UNIT 7: ESTABLISH PAYROLL REQUIREMENTS AND PAYROLL PREPARATION

Key unit competence: To be able to prepare payroll according to

organizational policy

Introductory activity

Case study:

Ineza company is located at Gisenyi sector, Rubavu district, western province.

The core value of Ineza is to provide better services to its customers and

achieving its goals. INEZA company is in competition with different local

companies. INEZA company is encountering challenges of paying staff

salaries on time, secondly complains on discrepancies of wrong computation,

wrong deduction, missing allowances are often raised by staff. This is due to

lack of qualified and competent accountant. In other words INEZA company

has a challenge of performing those issues.

From the passage above answer the following questions:

1. What is the name of document required to prepare for the above case study?

2. Give the difference between salary and wage.

7.1. Employment contract

Activity 7.1

Analyze the photos below and answer the questions that follow.

Q1. After defining the term “contract” differentiates the object from the

purpose.

7.1.1. Definition of employment contract

Employment contract is an agreement between an employer and an employee

whereby an employee undertakes to work under the authority of the employer in

return for remuneration.

7.1.2. Terms used

a) Employee

A person having agreed to work for an employer under a contract concluded

between them, and in return for remuneration.

b) Employer

An individual, a public or private entity that employs one or more employees on

a permanent or temporary basis.

c) Probation period

The probation period cannot exceed three (3) months.

However, after the written evaluation of the employee’s performance has been

notified to the employee, the employer can for valid reasons related to the nature

of work, employee’s performance and conduct, decides that an employee

retakes the probation for a period not exceeding three (3) months.

If the probation period comes to an end and proves to be conclusive, the

employee is immediately offered employment and notified in writing by the

employer.

d) Salary

A fixed regular payment, typically paid on a monthly basis but often expressed

as an annual sum, made by an employer to an employee.

e) Wage

A fixed regular payment earned for work or services, typically paid on a daily or

weekly basis.

7.1.3. Types of employment contract

a) Permanent employment contact

Permanent employment contracts apply to employees who work regular hours

and are paid a salary or hourly rate. The contracts are ongoing until terminated

by either the employer or employee and may be for full or part time work.

Employees on these contracts are entitled to the full range of statutory

employment rights.

b) Fixed-term contracts

Fixed-term contracts give a set end date, for example six months or one year.

c) Casual employment contracts

The casual employment contract is suitable for scenarios where you want an

individual to commit to working for you, but you’re not sure how many hours of

work you’ll be able to offer him/her each week and cannot guarantee a regular

working pattern. The contract should specify the minimum number of hours that

you expect them to work each week, with the expectation being that the working

pattern and hours offered above this minimum, is likely to fluctuate.

7.1.4. The details of employment contract

It must contain the following particulars or details:

• The names of employee and employer;

• The date on which the employment began;

• The date on which the employee’s period of continuous employment

began, taking into account any previous employment is to count as

continuous employment

• The scale or rate of pay and the method of calculation;

• The intervals at which payment is made;

• Any terms and conditions relating to holiday entitlement;

• The end of notice which either party needs to give notice to end an

employment;

• The job title of the employee, or a brief description of his duties;

• Where the employment is not intended to be permanent, the period for

which it is expected to continue, or if it is a fixed term, the date at which

the term is expected to end;• The place of work;

Application activity 7.1

Q1. Explain the different types of an employment contract.Q.2. Talk about the duration of a probation period

7.2. Valid contract requirements and general working conditions

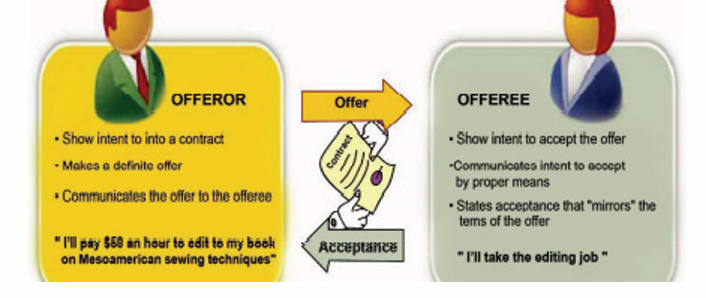

Activity 7.2

Analyse the Photo above and answer the questions that follow.

Q1. Describe different parties to a valid contract.Q2. Outline the obligations of employer.

7.2.1. Valid contract requirements

a) Parties to a valid contract

Parties of contract are persons who can sign the contract. For a contract to be

considered valid, it should include three parties. These are; Offeror who makes

an offer, Offeree to whom an offer is made and Witness who sees an eventhappening.

b) Elements of a valid contract

For a contract to be valid and therefore enforceable by law, it must have thefollowing elements:

• Intention to be bound by the contract: the two parties should have

intended that their agreement be legal. Domestic agreements between

husband and wife are not taken as valid.

• Offer and acceptance: there must be an offer and the two parties

must lawfully come to acceptance leading to a valid contract. Until an

offer is accepted, it’s not a valid contract.

• Consideration/price: this is the price agreed upon by the parties to

the contract and paid by one party for the benefit received or promise

of the other parties.

• Capacity of the parties: the parties to the contract must have

contractual capacity for the contract to be valid, i.e. should be sober,

above 18 years, not bankrupt, not insane, and properly registered.

• Free Consent: parties to the contract must agree freely without any of

the parties being forced to accept or enter the contract.

• Legality/lawful object: the object and the consideration of the

contract must be legal and not contrary to the law and public policy.

• Possibility of performance: if the contract is impossible to be

executed in itself either physically or legally, then such contract is not

valid and cannot be enforced by law.

• Certainty: the terms of the contract must be clear and understandable

for a contract to be valid. If the terms are vague or ambiguous, where

even the court may not be able to tell what the parties agreed, then itwill be declared invalid.

1. Rights and Obligations of employee

a) Rights of an employee

The rights of an employee include the following:

• To work in an environment where health and safety in the workplace are

guaranteed;

• To be provided leave as provided for by Law;

• To join a trade union of his/her choice;

• To receive equal salary for works of equal value without discrimination

of any kind;

• To be trained by his/her employer;

• To receive information relevant to his/her work.b) Obligations of an employee

An employee has the following main obligations:

• To personally carry out his/her work or service on time and achieve

performance;

• To respect the employer’s or his/her representative’s instructions;

• To abstain from an act that would threaten his/her security and that of

his/her colleagues or that of his/her workplace;

• To keep in good conditions tools given to him/her by the employer;

• To report at work on time;• To protect the interests of the work.

2. Rights and Obligations of employer

a) Rights of employer

Subject to collective convention, rules of procedure or employment contract,

the rights of an employer are the following:

• To recruit an employee;

• To give the employee instructions related to work;

• To evaluate the performance of an employee, promote, transfer, impose

disciplinary sanctions and terminate the employment contract of the

employee;

• To modify, extend or cease activities.

b) Obligations of an employer

Subject to collective convention, rules of procedure or employment contract,

the employer has the following main duties:

• To provide an employee with an employment contract and its copy

• To give the employee the agreed work at the time and place as agreed upon;

• To supervise the employee and ensure that the work is done in suitable

working conditions, as far as security and health in the workplace are

concerned;

• To pay the employee the agreed salary on time;

• To avoid whatever can hamper the company’s life and safety, its

employees and the environment

• To affiliate and contribute for an employee to the social security organ

in Rwanda;

• To discuss with the employees or their representatives on matters

relating to work;

• To provide employees with professional training and continue upgrading

their capacity;

• To provide an employee with working equipment;

• To notify the labour inspector work-related accident or death of an employee

3. Disciplinary sanctions

Subject to the favorable provisions of collective conventions, rules of procedure

or employment contract and depending on the severity of the misconduct, the

disciplinary sanctions that may be imposed on the employee are the following:

• oral warning;

• written reprimand;

• temporary suspension not exceeding eight (8) working days without pay;

• dismissal

4. Working hours

The maximum working hours are forty-five (45) hours a week. However, an

employee can work extra hours upon the agreement with his/her employer.

The daily timetable for work hours and break for an employee is determined by

the employer. The daily rest granted by the employer to the employee is not

counted as work hours.

An Order of the Minister in charge of labour determines modalities for theimplementation of working hours a week.

Application activity 7.2

Q1. What are five obligations of each party under employment contract?Q2. Discuss about Working hours according to the labor law.

7.3. Leaves

Activity 7.3

Analyze the Photos above and answer the following question: talk about types of leave.

7.3.1. Definition of leave

Referring to human resource, leave is simply taking an off from work

day after informing the management formally and sometimes even

informally. Leaves are the days that every working professional is entitled to

and paid for, apart from the holidays. Paid leaves are a part of benefits offeredby companies apart from medical claim.

What is example of leave?

Leave is defined as permission, or is time off from work. When you are given

permission to attend a party, this is an example of when you are given leave

to attend. When you take two months off work to care for your new baby, this isan example of maternity leave.

7.3.2 Types of leaves

a) Annual leave

A public servant is entitled to an annual leave of one month that may be split into

three portions maximum. However, a newly recruited public servant is entitled toan annual leave after twelve months including the probationary period.

b) Incidental leave

An immediate supervisor grants incidental leave to a public servant in case of

fortunate or unfortunate event that occurs in his/her family as follows:

• Two (2) working days in case of his or her civil marriage;

• Four (4) working days in case of delivery of his wife;

• Seven (7) working days in case of death of his or her spouse;

• Five (5) working days in case of death of his or her child or adoptive child;

• Four (4) working days in case of death of his or her father, mother,

father-in law or mother-in-law;

• Four (4) working days in case of death of his or her brother or sister;

• Three (3) working days in case of death of grandfather or grandmother;

• Three (3) working days in case of his or her transfer over a distance of

more than thirty (30) kilometers from his or her usual place of work.

A public servant on incidental leave continues to receive his or her salary andfringe benefits.

c) Maternity leave benefits

A female employee who has given birth is entitled to a maternity leave of at least

twelve (12) consecutive weeks.

d) Coincidence of leaves

When annual leave coincides with incidental leave or maternity leave, the annual

leave is suspended and resumes after the incidental leave or maternity leave.

e) Sick Leave

• Short-term sick leave

An immediate supervisor grants to a public servant a short-term sick leave not

exceeding one (1) month for reasons of sickness ascertained by a recognized

medical doctor.

• Long-term sick leave

The head of an institution grants to a public servant a long-term sick leave

exceeding one 1month but not exceeding six (6) months basing on the decision

of a committee of at least three (3) medical doctors, which examines a medical

report issued by a medical doctor who treated the public servant, attesting thathe or she is unable to work.

f) Authorized absence

For justified reasons, an immediate supervisor may grant to a public servant a

written authorized absence from work for one (1) day maximum not deductedfrom annual leave.

However, the immediate supervisor does not grant an authorized absence for

more than ten (10) days per year.

g) Official public holidays

A Presidential Order determines official public holidays.

Examples:

– Jan 01: new year day

– Feb 01: heroes’ day

– Apr 07: Genocide against the Tutsi Memorial Day

– May 01: workers day

– Jul 01: Independence Day

– July 04: liberation day– Dec 25: Christmas day

Application activity 7.3

Q1. State four incidental leavesQ2. List two official public holidays

7.4. Payroll process

Activity 7.4

Analyze the photos above and answer the following questions:

Q1. What is a payroll?Q2. State two documents required to produce payroll.

7.4.1. Definition of payroll

Payroll is a list of all employees showing the details of their gross wage,

deductions and net wages due to them .it is also known as wage sheet.

In a company, payroll is the sum of all financial records of salaries for an

employee, wages, bonuses and deductions.

In accounting, payroll refers to the amount paid to employees for services they

provided during certain period of time. Therefore, for proper accountability, the

employer gives the employee an individual monthly pay slip which details the

basic salary, other various allowances and bonuses, withholdings and the netsalary on employee’s request.

7.4.2. Relevant documents required to produce payroll

1. Clock cards: these show the number of hours worked by each employee.

One clock card is allocated to each employee for each pay period. IN

and OUT times are recorded on clock cards to determine total hours

worked including overtime hours so that remuneration payable to each

employee can be computed.

2. Piece tickets: these provide information regarding the number of items

produced by each worker. They are used for workers who are paid

according to the work completed.3. Employee’s personal cards: they provide information regarding wage rates.

7.4.3. Importance of preparing payroll on time

• It helps to pay employees on time

• Reduces conflicts between workers and employers• It increases employees’ motivation

Application activity 7.4Q1. What are the importance of preparing payroll on time?

7.5. Payroll system and Elements of payrollActivity 7.5

Case study: In any entity, payroll is very important document for measuring

the amount paid to each employee. Besides, it shows the amount to be

paid to the different agencies like RSSB, RRA.. Thus, the human resource

management unit is supposed to create and control personnel records for the

success of organization’s operations. The effective management of personnel

records enables organizations to manage their employees effectively and

efficiently, to initiate informed decision making, to encourage transparency

and accountability and to facilitate the monitoring and evaluation of staffperformance.

All operations in relation to human resource management, from preparation

of pay slips to strategic planning, ultimately depend on reliable and accurate

personnel records. The management needs to understand the special

characteristics of personnel records, the legal framework for human resource

management and the effect of changing technology on the nature andstructure of personnel records.

Reference made to the above case study, answer the following questions:

1) Outline any 4 parts included in payroll program2) State Payroll system

7.5.1. Payroll system

• Manual payroll system means that accounting systems allow you to

process all your normal payroll tasks by hand.

Advantages of manual payroll system

• Relatively cheaper since you only need to use either the old-fashioned

books or use programs like excel.

• Independence from network and electricity

• Doesn’t require high knowledge compared to the computerized payrollsystem

Disadvantages of manual payroll system

• Becomes more difficult as the number of employees grows

• More tedious to prepare

• Does not allow real time reporting and analytics

• Human error can be a major inconvenience since an individual carries

out all timesheets, taxes, wages and other processes

• Errors can also be harder to track and might result in various business

penalties

• Errors can be also cause employees to be under / over paid

Computerized payroll accounting systems allow you to process all your normalpayroll tasks via a computerized system using a software.

Advantages of a computerized payroll system

Avoids most common human errors by implementing a system which requires

present data and automatic calculations.

• Payroll computation tends to be more accurate.

• Payroll can be done on a timely basis.

• It is easier to maintain.

• It is easier to track and correct errors.

• Number of employees being processed will no longer be a problem.

Disadvantages of a computerized payroll system

• more expensive compared to manual payroll systems.

• Needs standard computer setup in order to operate it well with certain

prerequisites.• Needs an initial training for those who will maintain the payroll system.

7.5.2. Elements of payroll

a) Serial number

In payroll records there is a serial number which shows the unique number used

for identification of employees.

b) Name of employee

In payroll records there are also the names of persons having agreed to work

for an employer under a contract concluded between them, and in return forremuneration

c) Account number

An account number is a unique number which show the employee’s owner’s

account.d) Basic salary

Basic salary is an amount of money paid to an employee for the work performed,which does not include any allowance

e) Allowances

Any monetary benefit offered by the employer to employees so as to facilitate

them to perform well. Among allowances we can list for illustration the following

examples:

• Transport benefit in Kind: if the employee benefits from use of a motor

vehicle provided by the employer during the tax period, add back 10%

of the taxable income in FRW, excluding other benefits in kind.

• Housing benefit in Kind: if the employee benefits from accommodation

provided by the employer during the tax period, add back 20% of the

taxable income in FRW, excluding other benefits in kind.

• Communication allowances. Etc…

f) Gross salary

Gross salary is the amount of money employees receive before any tax deduction

or taken out.

g) Deductions

Deductions are money that the employer withholds to contribute to certain

agencies like RRA, RSSB, especially from the gross salary. E.g. :

• Pay As You Earn (PAYE)

• RSSB employee contribution

• Contribution to maternity leave

• Etc…• Pay As You Earn calculation

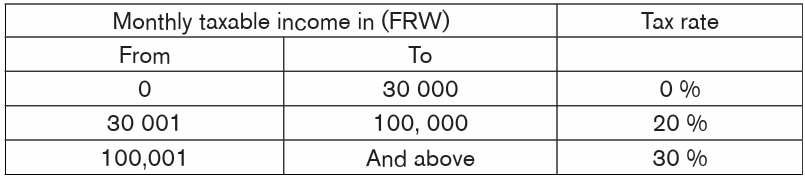

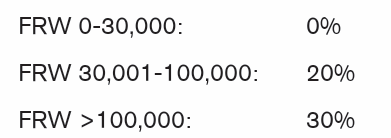

What are the tax rates for ‘permanent’ employees?

There are different marginal tax rates for permanent employees depending

upon their taxable employment income. The groupings of income are called taxbrackets. The tax rates for each tax bracket are as follows:

Tax rate

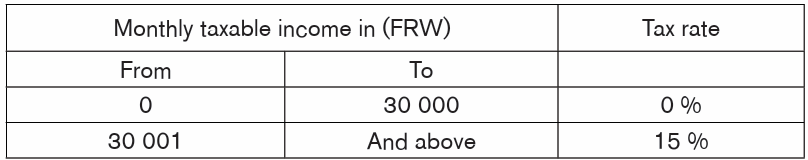

What are the tax rates for ‘casual labourers’?

Similarly, there are different marginal tax rates for casual employees depending

upon their taxable employment income. The groupings of income are called taxbrackets. The tax rates for each tax bracket are as follows:

Tax rate

What are the tax rates for ‘employees with more than one employer’?

The first employer declares the employee as a ‘permanent employee’ as normal.

Any additional employers must withhold PAYE at the rate of 30% on all taxable income.

Practical example: Dr DUSHIME is a lecturer in University of Rwanda where

he is paid a monthly basic salary of FRW600,000, housing allowances of FRW

75,000, transport allowances FRW75,000, responsibility allowances FRW200,000 as a coordinator of evening program in his faculty.

This one is also a teacher at University of Kigali (UoK) on part time basis and

gets the monthly gross salary of FRW 260,000

Required: Calculate the PAYE

Solution: PAYE withheld by UR: Gross salary: FRW 600,000 + FRW 75,000

+ FRW 75,000 + FRW 200,000 = FRW 950,000

From FRW 0 to FRW 30,000: 0% = FRW 30,000 x 0% = FRW 0

From FRW30, 001 to FRW 100,000: 20 % = (FRW 100,000 – FRW 30,000)

x 20% =FRW14,000

From FRW 100,001 to FRW 950,000: 30 %= (FRW 950,000 –FRW 100,000)

x 30% = FRW 255,000

FRW 0 + FRW 14,000 + FRW 255,000 = FRW 269,000

PAYE withheld by UoK: FRW 260, 000 x 30% = FRW 78,000

• Rwanda Social Security Board (RSSB) elements

What are the rates of the pension scheme?

The pension scheme totals a rate of 8%. This is made up of 3% withheld from the

employee and 5% paid by the employer including payments to the occupational

hazards scheme. This is charged on all employment income except for transport

allowances and transport benefits in kind

Therefore, the pension base is equal to:

Pension base = basic salary + benefit in kind house + benefit in kind others +

cash allowance house + cash allowance others.

What are the rates of the Maternity leave scheme?

The Maternity Leave scheme totals a rate of 0.6%. This is made up of 0.3%

withheld from the employee and 0.3% paid by the employer. This is charged on

all employment income except for transport allowances and transport benefits

in kind. Therefore, the pension base is equal to:

Pension base = basic salary + benefit in kind house + benefit in kind others +

cash allowance house + cash allowance others.

What are the rates of the Medical Scheme?

The Medical Scheme totals a rate of 15%. This is made up of 7.5% withheld

from the employee and 7.5% paid by the employer. This is charged on the

‘Basic Salary’.

a) Net salary

The net salary refers to the amount of money employees receive after all

deductions?

b) Community-based health insurance (CBHI)

This order has introduced a statutory deduction of 0.5% from every employee’s

net salary as a contribution to the community-based health insurance scheme.

Employers are to remit these contributions to the Rwanda Social Security Board

(RSSB) on or before the 15th of the following month.

Application activity 7.5

Q1Amahoro employs Innocent and pays him a basic salary of FRW 57,000

and a cash allowance of FRW 2,000 for transport and FRW 3,000 for airtime

related to calls on behalf of the business. Calculate RSSB contributions for

pension and maternity leave.

Q2. Discuss about allowances and state 4 examples of allowances?

Q3. Write in full words the following abbreviation used in payroll preparation

a) P.A.Y.E

b) R.S.S.B

7.6. Salary computation and the payment methods of payroll

Activity 7.6Case study

The major problem is delay of salaries, which is caused by computations that

are manually done. These computations are also prone to errors. The whole

process is tiresome and takes long. All this can be solved by automating the

system. After identifying the problems in the underlying system, an automated

computerized system was developed, to curb the loopholes in the manual

payroll system. This system is speedy in the calculations of the net salaries

and no errors in the salaries. It also stores the payroll information very well.

Most computer payroll system keeps track of details like computer payroll

numbers, tax identification numbers, district code, department or institution,

country, bank code, name of employee, paying code, title of employee, run

date, date of payment, gross pay. P.A.Y.E., RSSB contribution, basic pay,

salary scale among other things.

After the accounts clerk has deposited the employee’s cheques in their banks

and given pay slips by the bank, they need to record the payments made

in the system for decision making purposes and generation of monthly and

annual reports. Analyze the case study above and referring to the last lesson,

answer the following questions.

Q1. State RSSB contribution rates you know according to the Rwandan law

Q2. Outline three payment methods

Q3. Explain any five payroll functions.7.6.1. Salary computation and the payment methods of payroll

1. Salary computationA. Calculation of gross salary

Gross salary is the amount of money employees receive before any tax deduction.

Gross salary = Basic salary + accommodation allowance + transport allowance

+ communication allowances+ any other allowance

B. Calculation of deduction

• For PAYE, Rwanda labour law should be enforced by applying Personal

Income Tax (PIT) formula with consideration that PAYE is reported on

monthly basis while adhering to the three tax bands:

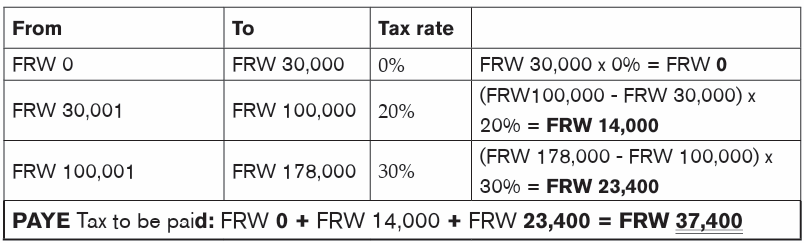

Example: Calculate an annually professional tax of an employee who earns

the monthly basic salary of FRW 141,000, housing allowances FRW 19,000,

communication allowances of FRW 6,000, transport allowances FRW 12,000

Answer:

Data:– Monthly income: FRW 141,000

– Housing allowances: FRW 19,000

– Communication allowances: FRW 6,000

– Transport allowance: FRW 12,000

– Gross Salary: 141,000 + 19,000 + 6,000 + 12,000 = FRW178,00

– Annual tax computation:

Annual professional tax: FRW 37,400 x 12 = FRW448,800

• For Rwanda Social Security board (RSSB), the following should be

considered:

What are the rates of the Pension Scheme?

The Pension Scheme totals a rate of 8%. This is made up of 3% withheld from the

employee and 5% paid by the employer including payments to the occupational

hazards scheme. This is charged on all employment income except for transport

allowances and transport benefits in kind

Therefore, the Pension Base is equal to:

Pension base = Basic salary + Benefit in kind House + Benefit in kind others +

Cash Allowance house + Cash allowance others.

What are the rates of the maternity leave scheme?

The Maternity Leave scheme totals a rate of 0.6%. This is made up of 0.3%

withheld from the employee and 0.3% paid by the employer. This is charged on

all employment income except for transport allowances and transport benefits

in kind. Therefore, the pension base is equal to: Pension base = Basic salary +

Benefit in kind House + Benefit in kind others + Cash Allowance house + Cash

allowance others

What are the rates of the medical scheme?

The medical scheme totals a rate of 15%. This is made up of 7.5% withheld

from the employee and 7.5% paid by the employer. This is charged on the

‘Basic salary’.

A. Calculation of net salary

Net salary= Gross salary - Deductions

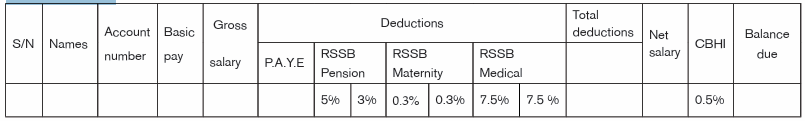

Format of payroll

Company names:….. Pay period:…………Company address:…….. Bank names:………

PAYROLL

Prepared by:…………….. Verified by:…………..….. Approved by:…………

7.6.2. The payment methods of payroll:

1. Cash payment

Cash payment is a form of liquid funds given by the employer to different

institutions entitle to any professional contribution payment like PAYE to RRAand different RSSB contributions through RRA.

2. Mobile money

In this case the employer pays taxes and RSSB contributions using Telephone

Mobile Money.

3. Cheque

A cheque is a written order from an account holder (the bank current account

holder) addressed to his bank to pay a stated sum of amount to the order of an

announced person or its bearer. A cheque is a document of payment in which

the holder of an account orders to his bank to pay a certain amount to a payee.

4. Electronic transfer

Include a transfer made between an individual’s varies accounts or from one

individual account to a corporation account

Application activity 7.6Q1. Write in full the following abbreviation: a) RSSB

b) PAYE

c) RRA

Q2. Mugisha is entrepreneur. Her small business is located in HUYE District.

She employs one employee called Munezero. At the end of every month,

she pays him a basic salary of FRW 35,000, a transport allowance of FRW

5,000, and a housing allowance of FRW 8,000. As a student of senior four

accounting, calculate:

a) The gross salary paid by Mugisha to Munezero at the end of the month

b) The net salary received by Munezero after paying compulsory deductions

(PAYE, Pension, and Maternity leave only).

Q3. Explain a payroll and its details.

Skills Lab 7

After a visit of resource person (accountant of school), students write a

note on the following:

• Payroll process

• Preparation of payroll

• Payment methods of payroll prepared

End of unit assessment 7

Q1. Yusufu Kagina is a technician at Fit Metal Industries Limited, receiving

a monthly salary of FRW 500,000. He is also allowed a car and an

accommodation by the company. How much will be deducted as PAYE

from Yusufu’s salary?

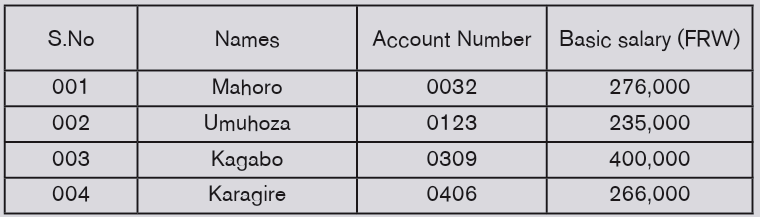

Q2. MRK ltd company is a small sole trade business of purchasing and

selling computers. It is located in Jenda sector, Nyabihu District, WesternProvince (Tel +250788888888-722222222; P.O Box 1123 Gisenyi).

MRK Ltd company Shop is well known for its services in Society and

this attracts clients. Now days MRK Ltd company Shop is facing serious

problems related to the use of manual accounting, lack of tool which helps

to analyze the challenge of performing an effective payroll system.

Besides all staff being accommodated and transported by the company,the following information has been provide:

As a qualified accountant, you are requested to assist the Company to

Prepare payroll according to Rwandan law for the month of June 2021. Thepayment is made through GJ Bank.