UNIT 1:GENERAL INTRODUCTION AND OVERVIEW OF ACCOUNTING

Read the following case study and answer the given questions

Accounting is an essential function of any business entity. It gives the

using the knowledge acquired in entrepreneurship subject.

framework to record all the business transactions and events that happen

during the working of the business entity. Accounting is the language

of business, with books of accounts being its script and debit-credit its

style, i.e., the way of expressing it.

According to the American Accounting

Association, Accounting is the process of identifying, measuring, and

communicating information to permit judgment and decisions by the

users of accounts. According to the American Institute of Certified

Public Accountants, Accounting is the art of recording, classifying, and

summarizing in a significant manner and in terms of money, transactions,

and events, which are at least of a financial character and interpreting the

result thereof.

Accounting is an art as well as a science. Accounting is an art of

recording, classifying, and summarizing all business transactions. It is a

science as well as it follows certain guiding accounting principles and

standards. It records financial transactions only, which can be expressed

in terms of money. First, the transactions are recorded and then classified

and summarized to interpret the business’s financial performance and

position. One needs to keep in mind that Accounting and Accountancyare two different concepts.

Experimenal version

Accounting is the recording, classifying, and summarizing of business

transactions to ascertain the financial performance and position of the

business firm. On the other hand, Accountancy is the body of knowledge

based on principles for recording, classifying, and summarizing businesstransactions to help in the decision-making function of management.

1. Accounting gives the -------------- to record all the business

transactions.

b) Framework

c) Process

d) Moneye) Classification

2. Accounting is the art of recording, classifying, and summarizing in a

significant manner and in terms of money, transactions, and events

which are, in part at least of a financial character and interpretingthe result thereof. This accounting definition is given by:

a) Institute of Certified Public Accountants of Rwanda

b) American Accounting Association

c) American Institutes of Certified Public Accountants

d) International Financial Regulation System

3. Accounting is called science because it follows certain guiding

-------------

4. Accounting records only --------------------- transactions5. Who are the users of accounting information?

Experimenal version

1.1 Meaning and Purpose of Accounting

1.1.1 Meaning of accounting

Accounting is defined as the process of identifying, recording, classifying and

summarizing economic data so as to come up with useful information to help

users make informed decisions. Many businesses carry out transactions. Some

of these transactions have a financial implication i.e. either cash is received or

paid out. Examples of these transactions include selling goods, buying goods,

paying employees and so many others.

Accounting is involved with identifying these transactions measuring (attaching a

value) and reporting on these transactions. If a firm employs a new staff member

then this may not be an accounting transaction. However, when the firm pays

the employee salary, then this is related to accounting as cash involved. This has

an economic impact on the organization and will be recorded for accounting

purpose. A process is put in place to collect and record this information; it is

then classified and summarized so that it can be reported to the interested

parties.

Accounting, as a preamble, could be termed the language of business. It is the

common media through which people of all walks can effectively communicatebusiness matters and understand one another equally.

Experimenal version

It is the language accountants use to communicate i.e. record business

transactions and summarize results of business operations. Accounting is the art

of recording, classifying, and summarizing in a significant manner, and in terms

of money, transactions, and events of a financial character, and interpreting the

results thereof. It encompasses the recording of information of economic valueto a business. The information then forms the basis for judgment by the users.

1.1.2 The objectives of accounting

Accounting has many objectives; including letting people and organizations

know:

– If they are making a profit or a loss;

– What their business is worth;

– What a transaction was worth to them;

– How much cash they have;

– How wealthy they are;

– How much they are owed;

– How much they owe to someone else;

– Enough information so that they can keep a financial check on the

things they do.

However, the primary objective of accounting is to provide information for

decision making. The information is usually financial, but can also be given in

volumes, for example the number of cars sold in a month by a car dealership

or the number of cows in a farmer’s herd herd (this kind of non-financial

information, however is more useful in management/managerial accounting than

it is in financial accounting). So, for example, if a business recorded what it

sold, to whom, the date it was sold, the price at which it was sold, and the date

it received payment from the customer, along with similar data concerning the

purchases it made, certain information could be produced summarizing what

had taken place. The profitability of the business and the financial status of the

business could also be identified, at any particular point in time. It is the primary

objective of accounting to take such information and convert it into a form thatis useful for decision making

Experimenal version

1.1.3 Branches of Accounting

Accounting, in all its broadness, can be sub-divided into areas of specialization;

a) Financial accounting; concerns itself with the collection and

processing of accounting data and reporting to interested parties

inside and outside the firm.

b) Tax accounting; deals with the determination of the firm’s tax liability

which could be, Value-added tax (VAT), customs duty, Pay As You

Earn (PAYE), corporation tax, etc.

c) Cost accounting; helps establish costs relating to the production of a

good or service and allocating it to the various factors that contributed

to the cost of production.

d) Managerial accounting; deals with the generation of accounting

information to be used categorically by the firm’s internal management

in their day-to-day decision making.

e) Auditing; concerns itself with the vouching and verification of

transactions from the financial accounting to determine that they are a

true representation of the business’ activity i.e. the true and fair view of

the company’s state of affairs.

Other subdivisions of accounting include forensic accounting which combines

accounting, auditing, and investigative skills to examine the finances of an

individual or business, fiduciary accounting which is the recording of transactions

associated with a trust or estate and accounting information system which is a

computer-based method, it tracks accounting activity that has been combinedwith information technology resources

Application activity 1.1

1. Explain the term accounting

2. What do you understand by accounting information

3. Mention two objectives of accounting

4. State the uses of accounting information

5. Mention five different branches of accounting

6. State two differences between financial accounting and managementaccounting

Experimenal version

1.2 Users of Accounting Information

Activity 1.2

Refer to the knowledge acquired in Entrepreneurship and state who you

think need accounting information of a certain business.

Today, more people than ever before recognize the importance of accounting

information and the profound effect that unethical and misleading financial

reports can have on a business, its owners, its employees, its lenders, and the

financial markets.

The people who use accounting information to make decisionscan be classified

into three categories:

– Those who manage a business

– Those outside a business enterprise who have a direct financial interest

in the business

– Those who have an indirect financial interest in a business

These categories apply to governmental and not-for-profit organizations as well

as to profit-oriented ventures.

Note that the users may also be classified into internal and external users of

accounting information. Internal users are those within an organization who use

financial information to make day-to-day decisions. External users are those

outside of the organization who use the financial information to make decisionsor to evaluate an entity’s performance and position

1.2.1 Management

Management refers to the people who are responsible for operating a

business and meeting its goals of profitability and liquidity. In a small business,

management may consist solely of the owners. In a large business, managers

are not necessarily the owners and thus may be agents of the owners.

Managers must decide what to do, how to do it, and whether the results match

their original plans. Successful managers consistently make the right decisions

based on timely and valid information. Note that managers and other employeesare internal users of accounting information.

Experimenal version

1.2.2 Users with a direct financial interest

Another group of decision makers who need accounting information are those

with a direct financial interest in a business. They depend on accounting to

measure and report information about how a business has performed. Most

businesses periodically publish a set of general-purpose financial statements

that report their success in meeting the goals of profitability and liquidity.

These statements show what has happened in the past, and they are important

indicators of what will happen in the future. Many people outside the company

carefully study these financial reports. The two most important groups areinvestors (including owners) and creditors.

1.2.2.1 Investors

Those are current and future stockholders who may invest in a business and

acquire a part ownership in it are interested in its past success and its potential

earnings. A thorough study of a company’s financial statements helps potential

investors judge the prospects for a profitable investment. After investing, they

must continually review their commitment, again by examining the company’s

financial statements.

1.2.2.2 Creditors

Most companies borrow money for both long- and short-term operating needs.

Creditors, those who lend money or deliver goods and services before being

paid, are interested mainly in whether a company will have the cash to pay

interest charges and to repay the debt at the appropriate time. They study a

company’s liquidity and cash flow as well as its profitability. Banks, finance

companies, mortgage companies, securities firms, insurance firms, suppliers,

and other lenders must analyze a company’s financial position before they make

a loan. Note that investors and creditors are primary external users of accounting

information.

1.2.3 Users with an indirect financial interest

In recent years, society as a whole, through governmental and public groups, has

become one of the largest and most important users of accounting information.

Users who need accounting information to make decisions on public issuesinclude tax authorities, regulatory agencies, and various other groups

Experimenal version

1.2.3.1 Tax Authorities

Government at every level is financed through the collection of taxes. Companies

and individuals pay many kinds of taxes, including national, and city income

taxes; Social Security and other payroll taxes; excise taxes; and sales taxes.

Each tax requires special tax returns and often a complex set of records as well.

Proper reporting is generally a matter of law and can be very complicated. The

Internal Revenue Code, for instance, contains thousands of rules governing the

preparation of the accounting information used in computing federal incometaxes.

1.2.3.2 Regulatory Agencies

Most companies must report periodically to one or more regulatory agencies

at the national and local levels. For example, all publicly traded corporations

must report periodically to Capital Market Authority (CMA). (CMA) is a public

institution established by Law No.23 /2017 of 31/05/2017 responsible for

developing and regulating the capital markets industry, commodities exchange

and related contracts, collective investment schemes and warehouse receipts

system. Companies listed on Rwanda Stock Exchange (RSE) must meet

the special reporting requirements of their exchange. Another example of a

regulatory agency is the National Bank of Rwanda – All financial institutions arerequired to report periodically to the National Bank of Rwanda.

1.2.3.3 Other groups

Labor unions study the financial statements of corporations as part of preparing

for contract negotiations; a company’s income and costs often play an important

role in these negotiations. Those who advise investors and creditors—financial

analysts, brokers, underwriters, lawyers, economists, and the financial press—

also have an indirect interest in the financial performance and prospects of a

business. Consumer groups, customers, and the general public have become

more concerned about the financing and earnings of corporations as well as the

effects that corporations have on inflation, the environment, social issues, and

the quality of life.

Note that a part from managers and employees who are internal users, all otherusers are external users of financial information

Experimenal version

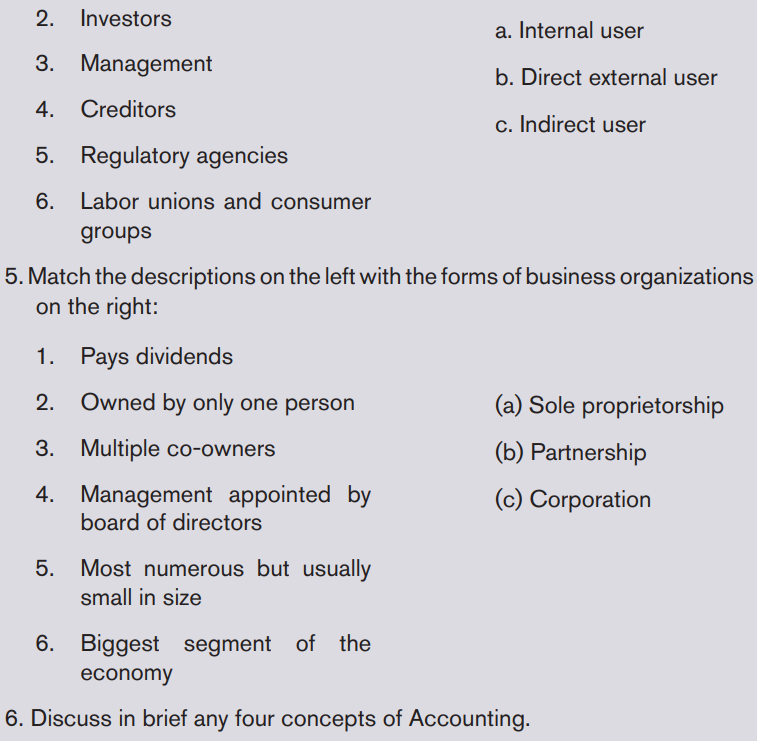

Application activity 1.2

1. State three categories of users of accounting information

2. Match the terms below with the type of user of accounting information(Some answers may be used more than once):

1. Tax authorities

2. Investors

3. Management

4. Creditors

5. Regulatory agencies

6. Labor unions andconsumer groups

a. Internal user

b. Direct external userc. Indirect user

3. Why the following are interested accounting information

a) Creditors

b) Tax authorities

c) Investorsd) General public

Experimenal version

1.3 Forms of Business Organizations

Activity 1.3

Read the following case study and answer the given questions

Kamariza, a bright final year student was waiting for her result to be

declared. While at home, she decided to put her free time to use. Having

a painting talent, she tried decorating clay pots and bowls with designs.

She was excited at the praise showed on her by friends on her work. She

even managed to sell few pieces of unique hand pottery for her home to

people living in and around her village. Operating from home, she was able

to save on rental payments. She gained a lot of popularity by word of mouth

publicity as a sole proprietor. She further perfected her skills of painting

pottery and created new designs. All this generated great interest among

her customers and provided a boost to the demand for her products. By

the end of summer, she found that she had been able to make a profit of

FRW 100,000. She felt motivated to take up this work as a career. She has,

therefore, decided to set up her own business.

She can continue running the business on her own as a sole proprietor,

but she needs more money for doing business on large scale. Her father

has suggested that she should form a partnership with her cousin to meet

the need for additional funds and for sharing the responsibilities and risks.

Besides, he believes that it is possible that the business might grow further

and may require forming a company.

a) She is in a dilemma as to what form of business organisation she

should go in for?

b) Which factors to be considered in selecting an appropriate formof business?

Experimenal version

To start a business, a potential owner must have a sufficient amount of capital

and must choose an appropriate form of business organization. The three basic

forms of business organization are the sole proprietorship, the partnership,

and the corporation. Accountants recognize each form as an economic unit

separate from its owners. Legally, however, only the corporation is separate

from its owners. The characteristics of corporations make them very efficient in

amassing capital, which enables them to grow extremely large. As even though

corporations are fewer in number than sole proprietorships and partnerships,they contribute much more to the economy in monetary terms. .

1.3.1 A sole proprietorship

Sole means “single” or “one.” Proprietor means “owner.” A sole proprietorship,

therefore, is a business owned by one person. It is sometimes simply called a

proprietorship. Being a sole proprietor does not mean working alone. Based on

the operation’s size and scope, a sole proprietorship may have many managers

and employees. The oldest and most common form of business organization,

the sole proprietorship is the easiest business form to start. Little or no legal

paperwork (forms and documents) is required. The success or failure of thebusiness depends heavily on the efforts and talent of the owner

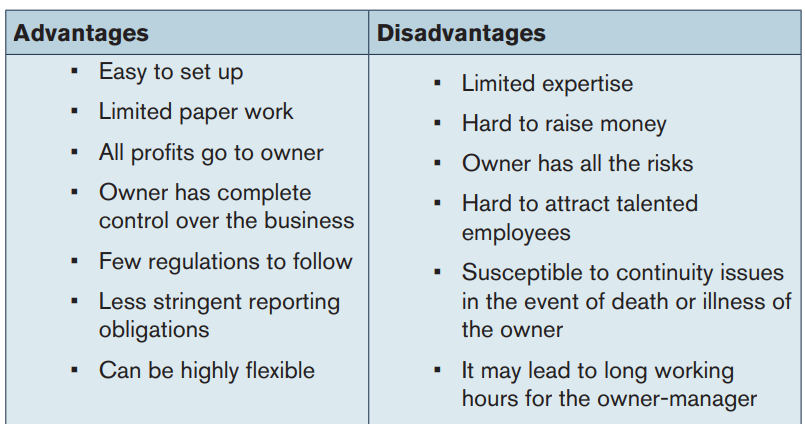

A sole proprietorship advantages and disadvantages

1.3.2 A partnership

A partnership is a business owned by two or more persons, called partners,

who agree to operate the business as co-owners. The partners share the profits

and losses of the business according to agreed proportions.

The partners share between them ownership of the business and the obligation to

manage its operations. Professional people, such as accountants, solicitors and

doctors, commonly organize their business activities in the form of partnerships.

Accounting statements are required as a basis for allocating profits between the

partners and, again, for agreeing tax liabilities with the Tax Revenue Authority.

Business partners usually enter into a written, legal agreement. This agreement

specifies each partner’s investment in money or property, responsibilities,

and percentage of profits and losses. Partnerships are often formed when a

business needs more capital than one person can invest. Partnerships are notalways small.

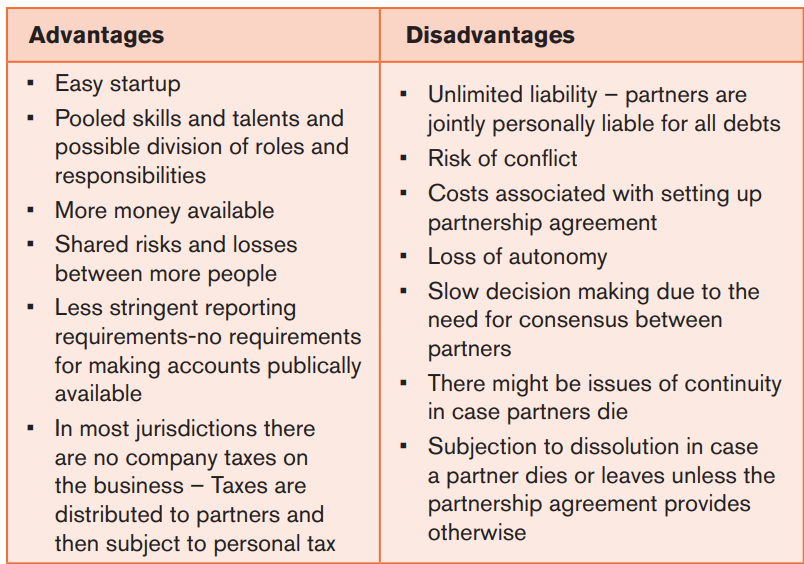

A Partnership advantages and disadvantages

1.3.3 A corporation

A corporation, on the other hand, is a business unit chartered by the state

and legally separate from its owners (the stockholders). The stockholders,

whose ownership is represented by shares of stock, do not directly control

the corporation’s operations. Instead, they elect a board of directors to run the

corporation for their benefit. In exchange for their limited involvement in the

corporation’s operations, stockholders enjoy limited liability; that is, their risk ofloss is limited to the amount they paid for their shares.

Thus, stockholders are often willing to invest in risky, but potentially profitable,

activities. Also, because stockholders can sell their shares without dissolving the

corporation, the life of a corporation is unlimited and not subject to the whims

or health of a proprietor or a partner. The business owner(s) may “incorporate”

to obtain money needed to expand. To raise this money, organizers sell shares

of stock to hundreds or even thousands of people. These shareholders, or

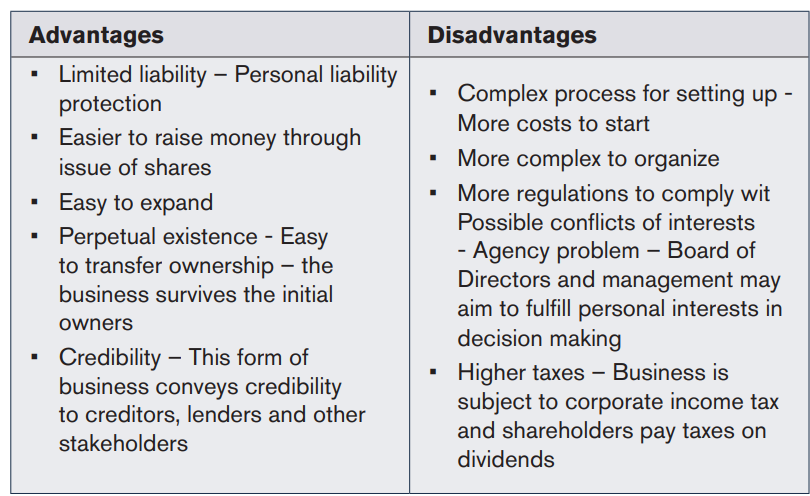

stockholders, are the corporation’s legal owners.A Corporation advantages and disadvantages

Other forms of businesses

A part from the above three main types of businesses we also have other forms

of entity that may not necessarily be referred to as businesses but they relate

to businesses and some authors refer to them as other forms of businesses.

Those are:

• Cooperatives: members come together to start the business to satisfy

their needs/common interest

• Not for profit entity: they are started to just offer a given service or

good mostly to their members or to a particular group of people with

common interest but they do not have profit as the motive.• Parastatal: is a company wholly owned by the government

Application activity 1.3

1. Mr. Gasagure is a sole proprietor. Over the past decade, his

business has grown from operating a neighborhood corner shop

selling different items to retail chain with three branches in the city.

Although he looks after the varied functions in all the branches, he

is wondering whether he should form a company to better manage

the business.

a) Explain two benefits of remaining a sole proprietor

b) Explain two benefits of converting to a limited liability company

2. Match the descriptions on the left with the forms of businessorganizations on the right:

1. Pays dividends

2. Owned by only one person

3. Multiple co-owners

4. Management appointed by

board of directors

5. Most numerous but usually

small in size

6. Biggest segment of theeconomy

(a) Sole proprietorship

(b) Partnership(c) Corporation

1.4 Accounting Concepts

Activity 1.4

Why do you think accounting concepts and conventions are important to a

business entity?

Activity 1.4

Accounting concepts, conventions, or principles are the basic ground rules that

must be followed when financial accounts are prepared and presented. They

are also referred to as assumptions or prepositions that underlie the preparationand presentation of financial statements.

1.4.1 Business entity assumption

This concept states that business is regarded as a separate entity different/

distinct from owners and managers. This means assets and liabilities of thebusiness should be separated from those of the owners.

1.4.2 Monetary unit assumption/ Money measurement

concept

This concept states that only items which can be expressed in monetary terms/

value are to be recorded in book. An economic entity's accounting records

include only quantifiable transactions. For example, certain economic events

that affect a company, such as hiring a new chief executive officer or introducing

a new product, cannot be easily quantified in monetary units and, therefore, donot appear in the company's accounting records.

1.4.3 Time period assumption

This concept states that financial statements must be prepared on regular

intervals. Most businesses exist for long periods of time, so specific time periods

must be used to report the results of business activity. Depending on the type of

report, the time period may be a day, a month, a year, or another arbitrary period.

However, the most common reporting period is one year. Using artificial time

periods leads to questions about when certain transactions should be recorded.

For example, how should an accountant report the cost of equipment expected

to last five years? Reporting the entire expense during the year of purchase might

make the company seem unprofitable that year and unreasonably profitable in

subsequent years. Such issues like allocation of the cost of an asset over itsuseful life are dealt with in subsequent units/levels.

1.4.4 Accrual basis accounting

This concept states that a transaction is recorded when it occurs rather than

when cash is paid or received. In most cases, the principle requires the use of

accrual basis accounting rather than cash basis accounting. Accrual basis

accounting, which adheres to the revenue recognition, matching, and cost

principles discussed below, captures the financial aspects of each economic

event in the accounting period in which it occurs, regardless of when the cash

changes hands. Under cash basis accounting, revenues are recognized only

when the company receives cash or its equivalent, and expenses are recognized

only when the company pays with cash or its equivalent.

According to the accruals assumption, in computing profit revenue earned must

be matched against expenditure incurred in earning it. This is also known asmatching convention.

1.4.5 Historical Cost principle

The principle states that aAssets are recorded at cost, which equals the value

exchanged at their acquisition. Even if assets such as land or buildings appreciate

in value over time, they are not revalued for financial reporting purposes if theyare measured on historical cost basis.

1.4.6 Going concern principle

Unless otherwise noted, financial statements are prepared under the assumption

that the company will continue in operation for the foreseeable future . Therefore,

it is assumed that the entity has neither the intention not the need to enter into

liquidation or to cease trading. If such a need or intention exists, the financial

statements will have to be prepared on a different basis and they would mentionsuch a basis.

1.4.7 Consistency Concept

Consistency refers to using the same methods for the same items (i.e.

consistency of treatment) either from period to period within a reporting entityor in a same period across entities.

1.4.8 Principle of conservatism/ prudence

As per the conceptual framework, prudence is described as the exercise of

caution when making judgements under conditions of uncertainty. The exercise

of prudence means that assets and incomes are not overstated and liabilities

and expenses are not understated. Accountants must use their judgment to

record transactions that require estimation. The number of years that equipment

will remain productive and the portion of accounts receivable that will never be

paid are examples of items that require estimation. In reporting such financial

data, accountants follow the principle of conservatism, which requires that

the less optimistic estimate be chosen when two estimates are judged to be

equally likely. For example, suppose a manufacturing company's Warranty Repair

Department has documented a three-percent return rate for product X during

the past two years, but the company's Engineering Department insists this

return rate is just a statistical anomaly and less than one percent of product X

will require service during the coming year. Unless the Engineering Department

provides compelling evidence to support its estimate, the company's accountant

must follow the principle of conservatism and plan for a three-percent return

rate. Losses and costs—such as warranty repairs—are recorded when they areprobable and reasonably estimated. Gains are recorded when realized.

1.4.9 Materiality principle

Accountants follow the materiality principle, which states that the

requirements of any accounting principle may be ignored when there is no effect

on the users of financial information. Certainly, tracking individual paper clips or

pieces of paper is immaterial and excessively burdensome to any company’s

accounting department. Although there is no definitive measure of materiality,

the accountant’s judgment on such matters must be sound. Several thousand

francs may not be material to an entity such as BRALIRWA, but that same figureis quite material to a small business.

1.4.10 Duality/ double entry concept

It requires a transaction to be recorded twice (dual recording). The dual aspect

rule is recognition that every transaction involves giving and receiving effect.

When somebody gives something, another must receive it. This is in effect a

requirement for double-entry bookkeeping. Double entry is a principle rule or

principle in accounting and is thoroughly explored in later chapters. For now,

it suffices to mention that the receiving account is debited while the giving

account is credited. Double-entry therefore means that one account is debited

while another is credited. The meaning of debit and credit are also explained inlater chapters.

Application activity 1.4

1. The recognition that every transaction has two sides to it, is the leading

principle of

b) Accrual concept

c) Duality concept

d) Matching concept

e) Going concern concept

2. The ------------- concept means that similar items in a set of accounts

should be given similar accounting treatment and it should be applied

from one period to another.

a) Going concern

b) Prudence

c) Consistencyd) Materiality

3. Accounting does not record non-financial transactions because of -----

a) Economic entity concept

b) Accrual concept

c) Monetary unit concept

d) Going concern concept

4. Recognize the accounting concept in the following:

a) The transactions are recorded at their original cost.

b) The business will run for an indefinite period.

c) Every transaction has two effects to be recorded in the books of

accounts.

d) Accounting treatment once decided should be followed periodafter period

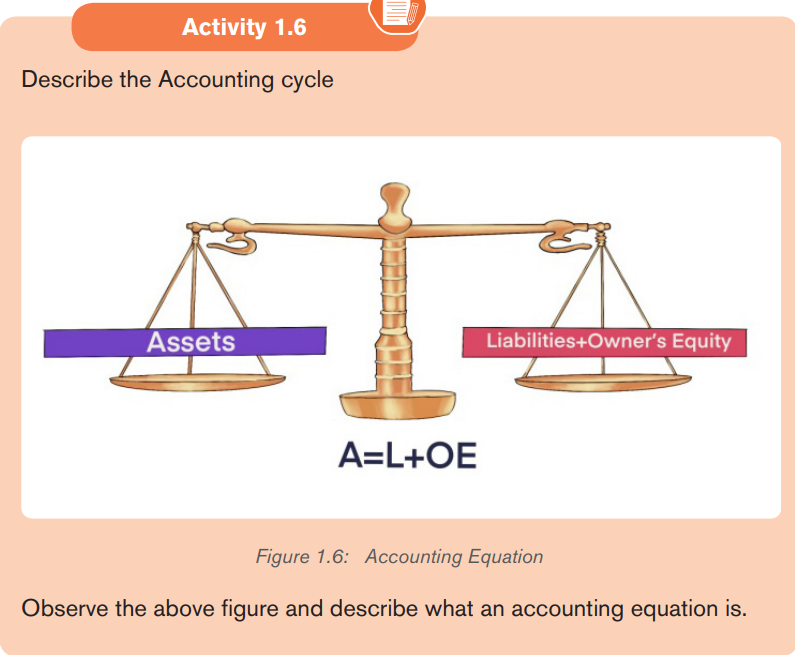

1.5 Accounting cycle

Activity 1.4

Describe the Accounting cycle

Accounting cycle is the process which is followed by accountants and

bookkeepers in processing raw financial data into output information in form of

financial statements. This process ranges from occurrence and documentation

of transactions up to the production of final accounts or financial statements.

It is called a cycle because the same procedure is repeated from one financial

year to another. When the financial year ends, books are closed and the financial

statements extracted, when the new financial year starts, the same books are

opened and the same procedure followed. It is therefore a cycle.

The accounting process or cycle is described below.

Stage 1: Occurrence and documentation of business transactions

Business transactions must be concluded first before anything is documented

and recorded. When a business transaction occurs, the immediate thing to

do is to prepare a business document to show evidence of the transaction.

Documents are means of accountability. Various parties including auditors will

want to ascertain whether the transactions took place and were authorized

by examining the documents. Besides for accountability, documents are alsoimportant as sources of generating the information to be entered into books of

account. The key documents normally prepared are invoices, payment vouchers,

receipts, cheques, local purchase orders, delivery notes, goods received notes,

bank paying-in slips, etc.

Stage 2: Entering transactions into journals

Journals are books of original or prime entry. They are the first books to which

transactions are entered. Information entered into journals is generated from the

documents described above. There are several types of journals, the major ones

include the general journal, sales journal/sales day book, purchases journal/

purchases day book and the cash book (the cash book is sometimes taken to

be part of the ledger). Details of these journals including their preparation will

be treated later.

Stage 3: Posting of transactions to the ledger

The information which had been entered into the journals is posted to the

ledger. It is therefore true to say that the journal feeds the ledger. A ledger

is a book which contains a collection of accounts. For easy of recording, the

ledger is sometimes subdivided into subsidiary ledgers. Detailed information on

preparation of the ledger will be seen later.

Stage 4: Preparation of the trial balance

At the end of a period, normally a month, all accounts are closed or balanced

off and the trial balance is extracted. A trial balance is a list of debit and credit

balances extracted from the ledger. Its purpose is to check the accuracy of

the double entry i.e. to check whether the double entry was complete and to

check whether no arithmetical errors of addition or subtraction were made in

the balancing of the ledger. If the double entry rule was not observed, the trial

balance will not balance, like wise if arithmetical errors were made, it will not

balance.

Stage 5: End of year adjustments and preparation of financial

statements/ final accounts

Financial statements are prepared from the trial balance. However, before

this is done, the trial balance needs to be adjusted at the end of the year in

order to make it up-to-date. The major adjustments or provisions made before

preparation of final accounts include, provision for depreciation, provision for

bad and doubtful debts, adjustments prepaid expenses and incomes, accrued

expenses and incomes, provision for corporation taxes, appropriations such asprovisions for dividend, transfers to reserve, etc

Once the above adjustments have been made, financial statements are prepared.

The major financial statements include the income statement also called the

trading profit and loss account sometimes abbreviated as the profit and loss

account. This account or statement shows the profitability of the business.

Another major statement is the balance sheet which shows the assets of the

business and the claims against the assets. These claims are the owner’s equity

and liabilities. The third major statement is the cash flow statement which shows

the source of cash and how it was disbursed. These are the financiers of the

assets of the business. These financial statements will be treated in more details

later.

Stage 6: Analysis and interpretation of financial statements

This is not supposed to be the work of an accountant but is the domain of

the financial analyst. Strictly speaking, the work of an accountant stops at the

preparation of financial statements. However, an accountant could also analyze

and interpret his statements. Though it could be advisable to have another

independent person to analyze and interpret the accounts.

Analysis and interpretation of financial statements makes the statements user

friendly. Lay people in accounting cannot read the figures in the financial

statements and the jargon used by accountants. These people need to be told in

simple terms whether the business is healthily operating in terms of profitability,

solvency/ liquidity etc. Analysis and interpretation of financial statements ismajorly done by the use of accounting ratios.

Application activity 1.5

1. What is the accounting cycle?

2. What is the main purpose of accounting cycle?

3. What is the name of the book in which the transactions are initially

recorded with brief explanation of the debit and credit analysis?

4. Which is the list of debit and credit balances of the ledger account?

5. What is the main objective of preparing a financial statement?

6. Why the specific process of accounting is called accounting cycle?

7. In the accounting cycle, which step immediately comes beforeanalyzing transactions?

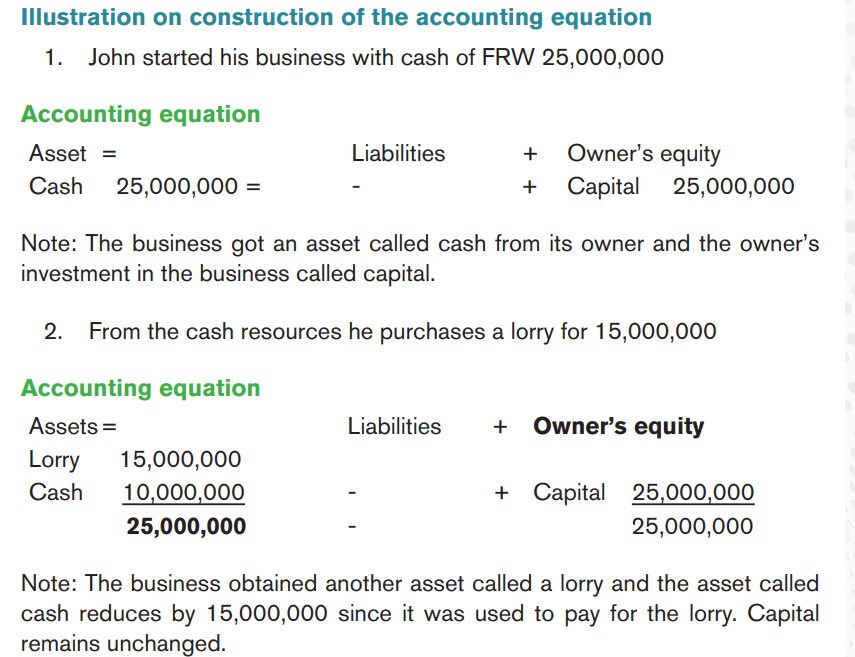

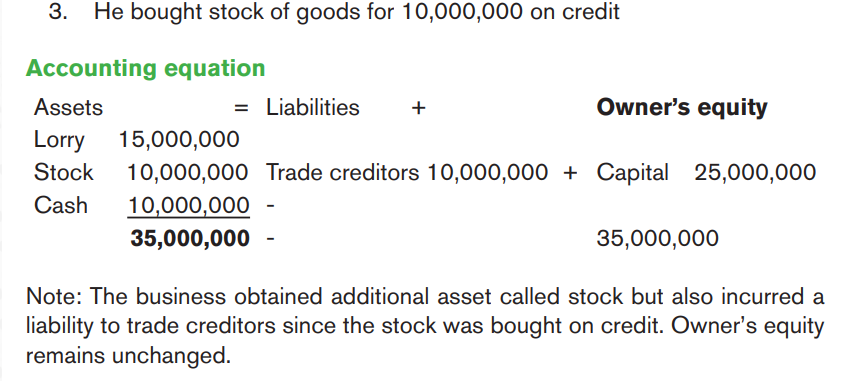

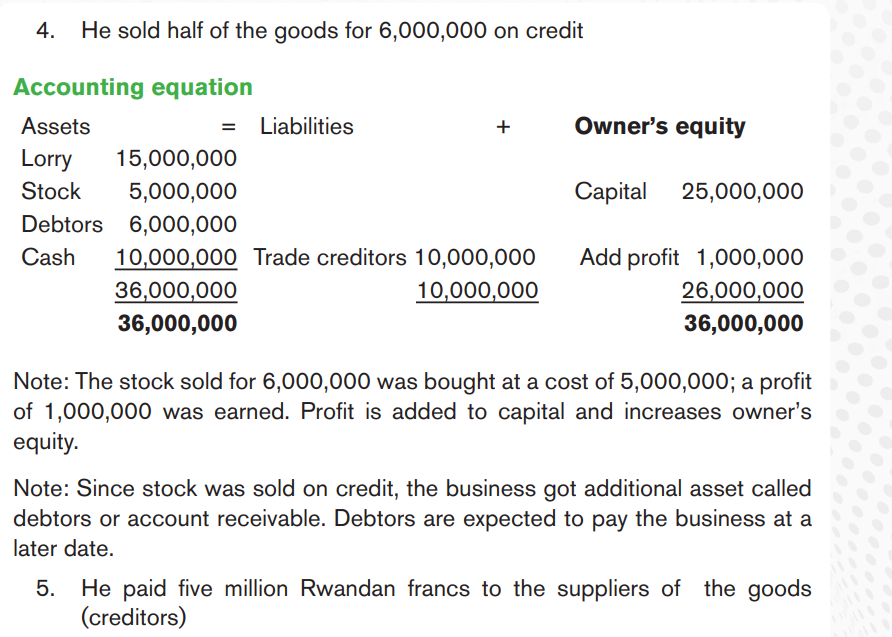

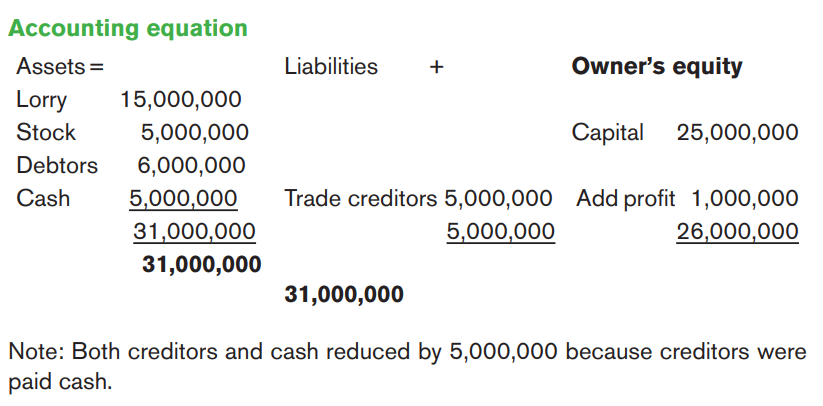

1.6 Accounting equation

The ability to read financial statements requires an understanding of the

items they include and the standard categories used to classify these items.

The accounting equation identifies the relationship between the elements of

accounting.

A business owns properties. These properties are called assets. The assets are

the business resources that enable it to trade and carry out trading. They are

financed or funded by the owners of the business who put in funds. These funds,

including assets that the owner may put is called capital. Other persons who are

not owners of the firm may also finance assets. Funds from these sources are

called liabilities.

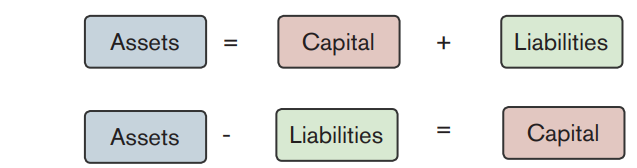

The total assets must be equal to the total funding i.e. both from owners and

non-owners. If all the resources of the business are supplied by the owner, theaccounting equation will be presents as follows:

Assets = Capital

However, some of the assets normally have been provided by some other person

than the owner. This indebtedness of a firm is referred to as Liabilities.Therefore, the equation is now referred to as:

Each item in this equation is briefly explained below:

Assets

An asset is a present economic resource controlled by the entity as a result of

past events. An economic resource is a right that has the potential to produce

economic benefits. An example is if a business sells goods on credit then it has

an asset called a debtor. The past event is the sale on credit and the resource

is a debtor. This debtor is expected to pay so that economic benefits will flow

towards the firm i.e. in form of cash once the customers pays.

Current assets typically include cash and assets the company reasonably

expects to use, sell, or collect within one year. Current assets appear on the

balance sheet (and in the numbered list below) in order, from most liquid to

least liquid. Liquid assets are readily convertible into cash or other assets, and

they are generally accepted as payment for liabilities.

Assets are classified into two main types:

a) Non-current assets (formerly called fixed assets)

b) Current assets

Non-current assets are acquired by the business to assist in earning revenues

and not for resale. They are normally expected to be in business for a period of

more than one year. Current assets are not expected to last for more than one

year. They are in most cases directly related to the trading activities of the firm.

Examples of non-current assets include:

Major examples include:

– Land and buildings

– Plant and machinery

– Fixtures, furniture, fittings and equipment– Motor vehicles

Current assets typically include cash and assets the company reasonably

expects to use, sell, or collect within one year. Current assets appear on the

balance sheet (and in the numbered list below) in order, from most liquid to

least liquid. Liquid assets are readily convertible into cash or other assets, and

they are generally accepted as payment for liabilities.

Current assets are not expected to last for more than one year. They are

in most cases directly related to the trading activities of the firm. Examples

include:

– Stock of goods – for purpose of selling. Inventory is the cost to acquire

or manufacture merchandise for sale to customers. Although service

enterprises that never provide customers with merchandise do not use

this category for current assets, inventory usually represents a significant

portion of assets in merchandising and manufacturing companies.

– Accounts receivable are amounts owed to the company by customers

who have received products or services but have not yet paid for them.

– Other debtors – owe the firm amounts other than for trading.

– Cash at bank

– Cash in hand

– Marketable securities include short-term investments in stocks, bonds

(debt), certificates of deposit, or other securities. These items are

classified as marketable securities—rather than long-term investments—

only if the company has both the ability and the desire to sell them

within one year.

– Prepaid expenses are amounts paid by the company to purchase items

or services that represent future costs of doing business. Examples

include office supplies, insurance premiums, and advance payments

for rent. These assets become expenses as they expire or get used up.

Liabilities

A liability is a present obligation of the entity to transfer an economic resource

as a result of past events.

Liabilities are the company's existing debts and obligations owed to third parties.

Examples include amounts owed to suppliers for goods or services received

(accounts payable), to employees for work performed (wages payable), and to

banks for principal and interest on loans (notes payable and interest payable).

An example is when a business buys goods on credit, then the firm has a liability

called creditor. The past event is the credit purchase and the liability being the

creditor the firm will pay cash to the creditor and therefore there is an out flowof cash from the business

Liabilities are also classified into two main classes

i) Non-current liabilities (or long term liabilities)

ii) Current liabilities.

Liabilities are generally classified as short-term (current) if they are due in one

year or less. Long-term liabilities are not due for at least one year.

Non-current liabilities are expected to last or be paid after one year. This

includes long-term loans from banks or other financial institutions.

Current liabilities last for a period of less than one year and therefore will be

paid within one year. Major examples:

– Trade creditors/ or accounts payable: owed amounts as a result of

business buying goods on credit.

– Other creditors: owed amounts for services supplied to the firm other

than goods

– Bank overdraft: amounts advanced by the bank for a short-term.

– Accrued expenses

Capital (Equity)

Equity is the residual interest in the assets of the entity after deducting all its

liabilities. Owner´s Equity represents the amount owed to the owner or owners

by the company. Algebraically, this amount is calculated by subtracting liabilities

from each side of the accounting equation. Owner's equity also represents

the net assets of the company. Items like introduced capital, profit/ loss and

drawings appear under equity. By rearranging the accounting equation, we can

define owner’s equity in this way::

Owner’s equity = Assets – Liabilities

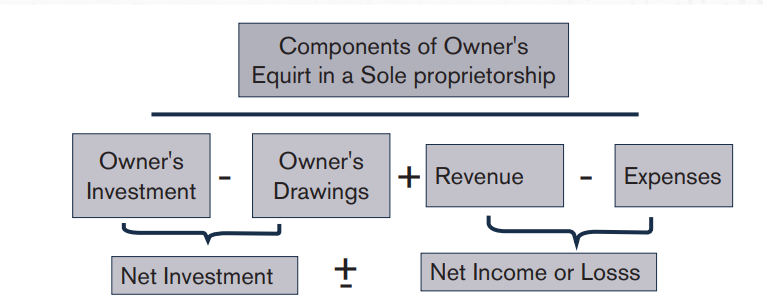

In a sole proprietorship or partnership, owner’s equity equals the total net

investment in the business plus the net income or loss generated during the

business’s life. Net investment equals the sum of all investment in the business

by the owner or owners minus withdrawals made by the owner or owners.

The owner’s investment is recorded in the owner’s capital account, and any

withdrawals are recorded in a separate owner’s drawing account. For example,

if a business owner contributes FRW 10,000,000 to start a company but later

withdraws FRW 1,000,000 for personal expenses, the owner’s net investment

equals FRW 9,000,000. Net income or net loss equals the company’s revenues

less its expenses. Revenues are inflows of money or other assets received from

customers in exchange for goods or services. Expenses are the costs incurredto generate those revenues.

Example: Johnson Company had assets of FRW 140,000 and liabilities of FRW

60,000 at the beginning of the year, and assets of FRW 200,000 and liabilities

of FRW 70,000 at the end of the year. During the year, FRW 20,000 was

invested in the business, and withdrawals of FRW 24,000 were made. What

amount of income did the company earn during the year?

Beginning of the year

Assets Liabilities Owner’s equity

FRW 140,000 = FRW 60,000 + FRW 80,000

During the year

Investment 20,000

Withdrawals 24,000

Net Income ?

End of the year

FRW 200,000 FRW 70,000 FRW 130,000

Answer

Net income FRW 54,000

Start by finding the owner’s equity at the beginning of the year. (Check: FRW

140,000-FRW 60,000 = FRW 80,000).

Then find the owner’s equity at the end of the year. (Check: FRW 200,000 –

FRW 70,000 = FRW 130,000).

Then determine net income by calculating how the transactions during the

year led to the owner’s equity amount at the end of the year. (Check FRW80,000+20,000 – FRW 24,000 +54,000 = 130,000)

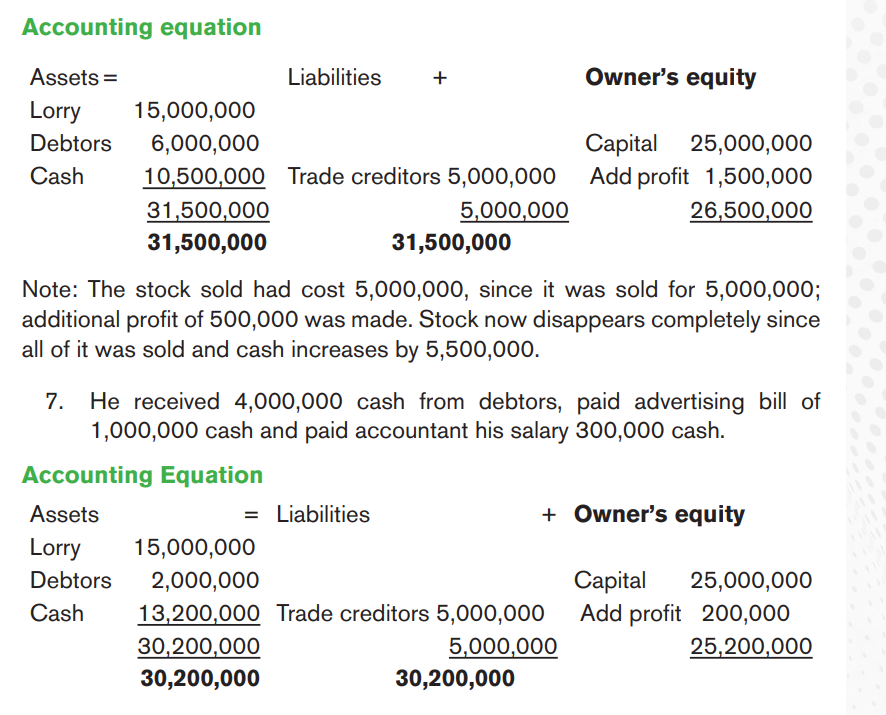

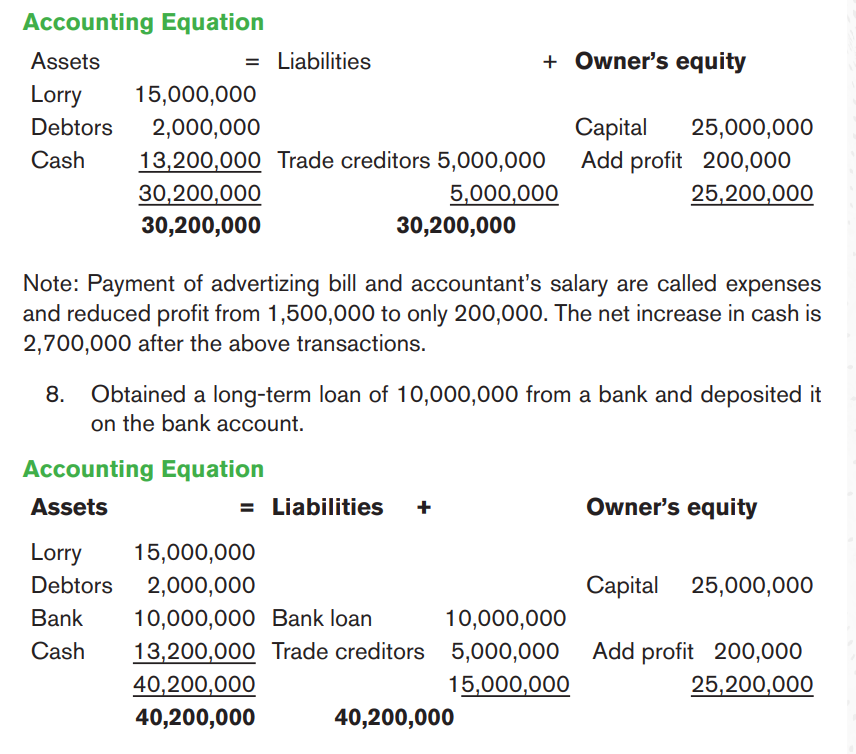

Note: The loan was deposited on the bank account and it is reflected as an

asset. Cash at bank is sometimes abbreviated as simply bank. The liabilities also

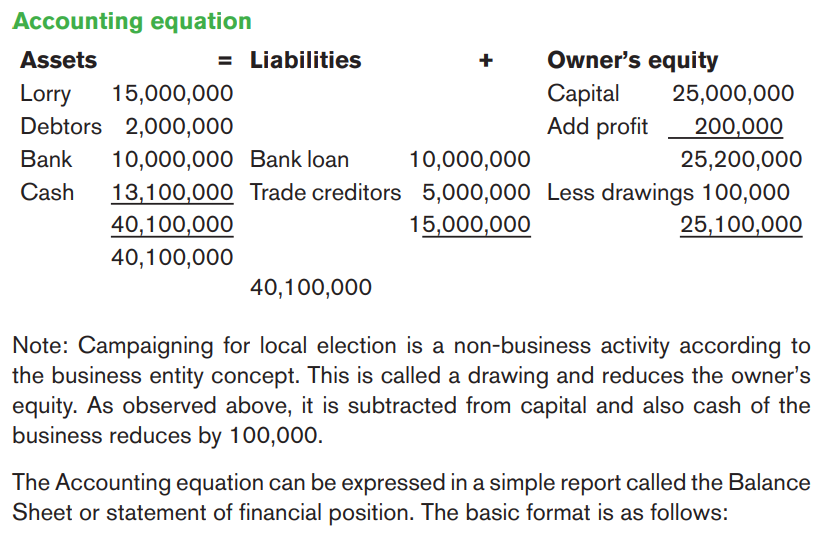

increases by 10,000,000 because of the loan acquired.9. Used 100,000 of the business to campaign for a local election.

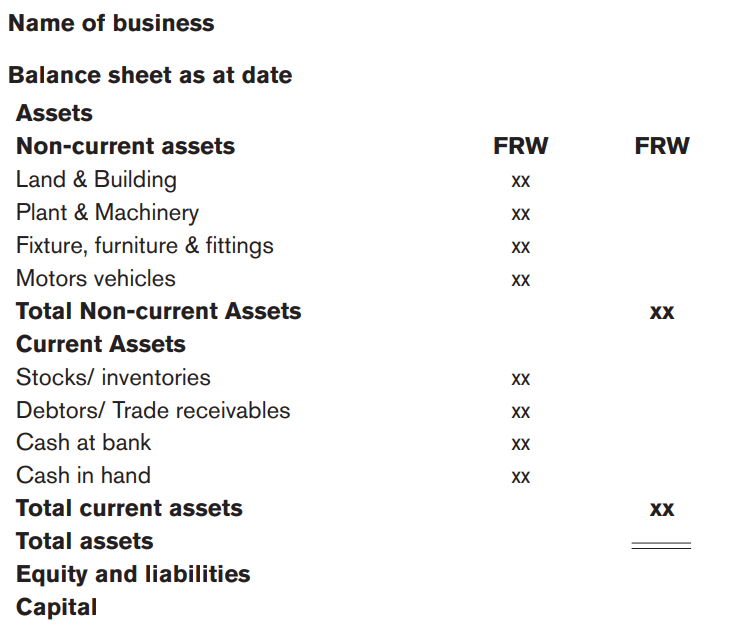

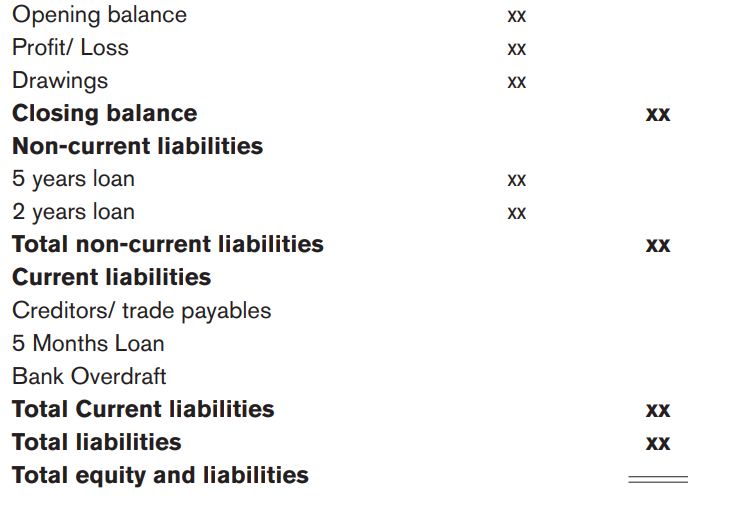

Balance sheet using the vertical format which is shown below:

Please pay attention to the format. The Non-Current assets are listed in order

of permanence as shown i.e. from Land and Buildings to motor vehicles. The

Current Assets are listed in order of liquidity i.e. which asset is far from being

converted into cash. Example, stock is not yet sold, (i.e. not yet realized yet)

then when it is sold we either get cash or a debtor (if sold on credit). When the

debtor pays then the debtor may pay by cheque (cash has to be banked) or

cash. The current Liabilities are listed in order of payment i.e. which is due for

payment first. Bank overdraft is payable on demand by the bank, then followed

by creditors.

Note that in the vertical format, current liabilities are deducted from current

assets to give net current assets. This is added to Non-Current assets, which

give us net assets. Net assets should be the same as the total of Capital andNon-Current liabilities

Application activity 1.6

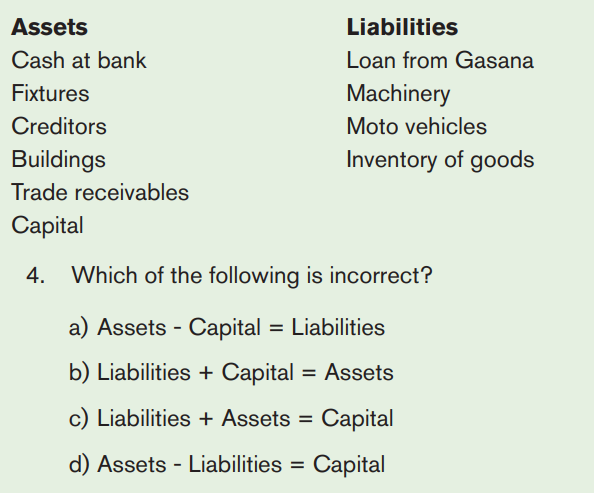

1. Which of the following is not an asset?

a) Building

b) Cash balance

c) Trade receivables

d) Loan from Kamanzi

2. Which of the following is a liability?

a) Machinery

b) Trade payables for goods

c) Moto vehicles

d) Cash at bank3. Which of the following items are shown under the wrong headings:

5. Which of the following is incorrect?

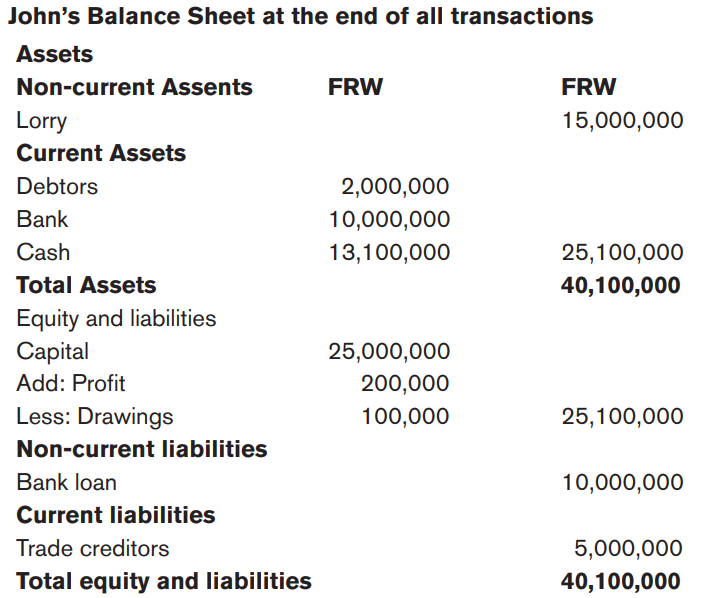

You are required to prepare a simple Balance Sheet as at 31

December 2021

7. Mukamana sets up a new business. Before he actually sells

anything he has bought motor vehicles of FRW 3,000, premises

of FRW 7,000, stock of goods FRW 2,000. He still owes FRW

800 in respect of stock purchased. He had borrowed FRW 4,000

from Kanyemera. After the events just described and before trading

starts, he had FRW 300 cash in hand and FRW 600 cash at bank.You are required to calculate the amount of his capital

1. Mention two objectives of accounting?

2. Mention five different branches of accounting?

3. Why Creditors, Tax authorities, Investors, and general public are

interested in accounting information?

4. Match the terms below with the type of user of accounting information(Some answers may be used more than once):

7. Which of the following is a form of internal control that ensures the

ledger is balanced?

a) Financial statements

b) Sequentially numbered source documents

c) Trial balance

d) Journal entries

8. In each of the following pairs of activities, tell which activity is done first

in the accounting cycle

(a) Close the accounts or adjust

the accounts

(c) Record the transactions in the

journal or prepare the initial trial

balance

(b) Analyze the transactions or

post the entries to the ledger

(d) Prepare the post-closing trial

balance or prepare the adjusted

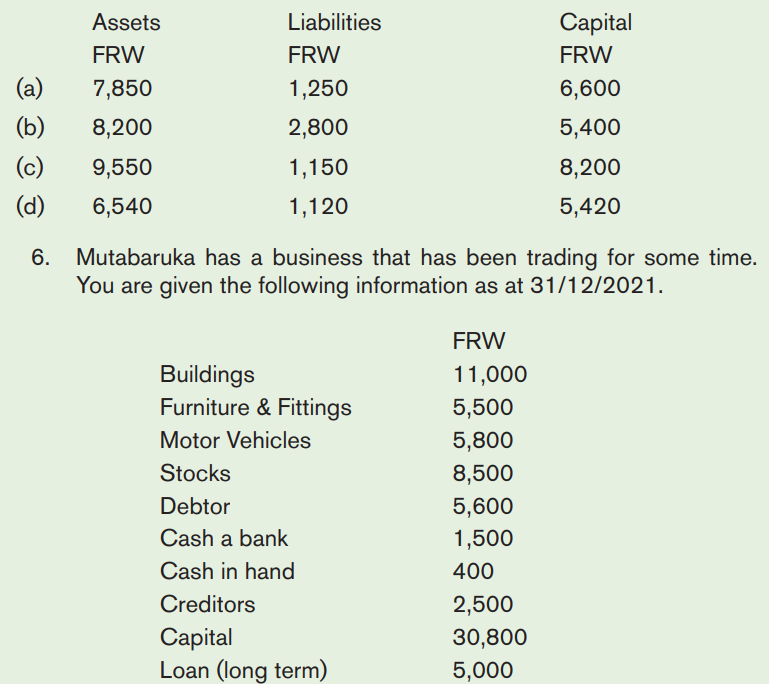

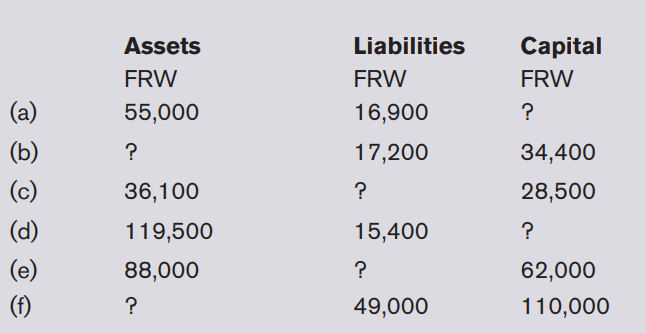

trial balance9. You are to complete the gaps on the following table?

10. Mugabowindekwe has the following items in his balance sheet as on

30 June 2021. Capital FRW 41,800, Creditors FRW 3,200, Fixtures

FRW 7,000, Motor Vehicles FRW 8,400, Stock of goods FRW 9,900,

Debtors FRW 6,560, Cash at bank FRW 12,900 and Cash in handFRW 240

During the first week of July 2021:

a) He bought extra stock of goods FRW 1,540 on credit.

b) One of the debtors paid him FRW 560 in cash.

c) He bought extra fixture by cheque FRW 2,000.

You are to draw up a balance sheet as on 7 July 2021 after the abovetransactions have been completed