UNIT 8 :ICT TOOLS IN ACCOUNTING

Introductory activity

Kamali’s grandfather worked in a bank in 1980. He narrates that at that time

when a customer came to the bank, a bank staff had to get his/her booklet,

locate his/her information sheet which was kept in a box with other clients’

information sheets and bring it to the teller. When a transaction was done

the information about that transaction was kept both in the booklet and the

customer information sheet. The teller had to count the money by hand and

give it to the customer. The bank’s staff had then to take back the customer

information sheet and put it again in its appropriate place.

Visit the nearest bank of your home or school, and request to branchmanager some information about:

a. How the bank process was done in the years 1980

b. What are the dangers presented in that banking process stated in question 1?

c. What are the common ICT tools used at banks in these days?

d. How the current banking system corrected the problems that

were in the old banking system.

8.1 Counting machines

Activity 8.1

Kamanzi is a company owner whose activities are carried out in East Africa

and China. At the end of the day the company’s headquarter have to count

the received money and deposit it to the company’s accounts.

1) If at the end of the day this company has hundreds of millions to

count, what are the tools that they will use to ease this task?

2) State the process of using the tool given in questions 1)

3) Give at least the parts of the tool you have given.

A counting machine or more precisely a currency counting machine is a machine

that counts money. They are in different types namely bank note only counters,

banknote and coin counters, coin sorters, coin counters. All these machines

have many advantages including among others saving time and resources,

fighting counterfeited notes, increased accuracy in accounting and facilitatingthe keeping book of accounts.

8.1.1.Banknotes only counters

These are devices which can count bank notes only. Most of the counters need

to be fed with sorted notes for counting to be properly done meaning that they

can count only same value bills at the same time. However more advanced

counters can identify different bill and provide a total currency value of mixedbanknotes, including those that are upside down.

NB: There are devices which can count both coins and banknotes. These are

called Banknotes and coins counters.

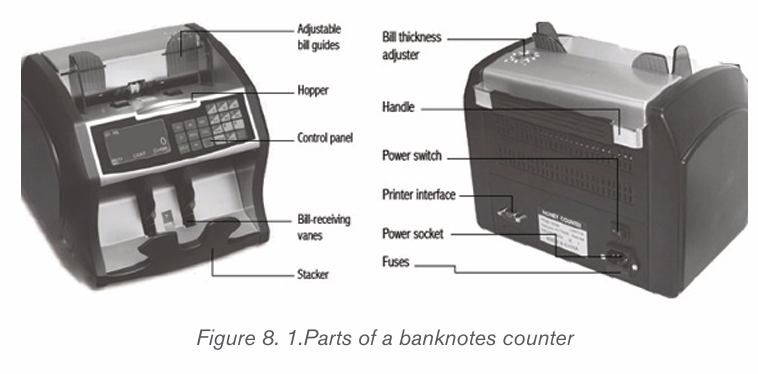

A. Parts of a banknote counter

Apart from the external frame, a banknote counter has different part which areseen from outside of which are not visible as they are encased inside.

B. Using a counter

A billing machine is used in the following process :

• The billing machine has first to be plugged to the power source using

its powercable then switched on. If the billing machine has a battery, it

can be operated without being plugged to the power source.

• Select the function that the counter will perform

• Place the bank notes in the appropriate tray

• Press the start button for the counting operation to start

i). Some of a counter’s functions

A counter has functions which facilitate how it is utilized by a user. Some of the

basic functions are:

Currency Code: After the machine is turned on, the currency kind is displayed

on the screen. To change the current currency press “CURRENCY” key to

choose a new currency.

Counting Mode: There are different counting mode which are selected by

pressing the MODE button. One example of counting is batch in which the user

specifies the number of notes to count say 100 notes.

ii). Counter basic maintenance

A counter may have slight problems that don’t need deep competences in order

to sort them out. Those problems can be prevented in this way:

• Clean regularly the counter for optimal performance. This cleaning

includes that of the hopper and stacker which has to be done using a brush

• Clean the banknote pathway using a soft brush or a dry soft lint free cloth

• Occurrence of error during banknotes counting can be solved by doing

one of these depending on the kind of error: Removing the banknote,cleaning the counter’s sensors.

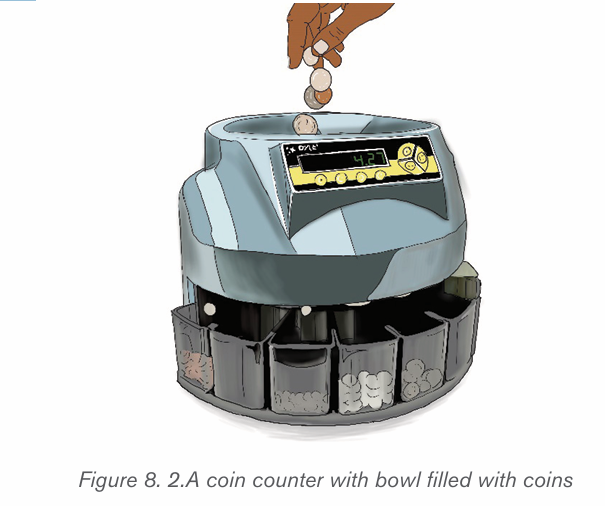

8.1.2.Coin sorters and coin counters

Coin sorters are devices used to arrange coins into separate groups according

to their denominations. These devices are commonly specific for coins of specific

countries as the size of coins may vary depending on countries. Some sorters

have screens which show the number of the coins that passed through it.

As its name suggest, a coin counter on the other hand is used to count the value

of coins. However some of these devices both sort and count coins at the same

time or count only presorted coins that are all the same size. Most counters use

bowl with flat spinning disks at the bottom of the bowl to distribute the coins

around the bowl perimeter. At the bottom of that bowl there is an opening which

allows the passing of one coin at a time. These coins then pass through a light

beam counter or are pushed through a spring loaded cam that accepts only onecoin at a time.

Application activity 8.1

1) What is a banknotes counter?

2) What are the different parts of a banknotes counter?

3) By doing a research identify the internal parts of a banknote only counter

4) By doing a research on the internet find at least 5 different banknotes

counters and their specifications. The specifications should at leastinclude the counting speed, hopper capacity, stacker capacity, weight.

8.2.3 Billing machines

Activity 8.2

Isimbi, a student in was doing a research about billing machines used in

Rwanda. She visited one supermarket to ask questions to the owner, clients

and the supermarket staff. Suggest the answers she will get about the

following questions:

1) Which machines are used to make bills in a supermarket?

2) How does the supermarket staff proceed in order to make a bill for

a customer?

3) Which type of information is found on a bill?

4) What are the advantages of the billing system in a supermarket in

regard to:

a) Stock management?b) Paying taxes?

These are machines that are used in entering in a system of customer informationand purchased goods so as to come up with invoices or bills.

For these machines to print bills they use a thermal printing process by which

images are produced by selectively heating coated thermochromic paper when

it passes over the thermal print head. The coating becomes black in the areas

where it is heated, producing an image. Two-color direct thermal printers can

print both black and an additional color (often red) by applying heat at two

different temperatures.

Bill printers print by direct contact between the thermal head which generates

heat and thermal paper which is thermally coated to be sensitive to heat. The

paper rolls available are sensitive to the heat and thus when the heat is produced

it can easily initiate the process of printing. It can print more than just a single

color by setting the printer to different temperatures.

The world is becoming more digital and this require that stores acquire billing

machines as every business is required to issue receipts generated using billing

machines. Billing machines reduce the chances of error, once the required

information is entered into the system, it automatically updates each new billwithout any additional effort.

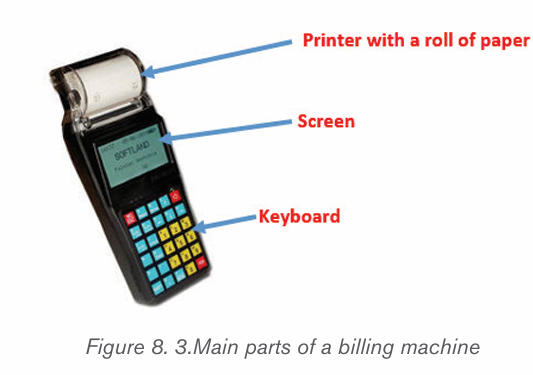

8.2.1.Main parts of a billing machine

Billing machine systems, like most electronic devices, consist of different parts

which play different roles grouped into three categories namely inputting data,

processing and printing bills. The first part is the keyboard which is used

to feed information like goods names in the billing machine. The second part

can be considered to be the processor and all parts working with it like memory

and motherboard. The third part is the printer which plays the role of helping

get hard copy bills. Also in the same third category is a screen which displays

information that a billing machine user can understand. Note that some billing

machines may have additional parts which help in payments like a weighingscale.

8.2..2.Operating a billing machine

Producing a bill by a billing machine requires the presence the information to

appear on the bill. That information can be fed to the billing machine’s printer

from different sources namely the database on which the billing machine is

connected through internet or a local network, the billing machine’s permanent

memory or temporary memory. The temporay memory of this machine keeps

information which is immediately fed to it by using its keyboard or any otherinput device

Before using a billing machine make sure the following is met :

• It is properly connected to a power source or that its battery has enough

power,

• It is properly connected to a local network or internet by the use of a

cable or wireless network. This is necessary when the machine gets or

submits data to a database stored at another location

• All the peripherals to a billing machine are properly connected

• Make sure that as a user, you have the right access credential if the

machine is password protected

When a billing machine is ready follow the following steps to use it:

• Log in to the machine. Some may need a username and password

while some need a swiping card accompanied by a password.

• Enter the billing information by using the keyboard. This information

is about the client details, purchased goods details and amount to be

paid. Most of the time the price of each item purchase is got from

the machine’s database and the total price to pay is automatically

calculated.

• Print the bill by pressing the key for printing

Note that:

Some billing machines may not require login depending on how their

setting were configured. There exist typically three types of user on a

billing machine namely Clerk who can only generate invoice, the Admi

nistrator who can generate Invoice and Reports, add or modify items and

their price, change print settings and the Supervisor who has access

to all that the administrator can do and more to that have access to

System settings, Erase Memory/Bills, Create different users and assign

password.

Billing machines allow users to get different reports. Depending on the

available functionalities, these machines can provide daily, weekly oryearly reports.

8.2.3.Billing machines in Rwanda

Rwanda through the Rwanda Revenue Authority (RRA) adopted the use of

billing machines from 2013. These machines which are known as Electronic

Billing Machines (EBM) are devices which receive information from the user like

bought items and generate a bill which is then printed. These devices come with

software installed by the manufacturer or the vendor and the user can not easily

remove or add a new software.

In 2017 Rwanda Revenue Authority adopted a new version of EBM which

is known as EBM version 2 (EBM ver2.0) which is a software installed on

a computer allowing then to have access to the central database. With this

software installed, after logging in the user has access to different functionalities

including among others item management, customer management, sales

management, purchase management. This EBM also allows the printing of aninvoice to be given to the customer.

8.2.4.Types of billing machines

There are machines which are dedicated to be billing machines. With these ma

chines the software which make them operate is installed by the manufacturer or the

vendor and these devices cannot play another role other than the one they were made

for. On another hand, billing machine functionalities are implemented in a software

which can then be installed on electronic devices like computers, ipad, smart phones

and therefore acting as billing machines.The different types of dedicated billing machines are outlined below :

A. Portable machines

Billing machines that can be moved from place to place are referred to as

portable machines. The handheld machines or the bus ticketing machines areexamples of such machines.

Among portable machines are card swipe machines which are devices that

read the magnetic stripe on a card and takes the information from it. The most

common card swipe machine is a credit card reader that is used with a cash

register. These machines come with a keypad for the customer to enter the PINof the card, a display bar and a swipe slot for swiping the card.

B. Automatic machines

These are machines come with software and algorithms inbuilt in it to add up the

taxes and deduct the rebates automatically. No additional manual instructionsare required for such type of machines.

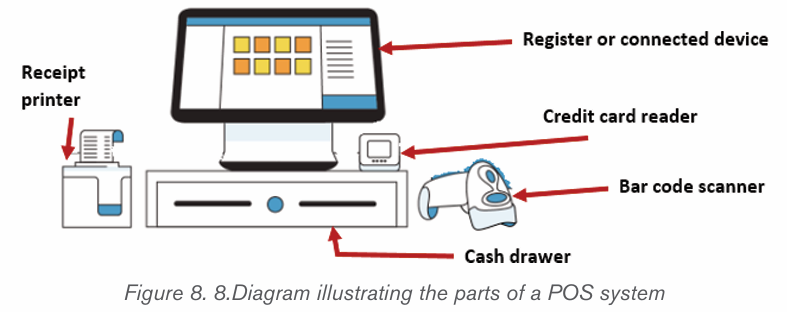

C. POS machines

The POS or the Point of Sale is a billing technology used in supermarkets to

keep track on the sales of goods. This system uses bar-code technology to

perform tasks like review sales or prepare the next fresh lot of products that

need to be replaced with the sold-out ones.

Normally a POS system is referred to as a cash register at a store. While this is

still true today’s modern POS systems accepts payments even when customers

are away from the POs system. What is needed in this case is a POS app and

an internet-enabled device, like a tablet or phone.

Hardware parts of a POS system

POS system uses POS software. However in the case of an online store the

POS system does not need to have the hardware. In this case of an online store

all of the sales happen on a website, so the business owner does not need POShardware to help accept payments.

Register: this helps calculate and process a client’s transaction.

Connected device, like an iPad or other tablet: These are devices

equipped with a monitor allowing the user to view a list of items and

interact with the system Credit card reader: A card reader lets a customer pay by credit card

while in the store.

Cash drawer: This is a place where cash can be kept in case the

store accepts payments in cash. POS software that’s connected to a

cash drawer can minimize fraud by tracking exactly when the drawer is

opened.

Receipt printer: A paper receipt shows customers exactly when and

what they purchased and how much they paid.

Bar code scanner: A bar code scanner reads an item’s product de

tails so you can ring it up. It can also be a quick way to double-checkthe price, stock level, and other details.

Application activity 8.2

1) What is the technology used by billing machines in printing the bills?

2) What are the 3 main parts of a billing machine?3) What is EBM version 2

8.3 Note detector

Activity 8.3

1) Suppose you are a teller at a new bank which features will you check

in a note in order to discover counterfeited notes

2) Which device will your bank buy in order to detect fake notes easily?

3) What are the advantages that using the device stated in question 2 has?

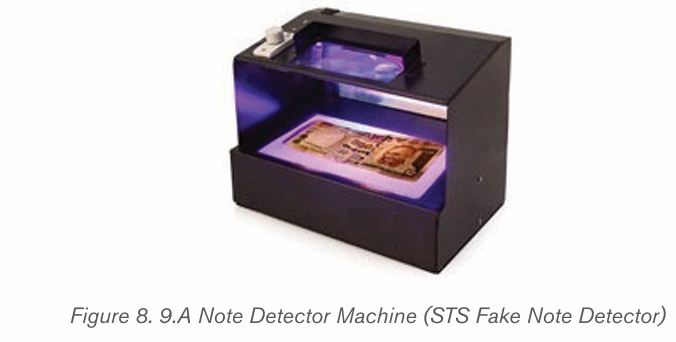

A note detector is a device which is designed to sort identify a fake note which

does not have all the attributes of a nation’s notes. Fake notes can be identified

by using hands and eye, a counterfeit detector pen, or a machine known as anote detector.

i) The Counterfeit Detector Pen

Counterfeiters don’t use expensive special inks to try to closely duplicate paper

currency. They instead try to create a bill that looks like the authentic one by using

their available means which include wood-based paper. However, their bills would

not raise any initial suspicion when used in an everyday purchase.

One of the simplest tools used for counterfeit detection is a Counterfeit

Detector Pen. This pen contains an iodine solution that reacts with the starch

in wood-based paper to create a black, marker-like stain. When the solution

found in this pen is applied to the fiber-based paper used in authentic bills there

is no change in color and no stain appears. This tool is useful for identifying

amateur counterfeit currency. However, when dealing with more sophisticatedcounterfeit bills, utilizing a more complex detector is be necessary.

ii) Fake notes detection by a counter

Some banknote counters can also detect counterfeit notes by using one of the

following methods:

• Magnetic counterfeit bill detection: This is a method by which the

specialized magnetic ink which is found in bills is read by currency

counters with magnetic detection capabilities to identify counterfeited

bills from genuine ones.

Magnetic inks are ones with pigments containing magnetic material typically

iron oxide similar to what is used in the coatings of audio and video tape. These

inks are employed by most countries in the printing of paper currencies.

There are different methods and devices used in detecting the magnetic

properties in currency such as hand-held units and single-bill readers that

require the user to rub or slide the bill across a sensor. This device then emits

an audible signal to indicate the presence of the magnetic properties in the

bill. These devices are easy to use and are effective but they are impractical

for banks and big businesses with big amounts of cash to verify. There are

also more effective and quick modern money counters equipped with magnetic

counterfeit technology which can scan hundred or even thousands of bills per

minute.

• UV counterfeit detection: This is a method in which detection

devices use ultra-violet light to detect fake notes. With this method the

counterfeit detector works by detecting the UV fluorescent phosphors

used on authentic bills. This phosphor produces a reaction when

placed under the UV light but remains hidden when viewed under

normal lighting conditions. The UV ink changes its appearance and can

then be easily seen by the human eye under UV light.

Apart from banknotes detectors which have fake notes detection functionalities,

there are note detectors which have the sole functionality of detecting fake

money by using the ultraviolet light or the magnetic detection method. To use

these devices the user places suspicious notes in the appropriate place and thedevice detects its authenticity

Application activity 8.3

1) Explain the methods used by a note detector to identify fake notes2) By doing a research on the internet, identify the parts of a note detector.

8.4 Automatic Teller Machine

Activity 8.4

You have at least once visited banks in Rwanda.

1) Explain how the process of withdrawing and depositing money at a

bank is done

2) Give the name of a machine that can do the task of a human teller?

3) Explain how withdrawing and depositing money using the machinestated in 2) is done.

An ATM known in full letters as an Automated Teller Machine, is a specialized

computer device that is used by bank customers to perform transactions on their

bank accounts. With these devices customers can check account balances,

withdraw or deposit money, transfer funds from one account to another, print astatement of account activities.

ATMs can be found in financial institutions like banks. However there are also

ATMs that can be displaced and found at other places like airports, shopping

malls where there may be many people needing cash. ATMs started being usedas a response to labor cost and request to get cash even after working hours.

8.4.1.Parts of an ATM

Like other computers and most electronic devices, an Automatic Teller Machinehas two parts namely hardware and software.

A. Hardware

The hardware parts of an ATM work together in order to make a transaction

possible. An ATM has parts that are visible by the client that can be considered

as an interface and other parts which are visible by the bank administrators.

Although each ATM offers various features other than basic services, all the

devices contain the same components. The parts of ATM are detailed below :

Card Reader

A card reader is a device that can decode the information contained in a credit

or debit card’s magnetic strip or microchip. In finance, this term refers to the

technologies used to detect the account number, cardholder information, and

authorization code contained on a credit card. When a customer inserts a card

in the machine, a card reader reads the account details of the clients then verifythe provided information and process the transaction.

Keypad

A keypad for electronic devices is an input unit which enters data in that device.

Keypads have keys which are mostly numeric and letter keys. When the bank

card holder has put it in the ATP slot, he/she is prompted to enter a password,

choose among different options, etc and this is done using the keys found onthe keypad

Cash Dispenser

A cash dispenser is the part that contains cash. Cash dispensers are connected

with a safe that contains cash. Through cash dispensers, customers receivebanknotes in return to the transaction they made.

Printer

An ATM printer has the role of printing a receipt of the performed transaction.

The printed receipts include all the details of the transaction for cash withdrawal.

It further shows the total balance that a cardholder has in their bank account.

Screen

The display screen in ATM shows the cardholder all the details. It prompts the

customer through each step of the transaction process. Nowadays advanced

ATM screens may be touchscreens whereby instead of using the physical keythere is a virtual keypad laying under the screen.

SpeakerThe speaker provides feedback in form of audio when a particular key is pressed.

Vaults: This is a house to which store the parts of the machinery requiring restricted

access.

Note also that, like other computers, ATMs have most hardware parts found

inside a computer like processors and motherboards to support the whole

circuitry. Moreover they have sensors and indicators and cameras. One of the

functions of a sensor is to measure if the thickness of the bill is normal in order to

avoid that two bills may pass at the same time which would result in a customerreceiving more money than requested.

A. Software

Like any other electronic device that performs complex tasks, an ATM has an

operating system. Today, the vast majority of ATMs worldwide use Microsoft

Windows among which a big number runs on Windows XP (95% in 2014).

There are also a small number of ATMs which are still running older versions

of Windows such as Windows NT, Windows CE or Windows 2000. Some

others use newer operating systems such as Windows 8.1, Windows 10 andWindows 11.

Windows is not the only operating system for ATMs because in these days

Linux is also finding some ground like in Brazil where the Banrisul bank’s ATMsrun on Linux.

8.4.2.Withdrawing and depositing from an ATM

The process of withdrawing cash from an ATM machine has to go through a

number of steps starting by insertion of the bank card and a withdrawal of thatsame card. Those steps are outlined below:

Step 1: Insert an ATM Card in the card slot

Step 2: Select the language from the language options appearing on the display

screen

Step 3: Enter ATM Pin using the keypad. For most ATMs PIN are in 4 digits.

Do not ever share your ATM Pin with anyone even with bank staff. Ensure that

nobody is watching you, while you enter the Pin. Make sure you enter a right pin

as entering a wrong one may lead to the blockage of the ATM card.

Step 4: Select the type of transaction which can be withdrawal, deposit or

transfer.

Step 5: Select your type of account: As an individual banker, you should be

choosing a savings account, as current accounts are a special type of accounts

used by businesses. Some ATMs offer you a choice to add a line of credit to

your account. This can help a banker when they need excessive money in an

emergency.

Step 6: Enter the withdrawal amount. The withdrawal amount should not be

more than the balance in your account.

Step 7: Collect the cash from the ATM cash slot

Step 8: Take the receipt which is produced by the ATM printer. Making the

printer produce a receipt is done by prompting the ATM to print it. If you choosenot to have a receipt, it will not be produced.

A. ATM malfunction errors

The hardware components specifically the ones which move may wear out or

get old therefore resulting in a faulty equipment

• Faulty dispenser

When the dispenser has problems, customers insert their ATM cards in the slot,

enter their password or PIN, select the cash withdraw option and fill the cash

amount but when it arrives at the steps of counting and dispensing the cash

everything halts yet the customer’s account has already been to the full amount.

Another scenario is that ATM may fail to provide the full requested amount.

When such errors happen, the customer will have to apply for payment and the

bank manager will verify that application.

• Worn out card reader

Bank cards have a dark magnetic stripe on the back which contains specific

details about the card and its owner. When the bank card is inserted in an ATM,

the reader verifies the information on the card before it authorizes the transaction.

As a card is used again and again, the ATM card reader wears it out therefore

making the reading of information on the card impossible. If this happen, obviously

the transaction the customer wanted to carry out will not be done.

• Broken Keypad

The keypad which is used as an interface between a custom and the ATM may

be broken or one key may stick or may be unresponsive. If among the keys that

the customer needs have such problems, a transaction will not be possible.

• Receipt Malfunctions

The ATM printer may not give a receipt due to different reasons such as when

the machine has run out of paper, the printer has run out of paper, there is a

paper jam or any other problem with the ATM printing system. Since the receipt

contains vital information about the ATM transaction, it’s imperative that any

issues with printing receipts is handled quickly.

• Software glitches

ATM have different software whose technology never ceased to advance. Many

ATMs now have touch screen and other technology that relies on computer

software to function. Like other machines that run on computer software, ATMs

can have software glitches. When such problem happens, a transaction in not

possible.

Application activity 8.4

1) By doing a research on the internet, identify the internal parts of an

Automatic Teller Machine

2) Can an ATM be hacked? If yes explain the likely consequences of this hacking.

Skills Lab 7

Use different ICT tools in Accounting you have learnt to perform the

following activities:

a) Counting money

b) Detecting fake money

c) Withdrawing using ATM cards

End of unit assessment 8

1) What are the benefits of using ICT tools in Accounting

2) Describe the ICT tools you have seen in this unit

3) Using the internet do a research on the software tools used inAccounting

REFERENCES

1. MINEDUC, (2013), Education Sector Strategic Plan, Kigali.

2. MINEDUC, (2014), ICT in Education Policy, Kigali: MINEDUC.

3. MYICT, (2011), National ICT strategy and plan NICI III-2015, Kigali.

4. Herman Oduor, 2014, Senior Secondary Certificate Computer Science

for Rwanda student’s book 4, East African Publisher, Kigali

5. National Curriculum Development Centre(NCDC), (2010), computer

science curriculum for computer science economics and mathematics

option & mathematics physics and computer science option, Kigali,

Rwanda

6. www.sumup.co.uk/invoices/dictionary/quotation/ 27/03/2022

7. www.umucyo.gov.rw/ 27/03/2022

8. https://www.reviews.in/best-billing-machine.html

9. http://mybillmachine.com/ visited on 27/03/2022

10. https://carnation-inc.com/ visited on 28/03/2022

11. https://tax-handbook.rra.gov.rw/handbook/explanation-of-ebms/ visited

on 30/03/2022

12. https://squareup.com/us/en/townsquare/what-pos-system visited on

31/03/2022

13. https://en.wikipedia.org/ visited on 01/04/2022

14. https://www.tutorialspoint.com

15. https://www.tutorialandexample.com16. https://www.tutorialandexample.com