UNIT 8:RECEIVING MONEY AND THE BANKING SYSTEM

Key unit competence: To be able to explain banking system

Introductory activity

Observe the above picture and answer the questions below.

1. Enumerate the components of banking system in Rwanda

2. Define clearing system

3. State the procedures for preparing pay-in-slip

4. What are the factors to be considered by a teller before processingcheques of bank customers?

8.1 The banking system

Activity 8.1

The Central Bank supervises and controls the operations of the formal

financial sector. There are currently 16 commercial banks in Rwanda

and a number of microfinance institutions and rural savings and credit

co-operatives. You are required to differentiate commercial banks with

Microfinance institutions.

Activity 8.1

8.1.1 Banking system in Rwanda

There are various ways that business can receive money, the main methods are:

– Cash

– Cheque

– Credit and Debit cards

– Electronic receipts

Banking procedures for various kinds of receipts should be fully understood and

you should observe whenever transactions are possible. This lesson concerned

with the practical aspects of banking the payments received by business. Before

dealing with these aspects however it would be useful to understand some

background details about the clearing bank system.

The banking system in the Rwanda consists of the following components:

a) The national bank of Rwanda (BNR) is the central bank which regulates

and play a supervisory role over the banking industry

b) Clearing banks, retails banks or banks which provide microfinance

service include:

i) Urwego Opportunity bank

ii) Copedu ltd

iii) Equity bank Rwanda limited

iv) Banque populaire du Rwanda ltd

v) Bank of Kigali

Note: Note: this is not an exhaustive list of Rwandan banks – Rwanda has

around 16 banks including development bank and cooperative banks.

We also have currently above 400 institutions that provide microfinance

services including Umurenge SACCOs. There is currently an initiative

aiming at consolidating these microfinance institutions to reduce them

down to 30 institutions across the country

c) Microfinance services which are a type of banking service that is

provided to unemployed or low income individuals or group who

otherwise have no access to financial services. Small loans are made

so that people can start and operate a business. The borrowers pay

back the loan over time.

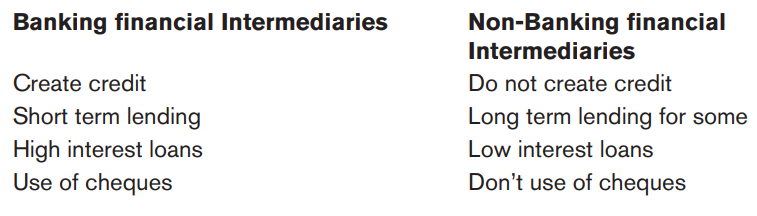

Banking financial intermediaries and non-banking financial

intermediaries

Banking financial intermediaries are financial institutions that accept

deposits and create credit or extra deposits by use of cheques. They extend

loans to borrowers using part of primary deposits and extra deposits created.

Commercial banks are an example of banking financial intermediaries.

Non-banking financial intermediaries: these are financial institutions which

do not create credit or extra deposits by use of cheques or which do not receive

deposits at all.

They extend loans to the borrowers using primary deposits got from surplus

lending units

Example of non-banking financial intermediaries

– Insurance companies

– Pension funds– Development ban

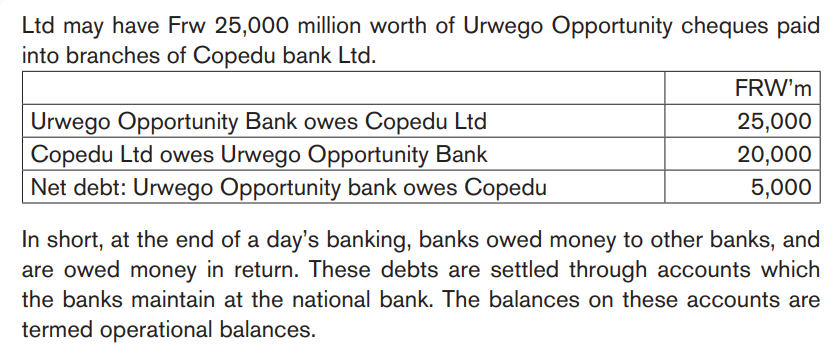

8.1.2 The clearing system

Clearing is the mechanism for obtaining payment for cheques.

Banks settle cheques and credits through the clearing system. Once the values

of cheques passed between the banks at the end of particular day’s clearing

have been determined, the resulting debts arising between the banks need to

be settled.

For Example, Urwego Opportunity bank may be asking for settlement of

equivalent of frw 20,000 million worth of cheques drawn on Copedu Ltd bankpaid in by its customers into their accounts at local branches. In turn Copedu

8.1.3 Banking Services

Retail banking

Traditionally the main services offered by banks to their customers were current

accounts and savings accounts. In recent years however the range of services

has expanded so that now the retail banks may offer.

- Credit cards

- Investments

- Share dealing

- Loans

- Home insurance

- Travel insurance

- Foreign currency

- Pet insurance

- Wealth management

In addition, branches will have specialist accounts and services for business

customers and may have advisors available to deal with the requirements oflarge and small commercial enterprise.

Application activity 8.1

1. What is the bank clearing system?

A It is the mechanism for obtaining payment for Cheques

B It moves cash between banks

C It sets credit levels for banks’ business customers

D It arranges long term loans for bank customers

2. Groupe Scolaire Mater Dei Nyanza is a Boarding School located

in Southern Province; Nyanza District. It has a bank account in bank

populaire, its checques equivalent to Frw 12,000,000 was drawn

in Bank of Kigali, and in turn, bank populaire have paid Cheques of

client of bank of Kigali equivalent to Frw 18,000,000.How much each bank should be reimbursed?

Activity 8.2

Observe the picture above and answer the following questions

1. Which of the following statements is true with respect to a remittance

advice note?

A It is sent to a customer to advise them of the amount due

B It is sent to the bank to instruct them to make a payment

C It is sent to a supplier to advise them of the amount being paid

D It is an internal document recording amounts received from

2. Anna sends cheques to a supplier and encloses with it a document

detailing the invoice being paid. What is this document called?

A Supplier’s statement

B Debit note

C Remittance advice

D Remittance list

3. Narvinda buys goods from Jamal for $ 2,500. He returns half of

the goods on 15 May. Which of the following documents would be

issued by Jamal for the return of the goods?

A Invoice

B Credit note

C Debit note

D Remittance advice

4. Malindra sent a payment to Nicholas along with a document detailing

the items and invoices the payment related to. What is this document

known as?

A Debit note

B Credit note

C Remittance advice

D Delivery note

5. What is the document that a business sends to customers to

summarise transactions at the end of an accounting period?

A Remittance advice

B Statement of account

C Credit note

D Invoice

6. What is the purpose of a remittance advice?

A It provides details of amounts being paid

B It identifies goods that have been received by the business

C It identifies goods that have been dispatched by the business

D It provides details of Cheques to be issued

Receipts will be accompanied by documentation. This enables the receiving

business to check that the correct amount is accurately processed and

recorded. For example, Tax revenues will be recognized in the books of accounts

when cash is received. Cash is considered as received when notification of tax

remittance is received.

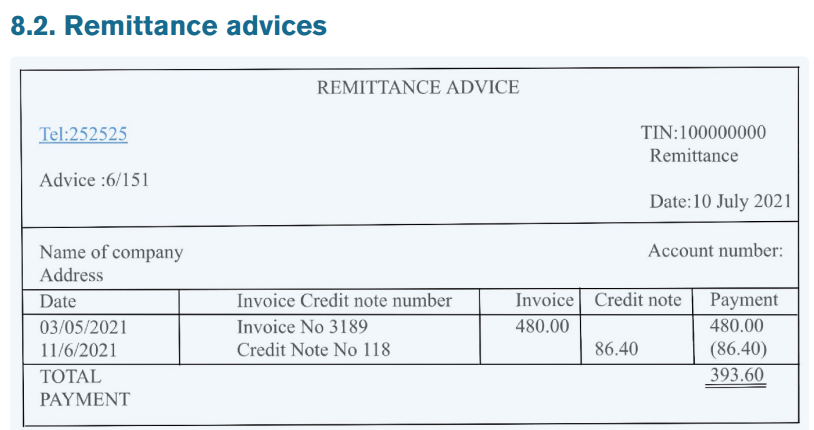

Documentation Advices

Documents which are used to record transactions in the books of account of

the company are called source documents. Source documents were covered

in details in detail in unit 1 of this text. When a cheque arrives from a trade

(business) customer, it is usually accompanied by a remittance advice.

A remittance advice shows which invoices a payment covers.

For example, LB Company sends a cheque payment of RWFFRW 37,360,000

to NT Company this payment is accompanied by remittance advice noteexplaining the invoice and credit note that the payment relates to

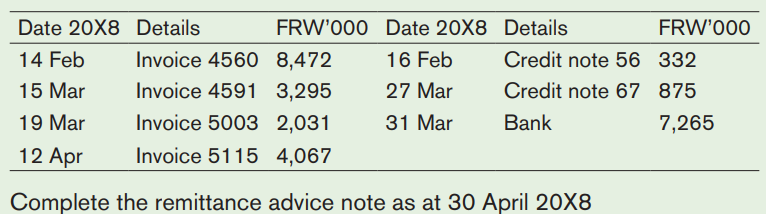

Application activity 8.2

1. J. Savério has a key customer, Cyprien Rugamba. The terms of the

agreement are that Cyprien Rugamba settle amounts due to J. Savério

on the last day of the month following the month of invoice, with credit

notes being settled in that same period too.

A remittance advice note must accompany payments.

Below is an extract from J. Savério’s sales ledger showing recent transactions

with Cyprien Rugamba and an uncompleted remittance advice note.Cyprien Rugamba

2. Cyami Ltd sold FRW 100,000 worth of goods to Maso Co in November

2020 and the sales to Maso will grow at the rate of 10% per month. All

sales made by Cyami Ltd to Maso Co are on credit and it is estimated that

60% of sales made to Maso Co will be paid in the month following sale;

the remaining will be paid two months after sale. All Payment from Maso

Co to Cyami Ltd are done by end of month and these are accompanied

by a remittance advice. How much will appear on the remittance advice

as at 28 February 2021

A FRW 133,100

B FRW 106,000

C FRW 116,600D FRW 128,260

Activity 8.3

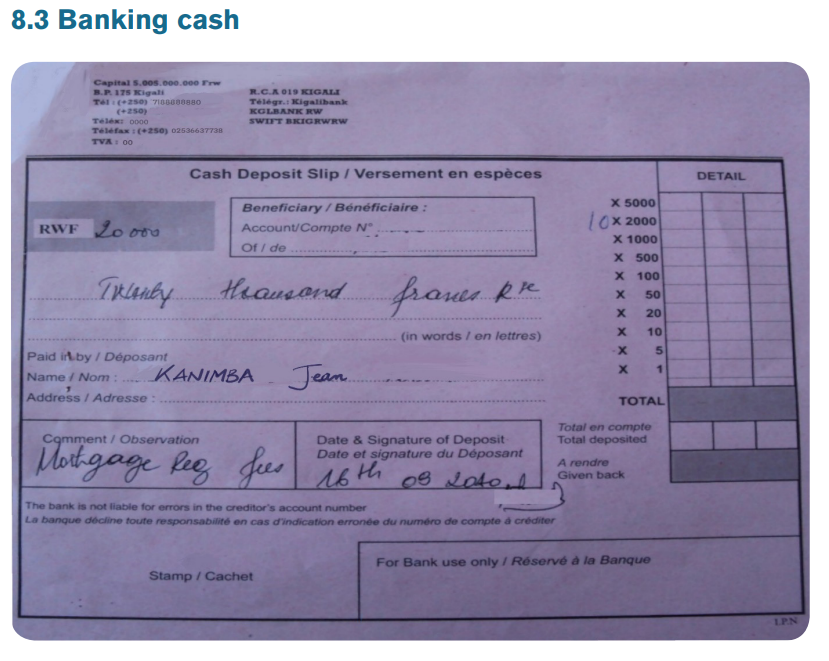

From the picture answer the following questions

1. What are the qualitative characteristics of paying in slips?

2. State Procedures for preparing a paying-in slip

Activity 8.3

8.3.1 The paying-in slips

When a business or an individual wants to pay money into the bank, then

normally a paying-in slip must be used. The bank treats this as a kind of summary

document which ‘totals up’ the cash (or other forms of money) which is being

banked.

A paying-in slip will look similar to the one shown above.

Pay-in-slip is an outline presented in banks and is used to deposit money

into a bank account. Each pay-in-slip has a counterfoil which is returned to

the depositor accordingly sealed and signed by the bank officer. This source

document relates to bank transactions. When an individual needs to deposit

checks or cash in his bank account he usually fills out a slip to show the number

of his account, the date, and the details of the deposit. Some deposits will

consist of checks, and the depositor will list each check with the check number

and the whole amount of the deposit. Pay-in-slip gives details regarding date,

account number, the amount deposited (in cash or cheque), and the name of

the account holder and approval.

The Importance of the Paying –In Slip

– Bank printed pay-in-slip provided by the bank free of charge is used by

the account holder for depositing cash as well as cheque into his bank

account

– Copy of pay-in-slip remains with the bank after depositing cash or

cheque into the bank. This part of the pay –in –slip is used by the bank

for making entries in the registers of the bank.

– Pay-in-slip can be used as legal evidence or documentary proof of cash

or cheque deposited into the bank

– Business and company can use pay-in-slip for entries in cashbook– Pay-in-slip is useful to the auditor to verify the entries passed in the cashbook

8.3.2 Procedure for Preparing a Paying –In-Slip

The following procedures are good practice to follow when preparing money

for banking

Step 1 Count the cash as described above.

Step 2 Add up, on a separate piece of paper, how much cash you are banking.

Step 3 Compare the calculated total to the total according to the cash register.

Step 4 Calculate any discrepancy between the cash counted and the cash

register total. If it is large then it should be investigated, but if it is small

then it may be ignored, depending on company Policy.

Step 5 Enter the total for each denomination of note in the appropriate place

on the paying in slip.

Step 6 Add up the numbers again to check the total and enter it in the ‘total

cash’ box.

8.3.3 Security

Holding cash creates problems and careful Security procedures are required

Theft by staff

This risk can be reduced by being careful about the people the business

employs; their references should be checked properly and they should be

monitored closely for their first few months of work

Cash register security

The cash register should be secure, with keys needed to operate it. Staff should

be trained to make them aware of the importance of keeping their keys safe and

of not leaving the cash register open. Cash registers which are activated by

different keys unique to each member of staff can give a breakdown of sales by

staff member. This is another aid to preventing theft, as it will indicate staff who

are not entering sales and pocketing the customer’s money.

Safes

If possible, cash should be removed from the till regularly (so that there is only

a relatively small amount in the till) and stored in a safer place. The ideal place

would be a safe.

The safe should be in a place out of view of the customer. The number of safe

keys should be kept to a minimum and access to the keys should be restricted.

Frequent banking

In general, cash should be taken to the bank on a regular and frequent basis;

this minimizes the amount of money on the business premises. This may be

particularly important if the amount of money the business can hold is limited

under its insurance policy.

It is not a good idea to let the same person go to the bank every day at the same

time. For security reasons it is better to vary the member of staff who takes the

money to the bank and the time of day it is taken.

Cash should never be sent by post, if it is lost or stolen there is no way to trace

or recover it

Application activity 8.3

You are preparing the day’s takings for banking. When you have sorted and

counted the notes you find you have the following.

(a) Five FRW 5,000 notes

(b) Twenty FRW2,000 notes

(c) Thirty-five FRW1,000 notes

(d) Sixty FRW 500 notes

(e) Six bags each containing thirty 100 franc coins

(f) Two bags each containing ten 50 franc coins

(g) Ten bags each containing fifty 20 franc coinsOther coins worth FRW10,500 in total

Prepare the paying in slip so that the cash can be banked.

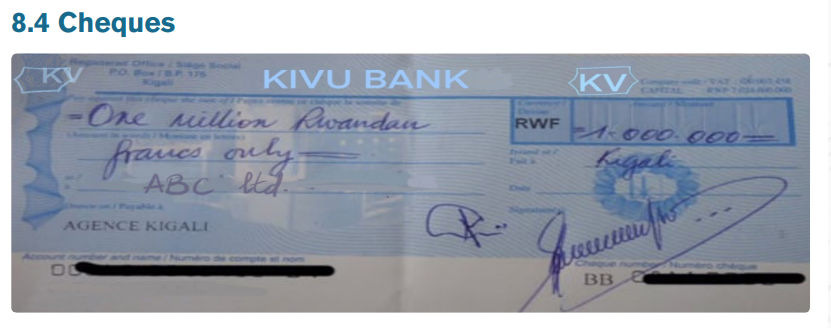

Activity 8.4

From the picture above, answer the following question

Rwanda Education board (REB) has issued a purchase order to ABC Ltd

hotel for a meeting room and catering for 50 persons involved in curriculum

development. The purchase order was composed by one meeting room,

breakfast and lunch. At the end of assignment ABC hotel provided an invoice

to REB amounted to FRW 1,000,000. An Accountant of REB processed

the payment by Cheque. What is the information to be contained on a valid

cheque?

Activity 8.4

A cheque is an unconditional order in writing addressed by a person to a bank,

signed by the person giving it, requiring the bank to pay on demand a sum

certain in money to or to the order of a specified person or bearer.

When a firm opens a current account with the bank, a cheque book containing

cheques is issued. The cheques allow the firm to make payments against

the account with the bank. When a firm issues a cheque to its creditors for

payments, it authorizes the bank to honour payments against the firm’s account

with the bank.

8.4.1 Format of Checques

Cheques are a reasonably common method of payment. They are a written

order to the bank, signed by the bank’s customer to pay a certain amount to

another person or company. The cheque must be banked by the payee and then

clear into their account before the money is available for use.

Generally, it takes around three working days for a cheque paid into a bank

account to clear into that account. At this point, the funds can be drawn on by

the recipient of the cheque. The clearing system is used for this process.

There are three parties involved in a cheque:

Drawee: The bank that has issued the cheque and will have to pay the cheque

Payee: The person to whom the cheque is being paid (eg the supplier)

Drawer: The person who is writing and signing the cheque in order to make a

payment (eg the customer).

When cheques are paid into a bank account (using a paying-in slip) they will

appear as a counter credit’ on the bank statement of the business receiving the

money.

8.4.2 Receiving cheques

It is best practice to follow these procedures when an individual customer pays

by cheque.

Step 1: Examine the face of the cheque to ensure all the details are correct.

- Date (including the year)

- Payee name

- Amount in both words and figures

Step 2: Make sure that the cheque is signed by the drawer.

8.4.2 Banking cheques

The details required on the paying-in slip when cheques are banked include:

- Name of drawer (or endorser)

- Amount of cheque

- Total value of cheques banked

8.4.3 Returned/dishonoured cheques

After a cheque has been received and banked, the bank may find it necessary

to return the cheque to the payee and to remove its amount from the payee’s

bank account. This is because the cheque has been dishonoured for payment.

A cheque would be dishonored because:

– Stale cheques

– Post – dated cheques

– Insufficient funds– Differences in amounts in words and figures

Application activity 8.4

1. Complete the following statements by selecting from the picklist below.

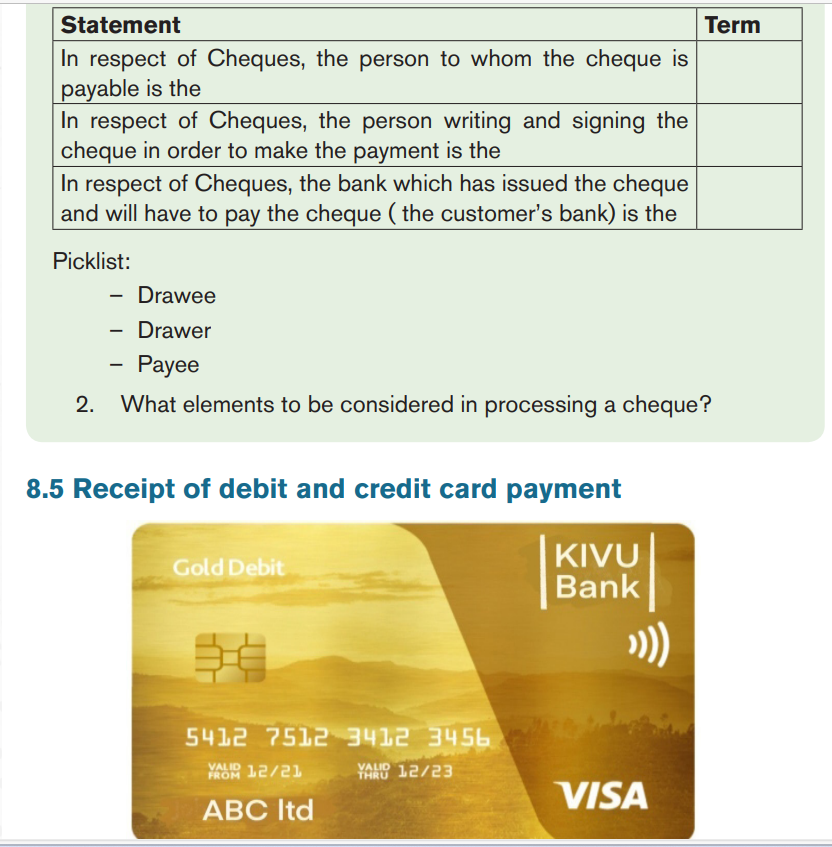

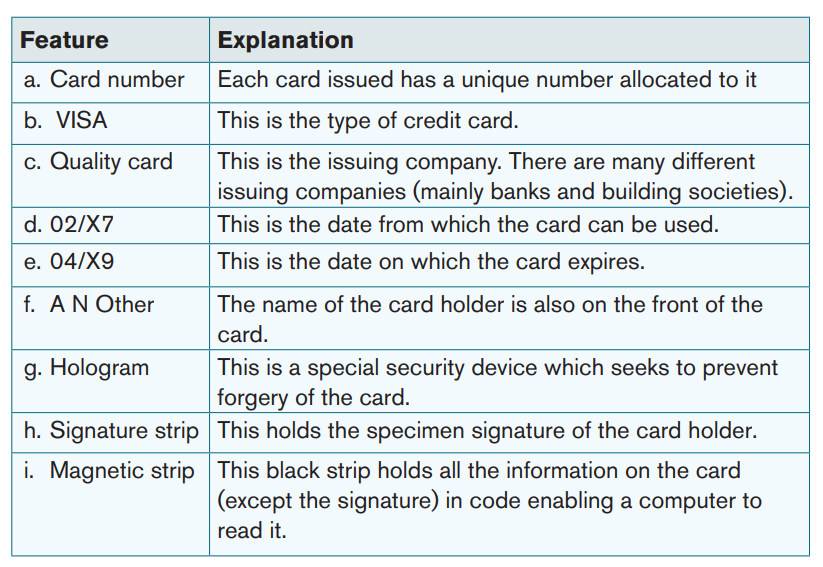

Activity 8.5

From the picture above, answer the following questions

1. State feature of visa card?

2. Where does debit card and credit card used?

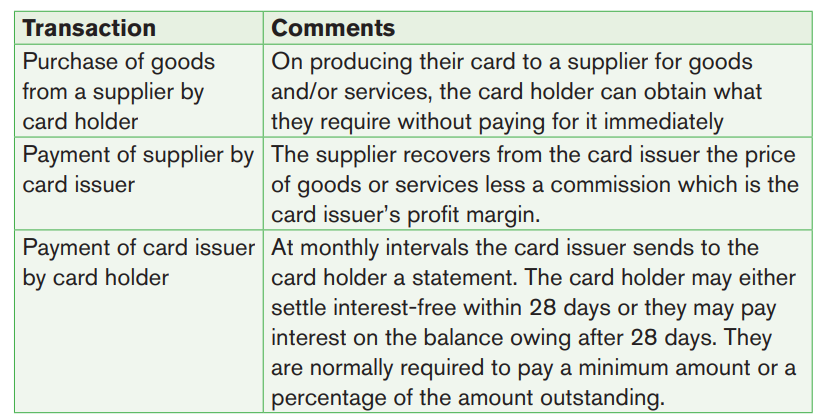

Debit and credit card payments have become progressively more popular as

methods of payment over the last few years. They are used primarily by individuals

rather than by companies (although companies do own credit cards which are

generally allocated to members of staff for their use to pay business expenses).

Most retail outlets which accept credit and charge cards now use an electronic

system known as EFTPOS (Electronic Funds Transfer at Point of Sale)

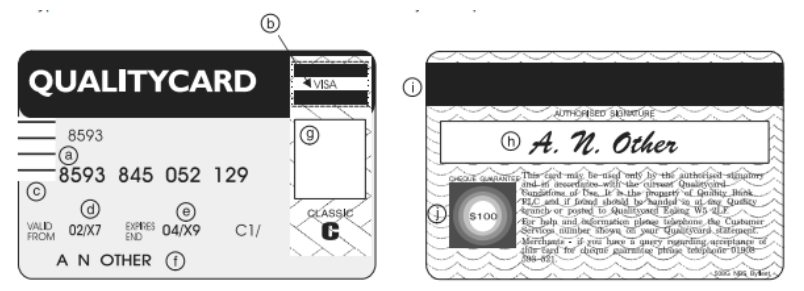

8.5.1 Debit and credit cardsA typical card would look like this and the letters (a) and (j) are explained below.

There are two main types of card, and we will look at them in turn.

– Credit cards

– Debit cards

Credit cards

A credit card payment involves three transactions and three parties (see

below). Whilst credit is involved, for a supplier receiving payment in this way,credit card payments are treated as cash.

Card issuers often charge a flat yearly membership fee as well as charging

interest. Most banks and finance houses issue either Visa or MasterCard credit

cards, some issue both. American Express issues its own credit card (Optima).

Accepting a credit card receipt

Credit card transactions can be accepted remotely over the telephone or

via the internet or at point of sale. Retailers using a point-of-sale system will

have a checkout terminal that includes a credit card swiper or NFC (near-field

communication) reader to enable contactless payments for systems such as

Apple Pay or Android Pay. Some businesses, such as restaurants, have mobile

credit card processors. A credit card isn’t linked to your current account and is

a credit facility that enables you to buy things immediately, up to a pre-arranged

limit, and pay for them at a later date. The cost of the purchase is added to your

credit card account and you get a statement every month.

Debit cards

The same procedures are used for debit card receipts. For the Customer, the

difference is that debit card payments are made directly from their bank account.

Debit cards are used to pay for goods in shops and to withdraw money at cash

machines. The money is automatically taken from your current account when

you spend it, so you must have enough money in your account or an agreedoverdraft to cover the transaction

Application activity 8.5

1. A customer wants to pay for items bought over the internet from a

supplier used infrequently by the business. Which payment method

is most appropriate?

Credit card

Debit card

A chequeCash

8.6 Electronic receipts and retention of documents

Activity 8.6

1. What is POS machine and where can be used?

2. Peter works in a public hospital as an Accountant and he is a student

at master’s level in project management in one of private universities.

He uses part of his salary to pay tuition fees. What is an appropriate

method of transferring his tuition fees; Frw 150,000 per month to

account number of university?

Customers may chose to transfer money owed to another business by other

electronic methods of transfer. Electronic transfers methods include BACSdirect credit, CHAPS and faster payments.

8.6.1 BACS direct credit

A direct credit is a deposit of money by a payer directly into a payee’s bank

account. Direct credit payments are usually made electronically. This method

may be used by businesses when they pay salaries and suppliers. When making

payments, details of each recipient’s bank account and the amount to be paid

are submitted to the BACS clearing centre. The payments are then taken directly

from the business’s bank account and paid in to each recipient’s bank account.

Tools Used For Direct Credit

Mobile Banking: Keeping money exchange transactions through a cell phone,

mobile Banking refers to provision Banking and Financial service with the help

of mobile telecommunication devices.

Point of sales (POS) is portable machine that allows businesses to receive

cash payments with bank card like debit card.

8. 6.2 CHAPS (Clearing House Automated Payment System)

Payment by direct credit reduces the payer’s bank balance on the date the

payment is made. Unlike a cheque, the funds transfer is performed instantaneously

so there is no chance for the business to stop the payment, and the bank cannot

refuse payment once it has been made, due to insufficient funds. CHAPS

transfers are commonly used for large amounts such as transferring funds to

solicitors for the purchase of property. Payment by CHAPS reduces the payer’s

bank balance on the date the payment is made.

8. 6.3 Faster payments

Most large banks now allow their customers to make small and medium-sized

payments via the internet using the faster payments system. This system

enables customers to send same-day payments from their bank account to the

recipient’s bank account, The business must follow various security procedures

to access its bank account online, then enter the recipient’s details and authorize

the payment. Usually the payment is deducted immediately from the business’s

account, and is available almost immediately in the recipient’s account (around

two hours). A faster payment reduces the business’s bank balance on the date

of payment.

8.6.4 Retention of documents

In the event of queries regarding individual transaction or bank account credits,

the retailer will need to produce relevant copies of the receipts. It is therefore

essential that all copy receipts are kept in a safe place, preferably in date order,for a minimum period of six months and sometimes even longer.

Application activity 8.6

1. Which of the following is an example of a payment which is most

appropriate for settlement using BACS?

A Paying a regular sum to a supplier

B Paying a regular, but variable sum to a supplier

C Paying wages and salaries to employees

D Making irregular payments to overseas suppliers

2. For a large organization which of the following transactions would

be most efficiently made by online transfer?

A Quarterly utility bills

B Purchase of office sundries

C Monthly employee salaries

D Refunds to customersEnd of unit assessment

1. Which of the following is not a method of payment by a customer?

A A cheque

B A journal

C A credit card

D A debit card

2. Which of the following are services banks may offer?

i) Investments

ii) Paying accounts payable on behalf of a business.

iii) Share dealing

iv) Posting entries to the general ledger.

A (i), (ii), (iii)

B (i), (iii)

C (ii), (iii), (iv)

D (i), (iv)

3. A customer wants to pay for items bought over the internet from a

supplier used infrequently by the business. Which payment method is

most appropriate?

A Credit card

B Debit card

C A cheque

D Cash

4. What is the bank clearing system?

A It is the mechanism for obtaining payment for Cheques

B It moves cash between banks

C It sets credit levels for banks’ business customers

D It arranges long term loans for bank customers

5. Which of the following are reasons for a bank returning or dishonouring

a cheque?

i) Words and figures differ

ii) Cheque less than guaranteed amount

iii) Cheque and guarantee card stolen

iv) Cheque unsigned

A (i), (ii), (iii), (iv)

B (i), (iii), (iv)

C (i), (ii), (iv)

D (ii), (iii), (iv)

6. When a business or an individual hands over cash to be paid into their

bank account, which of the following documents should be prepared?

A Cheque

B Credit card mandate

C Paying-in slip

D Remittance advice

7. Alfredo is the Managing Director of a large engineering company. He

signs his name on a company cheque for FRW 260,000 in accordance

with the bank mandate. The company name appears on the cheque. If

the bank dishonours the cheque as the company has insufficient funds

in the account, who is liable for the FRW 260,000?

A The engineering company

B Alfredo

C The bank

D No one

8. Selina receives a cheque from a customer. What term describes Selina’s

role in this transaction?

A Payer

B Drawer

C PayeeD Drawee