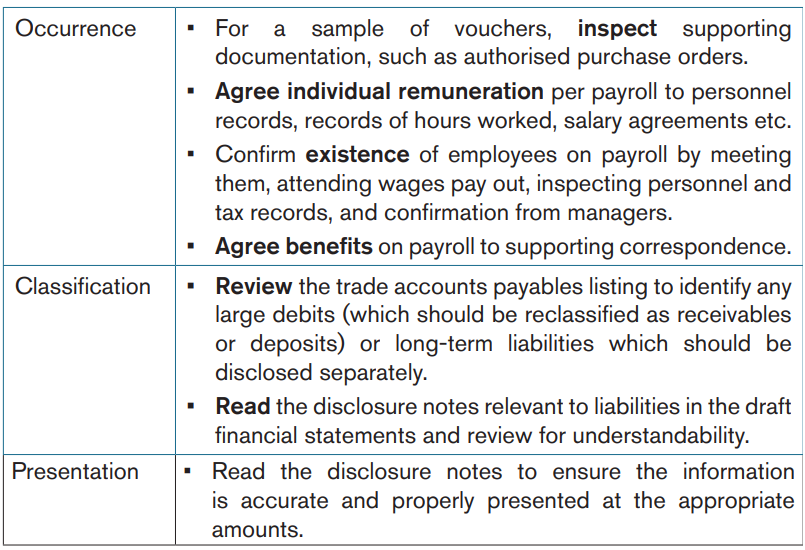

a) Audit procedure for accounts payables and accruals

Note that payables are audited with purchases/expenses. This therefore

requires the auditor to adopt some audit procedures for income statements

items (classes of transactions and events). In this regard, some of assertionslike cut off and occurrence are tested.

• Substantive audit procedures for provisions

The auditor should observe the requirements of IAS 37 during the audit of

provisions. As per IAS 37 provision, a provision is a liability of uncertain timing

and amount. It is therefore of paramount importance for audit to apply appropriate

audit procedures while carrying the audit of the provisions. The auditor shouldendeavour to apply these audit procedures.

– Obtain details of all provisions which have been included in the

accounts and all contingencies that have been disclosed

– Obtain a detailed analysis of all provisions showing opening

balances, movements and closing balances.

– Determine for each material provision whether the company has a

present obligation as a result of past events

– Review of correspondence relating to the item

– Discussion with the directors. Have they created a validexpectation in other parties that they will discharge the obligation?

– Determine for each material provision whether it is probable that

a transfer of economic benefits will be required to settle theobligation by:

– Checking whether any payments have been made in the post yearend period in respect of the item by reviewing after-date cash

– Review of correspondence with solicitors, banks, customers,insurance company and suppliers both pre and post year end

– Sending a letter to the solicitor to obtain their views (whererelevant)

– Discussing the position of similar past provisions with thedirectors. Were these provisions eventually settled?

– Considering the likelihood of reimbursement.

– Recalculate all provisions made.

– Compare the amount provided with any post year end paymentsand with any amount paid in the past for similar items.

– In the event that it is not possible to estimate the amount of the

provision, check that a contingent liability is disclosed in theaccounts.

– Consider the nature of the client’s business. Consider likely

provisions not disclosed by the management of a company underaudit.

– Consider the adequacy of disclosure of provisions, contingentassets and contingent liabilities in accordance with IAS 37.

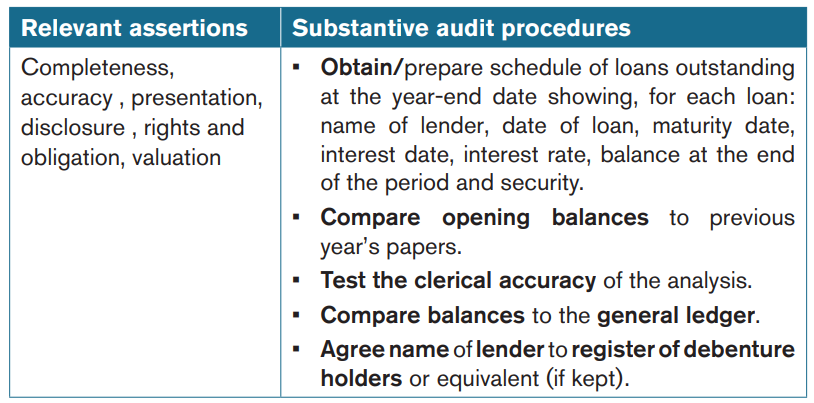

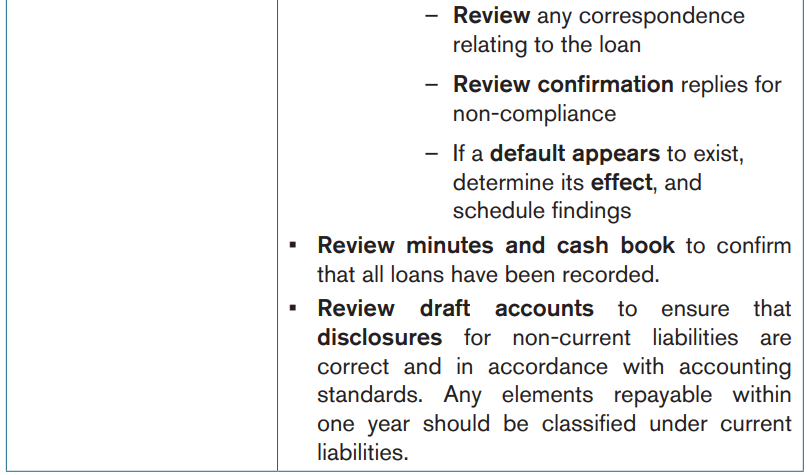

b) Audit procedures for Non-Current Liabilities

c) Substantive audit procedures for capital and related issues

The auditor should review transactions and events could have affected the

equity. This helps the auditor in collecting sufficient and appropriate audit

evidences. Thus, come up with the appropriate audit conclusion. The following

are some of audit procedures auditors perform during the review of capitalbalance disclosed in the financial statements of a company.

• Share capital

– Agree the authorised share capital with the statutory documentsgoverning the company’s constitution.

– Agree changes to authorised share capital with properlyauthorised resolutions.

• Issue of shares

– Verify any issue of share capital or other changes during the yearwith general and board minutes.

– Ensure issue or change is within the terms of the constitution, anddirectors possess appropriate authority to issue shares.

– Confirm that cash or other consideration has been received orreceivable(s) is included as called-up share capital not paid.

• Transfer of shares

– Verify transfers of shares by reference to:

• Correspondence

• Completed and stamped transfer forms

• Cancelled share certificates• Minutes of directors’ meeting

– Review the balances on shareholders’ accounts in the register of

members and the total list with the amount of issued share capital inthe general ledger.

– Agree dividends paid and declared pre year end to authority in

minute books and reperform calculation with total share capital

issued to ascertain whether there are any outstanding or unclaimeddividends.

– Agree dividends payment to documentary evidence (say, thereturned dividends warrants).

– Test that dividends do not contravene distribution of provisions byreviewing the legislation.

• Reserves

– Agree movements on reserves to supporting authority.

– Ensure that movements on reserves do not contravene the

legislation and the company’s constitution by reviewing thelegislation.

– Confirm that the company can distinguish distributable reservesfrom those that are non-distributable.

– Ensure that appropriate disclosures of movements on reserves

are made in the company’s accounts by inspection of the financialstatements.

12.3.6. Substantive audit procedures for expenses

During the audit of expenses, the auditor should focus on potential risks. Thefollowing are key potential risks:

• Occurrence- recorded transactions may have not occurred /not valid

• Completeness- not all transactions are recorded

• Accuracy- some transactions are inaccurate• Cut- off- some transactions are recorded in wrong accounting period

The following are some of audit procedures for expenses;

• For transactions sample, obtain their relevant supporting documents

such as invoice, goods received note and payment advice note

• Review the supporting documents and check whether the transactions

occurred and relate to the entity

• Check whether all expenses were recorded in the books of accounts

at the correct amounts by agreeing the recorded amounts with their

relevant supporting documents such as invoices, good delivered note

and good received note and invoice register, verify the accuracy of the

amounts shown on the invoices by reconciling the invoices with good

received note and payment advice.

• Ensure that the transactions were recorded in the correct accounts

following the entity’s chart of accounts by agreeing the entries passed

with the entity’s chart of accounts

• Confirm whether the expenses relate to the correct period( accounting

period) by comparing when services have been consumed/benefited(

in accrual basis of accounting) and the period of accounting for theexpenses.

12.3.7. Substantive procedures for revenue

During the audit of revenue both test of controls and substantive audit procedures

are applied. The following are some of substantive audit procedures that shouldbe executed by the auditor during the audit of revenue:

• Compare the total revenue with that reported in previous years and therevenue budgeted, and investigate any significant fluctuations.

• For a sample of customer orders, trace the details to the related

despatch notes and sales invoices and ensure there is a sale recordedin respect of each (to test the completeness of revenue).

For a sample of sales invoices for larger customers, recalculate the discountsallowed to ensure that these are accurate.

Select a sample of despatch notes in the month immediately before and

month immediately after the year end. Trace these through the related

sales invoices and resultant accounting entries to ensure each sale

was recorded in the appropriate period.

• Obtain an analysis of sales by major categories of toys manufactured

and compare this to the prior year breakdown and discuss any unusual

movements with management.

• Calculate the gross profit margin for the year and compare this to the

previous year and expectations. Investigate any significant fluctuations.

• Recalculate the sales tax for a sample of invoices and ensure that the

sales tax has been correctly applied to the sales invoice.

• Select a sample of credit notes issued after the year end and trace

these through to the related sales invoices to ensure sales returns wererecorded in the proper period.

Note that the audit of revenue should always linked with audit ofreceivables.

Application activity 12.3

You are the Senior auditor at MK CPA Ltd and you are requested to perform

the audit of the following balances disclosed in the financial statements of

MT Ltd for year ended 30 October 2022.

a) Stock of FRW 10,000,000

b) PPE of FRW 50,000,000

c) Receivables FRW 50,000,000

d) Revenue FRW 100,000,000

Identify four substantive audit procedures you would perform during the auditof the above balances.

Skills lab activity 12

With the guidance of the teacher, the learners should be shared the school

financial statements and underlying records (accounting information).

• Students will use financial information and carry out analytical

review of different informations presented in financial statement

where deemed necessary. They will be asked to carry out the

comparison of the current financial information with the previous

year and asses the relationships of the identified differences , and

be helped to assess the explanations

• Students will use financial information and evaluate the reliability

of the data from which the expectation has been developed

• Students will be helped on how to establish substantive audit tests

on each balance, class of transactions and disclosure included in

the financial statement

• Students will be helped on how to obtain audit evidences

during performance of the substantive audit tests on individualtransactions, balances and disclosures

End unit 12 assessment

1. What is the purpose of substantive audit procedures?

2. Differentiate substantive audit procedures from analytical procedures

3. What are the different methods of collecting audit evidences?

4. What is the main purpose of audit evidences?

5. What are the key audit procedures you would perform on thefollowing financial statements balances

a) Cash and bank balances

b) Liabilities

c) Property plant and equipment

d) Revenue

e) Expenses