Topic outline

UNIT 1: TAXATION OF CORPORATE 1 BUSINESS PROFITS

Key unit competence: Compute corporate income tax (CIT)

Introductory activity

John is tax consultant who works with different companies in providing

advisory services regarding to taxes matters and do the declaration of their

taxes as well. For the year ended 30 June 2022, John had many clients andamong matters that dealt with are shared below:

1. One of his clients called KIGALI CITY, a government entity, has made

a surplus of FRW 500,000 and wants John to advice on tax that is

required to comply

2. Rweru Ltd another client, has prepared its financial statements for

the year ended 30th June 2022 and approved, wants John to assess

and file its annual return to Revenue Authority.

3. Rubengera company Ltd, a parent company, during the year ended

30th June 2022, acquired 65% of share in Rutsiro Investment Ltd

and wants John also to advice on the implication of taxes on the

investment made in Rutsiro Investment Ltd.

4. XYZ company Ltd has made a huge investment in construction of

factory, and during the year ended 30 June 2022, it made a loss of

FRW 2billion and as the new company has approached also John as

tax expert to advise them on the implication of taxes on this issue.

Suppose you are John, advice your clients on these matters noted

above. What do you think John would base on to advice and drawnconclusion to the above matters?

1.1: Relevant legislation, Chargeable and exempt entities

1.1.1: Relevant legislation

The legislation on income tax is established by law no

027/2022 of 20/10/2022.

The legislation covers both personal income tax and corporate income tax (CIT)

besides withholding tax, capital gain tax and tax on gaming activities. In this

unit we will focus on the calculation of corporate income tax, which is coveredin Chapter III of the legislation.

The processes related to calculating both personal income tax and corporate

income tax, including filing and paying taxes, are very similar and you will haveseen certain aspects of this unit in Units 4 and 6 in Senior Four.

Corporate income tax is levied on business profits received by taxpayers otherthan individuals.

Therefore, in this unit we will consider how we calculate the profits on whichcompanies are charged to tax.

1.1.2: Chargeable and exempt entities

Any company that receives taxable income must register and pay corporateincome tax unless the company is exempt.

1. Taxpayers

The following entities will be liable to corporate income tax:

a) A Ccompany established in accordance with Rwandan law and a

foreign company registered in Rwanda;

b) A cooperative society;

c) A State-owned company;

d) Trustee, enforcer or protector of a trust;

e) A foundation;

f) A protected cell company or a cell of a protected cell company depending

on the choice of the investor at the time of company registration;

g) A non-resident in Rwanda person with a permanent establishment;

h) An entity established by a District or the City of Kigali if that entity

performs an income generating activity;

i) An association or entity that is established to realize profits regardlessof its nature.

2. Entities exempted from corporate income tax

The following entities are exempted from corporate income tax:

a) The Government of Rwanda;

b) The City of Kigali;

c) The district;

d) The National Bank of Rwanda;

e) Organisations that carry out only faith-oriented activities,

humanitarian, charitable, scientific or educational character unless

the revenue received exceeds the corresponding expenses or if those

entities conduct a business;

f) International organisations or agencies of technical cooperation

if such exemption is provided for by international agreements or

an agreement concluded between these organisations and the

Government of Rwanda;

g) Qualified pension funds;

h) Public institutions in charge of social security;

i) Development Bank of Rwanda « BRD »;

j) Agaciro Development Fund Corporate Trust;

k) Business Development Fund limited “BDF Ltd”.

l) Special purpose vehicle, unless the revenue received exceeds the

corresponding expenses;

m) Common benefit foundations;

n) Resident trustee for income earned by a foreign trust.

However, entities exempted from corporate income tax are required to submit

to the tax administration their financial statements not later than 31st March

following the tax period or three (3) months following specific tax period

granted to taxpayers who have made an application in accordance with

provisions of Article 9 of the law No027/2022 of 20/10/2022.

Entities resident in Rwanda will be liable to corporate income tax on their

worldwide business profits. However, dividends paid between resident

companies that have not been subject to withholding tax (as the recipient

company, being registered with the tax administration, will be exempt fromWHT) are not included in corporate taxable income.

This is because the paying company would have already paid the relevant

amount of Rwandan CIT on the profits out of which the dividend is paid. Note

that dividends from overseas companies (for example a foreign subsidiary of

a Rwandan parent company) are liable to CIT in Rwanda; the amount gross of

overseas taxes should be included in taxable profit and then the overseas taxsuffered can be deducted from the CIT liability (as double taxation relief).

Application activity 1.1

1. The Government of Rwanda, the City of Kigali, the Districts, the

National Bank of Rwanda are exempted from corporate income tax,

however if they perform an income generating activity are liable to

corporate income tax.

On that context, with convincing reasons explain which of the

following entities are not subject to Corporate Income tax?

A. Keza Co Limited that imports sugar, cooking Oil and salt and sell

them to the retail and wholesalers.

B. Navigation Co that provides Human resource services to the

different clients in Rwanda

C. Gasabo District’s conference hall with its unique TIN that is rented

to the staff of the district and other people in the country.

D. None of the above

2. Tick to show whether the following are taxable or exempt for thepurposes of corporate income tax:

1.2: Income tax

1.2: Income tax

Learning Activity 1.2

Muhire is a business man who used to sell the home appliances. He started

his business in 2018, after 1 year, 2 years and 3 years in business. He made

a total revenue of FRW 5,000,000, FRW 10,000,000 and FRW 15,000,000

respectively. As the business was growing, Muhire recruited an accountant

to facilitate him in preparing the financial statements and declaration of

taxes. During the year ended 31st December 2022, Muhire’s profit or loss

account shown a total revenue of FRW 50,000,000 and expenses of FRW

30,000,000 but included in the expenses were personal expenses of FRW20,000,000.

Question:

As student of taxation, advice Muhire on the income tax to pay1.2.1: The income tax regimes

Different income tax regimes apply to calculate corporate income tax for

companies’ dependent on their level of turnover. For companies with turnover

exceeding FRW 20,000,000 the real regime applies which means that companies

will need to calculate their taxable trading profits. This is done by adjusting theaccounting profits in exactly the same way as we saw for a sole trader.

As you saw in Unit 6 in Senior Four, income tax has three rules (regimes) for

taxpayers based on their annual sales. These rules apply equally to corporate

taxpayers. The calculation of corporation tax under flat rate taxation and sales

tax/lump sums has been summarized in Senior Four’s Unit 6. Businesses with

annual sales (annual turnover) of more than FRW20,000,000 must apply the

real regime and pay corporation tax at 30% on their taxable income. The

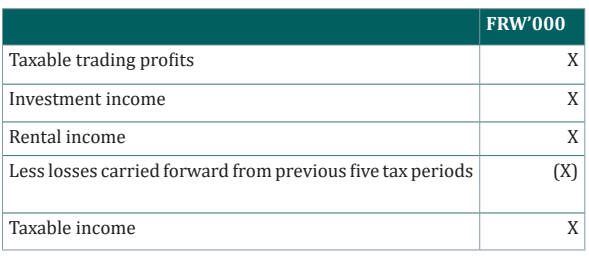

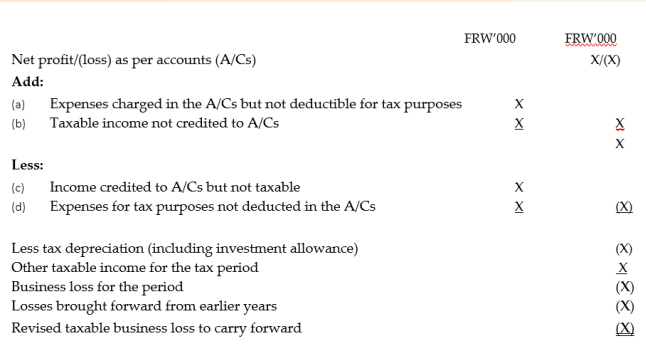

calculation of taxable income is covered in this unit.1.2.2: Taxable income

The taxable income is the amount on which a company will be liable to corporate

income tax.Taxable income for companies is calculated as

In this topic we look at the calculation of taxable trading profits. The other

income to be included is covered in sub-heading 1.3 and losses are covered insub-heading 1.6

1.2.3: Taxable trading profits

In exactly the same way as for a sole trader business, the accounting profit of thecompany must be adjusted for tax purposes to give the taxable trading profits.

The adjustments made for companies are identical to those for a sole traderand are covered in Unit 6 of senior four.

Companies are entitled to the same tax depreciation as we saw in Unit 4 in

senior four and the same adjustment is made for the difference between

the amount charged as depreciation in the accounts and the amount of taxdepreciation which is deductible.

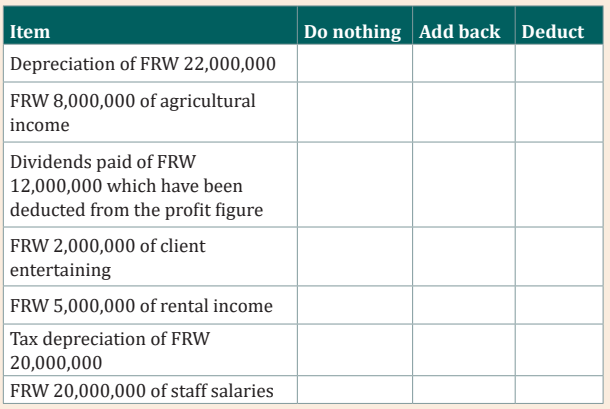

Application activity 1.2

Which of the following correctly states the adjustments to be made to a

company’s trading profits for tax purposes? (Tick one column for eachitem)

1.3: Other income for companies

Learning Activity 1.3

Muhanga Enterprise Ltd, is company located in Muhanga district that

do farming activities. During the board members’ meeting, the chair

suggested to expand the investment as the accumulated profit presented

by the management showed that the company has so far generated more

reserves. From the suggestion of chair, the meeting resolved the following:

1. To buy 10% of share in Shyongwe Ltd one company specialized in

bookkeeping.

2. To deposit some money in one commercial bank under the fixed

term deposit at the annual interest rate of 12%.

3. To construct residential houses near Muhanga city and start rentingthem to the visitors.

Question

Apart from the income Muhanga Enterprise Ltd generating from its main

business of doing farming activities, what else do you think as other

incomes that are going to be generated if the resolutions of Board meetingare implemented by Muhanga Enterprise Ltd’s management.

1.3.1: Taxable income

In addition to the taxable trading profits, companies will also be taxed on theirinvestment income and rental income receivable during the year.

After the taxable trading profits are calculated, other income must be broughtin to calculate the company’s taxable income.

1.3.2: Investment income

Dividends received by Rwandan companies from another Rwandan entity will

be non-taxable and should be excluded from the taxable income calculation.Only overseas dividends would be included in the calculation of taxable profits.

From the investment income any investment expenses can be deducted. Thiswill include any carrying charges and interest expense.

The net investment income is then included in the taxable income calculationalthough when submitting a corporate income tax declaration, the investment

income and investment expenses will actually be entered in different rows ofthe declaration.

Be reminded that, all investment income in the form of interest, dividends

and royalties must be included unless these are non-taxable. These may have

been received net of withholding tax but the gross amount must be declared as

taxable income and then the tax withheld will be included in the calculation ofthe tax due.

1.3.3: Rental income

Rental income from buildings is included in taxable income. Related expenses

are allowable, including tax depreciation on the building and any relatedinterest on loans to acquire/improve the building.

A deduction can be made for rental income from machinery, equipment, landand livestock.

The deduction can include:

10% of the rental income as wear-and-tear expense

Interest paid on loans to purchase the rented itemsTax depreciation according to the usual rules (as per Unit 4 of senior four)

Note that rental income for personal income tax purposes of taxpayers (i.e.

individuals) is declared separately from corporate profits, while rental income

for a corporation is included in the calculation of taxable income. This includes

rental income from the rental or leasing of machinery, equipment, land,

buildings and livestock. The special regulations for calculating the amountssubject to rental income tax for buildings do not apply to companies.

Application activity 1.3

1. Mwiza Ltd prepares its accounts to the year ended 31st December.

In the year its financial statements show the following:

– Interest income of FRW 680,000, which is received net of 15%

withholding tax

– Royalty income of FRW 595,000, also received net of 15%

withholding tax

– Expenses of managing the investments at FRW 50,000.

Calculate the investment income which will be included in Mwiza Ltd’staxable income.

2. Mugonero Ltd bought a tractor for FRW 1,000,000 in the year ended

31 December 2021 which it rents out. During the year ended 31

December 2022 it received monthly rental income of FRW 20,000.

When it bought the tractot Mugonero Ltd took out a loan of FRW

800,000 to help purchase the tractor and it pays interest on this

loan at a rate of 4% per annum.

Required: What is Mugonero Ltd’s rental income to be included in its

taxable income calculation?

A. FRW 134,000

B. FRW 240,000

C. FRW 184,000D. FRW 158,000

1.4: Total taxable income for companies

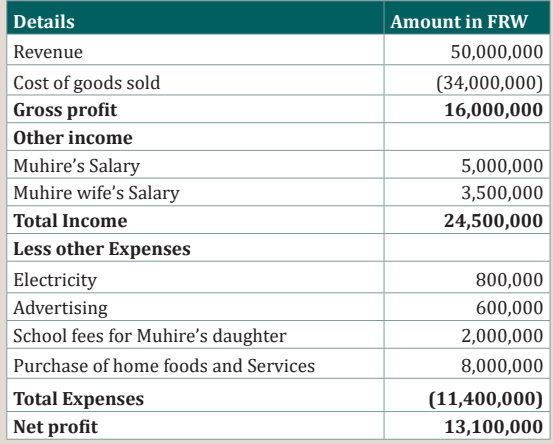

Learning Activity 1.4

Muhire is Managing Director and founder of Urumuri Ltd and he is looking

for an expert in tax to help his company to prepare the taxable income. The

following is the extract of the profit or loss account of Urumuri Ltd for theyear ended 31st December 2022.

Suppose Muhire has approached you as an expert, help Urumuri Ltd to

prepare the total taxable income for the year ended 31st December 2022.

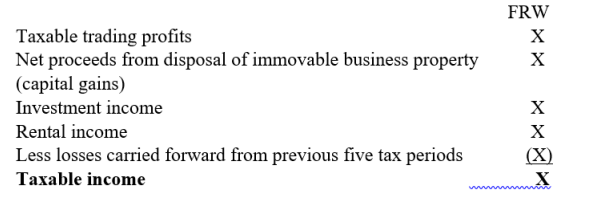

1.4.1: Calculation of total taxable income for companies

The taxable income is calculated by bringing together all the sources of taxableincome as below:

Application activity 1.4

Turakize Plc is a Rwandan company registered with the tax administration

and trading in furniture manufacturing. Its audited profit or loss accountfor the tax period is shown below:

Notes

1. Rental income was earned by letting out spare items of machinery

that cost FRW 150,000,000. These items are included in the other

plant and machinery pool (see Note 3).

2. This interest did not suffer withholding tax as it was derived from a

long-term bank deposit.

3. There were no acquisitions or disposals of assets in the period.

4. Tax written down values of fixed assets at 1st January are as follows:

5. Buildings: FRW 300,000,000 (original cost FRW 500,000,000)

6. Other plant and machinery pool: FRW 60,000,000

7. This bad debt was written off in the period after the customer was

declared insolvent by a court. The income was taxed in the previous

accounting period.

8. This represents a proportion of the value of all goods sold.

9. The company has paid the correct PAYE on all amounts included as

wages and salaries.

10. Legal and professional fees include a fine for breaching safety

regulations of FRW 1,500,000. The remaining FRW 2,500,000

relates to accountancy and debt collection services.

11. Interest payable is on a business loan used to invest in working

capital.

Required: Compute the total income chargeable to corporate tax onTurakize Plc for the tax period.

1.5: Corporate restructuring and tax on liquidation

Learning Activity 1.5

Karangazi Ltd is a company specialized in producing and selling Maize flour,

during the year ended 31st December 2022, the shareholders of Karangazi

Ltd decided to transfer their 70% of assets and liabilities to Kiramuruzi Ltdafter assessing the performance of the company.

Question

1. On your understanding, what do you think was happened in

Karangazi Ltd?

2. Assuming, you have been appointed to assess the implication of

taxes on the above decision made by Karangazi Ltd’s shareholders,what is your recommendation?

1.5.1: Definition of restructuring

A corporate reorganization occurs when one of the following events occurs:

• A merger of two or more Rwandan resident companies

• The acquisition of 50% or more of a company in exchange for shares in

the purchasing company

• The acquisition of 50% or more of the assets and liabilities of a company

in exchange for shares in the purchasing company.

• The purchase of all of a company’s assets so that it is replaced by

another company

• The splitting up of a Rwandan resident company into two or moreseparate companies

1.5.2: Implications of restructuring

The transfer of assets by a company during restructuring is exempt fromcorporate income tax.

In case of restructuring of companies, the transferring company is exempt from

tax in respect of capital gains and losses realized on restructuring. The receiving

company values the assets and liabilities involved at their book value in the

hands of the transferring company at the time of restructuring. The receiving

company depreciates the business assets according to the rules that would have

applied to the transferring company as if the restructuring did not take place.

In case of restructuring, the receiving company is entitled to carry over the

reserves and provisions created by the transferring company, subject to the

conditions that would have applied to the transferring company as if the

restructuring did not take place. The receiving company assumes the rights

and obligations of the transferring company in respect of such reserves andprovisions.

1.5.3: Implications of liquidation

When a company goes into liquidation, its assets are sold and the money is

used to pay off all of the company’s debts. The remaining money is then paid

out to the shareholders and treated as a dividend (for personal income tax andwithholding purposes) in the last taxable period of the company’s existence.

1.5.4: Impact on losses

A restructuring is likely to lead to a transfer of over 25% of a company’s share

capital; in this case losses being carried forward may no longer be permitted tobe offset against profits

Application activity 1.5

Mibabaro Plc, a Rwandan company, transfers its trade and all of its assets

to Gakire Plc, an unconnected Rwandan company, in exchange for sharesin Gakire Plc on 30th November 2022.

One of the assets transferred was a factory used in the trade that originally

cost FRW 40,000,000 six years ago and had a written down value of FRW

28,000,000 for tax purposes. Its market value was FRW 50,000,000 at 30thNovember 2022.

Which one of the following statements is true in relation to the taxtreatment of the transfer of the building?

A. The building will be transferred at its market value of FRW

50,000,000 and Mibabaro Plc will pay corporate income tax on

the gain of FRW 22,000,000.

B. The building will be transferred at its original cost of FRW

40,000,000 and Gakire Plc will claim 5% tax depreciation on the

FRW 40,000,000.

C. The building will be transferred at its written down value of FRW

28,000,000 and Gakire Plc will claim 5% tax depreciation on the

original cost of FRW 40,000,000.

D. The building will be transferred at its written down value of FRW

28,000,000 and Gakire Plc will claim 5% tax depreciation on theFRW 28,000,000

1.6: Business loss reliefs

Question

The photo above showing the decline of profit and as far as taxation is

concerned, what do you think the company should do in case the profitdropped down until resulting into loss?

1.6.1: When does a business loss arise?

Not all companies are profitable. In this lesson, we look at how a company can

use a loss to reduce the income tax it owes. In addition, there is a loss on a longterm

contract, we see that there are special rules on how this loss can be usedto save income tax.

A company makes a loss when its accounting profit or loss is adjusted for tax

purposes, the tax depreciation is deducted and the resulting figure is a loss.

The corporation’s taxable profits for the period of the loss are nil and the loss is

carried forward to be used against future corporate taxable profits in the nextfive tax periods.

Where a business makes a loss, Article 31 of Law No

027/2022 sets out the rules

as to how that loss can be utilised to save income tax. The rules are the samewhether the business in question is a sole trader, partnership or company.

A loss arises when the taxable business profits show as a negative figure after

the adjustment to profit and after the deduction of tax depreciation. It does

not matter whether there is a profit or loss in the accounts at the start of the

adjustment. What matters is that once the profit or loss has been fully adjustedfor tax purposes, it is a negative number.

1.6.2: What can be done with a business loss?

If a company makes a loss, this negative amount is included in the calculation

of taxable income (because the taxable income is less than the deductibleexpenses).

The legislation provides that business loss is carried forward and offset against

business profits within the next five tax periods. But on request, you can begranted more than five years if you fulfill the requirements.

Remember that, if there are losses incurred in more than one period, thelegislation states that the losses of earlier periods must be deducted first.

Note that while the law requires the loss to be offset against business income,

the offset is actually against all taxable income received by the individual or

by the company receives, as all income is reported on their income tax return

(personal or corporate). A business loss is the loss arising from all of the taxableactivities of the individual or company, not just their trading.

However, if the loss is from a foreign source, this loss cannot be used to offsetagainst Rwandan sourced business profits.

1.6.3: Losses on long-term contracts

A loss incurred on a long-term contract can be offset against previous profit

recognised on that same contract, if it cannot be used against other businessprofits of the period.

Carry back of losses on long-term contracts

As seen in Unit 6 (Senior four taxation book), the income and expenses relating

to a long-term contract are charged to the accounts on the basis of the percentageof costs actually incurred relative to the total expected costs of the project.

When a project is expected to be profitable it means that a percentage of profit

is recognized in each period in relation to the percent completion of the project.

It is possible that the contract could then incur some unexpected costs. This

could result in the contract becoming loss-making despite taxation of profitstaxed in previous periods.

The loss incurred will reduce the company’s taxable profit of the business in the

relevant year. If the loss incurred is large enough that it cannot be absorbed by

other profits of the period in which the contract is completed, the excess loss

may be “carried back” and used against profits previously recognised for that

contract. While the legislation does not specify settlement order, it is assumedthat losses are offset against the most recent contract profits first.

Any remaining losses are then carried forward in the normal way.

Application activity 1.6

Bibaho Ltd incurred a FRW 80,000,000 business loss in the year ended 31st

December 2020. In the year ended 31st December 2021 it makes taxable

trading profits of FRW 120,000.000 and has investment income (gross) of

FRW 2,500,000 and taxable rEntal income of FRW 5,000,000.

Calculate Bibaho Ltd’s taxable income for the year ended 31st December

2021.

Skills Lab 1

In group discussions, invite students to make research in library or on

internet about the calculation of taxable income for companies and

compute corporate income tax related to the income tax at home / in clubthen present their findings

End of unit assessment 1

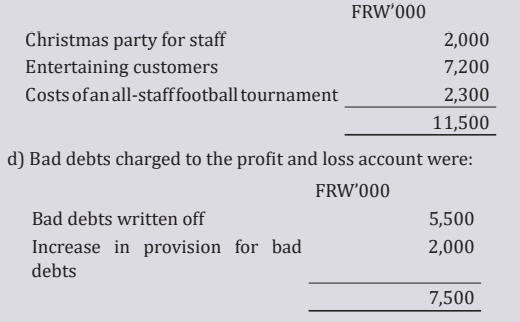

1. Shakisha Plc is a small Rwandan company which sells scrap metal.The company prepares its accounts annually to 31st December.

For the year ended 31st December 2022, the company’s net profit in

the profit or loss account was FRW 74,500,000. This was arrived atafter accounting the following items:

a) FRW 6,000,000 incurred on repairs to their warehouse was

charged as an expense. The warehouse was purchased in March

2022 after it had been damaged in a flood and could not have been

used in the state it was in at the time of purchase.

b) Depreciation on fixed assets of FRW 13,000,000.c) Entertainment expenditure charged to the accounts was as follows:

The bad debt relates to a sale which had been taxed in the year

ended 31 December 2021 and was written off during the year. This

was due to the debtor being declared insolvent and Shakisha Plchas taken all reasonable steps to recover the debt.

e) The amount of dividend received from Haza Ltd, a fellow Rwandan

company, recorded in the profit and loss account was FRW

5,200,000. Shakisha Plc paid dividends of FRW 2,000,000 whichhad been deducted in arriving at the net profit of FRW 74,500,000.

f) Shakisha Plc received royalty income of FW 4,250,000 during the

year. This was the amount received during the year. It also received

FRW 1,200,000 during the year from renting out spare warehousespace.

Tax depreciation for the year end has been correctly calculated atFRW 7,000,000.

Required: Calculate Shakisha Plc’s taxable income for the yearended 31st December 2022.

2. UB Ltd had initially agreed a contract for FRW 20,000,000 and had

estimated the costs to fulfill the contract at FRW 15,000,000. At the

end of Year 1, the contract was still in progress and costs incurred to

date were FRW 10,500,000. Accordingly, the contract was deemed

70% complete and FRW 3,500,000 of profit was recognized and

taxed during that year. The company generated FRW 3,000,000 oftaxable profit on its other business activities in Year 1.

In Year 2 the contract was completed, and UB Ltd incurred some

unexpected costs it had not initially anticipated. The total costs

actually incurred were FRW 22,000,000. This gave an overall lossof FRW 2,000,000.

The project was accounted for correctly, and a loss of FRW 5,500,000on this contract was recognized in Year 2.

UB Ltd has other business profits for Year 2 of FRW 2,750,000 plusinvestment income of FRW 250,000.

Assuming that UB Ltd wants to claim relief for the contract loss asearly as possible, how will the loss of FRW 5,500,000 be used?

A. It will be offset in full against total business profits of FRW

6,500,000 in Year 1.

B. It will be offset against total income in Year 2 of FRW 3,000,000,

and then the remaining FRW 2,500,000 will be offset against the

contract profit in Year 1.

C. It will be carried forward and used against future business profits

D. It will be offset against business profit in Year 2 of FRW 2,750,000,

and then the remaining FRW 2,750,000 will be offset against thecontract profit in Year 1.

3. Nakoze Ltd has incurred the following business profits and losses

over the last four tax periods:

Year ended 31st December 2016; Loss FRW (500,000,000)

Year ended 31st December 2017; Loss FRW (200,000,000)

Year ended 31st December 2018; Profit FRW 150,000,000

Year ended 31st December 2019; Profit FRW 400,000,000

No shares in Nakoze Ltd have been bought or sold over this period.

Show how the losses are used against profits, compute the

remaining losses to carry forward at 1st January 2020, and state towhich year they may be carried forward.

UNIT 2: WITHHOLDING TAXES

Key unit competence: Use different percentages to compute relatedwithholding taxes.

Introductory activity 2.1

ALICE from Bugesera District, last year 2022 she was given FRW

200,000,000 from expropriation and that money was invested in Bugesera

Town and then she has invested in different projects. Buying shares from

Bank of Kigali (BK) and buying Machine Tractors construction roads in

that District. ALICE has imported construction materials to be used in roadconstruction.

Q1. Based on above case, is ALICE liable to pay taxes? Which type of tax?Q2. Based above case, which goods and services will be taxable?

2.1: The feature of withholding taxes, imports and publictenders

Learning Activity 2.1

Ms. Kevine, legal expert, importer and a businessman who bids public

tenders has been given a contract for law writing services for Rwandan

central government for a value of FRW 500,000 plus VAT at 18%. Kevine was

registered by the tax administration and she complies with all regulationsrelating to tax declarations and record-keeping.

Question

From the above scenario, identify the careers of Kevine that are related towithholding tax.

2.1.1: The features of withholding taxes

Definition of withholding taxes: Withholding taxes is a deduction of tax levied

at source of income as advance payment on income. Within the Rwandan tax

system, certain types of payment are liable to withholding taxes. Withholding

taxes is due to be paid on or before the15th days of the month following therelevant payment that is subject to WHT.

Sometimes withholding taxes is the only tax suffered by the recipient of the

payment these are referred to as final taxes and nothing further will be due to

the tax authorities in respect of this source of income. This would be the case

if the recipient of the payment was not resident in Rwanda. It would also be

the case if the recipient were a Rwandan resident individual whose only otherincome was employment income.

However, if the law does not specify that a WHT is a final, the recipient of the

payment that has been subject to the withholding tax must declare the income

on their tax declaration, usually grossed up for the withholding tax, and then

the withholding tax may be deducted in arriving at their tax payable. Most

Rwandan withholding taxes are not final taxes, and therefore Rwandan resident

person will be required to include the relevant income on their tax declaration.

The main exception to this is for dividends paid out of the profits of a Rwandan

company, which have already suffered corporate income tax (CIT).2.1.2: Import and Public Tenders

a) Withholding tax on goods imported for commercial use

An import is the name for the purchases from another’s country. When goods

are imported into Rwanda for commercial use, they are held at customs untilthe trader collects them.

The importer has to pay 5% of the CIF value of the goods purchased at the firstentry port into East Africa Customs Union.

b) Withholding tax on public tenders

When a public body requires goods or services, it will usually get several quotes

from different suppliers. This is called public tender. The public body will awardthe tender to a supplier and pay the quoted fee.

Besides VAT, the public body will deduct withholding tax from the payment at

a rate of 3% of the VAT-exclusive value of the contract. This withholding tax is

not a final tax for a business liable to rwandan income taxes, the grossed-up fee

paid will be included within taxable income on the tax declaration, and the 3%withholding tax can then be claimed as a deduction from the tax liability.

Application activity 2.1

Q. 1 a) Define withholding taxes?

b) Distinguish between Withholding taxes 5% and Withholding taxes3%.

2.2: Person exempted from withholding taxes and others

payment subject to withholding tax.

Learning Activity 2.2

Uwineza, was discussing with her classmates: “In Senior four we have

studied types of tax and taxpayers and if you remember last week our

teacher tough us about withholding taxes so now I wondering whether all

taxpayers are supposed to pay withholding taxes or not, mates may youshare me what you know about this?” Said by Uwineza.

Question,

In context with taxation, what are the expected answers that you think herclassmates will share about exemptions of withholding tax?

2.2.1. Persons exempted from withholding taxes

The following taxpayers are exempted from withholding taxes:

1. those whose business profit is exempted from taxation;

2. those who have tax clearance certificate issued by the Tax Administration;

3. those who are newly registered during the concerned annual tax period.

The Tax Administration issues a tax clearance certificate to taxpayers who have

filed their tax declarations on their business activities; paid the tax due on a

regular basis, and have no tax arrears. The certificate is valid in the year in

which it was issued.

The Tax Administration may revoke a tax clearance certificate at any time if theconditions required by the tax administration are not fulfilled.

2.2.2 Other payments subject to withholding taxesA. Conditions required for WHT

For withholding tax to apply to any of the following payments (or any others

method of extinguishing an obligation, for example a payment made in goods

rather than cash), the following circumstance must be met:

– The withholding agent must be Rwandan resident (note however that

they may be a tax-exempt body) or the permanent establishment of anon-resident company

– The recipient is either:

– (i) not register with the Rwandan tax administration(ii) or registered but without a recent income tax declaration.

B. Types of payment subject to withholding tax

Payments subject to the withholding tax of fifteen percent (15%) are relatedto the following:

a) Dividends

Dividend income includes income from shares in any societies, other similar

income that may be generated by all entities that pay corporate income tax, as

well as the outstanding balance after the taxation of income from the correction

made by the Tax Administration in the transfer pricing.

All dividends are taxable except those paid between resident companies and

income distributed to the holders of shares or units in collective investmentschemes.

b) Financial interests

Financial income includes:

1. incomes from loans, debentures or other debt securities;

2. incomes from deposits;

3. incomes from guarantees;

4. incomes from government securities, negotiable securities issued by the

Government, securities issued by companies or other persons as well asincome from cash negotiable securities.

All financial interests are taxable except:

i. interests on deposits in financial institutions for at least a period of one

(1) year;

ii. interests on loans granted by a foreign development financial institution

exempted from income tax under applicable law in the country of origin;

iii. interests that banks or deposit-taking microfinance institutions operating

in Rwanda pay to banks or other foreign financial institutions;c) Royalties

Royalty income includes all payments of any kind received or receivable:

1. on the use of or the right to use any copyright of literacy, craftsmanship

or scientific work including cinematograph films, films or tapes used for

radio or television broadcasting;

2. on the use, right to use or exploitation of a trademark or a trade name, a

design or a Model, a computer application, a software and a patent;

3. as the price or consideration of using, or of the right to use industrial,

commercial or scientific equipment or for using information concerning

industrial, commercial or scientific knowledge or formula;4. on the right to exploit or explore natural resource.

a) Service fees including management and technical service fees exceptN.B: However, the withholding tax is five percent (5%) if levied on the following

transport services;

b) performance payments made to a crafts person, a musician, an artist, a

player, sports, cultural or leisure activities irrespective of whether paid

directly or indirectly;

c) Goods sold in Rwanda;

d) Profit after tax or retained earnings that are converted into shares,

except for financial institution with paid-up capital below the minimum

requirement set by the National bank of Rwanda;

e) Profits repatriated from Rwanda;

f) Payments made in cash or in kind by a resident person in Rwanda on

behalf of a non-resident in Rwanda contracted person provided for

under the contract in addition to contractual remuneration;

g) Re-insurance premiums paid to a non-resident insurer except premiums

paid to insurers that have signed agreements with the Government ofRwanda.

interests:1. dividends and interest on securities listed on capital market if the

beneficiary of the dividends or interest is a resident taxpayer of Rwanda

or of the East African Community;

2. interests derived from treasury bonds with a maturity of at least three(3) years.

Application activity 2.2

Q1. The group INTORE won the award of PRIMUS GUMA GUMA. The value of that award is twenty-four million (FRW 24, 000,000) excluded tax laws.

a) What is the type of income earned by INTORE group?b) Calculate the tax to be paid by that group?

Q2. MUGISHA is hired by Modern Business Ltd as a technical consultant

on a short-term contract. MUGISHA gross income for this contract is FRW

3,500,000. As the source of this income, Modern Business Ltd must declare

and pay withholding tax on this income.Calculate the withholding tax to be paid

2.3: Withholding taxes on gaming activities and DoubleTaxation Agreement (DAT).

1. Withholding tax on gaming activities.

The fifteen per cent (15%) tax is withheld by a company that carries out

gaming activities on the difference between winnings of the player and amount

invested by the player.

2. Double Taxation Agreement (DTA)

Definition of DTA: Double Taxation Agreement in international taxation involves

taxation which is cross border.

It arises from individual having taxable income or assets in two countries or a

business operating in two (or more) countries. Due to increased globalization,

the growing level of business trading international around the globe andincreased personal mobility, international taxation is becoming prevalent.

What is international taxation?

It should be clear from the onset that laws are not “international”. Laws are

creations of sovereign states. What is referred to as international tax law is the

international aspect of the income tax law of particular country. It is the taxationof foreign-related transactions (taxation of international transactions).

International tax system is made of specific, piecemeal response to the way

investment of business operations are carried out across national boundaries.

Many of the most important international tax rules are designed to mitigate oreliminate double taxation.

Jurisdiction to Tax“Source of Income Taxation “inbound” and Residence Taxation “Outbound”.

From the perspective of the Rwandan tax system, there are two broad classes in

which international economic activity falls:a) Investments or business undertakings of foreign persons in RwandaThis is what is referred to as taxation basing on the “source of income” or

b) Investments or business undertakings of Rwandans abroadtaxation basing of the residence of the person.

1. Source Jurisdiction

The term “Source of income” is the location of the property or business from

which income is derived. (Look at the Article on Business income is treated as

having its source in Rwanda only if the income is earned through a permanent

establishment. (Look at the Article defining PE in Rwandan law, it confers to theOECD Model, Article 7)

It is also referred to as “territorial taxation”, which refers to taxation of limitedto income from source within the boundaries, no matter who derives it.

2. Residence Jurisdiction

Under Article 4(1) of the OECD Model Treaty, “resident) of a country for

purposes of the treaty is a person taxable in that country “by reason of his

domicile, residence, place of management or any other criterion of a similarnature.”

The UN Model Treaty adds “place of incorporation” to that list.

Article 4(2) provides a series of tie-breaker rules to give residence jurisdiction

to one country. These are;• Place where an individual has a permanent home;These tie-breakers are ineffective in making the individual of a residence of

• Country in which the centre of the individual’s vital interest is located

• Place of individual’s habitual dwelling;• Country of citizenship

only one country for treaty purposes, certain officials of the two countries ( the

“competent authorities” are mandated to determine a residence by mutualagreement.

For legal entities, resident in two countries, Article 4(3), of the OECD Model

Treaty makes the entity a resident of the country where its effective management

is located.

Note that some countries use a place-of-incorporation test as the sole test of

residence for corporation.

What is the Rwandan definition of a residence?

An individual is considered to be a resident in Rwanda if he or she fulfils one of

the following conditions:1. he or she has a permanent residence in Rwanda;

2. he or she has a habitual abode in Rwanda;

3. he or she is a Rwandan representing Rwanda abroad;4. he or she is present in Rwanda during the tax period for a period or

periods amounting in aggregate to one hundred and eighty-three (183)

days or more;5. he or she is present in Rwanda during the tax period of assessmentAs far as double taxation agreement is concerned, its main objective is “the

and has been present for periods averaging more than one hundred and

twenty-two (122) days in each of the two (2) preceding tax periods.

• A person other than an individual is considered to be a resident in Rwanda

during a tax period where it fulfils one of the following requirements:

a) where it is established according to Rwandan laws;

b) it has a place of effective management in Rwanda at any time during

that tax period.

• A Ministerial Order determines the person’s permanent residence andthe location of the effective place of management.

avoidance of double taxation with respect to taxes on income and on capital”.

“International double taxation” has been defined as the imposition of

comparable income taxes by two or more sovereign countries on the same

item of income of the same taxable person for the same taxable period (OECDdefinition)

The double taxation arises due to the inconsistent rules of source of income

in different countries imposing overlapping taxes. For example, one country

may consider origin of payment source of income while another country mayconsider where the work was performed as source of income.

U.S.A taxes its citizens on worldwide income irrespective of source of income.

Inconsistent residence rules also lead to double taxation. Some countries

consider the entity a resident of the country where its effective management

is located. While other countries use a place-of-incorporation test as the soletest of residence for corporation.

Double taxation risks typically arise when two or more country claim the right toimpose tax on the same item of income.

In short the basic causes for double taxation are;

1. Source-source conflict; Two countries asserting the right to tax the

same income of a taxpayer because they both claim the income is sourced

in their country.

2. Residence-Residence conflict; Two countries asserting the right to tax

the same income of a taxpayer because they both claim the income is

sourced in their country.

3. Residence-source conflict; One country asserts the right to tax foreign

source income of a taxpayer because the taxpayer is a resident of that

country, and another country asserts the right to tax the same incomebecause the source of income is that country.

Note that double tax agreements are used to avoid non taxation of income.

Double tax relief mechanism:

To eliminate the double taxation effect, there are different methods for granting

relief from international double taxation.a) Deduction method. Resident taxpayer is allowed to claim a deductionAs noted in the table below, a double taxation agreement (DTA) can override

for the taxes paid in foreign country

b) Exemption method. The resident country provides its taxpayers with

an exemption for foreign-source income

c) Credit method. The resident country provides its taxpayers with a

credit against taxes payable for income tax paid to foreign country

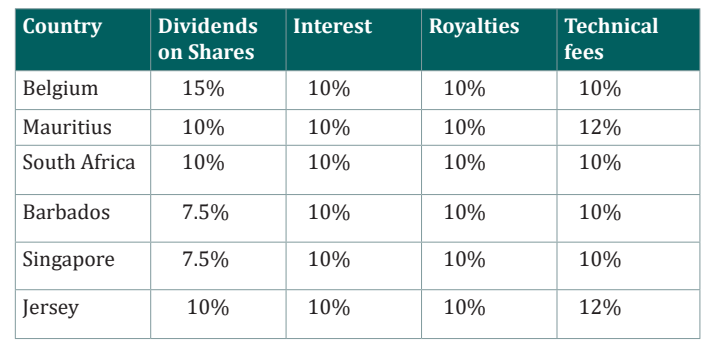

the normal 15% rate of WHT. The following rates of WHT apply under existing

Rwandan DTAs:

The application of the DTA rates is subject to the recipient of the payments

meeting certain conditions. Professional advice should be sought beforeapplying the above rates. Application activity 2.3

Application activity 2.3

Q1. Defining Double Taxation Agreement.Q2. State the purpose of Double Taxation Agreement.

In group discussion, invite a resource person from RRA to share with

students on the calculation of withholding tax for imports and public

tenders and ask students to apply using an illustration to computewithholding taxes then share findings.

End of unit assessment 2

Q1. Which TWO of the following statement are true in relation to withholding

taxes?1. Withholding taxes are paid to the tax administration by the recipientQ2. Which of the following payment by government bandies under public

of a payment.

2. If a withholding tax is a final tax, no further tax is due from the

recipient.

3. Income that has sulfured withholding tax will never be required to

be included in a tax declaration.

4. Withholding taxes at 15% are deducted from taxable income in

preparing the income tax declaration.

5. Withholding taxes at 15% may be deducted from the tax payable fora tax period.

tenders would be liable to withholding taxes of 3%?A. Payment to an overseas business that is not registered with the taxQ3. What is the rate of withholding tax on royalty made by Rwandan

administration.

B. Payment to a Rwandan registered business that does not hold a tax

clearance certificate.

C. Payment to a Rwandan business that is new and not yet registered

with the tax administration.

D. Payment to a Rwandan registered company that holds a taxclearance certificate.

taxpayers to countries which a double taxation agreement is in place?

A. 0%B. 5%Q4. Which Two of the following interest payments would not incur

C. 10%D. 15%

withholding tax at 15%?

1. Interest paid to a Rwandan resident individual on a short-term bank

deposit does not hold a tax clearance certificate.

2. Interest paid to a Rwandan individual on a four-year rwandan

treasury bond.

3. Interest paid by a Rwandan bank to a company resident in Mauritius.4. Interest paid by a Rwandan bank to a French individual on a shortterm bank deposit.

A. 1 and 4Q5. You work for a large company with many Rwandan and overseas

B. 2 and 3

C. 1 and 3D. 2 and 4

shareholders. The company listed on the Rwandan capital market and hasrecently declared a dividend to its shareholders.

List the factors you need to consider when determining the rate of

withholding tax to deduct on the dividends, and how these will impact thewithholding tax rate.

UNIT 3:TAXES AND FEES OF 3 DECENTRALIZED ENTITIES

Key unit competence: To compute taxes and fees collected by

decentralized entities

Q1. Describe the role of that person in the photo?

Q2. Are there any taxable activities in those areas?

3.1: Definition of key terms used in decentralized taxes and fees

Learning Activity 3.1

A person having houses in one of urban area in Rwanda and rents one of

the houses to another person in the year 2022. He receives a gross rental

income of FRW 4,800,000 during the tax year. On the above scenario who

is liable to pay tax.

3.1.1. Key terms used in decentralized taxes and fees

The Rwandan tax structure is categorised into two that is, the decentralised tax

structure and the centralised tax structure. The centralised tax structure is the

one that is collected by the central government whereas the decentralised tax

structure is the one that is collected by the local administration.

In this unit three, the following terms shall have the following meanings:1. Market value: amount of money for which property would be sold onA general/fiscal/revenue tax is levied to raise public funds for government service. Therefore, property tax is based on the value of property such as land, houses, shopping centers and factories. This tax is imposed by municipalities on owners of property within their jurisdiction based on the value of such property. In Rwanda, local government taxes were collected by the districts but in 2014 this task was delegated to the RRA.the market on a given date;

2. Small and medium enterprises: businesses which include micro, small

and medium enterprises that fulfil at least two of three conditions basedon net capital investments, annual turnover and number of employees,

as follows:

a) Micro enterprise: business having less than five hundred thousand

Rwandan francs (FRW 500,000) as net capital investments, less thanthree hundred thousand Rwandan francs (FRW 300,000) as annual

turnover and having between one (1) and three (3) employees;

b) Small enterprise: such business having from five hundred thousand

Rwandan francs (FRW 500,000) to fifteen million Rwandan francs

(FRW 15,000,000) as net capital investments, from three hundred

thousand Rwandan francs (FRW 300,000) to twelve million Rwandan

francs (FRW 12,000,000) as annual turnover and having from four (4)

to thirty (30) employees;

c) Medium enterprise: business having from fifteen million Rwandan

francs (FRW 15,000,000) to seventy million Rwandan francs (FRW

70,000,000) as net capital investments, from twelve million Rwandan

francs (FRW 12,000,000) to fifty million Rwandan francs (FRW

50,000,000) as annual turnover and having from thirty-one (31) to one

hundred (100) employees.

3. Basic infrastructure: activities that are made available to the population

by the government for the purposes of boosting their social development,

including roads, schools, health facilities, water, electricity, etc…

4. Improvements: immovable structures or amenities that are not

buildings but increase the actual value of a plot of land or a building;

5. Title deed: a written legal document confirming a person’s right to

property which is delivered by the competent authority in accordance

with the law;

6. Assessment cycle: a repetitive period of five (5) years that commences

on 01 January of the first year after the commencement of this Law for

which assessment of tax is done;

7. Plot of land: a registered piece of land with clear boundaries owned by

one or several persons;

8. Public institution: Government-owned commercial or non-commercial

entity having legal personality and enjoying financial and administrative

autonomy and which is established by a specific law;

9. Building: a house or other similar structure used on a permanent or

temporary basis;

10. Residential building: a house intended for occupancy for dwelling

purposes;

11. Industrial building: a house for which the competent authority has

authorized the construction for industrial purposes;

12. Commercial building: a house for which the competent authority has

authorized the construction for commercial purposes;

13. Decentralized entities: local administrative entities having legal

personality and enjoying administrative and financial autonomy;

14. Owner of a property: a person registered as owner of an immovable

property or a holder of other rights on the property and whoever is

considered to be the owner of the property thereof in accordance with

Rwandan law;

15. Usufruct: right to use and benefit from the proceeds from property of

another person in the same way as its owner on conditions of preserving

its substance;

16. Undeveloped land: land that is not utilized for the intended purpose as

provided for by laws governing land use and management;

17. Person: any individual, entity, government institution, company or any

other association;18. Taxpayer: any person who is subject to tax in accordance with this Law;

19. Immovable property tax: tax levied on property that has a fixedlocation and cannot be moved elsewhere and improvements thereto;

20. Rental income tax: tax levied on income derived from rented immovable

property;21. Trading license tax: a tax levied on business activities carried out in

defined boundaries of decentralized entities;22. Tax administration: institution in charge of assessment and collectionof taxes on behalf of decentralized entities.

Application activity 3.1

1. With examples, differentiate

a) Micro enterprise and Medium enterpriseb) Commercial building and Residential building2. What do you think is the purpose of decentralized entities?

3.2: Sources of revenue and property of decentralized entities

Learning Activity 3.2

In this context, which revenues are collected by RRA on behalf of localgovernment entity?

3.2.1. Sources of revenue and property of decentralized entities

The revenue and property of decentralized entities come from the followingsources:

i. Taxes and fees paid in accordance with the decentralized tax structure

ii. Funds obtained from issuance of certificates and their extension by

decentralized entities;

iii. Profits from investment of decentralized entities and interests from their

own shares and income-generating activities;

iv. Administrative fines;

v. Loans;

vi. Government subsidies;

vii. Donations and bequests;

viii. Fees from partners;

ix. Fees from the value of immovable property sold by auction;

x. Funds obtained from rent and sale of land of decentralized entities;

xi. All other fees and administrative fines that can be collected by decentralized

entities according to any other Rwandan law

Application activity 3.2

Burera District has a project plan of building a football stadium that will

cost 4 billion, Ministry of Finance has allocated 3 billion under Burera

District Budget

Burera district need other revenue to increase the budget for all planneddistrict activities.

Question:

Apart from the budget from Ministry of Finance, what are other Sources ofrevenues for Burera District?

3.3: Types of Taxes to be paid to Decentralized Entities

Learning Activity 3.3

Mr Robert rent a house owned by three siblings who are orphans, that

house was left by their parents

On 31st January 2023 is the deadline of property tax.

Both Robert and those siblings do not know about Property tax.

Suggest them who is liable to pay property tax among Robert and siblings.3.3.1: Immovable property tax

Immovable Property Tax is a tax levied on the market value of a building and

the surface of a plot of land. The land and buildings are referred to as the

‘Immovable Property’. In order to facilitate taxpayers, the market value of the

building only needs to be assessed every five years, unless major changes in the

building and structures occur.

1. Tax payers of immovable property tax

According to Article 6 of Law 75/2018, the immovable property tax is assessed

and paid by the owner, the usufructuary or any other person considered being

the owner. The owner who lives abroad can have a proxy in Rwanda. Such

a proxy must fulfil the tax liability that this Law requires from the owner.

Misrepresentation is considered as if it is done by the owner. The tax liability on

immovable property is not terminated or deferred by the disappearance of an

owner of immovable property, or if the owner has disappeared without leaving

behind a proxy or other person to manage the immovable property on his or

her behalf.

2. Commencement of the Tax Liability for the Usufructuary

Article 7 of Law 75/2018 stipulates that the tax liability for the usufructuary

runs from the date of commencement of the usufruct.

3. Co-ownership of Immovable Property

According to Article 8 of Law 75/2018, if immovable property is owned by

more than one (1) co-owner, the co-owners appoint and authorize one of themor any other person to represent them jointly as a group of taxpayers.

If co-owners of immovable property have not appointed a co-owner or a proxy

to represent them jointly as a group of taxpayers, the tax obligations related tothe immovable property will be settled in accordance with laws regulating coowned property

4. Persons considered being Owners of Property

According to Article 9 of Law 44/2018, the following persons are considered to

be owners of property:

i. The holder of immovable property where the property title deed has not

yet been transferred in his/her own name;

ii. A person who occupies or who has used the immovable property for a

period of at least two (2) years as if he/she is the owner as long as the

identity of the legally recognized owner of such property is not known;

iii.A proxy who represents an owner of property who lives abroad;

iv. A usufructuary;

v. An administrator of an abandoned property.5. Change of Ownership of Property

Article 10 of Law 75/2018 stipulates that in case there is a transfer of ownership

of an immovable property for any reason within the tax period, the acquirer of

immovable property is liable for tax from the date of the transfer. If the former

owner of the immovable property fails to meet his/her tax obligations, he/she

is liable for payment of the fines and late payment interests in accordance withthe provisions of the decentralized tax Law.

6. Immovable Property Tax Base

According to Article 11 of Law 75 2018, the immovable property tax is levied

on the market value of a building and surface of a plot of land. If the immovable

property consists of a plot of land that is not built, the tax on immovable

property is calculated on each square meter of the whole surface of the plot of

land. Where the immovable property consists of a plot of land, a building and

its improvements, the tax on immovable property for a plot of land is calculated

separately in accordance with the provisions of Paragraph 2 of Article 11, whilethe tax on the building and its improvements is based on the market value.

7. Immovable Property Exempted from Immovable Property Tax

The following immovable properties are exempted from the immovable

property tax as per Article 12 of Law 75/2018

i. One building whose owner intends for occupancy for dwelling purposes

and its annex buildings located in a residential plot for one family. That

building remains considered as his/her dwelling even when he/she does

not occupy it for various reasons;

ii. Immovable property determined by the District Council and donated to

vulnerable groups;

iii.Immovable property belonging to the State, Province, decentralized

entities as well as public institutions except if they are used for profitmaking activities or for leasing;

iv. Immovable property belonging to foreign diplomatic missions in Rwanda

if their countries do not levy tax on immovable property of Rwanda’s

diplomatic missions;

v. Land used for agricultural and livestock activities which area is equal to

or less than two hectares (2ha);

vi. Land reserved for construction of houses in rural areas but where nobasic infrastructure has been erected;

The exemption referred to under item 1 of Paragraph One of this section equally

applies to each individually owned portion of a condominium. All owners in

condominium are commonly liable for the tax on commonly owned portions

of plots of land on which a condominium is built. However, commonly ownedportions of the building are totally exempted from the tax.

8. Period of Immovable Property Valuation

As per Article 13 of Law 75/2018, the date of valuation of immovable property

is 1st January of the first taxable year. The value of immovable property is

determined for a cyclical period of five (5) years. This means that every 5 years

the property is revalued. It includes the market value of the building and the

plot of land. For the five (5) years assessment cycle to enable the taxpayer to

assess the market value of the immovable property, the following must be takeninto account:

i. In the beginning of the second assessment cycle which commences after

five (5) years and in the beginning of every next assessment cycle, a

general revision of market value takes place;

ii. A global fluctuation of the market value between two (2) general revisions

is not a reason for a new assessment of immovable property.

However, the value of immovable property can be reviewed before the end ofthe assessment cycle due to increase or decrease of its value.

9. Methodology of Valuation of Immovable Property

Article 14 of Law 75/2018 provides the following methods for evaluating the

market value of the immovable property.

If the immovable property was valued within the previous five (5) years and

no major changes in the buildings and structures, leading to an increase or

decrease of the immovable property value by more than twenty percent (20%),

have occurred, this value is regarded as the market value.

In this case, the taxpayer must provide the certificate of valuation

to the tax administration for verification purposes;

iii.If the immovable property was bought within the previous five (5) years

in the free market and no major changes in the buildings and structures,

leading to an increase or decrease of the immovable property value by

more than twenty percent (20%) have occurred, the purchase price is

regarded as the market value. In this case, the taxpayer must provide the

acquisition contract for verification purposes to the tax administration;

iv. If the taxpayer’s self-assessment on value of property is believed to be

under valuated, the tax administration will proceed to a counter-valuation.

If the value difference between the taxpayer’s self-assessment and the

tax administration’s counter-valuation is more than twenty percent

(20%), the value from counter-valuation will be regarded as the final

market value. Otherwise, the taxpayer’s self-assessment value applies.

The taxable value should be rounded up to the next full one thousand

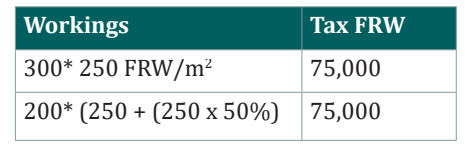

(FRW 1,000) in Rwandan francs.Illustrative Example

Mwubatsi owns a property in Bugesera valued at 100,000,000 FRW during the

year ended 31st December 2022, he extended his building by

a) 10,000,000

b) 30,000,000In each of the above cases show the tax base of the asset

c) Appreciation of the asset: 10%, since the increase in the value of the

asset is below 20%, the tax base will remain the same. d) Appreciation of the asset: 30%, since the appreciation in the value of

the asset is above 20%, the new tax base of the asset will be 100,000,000

+ 30,000,000 = FRW 130,000,000 10. Tax Rate on Buildings

According to Article 16 of Law 75/2018, the tax rate on buildings is determined

as follows:i. One per cent (1%) of the market value of a residential building;According to Article 17 of Law 75/2018, except for the tax rate of zero point one

ii. Zero point five per cent (0.5%) of the market value of the building for

commercial buildings;

iii. Zero point one per cent (0.1%) of the market value of industrial

buildings, buildings belonging to small and medium enterprises and

those intended for other activities not specified in this section.

11. Application of Tax Rate on Buildings

per cent (0.1%), the tax rates prescribed by Article 16 of this Law are applied

progressively as follows:

1. For residential buildings a progressive rate is applied as follows:

a) Zero point twenty-five percent (0.25%) from the first year after the

commencement of this Law;

b) Zero point fifty percent (0.50%) from the second year after the

commencement of this Law;

c) Zero point seventy-five percent (0.75%) from the third year after the

commencement of this Law;

d) One percent (1%) from the fourth year after the commencement of

this Law;

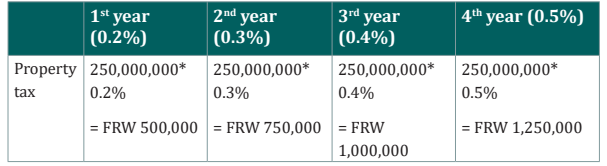

2. For commercial buildings a progressive rate is applied as follows:

a) Zero point two percent (0.2%) of the market value of the building is

applied in the first year of the commencement of this Law;

b) Zero point three percent (0.3%) during the second year of the

commencement of this Law;

c) Zero point four per cent (0.4%) during the third year of the

commencement of this Law;

d) Zero point five percent (0.5%) during the fourth year of the

commencement of this Law.

Residential apartments having a minimum of four floors,

including basement floors, benefit from reduction of tax rates,

equivalent to fifty percent (50%) of the ordinary rate.

12. Tax Rate on Plots of Land

Article 18 of Law 75/2018, provides that the tax rate on plot of land varies

between zero (0) and three hundred Rwandan francs (FRW 300) per square

meter. The tax rate determined by the District Council per square meter of land

in accordance with the provisions of Article 18 of this Law is increased by fifty

percent (50%) applicable to land in excess to standard size of plot of land meant

for construction of buildings. This is per Article 19 of the Law 75/2018. Any

undeveloped plot of land is subject to additional tax of one hundred percent

(100%) to the tax rate referred to in Article 18 of this Law.

Example

Haguma owns a property which is located on 500m2

; the district council

approved a tax of FRW 250 per square meter. Required: Compute property taxSolution:

Since the standard plot is 300m2, the first 300m2, will be taxed at FRW 250, theexcess to 200m2, the tax will be increased by 50%.

13. Tax Declaration on Immovable Property by the Taxpayer

According to Article 21 of Law 75/2018, the taxpayer must file the declaration

to the tax administration not later than 31st December of the year that

corresponds to the first tax period. The taxpayer files to the tax administration

his/her declaration of the immovable property tax determined in accordancewith provisions of the Order of the Minister in charge of taxes.

14. Declaration of Appreciation and Depreciation

If, due to changes to immovable property, the value of that property increases

or decreases by more than twenty percent (20%) within an assessment cycle,

the taxpayer submits within a period of one (1) month, a new tax declaration to

the tax administration with all changes thereof and the value of the immovableproperty.

15. Review and re-assessment of tax by the tax administration

Tax Administration reviews the tax declaration on immovable property within a

period of six (6) months starting from 1st January of the year following the year

for which the tax declaration was made. If the tax declaration on immovable

property was filed late, the six (6) months period starts from the date on whichthe tax administration received the declaration.

The review of the tax declaration on immovable property is based on the natureand general state of the immovable property, its location and its actual use.

16. Tax Assessment Notice

The tax assessment notice of the tax administration to be addressed to a failing

tax declarant contains at least the following details:

i. Tax base calculation outline;

ii. Calculation of the value of the concerned immovable property;

iii. Calculation of the tax;

iv. Names of the owner, his/her proxy or usufructuary;

v. Address of the owner, the proxy or the usufructuary;

vi. The due date for tax payment;

vii. Mode of payment;

viii. Consequences of late payment or non-payment of tax;ix. A reference to the taxpayer’s right to complain and appeal

17. Waiver of Tax Liability

According to Article 31 of the Law 75/2018, the concerned District Council can

only waive the due immovable property tax in the following cases:

a) The taxpayer has provided a written statement of an inventory of his

property justifying that he/she is totally indebted so as a public auction

of his/her remaining property would yield no result;

b) The taxpayer proves that he/she is not able to pay immovable property

tax. The taxpayer applying for waiver of immovable property tax liability

must write to the tax administration. When the request is found valid,

the tax administration makes a report to the executive committee of

the competent decentralized entity which also submits it to the District

Council for decision. The waiver of immovable property tax liability

cannot be granted to a taxpayer who understated or evaded taxes.18. Late Submission or Incomplete or Misleading Tax Declaration

Apart from collecting the actual amount of the tax due, the decentralized entity

shall levy a fine not exceeding 40% of the tax due where:

1. The fixed asset tax declaration form is not submitted;

2. The fixed asset tax declaration form is submitted late;

3. The fixed asset tax declaration form contains incorrect or fraudulent

information with intent to evade tax.

4. The fixed asset tax declaration form is substantially incomplete;19. Valuation of Fixed Asset

As mentioned in Article 6 of the Rwanda Tax Law, the fixed asset tax base is the

market value of such fixed asset. If the fixed asset constitutes a parcel of land

that is not built, the market value constitutes as per square meter value times

the size of that parcel of land. Where the fixed asset consists of a parcel of land

and a building and improvements, the aggregate value of the land, the building

and improvements constitute the market value of such fixed asset.

Where a parcel of land, building, improvement and usufruct have been

purchased, the purchase price shall be taken as the tax base, unless it is patently

clear that the purchase price is below the market value. The taxable valueshould be rounded up to the next full one thousand Rwandan francs.

Example 1

Bagirayabo is located in Gisenyi town. He owns the properties below which

are used for commercial purposes; the residential property which he dwells

with his family, and a commercial building. The market value of the residential

building is FRW 130,000,000 and the market value of the commercial buildingis FRW 250, 000,000

Required: Compute the property tax Bagirayabo should pay to RRA.

Solution

Since the residential house is dwelled by the owner, it is exempted from theproperty tax.

The commercial building will be taxed in the following ways:

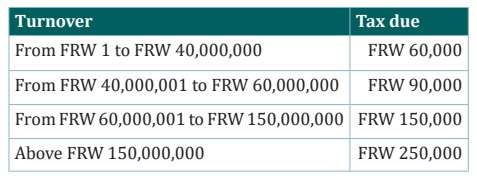

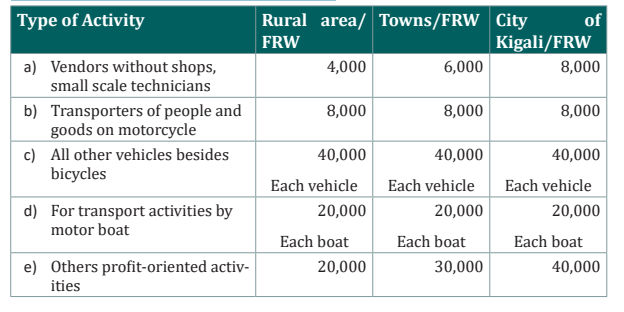

3.3.2: Trading License Tax

Trading License Tax, also informally known as ‘patente’, is a tax levied on any

person or business conducting profit-oriented activities. Trading License Taxmust be declared and paid for each business branch or premises.

a) Tax Year

The tax period for the trading license tax starts on January 1st and ends on

December 31st of that same year. If taxable activities start in January, the

trading license tax must be paid for a whole year. If such activities start after

January, the taxpayer must pay trading license tax equivalent to the remaining

months including the one in which the activities started. As regards to persons

conducting seasonal or periodic activities, the trading license tax must be paid

for a whole year, even though the taxable activities do not occur throughout thewhole year.

b) Trading license tax rate

The trading license tax is calculated on the basis of the following tables

Table I. All value added tax (VAT) registered profit-oriented activities

Table II. Other profit-oriented activities

Taxpayers who sell goods or services exempted from value added tax but

whose turnover is equal or greater than twenty million Rwandan francs (FRW

20,000,000) pay the trading license tax in the same manner as taxpayersregistered for value added tax.

The basis for the calculation of trading license tax in table I above is the turnoverof the previous year.

c) Tax Exemption

– Non-commercial State organs,

– Small and medium enterprises during the first two (2) years following

their establishment or 24 months of establishment, are exempted from

trading license tax. After expiration of the 24 months, the taxpayer

must declare and pay Trading License Tax within seven days.d) Trading license tax declarationAny taxpayer files a tax declaration to the decentralized entity where his/her

activities are undertaken not later than 31st January of the year that corresponds

to the tax period. If a taxpayer has branches, a trading license tax declaration is required for the

head office as well as for each branch of his/her business activities basing on

the turnover of the previous year for the head office and for each branch.

In case a branch does not have or cannot determine its turnover, the tradinglicense tax is declared based on the turnover of the head office.

If a taxpayer carries out different business activities in different buildings, he/

she files a trading license tax declaration for each business activity.

When a business is made of several activities carried out by the same person in

the same building, only one trading license tax certificate is required and onlyone tax declaration for all business activities is filed.

In case a business is spread across more than one District, the taxpayer fileshis/her declaration of trade license tax in each District where he/she operates.

e) Trading license tax payment

The trading license tax assessed by a taxpayer himself/herself is paid to the taxadministration not later than 31st January of the tax year.

If the trading license tax is not paid by the due date, the taxpayer is not allowed

to start or to continue his/her business activities without having paid such tax.

Business activities undertaken while the taxpayer is in arrears with the payment

of his/her trading license tax are illegal. The tax administration has the powerto stop such activities.

f) Posting of the trading license tax certificate

The trading license tax certificate is displayed clearly at the entrance of the

business premises or affixed to the car, boat or any other vehicle for which thetax was paid.

was paid.

g) Presentation of the trading license tax certificate

Whenever necessary, the holder of a trading license tax certificate presents such

a certificate with documents identifying him/her or his/her business activitiesto the tax administration.

Failure to present the trading license tax certificate is punishable by an

administrative fine of ten thousand Rwandan francs (FRW 10,000). The

taxpayer’s obligation to pay the trading license tax is not affected by theimposition of a fine.

If a trading license tax certificate is lost or damaged, a duplicate is issued by theh) Replacement of the trading license tax certificate

tax administration for a fee equivalent to five thousand Rwandan francs (FRW5,000).

In case the taxpayer terminates or changes his/her business activities duringi) Replacement of the trading license tax certificate

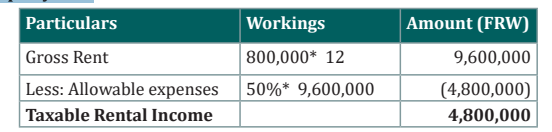

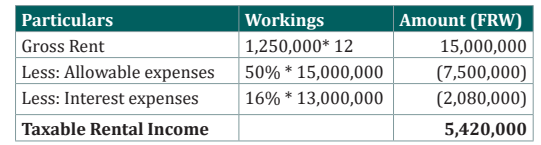

a taa) Payment of Rental Income TaxRental income tax is charged on income generated by individuals from rented

fixed assets located in Rwanda. The natural person who receives such an

income is the taxpayer. The income taxable year for calculating the tax starts on