UNIT 1 :FUNDAMENTAL CONCEPTS IN AUDITING

Key unit competence: To be able to explain the fundamental concepts

in auditing

Introductory activity

MUKESHIMANA decided to set up a business for selling flowers after S6

Accounting. She got up early in the morning, visited the market, and then

set up a stall by the side of the road. She started selling different kinds of

flowers. She was able to sell and gain some income from the business. Forthe first year, everything went well.

However, MUKESHIMANA thought that she could sell more flowers if she

was able to transport more to the place where she would sell them. She

also knew that there were several other roads nearby where she could sell

flowers.To achieve her ambition of selling more flowers; she needed to buy

a van and recruit more employees to transport flowers to different sellingpoints.

MUKESHIMANA realized the need for more money to expand her business.

Therefore, she requested her rich friend Alex to invest in the business.

Alex found out the potential of MUKESHIMANA’s business and decided

to invest in it, but he did not want to be involved in the management of thebusiness and bear liablities in case of failure its failure (bankruptcy).

He therefore suggested the following to MUKESHIMANA:

• To establish a limited liability company;

• To be the major shareholders (over 51%) and be entitled for more

dividends• Mukeshimana to be the managing director of the company

At the end of the first year of trading as a limited liability company, Alex

received a copy of the financial statements. He noticed that the profit of

the company was lower than expected, and this lowered significantly hisdividends.

He knew that MUKESHIMANA is being paid salary and she might not give

much attention to the performance of the company (making profit for thecompany).

To have proper understanding of the performance of the business, there

was a strong need of Alex to engage the third parties to provide annualassurance services on financial statements of the company.

Referring to the passage above, answer the following questions:

1. How do you call the work done by the third parties appointed?

2. What do you think about the work done by the third parties and the

work performed by MUKESHIMANA as managing Director?

3. What are the advantages that Alex will obtain from the work performed

by the third parties?

4. Differentiate the work of MUKESHIMANA from the work performedby the third parties.

1.1. Key terms applied in auditing

Learning activity 1.1

Analyze the photos above and answer the questions below:

1. Who is the auditor?

2. How do you call the work performed by the auditor?

3. What are main principles of audit?

1.1.1. Meaning of key terms

a) Audit

An audit is an official independent examination of the accounts or accountingsystems of an entity.

Audit is defined as an independent examination of books of accounts and

vouchers of business with view of forming an opinion/ judgment as to whether

these have been kept properly according to the company’s Act and as to whether

or not the statements present a true and fair view of the financial position of abusiness.

An audit is an exercise that auditors carry out in order to be able to give the

statutory opinion whether financial statements give a true and fair view.

An audit is an independent examination and expression of an opinion on a setof financial statements.

b) Assurance

The International Standards on Auditing (ISA) give a definition of an assurance

engagement as “ one in which a practitioner expresses a conclusion designed

to enhance the degree of confidence of the intended users other than the

responsible party about the outcome of the evaluation or measurement of asubject matter against criteria. “

Assurance means confidence. In an assurance engagement, an ‘assurance

firm’ is engaged by one party to give an opinion on a piece of information thathas been prepared by another party.

The opinion is an expression of assurance about the information that has been

reviewed. It gives assurance to the party that hired the assurance firm that theinformation can be relied on.

c) Auditor

An auditor is a person who conducts an audit. An auditor is a person authorized

to examine and verify the books of account of an organization.

An auditor is a qualified accountant appointed by the shareholders, government,or management of a company to examine independently the financial information.

d) Auditing

Auditing may be defined as the examination of financial statements covering

the transactions over a period and ascertaining the financial position of an

organization on a certain date in order that the auditor may issue a report on

them. It means that the auditing is the application of auditing principles andmethods as may be considered as necessary by an auditor.

e) Integrity

An auditor should be straightforward, honest and sincere in his/her approach tohis/her professional work.

f) Objectivity

Is not to allow bias, conflict of interest or undue influence of others to overrideprofessional or business judgments

g) Professional Independence

The auditor is an agent/watchdog for the shareholders and must be independent

of directors and management who look after the interests of shareholders in acompany or of the government.

The profession requires the auditor to be independent so as to be able to

express a balanced opinion on the accounts presented by the directors to theshareholders whose company he has audited.

h) Professional competence and due care

To maintain professional knowledge and skils at the level required to ensure

that a client or employer receives competent professional services based on

current developments in practice, legislation and techniques and act diligentlyin accordance with applicable techniques.

i) Confidentiality

The state of keeping or being kept secret or private, the auditor should notdisclose any information to the third party.

j) Professional behavior

Auditor should comply with laws and avoid any actions, which discredit theprofession.

k) Planning

Planning is the process of thinking regarding the activities required to achievea desired goal

l) Impartiality

Is the principle holding that decisions are based on objective evidence obtained

during audit, not on the basis of bias or prejudice caused by influence of differentinterests of individuals or other involved parties.

m) Evidence

During the audit, the auditor can collect the evidence through the workingpapers. He/she can surround his/her opinion on the audit evidence.

n) Consistency

The consistency principle states that once you decide on an accounting method

or principle to use in your business, you need to stick with and follow this methodor principle consistently throughout your accounting periods.

o) Legal Frame Work

The business activities may run within the rules and legal formalities. To protectthe rights of the interested party, rules must be applied/followed.

p) Working papers preparation

Audit working papers are documents which contain all information gathered

from the company audited and show all evidences to help the auditor to preparethe final report and to form his/her opinion.

q) Internal ControlThe auditor will examine the accounting system and internal control in operation.

r) Report

Report is the end product of the external audit process or of the performed auditwork.

s) Professional skepticism

Professional skepticism is defined in the ISAs as an attitude that includes a

questioning mind, being alert to conditions, which may indicate possiblemisstatement due to error or fraud, and a critical assessment of audit evidence.

Application activity 1.1

1. What is the meaning of assurance in auditing?

2. Briefly explain the following terms.

a. Integrity

b. Objectivity

Learning activity 1.2

1.2. Objectives, advantages and disadvantages of auditing

1. Is it important to know the objectives of audit?

2. What are the objectives of audit you know?

1.2.1. Objectives of auditing

The objectives of audit may be classified into two categories:

a) Primary or principal objectives of auditing

• To determine the accuracy of financial statements or accounts;

• To prove the true and fair view of the company’s financial state of affairs;

• To confirm that the proper books of accounts are being kept or not;

• To prepare audit report;• To confirm the exactitude of final accounts.

b) Secondary or subsidiary objectives of an auditing

• To detect errors;

• To detec frauds;

• To prevent errors;

• To prevent frauds ;

• To assist the client to improve their accounting systems;

• To find out whether the internal control system is working properly or not;• To advice the management.

1.2.2. Advantages and disadvantages of auditing

a) Advantages of audit

For the shareholders:

• Shareholders are assured that directors and management are acting to

the best of their interests ;

• They use audited accounts to determine amount to be paid to dead

partner;

• They use audit report to admit a new partner by examining his/her

business;• Audit ensures that regulations and statutory requirements are followed.

For the employees:

• Audit keeps accounting staff vigilant and careful in their work;

• Employees ensure their job security and continuity of good remuneration

by the audited company;• Act as a detective and preventive measure against errors and frauds.

For the state:

• Audited companies ensure the accomplishment of fiscal duties

regarding companies (payment of taxes and social contributions);

• The government is assured that public funds are being well used;

• The government ensures continuity of business for the purpose of

general interests of the people;

• The state ensures that books of accounts are maintained according tolegal requirements and companies Act.

For the management of an enterprise and third parties in general:

• Audit provides assurance and credibility to the accounts for interested

parties;

• Third parties not taking active part in the organization are protected;

• Audited accounts minimize disputes between parties;

• Audited accounts are acceptable as the basis of ascertaining tax

liability;

• The auditor promotes general management efficiency by advisingmanagement.

b) Disadvantages of auditing

• If the auditor has many clients, planning and personnel problems lead to

inefficient audit, leaving errors and frauds undetected. Thus, increasing

auditor’s liability to third parties.

• It is expensive and third parties may not be able to afford it.

• The audit report provides information that may otherwise be confidential

to competitors.

• A qualified report may affect the company’s credibility with third parties.

• An audit can disrupt the client’s (audited company) work.

• Audited figures may be altered (changed) leading to inaccurate opinion.

• May prompt trade unions to demand for higher wages for their

employees e.g. in cases of unreasonable reserves.

• An audit can lead to conflict between the internal auditor and

management in cases where the internal auditor co-operates with the

external auditor.

• Revelations of weaknesses in the management letter or letter of

weaknesses may make managers to resign. Thus, leading to apathy inthe organization.

Application activity 1.2

1. Explain the advantages of audited accounts to shareholders.2. What are the primary or main objectives of auditing?

1.3. Types of Audits according to the different classifications

Learning activity 1.3

G&P Partners is an auditing firm, registered in Rwanda to provide an audit

and advisory services since 2010. For the year ended 31st December 2021,G&P Partners received the assignement from different clients as follows:

1. On 05th January 2021, G&P Partners singed an engagement

letter with Sika Ltd for providing the audit opinion on their financial

statements and compliance with company’s procedures manuals,

rules and regulations. Sika Ltd agreed with auditor also to conductits audit in every 3 months until the end of the year.

2. On 20th March 2021, during the annual general meeting, Bwiza Ltd

appointed G&P Partners as a new auditor to conduct an audit oftheir annual accounts.

3. On 01st April 2021, G&P Partners signed an engagement letter with

office of auditor general to conduct an audit for one of government

projects to evaluate whether the project objectives were attained or

not and to evaluate whether the transcations passed by the projectcoordinator were made in economic, efficient and effective manner.

Question

From the above assignment received by G&P Partners, List the types ofaudits that will be conducted.

1.3.1. Forms of organizations

a) Auditing of a sole proprietorship

This is a form of audit of the accounts of a private individual or sole trader. An

auditor is asked to audit the accounts of a private individual or a sole trader. He/

she must get clear instructions in writing from his/her client as to what he/she is

expected to do i.e. his/her duties, nature of work, scope of work etc and will beclearly defined in the engagement letter.

Advantages of auditing of the accounts of sole trader are:

• Assured that his/her accounts are properly kept or not;

• Audited accounts are helpful in confirming that the profit or loss has

been made;

• Sole trader agents are kept vigilant (in the case of consignment);

• Taxes are assessed and paid very well;• Audited accounts are basis for obtaining bank loans and public markets.

b) Auditing of partnership

The scope and conduct of auditing and rights and duties of the auditors

are determined on the basis of the agreement between the firm and auditor

(engagement letter). While conducting auditing of partnership firm, the auditormust also consider the partnership Deed.

Advantages of auditing of partnership

• Avoids any financial dispute among partners.

• Third parties are assured that there are no frauds.

• Helps in the valuation of goodwill of a dead partner and incoming

partner.

• Expertise of audit contributes to increase profit, better managementand compliance with tax laws.

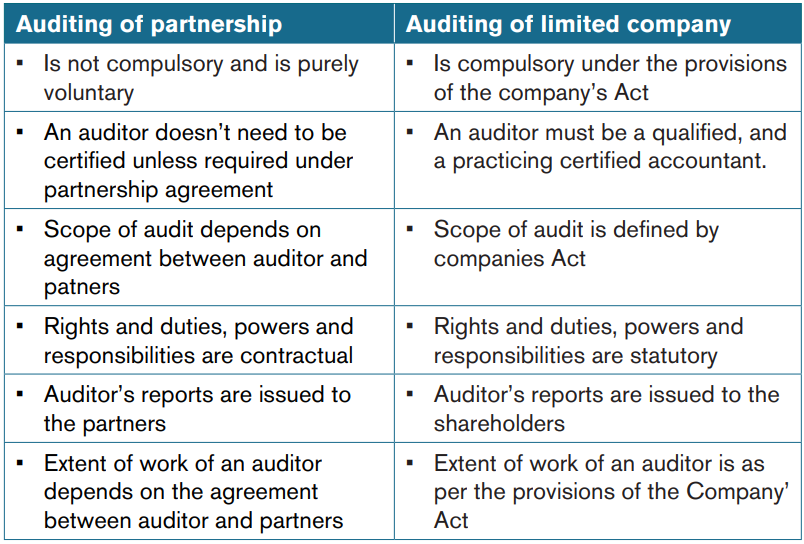

Distinction between auditing of partnership firm and auditing of alimited lability company

c) Audit of limited company

An audit of a limited liability company is an examination of the financial statements

of a company, such as the income statement, cash flow statement, and balance

sheet. Audit provides to investors and regulators the confidence in the accuracyof a corporation’s financial reporting.

During the audit of a limited liablty company, it is clarified whether the financialstatements are fairly presented and free from material misstatements.

The auditor’s role is to examine annual final accounts of the company and makesure they are correct and reliable but not to manage those accounts.

1.3.2. According to the nature of work

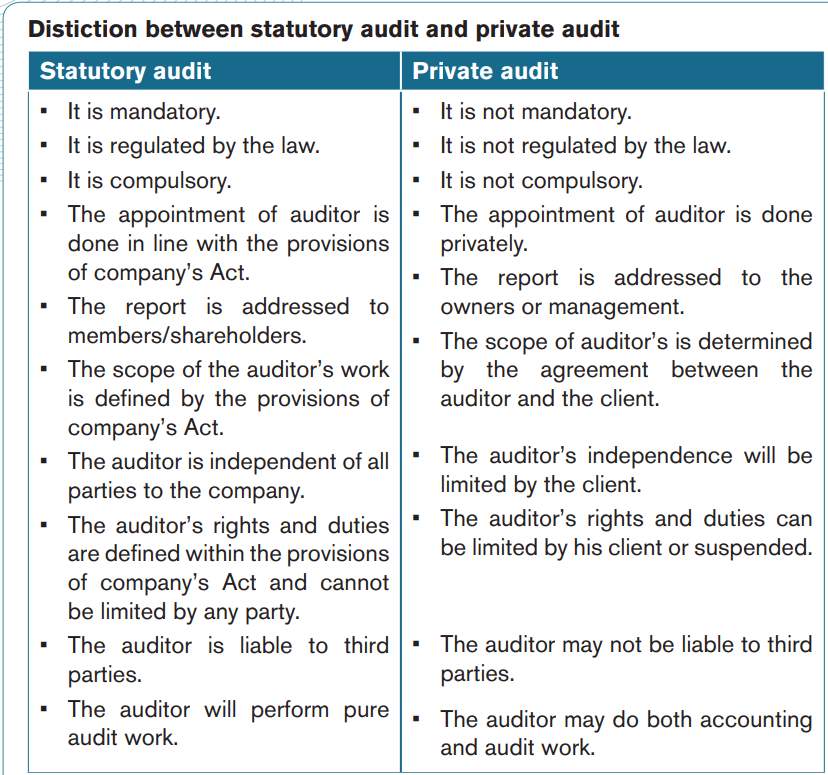

a) Private Audit

Private or voluntary audit is that audit which is not legally required. It is conducted

in line with the agreement between the auditor and the client (audited company),and is not governed by any particular law.

This audit is conducted to obtain an audit report for the use by different users of

the financial statements( management for an organization, investors, employeesetc...).

The private audit includes the audit of sole trader, and audit of partnership.

The contract (engagemennt) between auditor and his/her clients is important

because:

• It defines the scope of audit;

• It is the basis of charging the audit fees;

• It is the basis of the information to include in the report;

• It serves as an evidence;

• It protects both parties;

• It prevents misunderstanding between parties;

• It is legal binding;

• It specifies the rights and duties of both parties;

• It can be used to solve disputes between parties;

• It minimizes risks;• It outlines expectation for both parties.

b) Statutory Audit

Statutory audit is the audit conducted under the provisions of the companiesAct.

Similarities between statutory and private audits

• In both audits, the auditor’s duties and scope of work can be increased

by the client.

• In both audits, the auditor earns the audit fee.

• Both audits are conducted at the end of the year when the records

have been balanced and closed off.

• In both audits, the auditors apply similar techniques and audit tests.

• Both auditors might be the members of professional accountants’ body

like ICPAR, ACCA, and IFAC.

• In both audits, valuable advice is provided to the client at the end of

audit work.

• Both audits are used as basis for decision-making.

• Both safeguard company’s assets.

• In both audits, the auditors issue audit reports.

• Both audits are concerned with the review of the activities of the

company.

• They are concerned with the preventive measures against errors and

frauds.• They are concerned with the strength of the ICS.

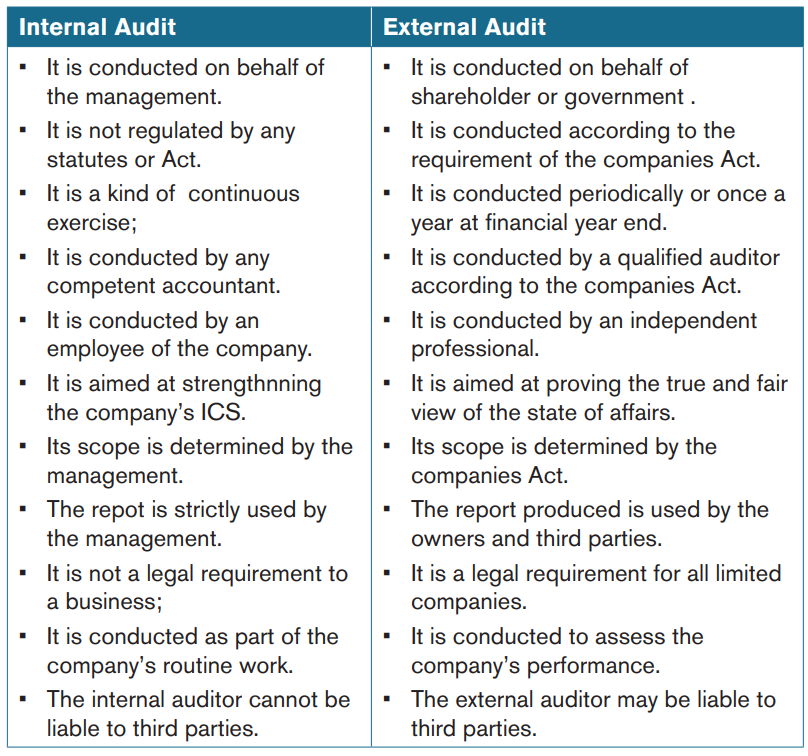

c) Internal Audit

Internal auditing is an independent, objective assurance and consulting activity

designed to add value and improve an organization’s operations. It helps an

organization to accomplish its objectives by bringing a systematic, disciplined

approach to evaluate and improve the effectiveness of risk management, control,and governance processes.

The report of internal audit is used by the management for the improvement ofinternal control system.

The internal auditor carries out checking work throughout the year. Although,

he/she is an employee of the organization, he/she is given some form ofindependence in order to perform his/her duties as required.

d) External Audit

An external audit is an objective examination by an auditor to examine the

company’s books of accounts and determine if the company’s financial

statements are fair and true. An auditor also determines if the company follows

accounting standards and systems. An independent auditor reviews the

accounts and provides the reassurance and transparency to the company›s

shareholders about the correctness of the accounts.It makes the company andits financial statements more credible and respected.

External audit is conducted by an independent auditor who is not an employee

of the organization.The external auditor is appointed by owners of a businessandby the shareholdres in a case of a limited company.

The main purpose of external audit is to provide an audit report on financial

statements audited. The audit report is used by the shareholders and thirdparties like bank managers, creditors, and income tax authorities.

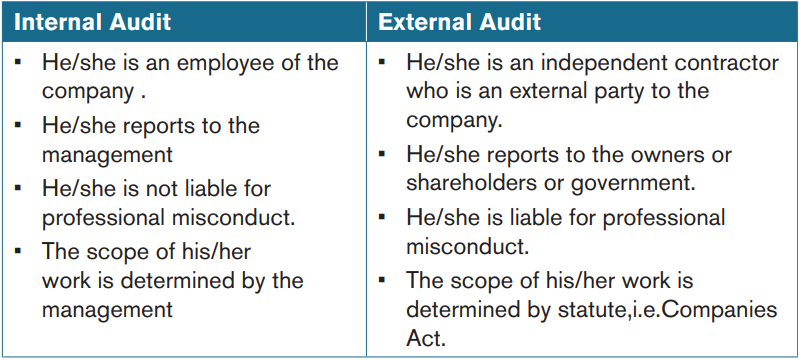

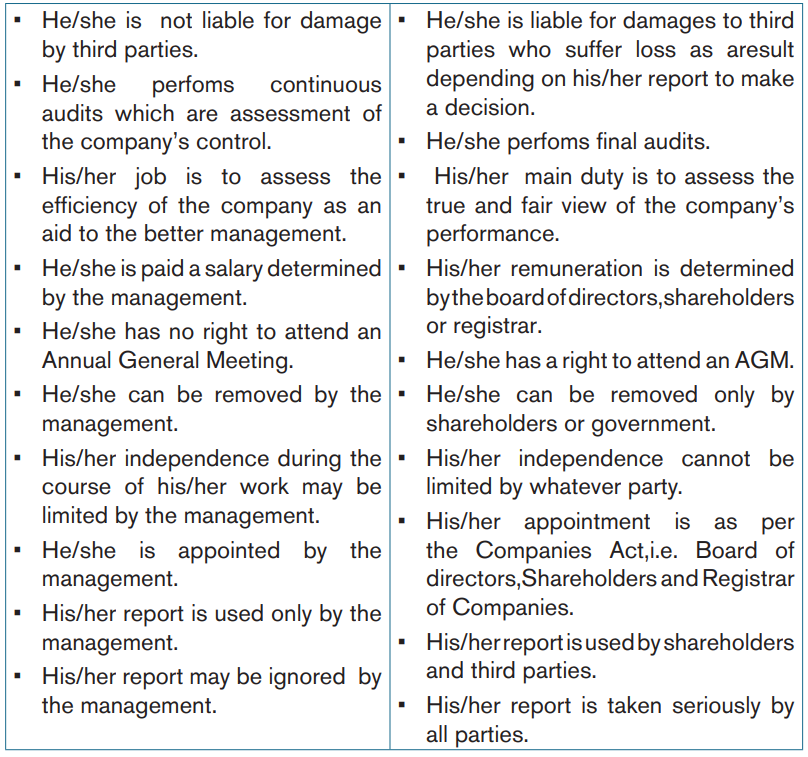

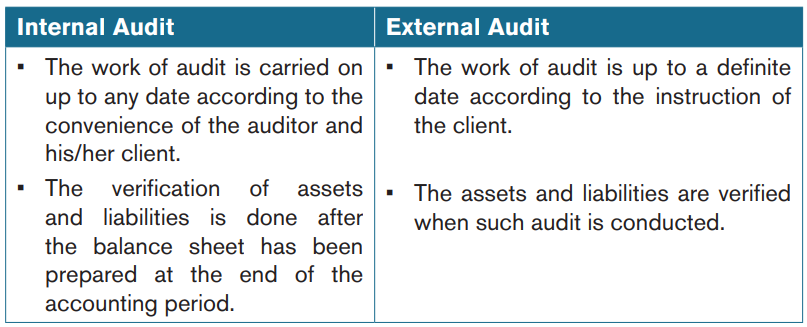

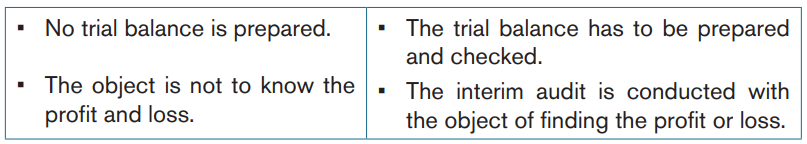

Differences between Internal Audit and External Audit

Differences between an internal Auditor and External Auditor

1.3.3. According to the time

a) Final audit (periodic/Detailed/Complete Audits)

It is conducted at the end of the financial period when accounts have beenclosed off, and financial statements have been prepared and approved.

Advantages of final Audit

• Chances of figures being changed are minimal.

• It is flexible as the auditor can prepare good programme to cover all

areas well.

• It is very ideal for small business whose transactions are few and can

be audited at one sitting.

• It is not expensive.

• This audit does not interrupt the client’s work.

• It eliminates notes taking which are a phenomenon of other audits.Disadvantages of final audit

• The delays may occur if there is large volume of work.

• The frauds and errors are discovered after the close of the year.

Sometimes, it is too late to rectify or take preventive measures.

• As the financial periods of most of the clients end on the same date , itbecomes difficult for the auditor to deploy audit staff adequately.

b) Interim Audit

Interim audit is conducted to a particular date within the accounting period.

It is conducted within the accounting period usually half yearly. It is a kind of

audit which is conduted between the two periods or during transitional period.

It is aimed at assessing the company’s performance in order to pay interimdividends.

Advantages of interim audit

• It facilitates completion of the final audit.

• Errors and frauds can be more quickly found and detected during the

course of the year.

• It is ideal for situations under which the company is required to publish

figures for purposes of paying interim devidend.

• It is less expensive than continuous audits because the auditor will

spend less time in the company in interim audit.

• It has a moral effect on the staff of the client in that they will be uptodate .

Disadvantages of Interim audit

• Figures already audited can be changed/altered after this audit.

• It will interrupt the client’s work as his/her books will be taken away for

the purpose of audit.

• It involves a lot of notes taking.

• The client’s staff may develop the habits of depending upon the audit’s

staff to solve their accounting problems.

• Since it is aimed at the declaration of interim dividends, the management

may manipulate the accounts to show more profits so as to declare

better dividend which will amount to a big fraud.• This means additional work.

c) Continuous Audit

It is that audit which involves detailed examination of the books of accounts at

regular intervals of 1, 2 or 3 months. Continuous audit is applied where:

• Financial businesses whose transactions must be up to date to prevent

errors and frauds;

• The number of transactions are too numerous to audit at the end of the

year;

• There are no satisfactory internal control systems; in risky businesses

where decision making has to be made timely and accurately;

• It is desired to present the accounts just after the end of the financial

year for example in banks;

• The statement of accounts is required to be presented to the

management after every month or each quarter;• There is no satisfactory internal control system in operation.

Advantages of continuous audit

• Easy and quick discovery of errors.

• Quick presentation of accounts.

• Moral check on staff.

• Keeps client’s staff regular.

• Audit staff can be kept regular.• Efficient audit.

Disdvantages of continuous audit

• Alteration of figures.

• Altered by dishorest clerk.

• Dislocation of client’s work.

• This method is expensive.• It involves extensive note taking so as to avoid alteration of figures.

Distinction between continuous audit and Interim audit.

1.3.4. According to the method of approach

According to the method of approach ,various types of audits are:

a) Procedural audit

A procedural audit is an examination and review of the internal procedures and

records of an organization in order to ascertain their accuracy and reliability.The

main purpose of this audit is to ascertain whether the internal procedures arereliable or not.

Advantages of procedural audit

• This audit will provide a feedback to the management.

• The audit will reveal which procedures are outof dated and uneconomical

and which calls for replacement.

• It will identify the strength or weakness in ICS.

• It will reveal the management weakness in supervising the company’s

operations.

• It will ensure co-ordination of the company’s operations which may

boost its profitability.

• It will reveal whether procedures in accounting department are workingpropely or not.

Disadvantages of procedural audit

• It may be a very expensive audit.

• It may be frustrated for the management.

• It may mean duplication of effort if the same procedures are examined

in the final audit.

• This type of audit may be tedious in particular if the company hasnumeruos procedures.

b) Management audit

Management audit is an independent and systematic analysis and evaluation

of a company’s overall activities and performance. It is a valuable tool used to

detremine the efficiency,functions,accomplishments and achievements of thecompany.

The purpose of this audit is to prepare a report on the effectiveness of the

management from the point of view of the profitability and efficient running ofthe business.

Advantages of management audit

• It will improve the quality of the management in the business.

• It will identify how decisions are made in a business.

• It will reveal the weaknesses of the management.• It will reveal the efficiency of budgetary system and its management.

Disadvantages of management audit

• It may lower the morale of top management.

• It is not possible for the mangement and audit staff to reveal their

inefficiencies during the auditor’s presence and this may lead to abiased report.

c) Vouching Audit

Vouching audit is that audit where the auditor checks each and every transaction

right from the origin in the books of prime entry till they are posted and the finalaccounts are prepared from the amounts posted.

d) Balance sheet audit

The term balance sheet audit means verification of the value of assets,liabilities,the

balances of reserves and provisions and the amount of profit earned or loss

incurred by a business during the year.

The balance sheet items are verified by checking the following;

• Description

• Ownership (recording of items)

• Net Book Value (NBV=cost less totaldepreciation)• Existence (physical existence of the asset)

Advantages of a balance sheet audit

• Less expensive because it only checks the balance sheet items.

• Results in a balanced opinion because the balance sheet contains the

most important items the auditor’s report is based on.• Chances of changing figures after the audit are minimal.

Disadvantages of a balance sheet audit

• It is partial audit and not therefore suitable to limited companies.

• It is only applicable to companies with a strong internal control system.

• If undertaken for a limited company, it may increase the auditor’sliabilities because it covers a limited area.

e) Standard audit

This is a type of audit, which is conducted to ascertain whether the client

accounting system complies with the required levels of standards set by theprofessional bodies.

These may include:

• Statement of standards of accounting practices (SSAP);

• International Accounting Standards (IAS);• Generally Accepted Accounting Principles (GAAPs).

1.3.5. According to the public sector’s audit

Main Objective

The main objective of public sector’s audit is to provide assurance to parliament,

the government and the public that government departments, ministries and

agencies are operating and accounting for their performance in accordancewith the Act of Parliament, the relevant regulations and public interests.

The three main types of public sector’s audits

a) Financial audit

It focuses on determining whether an entity’s financial information is presented

in accordance with the applicable financial reporting and regulatory framework.

This is accomplished by obtaining sufficient and appropriate audit evidence to

enable the auditor to express an opinion as to whether the financial informationis free from material misstatement due to fraud or error.

b) Performance audit

It focuses on whether interventions, programs and institutions are performing in

accordance with the principles of the economy, efficiency and effectiveness and

whether there is room for improvement.

Performance audit is executed against suitable criteria, and the causes ofdeviations from those criteria or other problems are analyzed.

The aim is to answer key audit questions and to provide recommendations forimprovement.

c) Compliance audit

It focuses on whether a particular subject matter is in compliance with identified

criteria obtained from laws and regulations. Compliance auditing is performed

by assessing whether activities, financial transactions and information are,

in all material respects, in compliance with the existing laws and regulationsgoverning the audited entity.

Application activity 1.3

1. Explain the following types of audits according to the time factor.

a. Final audit

b. Interim audit

c. Continuous audit2. Give the advantages and disadvantages of procedural audit.

1.4. Investigation

Learning activity 1.4

Analyze the photos above and answer the follow questions:

1. What do you see on the image above?

2. Differentiate these persons according to their work

1.4.1. The difference between auditing and investigation

a) The meaning of investigation

Investigation is an act that involves the examination of accounts and the use

of accounting procedures to discover financial irregularities and to follow the

movement of funds and assets in and out of organisations.

Investigation is an inquiry commissioned by a client for some purpose.

Investigating is a kind of special audit with a limited or extended scope accordingto the purpose for which it is conducted.

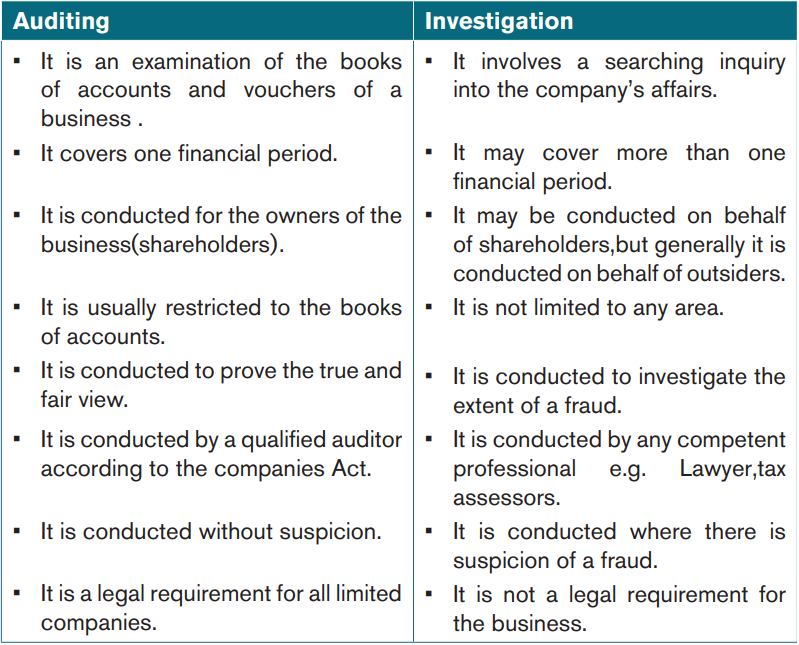

b) Difference between auditing and investigation

1.4.2. Characteristics and reasons of investigation

a) Characteristics of investigation

• Investigation is an enquiry.

• Investigation implies systematic and critical examination of accounts

and records of a business enterprise for a specific purpose.

• It is conducted for a specific purpose (suspicion).

• Its specific purpose may be evaluated of state of affairs or establishment

of a fact.

• Conducted for a non-fixed period (any time) and any person (police,lawyers, consultants, etc.) and describes a fact not an opinion.

b) Reasons for investigation

Investigation is carried out due to the following reasons:

Purchase of a company

When an individual is interested to purchase a business, he/she can appoint an

accountant of his/her choice to carry out investigation in respect of business

which he/she wants to purchase. The main purpose of this investigation is to

find out the details about this purchase. If the investigation report is in favor ofthis business, then it can be purchased.

Admission of a new partner

An investigation may arise, either on behalf of a person intending to bring capital

in order to become a partner, or for the existing proprietors who intend to take

in a partner. If the investigation is arranged by the prospective partner. The main

purpose will be to ascertain whether to become a partner is beneficial or not. Inthis case, investigation will be similar as in the case of a purchase of a business.

Fusion of the companies (Acquisition of a Merger)

Mergers mean to convert two or more business enterprises into one unit. In

this case, one business enterprise can acquire the assets or shares of another

enterprise. The most important term that must be negotiated in a merger

arrangement is the price the acquiring firm will pay for the acquired business. In

mergers or fusions, a larger firm generally takes over a small one and assumesall management control.

Before the merger of two or more business enterprises, investigations are carriedout through some accountants by the firm, which intends to acquire other firms.

The main purpose of these investigations is to find out the details about financialposition of the other businesses.

Prospecting of the investments (Prospective investment)

Some individuals or firms might be interested to make some investments in

the form of shares or debentures of other companies. In order to make their

decisions, they want to know the details about the financial standing of those

companies. For this purpose, they can arrange some investigations throughsome accountants.

Prospecting of a loan or investigations on request for loans (Prospective

lending)

Some banks carry out some investigation before advancing loans to some

business enterprises. Similarly, some suppliers need independent investigation’sreports before granting credit facilities to their clients.

Suspicion of fraud or fraud investigation (Fraud)

Investigations are carried out on the instructions of management to detect fraud

if the behavior of some employee is suspicious. If the fraud is concerned only

with the section of the work e.g. the entry of dummy workmen on a wages sheet

by one clerk, the extent of the investigation should be restricted to that onesection.

On the other hand, if misapplication of cash is the result of collusion between

two or more employees then the investigation can be extended to varioussections or departments of the organization.

Legal or statutory investigation

Investigation conducted to satisfy some legal requirements. The following cases

indicate when a legal investigation can be conducted:

• An investigation by the liquidator of a company where directors are

suspected of fraud regarding the affairs of the company;

• An investigation by a trustee in a bankruptcy where the bankrupt issuspected of having acted fraudulently in the past.

c) Steps of investigation

• Determine the scope/objectives of investigation.

• Planning the investigation (Formulate investigation program).

• Establishment of the fields of application (by examining or studying

various records).

• Analysis and interpretation of findings/results.

• Preparation of the investigation’s report/writing of the investigationreport.

d) Report of investigation.

On the completion of investigation, the report is submitted to concerned parties.

The report submitted in respect of an investigation should cover the following

points:

• Reference to instruction given by the client;

• Reference to basic documents covering information obtained;

• General outline of the work done;

• Summary of information obtained;• Recommendations in accordance with information obtained.

Application activity 1.4

1. The scope of investigation is very large than the scope of accounting.

State some areas in which investigation should be applied.2. What are the steps of investigation?

1.5. Auditing and acccounting

Learning activity 1.5

1. Observe carefully the pictures above and establish the difference

among them.

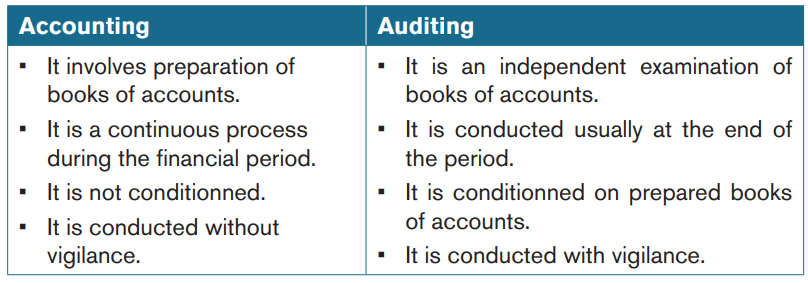

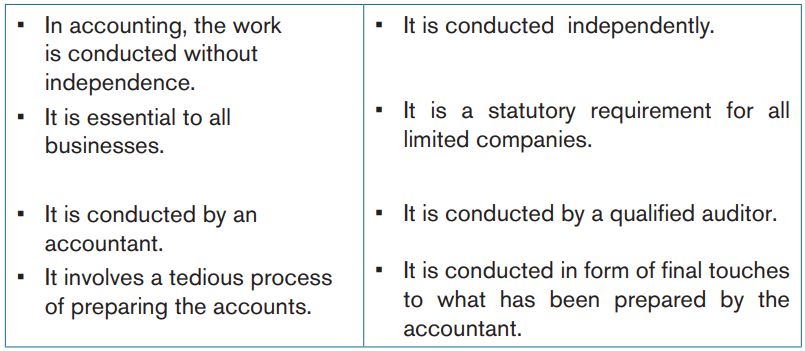

1.5.1. Difference between auditing and accounting

1.5.2. Benefits and limitations of an audit

a) Benefits of an audit

• The shareholders of a company are given an independent opinion as

to the true and fair view of the accounts that have been prepared bymanagement.

• The use made by third parties such as suppliers and banks adds

confidence in the performance of a company.

• While not responsible for detecting fraud, the very fact that an audit

is carried out and may uncover evidence of fraud, can help to mitigateagainst such risks.

b) Limitations of an audit

• Every item is not checked. In fact, only test checks are carried out by

auditors.

• Auditors depend on representations from management and staff.

• Evidence gathered is persuasive rather than conclusive.

• Auditing is not purely an objective exercise. Judgments have to be

made in a number of areas.

• The timing of an audit.

• An unqualified audit opinion is not a guarantee of a company’s future

viability, the effectiveness and efficiency of management, nor that fraudhas not occurred in the company.

Application activity 1.5

1. You are a shareholder in AKARABO Co.Ltd. What are the benefits

could you get from an audit?2. Explain the limitations of an audit

Skills lab activity 1

Using two learning groups, one being as an accountant and another as

an auditor. Students visit library and pairs exchange roles as the teacher

supports accordingly. Let students present their views on the similaritiesbetween auditing and accounting.

End unit 1 assessment

1. Write short notes on the following:

a. Statutory Audit

b. Private Audit

c. Interim Audit

2. Explain the term continuous audit and outline its advantages and

disadvantages.

3. What are the types of audits according to the time factor?

4. Give the difference between Auditing and Accounting

5. Explain the following principles of auditing:

a. Objectivity

b. Professional Independence

6. What are the elements of an investigation report?