UNIT 3: TAXATION OF EMPLOYMENT INCOME

Key unit competence: To be able to compute employment income tax

Introductory activity

Analyze the photo below and answer the question:

Refer to the picture above, which activities are being conducted?

3.1. Components of employment income

Activity 3.1

Assume that at the conclusion of your studies, you have been chosen to be

a member of the personnel (staff) at your institution. Do you believe you will

be compensated at the end of the month? If so, what kind of remuneration do

you expect? If not, what is the reason?

An individual’s employment income is calculated as the sum of all taxable cash

components and taxable benefits in kind less any applicable reliefs.

Employment income includes all payments paid to an employee by his/her

employer in cash or in-kind in relation to the work performed. Those payments

are composed of the following:

• Wages, salary, leave pay, sick pay and medical allowance, payment in

lieu of leave for an employee who stops working before benefiting from

his/her annual leave, sitting allowances, commissions, bonuses, and gratuity;

• Allowances relating to the cost of living, subsistence allowances,

housing allowances, and entertainment or travel allowances;

• Any discharge or reimbursement of expenses incurred by the employee or an associate;

• Pension payments;

• Payments to the employee working in exceptional conditions of employment;

• Payments for redundancy or loss or termination of the contract;

• Other payments made in respect of previous, current, or future employment.

Application activity 3.1

PAYE is a tax on income derived from employment. The profession tax on

remuneration is collected by means of monthly deductions from salaries by

employers. In your opinion, what are the main categories of income subjectto PAYE? List at least 4 examples per category.

3.2. Payments and persons exempted from employment income tax

Activity 3.2

1) Do you think that a provision on exemptions is necessary for PAYE in

Rwanda while source of income is worldwide?

2) On which condition the income of a foreigner who represents his or

her country in Rwanda should be exempted?

3) Given international conventions and as far as PAYE is concerned, what

is commendable when the employer is not obliged to withhold taxes due?

3.2.1. Payments exempted from employment income tax

The following payments are not included in the calculation of taxable employment

income:

• The discharge or reimbursement of expenses incurred by the employee

or his/her associate:

a) Wholly for business activities of the employer;

b) Those that are deducted or would be deductible in calculating the

employee’s income from all his/her business activities;

• Contributions made by the employer for the employee to the public

institution in charge of social security;

• Pension payment from the public institution in charge of social security

or from a qualified pension fund;

• Payments made to non-Rwandan citizens in return for aid services

under agreements signed by the Rwanda government; and

• Payments made to non-residents performing duties in Rwanda by a

non-resident employer.

3.2.2. Persons exempted from employment income tax

The following individuals are free from Rwanda’s employment income tax, as

allowed for by international agreements alluded to in Article 16 of the income

tax law No. 016-2018, for services rendered in the performance of their official

duties:

• A foreigner who represents his/her country in Rwanda;

• Any other individual employed in any Embassy, Legation, Consulate or

Mission of a foreign state performing State affairs, who is a national of

that State and who owns a diplomatic passport;

• A non-citizen individual employed by an international organization

that has signed an agreement with the Government of Rwanda inaccordance with Rwandan laws.

Application activity 3.2

Explain the logic behind the fact that any non-citizen individual employed by

an international organization formed under international law is exempted fromPAYE in Rwanda?

3.3. Benefits in kind

Activity 3.3

Benefits in kind can be more difficult to value than regular employment income.

In which way this statement is true? What are the possible shortcuts used byRwanda Taxation System to overcome this barrier?

Benefits in kind received by an employee are included in taxable employmentincome in consideration of market value as follows:

3.3.1. Motor vehicle benefit in kind

The benefit of the provision of a motor vehicle for either official or private use, with

or without a driver during a tax period, is calculated as 10% of the employee’stotal emoluments minus benefits in kind.

If the car is rented by the employer, rather than owned, . The amount is

considered as any other allowance an employee has received as per article 15of Law 16/2018

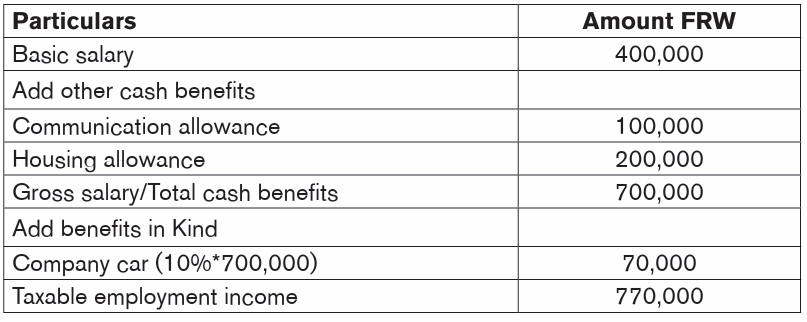

Illustration 1: Computation of Motor vehicle benefits

Rukundo has a basic salary of FRW 400,000 per month, he also receives a

communication allowance of FRW 100,000 per month, housing allowance of

FRW 200,000 per month and he also uses a company vehicle for both privateand official use.

Required: Compute the car benefit and taxable employment income

3.3.2. Loan interest benefit in kind

Loan and salary advances

There shall be added to the taxable income, benefits on a loan including advance

on a salary exceeding a three (3) months’ salary given to an employee valued at

a difference between:

a) The interest on loan, which would have been paid by the employee during

the month in which the loan was received, calculated at a rate of interest

offered to Rwanda;

b) And the actual interest paid by the employee in that month;

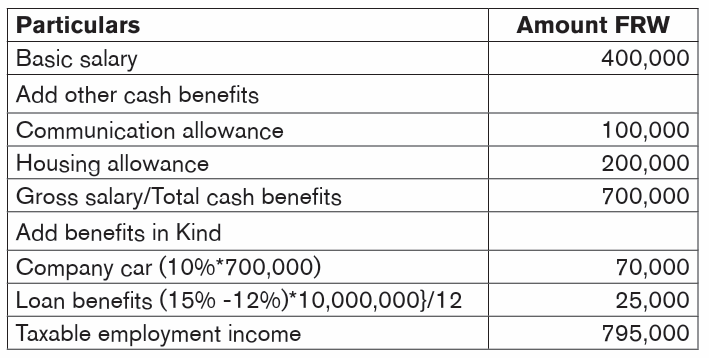

Illustration 2: Computation of Loan benefits

Rukundo has a basic salary of FRW 400,000 per month, he also receives a

communication allowance of FRW 100,000 per month, housing allowance of

FRW 200,000 per month and he also uses a company vehicle for both private

and official use. During the period, the employer gave him a loan of FRW

10,000,000 at an interest rate of 12%, per year when the interbank interest rate

is 15%.

Required: Compute the taxable employment income of Rukundo

Illustration 3: Computation of salary advance benefits

Uwimana received a salary advance of FRW 8,000,000 from his employer which

must be paid within one year. The basic salary of Uwimana is FRW 1,500,000

per month. She was not charged with any interest. The interbank interest rate is

8%. Compute his taxable benefit.

As said above, the three months’ salary is exempted 1,500,000 x 3 = 4, 500,000

The taxable benefit will be [8,000,000 – 4,500,000] x 8%

3.3.3. Accommodation benefits in kind

An employer may provide free residential accommodation to an employee. The

benefit of the provision of free accommodation, whether furnished or unfurnished,

is calculated as 20% of the employee’s total emoluments excluding benefits in kind.

If an employer rents a house rather than owning it, the amount paid is considered

as any other allowance as per article 15 of law 16/2018.

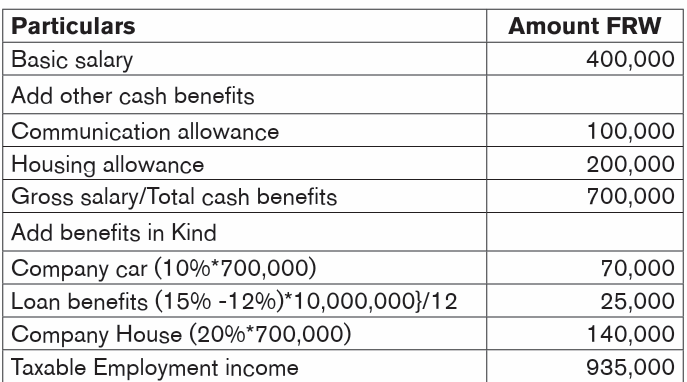

Illustration 4: Valuation of house benefits

Rukundo has a basic salary of FRW 400,000 per month, he also receives a

communication allowance of FRW 100,000 per month, housing allowance

of FRW 200,000 per month and he also uses a company vehicle for both

private and official use. During the period, the employer gave him a loan of

10,000,000FRW at an interest rate of 12%, per year when the interbank interest

rate is 15%. Rukundo also stays in a company house in Kabuga.

Required: Compute his taxable employment incomeSolution

Illustration 5: Valuation of benefits in kind:

Kirabo has a gross salary of FRW 620,000 she stays in the company house and

uses a company car for both private and official use. The employer also gave

her a loan of FRW 2,400,000 free of interest during the month. Also, assume

that the BNR interbank rate is 10%. The benefits and the taxable income are

determined as follows:

a) Housing = 20% of FRW 620,000 = FRW 124,000

b) Vehicle use = 10% pf FRW 620,000 = FRW 62,000

c) Interest = 10% of 2,400,000 times 1/12 = 20,000

d) Taxable income = FRW 620,000 + 124,000 + 62,000 + 20,000 =

FRW 826,000

In taxation, whatever kind of donation moving from the employer to the employee

is considered as a benefit in kind. Any other benefit which an employee receives

because of job or any assistance made to the family member of the employees

is considered as a benefit and therefore should be added to the employment

income. This is the case of domestic employee and school fees:

Domestic employees:

If the employer has domestic employees and those employees are paid by the

employer, the salary paid to the domestic employees is considered as a benefit

to the employee and therefore should be added to the employment income of

the employee.

School fees:

If the employer pays the school fees for the children of the employees, the

school fees paid should be considered as a benefit to the employee and added

to the employment income.

Illustration 6

Muvandimwe has a basic salary of FRW 300,000; he stays in a company

house and also uses a company car for both private and official use. His taxable

employment income will be

A. FRW 300,000

B. FRW 330,000

C. FRW 360,000

D. FRW 390,000Answer is D

Application activity 3.3

1. Robert Ngabonziza is provided with the use of a car owned by his

employer and a driver as a perk of his job. The driver is employed

separately by the employer and taxed under PAYE. Robert receives a

cash salary of FRW 4,200,000 per month. Compute Robert’s benefit in kind.

2. Nancy Umulisa borrowed FRW 5,000,000 from her company to pay

for her house’s repair. She is required to pay an annual interest rate of

1%. The National Bank of Rwanda is now lending money to commercial

banks at a 6.5% annual interest rate. Calculate Nancy’s benefit in kind.

3. Octave Murenzi obtains FRW 54,000,000 annual salary and FRW

700,000 bonus this tax period. In addition, his employer provides himwith a furnished house to live in. Compute Octave’s benefit in kind.

3.4. Categories of employee

Activity 3.4

In PAYE concerns, Rwanda Tax Legislation distinguishes three types ofemployees. List them and discuss their definitions.

There are three categories of employees:

(a) “Permanent employees” – this is everyone who does not fall into eithercasual Laboure's or employee with more than one employer.

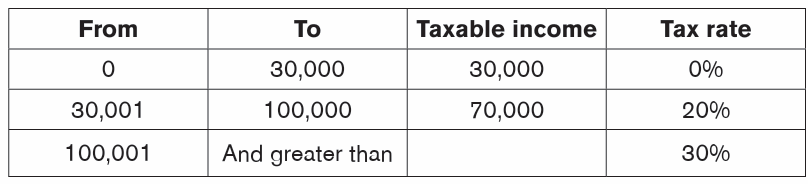

The following rates of income tax apply to monthly employment income forpermanent employees:

Monthly taxable income (in FRW)

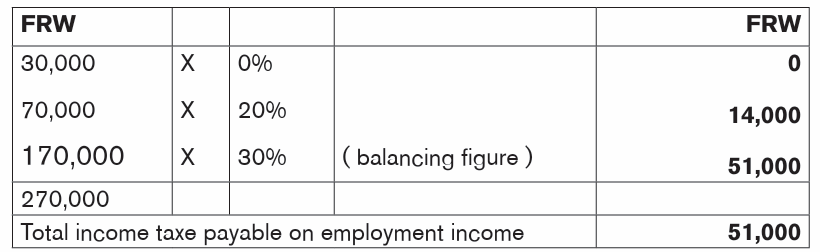

The following working is suggested for your income tax calculations for

permanent employees (based on monthly taxable employment income of FRW270,000):

(b) “Casual labourers” –this is an employee who fulfill the following conditions

at the same time:

• Performs unskilled labouring activities;

• Does not use machinery or any equipment requiring special skills; and

• Is engaged by an employer for a maximum of 30 days during a tax

period.

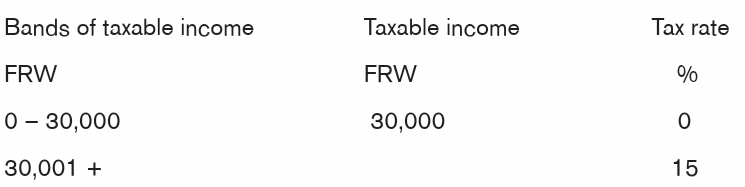

The following rates of income tax apply to monthly employment income forcasual Laboure's:

In brief, the tax law defines a casual labour as an employee who does not use

special skills on the job and does not exceed 30 days in a tax period. Casual

labour is taxed at a rate of 15% and the first FRW 30,000 is exempted

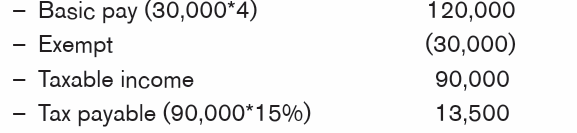

E.g. Jane was employed as a cleaner for four weeks. She is paid FRW 30,000perweek. Compute her taxable income and tax payable:

(c) “Employee with more than one employer”

– this is an employee who is

employed by more than one employer at the same time:

– The employer who pays them the highest taxable income is referred to as

the ‘first employer’;

– The first employer declares them as a ‘permanent employee’ and taxes

them as such;

– Any additional employers treat them differently (any additional employers

must withhold tax at 30% of their taxable income– Here there is the concept of second employer.

The law defines a second

employer as the one where the employee spends little time in the period.

Income from the second employment is taxed at a rate of 30%

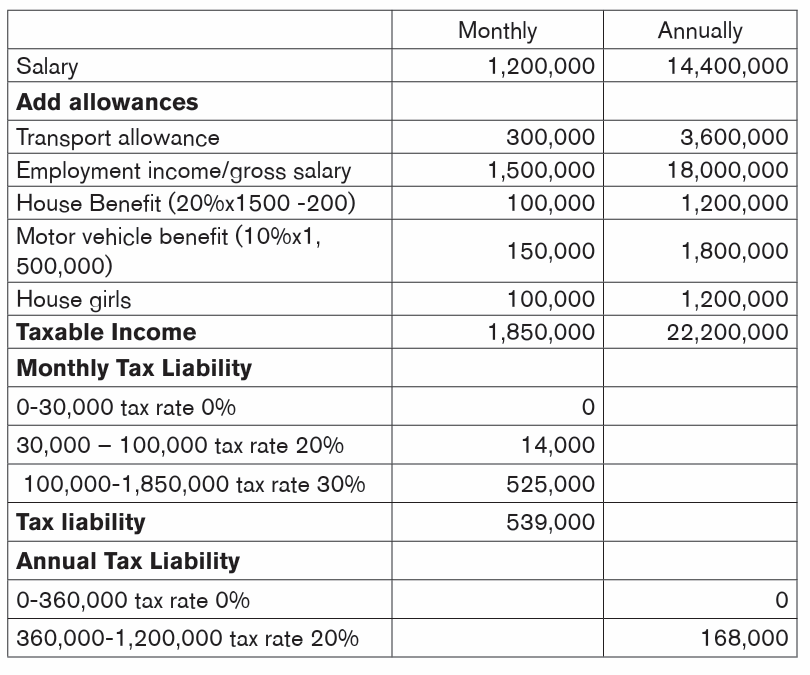

Illustration 1: Computation of taxable income and PAYE

Mujane is employed by KTB Musanze branch as the branch manager on the

following terms:

A monthly salary of FRW 1,200,000, Residential house where she contributes

FRW 2 00,000 per month, a company vehicle which she uses both private and

office, the company pays two house girls for her each FRW 50,000, transport

allowance of FRW 300,000 per month. During the month she went to Kigali to

attend the board meeting and she used FRW 120,000 on transport; she has

not yet received a reimbursement

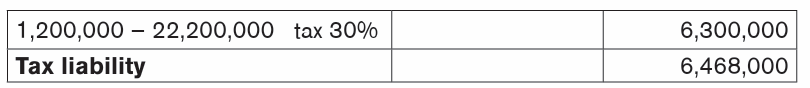

Determine the monthly and annual taxable income and tax liability of MujaneComputation of taxable employment income and tax liability

Illustration 2: Computation of taxable income and PAYE

Kayitesi is employed by Eco bank as the financial manager on the following

terms: Monthly salary of FRW 2,000,000 per month, a company house and

vehicle. Kayitesi uses the vehicle both private and business purpose. In addition

she also receives FRW 100,000 per month as transport allowance. The

company contributes for her FRW 50,000 per month in a licensed medical

provider. However, the general policy of medical insurance is FRW 20,000 to

all employees paid to RAMA. The bank also gave her an interest free loan of

FRW 3,000,000. Kayitesi employs one house girl paid by the company at FRW

60,000 per month. During the month she contributed FRW 95,000 as pay as

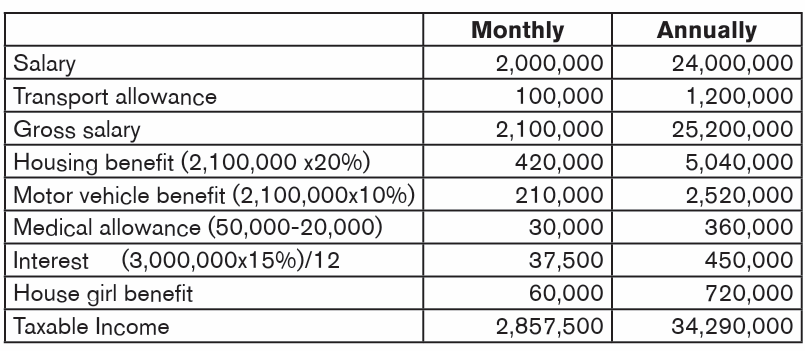

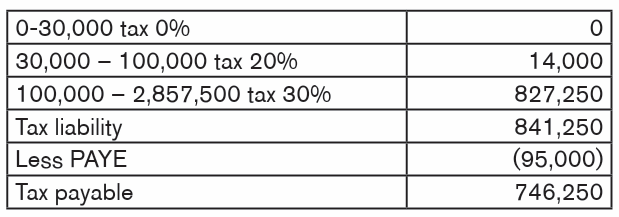

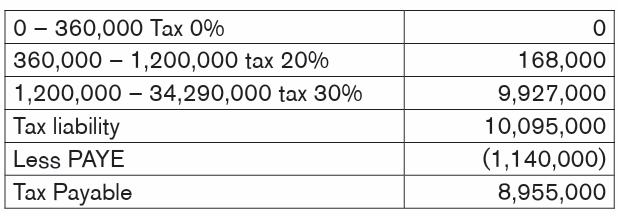

you earn (PAYE). Determine the monthly and annual taxable income and her taxliability. The interbank interest rate is 15%:

Monthly tax liability

Annual Tax Liability

Application activity 3.4

1. Dukore Company employs Muneza in an unskilled role on a temporary

basis. Muneza works for 20 days and Dukore Company pays him FRW50,000. Compute Muneza’s income tax payable

3.5. RSSB contributions and reliefs for employment income

Activity 3.5

Observe the picture here below of the Rwanda Social Security Board (RSSB)Headquarters and answer the question:

Refer to the picture above, which comment do you have on PAYE and Pension

Contribution management

Employee contributions to the Rwanda Social Security Board (RSSB) are

deducted from an employee’s paycheck in a similar manner to PAYE. Employer

contributions are also required and are deductible for tax purposes for the

employer.

These are withheld by the employer and paid to the Rwanda Revenue Authority(RRA) along with PAYE. Then the RRA passes them to the RSSB.

3.5.1. RSSB Contributions

RSSB contributions are paid by all employees and employers and these funds

the social security schemes run by the government.

The following schemes are worth looking into:

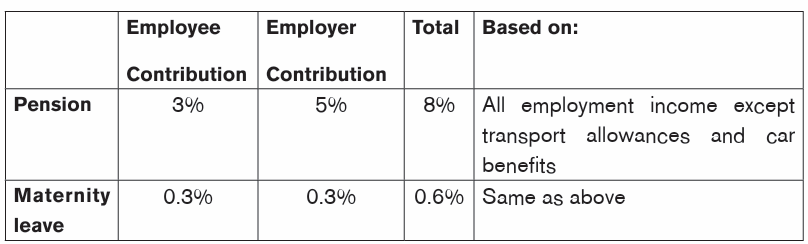

i. Pension and maternity leave schemes – mandatory for allemployers.

The rates of contributions required are:

Tax base = Cash benefits + benefits in kind – Transport allowance/car benefit

ii. Medical scheme

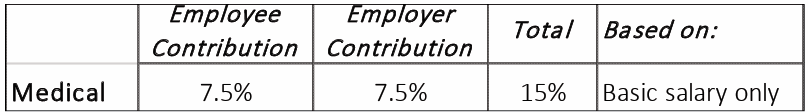

This scheme is compulsory for public sector employers but optional for employersin the private sector. It provides extra benefits to employees

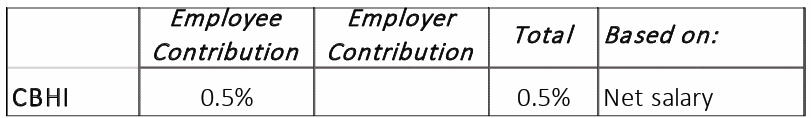

iii. Community-Based Health Insurance Scheme

This scheme is compulsory for employees and is deducted from the employee’s

net salary and remitted by the employer.

All employers must collect and remit these subsidies to the Rwanda Social

Security Board (RSSB) on a monthly basis not later than the 15th day of thefollowing month.

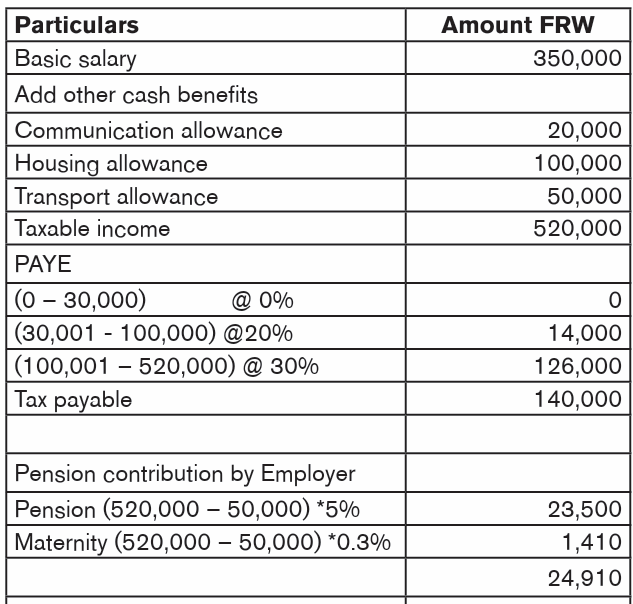

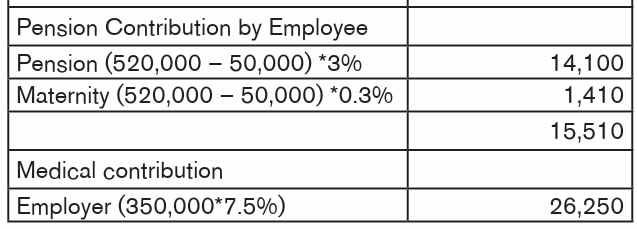

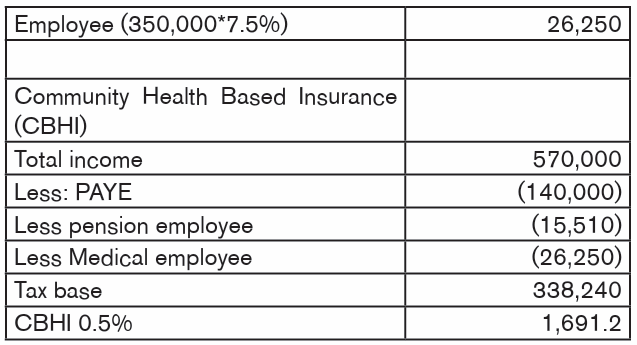

Illustration on computation of Pension and medical contribution

Lydia is employed by Kam investment Limited as the accountant on the following terms

a) Basic salary per month FRW 350,000

b) Communication allowances FRW 20,000 per month

c) Housing allowance FRW 100,000 per monthd) Transport allowance FRW 50,000 per month

Required: Compute the taxable income, PAYE, Pension contribution andMedical contribution

Answer:

3.5.2. Employee contributions

If the scheme applies, the employer withholds these contributions and pays

them to the RSSB on the employee’s behalf. They are not a tax-deductible

employment expense because PAYE is applied to gross taxable employment

income before RSSB contributions are deducted.

3.5.3. Employer contributions

These are not subject to employee taxation. When calculating taxable business

profits, they are allowed as an expense for the employer.

3.5.4. Pension relief

As per the law of 2018, an employee can contribute any amount. Thus, thethreshold of 10 % of salary not exceeding FRW1,200,000 is no longer binding

Application activity 3.5

Marcel Manzi is employed by Bahoneza Ltd. He receives a monthly basic

salary of FRW 950,000 and a cash allowance for living accommodation of

FRW 470,000 and is provided with a car giving rise to a benefit-in-kind of

FRW 142,000. Bahoneza Ltd has not elected to use the medical scheme.

Calculate the amounts which Bahoneza will pay over to the RRA in employerand employee contributions to the applicable RSSB schemes.

3.6. Declaration and Payment

Activity 3.6

Observe the picture here below of Rwanda Revenue Authority (RRA)Headquarters and answer the question:

Refer to the picture above, who pay PAYE and RSSB Contributions to

respective offices

3.6.1. Payment deadlines

The standard tax period for PAYE and RSSB is one month. This means that

PAYE is declared and paid on a monthly basis.

However, if an employer has an annual turnover of or below FRW 200,000,000

then they may choose to pay on a quarterly basis (although the RSSB

contributions must still be declared and paid on a monthly basis).

For example, the tax for the:

Taxpayers who declare PAYE on a quarterly basis have four quarters: the end of

May, August, November, and February.

The declaration and payment must be made by the 15th of the month after the

end of the tax period, whether monthly or quarterly.

• Month of March must be declared and paid by 15th April

• Quarter March to May must be declared and paid by 15th June

If the deadline falls during the weekend or on a public holiday, the next working

day will be considered as the deadline.

3.6.2. Declarations

Previously, PAYE and RSSB contributions were declared separately; however, a

unified declaration has been introduced and all newly-registered employers

must use it. It is definitely advised that current employers use it.

Each employee’s information, as well as their taxable pay and perks for which

PAYE is due, will be included in the declarations. To arrive at the overall liability,

a tax calculation for each employee will be performed. On different tabs of the

declaration, details of casual laborers and those for whom this employer is their

“second” employer is noted.

Depending on the circumstances, some employers may be excluded from

paying PAYE. If this is the case, an individual must calculate PAYE on their own

and remit it to the tax administration on a monthly basis.

3.6.3. Statement to employee

Employers are required to provide each employee with a statement each tax

period showing:

• The employee’s name

• The amount and type(s) of income received

• The amount of PAYE and RSSB contributions that have been withheldand paid on their behalf.

Application activity 3.6

Tracy Mwiza has just accepted a job working for Nziza as a shop assistant for

Nziza’s retail business, which has a turnover of FRW 30,000,000 per year.

Nziza has never previously employed anyone, and this is Tracy’s first job since

leaving school.Explain briefly to Tracy how her tax liability on her employment income will be paid.

Skills Lab 3

Through internet or after RRA officer presentation, students are required toprepare written report on PAYE and RSSB contributions in Rwanda.

End of unit assessment 3

1) Thierry Ngabo has an annual salary of FRW 75,000,000. He is provided

with unfurnished accommodation and a car for his private use, which are

both owned by his employer. Thierry Ngabo has three children attending

school and his employer provides an annual education allowance of

FRW 3,000,000 per child. Thierry Ngabo contributes FRW 50,000 per

month to a privately qualified pension fund.

Calculate Thierry Ngabo’s monthly income tax payable and PAYE.

2) Other sources of government revenue include “Rates,” which are

voluntary payments made to the government for specific services such

as medical insurance, pension funds, and so on. Let’s pretend that

an employee was owed the following monthly remuneration during a

certain month: Basic salary: FRW 885,000, responsibility allowance:

FRW 796,000, performance pay increase: FRW 190,500, transport

allowance: FRW 250,000, and post incentives: FRW 305,000 This

employee was also provided housing in kind for the month.

Required:

a) Calculate the employee and employer contributions to the pension fund.

b) Calculate the contribution of maternity leave on both sides as described

above.

c) As before, calculate the medical scheme (old RAMA) on both

sides.

d) Determine the employment tax (P.A.Y.E.)

e) Determine the NET SALARY

f) Calculate the contribution to the Community-Based Health Insurance

Scheme

g) Compute his take-home pay.

3) Karebu was employed as a cleaner in KY Limited for a period 6 months

and is being paid FRW 80,000 per month. Karebu will be taxed as:

A. Casual Labour

B. Permanent employee

C. Second employment

D. None of the above

4) Kamisi was employed as a casual labour for 3 weeks and is paid FRW

50,000 per week. His tax liability will be

A. FRW 45,000

B. FRW 22,500

C. FRW 18,000

D. FRW 20,000

5) Mugisha gets a basic salary of FRW 100,000, transport allowance of

FRW 50,000 and stays in the company house. His taxable income will be

A. FRW 150,000

B. FRW 180,000

C. FRW 165,000

D. FRW 170,000

6) The gross salary of Harelimana is FRW 500,000, he uses a company

car and stays in the company house. His tax liability will be

A. FRW 134,000

B. FRW 179,000

C. FRW 195,000D. FRW 75,000