UNIT4: PERSONAL FINANCE AND DEVELOPMENT

Key unit Competence:

To use language in the context of Personal finance and development

Introductory Activity Picture observation and interpretation

1. Observe the pictures and discuss

2. Describe what is taking place in the pictures observed.

4.1. Describing financial tools

4.1.1. Learning activity: Reading and text analysis

Pre-reading activity: Brainstorm on second hand clothes and made in Rwanda products.

• Text: Made in Rwanda clothes:

Read through the text and answer the questions that follow:

It started when second hand clothes had been introduced. Second hand clothes were in fashion in Rwanda a few years ago. One day, Ms. Mukandoli, a busy mum and a loving wife, went shopping for nice second hand clothes.

After a few hours of searching, she came home exhausted and disappointed because everyone was struggling to pick nice ones. In 2016, the government of Rwanda increased the price of second hand clothes, some women found it hard to find the right outfit. “I will help them,” Thought Ms. Mukandoli. With very little money, no connections in the fashion world and a community who laughed at her idea that it was not realistic, she persisted and decided to start up her own business. Ms. Mukandoli designed her first collection of twenty clothing items, bought suitable material and a sewing machine. Ms. Mukandoli was a tailor herself.

Her sitting room turned into a workshop. When the collection was ready, Ms. Mukandoli took them to fashion shops. To her surprise, they bought the whole collection at once. When they asked her about the name of her company, Ms. Mukandoli looked at them, smiled and said: “Inyarwanda”. Today many people have fallen in love with products from “Inyarwanda”.Ms.Mukandoli

has hired other tailors and expanded her business. Other people have copied her and now clothes made in Rwanda are on high demand across the country and abroad.

• Comprehension questions:

a. Do you really think that made in Rwanda is on a high demand?

Why?

b. What three difficulties did Ms. Mukandoli face when starting up her business?

c. What special character traits helped Ms. Mukandoli succeed in her new career?

d. What did Ms. Mukandoli do in order to start her business?

e. Where did Ms. Mukandoli sew her first collection?

What did Ms. Mukandoli do when she realised her clothes were in high demand?

f. Why did Mukandoli decide to call her collection “Inyarwanda?

g. What fact proves that “Inyarwanda” is a successful company?

4.2. Talking about Financial terms

4.2.1 Learning activity: Reading and text analysis

• Text: Financial terms

Business owners who struggle with finances should definitely hire an accountant, or utilize accounting software to make things easier. However, while it may be wisest to depend on expert help, it’s still important to have at least a basic understanding of the inner workings of your company’s finances. As such, there are some basic financial terms every entrepreneur should know as their business grows. These terms include; assets, liabilities, expenses, accounts receivable, cash flow, profit and loss, income statement and net profit.

First on the list of financial terms, assets are the economic resources a business has. In a broad sense, assets include everything your company owns that has some economic value.

If assets are the resources your company owns that contribute to its economic value, liabilities are its exact opposite. In fact, liabilities are just that — things your company is responsible for by law, especially debts or financial obligations. For example, any debt accrued by a business in the course of starting, growing, and maintaining its operations is a liability. This could include bank loans, credit card debts, and monies owed to vendors and product manufacturers. Liabilities, like assets, can be divided into subcategories.

As for expenses, business expenses are any cost that is “ordinary and necessary” to run a business or trade. These expenses are the costs your company incurs each month in order to operate, and include things like rent, utilities, legal costs, employee salaries, contractor pay, and marketing and advertising costs. To remain financially solid, businesses are often encouraged to keep expenses as low as possible.

Accounts receivable (A/R) is the amount that clients owe to a business.

Usually the business notifies the client by invoice of the amount owed, and if not paid, the debt is legally enforceable. On a business’s balance sheet, accounts receivable is logged as an asset.

As far as cash flow is concerned, cash flow is the overall movement of funds through your business each month, including income and expenses. For instance, cash flows into your business from clients and customers who purchase your goods or services directly, or through the collection of debts in the form of accounts receivable. On the other hand, cash flows out of your

business to pay expenses like rent, utilities, taxes, and accounts payable.

To remain financially healthy, a business must regularly generate more revenue from the sale of its product or service than it costs to make that product or service. Say it costs a company 2000frw to make a T-shirt, but that company sells the T-shirt for 5000frw. In this case, the company’s profit is 3000frw. On the other hand, a loss is money that a company, well, loses.

For instance, if a T-shirt is stolen or destroyed and can no longer be sold, it would be counted as a loss.

The income statement is where you analyse your company’s profits and losses. As such, it should come as no surprise that the income statement is also commonly referred to as the “profit and loss statement.”

In accounting jargon, your net profit might also be referred to as net income or net earnings. And because it’s usually found on the last line of a company’s income statement, it’s often also called the bottom line. But just what is it?

Well, this is the total amount a business has earned or lost at the end of a specified accounting period, usually a month.

Adapted from https://quickbooks.intuit.com/r/financial-management/15-financial-terms-every-business-needs-to-know/

• Comprehension questions

1. What can an entrepreneur do to have at least a basic understanding of the inner workings of their company’s finances?

2. Differentiate assets from liabilities.

3. Give at least four examples of expenses.

4. Define the term “accounts receivable” as related to finance.

5. What do you understand by “to remain financially healthy” as used in the 7th paragraph?

4.2.2 Application activity: Vocabulary and paragraph writing

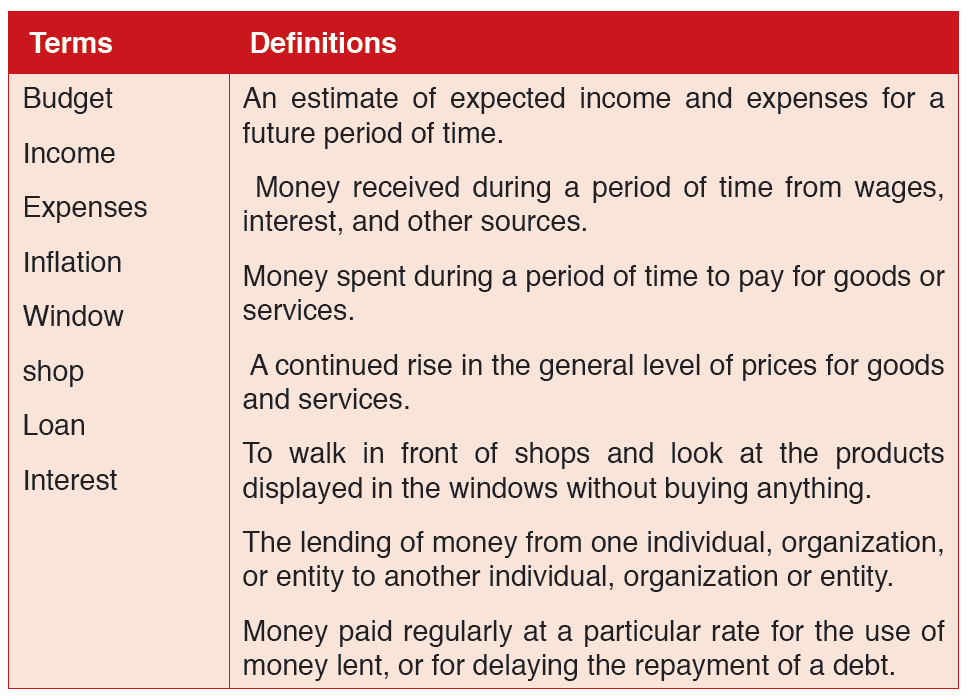

1. Use a dictionary and thesaurus to look up the missing meanings of tthe words/phrases in the table below. The words are highlighted in the passage above. Copy the table into your book and fill in the blank spaces.

2. Write a paragraph explaining why it is important to know language used in finance.

• Notes

The following table presents some financial terms with their definitions:

3.Write sentences using different terms as they were defined in the table above.

4.3. Idioms related to Finance

4.3.1. Learning activity: Explaining idioms related to finance

Explain the following idioms

1. Cash cow

2. A quick buck

3. Daylight robbery

4. From rags to riches

5. A pretty penny

4.3.2. Application activity:

Discussing and using idioms related to finance in sentences

1. With examples from your own experience, discuss the above idioms.

2. Make 5 sentences using the idioms above.

• Note:

An idiom is an expression that has an indirect meaning:

• a pretty penny – very expensive.

• a quick buck – money which was easy to make.

• cash cow – a business/product which generates a stable flow of income/profit.

• Daylight robbery – obvious, unfair overcharging.

• from rags to riches – from poverty to wealth.

4.4. Describing Financial Institutions

4.4.1. Learning activity: Reading and text analysis

• Pre-reading activity:

Brainstorm about financial institutions that you know focusing on their role in improving people’s well-being.

• Text: Financial institutions in Rwanda

Read the following paragraphs and answer questions that follow:

In Rwanda, we have different types of financial institutions. These include; commercial bank that offers financial services to individuals and businesses.

You can save money in a savings account and ask for a loan.

Firstly, Commercial banks in Rwanda include: Access Bank Rwanda, Bank of Kigali, I & M Bank, BPR (Bank Populaire du Rwanda), Cogebanque, Ecobank and GT Bank, etc.

Secondly, investment bank buys shares in a business and sells them to investors. The Development Bank of Rwanda (BRD) is an investment bank that buys shares from businesses mainly in agriculture and tourism.

Lastly by no means of least, a microfinance company offers smaller loans to individuals or businesses. The interest rates are cheaper than in a commercial bank. Microfinance companies include: Urwego Opportunity Bank, Copedu,

Zigama Credit and Savings Bank

• Comprehension questions

1. What are the types of financial institutions described in the text?

2. Explain the services that commercial banks offer to people.

3. Why do you think that some people can prefer microfinance companies than investment banks?

4.4. 2. Application activity: Sentence formation

Use the following words to make your own sentences with the help of dictionaries.

• Microfinance

• A bank

• Investment

• commerce

• Saving

• Low interest

4.5. Language structure: Use of present tense, word meaning and pronunciation and quantifiers

4.5.1. Learning activity Reading and exploitation of texts

A.Present simple tense

1. Give the present simple tense and pronunciation of the verbs with their sounds of the –s or –e s of the verbs[s/,z/iz].

2. Complete the dialogue using the words in the box bellow, practice their pronunciation.

Style , material , size , colour, Texture.

Customer: I don’t like this dress. It makes me look too old.

Sales Assistant: What _____1__________ of dress do you prefer?

Customer: This coat doesn’t suit me. I hate green.

Sales Assistant: What _______2________ are you looking for?

Customer: These T-shirts are not good for my sons – they will get stained very easily!

Sales Assistant: What ______3_______ do you like?

Customer: I don’t think this washing machine is big enough for my family.

Sales Assistant: What ______4______of washing machine are you looking for?

Customer: I need to order some ice cream for my party, but I don’t like chocolate.

Sales Assistant: What ____5________ do you prefer?

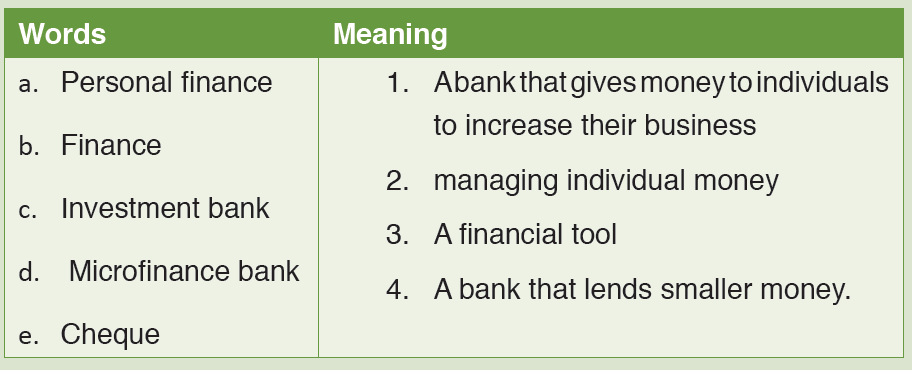

3. Match words with their meaning

Practice

1. Debate

Debate the following topic.

Read the instructions on how to conduct a debate in unite five of this book and debate the following motion:

“Investment is better than saving”

2. Read the paragraph below, discuss and answer questions:

Ruti is a learner. He lives far from his school and is planning to buy a bicycle. Mugisha is a business owner. He delivers bread to many hotels and restaurants in Kigali and is planning to buy a delivery van. Answer the questions about Ruti and Mugisha.

Comprehension questions

a. Give ideas for how Ruti could pay for the bicycle.

b. Why do you think that Mugisha would like a delivery van?

c. Give ideas for how Mugisha could pay for the delivery van.

d. What are the similarities between the things that a person needs and the those needed by a business?

e. Do you think that a business and a private person obtain (get) money to buy items in the same way? Explain your answer.

3. Discussion

Discuss the difference between the cost of things that a private person would like and the things that a business needs.

• Notes

1. Financial terms

This unit explores issues related to personal financial literacy such as saving, budgeting, income and borrowing. It also handles determiners of quantity as well as pronunciation. Activities in this unit are designed to reflect what you probably see in your community or have heard about.

The language skills in this unit are integrated and used in the context of tthe unit. Take time to go through each unit to remind yourself of what you learnt before attempting the unit test.

B. Quantifiers

1 “A little”, ‘little’ and ‘a few’ and ‘few’

Notes

A little and little are used with uncountable nouns while “a few” or “few” are used with plural countable nouns.

• When we say “a little” or “a few”, we mean a small amount, but it’s fine.

• A little is used with small quantity and non-countable nouns. [ A little means a small amount or some.]

Example:

There is a little milk in the refrigerator.

• ‘Little’ means almost nothing. Or not much.

Examples:

1. I’m sorry, I speak little French.

2. There was little time to finish my home work.

3. I have drunk little water this morning.

• Few is used with plural countable nouns. It means not many, not enough.

Examples:

1. I have got few friends in the city. So I am lonely.

2. They have got few cakes on the table.

3. He has few photos on Instagram.

• A few is used with plural nouns. It means some or a small amount.

Examples:

1. There are a few books on the shelf.

2. We stayed a few days in Kigali and visited Musanze.

On the other hand, “little” or “few” usually give us a different impression.

These also mean a small amount, but this time the amount is almost nothing.

If the noun is something that we want (like money or friends) then using ‘little’ or ‘few’ means that we don’t have enough.

Examples:

• Sorry, I have little money. I really can’t afford to go out. (money is not enough)

• The play made little sense to me, but I’m glad you enjoyed it. (sense is uncountable) = the play didn’t make much sense.

• There are few people that I think would be qualified for the job. (people is countable) = the number of people qualified for the job is enough.

2. Much vs. many

Much and many are known as “quantifiers”. They are used to talk about quantities, amounts or degrees. Many is used with plural, countable nouns while much is used with singular, uncountable nouns.

Examples:

1. There are many chequebooks on your desk. (Chequebooks are countable)

2. Many ATM cards were lost this year. (ATM cards are countable).

3. There isn’t much light in this room so let’s open the curtains. (light is uncountable).

4. Too much money was spent on his wedding day. (money is uncountable).

3. Some vs. any

The words some and any are used when the exact number or amount of something is not known, or when it’s not important. Some and any are both used to refer to an indefinite quantity or number. Although some and any are both used to describe an indefinite number, they are used in different ways; some is generally used in positive sentences while any is used in negative sentences and in questions.

Examples:

• I have borrowed some money from the bank. (positive)

• I have ordered some chequebooks. (positive)

• I don’t need any help with my homework because I can do it on my own. (negative)

• There isn’t any milk in the fridge so we’ll have to have black coffee. (negative)

• Do you have any brothers or sisters? (interrogative)

• Do you have any plans for the summer? (interrogative)\

Exercises

1. Fill in the blanks with “little”, “a little”, “few” or “a few”

a. I have……water left. There’s enough to share.

b. I have………. good friends. I’m not lonely.

c. He has ………. education. He can’t read or write, and he can hardly count.

d. There are………. people she really trusts. It’s a bit sad.

e. We’ve got…………. time at the weekend. Would you like to meet?

2. Fill in the blanks with “much” or “many.

a. How…………. players are in a handball team?

b. How……… pocket money do you get per week?

c. How…………… time is left?

d. How……………sisters does Ella have?

e. How……………… coins did you find yesterday?

3. Fill in the blanks with “some” or “any.

a) I have seen…………… nice postcards in this souvenir shop.

b) There aren’t………………. folders in my bag.

c) I have…………… magazines for you.

d) There are…………apples on the table.

e) Pam does not have…………pencils on her desk.

4.6. End unit assessment

1. Fill in the gaps with the correct verb, in the correct form (not) earn, inherit, borrow, lend, steal, find, invest, waste, pay (back), owe, withdraw.

a. When I was younger, I ________1_______ some money in land.

It was a really good idea.

b. I was very sad when my grandfather died, but I used the money I ______2_______ from him to study and I think he would be very happy that I am a teacher now.

c. Claire works as a nurse, but she ________3_______ much money, so her mum often has to

d. _______4_______ her some.

e. When I was a student I had to ______5_________ lots of money from the bank. I ____6______ all the money back last year, so

now I don’t ___7____ the bank anything.

f. You should be careful when you ______8________ money from a cash point/ATM machine because somebody might be behind

you waiting to _____9______ it from you.

2. Writing Practice

Either write an essay with a title “My Future Business Plan” or Write a formal letter applying for a loan from the Bank for your

business.

3. Fill in an appropriate determiner of quantity in each blank space.

a. There are ______ banks left in the area because so many infrastructures have been destructed.

b. The fishermen caught ______ fish, so the resource is being reduced.

c. ______ soil is eroded every year.

d. ______ people suffer ill health because they eat too little protein.

e. ______ financial institutions give loans at low interest rate in my community.

4. Fill in the blanks with “little”, “a little”, “few” or “a few”

a. Julie gave us…………… apples from her garden. Shall we share them?

b. She has………………. self-confidence. She has a lot of trouble talking to new people.

c. There are …………………women politicians in the UK. Many people think there should be more.

d. It’s a great pity, but the hospital has…………. medicine. They can’t help many people.

e. I’ve got ……………. cakes to give away. Would you like one?

f. There’s……………… milk left in the fridge. It should be enough for our coffee.

g. …………… children from this school go on to university, unfortunately.

5. Fill in the blanks with “much” or “many.

a. How……… water is in this bottle?

b. How………… crosswords did she solve correctly?

c. How…………milk do they have for breakfast?

d. How………. bikes were stolen last year?

e. How……… coffee do your parents drink per day?

6. Fill in the blanks with “some” or “any.

a) We need……………bananas.

b) You can’t buy…………posters in this shop.

c) We haven’t got………… oranges at the moment.

d) Peter has bought………… new books.

e) She always takes…………sugar with her coffee.