UNIT3:CREATION OF COMPANY PROFILE

Key Unit competence: Create a company profile using SAGE 100

Introductory activity

You are hired as an accountant of XYZ Company, and the manager of the

company asks you to start using Sage line 100 software in their accounting

records as one of end of year shareholders meeting decisions. The private

IT consultant has installed the software in all staff computers, including

the one reserved for company’s accountant. To be able to record the

company’s day to day transactions, you need to create company’s profile

in your accounting software.

1. Which process are you going to follow to create the profile of XYZ

Company?

2. What is the importance of keeping company’s basic information inyour accounting software?

3.1. Creation of accounting file

Learning Activity 3.1

The accountant of the church near your home place wants to start using

Sage line 100 in making accounting records for the church, including

weekly offerings and tenths from believers, different other contributions

from church members and invited guests, church expenses including water

and electricity bills, taxes and salaries. The software is already installed in

his/her computer, but doesn’t know how to create accounting file make

configurations relating to the type of business and preference of the user.

1. 1Help him/her to know how to configure the software depending on

his/her choice2. What is the importance of configuring accounting software?

ICT in Accounting | Student Book | Senior Five

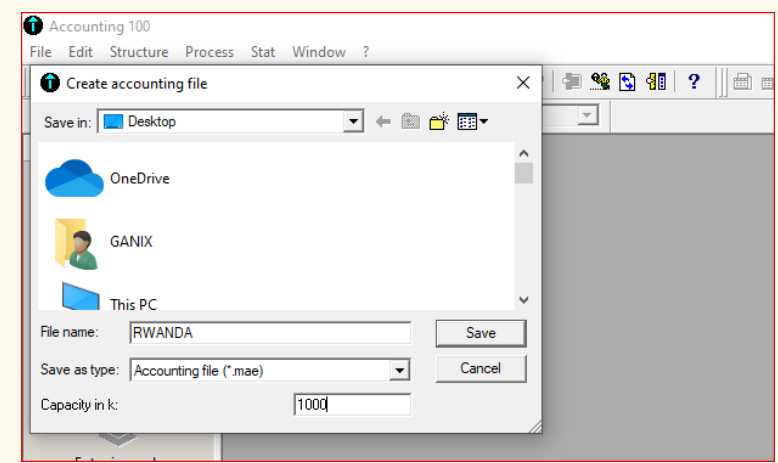

3.1.1. Renaming and saving accounting file

Before starting to use accounting file, you need to create accounting file, which

is a database where all accounting information will be kept. The following are

steps taken to create accounting file:

– Open SAGE line 100 interface by clicking on Start then click on

Programs- then click on SAGE-accounting100, click again on

Accounting 100. The Sage line interface will appear.

– Then click on File then on New, choose the field location of your file

(You may save it on desktop, my documents, local disk C or elsewhere).

– In the file name, delete *mae. and type the file name of your choice,then click Save

Figure 3. 1. Creating the name of accounting file

The file name is “Rwanda” and after clicking Save, the work will be saved on

desktop.

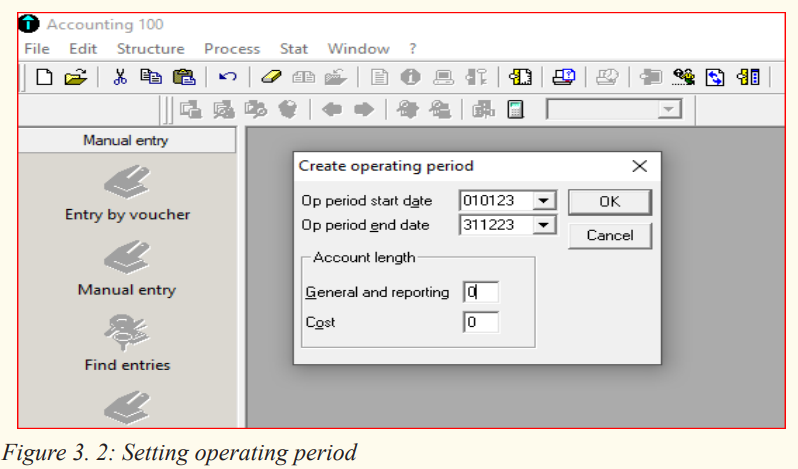

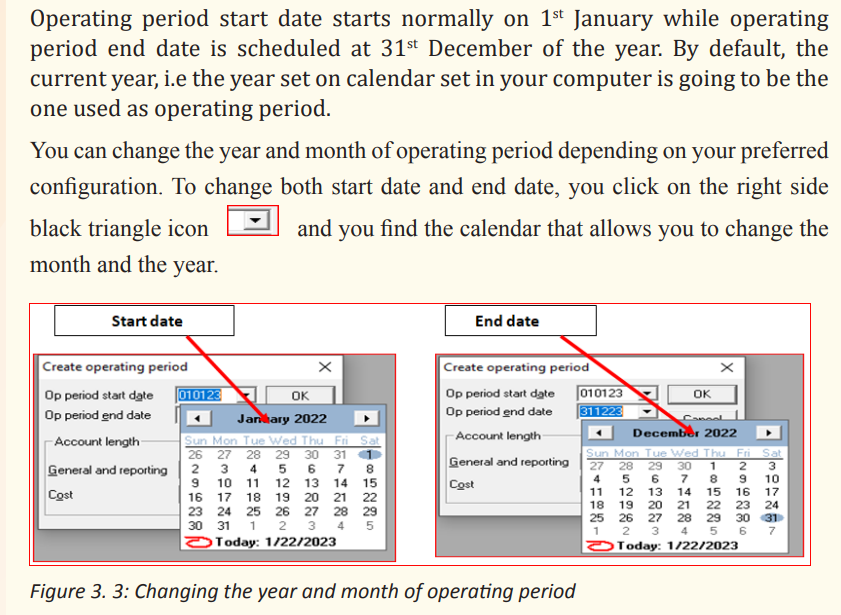

-By clicking Yes, you get the window allowing you create operating period

3.1.2 Operating period

An accounting cycle’s period can vary based on factors unique to each business,

but most business owners choose to start a new accounting cycle annually,

usually from 1st January to 31st December in a given year.

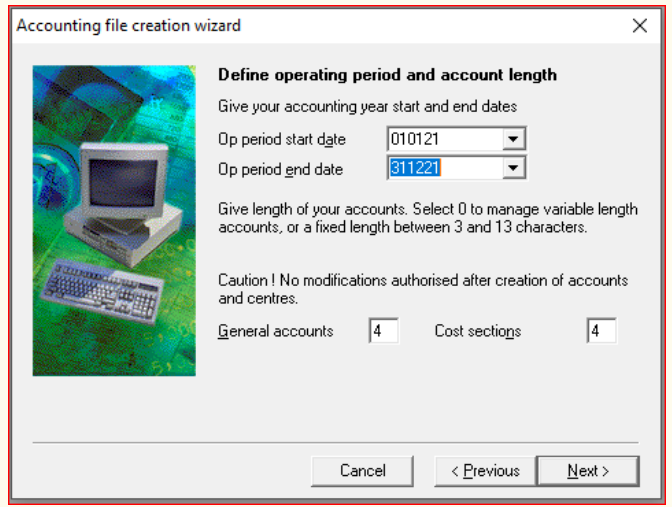

The configuration of operating period and account length is done simultaneously

with the creation of the file name and company’s profile. Below is the processfollowed.

ICT in Accounting | Student Book | Senior Five

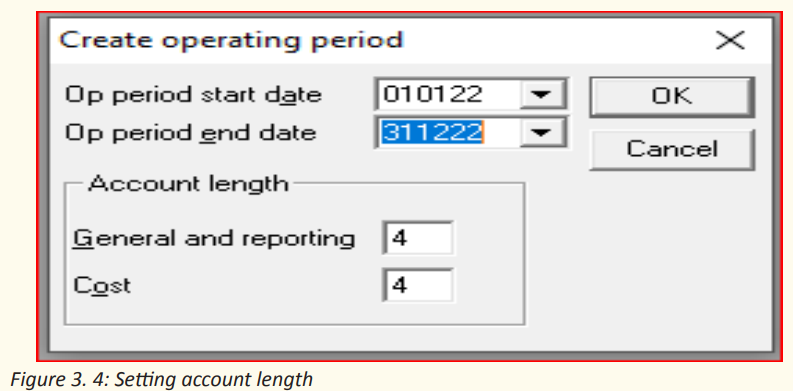

3.1.3. Account length

Account length is the number of digits used for account numbers whencreating chart of account and cost chart of account. Normally, in Sage line 100,

ICT in Accounting | Student Book | Senior Five

the minimum number of digits for account numbers is three (3), whereas the

maximum is thirteen digits (13). The user, depending on his/her choice can use

own prefer number of digits, provided that it ranges from 3 up to 13 digits.

As mentioned in previous section, account length ranges between 3 and 13

digits.

For example, if your accounting year is 2022 and you prefer to use four (4)digits for account length, you will have the following:

After setting operating period and account length of choice, you click Ok and

enter the company profile

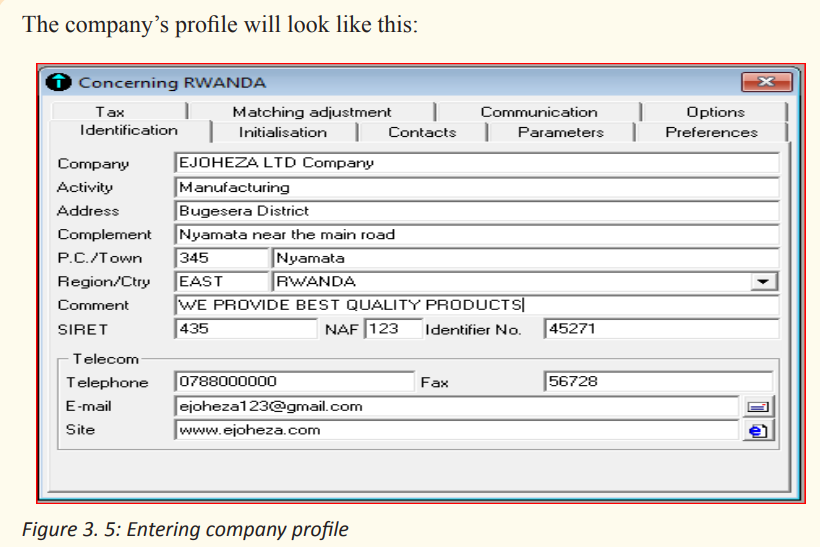

3.1.4. Company profile

The creation of company profile in SAGE line 100 is done just after creating

accounting file.

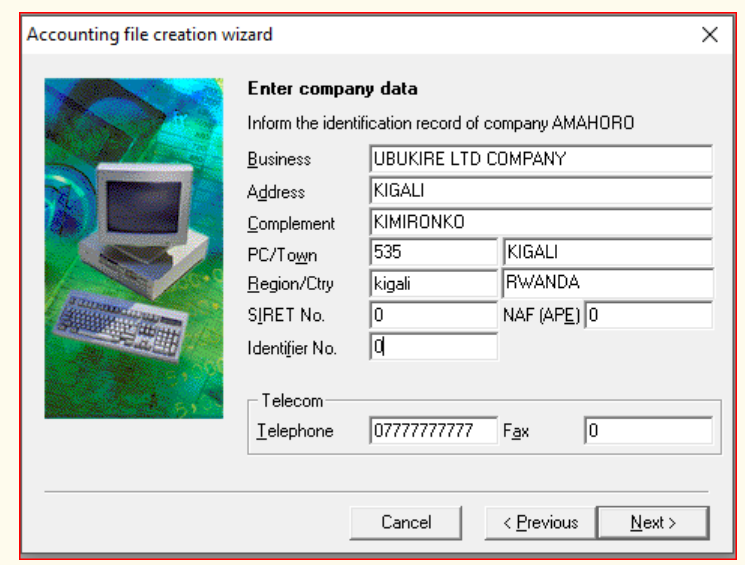

After getting the company profile wizard, the next step is to fill the required

company’s information like company name, activity, address, complement,

Postal code (like PO Box), town, region and country(ctry), comment, SIRET

(système d’identification du répertoire des établissements) identifying

each company in France (Not applicable in Rwanda), NAF (Nomenclature

d’activitéFrançaise), telephone, E-mail and site (website.)

Example: EJOHEZA LTD Company is a manufacturing company located in

Nyamata town Bugesera district, Eastern province. It is located near the main

road from Kigali- Nemba. Po. Box 345 Nyamata, phone number 0788000000,

Fax number: 56728 e-mail: ejoheza123@gmail.com, website: www.ejoheza.com. Enter the information above to create EJOHEZA Ltd Company’s profile.

ICT in Accounting | Student Book | Senior Five

Application activity 3.1

1. By using a computer with SAGE, show how to save or rename a file.

3.2. Configuration of accounting software (SAGE line 100

Learning Activity 3.2

KAMANA, a sole trader in RUSIZI town is constrained by the loss he is

used to get due to lack of adequate record keeping in his business. As a

solution, he has purchased a computer and installed sage line 100 and got

some basic information on the use of SAGE line 100 accounting software.

However, he doesn’t know how to make configurations in order to use the

software depending on his preferences.

1. Help him to configure SAGE line 1002. Why is it necessary to configure Accounting software?

ICT in Accounting | Student Book | Senior Five

ICT in Accounting | Student Book | Senior Five

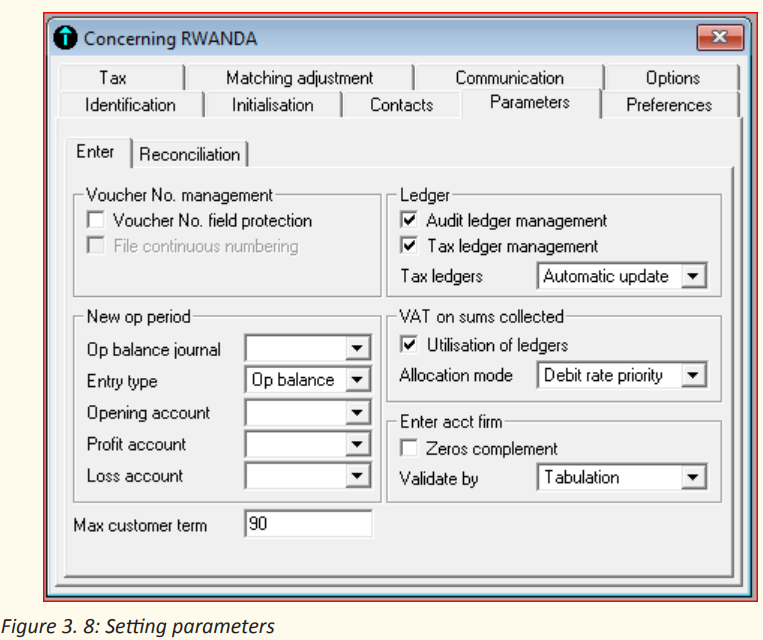

3.2.2 System defaults and Package parameters, VAT and

currency rates; exchange rates

1. System defaults and package parameters

Normally, before recording any information in accounting software it is

necessary, to make some parameters configuration for the ease of using

accounting software and depending on what is needed in the company. Defaults

set in package parameters are found by clicking on file-concerning yourcompany-parameters. The following window is displayed:

a. Voucher number field protection

When a tick is put in front of voucher number field protection, you protect the

voucher number field column heading in journals from being written in, i.e.

the field is disabled. If voucher number field protection is left without a tick,

you allow typing the number of the voucher in the heading of voucher number

column while recording transactions in journal.

b. New operating period

New operating period option allows to configure the journal in which openingbalance is to be recorded, entry type for opening balance where by default

ICT in Accounting | Student Book | Senior Five

the software suggests opening balance as entry type, selection of the opening

account and account where profit or loss will be recorded.

c. Maximum customer term

Maximum customer term is meant by maximum payment duration of customers

who purchase goods on credit. In other words, it is the maturity period. The

software sets maximum customer term 90 days by default corresponding to 3

months maximum. Nevertheless, the user may set other period depending on

his choice, like 30 days, or 60 days.

d. Ledger

The ledger option is used to configure audit ledger management and tax ledger

management. If a tick is put on audit ledger management the user allows the

system to enable audit report from the automatic ledger generated from the

books of account. Similarly, when a tick is put on tax ledger management, the

system allows tax ledgers to be updated automatically, or after confirmation.

e. VAT on sums collected

On this option, if a tick is put on utilization of ledgers, the system allows the

option of allocated VAT collected on sums of money gained, but if there is no

tick on utilization of ledgers the allocation mode is disabled, hence it becomes

impossible to allocate VAT on sums collected.

f. Enter account firm

If a tick is put on zeros complement, the system allows the zeros to be added

to the account number of a given account while creating the chart of account

to match with the already set account length. For example the user is creating

capital account and the account length set is four (4) digits, if the user types

only 2 digits (example: 10) in the Ac no field, other 2 zeros are going to be

added automatically to have four digits(1000). Validated by Tabulation or by

Enter keys depends on the user choice. If Tabulation or Enter key is selected, it

means to go to another step or field the user taps on Tabulation or Enter key.

2. VAT and currency rates

a. VAT

To make configurations on VAT

• Click on File

• Click on Concerning your company• Click on Tax

ICT in Accounting | Student Book | Senior Five

The following window appear

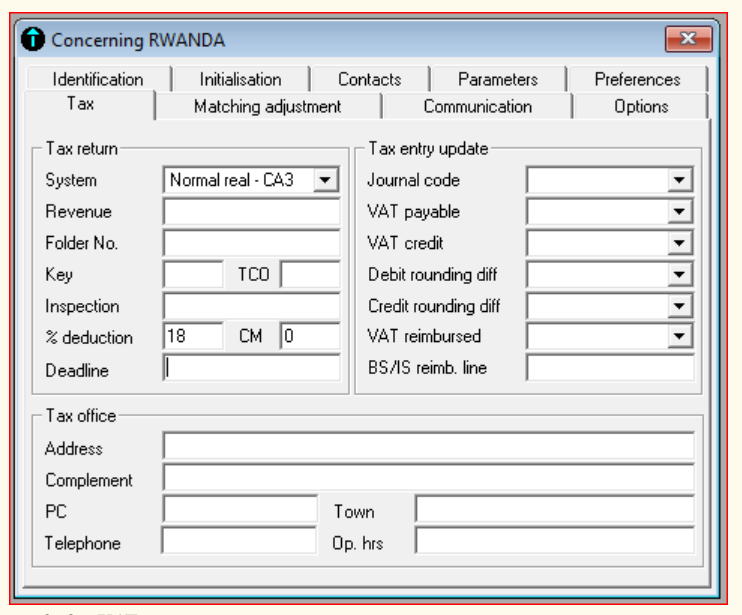

Figure 3. 9 : VAT setting

In tax return option, the system allows to select CA3 document showing formula

to use when calculating VAT collected, VAT deductible and net VAT payable

over the period of one month or quarterly in France between 19th and 25th of

each month. (CA3 formula is not applicable in Rwanda). The option also shows

revenue field where the user fill the revenue gained over the period, number of

folder where the CA3 document is kept, percentage of deduction as well as the

deadline.

In tax entry update option, the user simply select accounts where tax will be

recorded, these accounts should have been created in chart of account. The

user also selects the type of journal where the tax transactions will be recorded

and kept. Lastly, tax option contains the field where tax office (tax collectionagency office) address is to be written.

ICT in Accounting | Student Book | Senior Five

b. Currency rate

Sage line 100 allows the user to create reporting currency. This is normally

the currency of the country where the business is operating, by which most

purchases and sales transactions are performed.

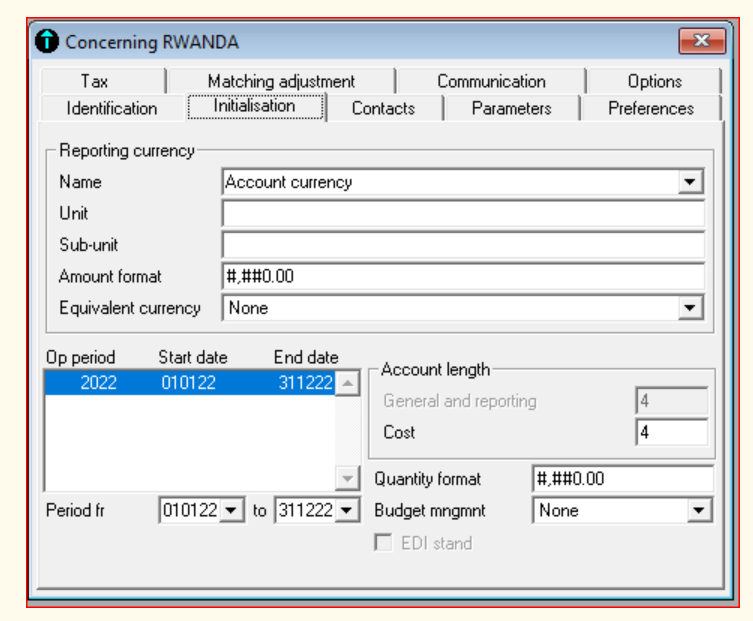

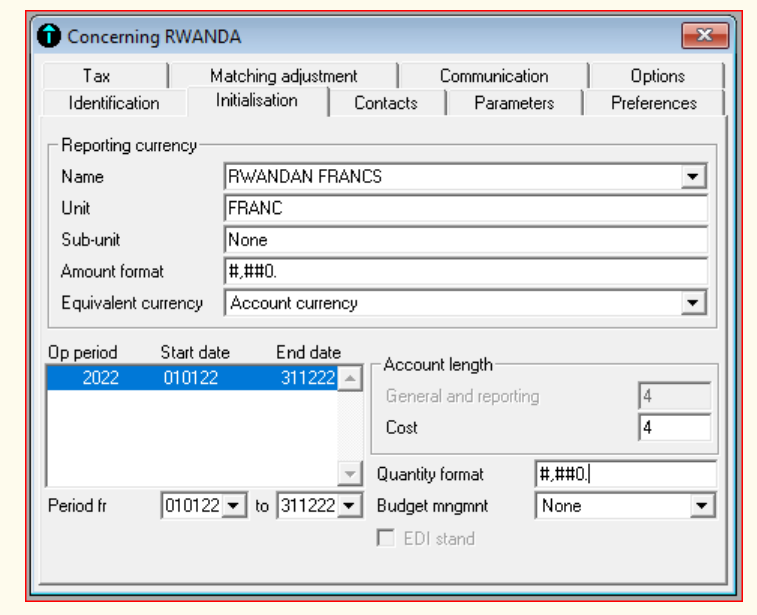

To create the reporting currency, click on Initialization and the followingwindow appear:

Figure 3. 10: Reporting currency configuration

In the Account Currency field, fill the name of the currency you are using in

day to day transactions, let’s say, Rwandan francs in Rwanda. In the unit field fill

the unit of the reporting currency and sub-unit of the reporting currency in the

sub-unit field. In the amount format, if last two zeros are removed, the amount

recorded in journal will have standard format (eg: ten thousand will be 10,000),

but if the last two zeros are not removed, there will be .00 at the end of each

amount figure in the journal entry (for eg. Ten thousand will be 10,000.00). The

same configuration generates similar results on quantity format. In equivalent

currency, select Account Currency, then the filled reporting currency will bereproduced in the field.

ICT in Accounting | Student Book | Senior Five

Figure 3. 11: Setting account currency

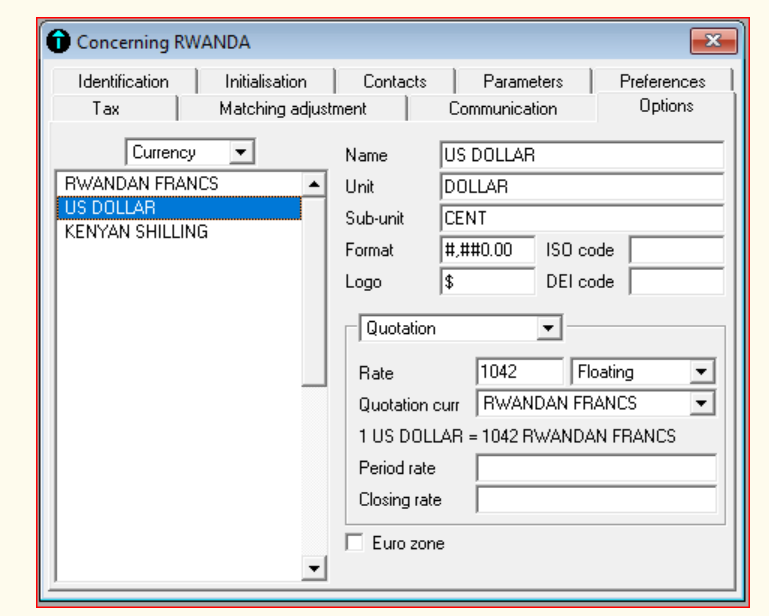

3. Exchange rates

The exchange rates are configured by creating the foreign currencies and the

rates of their exchanges with the reporting currency. To create exchange rates:

• Click on File

• Click on Concerning your Company

• Click on Option

• Click on Currency

• Press Enter on keyboard to leave space for other currencies to be created

Fill the currency information including currency name, unit, sub-unit, format,

logo and equivalent currency. In the rate field, select “floating”.

For example, if the current exchange rates are:

$1=1042 FRW

1Kenyan Shilling=8.9 FRWThe following results will be obtained:

ICT in Accounting | Student Book | Senior Five

Figure 3. 12. Currency exchange rates

Application activity 3.2

1. In parameters option, what happens if you tick on voucher no field

protection?

2. What is the purpose of setting maximum customer term?

3. In sage line 100 already created accounting file, make the required

configurations basing on the information below:

– Reporting currency: Rwandan francs

– Maximum customer terms: 60 days

– Tick on wizard mode

– Set currency rates by using $1=1038 FRW and 1 Ugandan

shilling=0.28 FRW

– Set VAT percentage deduction at 18% and tax office address asKigali, PO Box 2211 Kigali

ICT in Accounting | Student Book | Senior Five

3.3 Use of wizard mode to create the capital and income

accounts, expenses accounts and asset accounts

Learning Activity 3.3

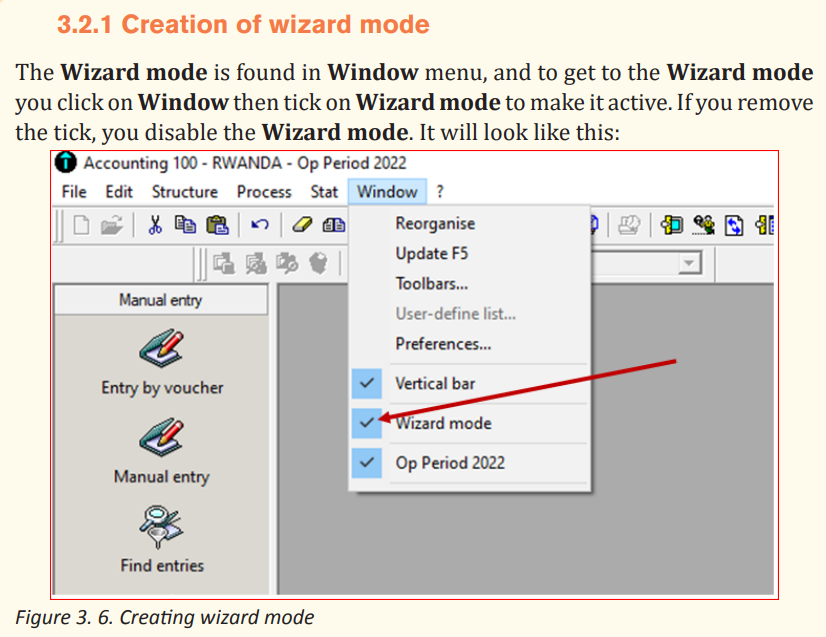

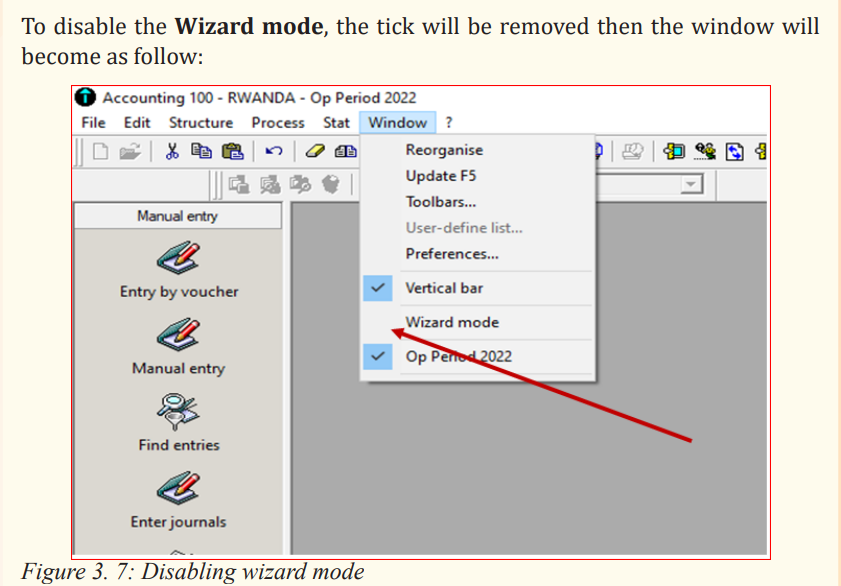

When entering data in Sage line 100, there is an option of using Standard

Mode or using Wizard Mode. This starts by creating file name, company

profile, Chart of account and SP chart.

1. How do you get to the Wizard Mode in Sage line 100?

2. Which method do you think is best between standard mode andwizard mode?

3.3.1 Use of wizard mode

First of all, the Wizard mode must be ticked on, then go to File click on New tocreate new company through the Wizard mode:

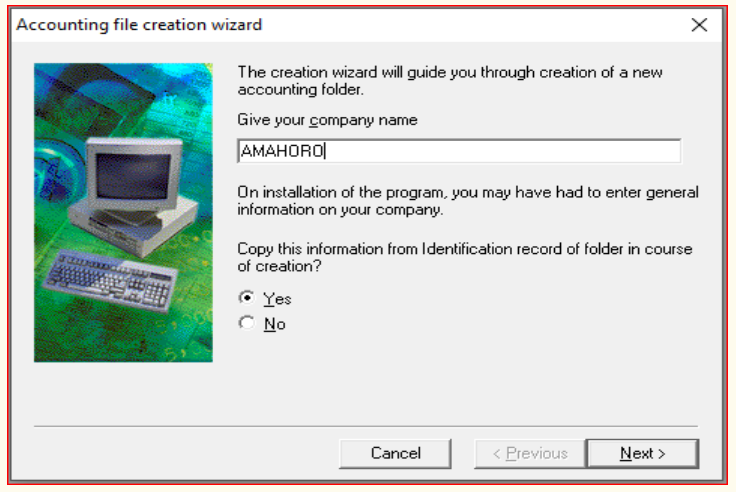

Figure 3.13. Creation of accounting folder in wizard mode

• Click Next to enter the company data:

ICT in Accounting | Student Book | Senior Five

Figure 3. 14: Entering company data in wizard mode

• Click Next to define operating period and account length. Using four digits

for account length and 2021 as operating period, we get the following:

Figure 3. 15: setting operating period through wizard mode

ICT in Accounting | Student Book | Senior Five

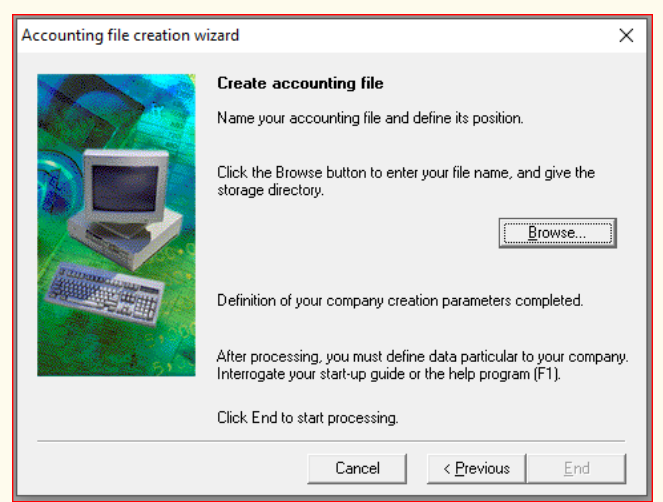

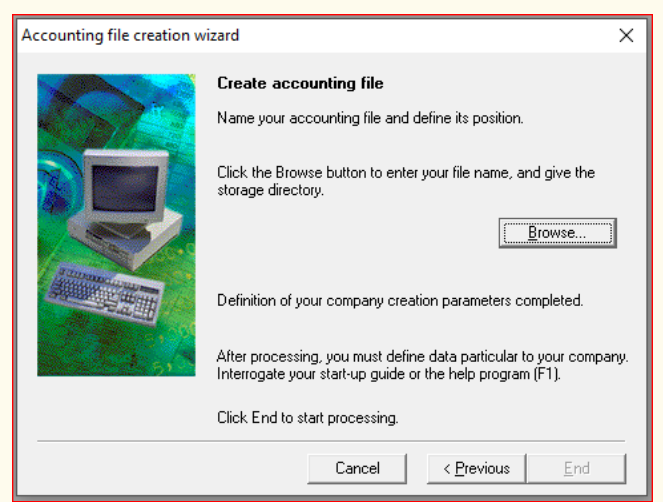

• Click Next to select account currency, then click Next again to copy

accounting data and click on “Browse” to select where your accountingfile will be located.

Figure 3. 16: Selection of storage directory

Figure 3. 17: Entering file name

To create Chart of Account in Wizard mode, the following steps will be followed:

ICT in Accounting | Student Book | Senior Five

• Click on Structure menu

• Right click

• Add new element

The chart of account appears in French with the accounts and account numbers

being set in the system of French chart of account (Plan comptable), since sage

line 100 version of accounting software is set in French system. At this stage it is

possible to add accounts depending on the accounts available in your company.

After the procedures of creating journal codes, recording transactions andproducing the reports are the same as in standard mode

Application activity 3.3

In Wizard mode, create the accounting file and company profile, using the

information below:

• File name: UBUMWE

• Accounting period: Start date 1st July 2020, End date 30th June 2021

• Account length: 4 digits

• Company name: TWITEZIMBERE• Activity: AGRO-PROCESSING

3.4. Use of maintenance tool

Learning Activity 3.4

Your class is in computer lab at school, doing some computerized

accounting practical exercises given by the teacher of accounting software

subject. However, you are interrupted by power outage and all computers

are switched off. After some while, the power is back and all students

switch on the computers to proceed doing their exercises. However, when

they reopen their accounting file created before power outage, they are

not being opened and they receive this notification: “Your file is already

opened, use maintenance tool”

1. What are you going to do in order to sort out this issue?

2. Suppose you fail to solve the problem, what will be the effect of thisfailure?

ICT in Accounting | Student Book | Senior Five

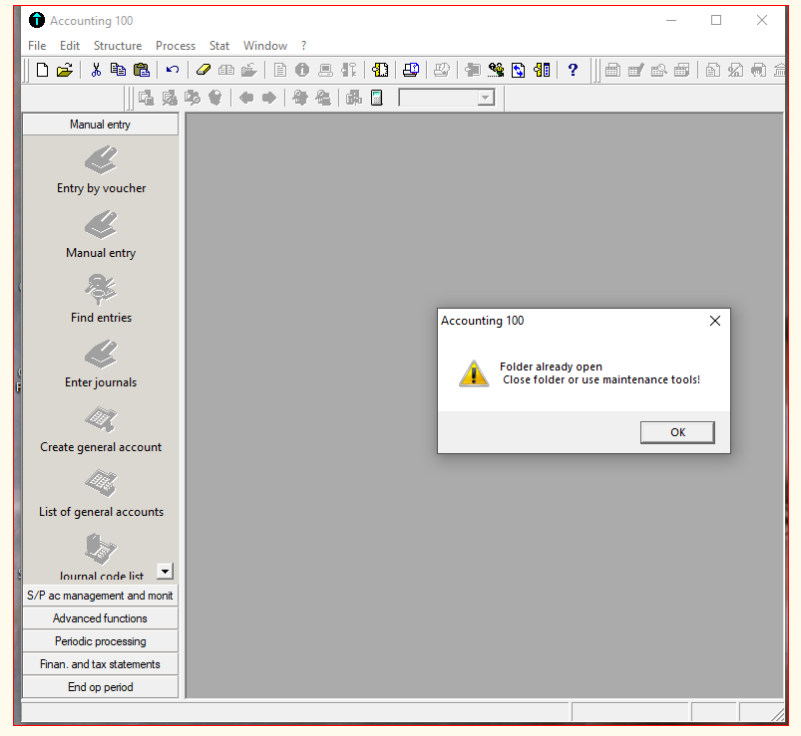

The maintenance tool is used when the program has stopped abruptly and

the folders created are no longer opened. When the user opens the folder he

receives the notification stating that the folder is already open, close the folder

or use the Maintenance tool. This happens mostly when the computer is

switched off abruptly especially when the power is off. This may also happen

when the accounting file fails to respond. If it fails to respond you can close it by

using the Task Manager, by using the combination keys Control+Alt+Delete.

Open the Task Manager and click on accounting 100 then click on End Task.

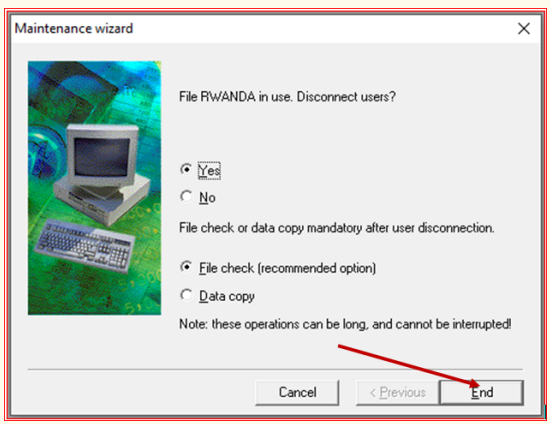

When reopening the file, the user gets the following warning message shown inthe window below:

Figure 3. 18: Notification requesting to use Maintenance Tool

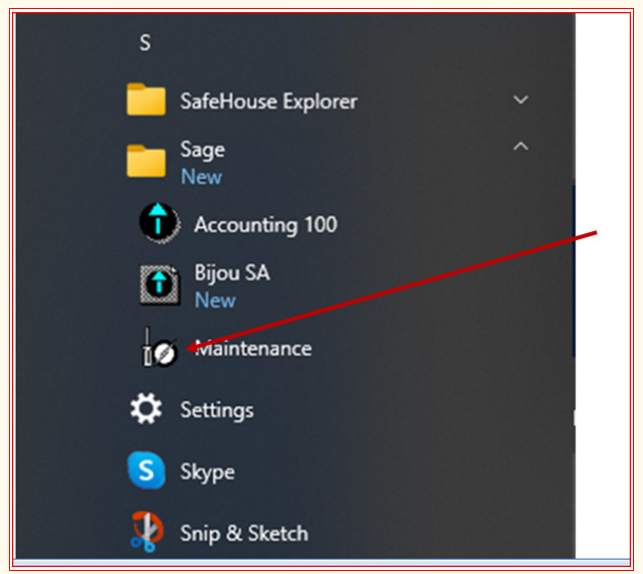

The process of using maintenance tool is the following:

• Click on Start button

• Click on Programs

ICT in Accounting | Student Book | Senior Five

• Click on Sage

• Click on Maintenanc

Figure 3. 19: Opening Maintenance Tool in SAGE line 100

Then the Maintenance window is opened

Figure 3. 20. Maintenance tool interface

ICT in Accounting | Student Book | Senior Five

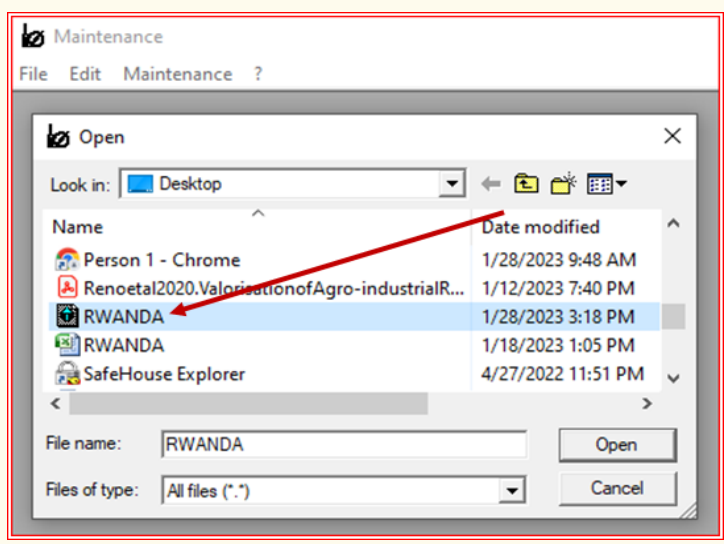

To get to the corrupted file that needs to be maintained, click on File menu

of the Maintenance tool-and click on Open, search for accounting file to be

maintained and click Open. The file to be maintained here is RWANDA. Click onit then click Open.

Figure 3. 21. Opening of file to be repaired under maintenance tool

After opening the file in Maintenance Tool, the windows of maintenance

wizard is displayed, and then click End

Figure 3. 22: Repairing the accounting file under maintenance tool

ICT in Accounting | Student Book | Senior Five

Finally, at that stage the file is repaired and can work normally.

Application activity 3.4

1. Under which circumstances do we use Maintenance Tool in Sage

line 100?

2. Assume that your accounting file is not responding or close abruptly.

Then when you close it by using Task Manager, it is not being opened

it requires you to use Maintenance Tool, what are the steps are you

going to follow to be able to access your information again by usingthe Maintenance tool?

3.5 Add/Amend records

Learning Activity 3.5

1. After entering records in account software, you may need to make

some changes of some amendments, under which circumstances

would this happen?

2. What is the importance of updating records in an accounting

software?

Once the user has already entered some data in accounting software, he/she

may need to amend or update some information. These amendments are only

possible if no journal entries have been made for that account to be amended.

3.5.1 Customer record

If the user wants to add some information on customer record, the steps

followed are the same as the steps followed when making initial record. For

example, if a new customer is to be added to SP chart, click on Structure then

on SP chart, Right click then click on Add New Element. Then follow the steps

of creating a customer in SP chart.

If some information is to be changed to existing customer, only account number

can’t be changed, but the name, address and other information can be changed.

3.5.2 Supplier record

The procedure of making changes in adding or deleting some information onsupplier is the same as for the customer. The user may need to add or remove

ICT in Accounting | Student Book | Senior Five

some information on the supplier name created depending on the changes that

need to be added in the system like the address of the supplier, product/raw

materials to be purchased from that particular supplier etc.

To make these needed amendments,

• Click on Structure menu then click on SP chart,

• Do a right click then click on Add New Element. This is followed when

the user wants to add a new supplier to his SP chart.

When only little information needs to be modified for a particular supplier,

double click on that particular supplier, then some modifications can be made

except the account number. For example, you can change the name and address

of the supplier.

3.5.3 Other third parties accounts

Apart from customers and suppliers, the business may have other third parties

like employees, sundry debtors, and sundry creditors. The same procedures

are followed to make changes for customers and for suppliers are followed forother third parties update.

Application activity 3.5

1. Assume that you are accountant of a given company and you use

Sage line 100 in your records keeping. You have made an error

in recording the debtor SALAMA’s information, where, instead of

recording her proper account type of customer, you saved her assupplier, how can you amend/ update her information

3.6. Check data records using IT tools

Learning Activity 3.6

1. When using accounting software, you may make some errors. Give

three examples of the errors can be discovered by the software

itself?

2. Once an error has been made and the system notify you with a

warning message, about how can you solve the problem?

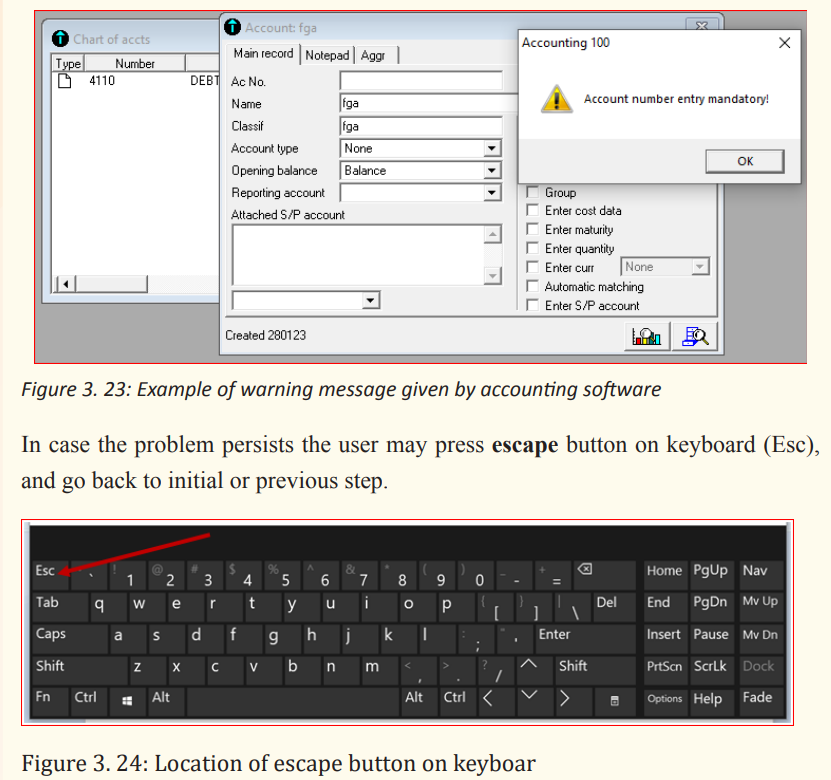

The recorded data may be checked using the software since there can be someerrors when entering the data in the system. For example, if the account related

ICT in Accounting | Student Book | Senior Five

to expenses is given the name of a fixed assets, the system does not recognize

the creation of that account. More exemplary, in journal entries, if for example

the cash transaction is recorded in sales journal the system notifies the user

that the account to be used is not of type credit sales. The user must always

read the warning notification given by the software before proceeding to next

steps. For example, if you typed a letter in Account field, Sage software tells

you that the field contains an invalid character. If the problem is a list entry that

doesn’t exist, the “list name Not Found” dialog box opens (where “list name” is

a list such as Terms) and tells you the value isn’t in the list. In the dialog box,

click Set Up to add the entry to the list. Fix any other errors, and then click Save

Changes again.

Sometimes the user may receive a notification warning about the important

and compulsory step skipped or mandatory field not filled, then the software

notifies and warns about it. For example in the creation of Chart of Account ifyou don’t fill in the account field the following notification is displayed:

ICT in Accounting | Student Book | Senior Five

Application activity 3.6

1. Why is it necessary to check data records in accounting software?

2. You have already created company name but you find that you have

recorded wrong accounting period. What are you going to do torecord the appropriate accounting period?

End unit assessment

1. Before recording any data in accounting software, we need to create

file name and company profile. Why is it necessary to create the file

name and company profile?

2. Create company profile and fill the information below:

– File name: UMURIMO

– Company name: UVW

– Activity: Service provision

– Account currency: Rwandan franc

– Tick on voucher number field protection3. Create the currency rates for USA dollar, for $1=1076 FRW

ICT in Accounting | Student Book | Senior Five