Topic outline

Unit 1: Ledgers and Trial Balance

Key unit competence

To be able to prepare ledger accounts and trial balance.

Introduction

It’s likely that you have heard the saying, “It costs money to make money.”

A businessperson contributes money and, ideally, makes good use of it to

create even more value.

You were introduced to Accounting prime books in Senior Five unit 10, for

you to acquire the necessary skills from this unit; whenever you attempt

a question in arithmetic, you try to verify whether your answer is correct.

Similarly, an accountant also wants to be sure that the ledger accounts she

or he has prepared are correct regarding the amount, side, balance, etc. To

determine whether the debit or credit amounts recorded in the ledger are

correct, you must prepare the trial balance. This unit will teach you how toprepare ledgers and a trial balance.

Introductory Activity

In Senior 5 unit 10, you studied accounting prime books, in which you

recorded a variety of transactions carried out by various businesses as

well as those for your club activities in different prime books (Purchases

journal, Sales journal, Sales returns journal, Purchases returns journal, Cash

book and General journal). As a result, it is important to continue posting

transactions to the respective accounts for the business’s financial status

to make more sense and assist the entrepreneur in making an appropriate

decision.

Use your previous experience and accounting skills to answer the following

questions.

a) Where do you think the information from journals is posted?

b) Why is posting accounting information important in business?

c) On 1st. June.2023, John started a business with 200,000FRW, of which

100,000FRW was at the bank account.

2nd June.2023 he purchased a machine to use in his business and paid cash80,000FRW.

Required:

i) Journalize the transactions above.

ii) Post the information to the appropriate ledger.iii) Prepare a trial balance for John’s business.

1.1. Ledger

Learning Activity 1.1

The average businessperson has so many matters to attend to, and his/her

transactions are so numerous that it is impossible to remember everything

that happens chronologically in journals. Using your prior knowledge

related to transactions.

a) What is meant by a term ledger and posting?b) Show the different classifications of ledgers.

1.1.1. The meaning and types of ledgers

A ledger is a collection or a set of accounts of a business. While the

journal records all transactions chronologically, ledger accounts classify the

transactions and record those of similar nature in one account. The process

of transferring information from the books of original entry to the ledger

accounts is called posting.

For instance, all transactions related to cash movement must be recorded

together under one statement called “Cash account”,

There are several types of ledgers in accounting. In this unit, focus is put on

three types of ledgers which include:a) General ledger: is a ledger that contains all accounts of the business

except sales and purchases. E.g., assets, liabilities, incomes, expenses,

and capital.

b) A sales ledger/ Debtors ledger is a collection of all accounts of people

or businesses to whom the business has sold goods on credit (debtors).

c) Purchases ledger/Creditors ledger is collection of accounts of people

or businesses from whom the business has bought goods on credit(creditors).

Skills Lab Activity

Case study:

Mupenzi, a businessman that deals in fruits, visits an organization that

offers rural business owners small grants to expand their businesses. The

review panel conducted a short interview to gather some information

about Mupenzi’s business to determine if he qualifies.

Panel: How much have you spent on equipment and materials for your

business so far?

Mupenzi: It’s quite some amount. More than 100,000.

Panel: How much have you sold this last quarter?

Mupenzi: Business hasn’t been good because of the heavy rains. A bit

lower than last year.

After the interview, Mupenzi learnt that he did not qualify for the grant.1. Why do you think Mupenzi failed to get the grant?1.1.3. Preparation of ledgers

2. What should Mupenzi have done differently to qualify him for thegrant?

After recording accounting transactions in appropriate accounting prime

books i.e.: general journal, purchases journal, sales journal, return inwards

and return outwards journals, as well as different forms of cash books in

chronological order, the next important step is to post accounting information

from different prime books listed earlier to respective ledgers. It is in the

ledger, that all transactions of similar nature are recorded together under one

account.

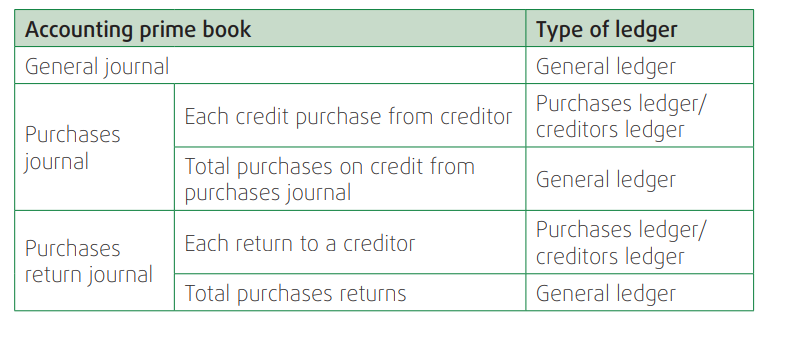

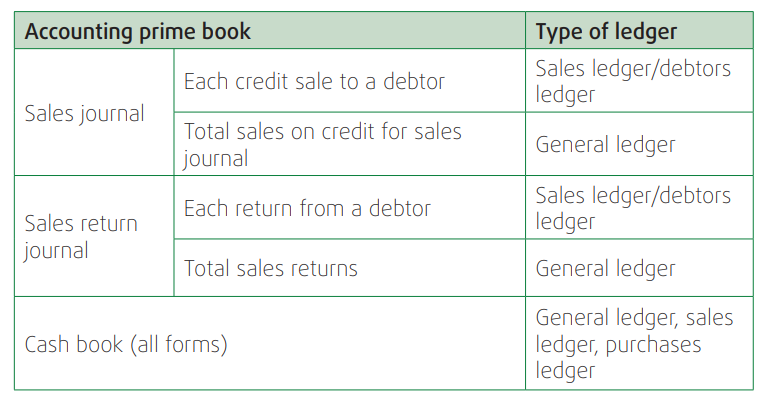

The table below summarises how and what to post from prime books toledgers

A. Purchases ledger/ Creditors’ ledger

The creditors’ ledger accumulates information from the purchases journal.

The purpose of the creditors’ ledger is to provide knowledge about which

suppliers the business owes money to, and how much. This is achieved by

posting information from the purchases journal to creditors’ ledger.

Normally, every account should be balanced off at the end each month.

Balancing an account off is the adding of both the debit and credit sides

in order to make the two sides equal. When balancing off an account the

following steps are put into consideration:

Step 1: Add the two sides separately to find out the total of each

Step 2: Subtract the smaller side total from the bigger side

Step 3: Record the differences on the smaller side and call it balance carried

down (bal c/d) or balance carried forward (bal c/f) using the last date of the

month.

Step 4: Now both sides are equal.

Step 5: Put balance c/d on the opposite side (bigger side) of the account and

call it balance brought down (bal b/d) or balance brought forward (bal b/f),

using first date of the next month or period

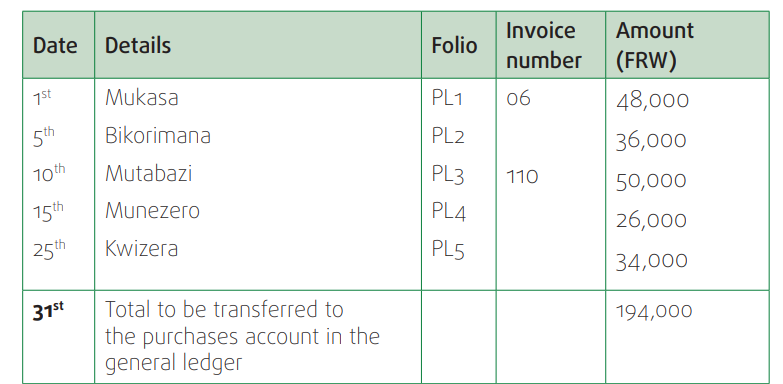

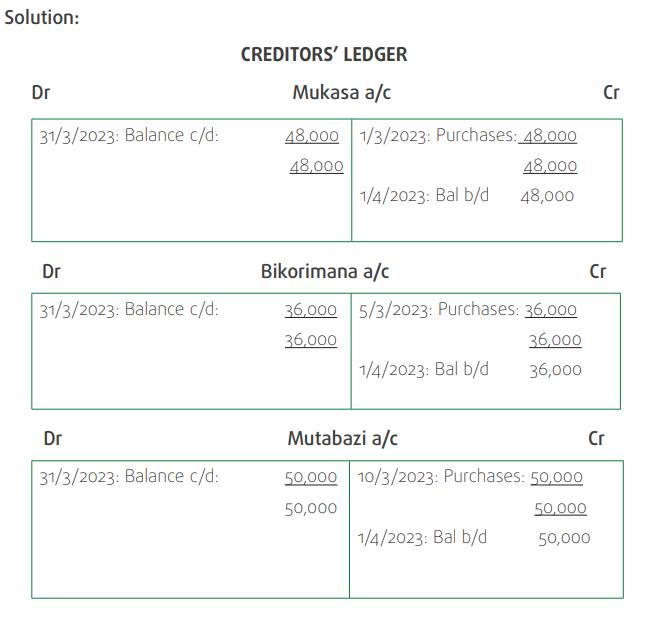

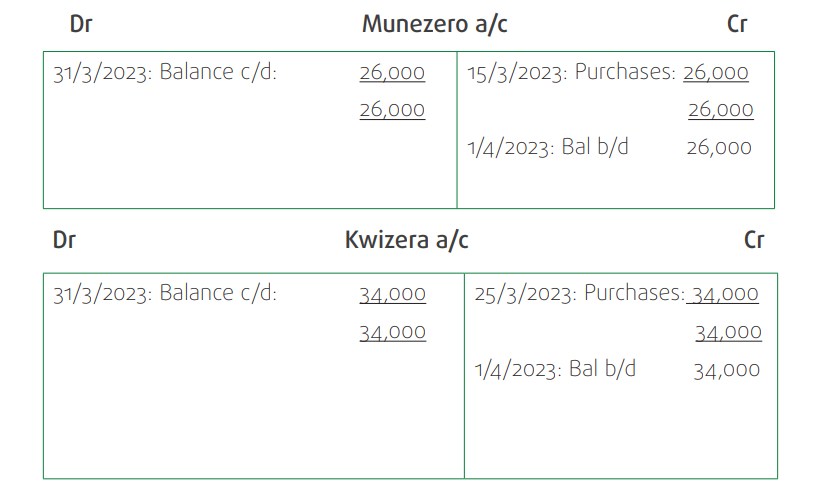

Example 1:

Given the following Akeza’s purchases journal, post the information to the

creditors’ ledger.UNIT 1

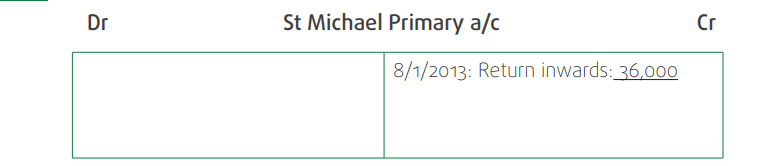

AKEZA’S PURCHASES JOURNAL FOR THE MONTH OF MARCH 2023

Note: The total of credit purchases is debited in the purchases account

which is opened up in the general ledger.

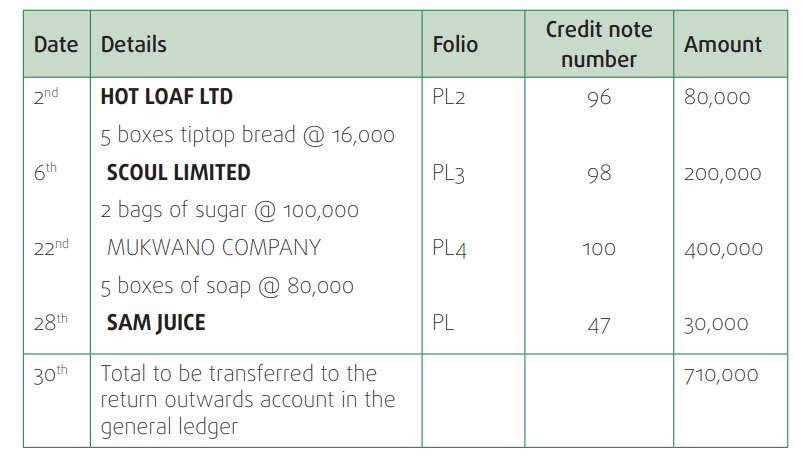

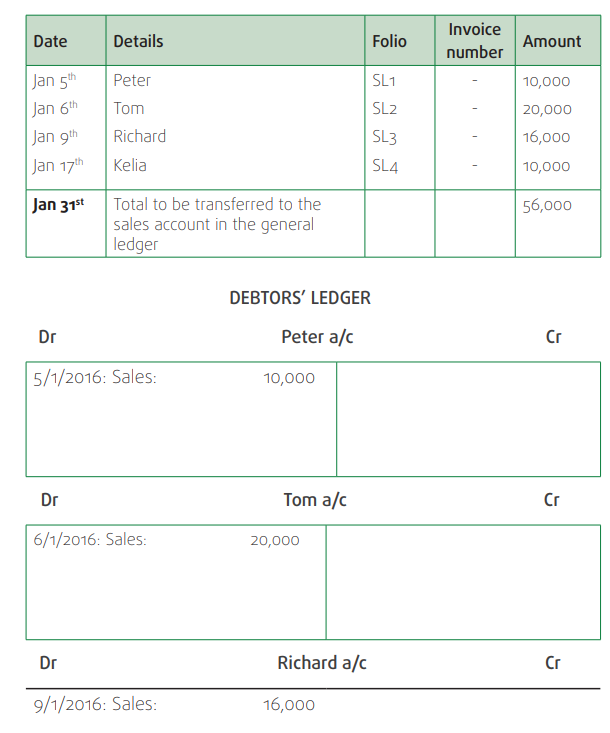

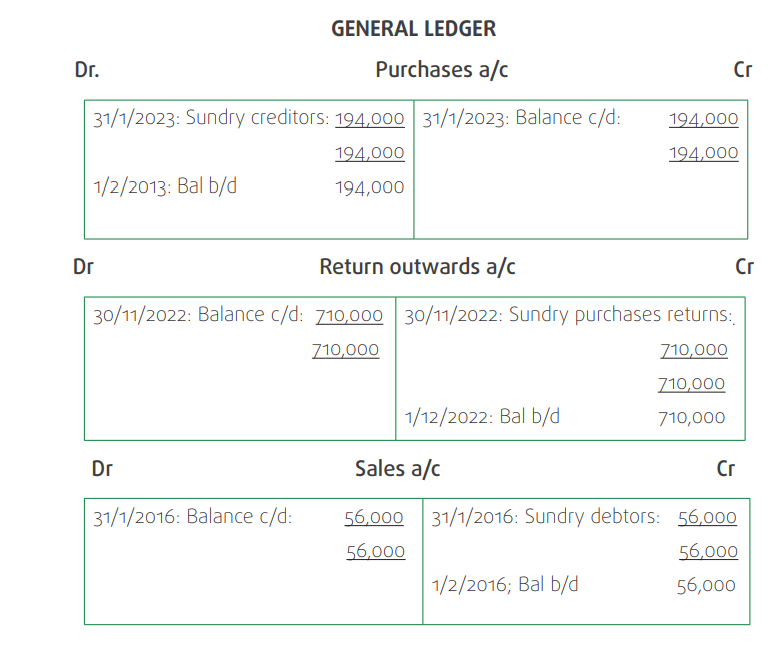

Example 2:

Given the following Kimironko wholesalers’ purchases returns journal, post

the information to the creditors’ ledger.

KIMIRONKO WHOLESALERS’ PURCHASES RETURNS JOURNAL FOR THEMONTH OF NOVEMBER 2022

Note: The total of purchases returns is credited in the return outwards

account which opened in the general ledger.

B. Sales ledger/Debtors’ ledger

The debtors’ ledger accumulates information from the sales journal. The

purpose of the debtors’ ledger is to provide knowledge about which customer

owes money to the business, and how much. This is achieved by postinginformation from the sales journal to debtors’ ledger.

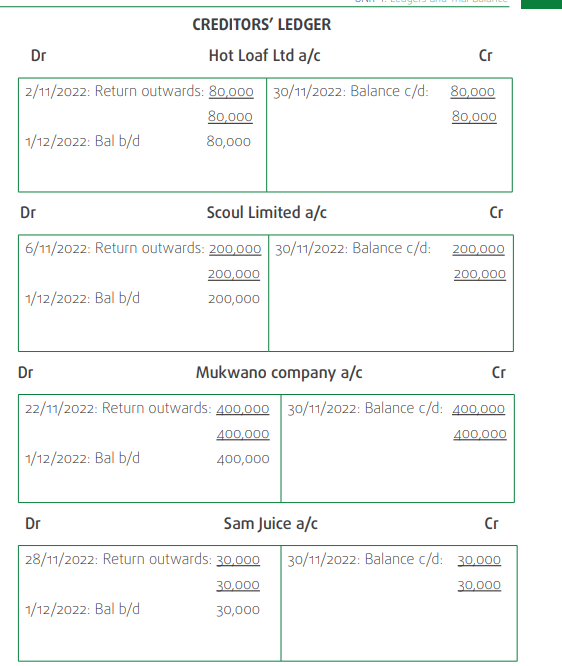

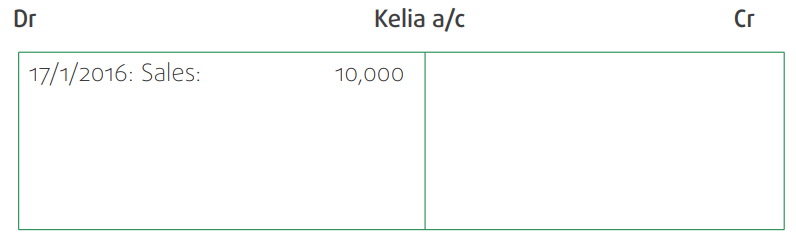

Example 3:

Given the following Alain’s sales journal, post the information to the debtors’ledger.

ALAIN’S SALES JOURNAL FOR THE MONTH OF JANUARY 2016

Note: The total of credit sales is credited in the sales account which

opened in the general ledger.

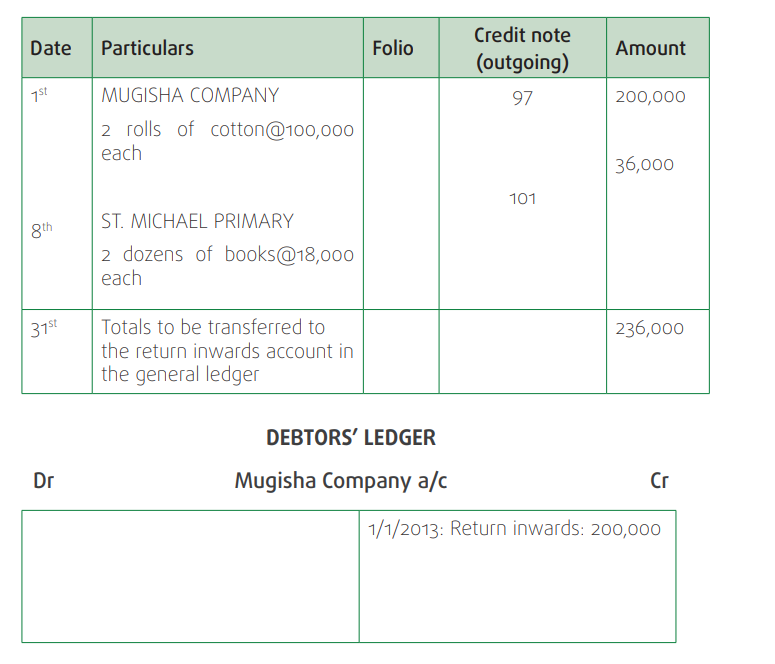

Example 4:

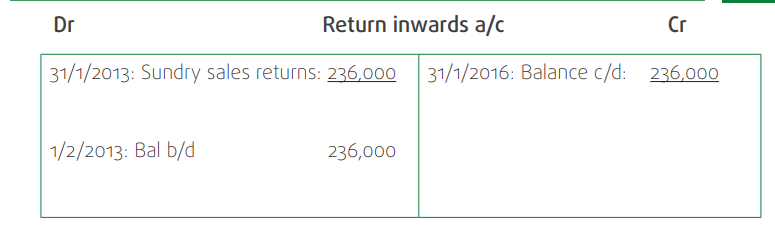

Given the following Gakuba’s sales returns journal, post the information to

the debtors’ ledger.

GAKUBA WHOLESALERS’ SALES RETURN JOURNAL FOR THE MONTH OFJANUARY 2013

Note: The total of sales returns is debited in the return inwards account

which opened in the general ledger.

C. General ledger

The general ledger contains all other accounts that are not kept in any other

ledger e.g., buildings, furniture, and stock account.

Note: personal accounts of debtors or creditors who do not arise out of sale

or purchase of goods on credit are kept in the general ledger e.g. debtors as

a result of sale of fixed assets on credit and expenses creditors.

Let us first of all post the totals of purchases journal, purchases return journal,sales journal, and sales returns journal used above:

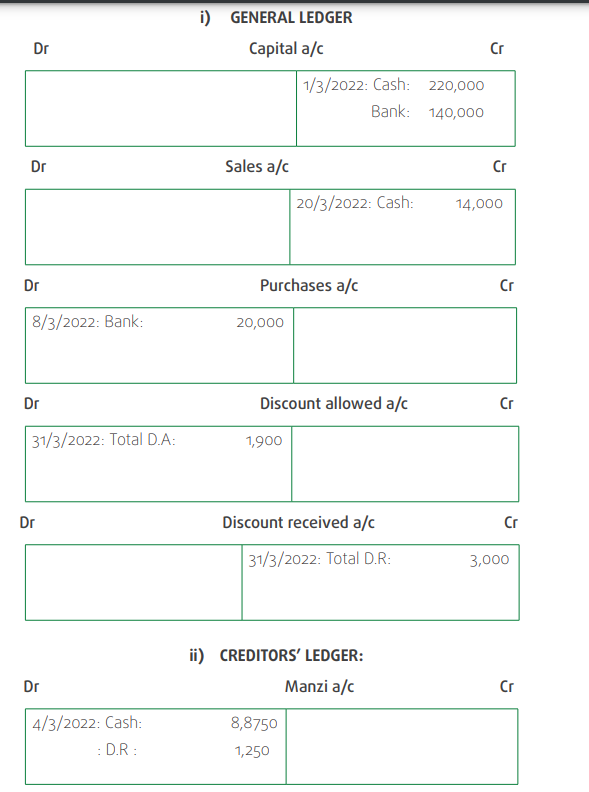

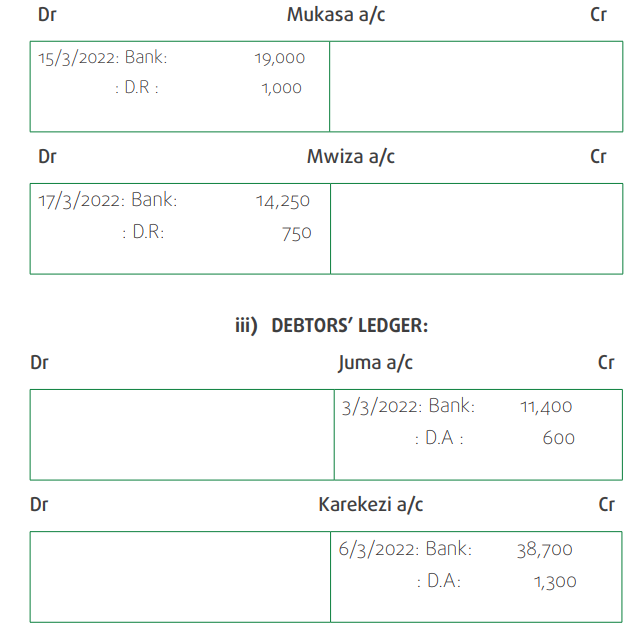

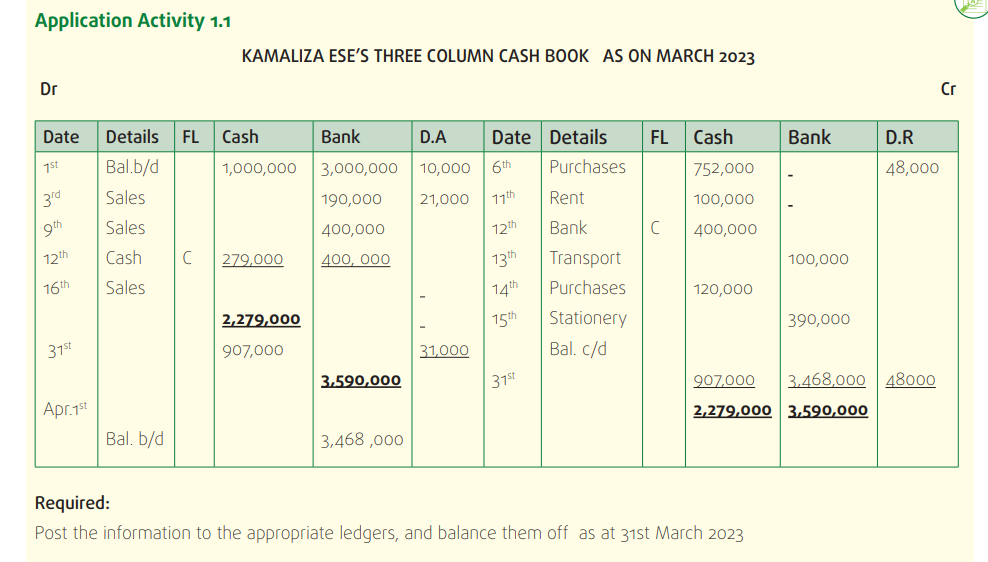

It is good time to remember that the records in the cashbook are posted to

the general ledger, creditors’ ledger, and debtors’ ledger depending on what

transaction took place.

Notes:

◾ When transactions are recorded in the cashbook, cash and bank

accounts are not opened up in the ledger. Because the recording of

transactions in the cash book takes the shape of a ledger account.

The cash book serves the purpose of a ledger account as well as a

journal for cash and bank accounts.◾ Contra entry transactions are not posted to the ledger because theirExample 5:

double entry is completed within the cashbook.

◾ Discount allowed and discount received are posted to discount

allowed account and discount received account respectively in the

general ledger

◾ While posting information from any type of cash book,

i) Details from the debit side are names of accounts to be opened

in the ledger and credited; and

ii) Details from the credit side are names of accounts to be opened

in the ledger and debited.

◾ The balance brought down (bal b/d) or balance brought forward (balb/f) is posted to the capital account in the general ledger.

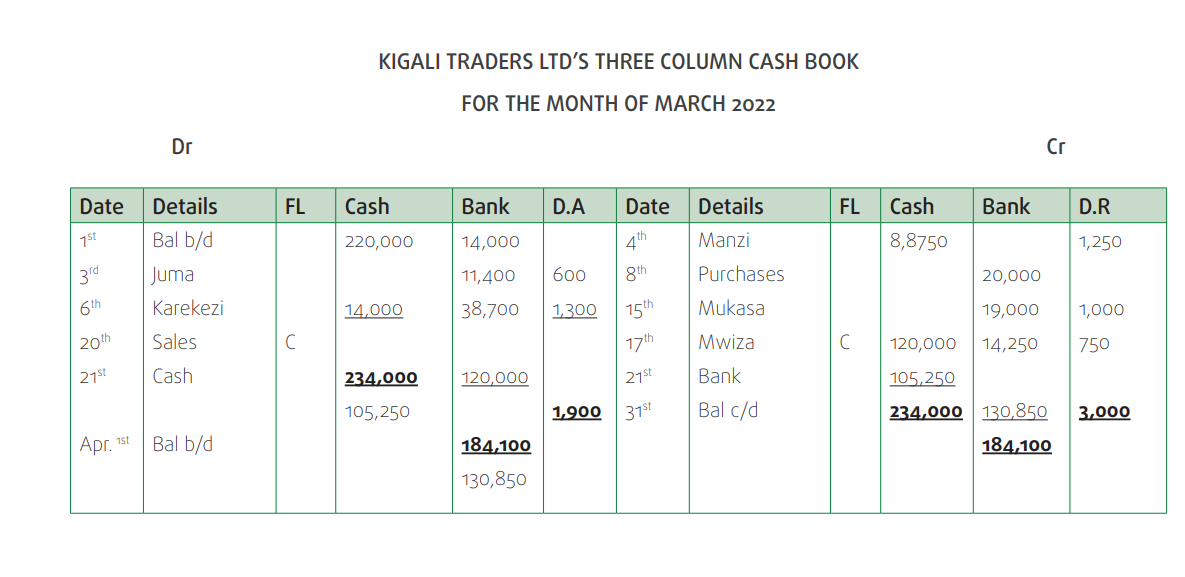

Given the cash book below of Kigali Traders Ltd, post the information to the

respective ledgers. Personal accounts appearing in the cash book below are

for businesses that one-time transacted goods on credit with Kigali TradersLtd.

Exercise:

Following the clear steps of balancing accounts, balance off accounts in allthe above ledgers.

1.2 Trial Balance

Learning Activity 1.2

1. At the end of every month, Mukamana draws a list of accounts to

check whether her records are properly recorded with arithmetical

accuracy or otherwise; she passes necessary accounting records

to correct detected errors in her books of accounts in case they

are not appropriately recorded.

i) Referring to what Mukamana does at the end of e each month,

what do we call that exercise in accounting?

ii) What do you understand by the term trial balance?

2. Do you think it is important to extract a trial balance? Justify your

answer.

1.2.1. Meaning of a trial balance

A trial balance is a list of the debit and credit balances extracted from the

ledgers at a particular date.

It is referred to as a tool to prove the arithmetical accuracy of the entries

made in the ledger. If the records have been correctly maintained based on

a double entry system, the totals of the credit and debit would be equal to

each other.

1.2.2. Importance of a trial balance

◾ It is used as proof of the arithmetical accuracy of the entries made

in the ledger.

◾ The trial balance helps to know the assets and liabilities of a business

by just looking at it.

◾ Easy preparation of final accounts to determine the profit or losses

of the business.

◾ One may rely on the results derived from the trial balance when the

total of debits equals the total of credits.

◾ Arithmetical errors made during recording and posting of transactionsare easily detected by preparing a trial balance.

1.2.3. Preparation of a trial balance

Trial Balance is not an account. It is only a list or schedule of balances of

ledger accounts. it I prepared following the steps below:

Step 1: Post all the journal entries to the appropriate ledgers.

Step 2: Balance off all ledger accounts and determine the credit or debit

balances for each ledger account.

Step 3: List all the accounts with their debit or credit balances. Ensure the

debit balances are in one column and the credit balances are in another.

Step 4: Add up all the credit balances and add up all the debit balances.

Step 5: The total of the debit balances should be equal to the total of the

credit balances. If the totals are unequal, recheck the process to identify and

correct the errors.

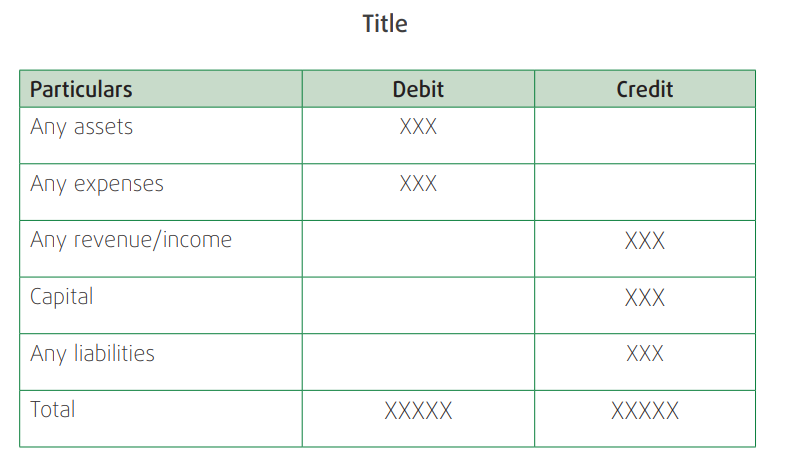

Note: The accounts having a debit balance are entered in the debit amount

column, and the accounts having a credit balance are entered in the credit

amount column.Format of a trial balance

Note: All expense and asset accounts normally have debit balances and are

listed in the debit column, and all liability and income accounts normally have

credit balances and are listed in the credit column.

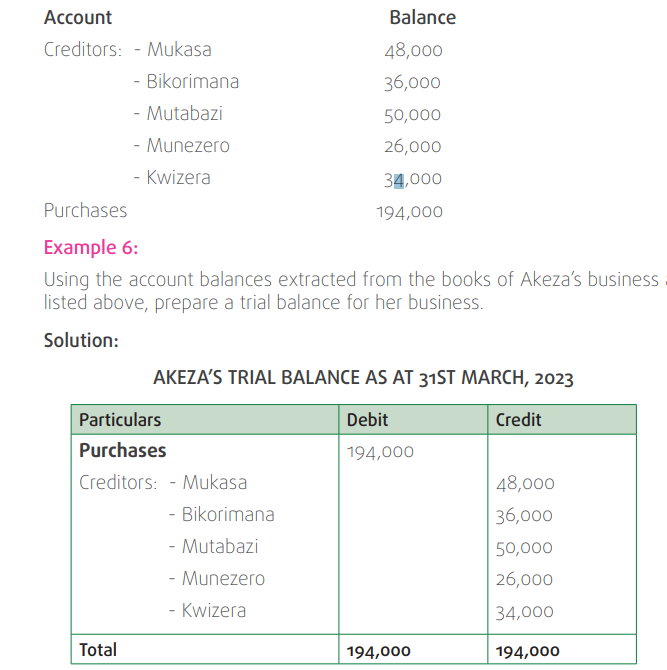

Let us use the example on page 4 to make a list of accounts of Akeza’sbusiness as at the end of March, 2023

Note: when details about opening and closing stock balances are given, the

opening stock balance is used in the trial balance while the closing stock

balance is used to prepare the income statement and balance sheet.

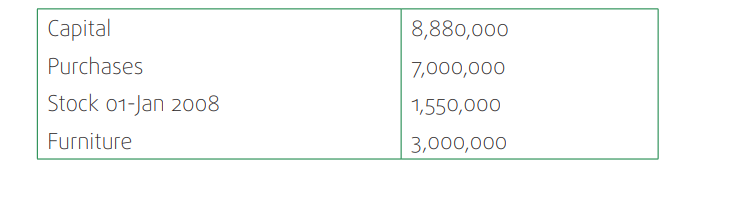

Example 7:

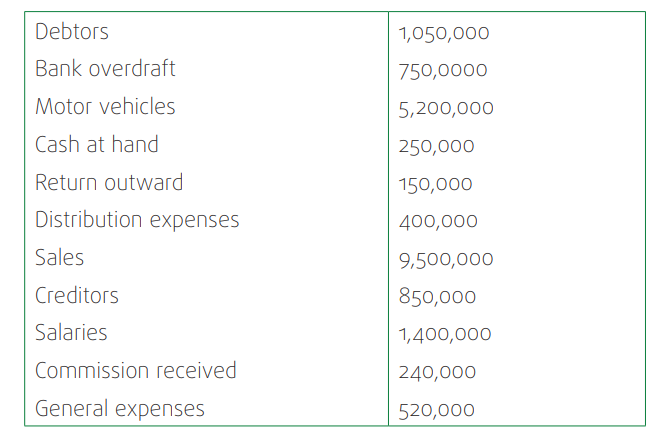

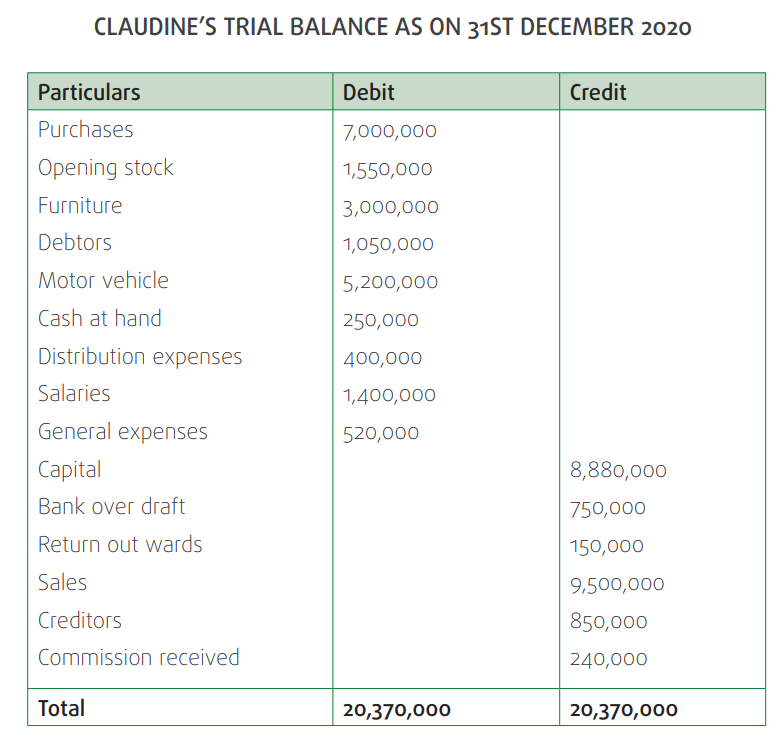

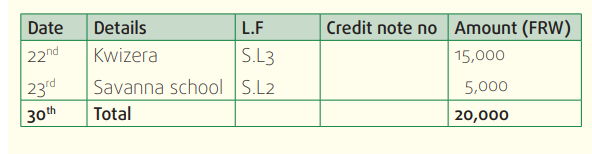

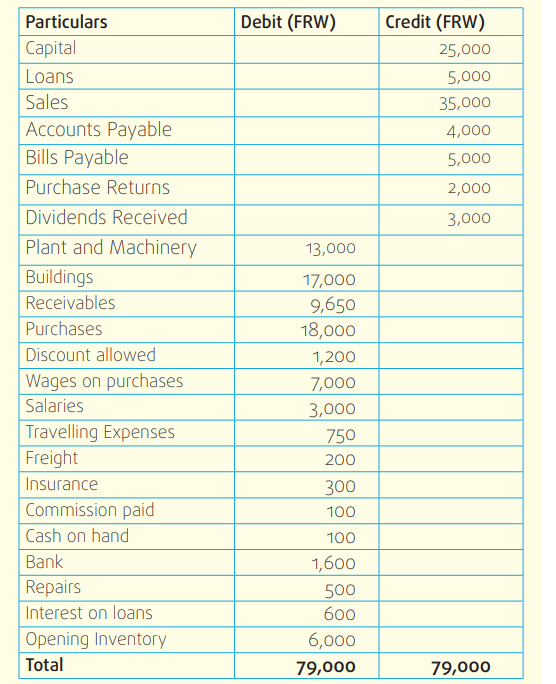

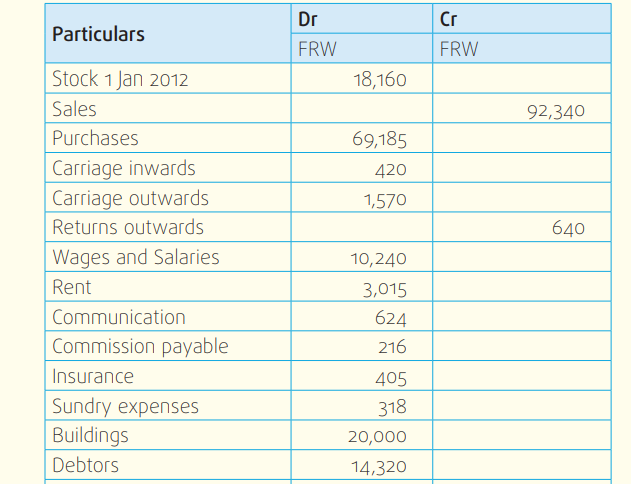

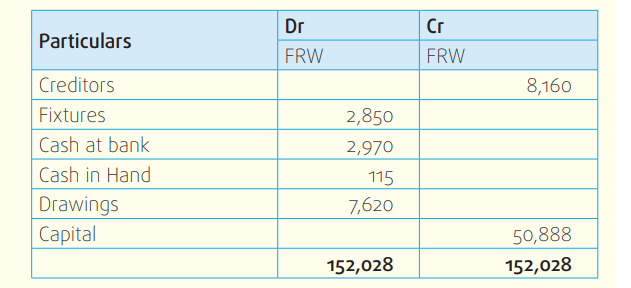

The following balances were extracted from Claudine Enterprises’ books as ofDecember 2020. Extract the trial balance.

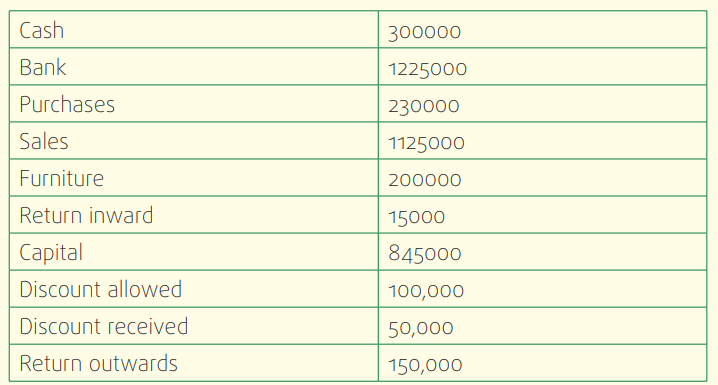

Application Activity 1.2

The following balances were extracted from the books of Umucyo BusinessClub as at the end of December 2020. Prepare the trial balance.

Additional information:

The closing stock as at 31st December 2023 was 28, 000FRW.

End of Unit Assessment

I. Project Activity

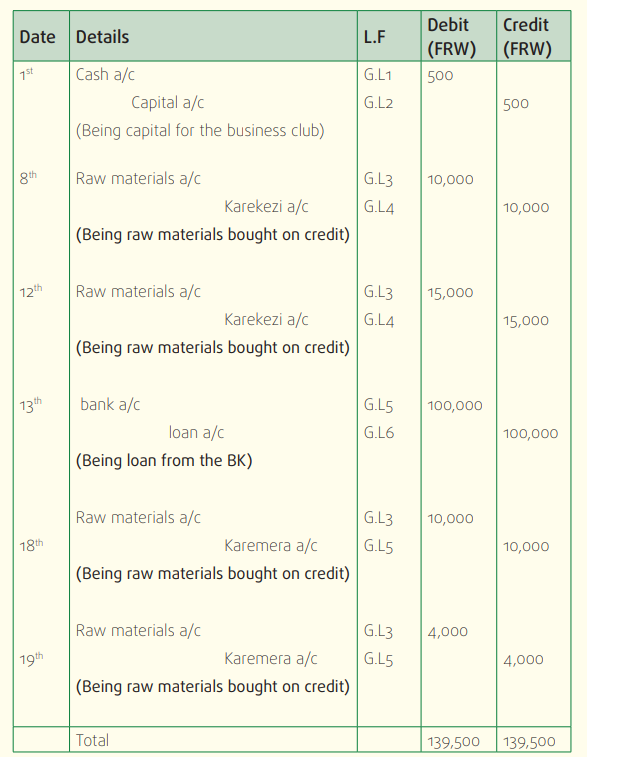

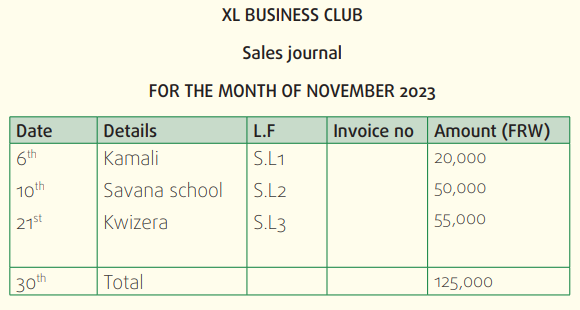

Given the following prime books extracted from XL business club’s

accounting books as at 30th November 2023, post the information torespective ledgers and there after extract a trial balance

XL BUSINESS CLUB

General journalFOR THE MONTH OF NOVEMBER 2023

XL BUSINESS CLUB

Return inwards journal

FOR THE MONTH OF NOVEMBER 2023

2. Explain the following terms:

i) Ledger

ii) Trial balance

3. Why is important to prepare trial balance.

4. Explain the steps that are taken to prepare a Trial Balance

5. Explain the term ‘Posting’?

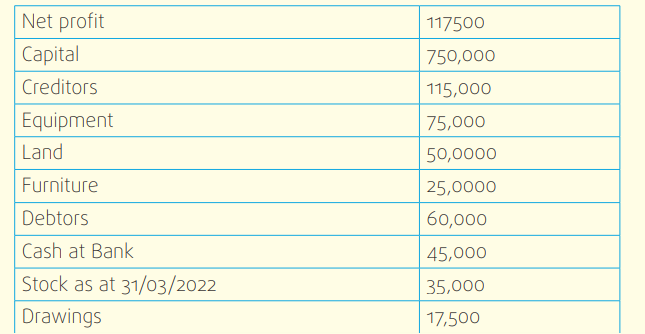

6. The following information was extracted from the books of Kezalimited on 31st December 2020.

Required: Prepare the Keza limited’ trial balance as on 31st December 2020

Files: 2Unit 2: Financial Statements

Key Unit Competence

To be able to prepare a balance sheet, income statement, and cash flow

statement.

Introduction

Business enterprises in today’s world take it as a requirement to ascertain

their performances at the end of every year (trading period). This can only be

attained by preparing different financial statements (final accounts).

The knowledge and skills acquired from the previous unit will enable you to

better understand the source of information used in financial statements.

This unit will enable you to prepare a balance sheet, income statement and

cash flow statement.

Introductory Activity

Read the scenario below and use it to answer the questions that follow.

James is a local entrepreneur in Huye town. He is so passionate and

committed to solving community problems in his hometown and the

nation at large. This made him start a crafts business. He travels to villages

and collects crafts from women groups to sell in his shop. His shop is

strategically located to attract tourists visiting Nyungwe Forest. James

has a book to record all daily sales, supplies, and operating expenses. He

thought it was the best way to keep track of all business transactions.

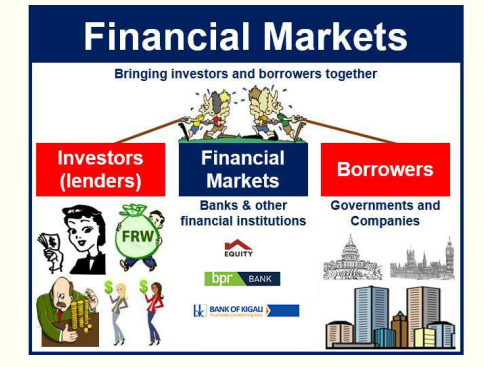

He desired to expand the business and believes that 5 million Francs would

be enough. His sister Uwera, a student of entrepreneurship, advised him to

approach investors and banks and pitch his business to convince them to

provide funding to enable him meet the business’s growth needs.

The investors only gave him 10 minutes to explain the profitability of his

business, the net financial position, and the financial projections he needed

for the next two years, but this presented a challenge because the book

he kept could not easily provide this information in the given time, so hefailed to convince the investors and missed out on the funding.

James realised he needed to organise the financial information he was

keeping in a specific order so that he could make quick decisions and make

it more presentable and easier to explain to investors.

Questions.

1. What types of documents would James have used to organise his

business’s financial data before presenting it to investors?

2. Do you think it was necessary for James to prepare those

documents? Justify your answer

3. What key information should be included in those documents?

2.1. Meaning and importance of Financial Statements

Learning Activity 2.1Study the quote below and respond to the questions that follow

Questions. a) What does the quote above mean to you as a student of2.1.1. Meaning of Financial Statements

a) What does the quote above mean to you as a student of2.1.1. Meaning of Financial Statements

entrepreneurship?

b) Why does the author of the quote emphasise the reliability of the

financial statements?

c) What do you mean by financial statements?

d) Why should entrepreneurs prepare financial statements for theirbusinesses?

Financial statements are the reports prepared by a company’s management

to present the financial performance and position at a point in time. External

users of accounting information like investors and creditors are more interestedin financial statements than books of accounts.

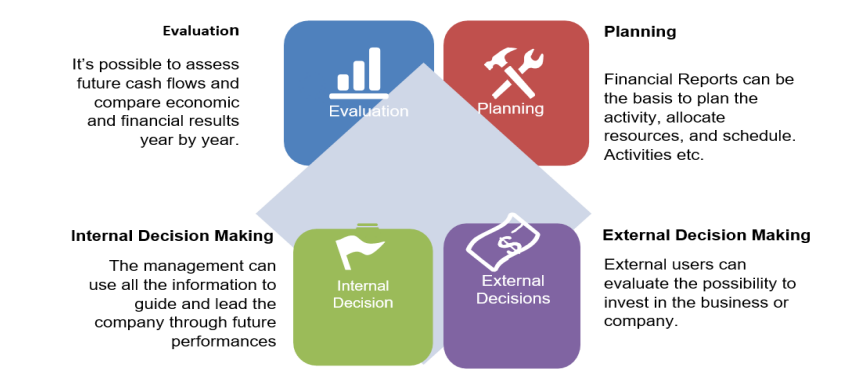

2.1.2. Importance of Financial Statement

Other importance of financial statements may include.

◾ To determine whether a business can pay back its debts.

◾ To track financial results on a trend line to spot any looming profitability

issues.

◾ To derive financial ratios from the statements that can indicate the

condition of the business.

◾ To investigate the details of certain business transactions, as outlinedin the statements’ disclosures.

Application Activity 2.1

JYAMBERE cooperative is a cooperative of 3,000 rice farmers that was

established in 2016. The cooperative collects and sells the members’

produce at a competitive price, allowing them to generate a lot of revenues

of over 50,000,000FRW every month. The money generated is used to

meet all the necessary costs. Their annual incomes and expenses reports

portray a lot of profits made by the cooperative. Using the scenario of the

JYAMBERE cooperative,

a) What do we call those reports in business?b) Why is it important to make those financial reports?

2.2. Types of financial statements

Learning Activity 2.2

a) Refer to your school business club and identify some items that may

be considered as expenses, revenues, assets, and liabilities.

b) Which financial reports does your business club prepare when

preparing for a general business club assembly? What do they include?

There are four main types of financial statements: Income Statement, Balance

Sheet, Cash Flow Statements and Statement of Owners Equity.

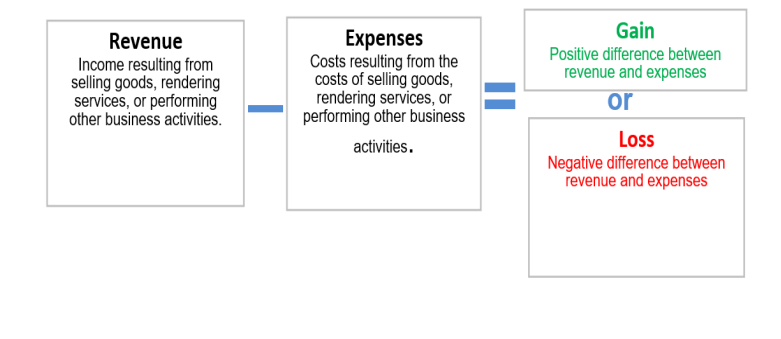

a) Income statement: this is a financial statement that reports a company’s

financial performance over a specific accounting period. Financial

performance is assessed by giving a summary of how the business incurs

its revenues and expenses through both operating and non-operating

activities. This statement is composed of two sections namely trading

account, and profit & loss account.

• Trading account

A trading account is an account which is prepared to determine the

gross profit or the gross loss of a trading business. It involves the

treatment of:

– Sales

– Stock (opening and closing stock balances)

– Purchases– Direct expenses i.e. purchase wages, carriage inwards

• Profit and loss account

The profit and loss account is prepared to determine the net profit

or loss after all expenses have been charged. It is prepared after the

trading account is completed. It is prepared in the following flow:– It starts with the gross profit figure from the Trading Account.

– It then lists any items of additional revenue raised by the as well

as any expenses incurred by the business not directly linked to

trading. Business. The sum of a gross profit or loss and additional

revenues is called “Gross income”,

– It shows the net profit (or loss) for the reporting period (the net

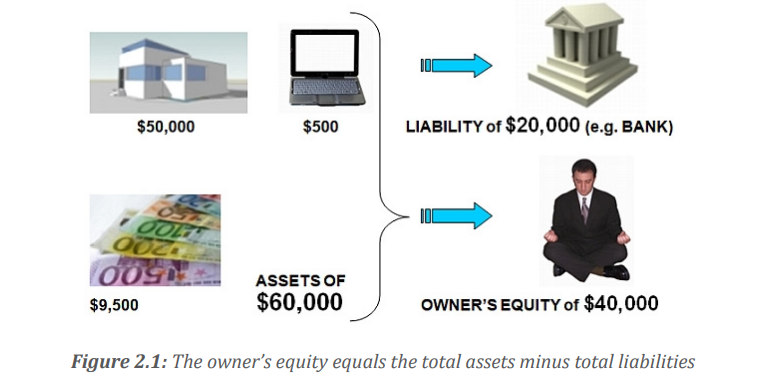

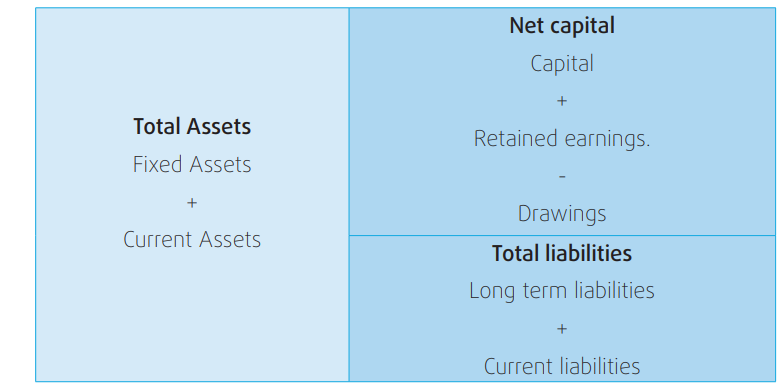

profit equals the gross income minus all expenses.b) Balance sheet/statement of financial position: this is a statement which

reflects the financial position of the firm at the end of the financial year.

The balance sheet helps to ascertain and understand the total assets,

liabilities and capital of the business. One can understand the strength

and weakness of the business with the help of the balance sheet.

The balance sheet is composed of the following three main parts:

– Assets

– Liabilities

– Capital

Assets

These are possessions owned by the business and have got money value.

They are grouped into fixed assets and current assets.

While fixed assets are the possessions of the business which are of a durable

nature bought for use in the business for a long period of time usually above

one year. E.g. land, equipment, machinery, motor vehicle etc. current assets

are possessions or properties of the business which last for a short time and

can easily be changed into cash. Current assets keep on being converted

from one form to another e.g. stock of goods, debtors, and cash at hand,

cash at bank, prepaid expenses or expenses paid for in advance, outstanding

income etc.

Liabilities

These are debts or amount of money that the business owes the outsiders.

They are claims of outsiders on the business’ assets. Properties/possessions

that are used by the business and which must be paid back in future. They

are grouped into long term liabilities and short term liabilities.

While long term liabilities refer to debts of the business that are expected to

be paid after a long time usually after one-year e.g. bank loans, debentures,

short term liabilities/current liabilities are debts of the business to be paid

within a short time usually within a year.

Owner’s equity

This is defined as the proportion of the total value of a company’s assets thatcan be claimed by its owners.

Mr. DUSABE and his wife KEZA are in agribusiness. They grow tomatoes on

a small farm. They paid labourers 4,500,000 FRW, transported tomatoes

to the market at 1,000,000 FRW, bought seeds at 200,000 FRW, and leased

land for 1,000,000 FRW. This season, the harvest was good with 45 Tons

of tomatoes harvested.

a) How much did DUSABE and KEZA pay for their farming activities?

b) How much did DUSABE and KEZA earn from sales of their Tomatoes,

if 1 kg of tomatoes was sold at 200 FRW?

c) What is the difference between their income received and expenses

incurred from selling tomatoes in their farming activities?

d) What do you understand by an income statement?e) Why is an income statement important for a business?

After extracting a trial balance, the next step is to determine the profit the

business has made during the trading period. This is done by preparing two

accounts, namely:

◾ Trading account where the value of the gross profit is determined by

deducting the cost of goods sold from net sales, i.e., gross profit = net

sales – the cost of goods sold.

◾ Profit and loss account where the value of net profit or net loss is

calculated by deducting expenses from the gross income, i.e., Gross

income – Total expenses.Where Gross income = gross profit or loss + additional revenues

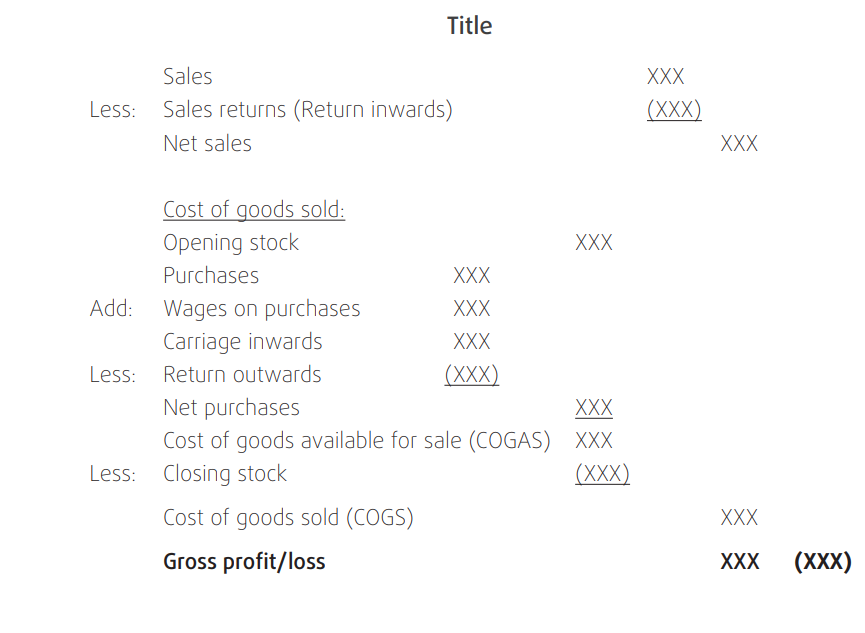

a) Trading account

It is an account prepared to determine the gross profit or loss of the business

concern. It shows the revenues from sales, the cost of those sales or goodssold, and the gross profit

Items found in a trading account

◾ Sales: refer to the revenues collected from goods sold by the

business. It is revenue earned from goods sold. They are entered into

the trading account to calculate gross profit or loss.

◾ Sales return goods that were previously sold but have been returned

to the business.

◾ Net sales = sales – return inwards/ sales return

◾ Opening stock: unsold goods in the business available at the beginning

of the new trading period

◾ Purchases: goods bought by the business for resale

◾ Purchases return: goods previously bought by the business for sale

but have been sent back to the suppliers. This value is treated in the

trading account and is subtracted from the purchases to get the net

purchases i.e., net purchases = purchases – return outwards/purchase

returns

◾ Carriage inwards: refers to the cost of transporting the goods or

bringing the goods up to the premises. It forms part of the goods

bought and hence added to purchases in the trading account.

◾ Net purchases = purchases + carriage inwards – purchases return

◾ Closing stock: goods not sold by the business at the end of a trading

period. It’s included in the trading account, and it is subtracted from

the goods available for sale to get cost of sales◾ Drawings of goods: sometimes an entrepreneur may take physical

items out of the business for private use; this must be subtracted

from the goods available for sale in the trading account. It should be

noted that only drawings in the form of goods must be treated in the

trading account.

◾ Gross profit: excess of net sales over the cost of goods sold or cost of

sales. It also refers to the total profit obtained by an enterprise before

paying off the operating expenses. Thus

◾ Gross profit = net sales – the cost of sales

◾ Gross loss: this is the excess of the cost of sales over the net sales

of the business.

Format of a trading account

There are two formats used to prepare a trading account. i.e.

◾ Horizontal

◾ Vertical formatHowever, this unit will use the vertical format only.

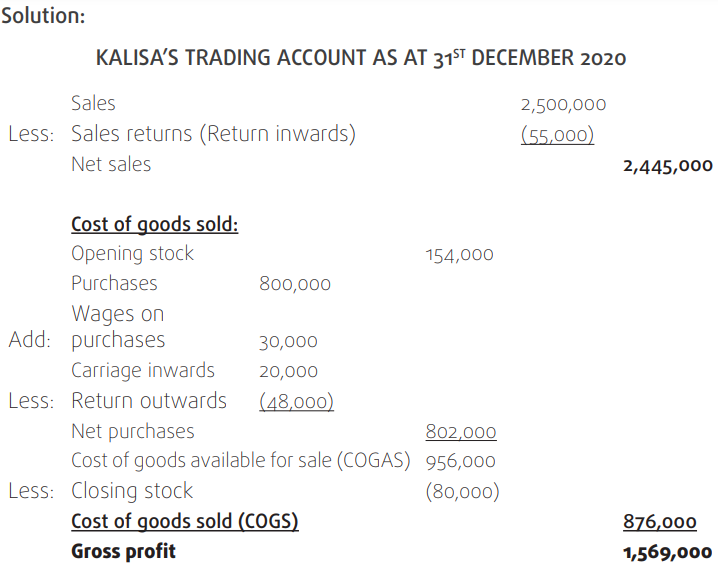

Example

a) The following information was extracted from the books of Kalisa Limited.

Opening stock------------------------154,000 FRW

Purchases------------------------------1,800,000 FRW

Sales------------------------------------2,500,000 FRW

Return inwards-----------------------55,000 FRW.

Return outwards---------------------48,000FRW

Closing stock--------------------------80,000 FRW

Wages on purchases------------------30,000FRW

Carriage on purchases----------------20,000FRW

Required; Prepare KALISA’s trading account for the month ending 31st

December 2020 using a vertical method.

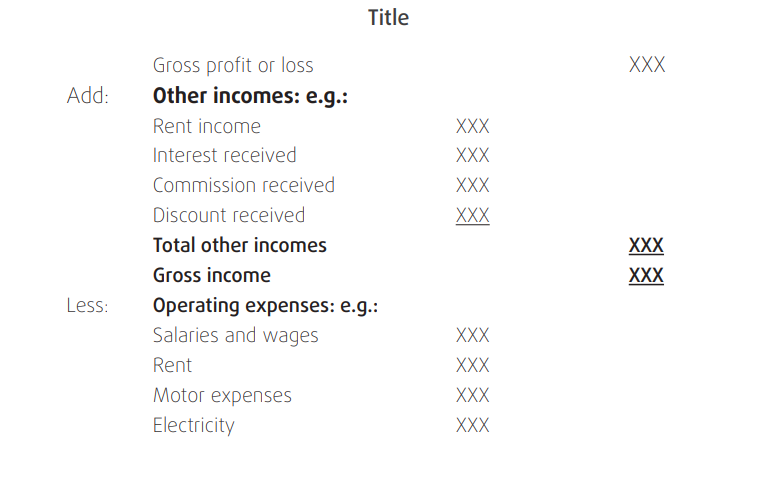

b) Profit and loss account

This is the final account or statement prepared by the business at the end

of the trading period to determine the business’s net profits or net losses.

It begins with the gross profit or loss transferred or brought down from thetrading account.

Elements of a profit and loss account

◾ Gross profits/loss: this is transferred from the trading account as

balance b/d

◾ Supplementary income refers to all income or revenue that the

business earns from sources other than sales. A company may earn

income from other sources apart from sales, which are treated in

the profit and loss account by adding them to gross profit. Examples

include; the discount received, the commission received, rent

received, and bad debts recovered. Etc.

◾ Operating expenses are the costs incurred by the business on services

that help in the regular operation and running of the company. Such

expenses include; transport, electricity, rent, insurance/premium,

carriage outwards salaries, water bills, postage discount allowed,

advertising, and communication. In the profit and loss account the

total operating expenses are subtracted from the total income or

gross income to get net profit or a net loss.

◾ Net profits/loss: excess of gross profits over the business’s expenses

at a given period. Therefore, Net profit= gross profit + supplementary

income – total expenses.

There are two formats used to prepare a profit and loss account i.e.

◾ Horizontal

◾ Vertical formatHowever, in this unit will use the vertical format only.

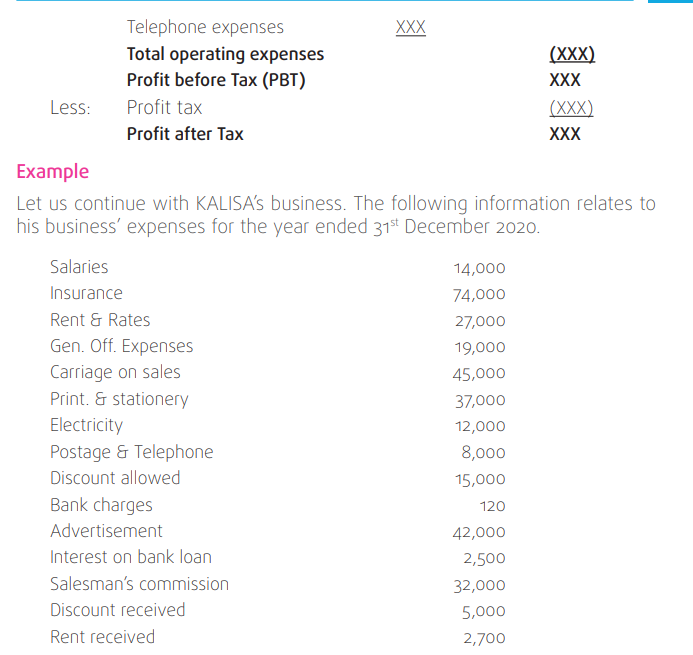

Required: Prepare the profit and loss account for the year ended 31st December

2020 using vertical format.

Note: when both the trading account and profit and loss account are prepared

within one statement, the statement is referred to as “Income statement” or“Trading, profit & loss account”.

Application Activity 2.3

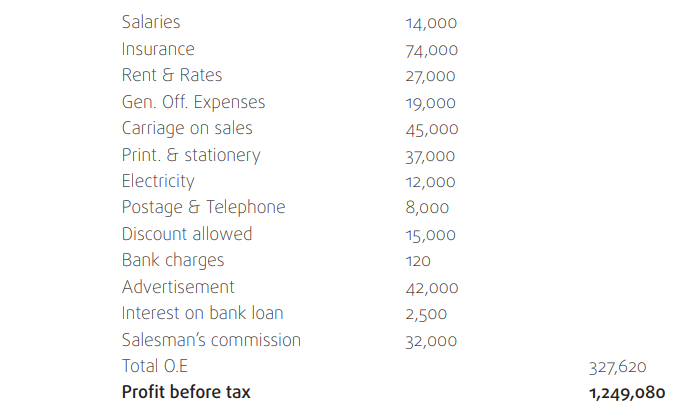

The following is the Trial Balance of the company M&N Ltd for the year

ended 31 December, 2017:M&N Ltd Company Trial Balance as on 31.12.2017

Additional information:

Closing Inventory 8,000 FRWRequired: Prepare the company’s income statement using a vertical format.

2.4. Preparation of a balance sheet

Learning Activity 2.4

Nyirawimana’s business had the following transactions during the

last month:

• Started business with cash 2,000,000 FRW.

• Purchase goods for cash 500,000 FRW and for credit from Uwineza

600,000 FRW.

• Purchased office equipment for cash 80,000 FRW.

• Paid office rent 10,000 FRW.

• Sold goods for cash 1,000,000 FRW

• Sold goods on credit to Kalisa for 160,000 FRW

• Bought insurance on cash for 50,000 FRW

• Salary due to her employee was 15,000 FRW

• The stock at the end of the month was 300,000 FRW

Questions

Using Prior knowledge on prime books you acquired from Unit 10 in Senior 5,

a) Identify what the business owns as at the end of the month.

b) Identify what a business owes to outsiders at the end of the month.

c) What do we call what a business owns?

d) What do we call what a business owes to outsiders?

e) How is a balance sheet different from an income statement?

f) What do you understand by the term balance sheet?

g) Why do you think it is important for a business to prepare a balance

sheet?

The balance sheet is prepared following the preparation of the income

statement. A balance sheet is not an account, therefore, not part of the

double entry, but it is prepared based on the ACCOUNTING EQUATION, which

states that: Assets =capital + liabilities

Parts of a balance sheet

There are three major parts of a balance sheet. i.e., Assets, Liabilities, Capital

Assets

These are possessions of the business and have got money value.

They are grouped into two.

◾ Fixed assets

◾ Current assets

Fixed assets: These are the business’s durable possessions, usually above

one year. E.g., land, equipment, machinery, fixtures and fittings, motor

vehicles, etc.

Current assets: Possessions or properties of the business which last for a

short time and are usually changed into cash. Current assets keep being

converted from one form to another, e.g., stock of goods, debtors, cash at

hand, prepaid expenses or expenses paid in advance, outstanding income,

etc.

Liabilities

These are debts or money that the business owes the outsiders. They are

claims of outsiders on the business’ assets. There are two types of liabilities:

◾ Long term liabilities◾ Short term liabilities

Long-term liabilities: These are debts of the business that are expected

to be paid after a long time, usually after one-year, e.g., bank loans or

debentures.

Short-term liabilities/current liabilities: These are business debts to be

paid within a short time, usually within a year. e.g., trade creditors, bank

overdrafts, outstanding expenses, prepaid income, etc.

Capital

These are the resources invested by the owner or the entrepreneur in the

business. Capital is also known as owner’s equity. To start any business, a

person requires capital in the form of money or other physical resources. The

capital increases or decreases over time.

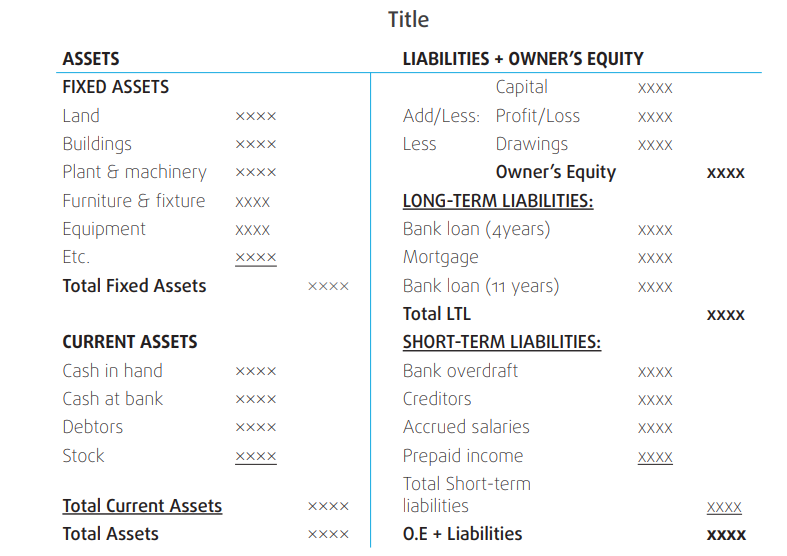

There are two formats used to prepare a balance sheet i.e.

◾ Horizontal

◾ Vertical formatHowever, this unit will use the horizontal format only.

There are two ways of arranging items in the balance sheet: Order of

permanency, which involves recording items that the business will keep

for a long time first. E.g., fixed assets, current assets on the debit side and

capital, long-term liabilities, and current liabilities on the credit side.

Order of liquidity; items that the business will keep items for a short time

are written first. E.g., Current assets, then fixed assets on the debit side and

current liabilities, long-term liabilities, and capital on the credit side.

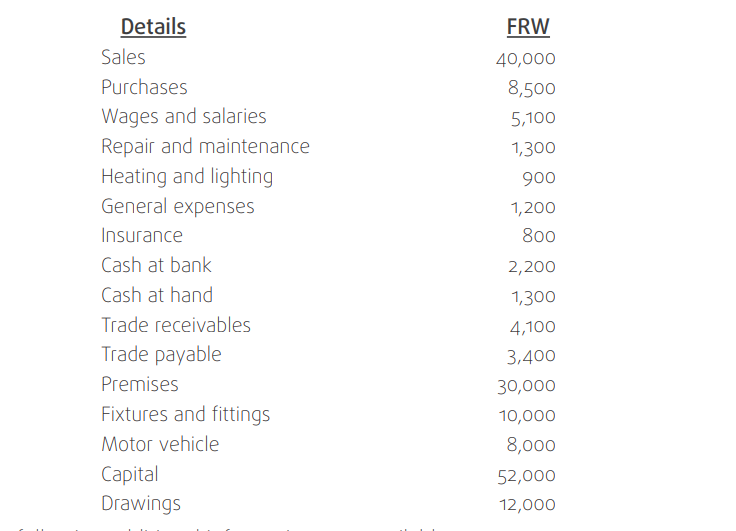

Example

The following balances were extracted from the books of UWERA’s businesson 31st Dec 2021

The following additional information was available:

Inventory as of 31st December 2021 was valued at 4,500 FRW

Required.

Prepare Uwera’s balance sheet as of 31st Dec 2021 using the order permanencyand horizontal method.

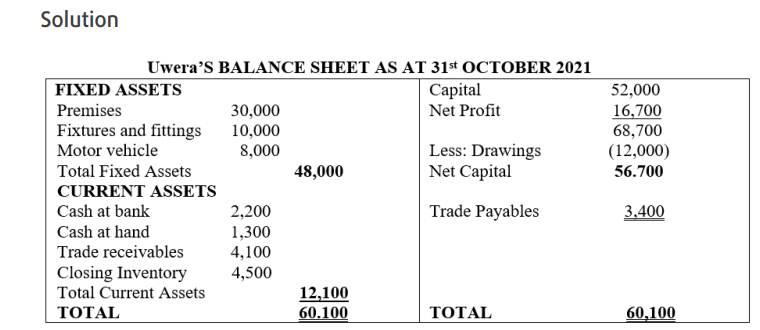

Application Activity 2.4

The following information was obtained from the books of savannabusiness club as of 31 March 2022.

Required.

Prepare savanna’s balance sheet using a horizontal format.

2.5. Cash Flow Statements

Learning Activity 2.5Analyze the case study and answer the questions that follow.

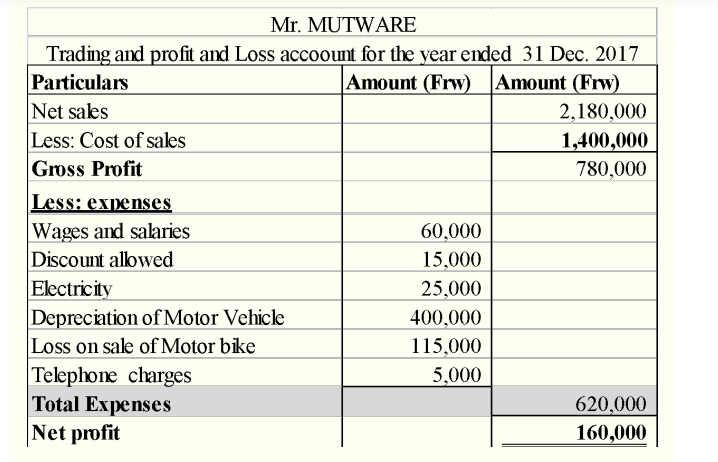

Mr. MUTWARE has been in business for the last year. At the end of the

year, he received financial statements from his accountant, a graduate

from one of the reputable business colleges in Rwanda. The following washis income statement as at December 31, 2022.

Mutware is confused by this report because he was told that he made a

profit of only 160,000FRW and needs more explanations.

a) Identify what money was spent on and how much?

b) Identify where the business got money from and how much it got?

c) Calculate the difference between money received and expenses

incurred. Is there any difference in the business’ profit?

d) What is a cash flow statement?e) Why do you think it is important for a business to prepare a cash flow statement?

2.5.1. Meaning of cash flow statement

This statement shows the cash inflows and outflows of the business. The

cash flow statement is composed of four components.

Cash inflows show activities that result in cash coming into the business

enterprise, i.e., sources of cash. For example, balance b/d, cash sales, debtors,

share capital, interest earned, and loans. At the same time,

Cash outflows show activities that result in cash going out of the business

enterprise, i.e., uses of cash. For example, cash purchases, salaries, drawings,

licences, rent, taxes, etc.

Balance brought forward (b/f)

Net cash position

2.5.2. Importance of Cash flow statement

◾ It helps to identify the source of cash inflows in the business and how

cash was used.

◾ It helps management properly plan cash to avoid excess cash or

deficits.

◾ It reports the total amount of cash used in long-term investment

activities such as purchasing fixed assets.

◾ It shows the amount of cash received from various financing sources,

such as long-term loans and the sale of shares.

◾ It helps management to avoid liquidity problems by anticipating when

cash is expected to flow in and plan payments accordingly.

◾ It helps investors understand how a company’s operations arerunning, where its money is coming from, and how it is spent.

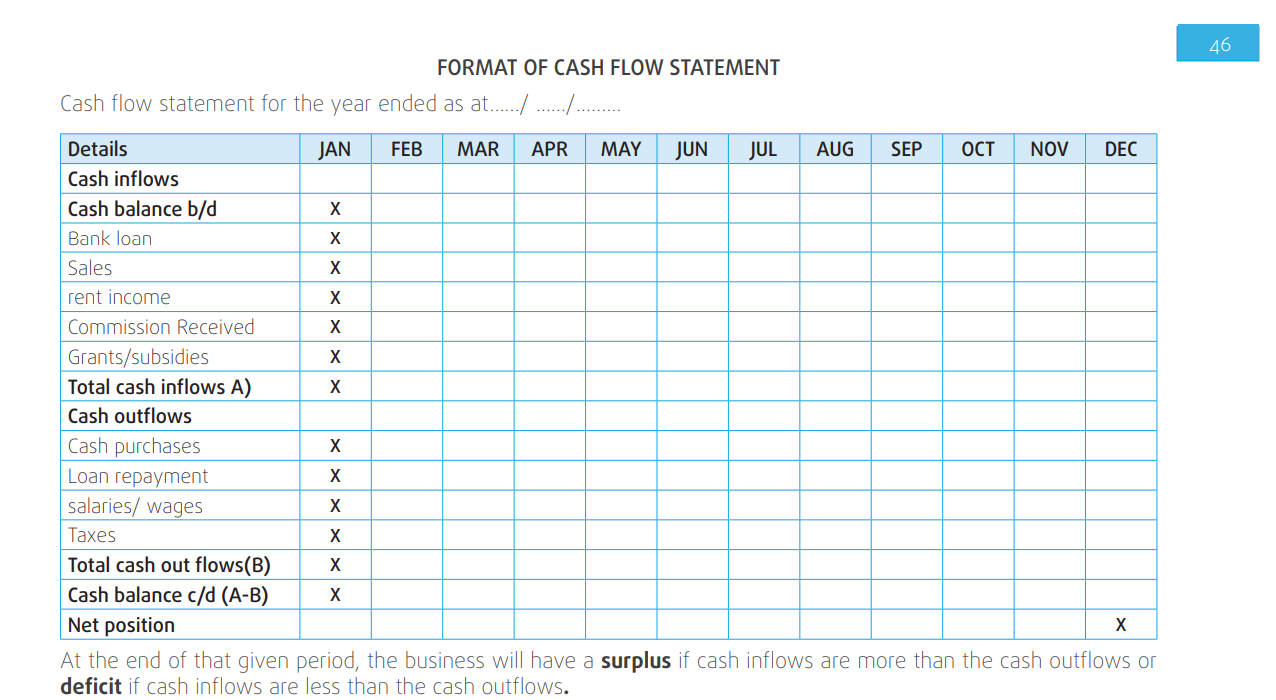

2.5.3. Preparation of Statement of Cash Flows

While preparing the cash flow, we will look at each section of the statement

of cash flows and put them all together. There are two methods of cash flow

statements.

Direct method

The direct method for creating a cash flow statement reports major classes ofgross cash receipts and payments (Cash inflow and cash outflow)

Example

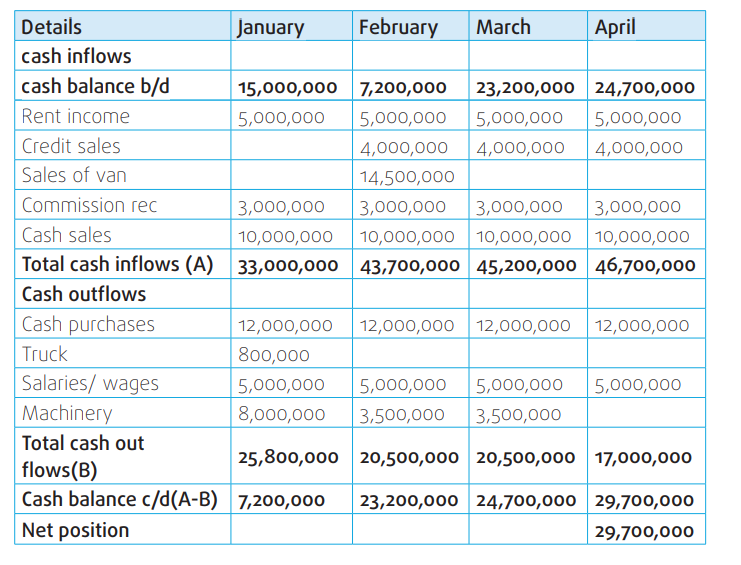

Prepare Dudu’s cash flow for the month of January, February, March, and April

2006, given the following information below:

◾ Cash balance b/d or b/f in January was 15000, 000FRW.

◾ Monthly rent income was 5000, 000FRW.

◾ Monthly credit sales to be paid in the next month were 4000,000

FRW.

◾ Sold a business van in February 14,500,000 FRW

◾ Monthly commission received was 3000,000 FRW.

◾ Monthly cash sales of 10,000,000 FRW

◾ Monthly cash purchases of 12,000,00 FRW

◾ Bought a truck in January for 800,000 FRW

◾ Monthly salaries and wages 5000,000 FRW

◾ Bought machinery worth 15,000,000rwf, payment of 8,000,000

FRW was made in January and the balance was paid in two equalinstalments during the months of February and March.

SolutionDUDU’S CASH FLOW STATEMENT FOR JANUARY, FEBRUARY, MARCH AND APRIL

Exercise

Given the information below on central trading company ltd (for the month

of April, May & June)

◾ On 1st April 2005 Central Traders Company Ltd had a cash balance of

10,000,000FRW.

◾ It expected monthly cash sales of 5000,000 FRW.

◾ Credit sales were 3,500,000FRW per month, and the payments would

be made in the following months.

◾ Monthly rent income from some of its properties was expected to be

1,000,000 FRW

◾ Monthly purchases were 6,000,000 FRW.

◾ Monthly salaries and wages bills were projected at 800,000 FRW.

◾ A loan from Umwalimu Sacco was 10,000,000 FRW.

◾ Interest Monthly payment of 100,000 FRW on loan.

◾ Monthly raw material for 5000,000 RFW.

Required: Prepare the central trading company’s cash flow statement forApril, May, and June.

Application Activity 2.5

Melissa soft drinks dealers started business on 1st/august/2019 with

50,000,000FRWand a loan of 40,000,000FRW from BPR bank. All

the money was kept in the bank. Interest on the loan per year is

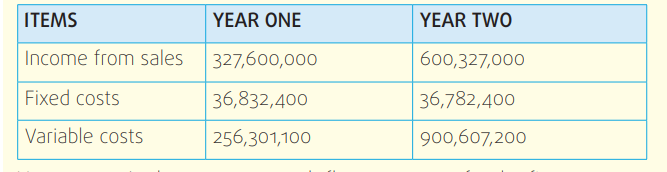

16% on a reducing balance basis over five years. The following arethe projected estimates (in FRW) for the first two years.

You are required to prepare a cash flow statement for the first two years

of operation.

Skills Lab Activity

From your business club activities, collect data from the transactions

carried out in the last year, then use it to calculate.

a) The Net profit/loss linking to the trading, profit, and loss account.

b) Balance sheet and make a report on how you will improve the financial

status of the school business club.End of Unit Assessment

I. Project Activity

Search for financial statements of a given business, interpret them,

and provide advice on what the business can do to improve financially.

II. Other Assessment Questions

1.

a) Which financial statement displays the revenues and expenses of

a company for a period?

i) Income statement

ii) Balance sheet

iii) Cash flow statement

iv) Statement of owners’ equity

b) What is the primary purpose of financial accounting?

i) Organise financial information

ii) Provide useful financial information to outsiders.

iii) Keep track of company expenses,

iv) Minimise company taxes

c) Which of these is not included as a separate item in the accounting

equation?

i) Assets

ii) Revenues

iii) Liabilities

iv) Stockholders’ equity

d) Which financial statement uses the expanded accounting equation?

i) Income statement

ii) Balance sheet

iii) Cash flow statement

iv) Owners’ equity

e) The account format that displays debits, credits, balances, and

headings.

i) General journal

ii) General ledger

iii) T account

iv) Ledger account

f) Asset accounts have what type of balance?

i) Credit

ii) Debit

iii) Contra

iv) All of the above.

g) Which account increases equity?

i) Expenses

ii) Withdrawals

iii) Stock

iv) Revenues

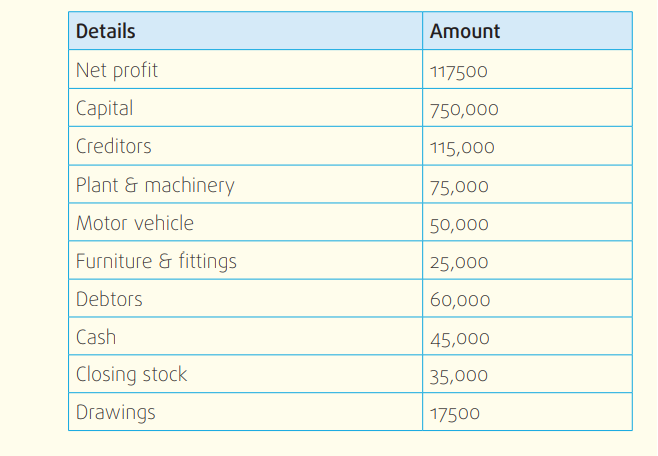

2. The following is the trial balance of KAMI Ltd as at 31 December

2012. Prepare the company’s trading, profit and Loss account anda balance sheet for the year ended 31 December 2012.

Closing stock is FRW 12,000

3. The following information was obtained from the books of Kanezaand Kamali Ltd Company as at 31 March 2010.

Unit 3: Environment Impact Assessment

Key unit competence

To be able to use EIA to manage the environmental effects of business

activities.

Introduction

You were able to evaluate the impact of economic activity on the environment

in unit 4 of socioeconomic development in S.5 You pointed out that all

economic operations, such as creating infrastructures (such as roads, pipelines,

mines, and tourism facilities, etc.), can have an impact on the surrounding

natural environment in one way or another. This is clear when we look at the

effects of large-scale development, such as open-pit mines, hotels that can

accommodate thousands of people, and large hydroelectric dams, frequently

negatively impact the environment.

Because there is such a strong connection between the natural and human

environments, it is crucial to consider how economic activities, initiatives, and

planned developments might affect the environment’s quality and people’s

well-being.

So, this unit is created to support you in being accountable and ensuring

that all environmental matters are considered early in the project planning

process. It will also help you acquire the knowledge, skills, attitudes, and

values you need to produce relevant EIA reports for the projects you intend

to start.

Introductory Activity

EIA Case Study

The government of Rwanda, through Rwanda Environment Management

Authority (REMA) and EIA guidelines, expects entrepreneurs to be cautious

and careful with goods produced, the technology used, the materials used

for the production, and their probable impact on the human health and

the environment. If the product/project does not meet the standard’s

requirements, it is not permitted for further production, and the owner will

have to change the technology and the structure of the product.

With the ever-increasing urbanisation and population growth rates, the

economic activities, if not well addressed, are bound to negatively impact

on the environmental attributes of the project areas and its surroundings.

Kigali, the country’s capital city, continues to have the most economic

activities and population. With the above economic situation, the economy

and the environment are bound to be affected negatively and positively

and thus entrepreneurs intending to start any project have to prepare

appropriate Environmental Impact Assessment reports showing the most

sustainable and cost-effective way of mitigating any negative impact that

may arise as a result of the implementation of the proposed project.

Questions

Referring to the above case study, answer the following questions.

a) What do the Environmental Impact Assessment guidelines expect

entrepreneurs to be observant of?

b) In what ways can the projects started in Kigali affect the economy

positively?

c) What are likely negative effects of the business activities or projects

to the environment and Kigali community at large?

d) What strategies would you propose to the entrepreneurs in Kigali to

mitigate the likely challenges because of the projects started?

e) Write a simple Environmental Impact Assessment report of the

business idea you intend to start in your community

3.1. Meaning of EIA and its importance

Learning Activity 3.1

Use the background knowledge from the introductory activity above to

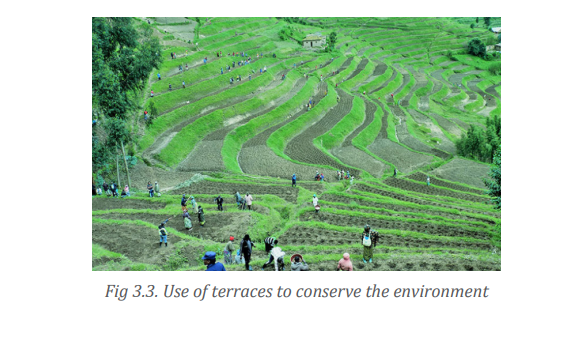

analyse the photo below and answer the questions that follow. Source: www.sciencephoto .comWhile entrepreneurs are undertaking economic activities or setting projects,3.1.2. Importance of Environment Impact Assessment

Source: www.sciencephoto .comWhile entrepreneurs are undertaking economic activities or setting projects,3.1.2. Importance of Environment Impact Assessment

they must be cautious to reduce adverse effects on the environment andhuman beings. This can be done by replacing and/or modifying plannedactivities to reduce negative impacts.Questionsa) What do you see in the photo?b) What do you understand by the term Environmental ImpactAssessment?c) Explain the major purpose of Environmental Impact Assessment.3.1.1. Meaning of EIAEnvironmental Impact Assessment (EIA) is the systematic method fordetermining, forecasting, and assessing the environmental effects ofsuggested actions and projects.Prior to making substantial decisions and commitments, this method is used,with a focus on preventing, minimising, and offsetting the significant negativeeffects of proposed activities.

i) Enabling incorporation of environmental considerations in design and

site selection for a project or development activities.

ii) Providing information beneficial to decision making.

iii) Enhancing responsibilities of relevant parties in the development

process.

iv) Mitigating and minimising environmental damage.

v) Avoiding costs and delays in implementation of projects that would

arise from unanticipated environmental problems.

vi) Making development projects more financially and economically

efficient.

vii) Making an active contribution to sustainable development.Application Activity 3.1

Assume you intend to start one of the projects above.

1. How do you think soil pollution may affect people’s health in

cities?

2. Show how carrying out an EIA process before starting your project

will benefit?

3.2. Roles and responsibilities of stakeholders

Learning Activity 3.2

Scenario

Fig 3.2 Industrialization activities lead to waste disposal which contaminates theenvironment. Source; www.ipsnews.net

Due to the different economic, political, social, and environmental changes

in today’s economy, there’s a need for proper planning for any economic

activity to be implemented. Entrepreneurs are expected to follow proper

EIA guidelines to avoid environmental, human, and economic risks.

The government of Rwanda through REMA ensures the protection and

sustainable management of the environment and encourages optimal use

of natural resources. Different stakeholders have different functions to

perform to execute proper EIA procedures.

a) From the above scenario, identify at least two stakeholders in EIA?

b) As a student of entrepreneurship, you have been approached by

MUTESI Chantal who is planning to start a project of brick laying in her

society. Advise her on the following.

i) What measures should she take to mitigate the likely

environmental challenges caused by her project?

ii) Why does she need to do EIA for her project?

Rwanda is very reliant on its natural resources, particularly its Land, water and

forests. For income and food security, over two thirds of the people work in

agriculture, forestry, transport and tourism.

For any economic activity to be carried out in the current economy, good

planning is required due to the various economic, political, social, and

environmental changes. Businesses must adhere to proper EIA criteria to

reduce hazards to the environment, people, and the economy. Priorities for

adaptation and resilience in Rwanda are based on the 2011 green growth and

climate strategy.

Thus, various stakeholders have a part to play in the EIA process. The roles of

stakeholders are listed below.a) REMA (Rwanda Environment Management Authority)

Mandated by law, REMA has a responsibility to organise the EIA procedure

by undertaking screening, guiding developers on assessment procedures,

conducting public hearings, reviewing EIA reports based on the terms

of reference (TOR) and taking decisions on approval or disapproval of

proposed projects. The Authority is also responsible for monitoringimplementation of environmental protection measures.

Roles of REMA

i) Receive and register EIA Applications (project briefs) submitted by

developers,

ii) Identify relevant Lead Agencies to review Project Briefs and provide

necessary input during screening, iii. Review Project Briefs and

determine project classification at screening stage,

iii) iii. Transmit Project Briefs to relevant Lead Agencies and concerned

Local Governments to provide input on Terms of Reference (TOR),

iv) Publicise Project Briefs and collect public comments during

development of TOR,

v) Approve EIA Experts to conduct EIA studies.

b) Developers

The developer has direct responsibility for the project and should provide

necessary information about the project at all stages of the EIA process.

Developers hire experts to undertake EIA studies on their behalf and

answer questions about potential impacts and proposed mitigation

recommendations at public hearings. Developers have the responsibility

to implement the environmental management plan including mitigation

measures as proposed in the EIA report and carry out subsequent

environmental monitoring and auditing.

Roles of Developers

i) Prepare and submit EIA applications (in form of Project Briefs) to

REMA,

ii) Hire experts to undertake EIA studies on their behalf,

iii) Prepare and append an addendum (Environmental Impact Report

Addendum) to the EIA report (if necessary),

iv) Submit the EIA report, Environmental Management Plan and the EIA

Report

v) Addendum (if applicable) to the Authority,

vi) Participate in public hearings and implement terms and conditions (if

any) REMA attached to approval of their projects.

c) Lead Agencies/Line Ministries

Lead agencies such as government ministries or departments +Lead

agencies have the responsibility to take part in EIA of projects under their

sectors. They provide valuable technical information to EIA experts duringEIA studies and are involved in the review process.

Roles of Lead Agencies/ Line Ministries

i) Participate in screening at the request of REMA,

ii) At the request of REMA, review Project Briefs to advise on Terms of

iii) Reference, iii. Ensure that their own projects adhere to EIA

requirements,

iv) Ensure that private-sector projects in fields over which they have

jurisdiction comply with EIA requirements,

v) At the request of REMA, they can serve on REMA’s Technical &

executive committee.

Application Activity 3.2

Concerns regarding how business owners involve the broader population

in the planning and execution of their projects have emerged in your

neighbourhood.

Explain how you would involve the community in the EIA process given

the project you plan to launch in your neighbourhood.

3.3. Environment Impact Assessment procedure

Learning Activity 3.3

For an EIA report to be finally submitted to the authorities (REMA offices of

a given district), there is a process that developers must go through. Given

your knowledge and background about EIA so far and for the project you

intend to start.What activities should one focus on during the EIA procedure?

Environment Impact Assessment in Rwanda consists of the following

procedures.

Project Brief Submission and Registration. As a first step in the EIA process,

a developer proposing to start a project shall notify REMA in writing by

submission of a Project Brief. The purpose of a Project Brief, which is to

provide information on the proposed activity so as to enable REMA and Lead

Agencies establish whether or not the activity is likely to have significant

impact on the environment, and thus determine the level of EIA necessary.

Scoping and consideration of alternatives. The responsibility for scoping is

done by developers (or their EIA experts) in consultation with Lead Agencies

and all relevant stakeholders. Scoping is intended to establish important

issues to be addressed in the environmental impact and eliminate the

irrelevant ones. After scoping, REMA approves the terms of reference that

would be used for carrying out the environmental impact study.

Baseline data collection and Analysis of Initial State. Baseline data describes

the status of the existing environment at a location before intervention of

the proposed project. Site-specific primary data on and around a proposed

site should be collected by experts conducting the environmental impact

study to form a basis for future environmental monitoring.

Impact prediction and analysis of alternatives. Impact prediction is a

way of forecasting the environmental consequences of a project and its

alternatives. This action is principally a responsibility of an EIA expert. For

every project, possible alternatives should be identified, and environmental

attributes compared. Alternatives should cover both project location and

process technologies. Alternatives should then be ranked for selection

of the most optimum environmental and socio-economic benefits to

the community. Once alternatives have been analysed, a mitigation plan

should be drawn up for the selected option and is supplemented with

an Environmental Management Plan (EMP) to guide the developer in

environmental conservation.

Public hearing. After completion of the EIA report, the public must be

informed and consulted on a proposed development. REMA may, if it deems

necessary, conduct a public hearing before EIA reports are appraised by its

technical committee. Any stakeholders likely to be affected by the proposed

project are entitled to have access to unclassified sections of the EIA report

and make oral or written comments to REMA. REMA shall consider public

views when deciding whether or not to approve a proposed project.

Decision-making. During the decision-making and authorization phase,

EIA documents submitted to the Authority are reviewed by two decisionmaking committees: a technical committee and an executive committee

constituted by REMA. If the project is approved, the developer will be issued

with an EIA certificate of authorization, which permits implementation of

the project in accordance with the mitigation measures in the EIA report and

any additional approval conditions.

Environmental Monitoring. Monitoring should be done during both

construction and operation phases of a project. It is done not just to ensure

that approval conditions are complied with but also to observe whether the

predictions made in the EIA reports are correct or not. During implementation

and operation of a project, monitoring is a responsibility of the developer

and REMA.

Application Activity 3.3

As an entrepreneurship student, the Sector Education Officer for your sector

has requested you to screen one of the major projects in your community.What aspects of the screening would you prioritise, and why?

3.4. Components of EIA report

Learning Activity 3.4

Your sector is running a youth empowerment program aiming at making

youths start sustainable projects in their communities. One of the conditions

is that for every group of youth to qualify for the program is to develop an

EIA report of the project that will be supported.

Using the information about the EIA report. write a simple EIA report forthe project you would present to the sector to win the above support.

According to REMA, the EIA report should entail the following:

i) Executive summary of the EIA report which should be brief and focus

on following matters:

◾ Name and location of the project.

◾ Name of the developer

◾ Name of the agency preparing EIA report.

◾ Main impacts identified.

◾ Mitigation recommendation

◾ Environmental monitoring plan

ii) Objectives of the project, including ideas, intentions, and particular

objectives.

iii) Description of the proposal and its alternatives. In this part, it is necessary

to describe in detail the proposed project and its alternatives including

those not subjected to pre-feasibility study or feasibility study.

iv) Discussion on the proposal and its relation to relevant policies, laws,

and programs (sectoral and regional). In this section, the proposal must

be shown to be in line with policies, laws, institutional framework, and

development strategy of Rwanda.

v) Impact assessment that includes assessment of all impacts to the local

population and measures to avoid and mitigate impacts.

vi) Evaluation and comparison of alternatives and selection of one

that is environmentally suitable that shows impacts with largest

effects, measures for avoiding, mitigating and managing them and

environmental improvement opportunities.

vii) Impact management and environmental monitoring plan (EMP).

This is a plan for monitoring and management of impacts during the

implementation and operation of the project, where the responsibilitiesbetween the state and investor are differentiated.

Skills Lab Activity

Create an EIA report for your respective projects in the student businessclub or an identified business nearby

End of Unit Assessment

I. Project Activity

REB in partnership with Educate! is running a youth empowerment

program aiming at making youths start strong viable and sustainable

projects in their districts. They will choose the best 5 projects to be

supported.

Prepare an EIA report for the project you would present to win the

above support.

II. Other Assessment Questions

Part A (Multiple choice questions)

Choose the most appropriate answers.

1. EIA is defined as (select one):

a) A process of identifying, predicting, and evaluating the likely

impacts of a proposed project or development to define

mitigation actions to reduce negative impacts and to provide

positive contributions to the natural environment and wellbeing.

b) A report written by government representatives on the planned

development impacts of environment, socio-economic issues,

and culture.

c) Project life-cycle assessment.

2. What is essential in an EIA? (Select all that apply):

a) That it allows decision makers to assess a project’s impacts in all

its phases.

b) That it allows the public and other stakeholders to present their

views and inputs on the planned development.

c) That it contributes to and improves the project design, so that

environmental as well as socioeconomic measures are core

parts of it.

3. What is the purpose of the “screening” step of EIA? (Select all that

apply).

a) To assess the quality of the project design.

b) To facilitate informed decision making by providing clear,

well structured, factual analysis of the effects and consequences of

proposed actions.

c) To determine whether a full EIA is needed

4. Which type of project usually requires an EIA? (Select all that

apply):

a) Small housing building.

b) Dams and reservoirs.

c) Industrial plants (large scale).

d) Community Garden development.

e) Irrigation, drainage, and flood control (large scale).

f) Mining and mineral development (including oil and gas).

g) Port and harbour development.

h) Development of wells in the community.

i) Reclamation, resettlement, and new land development

j) Thermal and hydropower development.

k) Outdoor recreation.

5. EIA is usually required for a development project when (select

all that apply):

a) Large changes are expected in the environment.

b) Limited impacts are expected in the environment.

c) A small area is expected to be affected by the project

d) There are potentials for transboundary impact.

e) Many people are likely to be affected by the project.

f) No cumulative impacts are expected.

g) There are protected areas in the project area of influence.

6. What specific aspects does a good EIA report and review include?

(Select all that apply);

a) Assessment, mitigation measures and related plans.

b) Terms of reference (TOR).

c) A generalised set of assumptions about the project benefits

described in highly technical terms.

d) A satisfactory prediction of the adverse effects of proposed

actions and their mitigation using conventional and customised

techniques.

e) Information that is helpful and relevant to decision making.

7. What kind of monitoring is referred to when we speak of

monitoring a development project (select all that apply?)

a) Monitoring indicators that measure the impacts on theenvironment and communities because of the development project.

b) Ensuring the fulfilment of all the commitments made in the

approved EIA.

c) Keeping track of changes that may happen in the environment

and communities because of the project and other local and/or

global changes, such as changes in livelihoods due to economic

crisis or migration, differences in water availability due to

drought, etc.

d) Keeping track of the political context, to ensure that the project

retains its licence.

Part B (True/False questions)

8. Frequency of monitoring will be determined by the nature of the

project.

9. A good quality EIA might still lead to the planned development

not being permitted to go ahead based on the identified impacts.

True or false?

10. The EIA Report is compiled by the designated government agency.True or false?

Unit 4: Business plan bitch

Key unit competence

To be able to pitch a business plan

Introduction

You were introduced to a business plan in O level and the business model

canvas in S5 . The knowledge and skills you attained from there will enable

you to plan and prepare the projects of your own choice. This unit will enable

you to confidently pitch the businesses you want to start in your communities.

This unit will as well equip you with confidence to present your projects to

attract investors for funding your projects.

Introductory Activity

EAST AFRICAN YOUNG ENTREPRENEURS’ PROJECT SHOW

Muhoza and Mazimpaka were delighted to attend the East African

Young Entrepreneurs’ Project Show (EAYEPS) held in Tanzania in 2020

representing young Rwandan entrepreneurs. Participants included youths

from Kenya, Tanzania, Uganda and Burundi. The event was sponsored by

many international companies including MTN, Airtel, Mango, East African

Breweries, safari com, RDB etc.

Muhoza presented the Huza App project whose aim is to connect local

and international farmers with customers without physical interface

(online). She started this business while in senior 5 after realising that most

remote farmers have less access to bigger markets in Rwanda, from time

to time the business expanded to even support urban and international

agriculturalists.

Muhoza’s project was unique because it favoured both customers with or

without the internet since it provided a USSD (customers can use mobile

phones to access services of the business) as well as a web-based platform

(can use computers or smartphones.)

Before the actual event, Muhoza prepared 2 pages of her business project

and shared them with her mentors, families, and friends for feedback.

From the feedback, she managed to write a good presentation about her

business and started to practise. This practice involved pitching to her

ENTREPRENEURSHIP FOR GENERAL EDUCATION | Senior 6 66

mentors and friends and gradually growing her presentation and pitching

skills.

This made Muhoza pitch her project excellently and became the lucky

winner of the show and was awarded a cheque of $20,000 to expand

her project. The second, third, fourth, and fifth were given $5000, $4000,

$2000, and $1000 respectively and the rest were not awarded any prize.

Questions

a) How is pitching a given project important to entrepreneurs? Refer to

the above case study.

b) What do you think enabled Muhoza to emerge as the winner?c) What steps did she use to prepare her business plan pitch?

4.1. Meaning and Importance of business plan pitching

Learning Activity 4.1

Patrick and Grace are having a conversation. Read it and answer the

questions that follow.

Patrick: I fear talking to people. I don’t know why.

Grace: But Patrick! You easily talk to me and your peers.

Patrick: I know, but I can’t easily talk to elders and leaders, yet I need to

tell the leaders of my sector about my business. You never know if they

can connect me to potential funders.

Grace: That’s a good idea, tell me about your business.

Patrick: It is a simple business, I create charcoal from used papers and sell

it to people around my community.

Grace: So, is that hard to explain to elders and leaders in your sector? I think

if you start talking first with friends and family, you will gain confidence.

Also, it can help to attract many customers and secure funds for investors.

Patrick: Thanks for your advice, Grace. I am really looking forward to

getting people who can fund my business.

a) From this statement said by Patrick in the dialogue above, “…I need to

tell the leaders of my sector about my business”. What do you think

pitching means? Relate your answers to the whole dialogue as well.

b) Why was Patrick interested in talking about his business to elders andleaders?

4.1.1. Meaning of a pitch

In business, a pitch refers to the presentation of ideas designed to attract

investors, get feedback to improve your business. Generally speaking,

consider pitching as a motivating action for your company. You might be

making a pitch for new clients, investments in your organisation, or even new

employees to come on board. The goal is to inspire the audience to join you

by sharing your vision for your work with them.

4.1.2. Importance of Pitching

It’s important to remember that a pitch to an investor may not strictly seek

startup capital. For example, a business may need an investment when it has

an unexpected but very profitable order beyond its current capacity. Such

a pitch is easier to make because investors feel far more secure with the

purchase order in hand.

◾ Business funding: a good business plan pitch enables an entrepreneur

to get funds for either starting up a business or expanding the already

existing one.

◾ Attracting investors: a good business plan pitch helps an entrepreneur

to persuade potential investors for both technical and financial

support.

◾ To share a clear picture of business: It enables the audience to

understand the business’ nature of operation and strategy

◾ Attracting customers: A well and persuasive presented pitch attracts

potential customers.

◾ Business positioning: Business plan pitching offers an opportunity

for creating a good impression to investors and potential clients.

◾ Boosting network: A well-presented business plan pitch persuades

the targeted audience. In this process, the entrepreneur increases the

level of his or her network.

◾ Communicate the brand message: A good pitching positions the

business brand well. Therefore, offering a good platform for sharing

the brand message with the targeted clients.

Application Activity 4.1

Your close friend has got a chance to pitch his or her business idea during

the Business Expo happening at Kigali Arena in two weeks’ time, but he/

she is hesitant. Write a letter explaining to her/him why she should go

ahead and pitch her business.ENTREPRENEURSHIP FOR GENERAL EDUCATION | Senior 6

4.2. Preparation of a project pitch

Learning Activity 4.2

Using the project of your choice that you can start after school, prepare a

business idea pitch that you will present to the class. Relate to the previous

case study to easily help you tackle the activity. What would you do as youprepare to pitch your business idea?

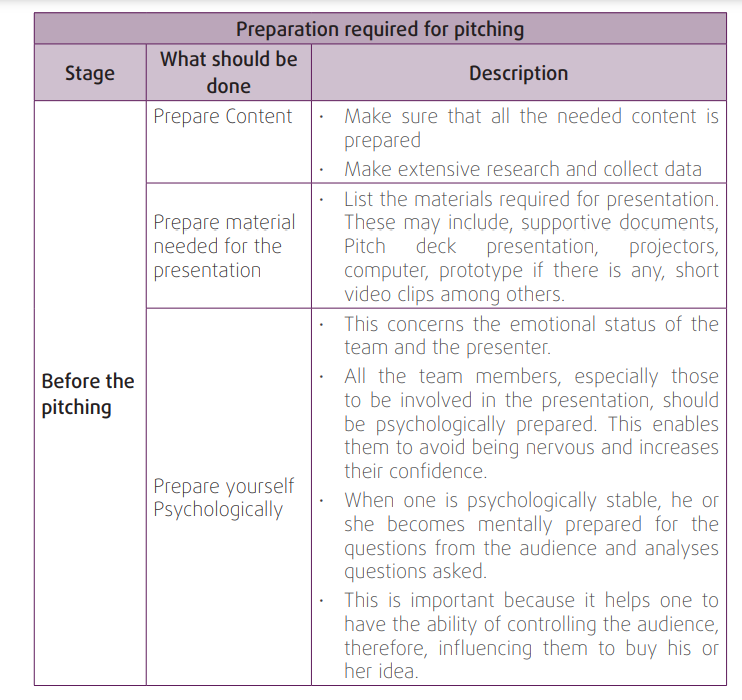

4.2.1. Preparation required

Preparation required for the pitch at this stage are as follows:

i) Content preparation: A good pitching effort requires great supporting

documents. Once you have the basics down, it’s pretty easy to prepare

all of these documents as needed. A good business pitch requires a

business plan conveying a few things quickly: the mission and vision,

the problem you solve, the solution you provide, and the people you

do it for.

ii) Materials needed for the presentation like powerpoint presentation,

projectors, invitations to your audience, venue or place for pitching

iii) Psychological preparation: Business plan pitching has to be planned

well by the owners of the business venture. There are specific steps

that should be followed in order to have the best persuasive pitching.

Your business pitch should be clear, concise, and persuasive. It should

explain what your company does, what problem it solves, and why it’s

a good investment.

4.2.2. Steps involved in preparation of business plan pitch

i) Analysis of the audience: Knowing the audience, one is going to

present the business plan pitch to determine the presentation, content

selection, pitching techniques, approaches, and anticipation of the

questions likely to be asked.

ii) Select a topic: Select a topic based on the problem to solve, and the nature

of the audience/ potential investors. The topic should be phrased in a way

that will persuade the audience.

iii) Define the pitching objective: The right business plan pitching objectives

enable the team to convince potential investors. This means that one must

have in mind why they are pitching their business idea, and work towards

delivering a successful pitch that can make them raise the capital needed.

iv) Prepare the body of the business plan pitch: The content of the business

plan pitch is expected to be organised in a sequential way. This therefore

calls for having a clear and understandable body of it. The smarter and well

organised the content presentation, the better the chances of winning the

attention of the investors.

v) Anticipate the questions from the audience: While preparing for the

business plan pitching, one must anticipate the possible questions likely to

be asked by potential investors. Then, list them down and brainstorm the

appropriate answers to the questions. This will enable one to avoid being

caught unawares.

vi) Prepare the suggestions and conclusion: It is good if you list various

suggestions that make the business venture unique. The suggestions must

reflect the new thing the business venture will bring to the community.

Suggest to the investors the possible solutions to the problem to be solved

and how they will benefit from the investment.

vii) Practice pitching of business plan (Micro- pitch): The team that intends

to pitch, should get the time and practice pitching the business plan. This is

important because it increases one’s confidence and having an opportunity of

getting feedback from teammates prior to the actual day of pitching.

4.2.3. The key items to cover in business plan pitch

A business venture owner to be able to persuade potential investors must

take note of the following in his or her business plan pitch:

i) Business idea and goals: A business plan pitch must address the

business idea to be pitched for. This should be clear and precious so

that potential investors are able to understand it. It must also contain

SMART goals. These two aspects are very fundamental in the business

pitching process. With no clear business idea and goals, it means the

presentation content will be irrelevant to the audience.

ii) Problem identified: The business plan pitch is developed around

the identified problem. The business venture, therefore, comes to

provide a solution. This is what the investors love to hear. The problem

identified must be affecting the community, not a specific individual.

The business idea being pitched should be worth investing in.

iii) Solution: The business plan pitch should clearly show the innovative

and creative solution that the business venture will execute in

addressing the problem at hand. The solution should be unique and easy

to implement. The more convincing solution increases the chances of

persuading potential investors to invest their funds into one’s business.

iv) Target Market: A pitching team must understand the target market.

This calls for serious research and study, and where possible the

projected market share percentages. This is very important because it

will provide a guide on the financial projections. The profitability levels

of the business form part of the convincing parts of the business plan

pitch content. The beachhead market and general market segmentation

targeted should be catered for.

v) Marketing strategy: The business plan pitch should show and describe

clearly the market strategy to be used. This determines the profitable

probability level of the business venture to be invested in. The investor

would like to know the marketing strategy to be employed. Therefore,

it is very important to take time and make clear research and study

the marketing strategy. One may have a wonderful business idea, but

if the marketing strategy is poor, chances of profiting from the venture

become low, hence discouraging potential investors.

vi) Industry Analysis: There must be a part of industry analysis in the

business plan pitch deck. For example, if the business idea deals with

Renewable energy, therefore, make research on the energy sector and

have data to use in the presentation.

vii) Management Team: The capability of the team that will be engaged

in managing the business venture is very important. Include this on

the pitch deck. Potential investors wish to know if they invest in the

project, will the team manage to handle the funds and generate profit.

viii) Competition: Knowing and understanding the competitors is very vital

to the success of a business. Therefore, potential investors would like

to know if you really know the competitors. In a business plan pitch, it

is very necessary to mention the competitive advantage that favours

the business. The competitors’ weaknesses and strengths should be

analysed so that one is able to provide a unique solution that would

out-compete them.

ix) Current status, amount of money requested, and the projected use

of funds: This is a very important section of the business plan pitch.

The potential investors need to know the financial abilities of the team

in order to make informed financial decisions. The financial status ofthe business venture should be honestly shown.

Application Activity 4.2

During the vacation, you are contacted by a women’s association that

has a start-up business specialising in Biogas production. The business

aims at supplying this biogas to all low-income earning homesteads in the

village, at an affordable fee. However, they would like to raise capital from

potential investors to be able to do so.

Questions

a) Prepare a one-page guide that you will give to the association

highlighting the steps they would follow and the key items they

would consider to have a successful pitching and win the interest of

the investors.

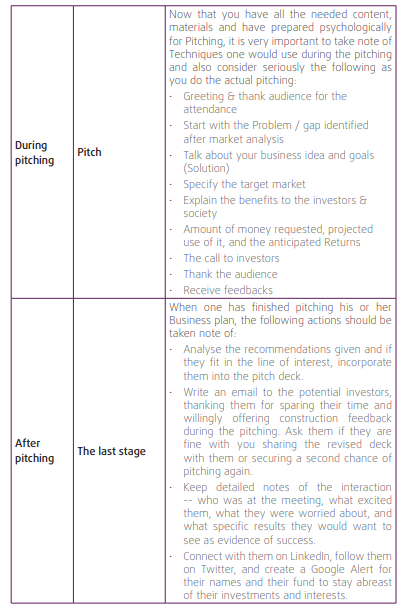

4.3. Activities performed during pitching

Learning Activity 4.3

Referring to the case study about East African Young Entrepreneurs Project

Show (EAYEPS) in the introductory activity, analyse it again to suggest

techniques you think Muhoza used to pitch her project successfully andemerged a winner of the show.

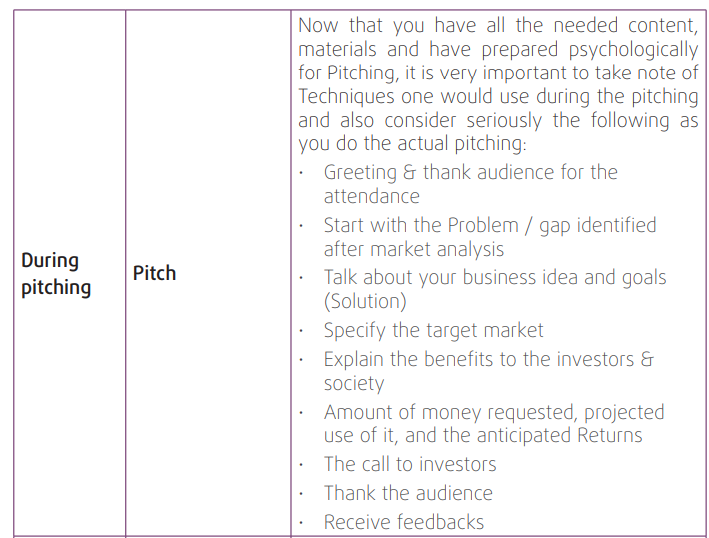

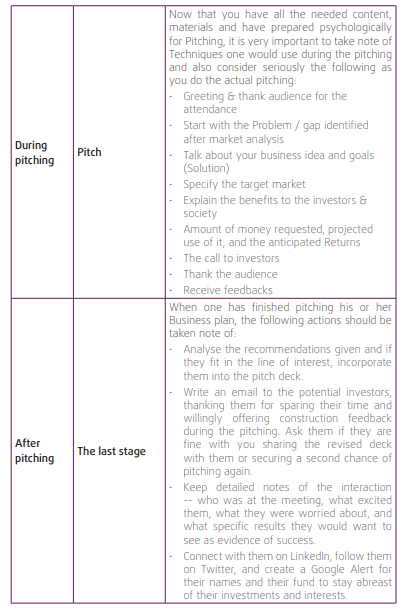

4.3.1. Techniques used to pitch the business project

Capital is a driving factor in the growth and development of a business.

Therefore, it is very important to master the best ways and techniques of

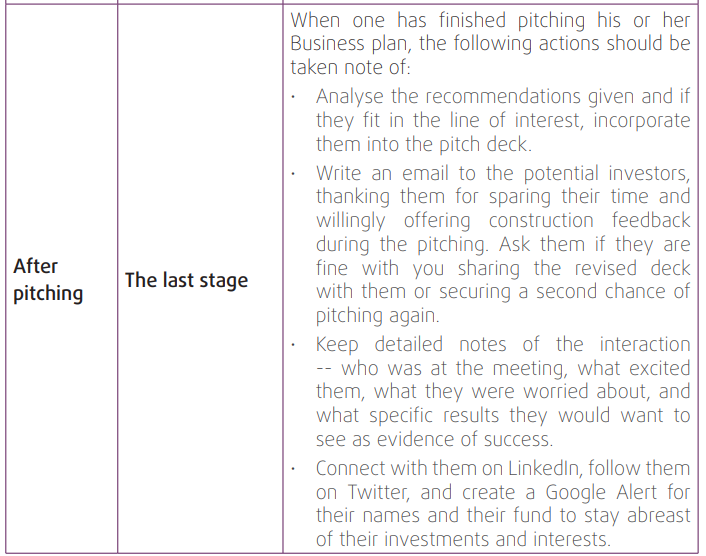

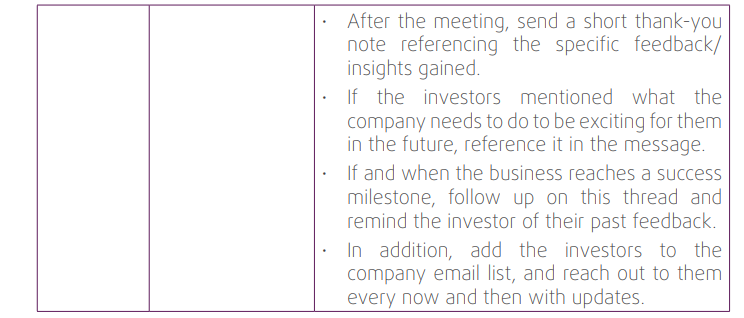

persuading potential investors. The following are some of the techniques onecan use in a business plan pitching: