UNIT5:VARIANCE ANALYSIS

Management Accounting | Experimental Version | Student Book | Senior SixKey unit competence: To be able to interpret the variance and advice the top management

Introductory activity:

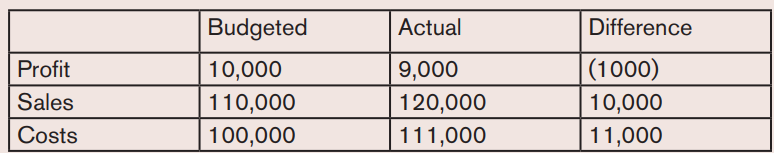

Read the following case study of Specialty Food ltd profit Report for the

month of June.

MUHIRE, the new management accountant, has just completed his first

month’s work. He has entered a huge amount of data into the finance and

accounting system and is now faced with a pile of report. One such report

is shown below.Specialty Foods ltd profit Report: June (unit-FRW)

a) Explain the meaning of the above report

b) What is the budget variance analysis?

Management Accounting | Experimental Version | Student Book | Senior Six

5.1. Identify any significant deviation

Activity 5.1

Read the following case study and answer the question below:

The chocolate Cow Ice Cream Company has grown substantially recently,

and management now feels the need to develop standard and compute

variances. A consulting firm was hired to develop the standards and the

format for the variance computation. One standard in particular that the

consulting firm developed seemed too excessive to plant management. The

consulting firm’s standard was production of 100 gallons of ice cream every

45 minutes. The plant’s middle level of management thought the standard

should be 100 gallons every 55 minutes, while the top management of the

company thought that the consulting firm’s standard would provide more

motivation to the employees.

1.Why is the company establishing a standard costs for production

2.What are some factors the company may need to consider beforeselecting one of the proposed standard costs

5.1.1. Meaning of Variance

Variance: is the difference between a forecasted variable and the actual

variable. Variances are common in budgeting, but you can have a variance

in anything that you forecast. In many accounting applications, a variance is

considered to be ”the difference between an actual cost and standard coast”.

The act of computing and interpreting variances is called Variance Analysis.

-Variance analysis: refers to identifying and examining the difference between

the standard numbers expected by the business and the actual numbers

achieved.

Frank wood and Allan Sangster defined variance analysis as” a mean of

assessing the difference between a predetermined cost and actual cost.

Analysing variance helps businesses understand current outgoings and them

budgeting for future expenses. Businesses often carry out variance analysis a

quantitative investigation into differences between planned and actual costsand revenues.

Management Accounting | Experimental Version | Student Book | Senior Six

Variance analysis can be applied to both revenues and expenses. When actual

results are better than planned, variance is referred to as “favourable”. If resultsare worse than expected, variance is referred to as” adverse” or” unfavourable”

5.1.2. Purpose of variance analysis

Variance analysis helps to reveal where your business exceeded expectations

and where it came up short.

A company must use variance analysis to determine how managers have

performed to achieve their objectives. In this case, variance analysis enhances

the benefits of budgeting. Variance analysis promotes responsibility in various

areas. Variance analysis can also identify any errors in a budget.

Variance analysis can provide information to prepare budgets in the future.

Variance analysis fixed that by establishing actual performance.

5.1.3. Structure of variance

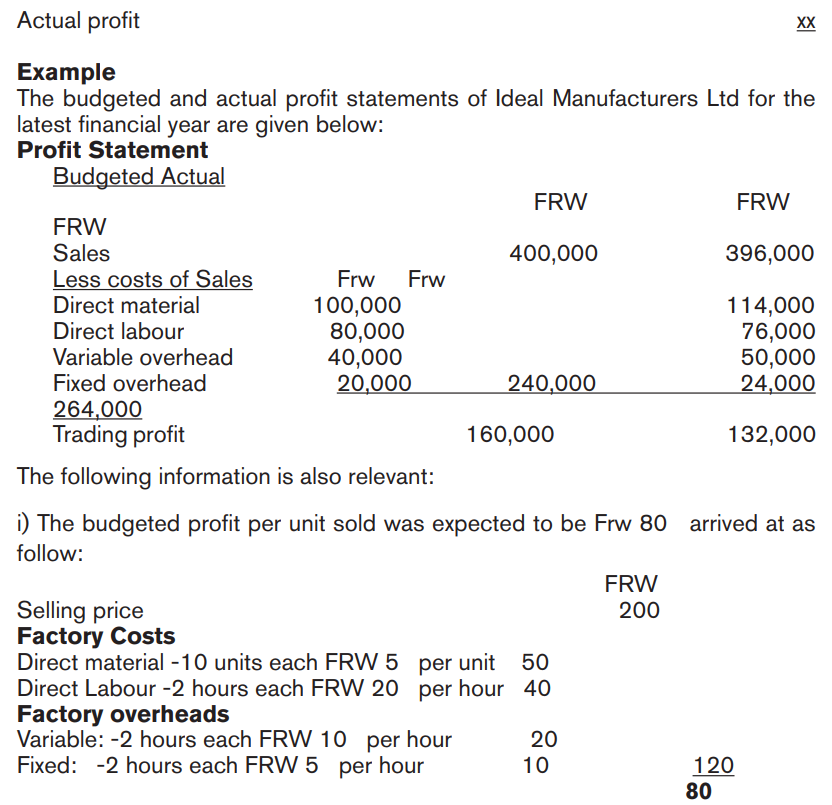

The total difference between the budgeted profit and actual profit for a specific

period is divided into various parts. These parts relate to material, labour,

overhead and sales variances. The particular variances which are computed in

any given organization are those which are relevant to its operations.

The operating profit variance is the difference between budgeted and actual

operating profit for a specific period. This variance is the sum of all other

variances. i.e. cost variances and sales variances.

5.1.4. Causes of budget variance

There are three primary causes of budget variance: errors, changing business

condition, and unmet expectations.

1. Errors by the creators of the budget can occur when the budget is being

compiled. There are a number of reasons for this, including faulty math,

using the wrong assumptions, or relying on stale or bad data.

2. Changing business conditions, including changes in the overall economy

or global trade, can cause budget variances. There could be an increase

in the cost of raw materials or new competitors may have entered the

market to create pricing pressure. Political and regulatory changes that

were not accurately forecast are also included in this category

3. Budget variance will also occur when the management team exceeds or

underperforms expectations. Expectations are always based on estimates

and projects, which also rely on the values of inputs and assumptions builtinto the budget. As a result, variances are more common than company

Management Accounting | Experimental Version | Student Book | Senior Six

managers would like them to be.

5.1.5. Types of budget variance

There is a need of knowing types of variance before measuring the variance.

Generally ,the variances are classified on the following basis.

a) On the basis of element of cost

1. Material variance

2. Labour variance

3. Overhead variance

b) On the basis of controllability

1. Controllable variance

2. Uncontrollable variance

c) On the basis of impact

1. Favourable variance

2. Unfavourable variance

d) On the basis of nature

1. Basic variance

2. Sub-variance

5.1.6. Calculation of budget Variance

A brief explanation of the above mentioned variance is presented below

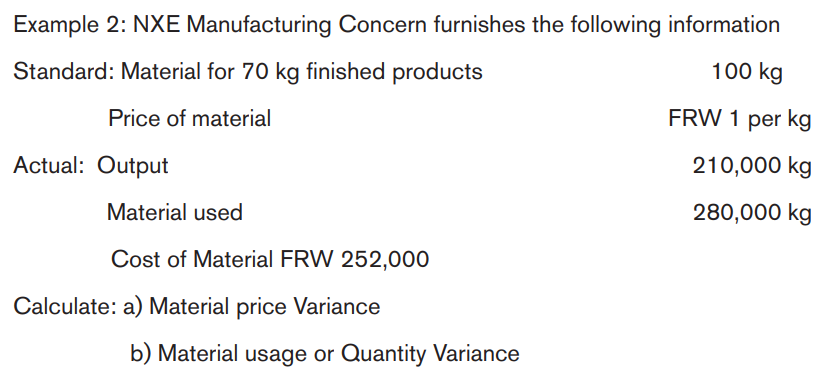

1. Material variance

It is the difference between actual cost of material used and the standard cost for

the actual output. The difference between the standard cost of direct materials

and the actual cost of direct materials that an organisation uses for production

is known as Material variance

Types/Methods of Material cost variances are:

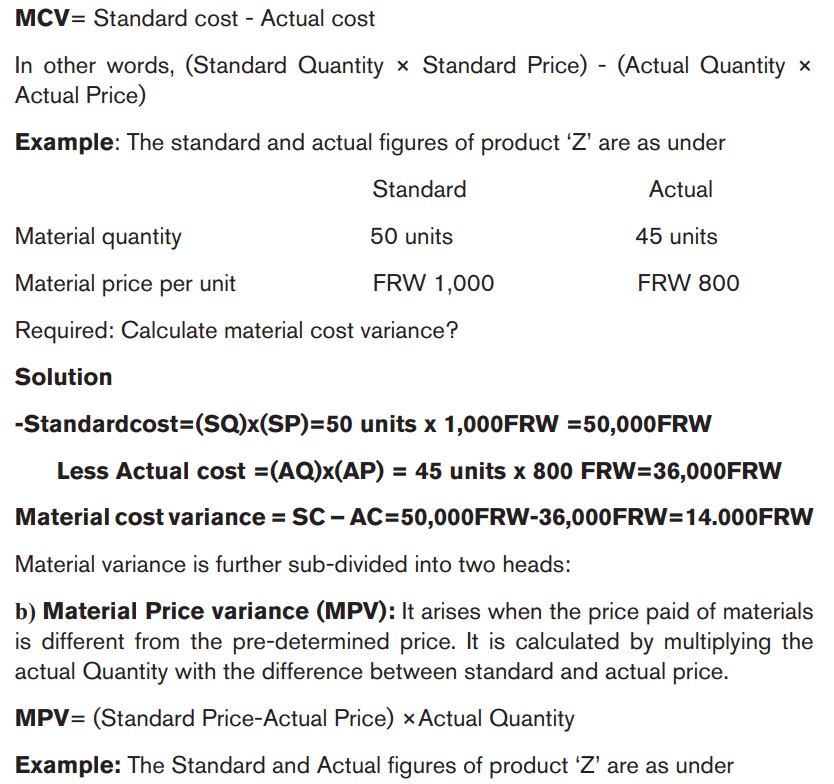

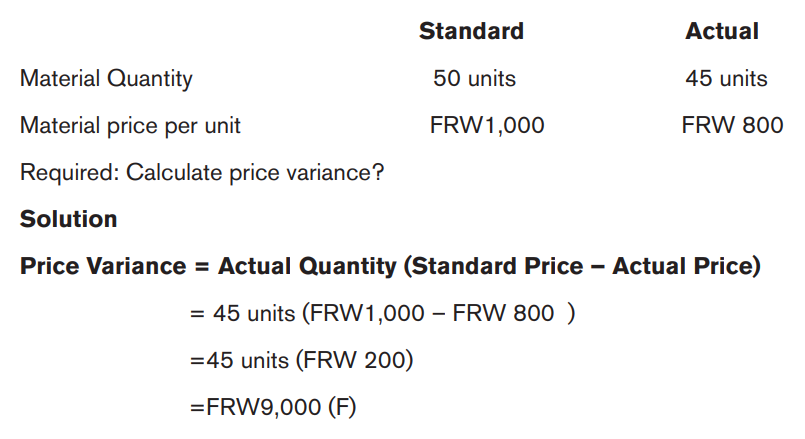

a) Material cost variance (MCV): It is the difference between the

standard cost of materials and actual cost. If actual cost is less than the

standard cost, it is a favorable variance and vice versa.Material cost variance formula:

Management Accounting | Experimental Version | Student Book | Senior Six

Management Accounting | Experimental Version | Student Book | Senior Six

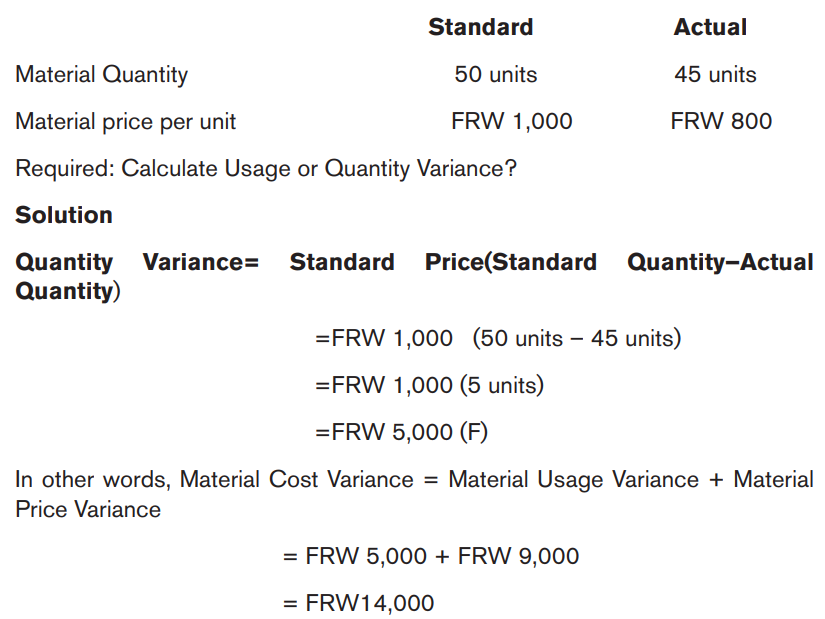

c) Material usage (or Quantity) Variance (MQV): It measures the difference

in material cost arising, from higher of less consumption of material than the

standard consumption. It is calculated by multiplying the standard Price with the

difference between the standard Quantity and actual Quantity

MUV= (Standard Quantity-Actual Quantity) × Standard PriceExample: The Standard and Actual figures of product ‘Z’ are as under

Management Accounting | Experimental Version | Student Book | Senior Six

c) Material Cost Variance

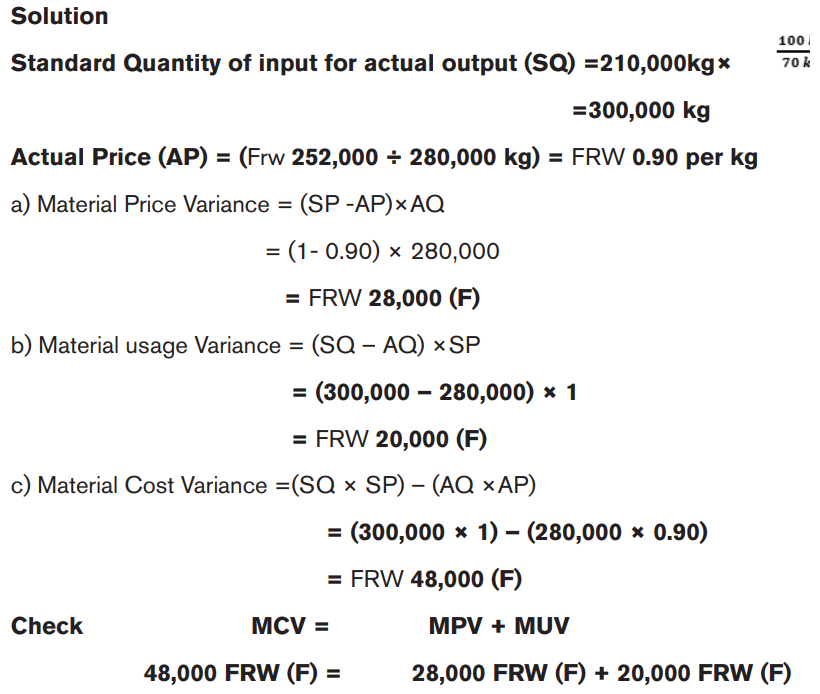

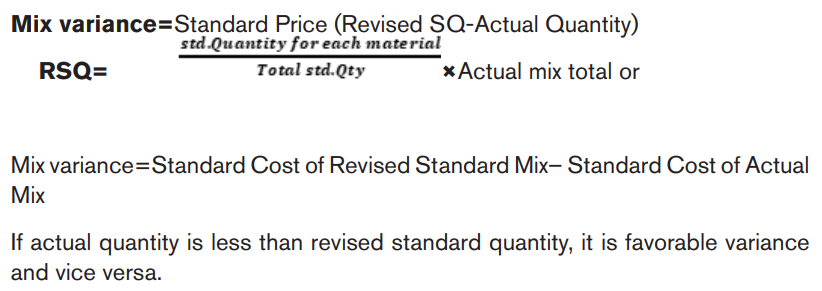

d) Material Mix variance (MMV): This variance arises when more than one

type of materials is used in manufacturing the product and the quantities of

materials issued are not in predetermined proportion. It is that part of direct

material usage variance, which is due to difference between the standard and

actual composition of a mixture. It is obtained by multiplying the standard price

of materials with the difference between revised standard Quantity and theActual Quantity.

Management Accounting | Experimental Version | Student Book | Senior Six

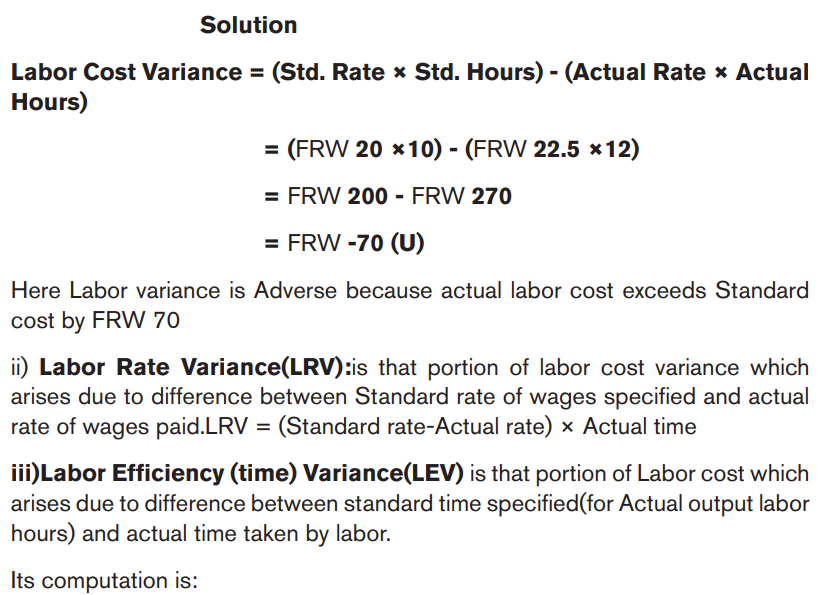

hours. But actual wage rate is Frw 22.5 per hour and actual hours used are 12

hoursCalculate Labor cost Variance

Management Accounting | Experimental Version | Student Book | Senior Six

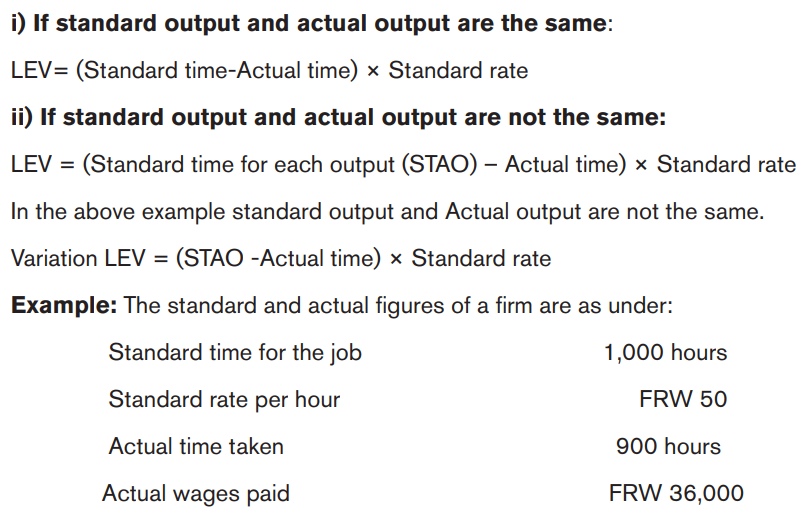

Required: Calculate the following Variances

a) Labor Rate Variance

b) Efficiency Variancec) Total Labor Cost Variance

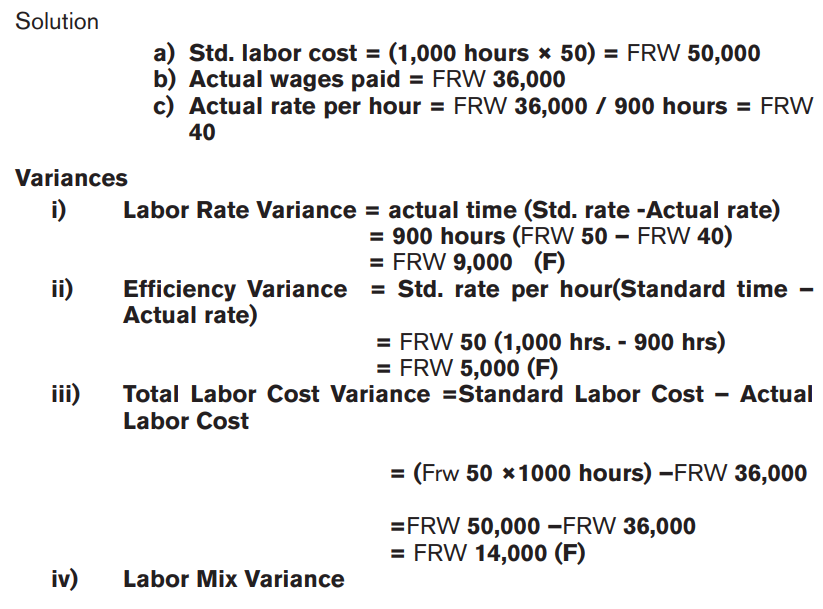

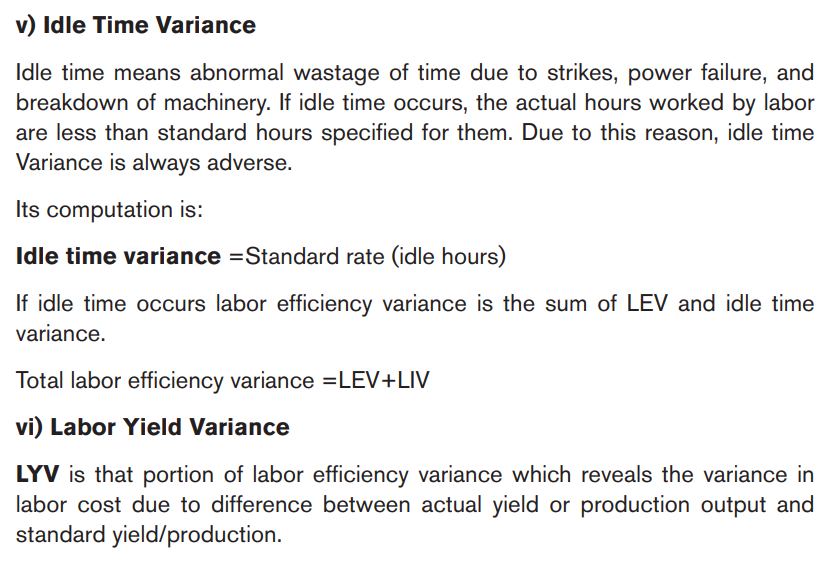

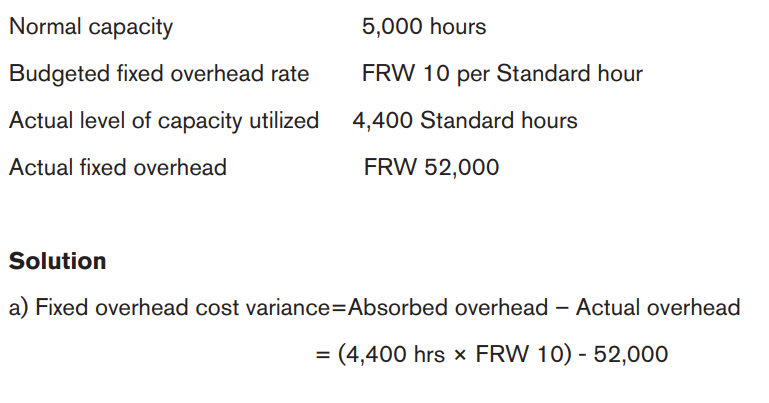

LMV arises due to change in composition of labor force (like mix in material).

It tells the management how much labor efficiency variance occurs due to

change in its composition and thus it a part of labor efficiency variance.

Its computation is:

i) If standard composition/mix of time and actual composition of time (time spent

by them) is same.

LMV =Standard cost of standard composition – Standard cost of actual

composition

Or

Total actual time spent by labour (standard rate per hour of standard mix –standard rate per hour of actual mix)

Management Accounting | Experimental Version | Student Book | Senior Six

Or

ii) If standard composition/mix of time and actual composition of time is not thesame

Management Accounting | Experimental Version | Student Book | Senior Six

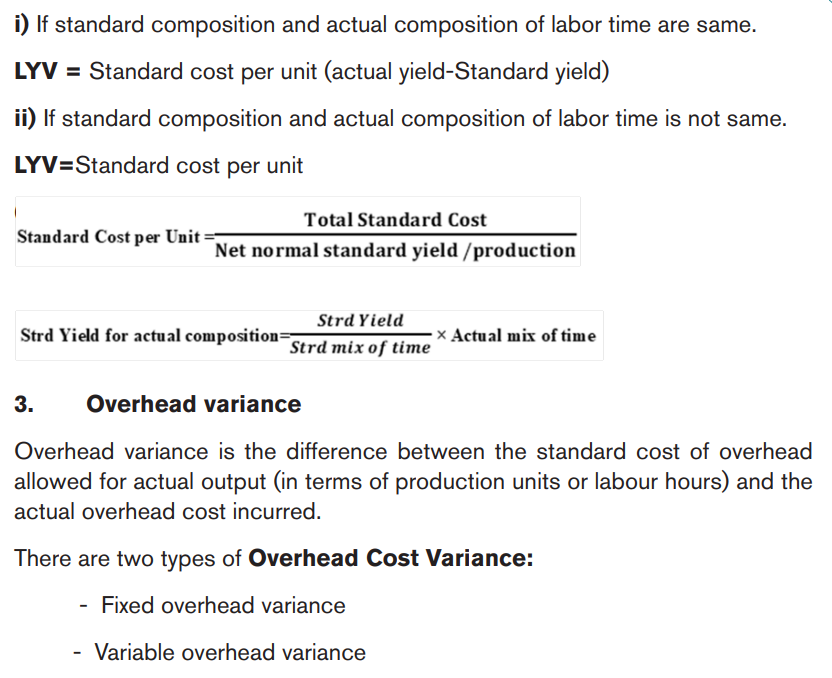

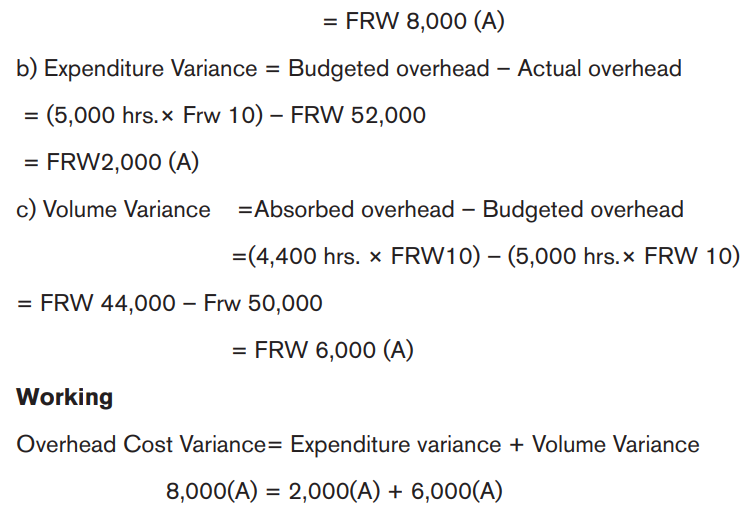

Fixed Overhead Variance: This is a cost that is not directly related to output;

itVolume variance can further be divided into three variances, which are:a) Capacity Variance

b) Calendar Variance

c) Efficiency Variance

a) Capacity Variance This is the portion of volume variance that arises due to

high or low working capacity. It is influenced by idle time, machine breakdown,

strikes or lockouts, or shortages of materials and labor. Thus, Standard rate

(Revised units – budgeted hours)

b) Calendar Variance This variance arises due to the difference in the number

of working days when the actual number of working days is greater than the

Standard working days. It is regarded as a favorable type of variance. It is

expressed in the following way:

Calendar variance = No. of working days more or less × Standard (st.)

rate per unit

c) Efficiency Variance This is the portion of volume variance that is due to

the difference between the budgeted output efficiency achieved. This is due to

Labor working efficiency. Thus, it can be expressed as:

Efficiency Variance = Std. rate (Actual production – Std. production)

in unit is a general time-related cost. Specially, fixed overhead variance is defined as

the difference between standard cost and fixed overhead allowed for the actual

output achieved and the actual fixed overhead cost incurred.

Formula to calculate Fixed Overhead Variance:

FOV=Actual output ×Standard fixed overhead rate-Actual fixed overheads

The following are the other variances:

i. Expenditure Variance

This shows the over/under absorption of fixed overheads during

a particular period. When the actual output exceeds the standard

output, it is known as over-recovery of fixed overheads. Expenditure

variance (EV) is expressed as follows:

EV = (Standard overhead – Actual overhead)

ii. Volume Variance

It is favorable if the actual output is less than the standard output, and

vice -versa.

This is due to the nature of fixed overheads, which are not expected

to change with the change in output. This variance can be expressed

Management Accounting | Experimental Version | Student Book | Senior Sixas:

Volume Variance = (Actual output ×Standard rate)-Budgeted

fixed overheads

Volume variance can further be divided into three variances, which are:

a) Capacity Variance

b) Calendar Variance

c) Efficiency Variance

a) Capacity Variance This is the portion of volume variance that arises due to

high or low working capacity. It is influenced by idle time, machine breakdown,

strikes or lockouts, or shortages of materials and labor. Thus, Standard rate

(Revised units – budgeted hours)

b) Calendar Variance This variance arises due to the difference in the number

of working days when the actual number of working days is greater than the

Standard working days. It is regarded as a favorable type of variance. It is

expressed in the following way:

Calendar variance = No. of working days more or less × Standard (st.)

rate per unit

c) Efficiency Variance This is the portion of volume variance that is due to

the difference between the budgeted output efficiency achieved. This is due to

Labor working efficiency. Thus, it can be expressed as:

Efficiency Variance = Std. rate (Actual production – Std. production)in unit

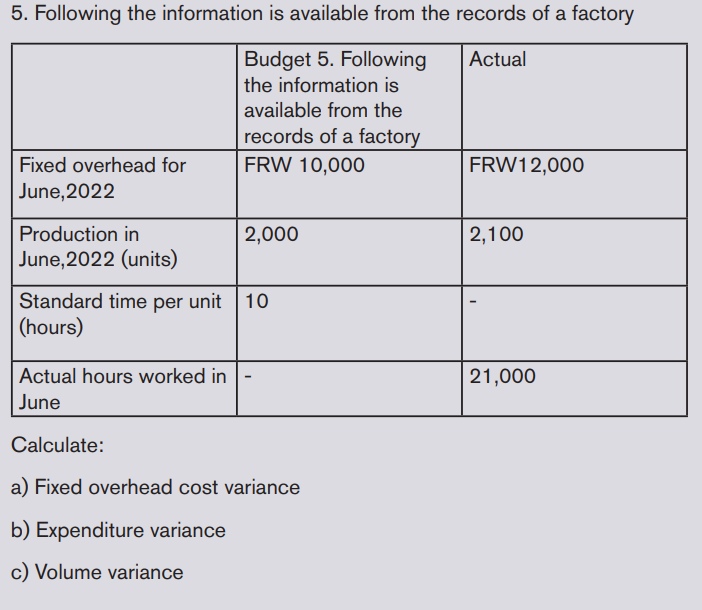

Example: Using the information given below compute the fixed overhead cost,Expenditure, and Volume variance

Management Accounting | Experimental Version | Student Book | Senior Six

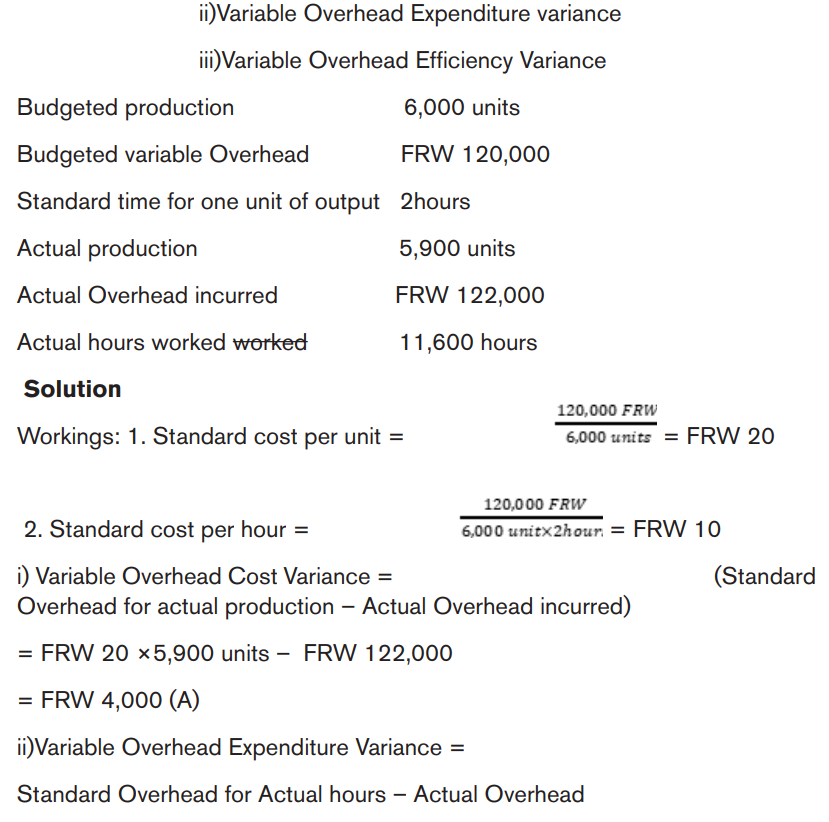

2. Variable overhead Variance

Variable overheads consist of expenses other than direct material and direct

labor which vary with the level of production. If variable overhead consists of

indirect materials, then in this case it varies with the direct material used. On the

other hand, if variable overhead is depending on number of hours worked then

in this case it will vary with labor hours or machine hours. If nothing is mentioned

specially then we take labor hours as basis. Variable overhead cost variance

calculation is similar to labor cost variance.

Variable overhead cost variance = (standard variable overhead for

production -Actual variable overheads)

The variable overhead cost variance is divided into two parts

Variable overhead expenditure variance

Variable overhead Efficiency variance

Variable overhead Expenditure variance= (Standard variable Overheads

for actual hours) –(Actual variable overhead)

Variable overhead Efficiency Variance= (Standard Variable Overheads for

production) – (Standard Variable Overheads for Actual Hours)

Example: From the following information of G ltd,Calculate i) variable Overhead Cost Variance

Management Accounting | Experimental Version | Student Book | Senior Six

Management Accounting | Experimental Version | Student Book | Senior Six

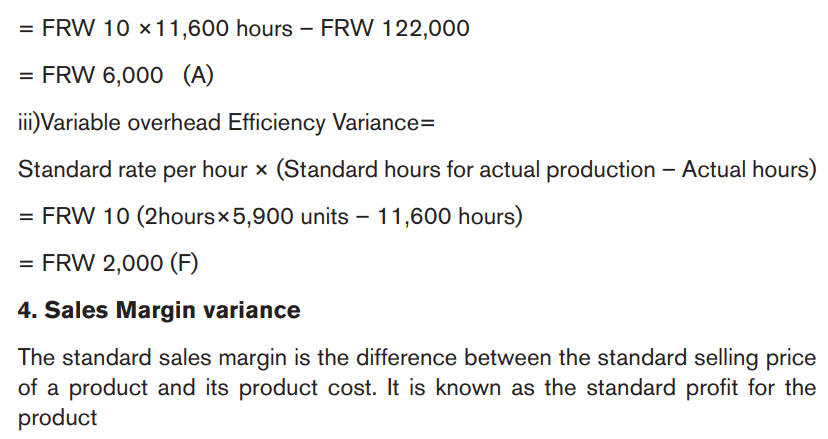

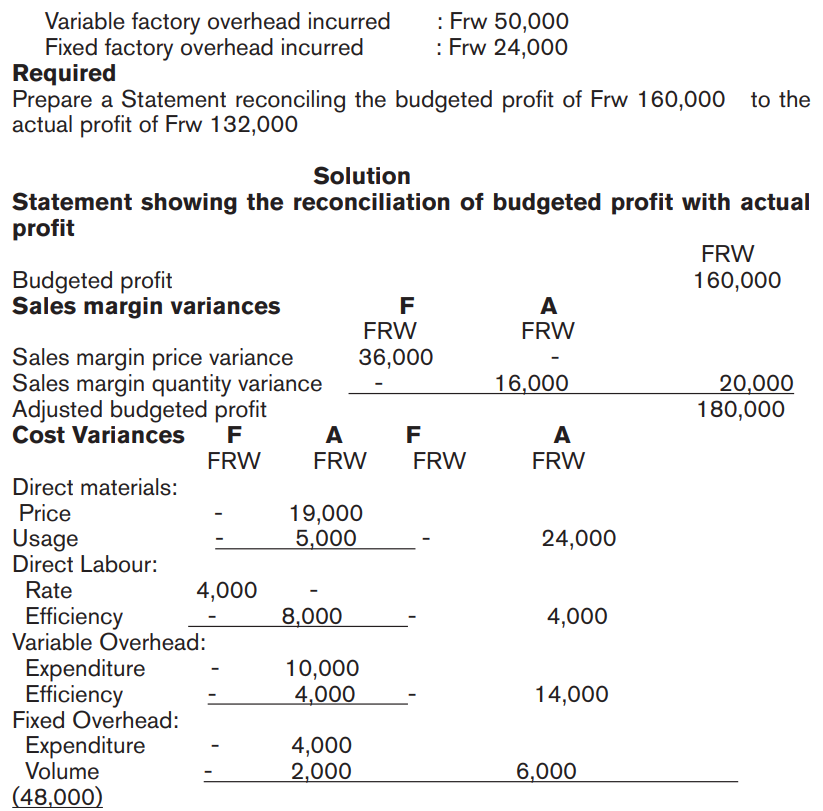

Total sales margin variance is the difference between the budgeted margin from

sales and the actual margin when the cost of sales is valued at the standard

cost of production. This is the sum of sales margin price variance and sales

margin quantity variance.

a) Sales Margin Price Variance

This is that portion of the total sales margin variance which is the difference

between the standard margin per unit and the actual margin per unit for the

number of units sold in the period.It is calculated as under:

Sales Margin Price Variance=Actual sales-(Standard selling price-Actual sales

quantity)

Sales Margin Quantity Variance

This is that portion of the total sales margin variance which is the difference

between the budgeted number of units sold and the actual number sold valued

at the standard margin per unit. It is calculated as under:

Sales Margin Quantity Variance=Standard sales Margin or profit (Actual Sales

Quantity – Budgeted Sales Quantity)Example: From the following information, calculate the sales variances

Sales selling price per unit FRW 30

Management Accounting | Experimental Version | Student Book | Senior Six

Controllable cost variance is a cost variance which can be identified as a primary

responsibility of a specified person.

6. Uncontrollable Variances

External factors are responsible for uncontrollable variances. The management

has no power or is unable to control the external factors. Variance for which a

particular person or a specific department or section or division can’t be held

responsible are known as uncontrollable variances.

7. Favourable variances

Whenever the actual costs are lower than the standard costs at per-determined

level of activity, such variance termed as favourable variances. The management

is concentrating to get actual results at cost lower than the standard costs. It

Management Accounting | Experimental Version | Student Book | Senior Six

shows the efficiency of business operation.

8. Unfavourable variances

Whenever the actual costs are more than the standard costs at predetermined

level of activity, such variances termed as unfavourable variances. These

variances indicate the inefficiency of business operation and need deeper

analysis of these variances.

9. Basic Variances

Basic variances are those variances which arise on account of monetary rates

(i.e.price of raw materials or labour rate) and also on account of non- monetary

factors (such as physical units in quantity or time)

10. Sub Variance

Basic variance arising due to non-monetary factors are further analysed and

classified into sub-variances taking into account the factor responsible for them.

Such sub variances are material usage variance and material quantity variance

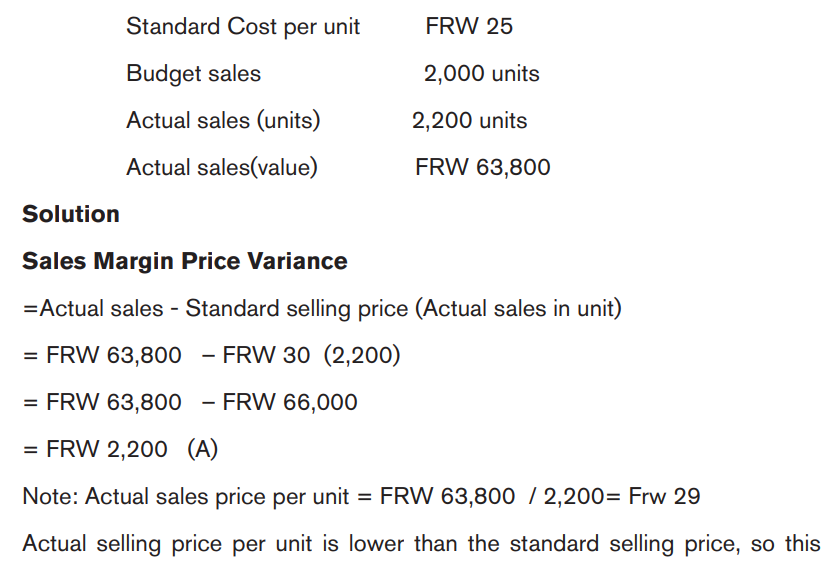

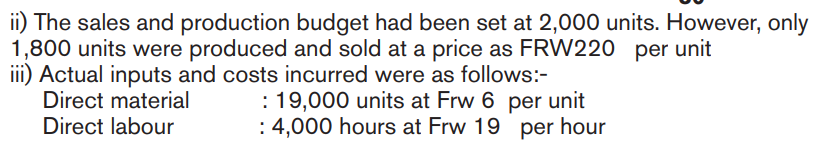

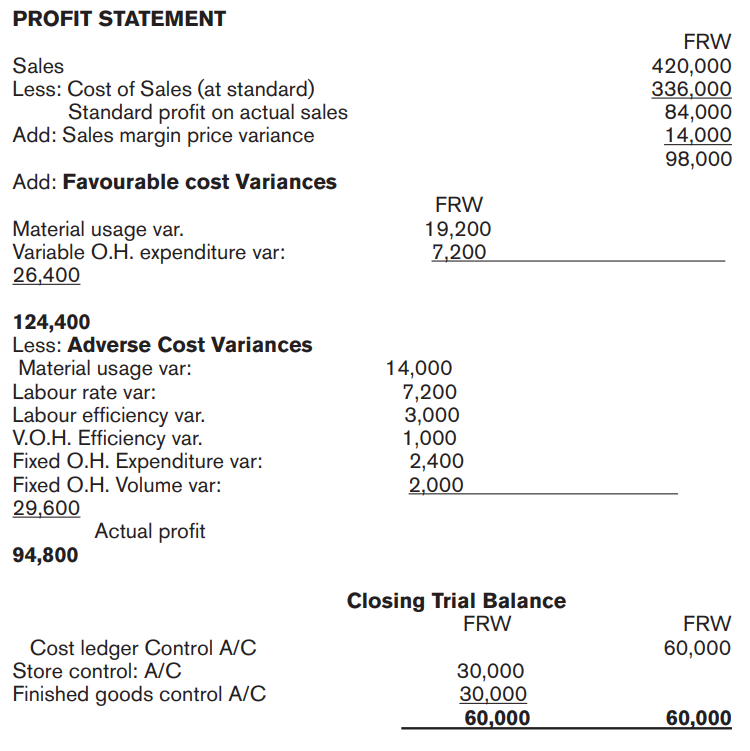

5.1.7. Reconciliation Statement budgeted profit with actual

profit

We have discussed above various cost variances and sales margin variances.

Sometimes the budgeted profit and actual profit are given and the students

are required to reconcile the budgeted profit with actual profit after calculating

various variances. The layout of a reconciliation statement is given as under:Statement showing the reconciliation of Budgeted Profit with Actual Profit

Management Accounting | Experimental Version | Student Book | Senior Six

Management Accounting | Experimental Version | Student Book | Senior Six

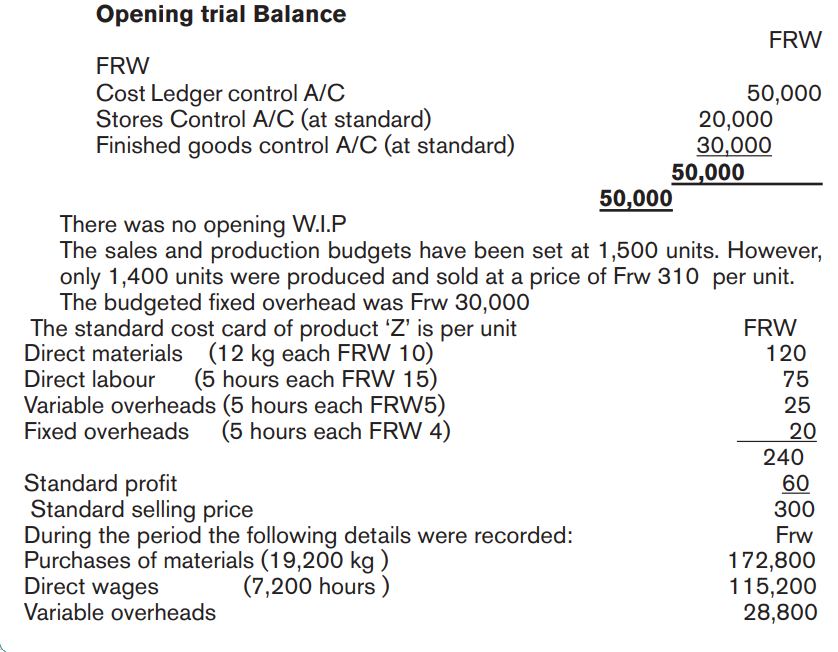

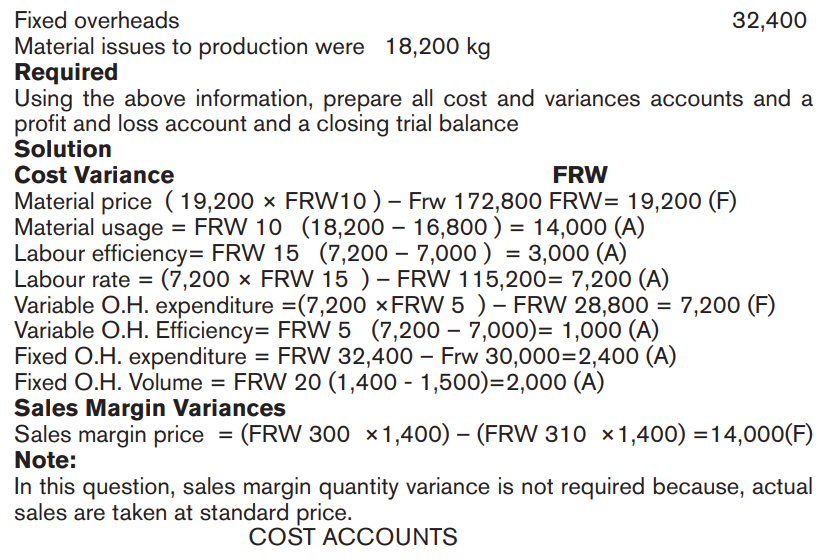

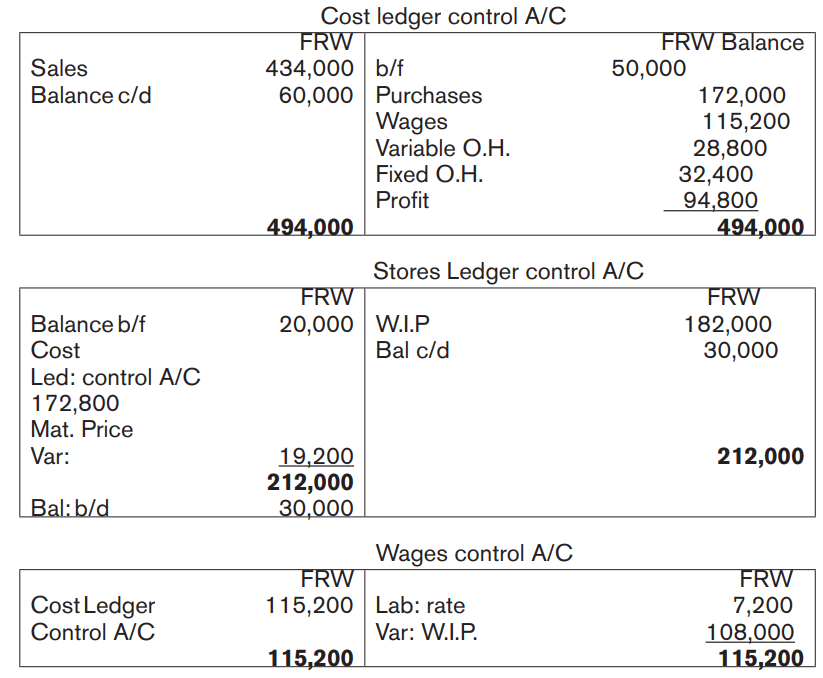

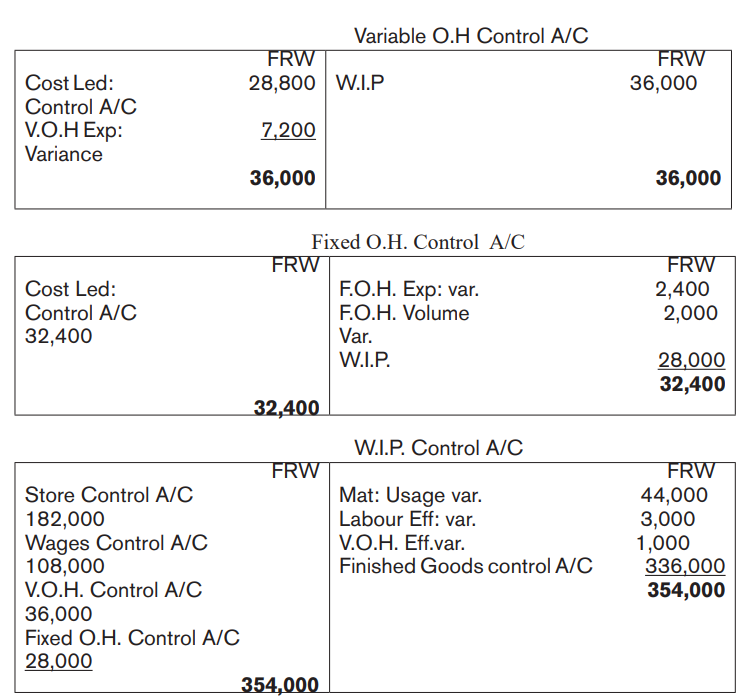

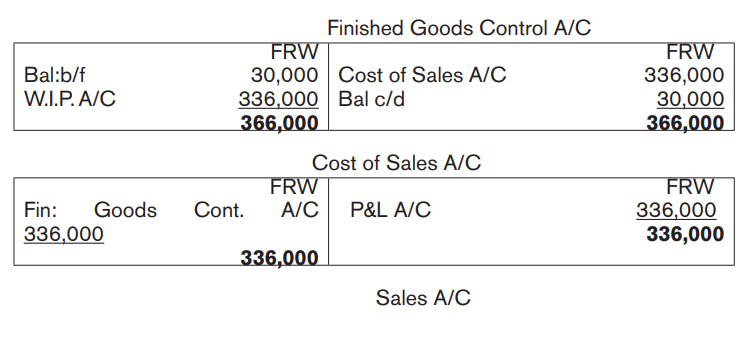

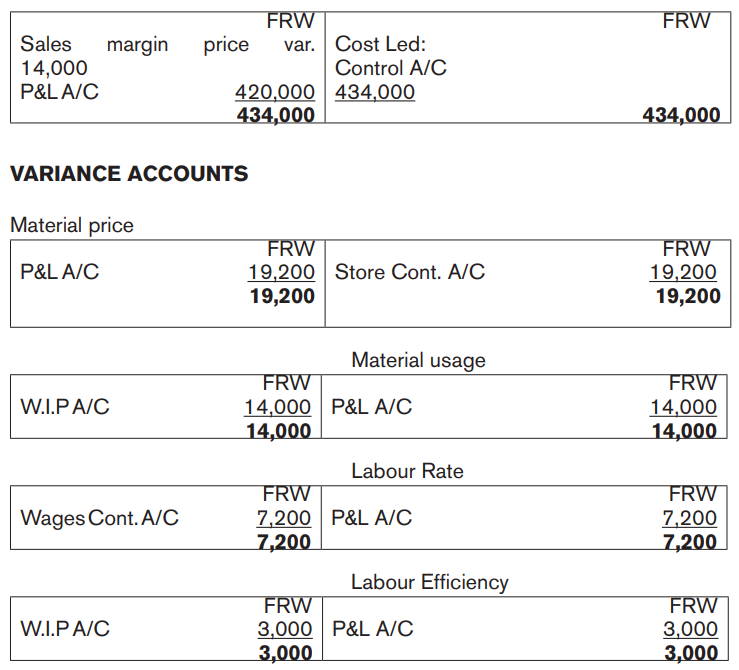

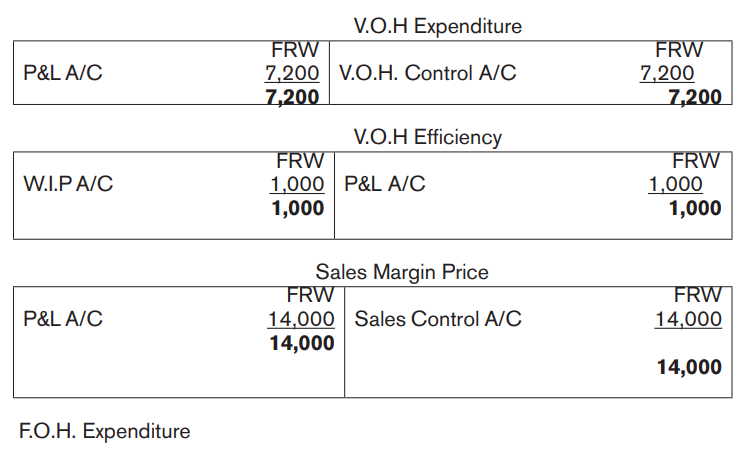

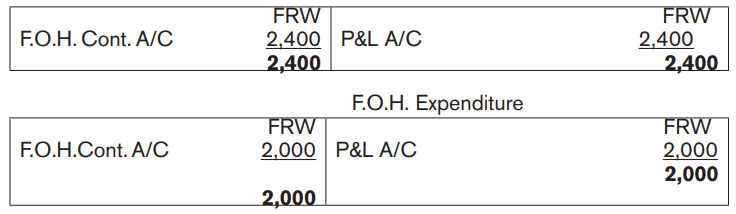

5.1.8. Accounting entries of Variance

The difference between Standard and Actual figures are called variances.

These variances may be favourable or unfavourable. These are recorded into

cost accounts. For this purpose, the following procedures are adopted:

a) Variance is calculated at the time of occurrence or when the respective

elements of cost are charged to production.

b) Variance accounts are maintained for each type of variance.

c) Transfers between the work – in- progress, finished goods and cost of

sales are made at the standard figures.

d) Stocks of raw materials, work-in- progress and finished goods are valued

at standard cost.e) Unfavorable price or expenditure variances are credited to the respective

Management Accounting | Experimental Version | Student Book | Senior Six

control account and debited to the respective variance account. For

example, adverse labor rate variance is debited to the labor rate variance

account and credited to wages control account. Similarly, adverse material

price variance is debited to material price variance account and credited

to stores control account. Favorable price or expenditure variances are

debited to respective control account and credited to respective variance

account.

f) Unfavorable usage or efficiency variances are debited to respective

variance account and credited to work-in-progress account. For example,

adverse material usage variance of adverse labor efficiency variance is

debited to material usage variance account or labor efficiency account

and credited to W.I.P. account. If the usage or efficiency variances

are favorable then debit W.I.P. account and credit respective variance

account.

g) At the end of the year, the balances in the variance accounts are transferred

to the profit and loss account. It means adverse variances are debited to

the profit and loss account and favorable variances are credited to the

profit and loss account.

Example; ABC Ltd. makes and sells a single product, Z. The company

operates a standard cost system and during a period, the followingdetails were recorded:

Management Accounting | Experimental Version | Student Book | Senior Six

Management Accounting | Experimental Version | Student Book | Senior Six

Management Accounting | Experimental Version | Student Book | Senior Six

Management Accounting | Experimental Version | Student Book | Senior Six

Management Accounting | Experimental Version | Student Book | Senior Six

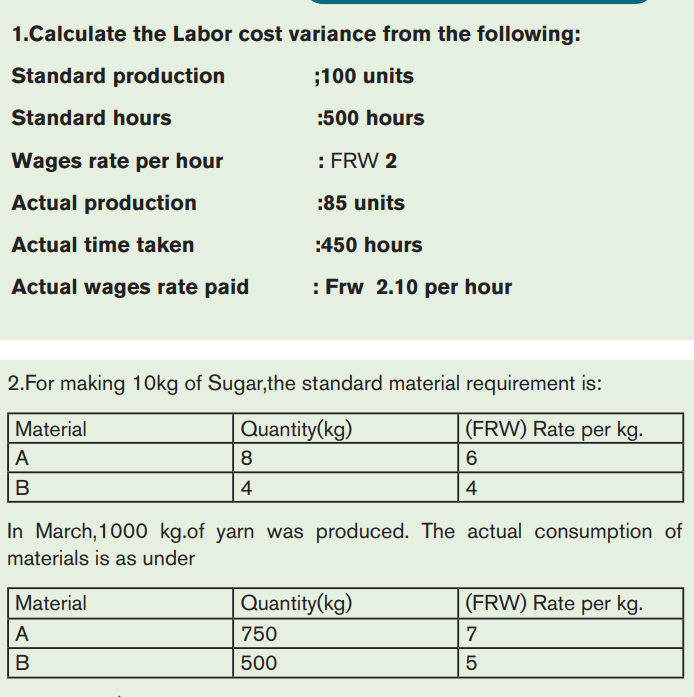

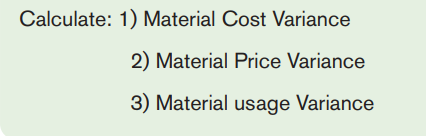

Application activity 5.1

Management Accounting | Experimental Version | Student Book | Senior Six

5.2. The use of budgetary control to ensure organization achievement of target

Learning Activity 5.2

Read the following information and answer the question below

Budgetary control is a system of controlling costs which includes the

preparation of budgets, coordination the departments and establishing

responsibilities, comparing actual performance with the budgeted, and

acting upon results to achieve maximum profitability.What are the functions of budgets in achieving the goal of an organization?

5.2.1 Management efficiency with budgetary control

Budgetary control is known as setting up particular budget by management to

know the variation between the company’s actual performance and budgetary

performance.

It is also helps managers utilize these budgets to monitor and control various

costs within a particular accounting period.

Importance of budgetary control is reflected from the fact that it helps the

management to efficiently track the company’s performance. Such monitoring

ensures that the deviation of the company’s actual performance from the

budgeted one is always under the scanner and can be rectified before it toolate.

Application activity 5.2

What are the benefits of having budgetary control mechanism to abusiness?

5.3. Report and Recommendation to Management

Read the following information and answer the questions below.

The reporting to management is a process of providing to various levels of

management, so as to enable them judging the effectiveness of their responsibility

centres and become a base for taking corrective measures.

Management Accounting | Experimental Version | Student Book | Senior SixQuestion:

What are the benefits of report and recommendation to management?

5.3.1. Report to Management

Reporting to management can be defined as an organized method of providing

each manager with all the data and which he needs for his decision, when

he needs them and in a form which aids his understanding and stimulates his

action.

Finally, compile all of the results into a singular report for management. The

report should contain the identified variances and the root causes of each

variance. It should also contain corrective actions and recommendations for

management on what to do.

5.3.2. Recommendation to Management

Management recommendations means determinations of, amount of, level of

intensity, timing of, any restrictions , conditions , mitigation , or allowances for

activities proposed for a project area pursuant to this rule.

Before approaching management with any recommendation, first point out the

following:

• Clarify your thoughts through the act writing.

• Serve as notes you can refer to during your discussion• Provide your manager with written record to refer to late

Management Accounting | Experimental Version | Student Book | Senior Six

Application activity 5.3

Skills Lab 5

Students visit the manufacturing company located in their school

environment with their teacher. The later requests in favour of students the

budget prepared for last 10 months. The planning officer or budget officer

provide again the document showing the actual cost incurred. Referring

to those two different documents, the students in manageable groups arerequested to calculate the variance if any and advice the current managers.

Management Accounting | Experimental Version | Student Book | Senior Six

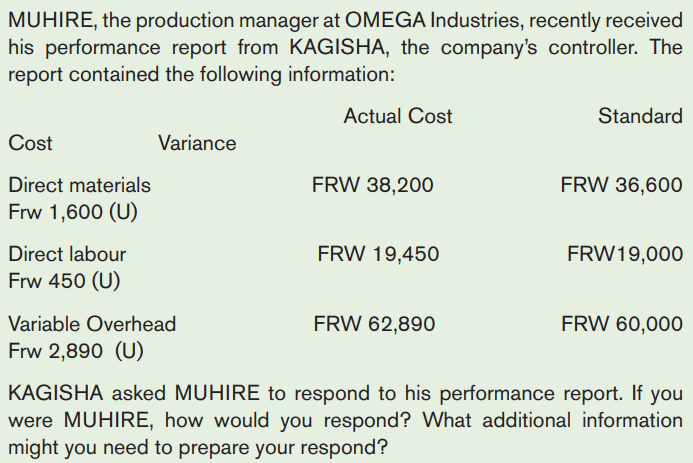

End of unit assessment 5

Management Accounting | Experimental Version | Student Book | Senior Six

Accounting Management | Student Book | Senior Six