UNIT 4 :TAX DEPRECIATION

Key unit competence: Apply tax depreciation to produce a tax liability

Introductory activity

The main causes of depreciation are the natural wear and tear of fixed

assets through use, which causes the value of fixed assets to decrease

every year, for example, a typewriter is replaced by a computer, an asset

is no longer used due to the change in enterprise size, and some assets

have wastefulness due to the extraction of raw materials from them.

Referring to the section above, answer the following questions:

1) What is depreciation?

2) Using research, outline the assets that are depreciated in a pool

system based on interest rates.

3) With research, the machines were bought in 2015 for FRW

40,000,000. Find the value of the depreciation using the fixed rateaccording to the Income Tax law No. 16/2018.

4.1. Definition, Nature of tax depreciation and its availability

Activity 4.1

If our school spend FRW 25,000,000 on a delivery vehicle, then the truck

is projected to be used for four years. Advise the school administration on

what they can do to ensure that it is replaced at the end of the planned usageperiod.

Depreciation is an accounting word that refers to a way of allocating the cost

of a tangible or physical asset over its useful life. Depreciation is a term used

to describe how much of an asset’s worth has been used. It lets businesses

generate revenue from the assets they possess by paying for them over time

Depreciation of fixed asset is defined as the allocation of the costs of the asset

to the years in which benefits is expected from its use resulting in the loss of

value of the asset due to physical deterioration or obsolescence.

Depreciation is an annual charge against the profits of a company to take

account of the theoretical reduction in value resulting from the use of fixed assets

belonging to the organization. It, therefore, forms deductible expenditure for the

fiscal year under consideration. However, some assets that are not subject to

physical deterioration and associated depreciation, in the same way, are not

allowable. These include in particular land, the works of art, and heritage assets.

a) Definition of tax depreciation

Tax depreciation is a method of accounting for the decrease in the value of an

investment property’s assets over time.

A tax depreciation allowance is available to individuals or corporations who

own depreciable assets at the end of the tax period and use those assets to

generate revenue.

b) Nature of tax depreciation and its availability

Tax depreciation is a form of tax relief given for capital expenditure. It replaces

accounting depreciation because it is given in a standard manner according to

tax legislation.

Accounting depreciation, capital purchases costing over FRW 500,000, and

acquisition costs of fixed assets were all disallowed expenses.

All enterprises can claim tax depreciation on most fixed assets that will be used

for business purposes. If a trader leases rather than owns an asset, the trader

can only claim tax depreciation if the lease is classified as a finance lease (i.e.

the asset is recognized on the trader’s balance sheet). The lessor (the legal

owner) is entitled to claim tax depreciation for operating leases.

Not all forms of capital expenditures are eligible for tax depreciation. The

categories of capital expenditures for which tax depreciation can be claimed

are listed in Article 28 of the income tax law No. 016/2018. Expenditure on the

following items qualifies as a qualifying expense:

– Buildings, heavy industrial equipment, and fixed machinery– the eligible

expenditure includes the costs of acquisition, construction, improvement,

renovation, and reconstruction of such assets

– Purchased intangible assets, including purchased goodwill.

– Information and communication systems – there are different rates of

allowances for these assets depending on whether their estimated useful

life is more than or less than 10 years.– Other qualifying business assets.

Land, Antiques, and Jewelry are examples of assets that do not qualify for tax

depreciation because they are not susceptible to wear and tear or obsolescence.

Internally generated intangible fixed assets, such as customer loyalty, are noteligible for tax depreciation.

Application activity 4.1

Goodwill was purchased by KBM Ltd, a Rwandan resident company, for a

price of FRW 150,000,000.

Which of the following statements is true in relation to the tax relief available

on this purchase?

a) KBM Ltd must have obtained a valid investment certificate in order to

claim 10% tax depreciation.

b) No tax depreciation is available as this is an intangible asset.

c) The tax depreciation rate is 10% on a reducing balance method basis.

d) An investment allowance of FRW 75,000,000 could be available to KBM Ltd.

4.2. Difference between tax depreciation and accounting depreciation

Activity 4.2

Before we talk about accounting depreciation and tax depreciation, what is

initial depreciation itself?

Depreciation is a way of accounting for the decrease in the useful life of tangible

assets owing to obsolescence, wear and tear, and other factors. Accounting

and tax depreciation are frequently different due to two key factors: computation

method and accounting for asset useful life (they are calculated according todifferent procedures and assumptions).

a) What is Accounting Depreciation?

Accounting depreciation (also known as book depreciation) is the cost of a

tangible asset allocated by a company over the useful life of the asset. The

recognition of accounting depreciation is driven by accounting standards and

principles such as GAAP. Remember that depreciation is a non-cash item. In

other words, depreciation expense does not represent an actual cash flow for

a business.

Despite its non-cash nature, depreciation expense still appears on the

company’s financial statements. A company records its depreciation expenses

on the income statement. Thus, this non-cash item ultimately reduces the net

income reported by a company.

In addition, most accounting standards require companies to disclose their

accumulated depreciation on the balance sheet. The accumulated depreciation

reveals the impact of the depreciation on the value of the company’s fixed assets

recorded on the balance sheet.

Accounting depreciation can be calculated in numerous ways. The two most

common ways to determine depreciation are straight-line and accelerated

methods.

The straight-line depreciation is the easiest and most frequently used depreciation

method. It distributes depreciation expenses equally over all periods of the

asset’s useful life.

Conversely, accelerated depreciation methods allow deducting greater

depreciation expenses in the earlier periods of the asset’s useful life and smaller

depreciation expenses in the subsequent periods. One of the examples of theaccelerated depreciation methods is the double declining depreciation method.

b) What is Tax Depreciation?

Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return for a

tax period to compensate for the loss in the value of the tangible assets used in income

generating activities. Similar to accounting depreciation, tax depreciation allocates

depreciation expenses over multiple periods. Thus, the tax values of depreciable assets

gradually decrease over their useful lives. By deducting depreciation, tax authorities

allow individuals and businesses to reduce their taxable income.

A taxpayer cannot claim depreciation for all assets. Only some assets that meet

the specific requirements in the given tax jurisdictions may be eligible for the

depreciation claim. Although the requirements generally vary among the tax

jurisdictions, the most common criteria for depreciable assets are:

• The asset is the property owned by a taxpayer

• A taxpayer uses the asset in the income-generating activities

• The asset possesses a determinable useful life

• The asset’s useful life is more than one year.

Tax authorities treat depreciation expenses as tax deductions. In other words,

taxpayers can claim depreciation expenses for eligible tangible assets to reduce

their taxable income and the tax amount owed.

Therefore, tax depreciation is calculated for the purpose of income tax. The

main purpose of this calculation is to reduce taxable income. This is based on

the Internal Revenue Service’s (IRS) rules. For example, the IRS may state that

a certain asset’s useful life is ten years, hence tax depreciation calculations

should be done for a ten-year period.

The IRS rules also allow a company to accelerate the depreciation expense. This

means charging more depreciation in the first few years and less depreciation in

the later years of the asset’s life. This saves income tax payments in the first few

years of the asset’s life but will result in more taxes in the later years. Companies

that are profitable find accelerated depreciation to be more attractive. Due to

this reason, the company has to maintain two types of records for depreciation:

one for the financial reporting purpose and the other for income tax purposes.

Furthermore, various businesses may have different depreciation policies, and

tax depreciation may be considered differently as a result. For example:

• Full year’s depreciation will be charged in the year of purchase

• No depreciation will be charged for the year if the asset is purchased in

the middle or near the end of the year.

• No depreciation will be charged on the year of disposing of the asset

The key difference between Accounting Depreciation and Tax Depreciation

is that while the accounting depreciation is prepared by the company for

accounting purposes based on accounting principles, the tax depreciation isprepared in accordance with Internal Revenue Service’s rules (IRS).

Application activity 4.2

1. What is Accounting Depreciation?

2. Brainstorm common criteria for depreciable assets.

4.3. Tax depreciation applied to individual assets and to pools of assetsActivity 4.3

Businesses can claim most of their labor costs on their tax returns as they

incur the cost, but typically have to deduct their investment costs over many

years. Due to inflation and the time value of money, the protracted amortization

of capital expenditures is forcing companies to understate their capital

expenditures in present values, thereby overstating their true revenues.

Tax on consumed income or personal expenses would have investment costs

deducted as they are incurred, which is the optimal treatment for achieving

the most economically efficient level of capital formation. Capital costs would

only be amortized if investments lost economic value over time. Economic

depreciation has two problems. First, it is impossible to measure because

similar assets in different uses wear out or become obsolete at different rates.

Second, the concept ignores the cost of locking money into an asset from the

date of its purchase, reducing investment.

Answer the following questions with reference to the section above:With research outline reasons for providing amortization.

4.3.1. Tax depreciation applied to individual assets

The following assets are each treated independently for the calculation of theapplicable tax depreciation, from the types of qualified assets listed in lesson

4.1 above:

• Buildings, heavy industrial equipment, and

• Heavy industrial machinery – these are depreciated annually each

on its own, on the basis of the rate of depreciation equivalent to five

percent (5%) on a straight-line basis, so the relevant cost is multiplied

by 5% and this remains constant until the asset is fully depreciated (20

years) or sold.

• Intangible assets including goodwill that is purchased from a third

party are depreciated annually each on its own, on a straight-line basis,

each on its own, on the basis of the rate of depreciation of ten percent

(10%) of the relevant cost of the asset.

• Information and communication systems with an expected life of over

10 years – are depreciated annually on a straight-line basis of the rate

of depreciation of ten percent (10%) of the relevant cost of the asset.

4.3.2. Tax depreciation applied to pools of assets

The remaining items of qualifying expenditure will be grouped, or ‘pooled’,

and tax depreciation applied to the group of assets rather than to each asset

individually.

The rates applicable are:

• Computers and accessories, and information and communication

systems with a life of no more than 10 years: fifty per cent (50%) on a

reducing balance basis

• Other qualifying business assets (Motor vehicle, Furniture, equipment

and simple machines): twenty-five percent (25%) on a reducing balance basis

Keep in mind that the calculation of the tax depreciation on a pool is on a reducing

balance basis; it is a percentage of the brought forward eligible expenditure

(known as the ‘tax written down value’ (TWDV)) as adjusted for acquisitions anddisposals that have taken place in the year.

Application activity 4.3

a) What rates of tax depreciation, if any, apply to the following items of

expenditure?

A. Production line machinery built into a factory

B. A piece of telephone equipment with an expected life of 15

years, acquired under an operating lease

C. The extension of a residential homeD. The purchase of patent rights

4.4. Computing tax depreciation

Activity 4.4

Analyze the picture above and answer the following question:

With research, the machines were purchased at a cost of FRW 45,000,000.

Find the value of the depreciation using the fixed rate according to the IncomeTax Law No. 16/ 2018

4.4.1. Calculation of tax depreciation on individual assets

The principle of calculating tax depreciation for a single item is straightforward:

simply apply the proper percentage to the asset’s qualifying cost. Remember

that assets that receive straight-line depreciation are treated individually, not

collectively. As a result, each asset’s computation must be prepared separately.

In the tax period in which the asset is acquired, a full year’s worth of tax

depreciation is given (irrespective of when in the period the purchase took

place). There is no tax depreciation available during the time when an asset is sold.

When an asset is sold (disposed of), the sale proceeds are included in the

trader’s taxable income calculation (under Article 5 of Income Tax Law No.

16/2018, items 5 and 6). The asset’s remaining balance must then be writtenoff as a separate deduction in the year of sale.

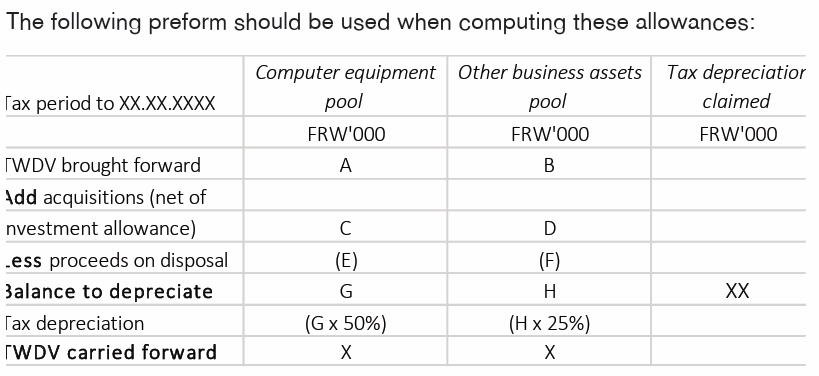

4.4.2. Calculation of tax depreciation on asset pools

Computers, accessories, and information and communication systems having a

10-year life expectancy, and other qualifying assets, are given tax depreciation

via ‘pools’ of expenditure. The balance of expenditure brought forward is

increased for items purchased during the year (net of the investment allowance

if applicable) and reduced by the proceeds of any relevant items sold. After that,

the remaining balance is multiplied by the appropriate percentage (50 percentor 25 percent for computer equipment and other assets respectively).

Notes

• If either G or H above are negative (due to the sale proceeds on assets

sold in the year being greater than the balance in the pool), a ‘balancing

charge’ arises: the negative balance increases taxable profit for the year

and the pool becomes zero.

Application Example

• If either G or H are a positive value of less than FRW 500,000, the

entire balance is deducted from profits as a balancing allowance (rather

than multiplying by 50% or 25%). Again, the pool will be reset to zero.

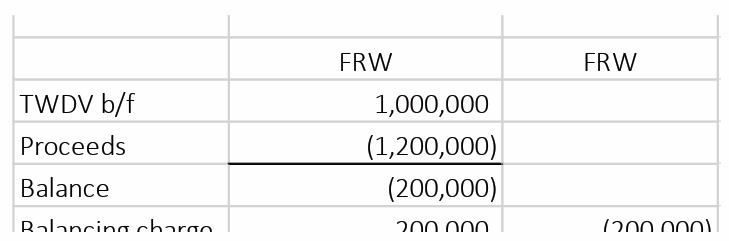

The TWDV brought forward on a computer equipment pool at the beginning

of a tax period is FRW 1,000,000. There are no new acquisitions of computer

equipment during the period.

• If computer equipment is sold during the year for FRW 1,200,000 the pool

would stand at a negative balance of FRW (200,000). This FRW 200,000

would be added to taxable profit:

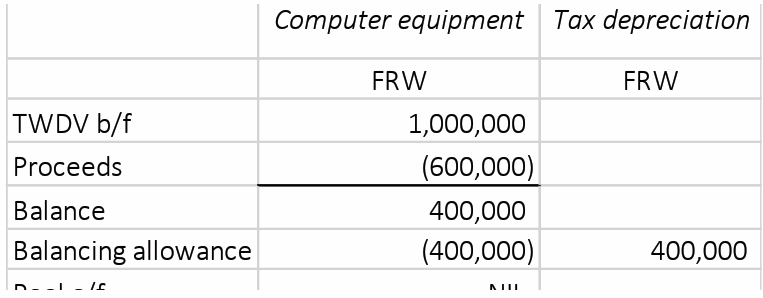

• If computer equipment was sold for FRW 600,000 the pool would stand at

FRW 400,000. Instead of a 50% allowance, the full FRW 400,000 would bededucted from taxable profit.

Application activity 4.4

Nkuvugishe Plc acquired a piece of telecommunication equipment at a cost

of FRW 20,000,000 on July 01st, 2018. The expected life of the equipment

was 20 years. The equipment was then disposed of on March 01st, 2020 for

FRW 9,000,000.

Nkuvugishe Plc did not purchase any other assets in the tax period to

December 31st, 2018.

Calculate the tax depreciation available on this asset for the three years to31st, December 2020.

4.5. Investment allowance and Private use of assets bybusiness owners

Activity 4.5

Analyze the images above and answer the following questions.

a) With research outline the rate of investment allowance4.5.1. Accelerated Depreciation

Rwanda encourages investment by providing a greater rate of tax relief (capitalallowance) during the year of acquisition.

a) Conditions for the Accelerated Depreciation to apply

• For the Accelerated Depreciation to be claimed, the following conditions

need to be met (Law No. 06/2015 relating to investment promotion

and facilitation):

• The taxpayer must have applied for, and hold, a valid investment

certificate issued by the Rwanda Development Board, specifying the

incentives to which the taxpayer is entitled

• The taxpayer has invested at least US$ 50,000 in each new asset or

used asset in the tax period

• Must Operate in at least one of the sectors below and meet therequirements:

i. Export projects;

ii. Manufacturing;

iii. Telecommunications;

iv. Agro processing;

v. Education;

vi. Health

vii. Transport excluding passenger vehicles with less than nine (9)people seating capacity;

viii. Tourism investments worth at least one million eight

hundred thousand United States Dollars (USD 1, 800, 000);

ix. Construction projects worth at least one million eight hundred

thousand United States dollars (USD 1,800,000);

x. Any other sectors provided the investment is worth at least one

hundred thousand United States dollars (USD 100,000);

xi. Any other priority sector as may be determined by an Order of the

Minister in charge of finance;

• The assets must be retained by the business for at least three taxperiods following the period of the claim; and

b) The rate of investment allowanceThe Accelerated depreciation is 50% of the acquisition cost of the asset.

c) The impact on tax depreciation

If the Accelerated depreciation is claimed on an asset, this will reduce the cost

that is eligible for standard tax depreciation. Depending on the type of asset

purchased, the remaining amount of qualifying expenditure will be given tax

depreciation on a straight-line basis or allocated to a pool after computing anddeducting the capital allowance.

d) Assets sold within three years

The investment allowance is revoked if a taxpayer claims the investment allowance

on an asset but then sells it within three years. The reduction in tax obtained

by claiming the investment allowance must be repaid to the tax administration,along with the applicable interest and penalties for the underpayment of tax.

4.5.2. Private use of assets by business owners

Private usage of a business asset by the owner or any employee limits the

amount of tax depreciation that may be claimed.

If an item qualifies for tax depreciation, but the owner uses it for personal

reasons, the tax depreciation deductible from cost is given in full at the usual

rate, depending on the type of asset, while the tax depreciation claimable is

limited to the proportion of business use only.

This arises when an asset is used partly for business and partly for privatepurposes by the trader, or any employee of the trader.

Keep in mind that, where an asset has divided use, then the tax administration

should determine the amount of tax depreciation to be given based on the

proportion of business use of the asset. Tax depreciation should be calculated

in full at an appropriate rate and then the deductible tax depreciation will be

that tax depreciation multiplied by the percentage of business use of theasset. Currently, the assumption is that 20% is for private use.

Application activity 4.5

A building is constructed in Musanze for use in the trade of Mwiza Plc, a

Rwandan resident trading company. The building cost FRW 200,000,000

and was paid for on 30th November 2019. Mwiza Plc has a tax period to 31st

December each year. Mwiza Plc holds a valid investment certificate for this

expenditure.

Which of the following statements is correct concerning the tax relief available

for Mwiza Plc on the cost of the building?

a) The investment allowance will be FRW 100,000,000 and the balance of

FRW 100,000,000 will qualify for straight-line depreciation at 5% per year.

b) The investment allowance will be FRW 100,000,000 and the remaining

FRW 100,000,000 will qualify for straight-line depreciation at 10% per year.

c) The investment allowance will be FRW 100,000,000 and the FRW

200,000,000 will also qualify for straight-line depreciation at 5% per year.

d) The building will only be eligible for standard tax depreciation at 5% per year.

End of unit assessment 4

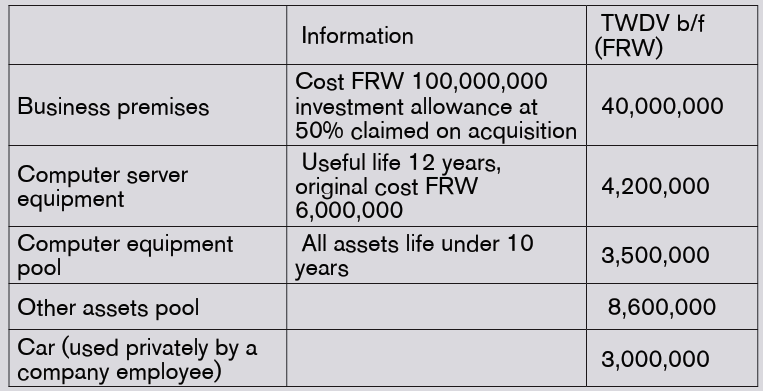

1. Gasabo Plc, a Rwandan resident company, has the following broughtforward balances on its assets that qualify for tax depreciation:

During the year, the following transactions took place:

Purchases

Office furniture costing FRW 600,000Disposals

Computer equipment – proceeds FRW 3,100,000

Calculate the total tax depreciation available to Gasabo Plc in the tax period.Show clearly the balances to carry forward for each pool or individual asset.

2. Ineza Company purchased a building during the tax period for a

price of FRW 50,000,000. No investment certificate was applied for

by Ineza Company. The building is mainly used as retail premises by

Ineza Company, but there is living accommodation above the shop

which is used by one of the directors. Compute the maximum annual

tax depreciation that can be claimed by Ineza Company in relationto this building.