UNIT 13: TAXES IN BUSINESS

Key unit competence: To be able to analyze the role of tax towards economic development of a country and pay taxes.

Introductory Activity: A case study

Why Do You Have to Pay Taxes?

Every year around, before and after June 15, everybody especially business people will be discussing about tax changes in the national budget. This is because tax reforms and new taxes introduced are announced on that day. However, have you ever wondered why you and businesses need to pay taxes?

In Rwanda, there are arms of the government (ruling bodies) from the village, sector, district, provincial and national levels. These bodies comprise: Legislature (who make laws), Executives (who enforce laws) and Judiciary (exercise laws). The salaries that public servants receive to do their jobs come from taxes. Paying taxes is considered a civic duty, although doing so is also a requirement of the law.

Taxes take many forms, too. When you work at a job to make money, you pay income taxes. Depending on how much money you make, a certain percentage (part) of the money you make is withheld (kept out of your paycheck and sent to the government).

When you buy things at a store, you also usually pay sales tax, which is a percentage of the cost of the item charged by the store. If you own property, you also pay property taxes on the value of your property.

Paying your taxes is considered a civic duty, although doing so is also a requirement of the law. If you do not pay your taxes, the government agency that oversees taxes — the Rwanda Revenue

Authority or RRA - will require you to pay your taxes or else face penalties, such as fines or going to jail.

The money you pay in taxes goes to many places. In addition to paying the salaries of government workers, your tax also help to support common resources, such as police and firefighters.

Tax money helps to ensure the roads you travel on are safe and well-maintained. Taxes fund public libraries and parks. Taxes are also used to fund many types of government programs that help the poor and less fortunate, as well as many schools!

Each year as the “Tax Day” rolls in, adults of all ages and businesses must report their income to the RRA, using special tax forms. There are many, many laws that set forth complicated rules about how much tax is owed and what kinds of special expenses can be used (“written off") to lower the amount of taxes you need to pay.

For the average worker, tax money has been withheld from paychecks throughout the year. On “Tax Day," each worker reports his or her income and expenses to the RRA.

Employers also report to the RRA how much they paid each worker. The RRA compares all these numbers to make sure that each person pays the correct amount of taxes.

If you have not had enough tax money withheld from your checks throughout the year to cover the amount of tax you owe, you will have to send more money (“pay in") to the government. If, however, too much tax money was withheld from your paychecks, you will receive a check (get a “refund") from the government.

Adapted from https://wonderopolis.org/wonder/why-do-you-have-to-pay-taxes)

From the passage answer the following questions:

a) What are the major changes expected by people especially business people on June 15, every year?

b) What makes the businesspeople so anxious to know the changes mentioned above in a)?

c) Why do you think it is important for businesses to pay taxes to the government?

d) How do the following benefit from taxes?

i) Entrepreneur.

ii) Government.

iii) Society.

e) Identify and briefly explain at least two types of taxes paid in Rwanda?

f) What happens to businesses or people who do not pay taxes?

g) What is the difference between tax and taxation?13.1 Tax and business tax

Activity 13.1

1. Explain the meaning of the following terms used in taxation:

a) Tax b) Business tax

2. In your community, you have probably heard people and business people complaining about the taxes they pay or charged to different or similar items. Identify any 5 things you have heard normally people complain about.

3. If you were the one determining or imposing taxes to people and businesses, mention any five things you would put into consideration.

Meaning of taxation concepts

Tax is a fee without direct exchange requested to the members of the community by the State according to the law, to financially support the execution of the government tasks.

Business tax refers to compulsory and non-refundable payments made by the business to the government or local authority to raise revenue to the government or local authority.

Taxation is a system of raising money or revenue by the government from individuals/businesses and companies by law through taxes.

Taxation is a system/practice of government collecting money from its citizens to pay for public services.Characteristics or principles of a good taxation system

A good tax system should possess certain characteristics. These include the following.

1) Convenience: places, periods and seasons in which the tax dues are collected should be convenient to the taxpayer. For example, the convenient time to a trader is when s/he has made a profit. For a farmer, is when s/she has sold his/her produce

2) Simplicity: the type of tax and the method of assessment and collection must be understandable by both the taxpayer and tax collectors. Complicated taxes may lead to disputes, delays and high costs of collection in terms of time and resources.

3) Certainty: the taxpayer must know the nature, base and amount of tax without doubt. Unpredictable taxes discourage investment and reduce work effort. Simply the tax should not be arbitrary.

4) Economy: the cost of collection and administration of tax must be much lower than the tax collected

5) Elasticity: a tax should change directly with a change in the tax base. If the tax base increases, the tax charged on the tax base should also increase.

6) Productivity: the fiscal authorities should be able to predict and forecast accurately the revenue a particular tax would generate and at what rate it would flow in.

7) Equity: tax assessment should be in such a way that taxpayers bear a proportionately equal burden. I.e., people who earn more income should be taxed more than those who earn less income.

8) Diversity: this canon requires that there should be several taxes of different varieties so that every class of citizen may be called upon to pay something towards the national priorities

Application activity 13.1

1. Why is it important to have principles of taxation?

2. Referring to the principles(characteristics) of a good taxation system you know, briefly explain why each is important to the taxpayer and tax authority (RRA)

3. With examples, differentiate between Tax and Taxation

13.2. Importance of paying taxesA good taxation system can contribute a lot to the economic development of a country and its national exchequer

Sources: http://www.kigalicity.gov.rw Figure 13.2 Taxes help the government to build infrastructures

Activity 13.2

1. With examples from your community or Rwandan community at large, why do you think people and business enterprises need to pay taxes to the government?

2. As an entrepreneur to be or referring to activities of entrepreneurs in your community, how do you think businesses or entrepreneurs benefit from paying taxes?

3. In general, how does your society benefit from paying taxes? Give examples to support your views.Importance of paying taxes to an entrepreneur

• Paying taxes by the entrepreneur helps the business activity to continue, as it does not face penalties and associated costs from the RRA for non-payment.

• When an entrepreneur pays taxes, it improves his/her reputation or public image which may result in increased customers and better services from the government

• To avoid inconveniences of closure of the business and its associated costs: when entrepreneur fails to pay assessed taxes, his/her business is subject to penalty even closure to some cases.

• Business needs certain infrastructures to operate successfully such as roads to move raw materials, finished goods, workers; security for their enterprises, goods, among others, which are provided by the government.

• Paying taxes means contributing money to government agencies or departments such as Development Bank of Rwanda (BRD), Business Development Fund (BDF), which support entrepreneurs to operate business activities through soft loans and other financial support.

Importance of paying taxes to the government

• Source of government revenue: taxes are the main source of government revenue to finance its public expenditure. So taxes enable the government to pay it workers, construct roads, maintain security, provide health care, education among others

• Taxes benefit the Rwandan government to meet its objectives and goals such constructing affordable houses to the citizens which helps improve the standards of living

• Taxes help the government to finance its policies especially on poverty alleviation through programs such as “GIRINKA”, “VUP”, “UBUDEHE” among others

• Taxes enable the government to regulate the prices of goods and services in the country hence ensuring a low cost of living and maintaining the standards of living of the citizens

• Taxes enable the government to maintain a balance between the poor and rich. The government uses the taxes from business people to provide services needed by the poor, which otherwise the rich could not provide.

•Taxes enable the government to promote its policy industrialization through reducing products from other countries that would otherwise outcompete the home industries.

• Taxes enable the government to ensure that the citizens have enough products. This can be through taxes charged to reduce products moving out of the country or removing taxes on goods needed in the country. This helps maintain a high standard of living.

Importance of paying taxes to Society

• There are reduced rates of poverty among the community due to a significantly equal distribution of income through various activities and projects set by the government.

• Improved wellbeing among the vulnerable and elderly as they benefit from the different government programs financed through taxes.

• Reduced infant mortality rates and increased life expectancy due to improved access to health facilities and services.

• Increase in the percentage of the population that completes secondary and TVET education, reducing the literacy levels, improving on the peoples’ skills through programs such as 12YBE.

• Increased community/social solidarity, general happiness, life satisfaction, and a significant more trust among the community members and for public institutions.

• Taxes are charged on some products to discourage their production and usage hence controlling over-exploitation of resources as well as protecting the environment which is vital for the existence of the society.

Application activity 13.2

1. By giving specific examples from your community, how does your society benefit from taxes?

2. What do you think would happen in the country if taxes were not paid?13.3. Calculation of taxes

Activity 13.3

1. Do you think it is important for an entrepreneur to know how to compute the amount of tax he/she is supposed to pay? Give reasons.

2. What do you think the term “Pay-As You-Earn (PAYE) tax means”? And how is it calculated?

There is a variety of taxes that a business has to pay such as corporate income tax, trading license tax, professional income tax or PAYE (Pay-As-You-Earn), rental income tax, fixed asset tax, Value Added Tax (VAT), Sumptuary tax, etc. but here, an emphasis is made on:

1. Pay- As- You Earn (PAYE) and

2. Value Added Tax (VAT

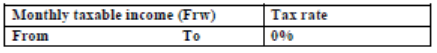

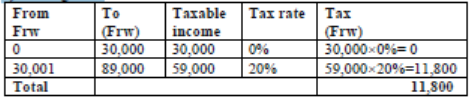

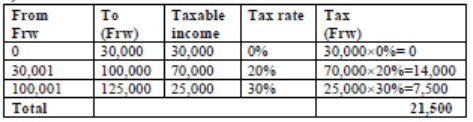

Pay-As -You-Earn (PAYE) tax or professional income tax The tax law requires that when an employer makes available employment income to an employee the employer must withhold, declare, and pay the PAYE tax to the Rwanda Revenue Authority within 15 days following the end of the month for which the tax was due.PAYE: is composed of Wages, salaries, leave pay, sick pay, medical allowances, pension payment etc. All kinds of allowances including any cost of living, subsistence, rent, and entertainment or travel allowances. Pay-As-You-Earn tax is computed as follows:

Example:

The following relate to monthly salaries of Kanyarwanda enterprise employees for 2018.

a) Rukundo earns 450,000Frw

b) Karinganire earns 89,000Frw

c) Keza earns 28500Fw

d) Buzima earns 12,5000Frw

Required:

Calculate the total PAYE for above employees that Kanyarwanda enterprise pays to RRA every month.

Solution:

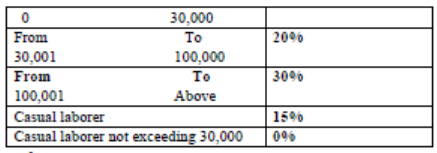

a) Rukundo :

Total TAX for Rukundo = 14000+105000= 119,000Frw

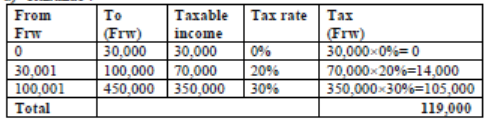

b) Karinganire:

Total tax for Karinganire is 11,800Frw

c) Since Keza earns less than 30000Frw she does not pay PAYE. Her total tax =0 (28500*0)d) Buzima

Total tax for Buzima =14000+7500=21,500Frw

Total PAYE for Kanyarwanda enterprise every month = (119,000+11,800+21,500) Frw= 152,300Frw

Note:

Exemption for PAYE is that every person who earns income less than 30000 does not pay PAYE to RRA.

The “casual laborer” means an employee or worker who performs unskilled labor activities, who does not use machinery or equipment requiring special skills and engaged by an employer for an aggregate period not exceeding thirty (30) days during the tax period.Value Added Tax (VAT)

Source: exceldatapro.com: VAT varies according to the level of value added on a product

Value Added Tax was introduced in Rwanda in 2001. VAT is a tax on the added value achieved by a firm. This is the difference between the buying price (of raw materials) and the selling price of the product in whatever forms it is sold.

Value added = F.P – I.C where F.P is final product, IC is intermediate costs

Tax rate

The VAT rate is applied to duty-free goods. Several rates can be applied depending on the nature of products. The standard rate is usually 18%

Example 1:

UTEXRWA industry bought cotton from a local farmer worth 1200, 000Frw to use in production of blankets.170 blankets were manufactured and sold to a wholesaler at a cost of 4,000,000Frw who later supplied it to LEMIGO hotel at a value of 8,000,000Frw VAT included. Calculate the value of VAT paid on blankets.

Possible solution

Step 1 VAT paid by local farmer:

VAT =1,200,000Frw*18% = 216,000Frw

Step 2 VAT paid by wholesaler:

VAT = FP -IC where FP is final product and IC is intermediate cost

Value added =4,000,000Frw-1,200,000=2,800,000Frw

VAT paid by wholesaler =2,800, 000Frw*18%= 504,000Frw

Step 3 VAT paid by LEMIGO hotel:

VAT paid by LEMIGO hotel= 8,000, 000-4,000,000Frw= (4,000,000Frw*18%)=720,000Frw

Therefore, total VAT =216,000+504,000+720,000 =1440, 000Frw

Alternative:

VAT is calculated on sales.

VAT =sales *18%

Which is equal 8,000,000Frw*18%=1,440,000Frw

Example 2:

A students’ business club has sold goods to XY enterprise at 100,000 Frw VAT excluded.

Calculate:

a) VAT received

b) The price VAT included

Solution:

a) VAT received=𝑃𝑟𝑖𝑐𝑒 𝑉𝐴𝑇 𝑒𝑥𝑐𝑙𝑢𝑑𝑒𝑑∗18100=100,000𝐹𝑟𝑤∗18100=18,000Frw

b) The price VAT included=100,000Frw+18,000Frw=118,000Frw

OR

The price VAT included=𝑃𝑟𝑖𝑐𝑒 𝑉𝐴𝑇 𝑒𝑥𝑐𝑙𝑢𝑑𝑒𝑑∗118100=100,000𝐹𝑟𝑤∗118100=118,000Frw

Example 3:

A students’ business club has bought goods from XY enterprise at 1,000,000 Frw VAT included.

Calculate:

c) VAT paid

d) The price VAT excluded

Solution:

a) VAT paid=𝑃𝑟𝑖𝑐𝑒 𝑉𝐴𝑇 𝑖𝑛𝑐𝑙𝑢𝑑𝑒𝑑∗18118=1,000,000𝐹𝑟𝑤∗18118=152,542.37Frw

b) The price VAT excluded=𝑃𝑟𝑖𝑐𝑒 𝑉𝐴𝑇 𝑖𝑛𝑐𝑙𝑢𝑑𝑒𝑑∗100118=1,000,000𝐹𝑟𝑤∗100118=847,457.63Frw

OR

The price VAT excluded= Price VAT included VAT paid

= 1,000,000Frw- 152,542.37Frw = 847,457.63Frw

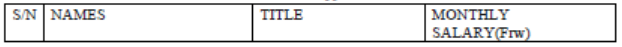

Application activity13.3

1. A students’ business club (SBC) in one of the TTCs has the following regular employees. Their salaries are in accordance with their appointment as follows:

Calculate

a) The PAYE tax on each individual employee

b) The PAYE tax to be withheld and paid by the business club to RRA

2. Using the information available on the above EBM issued receipt, compute the following:

a) Price VAT excluded

b) VAT to prove the amount appearing on the receipt

Skills lab 13

Justify the following statements with concrete examples:

• “Taxes are more of a benefit than a cost to an entrepreneur”

• “Tax evasion is a shortcut to business growth”

2. A business club at one of the TTCs has 3 regular employees namely KALISA, KALIZA and BERWA with monthly salaries of 35,000Frw, 40,000Frw and 20,000Frw respectively. On top of that the business made sales of 300,000Frw VAT exclusive, and the input VAT is 34,000Frw.

a) Calculate the total amount of tax that the business club has to pay to RRA

b) Advise the above business on how the above taxes would be paid.

End of Unit 13 Assessment

1. It is said that “tax is the free money to central or local authorities from taxpayers” do you agree with this statement. Justify your answer

2. Describe any four characteristics of a good taxation system

3. How are taxes used by government to:

a) Support Entrepreneurs

b) Support the community

4.

a) …………. punishment is the jail for a period between six (6) months and two (2) years; even the Minister’s order determines an award given to any person who denounces a taxpayer who engages in that act.

b) …………. is the compulsory and non-refundable payment made by the business to the Government or Local Authority so as to raise their revenues.

c)…………. is the one that is exempted from VAT.

d) …………. one of the taxes vested to the local government (Districts).

e) The degree to which the taxpayers meet their tax obligations as set out in the appropriate legal and regulatory provisions is……………………….

f) The………………. means an employee or worker who performs unskilled labor activities, who does not use machinery or equipment requiring special skills and engaged by an employer for an aggregate period not exceeding thirty (30) days during a tax period.

Bibliography

1. Akazi Kanoze Youth Livelihood project, (2009), Work Readiness Trainers’ Manual

2. Educate! Exchange, (2017), Resources & Competency-based Entrepreneurship Subject S4 Skills Lab Lesson Plans

3. Kalungi Rogers, Ngobi Dennis, Mutegaya Herbert, Okoroi David, Entrepreneurship for Rwanda Secondary Schools, Learner’s Book

4. Mark Ssempija (2011), Entrepreneurship Education for Advance level and business institutions, Kampala. Uganda: Book shop Africa

5. Mark Amon Mugaru, Edward Erasmus Kayanja (2017), Ordinary Level Entrepreneurship. Kigali, Rwanda: MASTEP General Suppliers Ltd

6. Richard Barekye, Alele Kevin. (2016). Entrepreneurship for Rwandan school (senior 1 students’ book). Kigali, Rwanda: East African Educational Publishers Ltd

7. Rwanda Education Board, (2015), Advanced Level Entrepreneurship syllabus for Rwanda General Education

8. Rwanda Education Board (2018) Entrepreneurship Senior 5 - Content and activities: Experimental version, Kigali, Rwanda

9. T Manimbi and S Paarman , Entrepreneurship FOR RWANDA S1 Student’s Book

10. Microsoft. (2019). job-specification-sample-marketing-manager. Retrieved September 16, 2019, from www.thebalance.com: https://www.thebalance.com/job-specificationsample-marketing-manager-1918560

11. Schneider Electric. (2005). tac-best_practices_for_telecom_network_reliability.pdf. Retrieved March 26, 2018, from www.tac.com: https://www.schneiderelectric.co.uk/.../best_practices_for_telecom_network_reliabilit...

12. Mutamba, A. H. (2008). In entrepreneurship. kampala: mk publishers.

13. Schneider Electric. (2005). tac-best_practices_for_telecom_network_reliability.pdf. Retrieved September 10, 2019, from www.tac.com: https://www.schneiderelectric.co.uk/.../best_practices_for_telecom_network_reliabilit...

14. http://www.teammate360.eu/index.php/en/teammatehttps://www.thebalance.com/leadership-definition-2948275http://courses.washington.edu/ie337/team.pdf https://en.wikipedia.org/wiki/Teamwork

15. http://smallbusiness.chron.com/5-sources-power-organizations-14467.html http://smallbusiness.chron.com/5-sources-power-organizations-14467.htmlhttps://www.mindtools.com/pages/article/newTMC_00.htm http://s3.amazonaws.com/inee-

assets/resources/14_PEP_Facilitators_Manual_for_Community_Workshops_EN.p df

16. http://www.cheryltay.sg/5-steps-for-effective-problem-solving/

17. https://sites.google.com/a/studentmba.org/ms-desalvo-s-classroom-page/civicsand-government/unit-1a-nature-of-power-politics-and-governmenthttps://www.slideshare.net/danishmahusay/essentials-of-leadership-1

18. http://www.teammate360.eu/index.php/en/teammatehttps://www.thebalance.com/leadership-definition-2948275http://courses.washington.edu/ie337/team.pdfhttps://en.wikipedia.org/wiki/Teamwork

19. http://smallbusiness.chron.com/5-sources-power-organizations-14467.htmlhttp://smallbusiness.chron.com/5-sources-power-organizations-14467.htmlSource:https://pt.slideshare.net/KritikaKeswani2/10-characteristics-of-successfulteam