UNIT4: PERSONAL FINANCE AND DEVELOPMENT

4.1 Describing financial tools

4.1.1 Learning activity:

Reading and exploitation of texts

Text: Different financial tools

As a child, I used to watch in amazement while my mom balanced the family cheque book. She used a handheld calculator, a cheque book register and a stack of bills and receipts to keep our finances in order. She had to call her broker to invest money in her company. She consulted a paper mortgage amortization schedule when making extra payments towards the debt

Even when we first got a computer and my dad started using Quicken, he still entered everything from his check register and then reconciled it with his bank statements.For those who don’t know what Quicken is, Quicken is a line of personal finance software that provides users with a computerized maintenance and documentation system to efficiently manage a variety of

tasks. The primary purpose of the software is to give everyday people the tools necessary to manage their own finances. Quicken is a part of Intuit, which also developed Quickbooks and other tax planning software. I loved watching my parents with their money, but at the same time, I don’t want to spend hours keeping track of everything.

Luckily, today, you don’t need to labour for hours every week to keep your financial house in order. If you use these five three financial tools (Personal Capital, Credit Karma and fidelity) , you can manage your financial life injust a few minutes per week.

Personal Capital is an application that allows users to connect all their assets (checking, savings, retirement, brokerages etc.) and their liabilities (student loans, credit cards, mortgages, etc.) to the application. The application then uses an encrypted connection to read and analyse your data. Personal Capital analyses your spending, and shows the spending in helpful pie and bar charts.

Managing your asset allocation across multiple platforms may be the most difficult part of modern investing. Thankfully, Personal Capital makes it easy to monitor your asset allocation no matter how many accounts you have. Remember if you can’t measure your management, you can’t improve it.

Credit Karma also makes it easy to understand how you can increase your credit score over time. One of the most overlooked areas of financial management is tracking your credit score. A clean credit report is vital to getting a mortgage, earning credit card rewards, or refinancing your student

loans. Even if you hate debt, you still need to monitor your credit report to ensure that you aren’t the victim of identity theft.

Fidelity makes it easy to open retirement accounts, fund your accounts, research investment options and place orders. Fidelity is my favorite discount brokerage because of the amount of investing options you have (especially the large amount of free options), the great service, and the ease of getting started. Even active traders will find low prices for equity and options trading. On top of that, Fidelity offers 24or7 phone support, live chat support and more.

Adopted from https://thecollegeinvestor.com/19733/5-free-financial-tools- ;everyone-needs/

Comprehension questions

1. Which financial tools was the mother of the narrator using to keep her finances in order?

2. Does the narrator enjoy spending time tracking his or her finances?

3. What are the electronic financial tools mentioned in the passage?

4. Explain how personal capital facilitated people to manage their asset allocation across multiple platforms.

5. State other financial tools you know which were not mentioned in

the passage?

6. Why does the narrator call Fidelity her favourite discount brokerage?

7. Which electronic financial tool can one use to track his or her credit score?

should know as their business grows. These terms include assets, liabilities, expenses, accounts receivable, cash flow, profit and loss, income statement and net profit.

First on the list of financial terms, assets are the economic resources a business has. In a broad sense, assets include everything your company owns that has some economic value.

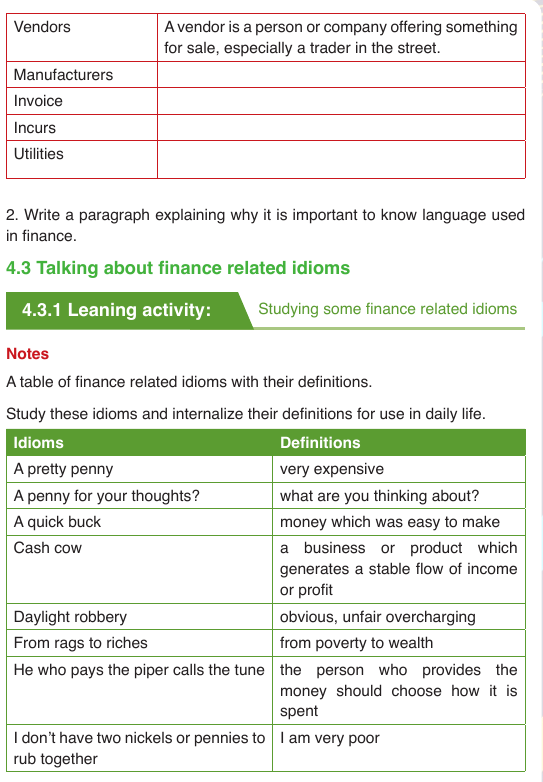

If assets are the resources your company owns that contribute to its economic value, liabilities are its exact opposite. In fact, liabilities are just that — things your company is responsible for by law, especially debts or financial obligations. For example, any debt accrued by a business in the course of starting, growing, and maintaining its operations is a liability. This could include bank loans, credit card debts, and monies owed to vendors and product manufacturers. Liabilities, like assets, can be divided into

subcategories. As for expenses, business expenses are any cost that is “ordinary and necessary” to run a business or trade. These expenses are the costs your company incurs each month in order to operate, and include things like rent, utilities, legal costs, employee salaries, contractor pay, and marketing and advertising costs. To remain financially solid, businesses are often encouraged to keep expenses as low as possible.

Accounts receivable (A/R) is the amount that clients owe to a business. Usually the business notifies the client by invoice of the amount owed, and if not paid, the debt is legally enforceable. On a business’s balance sheet,

accounts receivable is logged as an asset. As far as cash flow is concerned, cash flow is the overall movement of ffunds through your business each month, including income and expenses. The example here can be cash flows into your business from clients and customers who purchase your goods or services directly, or through the collection of debts in the form of accounts receivable. On the other hand, cash flows out of your business to pay expenses like rent, utilities, taxes, and accounts payable.

To remain financially healthy, a business must regularly generate more revenue from the sale of its product or service than it costs to make that product or service. Say it costs a company Frw 2000 to make a T-shirt, butthat company sells the T-shirt for Frw 5000.

In this case, the company’s profit is Frw 3000. On the other hand, a loss is money that a company, well, loses. For instance, if a T-shirt is stolen or destroyed and can no longer be sold, it would be counted as a loss.

The income statement is where you analyse your company’s profits and losses. As such, it should come as no surprise that the income statement is also commonly referred to as the “profit and loss statement.”

In accounting jargon, your net profit might also be referred to as net income or net earnings. And because it’s usually found on the last line of a company’s

income statement, it’s often also called the bottom line. But just what is it? Well, this is the total amount a business has earned or lost at the end of a specified accounting period, usually a month.

Adapted from https://quickbooks.intuit.com/r/financial-management/15-financial-terms-every-business-needs-to-know/ Comprehension questions

1. What can an entrepreneur do to have at least a basic understanding of the inner workings of their company’s finances?

2. Differentiate assets from liabilities.

3. Give at least four examples of expenses.

4. Define the term “accounts receivable” as related to finance.

5. What do you understand by “to remain financially healthy” as used

in the 7th paragraph?