UNIT 6:EXTRACTING A TRIAL BALANCE

Key unit competence: To be able to extract a trial balance

Introductory activity 4

Observe the images below and answer the questions:

a) Make a comparison between the above three images

b) What would happen if the content of the right side of the image2 is increased without increasing the content of its left side?

5.1 Meaning, purpose and limitations of Trial Balance

Activity 5.1

a) What does the book keeper do after balancing off ledger account?

b) How does he/she proceed?

5.1.1 Meaning of trial balance

A trial balance is simply a list of account balances. It can also be defined as

a statement of debit and credit totals of balances extracted from the various

accounts in the ledger with a view to test the arithmetic accuracy of books. It

may also be defined as a table in which all the ledger accounts are listed with

their corresponding balances with the purpose of controlling at the end of the

month the general equality of all the recordings in the journal and their posting

too the ledger accounts..

5.1.2 Purpose of trial balance

i) It gives the balances of all the accounts of the ledger. The balance of any

account can be found from the trial balance without going through the

pages of the ledger;

ii) It is the check on the accuracy of posting. If the trial balance agrees, it

proves:

a. that both the aspects of each transaction are recorded;

b. That the books are arithmetically accurate.

iii) It facilitates the preparation of profit and loss account ant the balance

sheet.

iv) Important conclusion can be delivered by comparing the balances of two

or more than two years with the help of trial balances of those years.

Though agreement of the trial balance is not an absolute proof of the accuracy

of the books, disagreement is an obvious fact that an error has been committed.

You will see on the unit on error correction that there exist errors that do not

affect the trial balance. When such errors are made, the trial balance can stillbalance despite those errors

5.1.3 Limitations of the trial balance

Agreement of the trial balance is not a sound proof that the book keeping has

been carried out perfectly. There are certain book-keeping errors that do not

affect the agreement of the trial balance. This limits the scope of a trial balance

as a financial statement.

The following are the important limitations of the trial balance:

– The trial balance can be prepared only in those concerns where double

entry system of book keeping is adopted. This system is too costly.

– A trial balance is not a conclusive proof of the arithmetical accuracy of

the books of account. If the trial balance agrees, it doesn’t mean that

now there are absolutely no errors in books. On the other hand, some

errors are not disclosed by the trial balance.

– If a trial balance is wrong, the subsequent preparation of trading, profit

and long account and the balance sheet will not affect the true pictureof the concern

Application activity 5.1

a) What is the trial balance?

b) What is its content?

c) What is the main purpose of preparing the trial balance?

d) How can you know that an error is committed when preparing the

trial balance?

e) What are the limitations of the trial balance?f) How would correct trial balance be?

5.2 Preparation of the trial balance

Activity 5.2

a) What does the book keeper do after balancing off ledger account?

b) How does he/she proceed?

As mentioned above, a trial balance is a list of debit and credit balances extracted

from the ledger and aimed at checking the accuracy of the accounting process.

Accounts with net debit balances i.e. before closing the account, the total on

the debit side was more than the total on the credit side. Meaning balance

carried down is on the credit side and balance brought down on the debit

side, will appear on the debit side of the trial balance. Likewise accounts with

net credit balances will appear on the credit side of the trial balance. Ideally,

all asset accounts (except bank in case of bank overdraft or debtors in case

of advance received), expenses accounts and drawings account are expected

to have debit balances. If you get credit balances on these accounts, it might

mean that your working was wrong. Similarly, all liability accounts, revenue or

income account, capital account and reserve accounts are expected to have

credit balances. If you get a debit balance on any of these accounts, then it is

an indication that you are wrong.

In the trial balance, asset account balances are recorded in the debit column

while the accounts for liabilities and capital are recorded in the credit column.

The nominal accounts which relate to expenses and losses are recorded in the

debit column of the trial balance, but those that relate to items of income and

revenue are recorded in the credit column of the trial balance.

When constructing a trial balance therefore, place assets (e.g. motor vehicles,

stock, cash in hand and at bank, debtors, etc.); expenses (e.g. salaries and

wages, rent and rates, discounts allowed, etc.), in the debit column and liabilities

(e.g. creditors, bank overdraft, unpaid salaries, etc.), revenues or incomes (e.g.

sales, discounts received, rent received, etc.), in the credit column.

The following is the procedure to prepare the trial balance:

• Before you start off with the trial balance, you need to make sure that

every ledger account is balanced off;

• Prepare a worksheet. The column headers should be for the account

name and the corresponding columns for debit and credit balances;

• For every ledger account, transfer to the trial balance worksheet the

account name along with account balance in appropriate debit or credit

column

• Add up the amounts of the debit column and the credit column. Ideally,

the totals should be the same.

Illustration 1

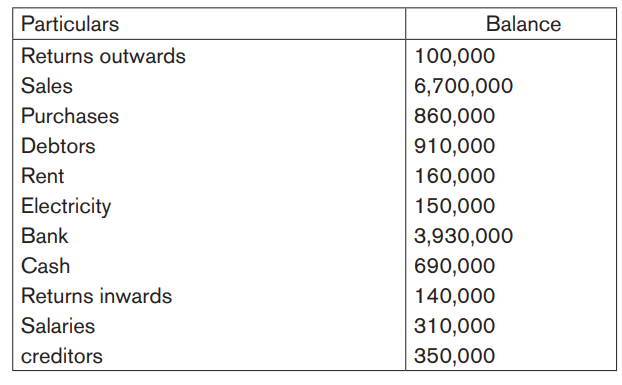

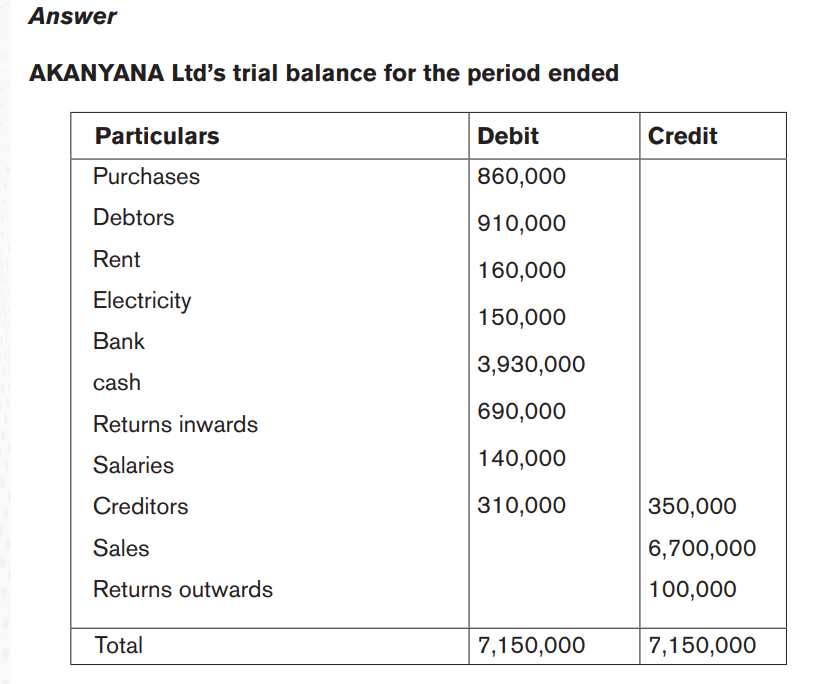

Referring to the application activity 4.5 above, prepare AKANYANA Ltd’s trialbalance knowing that the closing ledger balances are the following:

Illustration 2

Application activity 5.2

a) How account balances are listed in the trial balance?

b) What are the main ledger accounts with debit balances?

c) What are the main ledger accounts with credit balances?

d) What does credit balance of bank account mean?

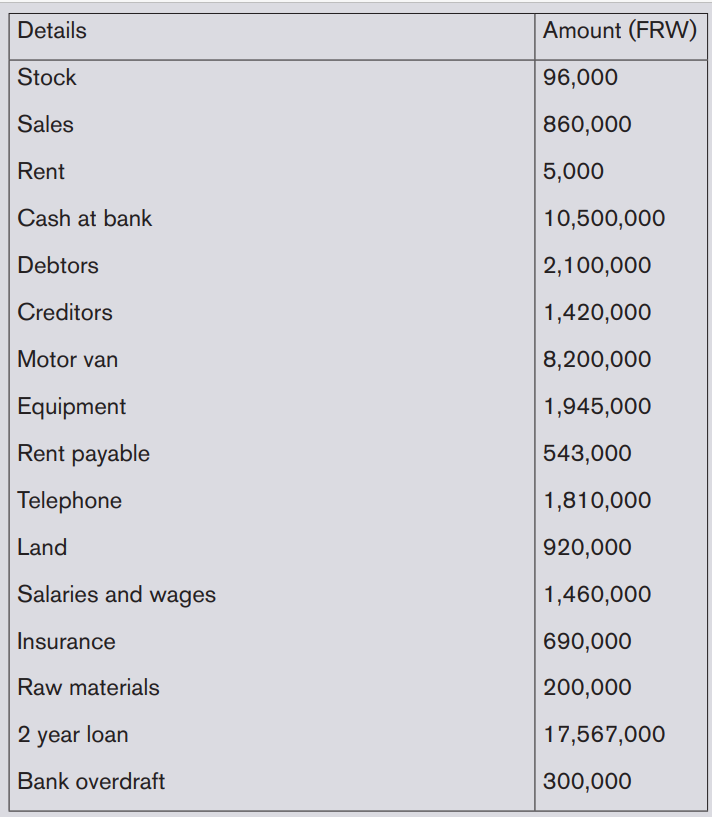

e) The following are balances in the books of ISHEJA Plc for the period

ended 31st March 2010: FRW

• Bank overdraft………...24,160

• Sales…………………...131,340

• Commission income…..13,670

• Debtors…………………41,300

• Postage and stationery... 6,000

• Repairs to buildings…. 6,200

• Heating……………….….2,130

• Purchases……………..112,100

• Cash in hand…………. 1,100

• Creditors…………… 26,950

• Premises………………269,000

• Owner drawings…… 7,150

Required: find out its capital and prepare the trial balance for theperiod ended

End of unit assessment

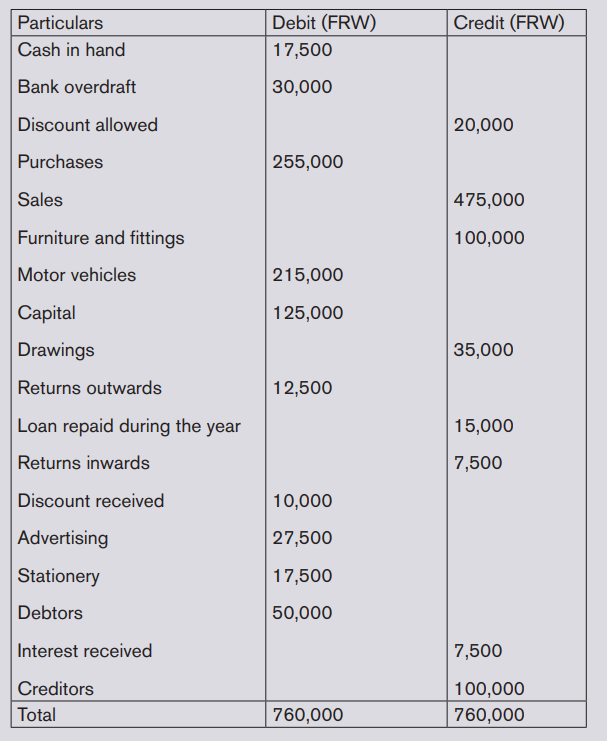

1. The following items were extracted from MUHIRE’S ledger account

for the year ending on 31st December 2014:

Required: Calculate the level of the owner’s capital and then prepare

the trial balance for the period ended.

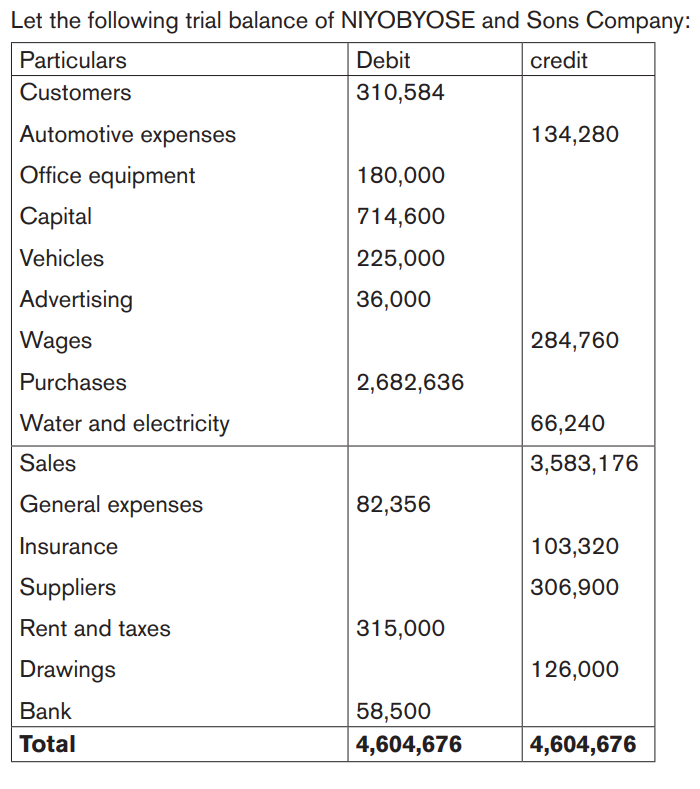

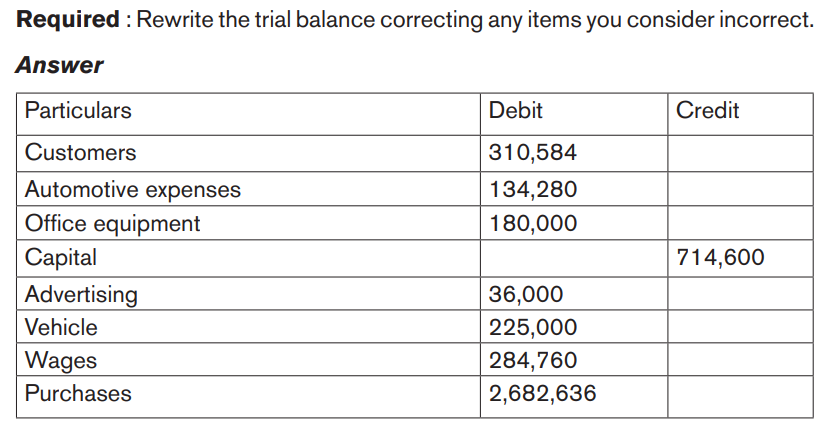

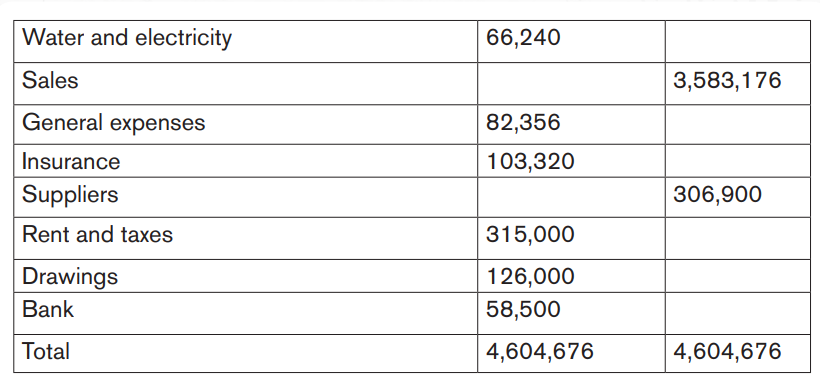

2. Rewrite the following trial balance correcting any items youconsider to be incorrect