Topic outline

UNIT1: INTRODUCTION TO QUICKBOOKS

Key unit competence: Create company profile in QUICKBOOKSsoftware

Introductory Activity

In today’s business environment, most financial accounting systems have

been computerized and automated in such a way that papers are not needed

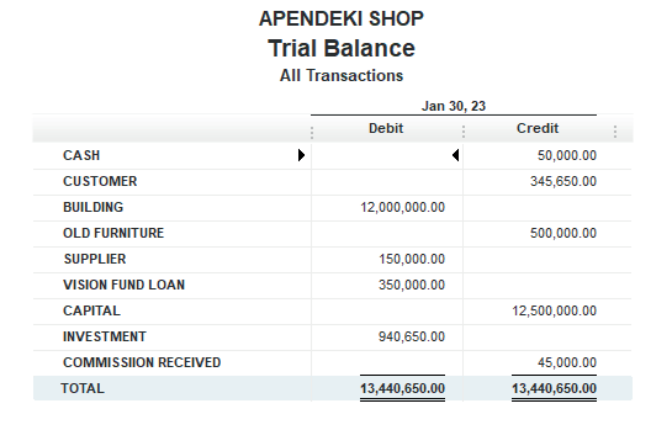

or needed less and less. Mr NGOGA Frank is an accountant in ABC Ltd.

His day to day activities is to identify and record, classify, summarize, analyze

and interpret financial transactions of the company in a significant manner

and in terms of money, transactions and events which are in part of financial

character, and interpret the related results. Mr NGOGA Frank uses a manual

book keeping accounting system. This causes him a low performance in

terms of providing timely financial information to the different users for rational

decisions. To overcome this, the owner is suggesting to shift from manual book

keeping system to computerized accounting system.

a) Advise him on accounting software that can be used by the company.

b) Do you think the software will help them to handle the challenges?Explain.

1.1 General overview on QuickBooks

Activity 1.1

Holly city Technology Ltd has a paper-based database and wants to have a

computerized one to use to keep all its customers, suppliers and third parties’

data. Every day Director of Holly city technology Ltd faces different challenges

of properly keeping customer’s data because of the system they use which isa paper based database and Microsoft Excel program.

By analyzing this scenario answer the following questions:

a. Advise him on the software the company can use for solving the above

challengesb. Differentiate a paper-based database from a computerized database

QuickBooks is one of the most popular accounting software for small

businesses. Moving from manual bookkeeping or spreadsheets have grown

into many problems, difficulties, obstacles and businesses need a better option

compared to other current software.

QuickBooks can be a good choice for small and medium businesses. It is best

known for its bookkeeping software; it offers a range of accounting and financesolutions for small businesses.

1.1.1. Key concepts

a. Accounting: Accounting is a process of identifying and recording,

classifying, summarizing, analyzing and interpreting financial transactions

of an entity for a certain financial period.

b. Accounting cycle: Accounting cycle refers to a series of steps followed

by companies to systematically process financial information from source

documents to the preparation of financial statements on a monthly,

quarterly, and/or annual basis. The collective process of recording,

processing, classifying and summarizing the business transactions in

financial statements is known as accounting cycle.

c. Manual Bookkeeping: This is a way of recording business activity

transactions without using a computer system with specialized accounting

software. In this way, transactions are registered by hand in accounting

books, using a written ledger of transactions, physical records, pads of

paper and books.

d. Computerized accounting: Computerized accounting system is an

accounting information system that processes the financial transactions

and events as per Generally Accepted Accounting Principles (GAAP) toproduce reports as per user requirements

1.1.2. Use of QuickBooks software in accounting records

QuickBooks provides a number of ready to use templates that business

owners can use to create invoices, spreadsheets, charts and business plan.

QuickBooks makes it easy to customize the look and feel of those documents.

QuickBooks allows the user to look at and manage purchases, sales, andexpenses in one spot.

Additionally, QuickBooks helps businesses in the following ways:

• QuickBooks like other accounting is important in digitalization of

accounting data

• Simplifies and automates data entry. For example, a point-of-sale

terminal may actually become a data entry device so that sales are

automatically “booked” into the accounting system as they occur

• Frequently divide the accounting process into modules related to

functional areas such as sales/collection, purchasing/payment, and

others.

• Is “user-friendly” by providing data entry blanks that are easily understood

in relation to the underlying transactions.

• Minimize key-stokes by using “pick lists,” automatic call-up functions,

and auto-complete type technology.

• Is built on data-base logic, allowing transaction data to be sorted and

processed based on any query structure. For example, producing an

income statement for July; providing a listing of sales to Customer

• Provide up-to-date data that may be accessed by key business decision

makers.

• Are capable of producing numerous specialized reports in addition tothe key financial statements

Application Activity 1.1

1. Define the following Terms:

a) Manual Bookkeeping

b) Computerized accounting

c) Accounting cycle2. Discuss the importance of QuickBooks

1.2. Installation of QUICKBOOKS software

Learning Activity 1.2

Holly city Technology Ltd accountant Uwimbabazi bought a laptop which

doesn’t have any accounting software

1. Demonstrate and outline the procedure will be used by Uwimbabazi forhaving QuickBooks in her computer.

Installation (or setup) of software is the act of making the program ready

for execution. Installation refers to the particular configuration of a software or

hardware with a view to making it usable with the computer. A soft or digital

copy of the piece of software (program) is needed to install it. There are different

processes of installing a piece of software (program).

Because the process varies for each program and each computer, programs

(including operating systems) often come with an installer, a specialized program

responsible for doing whatever is needed for the installation. Installation may be

part of a larger software deployment process.

Installation typically involves code (program) being copied/generated from

the installation files to new files on the local computer for easier access by

the operating system, creating necessary directories, registering environment

variables, providing separate program for un-installation etc. Because code is

generally copied/generated in multiple locations, uninstallation usually involvesmore than just erasing the program folder.

Common operations performed during QuickBooks software

installation include:

• Making sure that necessary system requirements are met

• Checking for existing versions of the software

• Creating or updating program files and folders

• Adding configuration data such as configuration files, Windows

registry entries or environment variables

• Making the software accessible to the user, for instance by creating

links, shortcuts or bookmarks

• Configuring components that run automatically, such as Windows

services

• Performing product activation• Updating the software versions

Steps of installing QuickBooks Software

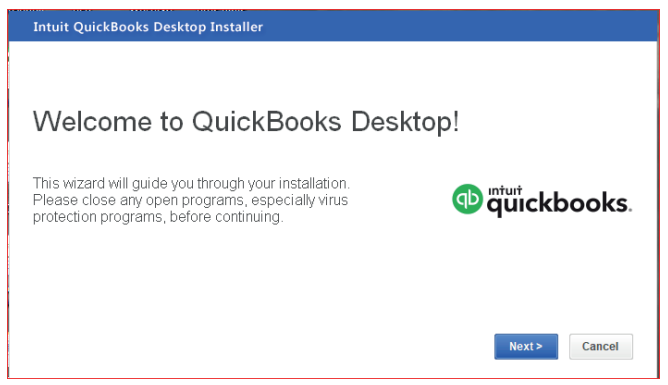

The following are the steps to install a QuickBooks software in a computer:Step 1. Open QuickBooks set up icon, then the following window appear:

Figure 1.1. QuickBooks Install Shield wizard

Step 2: In the Welcome Window that appeared click on NEXT and get thefollowing:

Figure 1.2. Welcome to QuickBooks Interface

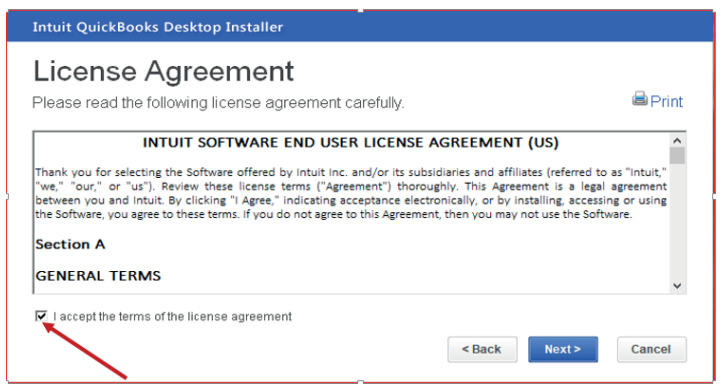

Step 3: Tick on “I accept the terms of the license agreement” and click onNext

Figure 1.3 QuickBooks License Agreement Interface

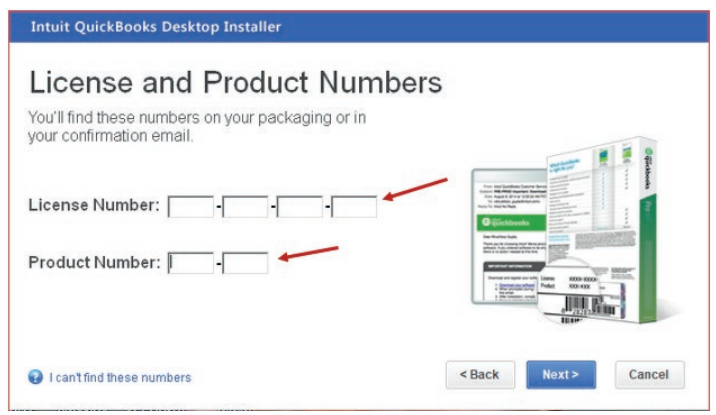

Step4: After accepting the terms and conditions of QuickBooks license,

activate the QuickBooks Desktop by filling the license and product numberin their field.

Figure 1.4 Field reserved for License Number and Product Number

After click on Next then the following window of custom and network optionswill appear.

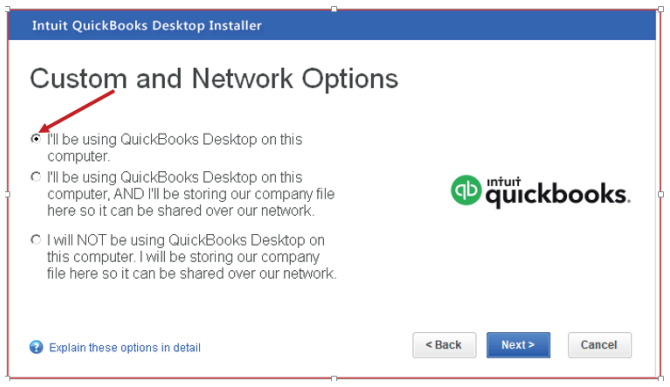

Figure 1.5 Interface used for selecting where QuickBooks Desktop will be used

Step 5: Select whether you will use QuickBooks Desktop on this computer

(which is the recommended option). Then click on Next. One of the three

options is chosen depending on how QuickBooks will be used.

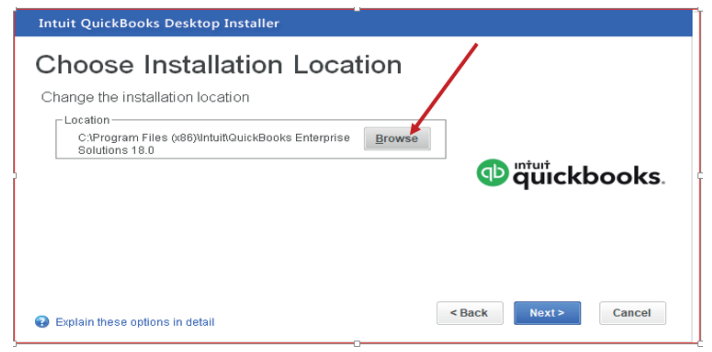

Step 6: Choose installation Location

Click on browse to select the installation location. By default, QuickBooks files

are saved in local disk C\Program Files (x86) \Intuit\QuickBooks Enterprise

solutions. But the user can locate it in other locations like on desktop or localdisk D.

Figure 1.6 Location of QuickBooks Software

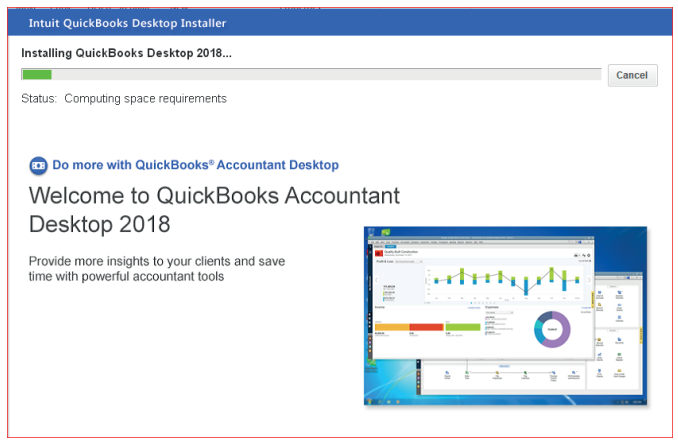

Click on install and wait for installation process

Figure 1.7 Interface with QuickBooks installation Progress

Application Activity 1.2

Assume you have got a job of being an accountant of five-star hotel

and the hotel wants to start using QuickBooks accounting software in

their accounting records. Even if the hotel manager has already bought

QuickBooks software, it is not yet installed in their computers. You are

therefore asked to help them to install it.

1. What are the steps will you follow to install QuickBooks in computer?

2. Install the QuickBooks software in one computer in the schoolcomputer lab

1.3. Creating company profile in QuickBooks

Learning Activity 1.3

ABADAHIGWA COOPERATIVE needs to use QuickBooks in its day to

day accounting records. It is necessary to ha a full complete profile of thecompany to ensure an easy and clear records of transactions.

• Suggest to the cooperative the main component of the

company profile

• Use your own example to show to the cooperative an exampleof a full complete company profile

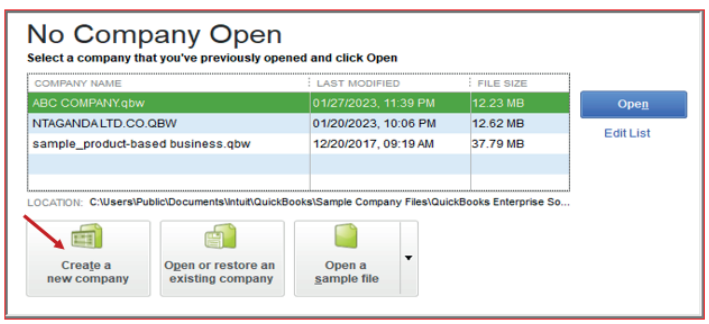

A company profile or company file is where the user stores company financial

records in QuickBooks. Therefore, it is the first thing to do in QuickBooks. You

can create a company file from scratch or convert records previously kept in a

small-business accounting program. It is a tool to use for analyzing the financialsituation of companies.

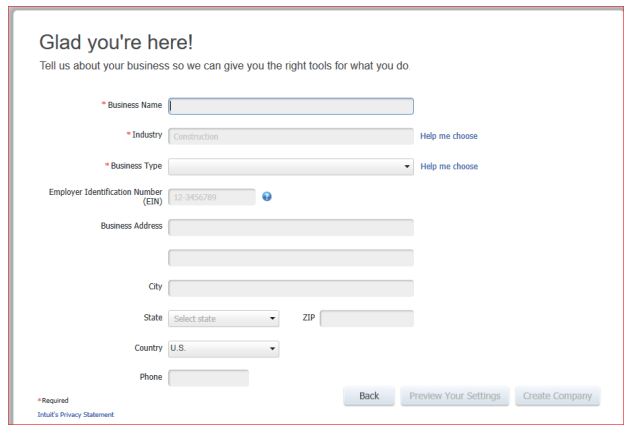

To create a company profile, follow this procedure:

• Click on the QuickBooks Home page• Click on create new company:

Figure 1.8 Creation of new company

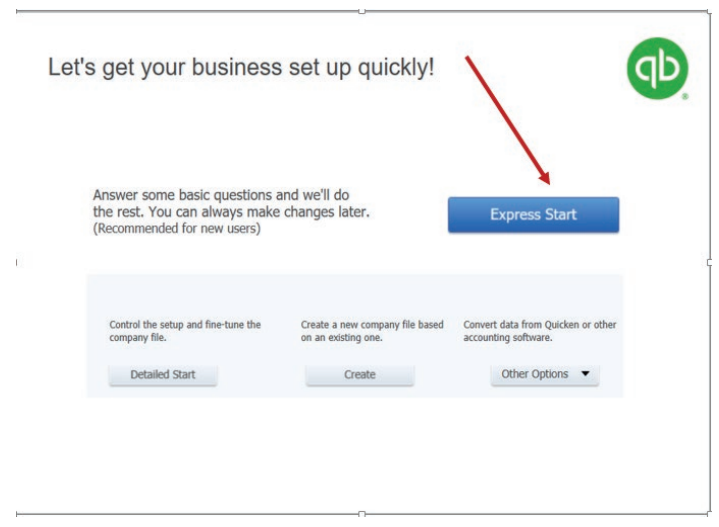

• Clicking on Expressing Start

Figure 1.9 The beginning of Easy setup of company identification

After clicking on Expressing Start, an easy setup of company profile interviewstarts.

• Complete the easy setup of company profile interview:

Figure 1.10 Business information interface

• Fill the business name

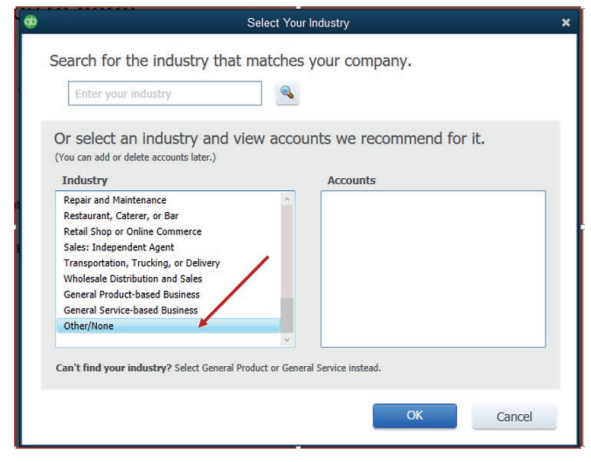

• For the industry, click on help me to choose so that the default chart

of accounts should not appear in the company charts of company.• Select other/none

Figure 1.11 interface with a list of industry types

The selection of Other/None allows the user to have a free field of charts of

account so that he can set the appropriate charts of account according to the

transactions he will be recording.

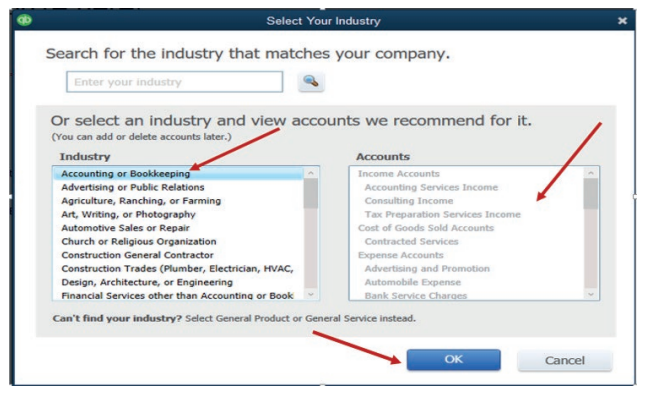

If the user selects the Accounting or bookkeeping on the field of Industry,

the default account relating to the selected industry will appear in the chart of

accounts including the ones the user does not want.

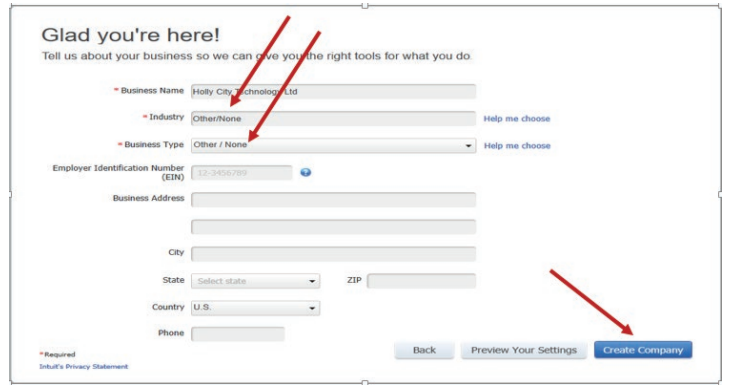

The field of Business Type should be filled according to the user’s choice. If

the user needs to continue by setting his own charts of account, he can selectOther / None. Then OK

Figure 1.12 Details of company information

Note: For Employer Identification Number use the format xxx-xx-xxxx (Three

digits- Two digits-four digits).• After filling all fields click on Create the Company

Then wait for the company creation process until the following window appear

Figure 1.13 Interface for adding Business People, Product or Services

In the above window the user adds people to do business with, product or

services sold by the company and bank accounts. Otherwise, the user may skipto start Working tab.

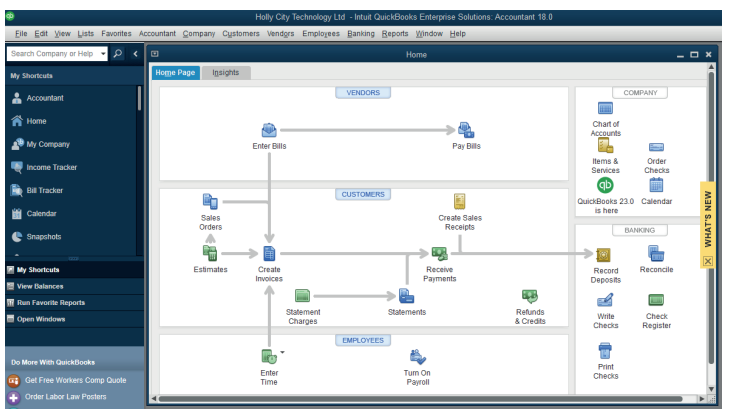

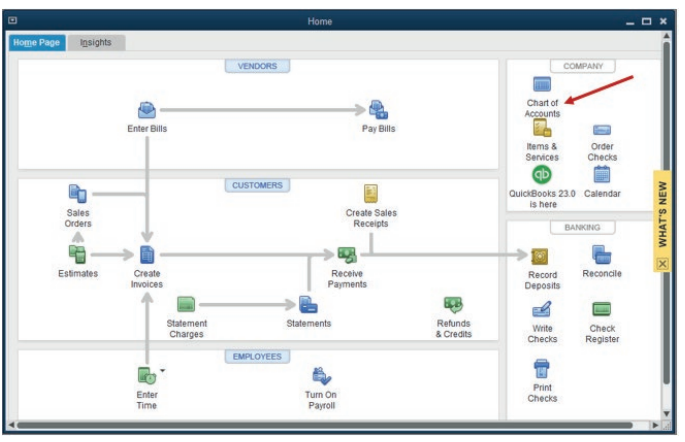

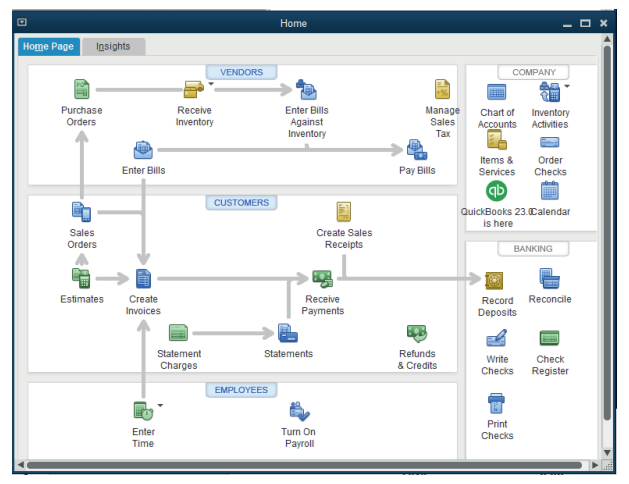

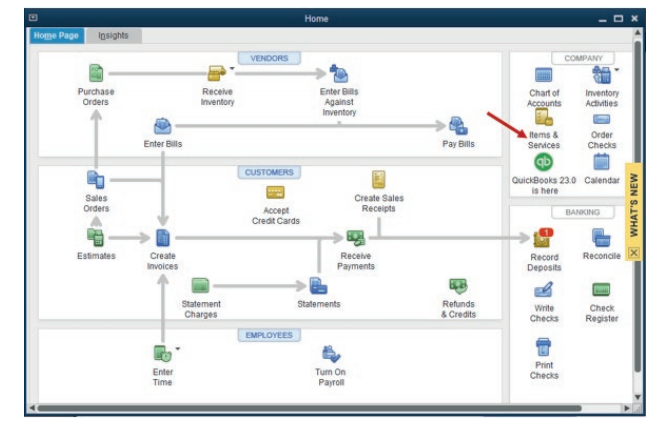

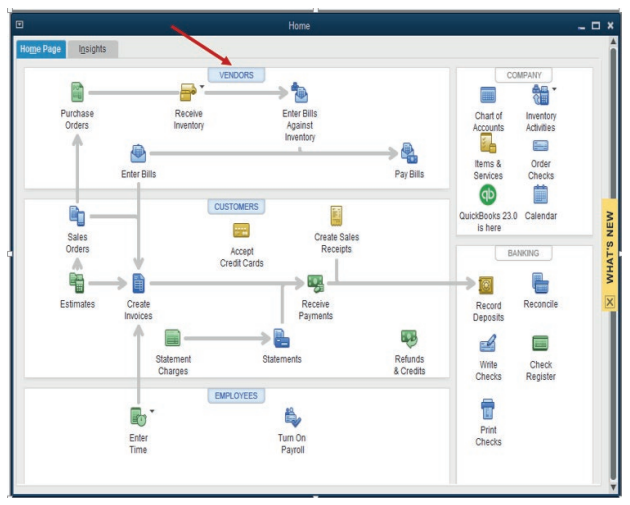

Then the QuickBooks Home Page interface appears as follows:

Figure 1.14 QuickBooks Home Page interface

The menu bar has fourteen menus namely: File, Edit, View, Lists, Favorites,

Accountant, Company, Customers, Vendors, Employees, Banking, Reports,Window and Help.

Application Activity 1.3

BWIZA Ltd is a small sole trade business of purchasing and selling of

Eggplants. It is located in NDUBA Sector, GASABO District KIGALI CITY

(Tel +250788567012-722567012; P.O Box 1123 Kigali).

BWIZA Ltd is facing serious problems related to the use of manual accounting,it decided to use QuickBooks. Create accompany profile for BWIZA Ltd.

1.4. Customization of company preference

Learning Activity 1.4

If the QuickBooks user wants to customize company preferences in QuickBooks

to fit his personal style and business needs he can do it with the help of

QuickBooks preferences as long as references permit the users to choose

how they want QuickBooks to manage things or to set own preferences.

• What should be the examples preferences that the user can

customize?• In which process it could be done?

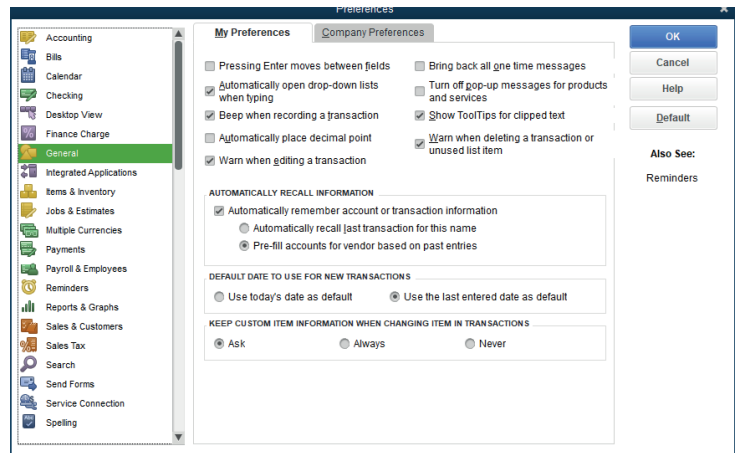

Preferences allow you as the user to decide how you want QuickBooks to

handle things or set personal or company preferences.

Examples of preferences that the user can customize:

– Age from due date: The overdue days appears on the invoice,

statement or bill, that start from the due date that

– Age from transaction date: The overdue days start on the creation

date of the invoice, statement or the date of when bill receiving.

– Format: If you click this button, then this button will open the Report

Format Preferences window which authorizes you to customize Header

or Footer & Fonts and Numbers on QuickBooks reports. You can modify

the appearance of the report.

– Reports: Show items by defining how reports display the name of the

items.

– Reports: If you need to display account numbers in your reports, click

Name and Description or Name only.

– The Classify button: With the help of this button, you can reclassifyaccounts for the Statement of Cash Flows report

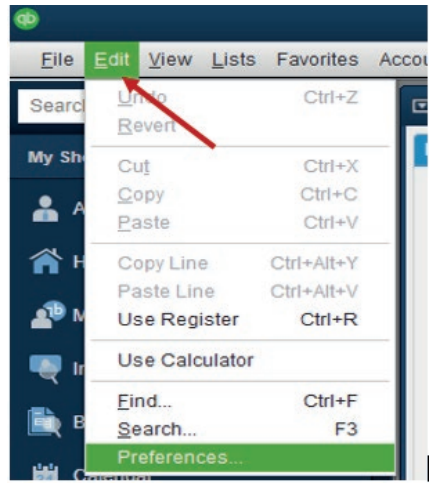

Preferences can be found by going to the top of the main QuickBooks Home

page and click on Edit and then preferences. Click on Edit Menu, on theQuickBooks Home page and find the following window:

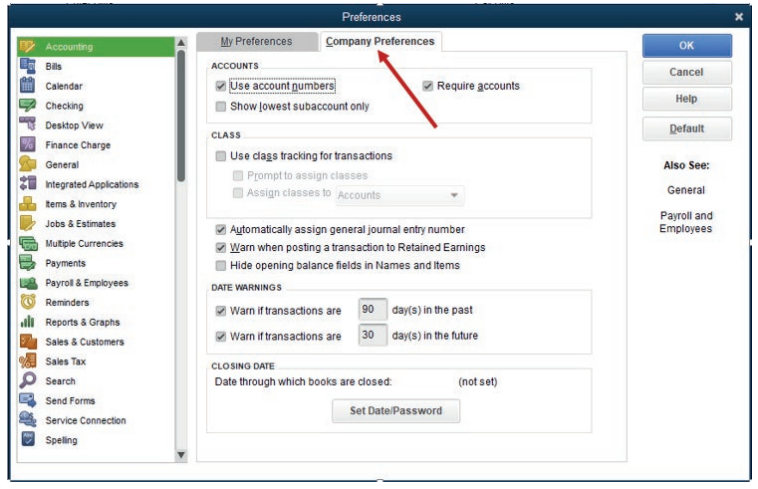

A click on Preferences gives to the user the wide option to customize either his

preferences or Company Preferences.

For example: If the user needs to customize the use of numbers on the

accounts, he/she must follow these steps:1. Click on Accounting

• Click on Company preference and tick on Use Account Numbers

and OK

• After clicking OK, check the accounts and see the numbers on the

accounts

Application Activity 1.3

1. What is the meaning of customization of company preferences?

2. Give the examples of preferences that the QuickBooks user can

customize to suit its work.

3. Present a preferences window where on My Preferences, Payroll &Employees, Only Online Payroll and Last Name are selected.

End of Unit Assessment

1. Define the Installation of software

2. List the common operations performed during QuickBooks software

installation

3. MUTARA ENTERPRISE is a small sole trade business of manufacturing

of furniture items. It is located in KAGEYO Sector, Gatsibo District

in Eastern Province (Tel +250788567012-722567012; P.O Box

1123 Gatsibo). MUTARA ENTERPRISE Shop is well known for its

services performed in Society that attracts customers.

• Use the information above to create a company profile.

• Customize the charts of accounts so that they appear withrelevant codes numbers

UNIT2: CREATION OF ACCOUNTS

Key unit competence: Create charts of accounts inQUICKBOOKS

Introductory Activity

MAREBE Ltd, a sole trading company uses QUICKBOOKS accounting

software in recording its daily financial transactions. The following are items

that the company is engaged in supplying: Computers, printers, projectors,

photocopying machines and TVs. During the month of January 2023, the

transactions below took place:

1. Starting the business with capital. A part of it at bank and the remaining

amount in Cash

2. Purchase of goods by cash

3. Bought goods on credit from Yvan.

4. Sales of goods on credit to MUSOZO

5. Cash sales.

6. Sales by cheque.

7. Returning goods to Yvan

8. Payment of accountant salary by cheque

9. MUSOZO returned goods to

10. Cash payment from Yvan for the total amount due from him. A discount

of 2% is received.

Required:

a) What are the type of accounts in which the transactions above

appear?b) List the whole accounts involved in the case study.

2.1. Creating charts of account names

Learning Activity 2.1

1. What is the meaning of charts of account?2. List the 2 uses of chart of account in accounting process

A Chart of Accounts is a list of financial accounts set up, usually use by

an accountant, an organization, and available for use by the bookkeeper for

recording transactions in the organization’s general ledger.

In QuickBooks, Chart of Accounts is a list of all the accounts that QuickBooks

uses to track financial information. These accounts are used to categorize your

transactions on everything from sales forms to reports to tax forms.

The Chart of Account allows to break down all the transactions that a business

made during a specific period into different subcategories.

By separating out the revenue, liabilities, assets, and business expenditures, a

chart of accounts enables to gain insight into the effectiveness of different areasof a business.

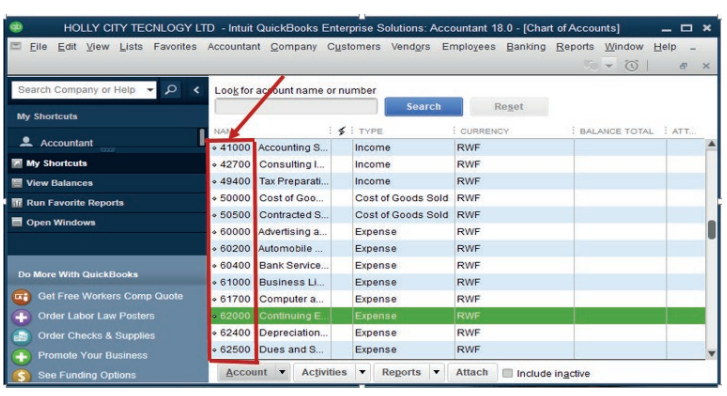

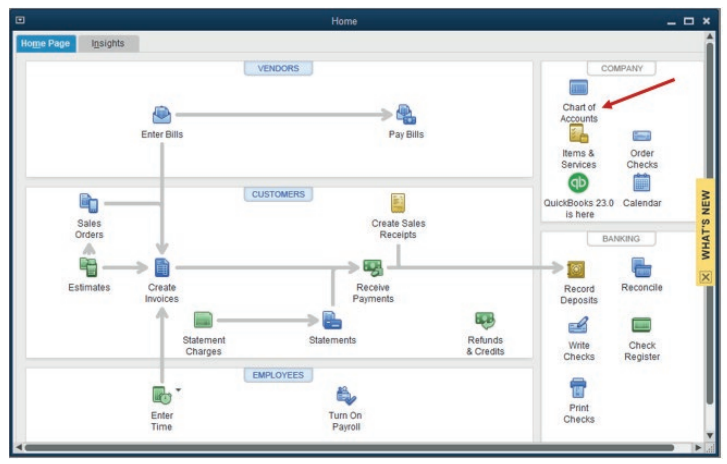

The following are the steps for creating Charts of Account in QuickBooks:• In the QuickBooks Home page, click on Charts of accounts

Figure 2.1 First step of Chart of Accounts Creation

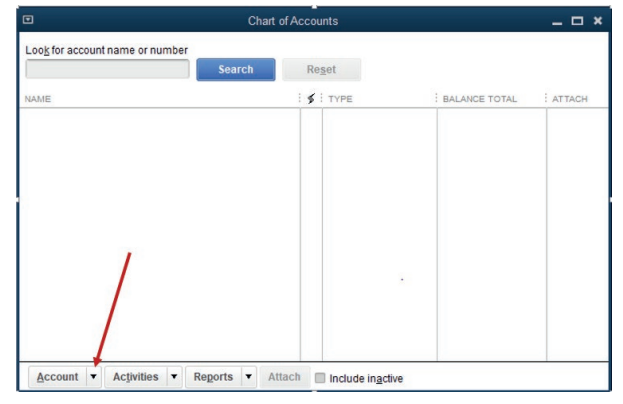

If the option Other /None was chosen in setting company profile, on business

type select industry, the charts of account windows appear empty and this gives

a free space to the company account as you want.

It also gives the option to create a New Account by Clicking on Account asillustrated in the windows below:

Figure 2.2 Option of Creating New Chart of Account

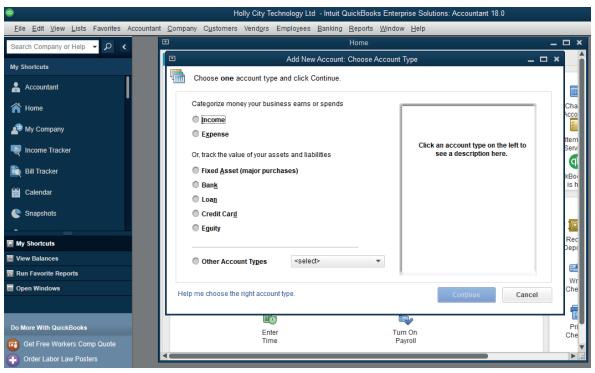

• Click on Account and New

• Choose the type of account from the window below and click onContinue.

The types of account can be Income, Expenses, Equity, Liabilities, Assets,Bank, Loan, Credit cards, Other types of account.

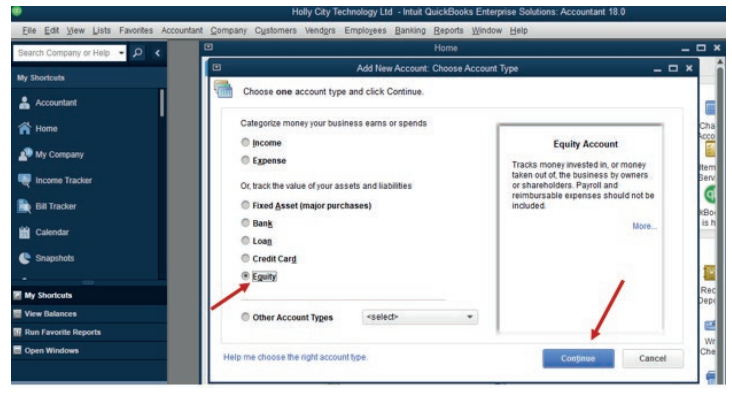

Figure 2.3 Selection of Account Type

Depending on the nature of transaction, the user can select the type of accountthat can be affected by the double entry recording.

Example 1:

1. Starting the business with capital. A part of it at bank and the

remaining amount in cash.

This transaction affects Capital, bank and cash accounts. To create capital

account, classify it in equity type by ticking the Equity radio button, write the

name of account which is CAPITAL and click Continue. Follow the same

process for bank and cash account.

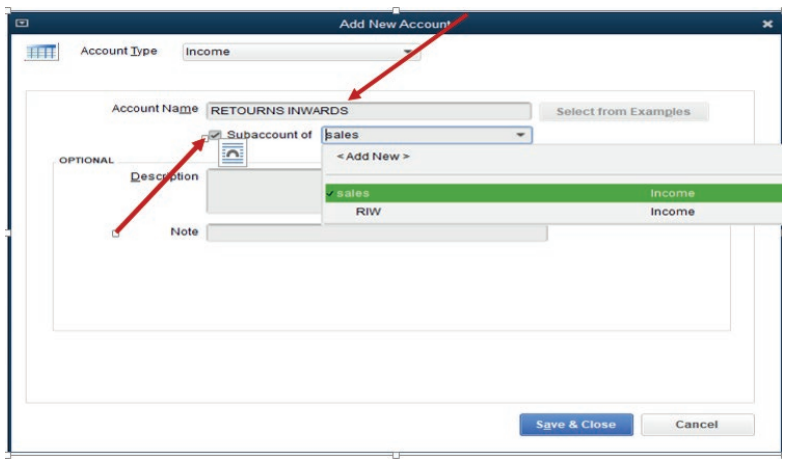

Some accounts have Sub Accounts. The user has to make sure that each

account created falls under the account type and Sub Account in which it

belongs to.

Create Sub-accounts QuickBooks lets the user create sub-accounts of other

accounts. This lets you track the details on about the account in more details

than a regular account offers. To add sub-accounts, do the following:

1. Go to the Chart of Accounts

2. Choose the account you want to make a sub-account and click the down

arrow next to Choose Edit account.

3. Edit the account and select the checkbox labeled Is sub-account.4. Choose the main account that it will be a sub-account of.

Figure 2.4 Equity Account is selected.

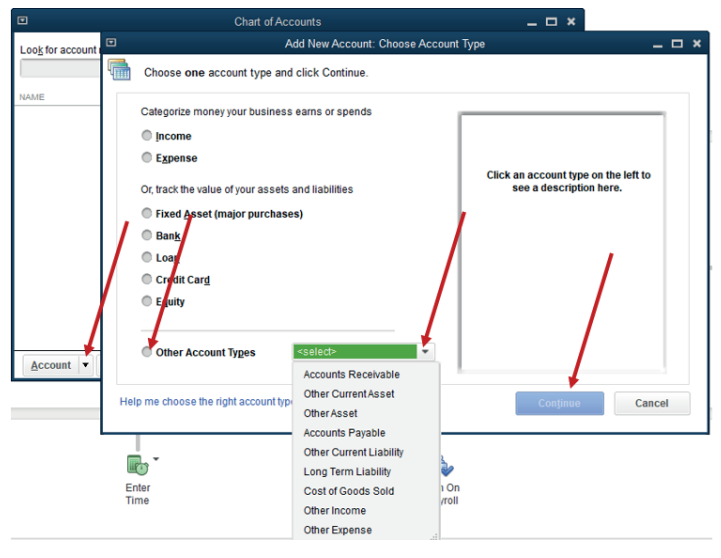

If there are other account found that do not fall into these types, there is an

option to search from Other Account Types which gives the types of accountbelow:

Figure 2.5 Selection of Account Type.

Example 2:

1. Discount received.

This transaction affects Discount received and creditor (account payable)

account.

These two accounts do not fall in the first account types. To create Chart of

Account, follow this procedure:

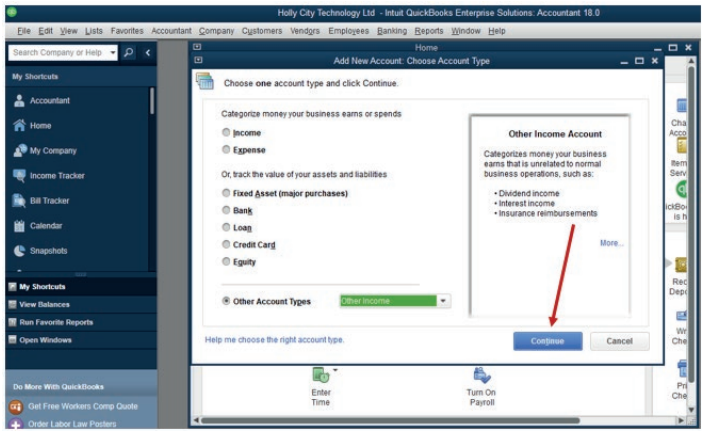

• From Other Account Type, select Other Income as account type

of discount received and Other Current Liability Account type forcreditor (account payable) then click Continue.

Figure 2.6 Interface of additional Income Account

Discount received is an Income type of account, Sub Account of Other income.

Creditor is an account payable type of account (Creditors), Sub Account of

Other current liabilities

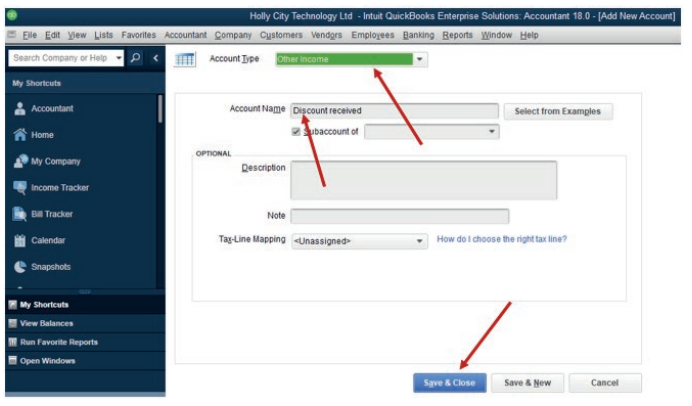

• The other income account type appears then Account name field is

filled.

If it is the last account created, click Save & Close. But if there are moreaccount to add, click Save & New.

Figure 2.7 Saving New account type and New Account Name.

• Click Save & New.

Application Activity 1.3

1. Match the accounts with their corresponding account types

2. The transactions below have been extracted from the books of

BWAIZA CO.

a) Starting the business with cash in hand

b) Bought office equipment by cash

c) Purchase of goods by cash

d) Sales of goods by cheque

e) Credit sales to AKALIZA Queen

Prepare the charts of account

2.2. Changing the account namesLearning Activity 2.2

The QuickBooks user creates the Charts of Accounts for the business. It

may happen that some of the accounts created seem to be not necessary

or are duplicated.

• What can you do if you are a QuickBooks user and you find a

situation like that?

• What do you think will be the dangers of keeping the unnecessaryaccounts in the business file?

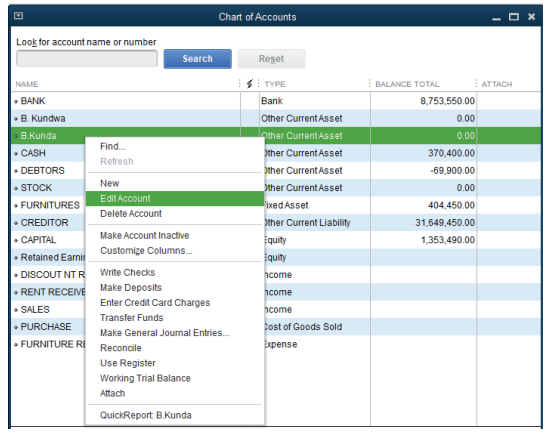

If the user finds that some chats of account name have to be changed, he can

do the following:• Click on Charts of Account on QuickBooks Home page

The list of account appears, and the user make a right click on the account

whose name is to be changed

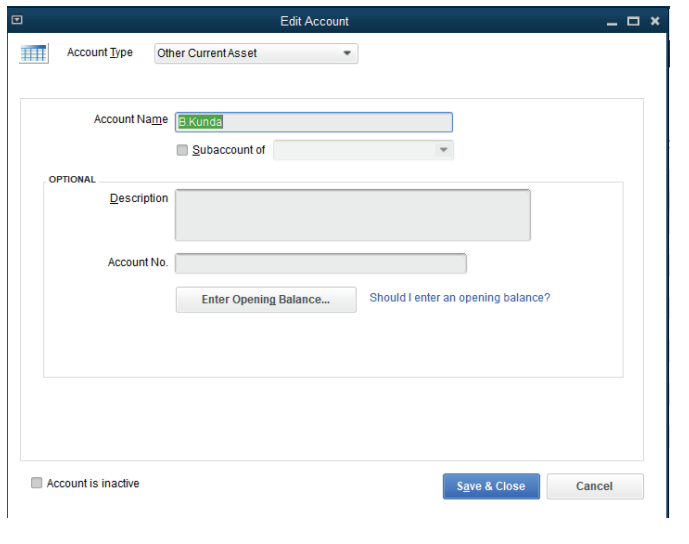

The user will find the following windows and the account name to be changed

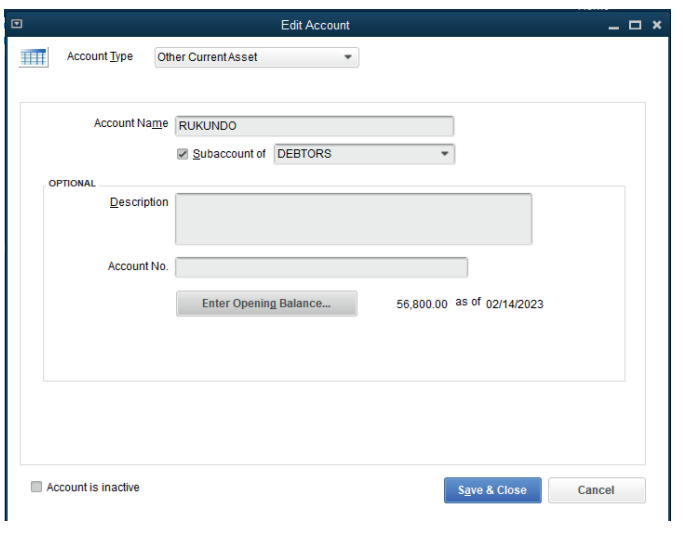

appears as here below with an option to fill the other names, account type, subaccount if any and opening balance.

In the window above B.Kunda is changed and it is replaced by Rukundo, the

sub account and opening balance is added. It finally appears as in the followingwindow:

• Click on Save & Close.

Application activity 2.2.

MUKAMURIGO, the accountant of MARANATHA CHURCH uses QuickBooks

in her daily activities. In the beginning, she created the following charts of

accounts: Cash, Bank, Sales< Capital, Purchase<, CUSTOMERS, Rent,

Purchase2, Stock and William. She finally finds that some of the accounts

are duplicated and William account is not necessary.

Replace the duplicated accounts by salary account and change Williamaccount in to Willy Account

2.3. Deleting and making inactive unnecessary accounts

Learning activity 2.3.

The following transactions have been extracted from the file of MUGEMANA

TRADING Ltd

a) Capital: cash and bank

b) Purchase of goods on credit from supplier

c) Sales of goods by cash

d) Returning defective goods to Martin

e) Payment to martin the remaining amount by cheque. 2.5 % Cash

discount received

Below are the charts of accounts prepared by the former accountant:

– Cash

– Bank

– Purchase salary expenses

– Bank overdraft

– Drawings account

– Payables

You are hired as a new accountant. Do you agree that all of these accountsare necessary? If not, remove the unnecessary accounts.

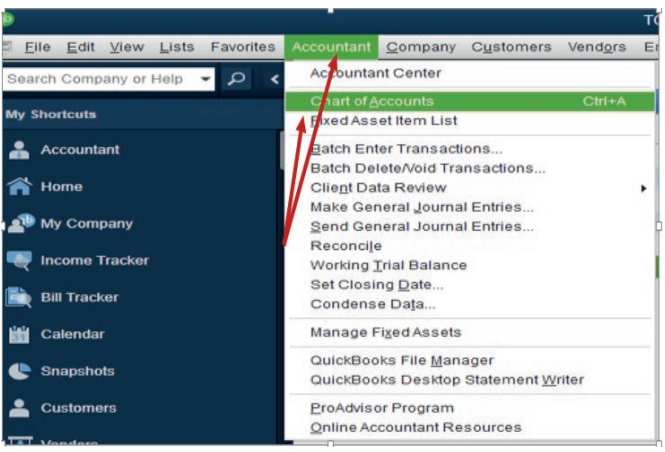

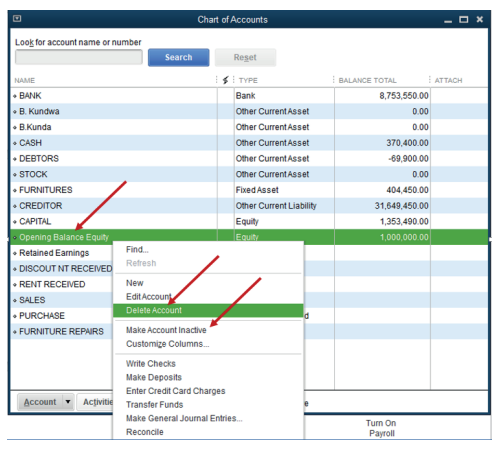

To delete an account, the following steps have to be done:

1. Click on Accountant on menu bar2. Click on Charts of Account

Figure 2.9. Search for an account

3. Find the account to be deleted

4. Here, opening balance Equity account is not necessary. Right click onthe account to delete or to make it inactive

Figure 2.9 Deleting or making Account Inactive unnecessary account.

Delete an account or Click on Make Account Inactive

Once an account is made inactive. It will no longer appear in list of charts of

account.

• Click OK when asked if the user wants to delete or to make an account

inactive.

Once you delete an account, it will be removed in the Chart of Accounts.

The good thing is, you can filter the COA page to include inactive or deletedaccounts.

Application Activity 2.3.

1. What are two reasons for deleting or making an account inactive?

2. Illustrate the process through which an account is deleted.

3. The following transactions have been extracted from the books of

Ganza Ltd:

a. 1/6/2020: Starting the business cash in hand

b. 4/6/2020: purchase of goods on credit from Kundwa

c. 6/6/2020: Sales of goods by cheque

The list of accounts below has been found in charts of account:

– Discount received

– Sales

– Account receivable

– Capital

– Bank

– Cash

– PurchaseRequired: Delete the unnecessary accounts if any.

2.4. Adjustment of account

Learning Activity 2.4.

The accountant of FRESH JUICE Ltd prepared the end of the year final

accounts before adjusting company accounts. During the next period,

the auditors advised her to deal with some accruals and prepayments for

reporting true and fair information.

What are the business account to be adjusted before preparing end ofperiod reports?

At the end of the accounting period, business account has to be adjusted

before preparing the financial statements. Account adjustments, also known

as adjusting entries, are entries that are made in the general journal at the end

of an accounting period to bring account balances up-to-date. Unlike entries

made to the general journal that are a result of business transactions, accountadjustments are a result of internal events.

2.4.1. Assets

Due to various reasons, the business fixed assets loose value through the years.

It is called depreciation. Before preparing the statement of financial position of

any business entity, the accumulated depreciation of any fixed asset must be

subtracted from its original cost so that the net value to report in balance sheet

will be true and fair.

The debtors are also business current asset that are adjusted in case of bad and

doubtful debts. Therefore, the business/firm should write the debtors account

off from the accounts and thus it becomes an expense that should be charged

in the profit & loss account. In practice a firm may also be unable to collect all

the amounts due from debtors. This is because a section of the debtors will nothonor their obligations.

2.4.2. Expenses A.

Accrued Expenses

An accrued expense is an expense that is payable or due for payment but has

not yet been paid during that period. An accrued expense should be charged in

the P&L account and shown in the balance sheet as a current liability. In quick

books, it is a liability account and it is recorded as follow:

Debit: expense account or P&L account

Credit: accrued expenseExample: Accrued salary: 10000Rwf

Figure 2.10 Record of accrued expense

It means that the accrued salary is added on the current salary of the period.

Therefore, it is charger on P&L account and it will appear in balance sheet under

a current liability

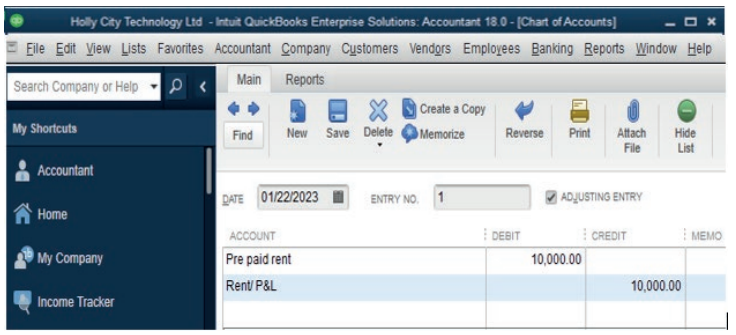

B. Prepaid Expenses

A prepaid expense is an expense that is not payable but cash has already been

paid. A prepaid expense should not be charged in the P&L a/c but should be

carried forward to the next financial period and should be shown in the balance

sheet as a current asset. In QuickBooks, prepaid expense is another current

asset account and recorded as follow:

Debit a prepaid expense account

Credit the expense for decreasing its valueExample: Prepaid rent: FRW 10,000

Figure 2.11. Record of prepaid expenses

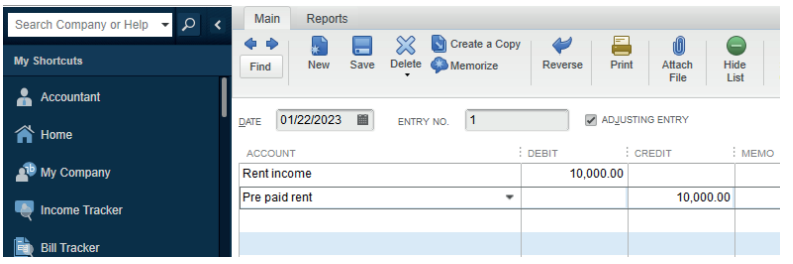

2.4.3. Income

A. Prepaid Income

This is income that is not yet due but cash has been received for it. This happen

when an income is payable in advance it can be called also the Unearned

revenue. e.g. Rent payable 3 months in advance. A prepaid income should not

be reported in the current financial period but should be carried forward and

reported in the period it relates to as a current liability. In quick books, prepaid

income is another current liability account and it is recorded as follow:

Debit the other income in P&L accountCredit the prepaid income account

Figure 2.13. Record of prepaid Income

B. Accrued Income

This is income that relates to the current year but cash has not yet been received.

An accrued income should be reported in the profit & loss account and the

same income will be shown in the balance sheet as a current asset. In quick

books, it is another current asset account and it is recorded as follows:

Debit accrued income

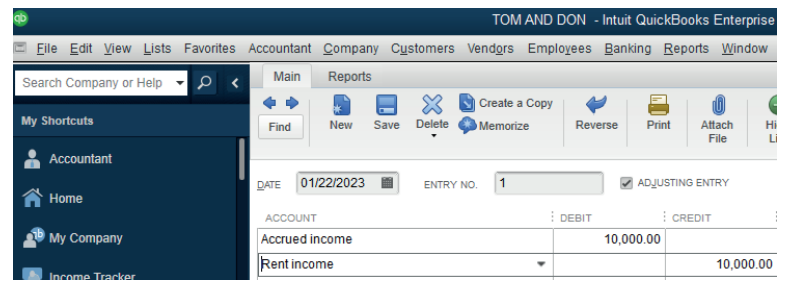

Credit the P&L account on that income accountExample: Accrued rent income of FRW 10,000

Figure 2.14 Record of accrued income

The assets (fixed and current) and liabilities are the quick books accounts that

have to be adjusted depending on business transactions that are taking placeduring the period.

Application Activity 2.4.

1. True or false

a) Prepaid expense is a current liability account

b) Accrued income should be shown in the balance sheet as a current

liability.

c) A prepaid income should reported in the period it relates to as a

current liability.

2. The adjusting entry that reduces the balance in prepaid insurance will

also include which of the following:

a) A credit to cash

b) A credit to insurance expense

c) A debit to insurance expense

3. KALISA owns and operates a dry cleaner. The following occurred

during the period of January:

a) Prepaid rent for January and February

b) Purchase of insurance in January that will six months

c) Paid salary of his assistant for the last two monthsRequired: Prepare the chart accounts for the above information.

2.5. Owner withdrawals and investments

Activity 2.5

Mrs. Agatha is a sole trader in GAKENKE District. She invested her money in

auditing and consultancy activities. For getting the capital she used to save

for 5 years and finally she got FRW 6,000,000 which she deposited at

bank. During the first month of activities, she withdrawn FRW 120,000 from

business bank account for private use.

• You are to advise her on the chart of account she can create for

recording the transactions in quick books

• Show her the process she will pass through to keep the transactionin the system.

2.5.1 Owners investments

Owner investment, also called contributed capital, is the amount of assets that

the owner puts into the company. In other words, this is the amount of money

or other assets that the owner contributes to the business either to start it or to

keep it running.

In quick books, an owner’s capital account is the equity account listed in

the balance sheet of a business. It represents the net ownership interests of

investors in a business

How to Record an owner’s investment in Quick books?

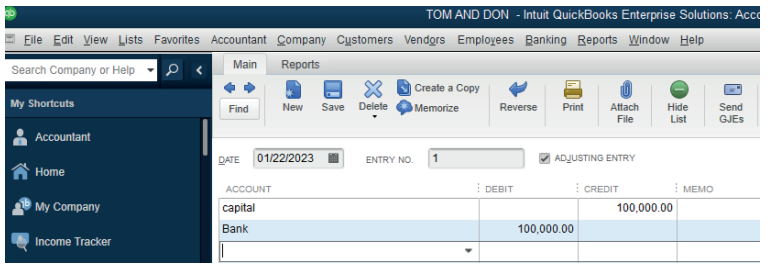

For recording owner’s initial investments (capital),

Capital account is debited

Cash /Bank account is credited

In case of re-investment for keeping the business running, the same entry will

be done or

Debit the Capital accountCredit any source of re-investment

Figure 2. 15 owner’s investment record

2.5.2. Owners’ withdrawals

“Owner Withdrawals,” or “Owner Draws,” in quick books is a contra-equity

account. This means that it is reported in the equity section of the balance sheet,

but its normal balance is the opposite of a regular equity account. Because a

normal equity account has a credit balance, the withdrawal account has a debitbalance.

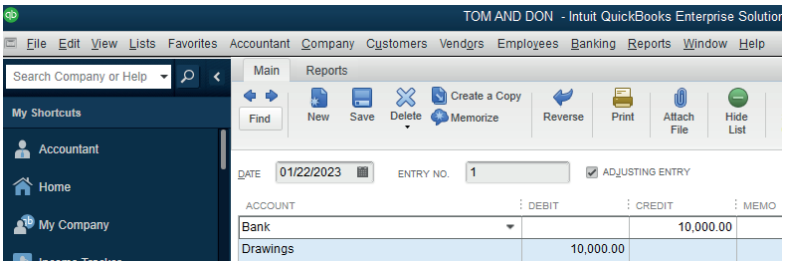

Withdrawal of any amount in cash or kind from the enterprise for personal use

by the proprietor is termed as Drawings. The Drawings account will be debited

and the cash or goods withdrawn will be credited.Example: Cash withdrawn from bank for personal use: 10,000Rwf

Figure 2.16 Drawings record

Application Activity 2.5.

1. Define the following concepts:

• Investment

• Owners’ equity

• Drawings

2. How can this transaction be recorded using quick books:Drawings of goods valued at 10,000RFW

2.6. Transfer of net income to the owner’s capital account.

Learning Activity 2.6.

BIGIRIMANA is the owner of BEST ELECTRONIC TRADING Ltd. He started

this company with the capital acquired from his saving with the loan got from

BANK OF KIGALI. During the year of business operations, he concluded

some transactions including drawings. At the end of the year, he prepared the

statement of profit or loss which shown that the business has a net income of

7,500,000Rwf.

Required:

• What do you thing is the drawings?

• Assume that you are BIGIRIMANA, what can you do with this netincome for the year?

2.6.1. Net income

Net income refers to the amount an individual or business makes after deducting

costs, allowances and taxes. In commerce, net income is what the business has

left over after all expenses, including salary and wages, cost of goods or raw

material and taxes. Net income shows how much money a company is making

after subtracting all expenses. It can also be referred to as “net profit” or “the

bottom line.”

As part of the closing entry process, the net income is moved into retained

earnings on the balance sheet. The assumption is that all income from the

company in one year is held onto for future use. Any funds that are not heldonto incur an expense that reduces net income.

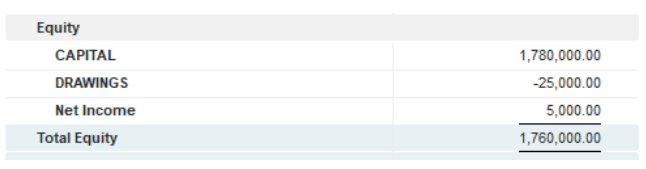

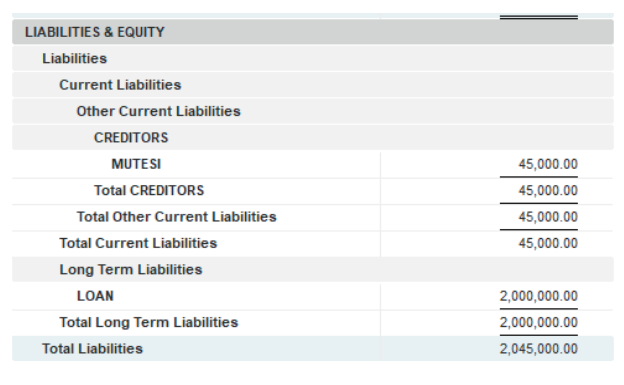

2.6.2. Owners’ capital account

A capital account is used in accounting to record individual ownership rights

of the owners of a company. The capital account is recorded on the balance

sheet and is composed of the following items: Owner’s capital contributions

made when creating the company or following the creation, as required by the

business.

Basically, the owner’s capital account represents the net assets of the company.

It’s the amount of money left over after the company sells all of its assets and

pays off all of its creditors. This remaining amount of money is what the owner

actually owns or networth.

Owner’s capital account is one of the accounts of equity type of account

which consists of:

Capital

Less: Drawings

Add: Profit in case of positive net income of business or

Less Loss in case of negative net income of the business

Quick books software will transfer the net income (profit or loss) of the business

for the period from the trading, profit or loss account to the statement of financial

position (balance sheet) automatically in its equity section.

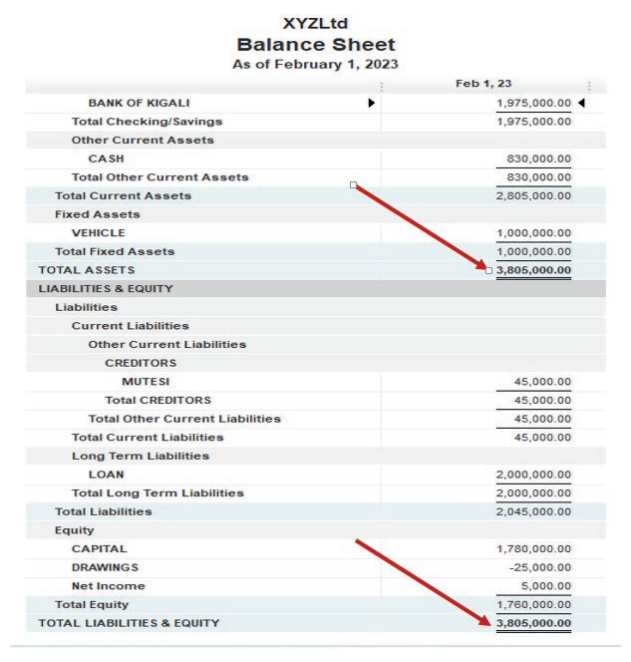

Example:

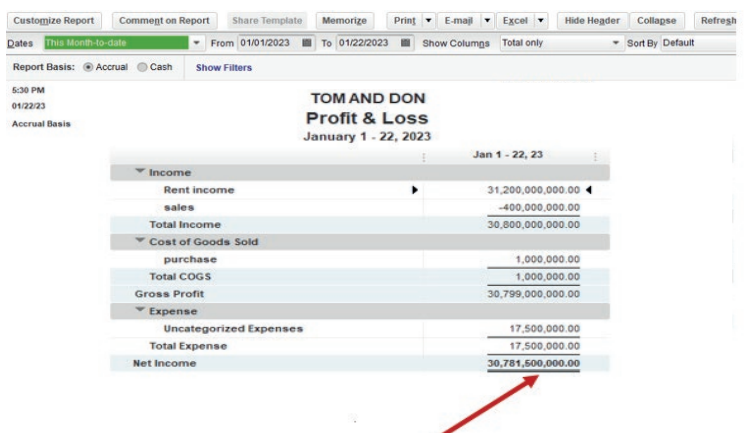

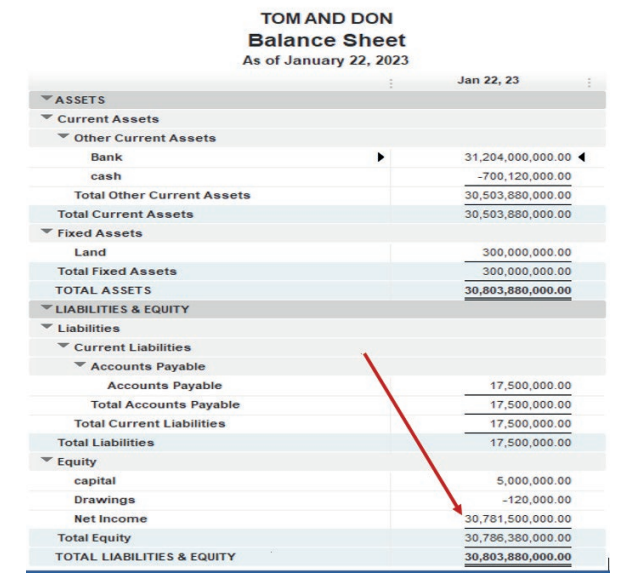

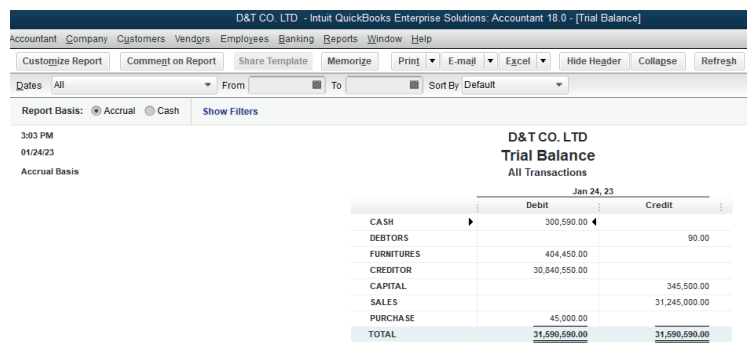

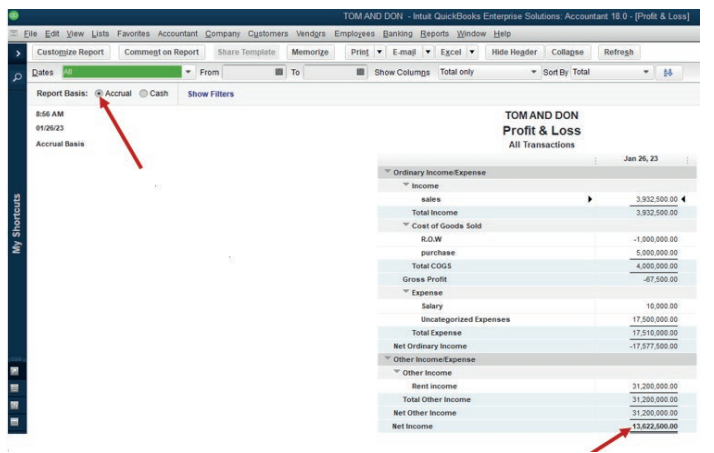

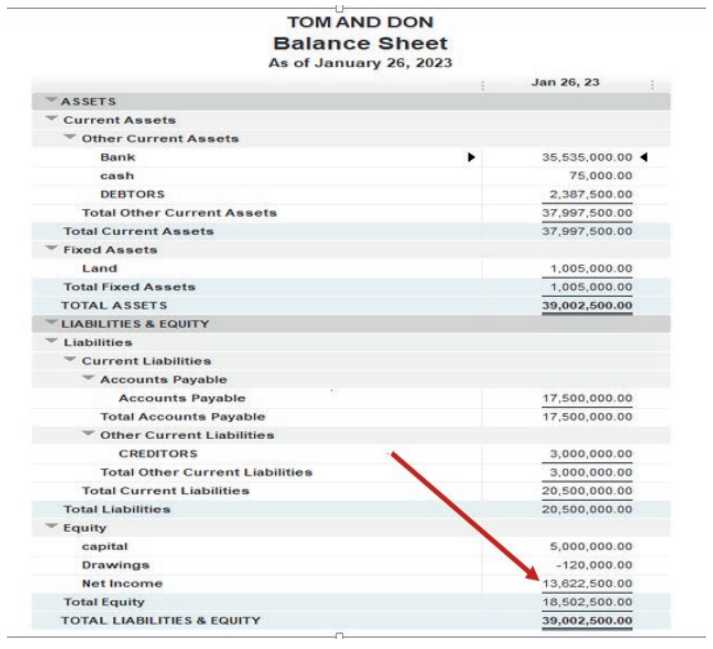

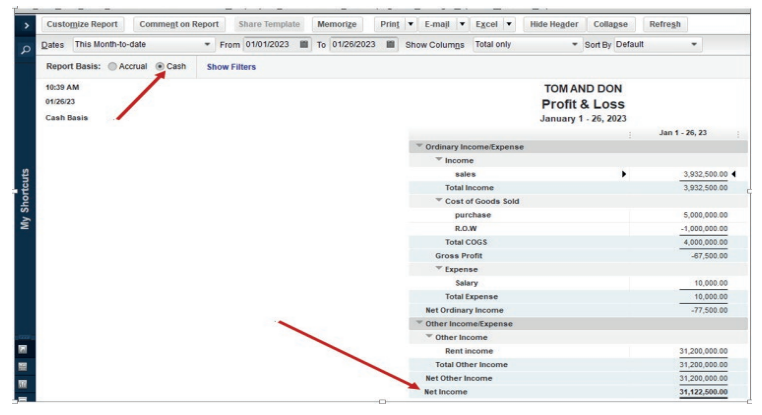

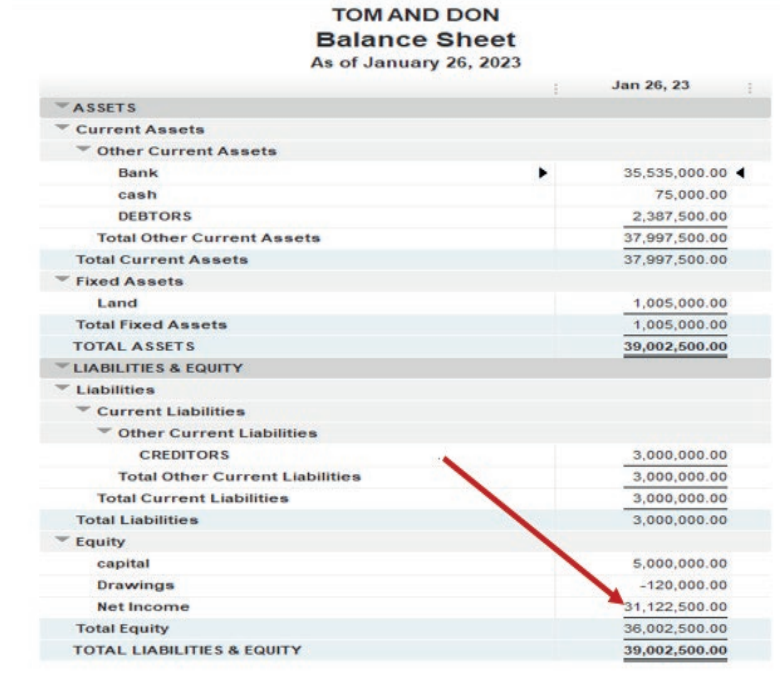

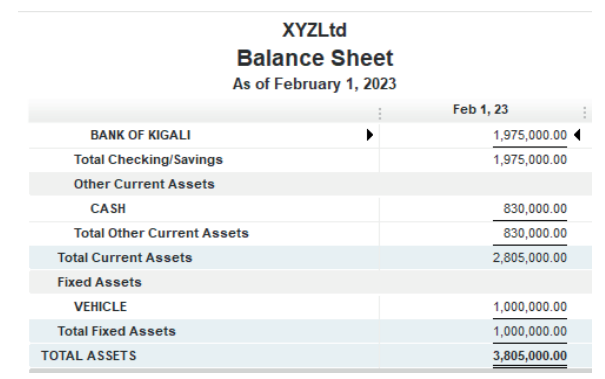

Here under, TOM AND DON business Net Income of the period is FRW30,781,500.

Figure 2.17 Net income to be transferred in balance sheet

This Net Income is transferred to the equity section of TOM AND DON Balancesheet as shown here under:

Figure 2.18 use Net Income in Balance sheet

Application Activity 2.6.

1. Define the following concepts:

a) Net income

b) Owners’ capital

2. BLESSED WORK LTD is a small sole trade business of purchasing

and selling of electronics items. It is located in MUHIMA sector,

NYARUGENGE District in KIGALI CITY (Tel +2507884324 -234712;

P.O Box 1213 Kigali. The owner decides to hire you knowing that you are

skilled in computerized accounting for preparing financial statements on

time.

The following past information is provided:

a. On 1st February, 2020: Starting business with RWF 10,000,000cash

and RWF 50,000,000 at bank.

b. 2nd February, 2020: Receiving a loan from Bk of RWF 70,000,000

8th February, 2020: Bought furniture for RWF 12,000,000 and paying

by cheque

c. 10th February, 2020: Purchasing goods on credit from TU` for RWF

4,000,000, cash purchase of FRW 2,500,000 and FRW 1,500,000 by

cheque.

d. 11th February, 2020: credit sales to KANYENGOGA for RWF 3,600,000,

cash sales of FRW 4,350,000 and sales by cheque of FRW 8,500,000.

e. Returns to TUBYIHERERANE FRW 500,000

f. Cash drawings: FRW100,000

g. 12th February, 2020: Paid rent of FRW 450,000 by cheque

12th February, 2020: FRW 1,750,000 Paid

to TUBYIHERERANE by cash. A discount of 7.5% is received.

h. 12th February, KANYENGOGA paid FRW 723,500 by cheque. A

discount of FWR 27,500 is allowed to him.

i. KANYENGOGA retuned goods valued at FRW245,000

j. 15th February, the following transactions took place:

a) Paid wages by cash of 250,500 FRW

b) The insurance is paid by cheque 740,000 FRW

c) Rent received by cheque is 90,450FRWShow the income statement transferred in the balance sheet.

End of Unit Assessment

1. MUGENI has the following items in her balance sheet as on 30 June

2021. Capital FRW 41,800, Creditors FRW 3,200, Fixtures FRW

7,000, Motor Vehicles FRW 8,400, Stock of goods FRW 9,900,

Debtors FRW 6,560, Cash at bank FRW 12,900 and Cash in hand

FRW 240

During the first week of July 2021 the below transactions took place:

b) He bought extra stock of goods FRW 1,540 on credit.

c) One of the debtors paid him FRW 560 in cash.

d) He bought extra fixture by cheque FRW 2,000.Prepare the charts of account

UNIT3: RECEIVING ITEMS AND ENTERING

Key unit competence: Prepare the bill by entering all goods/

services received on the appropriate dateusing QUICKBOOKS

Introductory Activity

Any business activity is intended to make a profit; this requires the sales of goods

or services. Somme businesses purchase goods and resale them without any

transformation. Other businesses transform raw material into finished goods.

For any business, goods or items received from different vendors have to be

recorded with reference to the vendor bills for payment process.

On the other side, other goods or services are sold to customers. For correcting

payment, the invoices are issued and sent to the customers. Payment in all

means are allowed and always recorded in appropriate books of account.

Required:

1) Discuss the purchase and sales of business goods and services2) Enter the business items, vendors and customers in the QuickBooks

3.1. Receiving items

Learning Activity 3.1.

NEW LIFE restaurant started it activities in January 2022. It provides services to

a number of customers in the village. Its owner explained to the new accountant

that the business record includes both services and products especially in

case of recording items received and entering the bills.

Assume that you are the new accountant of NEW LIFE restaurant,

• How will differentiate services from products

• Suggest the characteristics of list of items that will be recoded in yoursystem

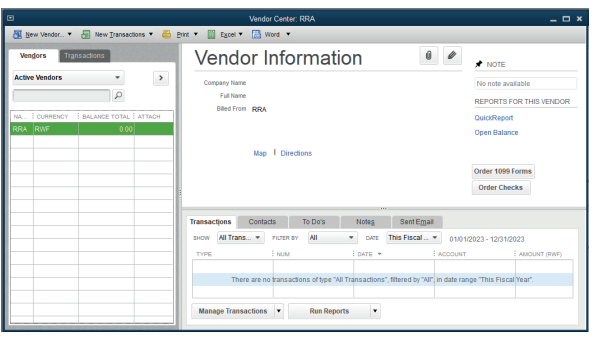

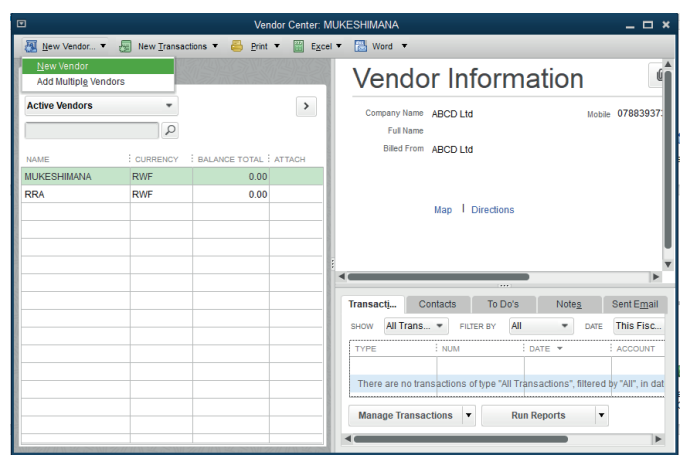

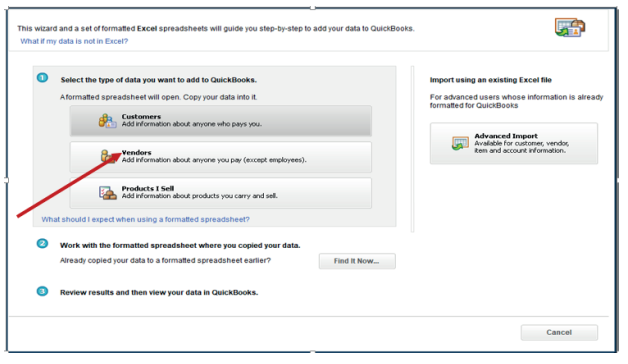

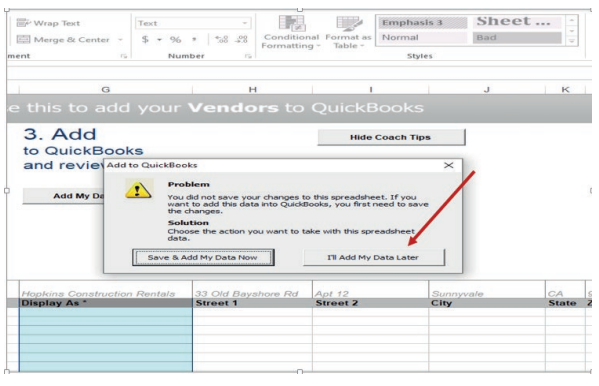

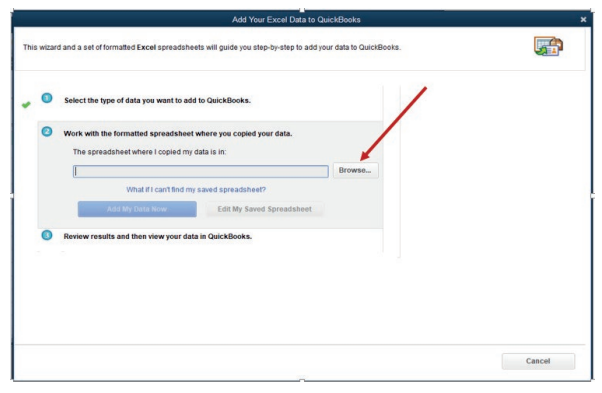

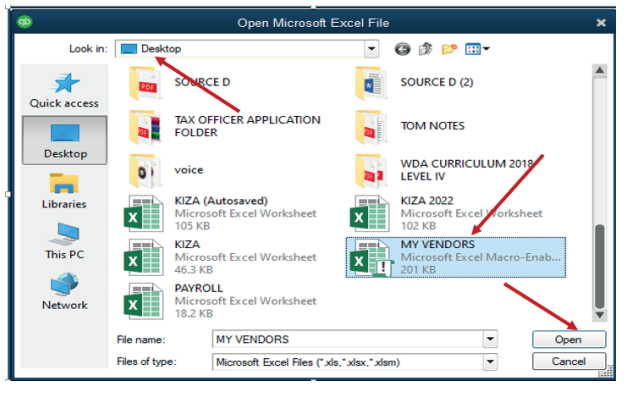

3.1.1. Enter the vendor’s name

In the context of accounts payable, a vendor is a person or business that supplies

goods or services to the company. Another term for vendor is supplier. The term

vendor can also be used to mean any seller of goods.

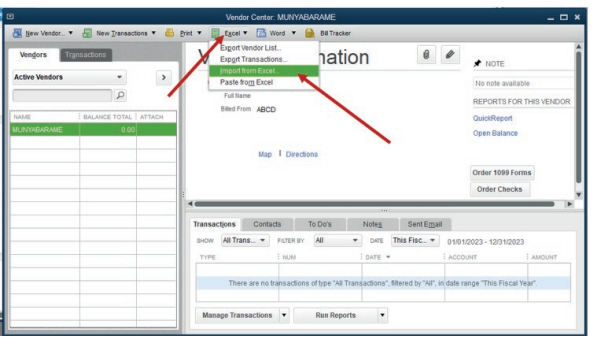

To create a vender name in QuickBooks, Follow these steps:

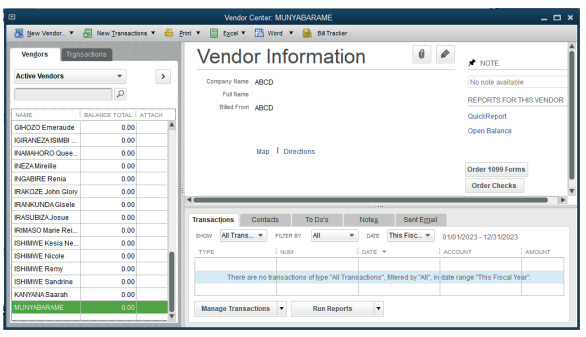

Click on vendor icon on QuickBooks Home page for finding and clicking onVENDOR.

A click on VENDOR will give the following window and the user click automatically

on New Vendor

A click on New vendor will allow to the user to get a field to fill the new vendor

names address and all other identification and OK

3.1.2. Enter the item list

In QuickBooks, items are the products and services a business buys and sells.

Users enter and track items in QuickBooks so they can quickly add them toinvoices and other sales forms. Items appear as lines on sales forms.

Each unique item gets a line with its name, description, quantity, and cost per

item. Items allow you to use Quantity, to track cost and/or price and even for

that same one thing as both.

When the user chooses to use Items in QuickBooks, the items entered will be

linked to specific accounts. These accounts are visible by looking at the “Chart

of Accounts” in QuickBooks interface. If you have multiple items that need to

be attached to a single job, it is possible to do so with QuickBooks. Simply link

the item to the appropriate account when you enter it in. Then all of the items for

that job will be visible when you run a report.

Example

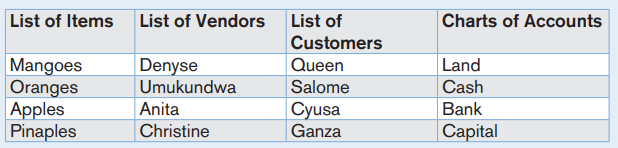

Cooperative DUTERIMBERE is operating in NYAMIRAMA market. It uses to

buy and sell agricultural products including rice, beans, maize, and sorghum.

To make the list of these items in QuickBooks will be done through the processbelow:

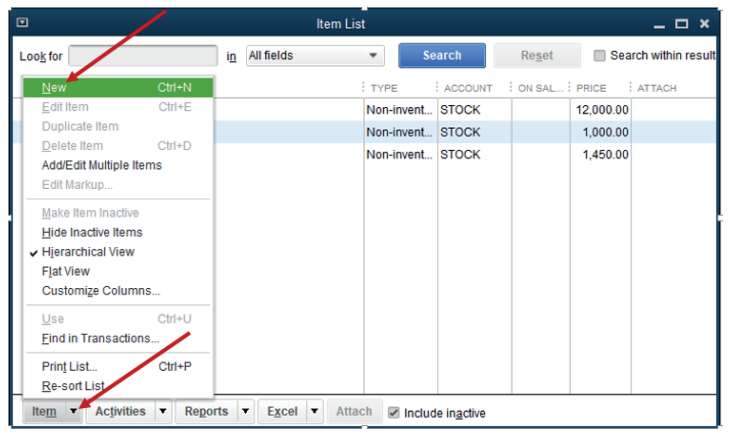

Click on item list &services at the right side of home page of QuickBooks

Figure 3.1 Items and Services icon usage

The items list appears as follow with an option to add new item by clicking onitem menu at the left bottom command of items list window and New.

Figure 3.2 Creation of new Item on the list

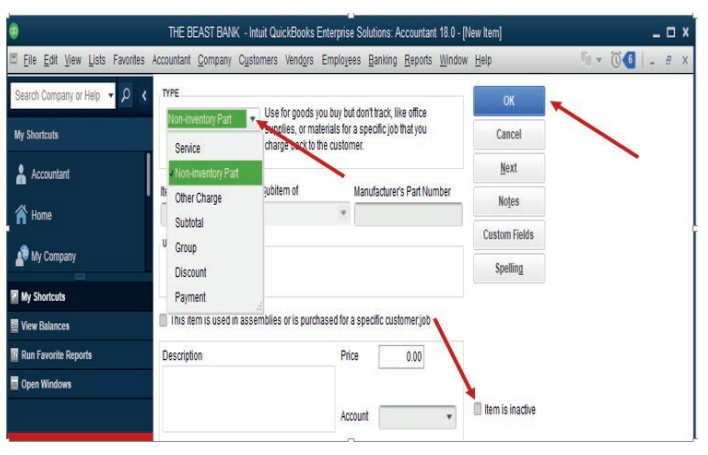

Choose whether it is an item list of products or services. Here under, it is a list

of products (Non inventory part), item number, there is also an option to add the

item name in description field and the price per unit, then the account related tothe item. Before clicking Ok, make sure the item is active.

Figure 3.3 Type of products or Services activation

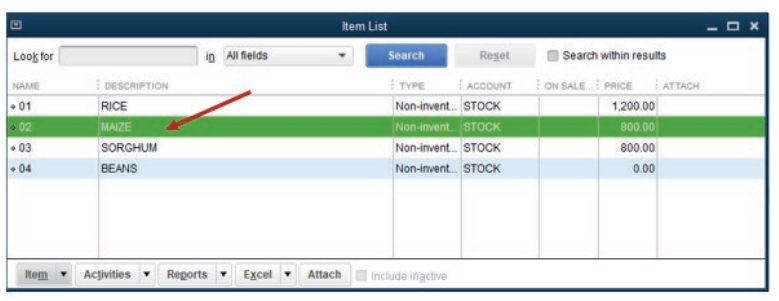

The item list is created and the QuickBooks displays it as here under:

Figure 3.4 List of created items

These items should be either linked to the vendors or the customers as the

cooperative buy and sell them. If some items are linked to the customers, it

means that the cooperative sells the by cash or cheques and on credit basis.

The credit sales are always associated with the debtors (Account receivable),and it is necessary to enter the bill for payment.

Application Activity 3.1.

The following transactions have been extracted from the books of

DUKUNDANE Ltd:

1/6/2015: Starting the business with 5,000,000 FRW cash and 10,000,000

FRW at bank

4/6/2015: purchase of tables and Chairs on credit valued at 12,000,000

FRW, from TUYISENGE

6/6/2015: Sales of goods by cash valued at 7,000,000 FRW

8/6/2016: Remaining goods returned to TUYISENGE

10/6/2016: Payment to TUYISENGE by cheque

• Enter the vendor name• Record the received items

3.2. Enter bill

Learning Activity 3.2.

If purchase transaction is concluded on credit basis, both the seller and the

keep the invoice that details goods or services purchased and sold so that

the transaction should be recorded in business system. How do you thingQuickBooks is used to enter the bill?

Learning Activity 3.2.

The word “bill” designates an accounting document that outlines the amount

a customer has to pay for a product or service that is purchased. It is also

considered as a payment reminder. A bill is issued before the payment is sent,

and it is used one-time and immediately

A bill is an invoice that one of business suppliers will give to the business,

and which, sooner or later, business will have to pay. It might also hear as a‘purchase invoice’ or a ‘supplier invoice.

3.2.1. The steps of entering the bills

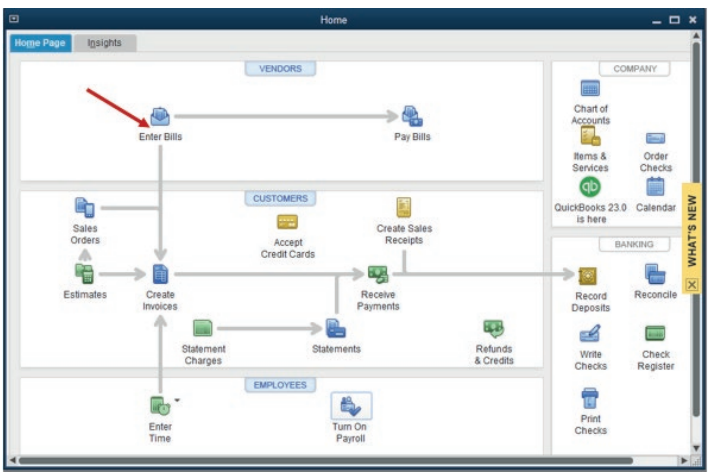

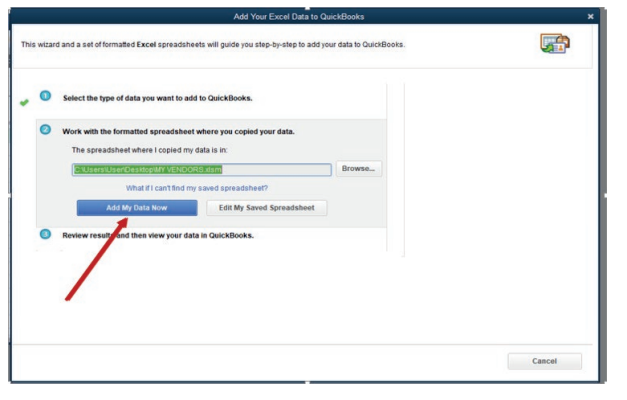

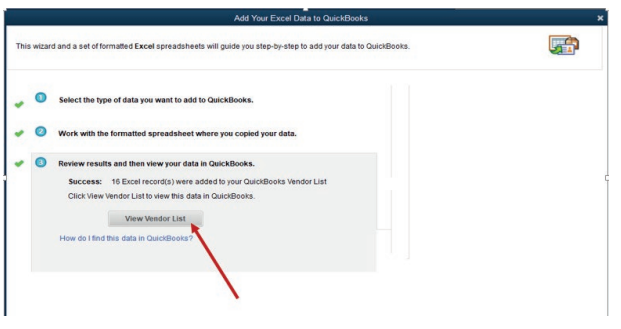

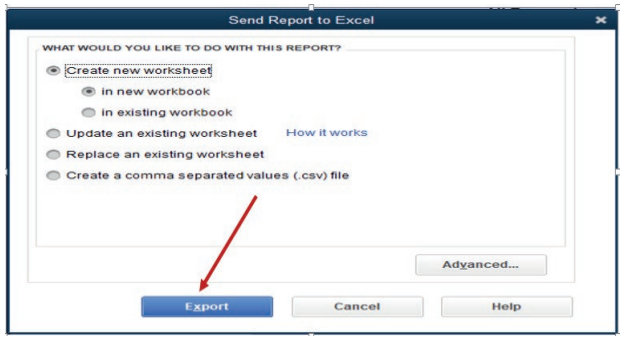

For interring the bill, follow the process below:Start by clicking on Enter Bills tool on the QuickBooks home page.

Figure 3.5 Start entering the bill

The bill menu that will give the option to select the vendor to whom the bill is

from. In case there is no vendor list or a there is a need to record a bill from a

new vendor, the user can add new.

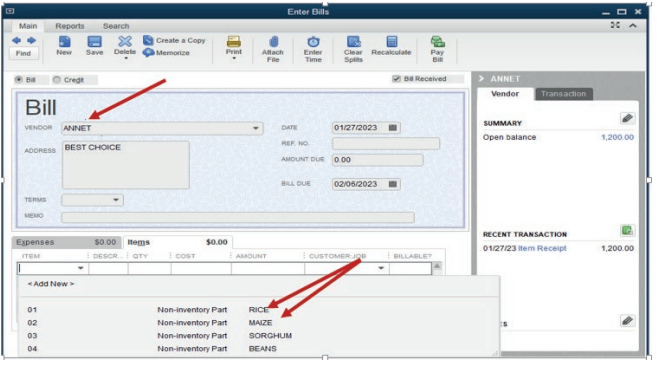

3.2.2. Choose the Vendor and the Items relating to the vendorto be paid

Figure 3.6 Add the vendor name

Assume that the bill is from vendor Annet. Annet is selected. It is time to additems supplied by Annet.

Figure 3.7 selection of items relating to the vendor

Select the item. If there is a missing item on the list, add it through

Add new then Save&Close or Save &New in case Annet’s bill consists of more

than one item. For our case, Annet’s bill consists of rice and maize.

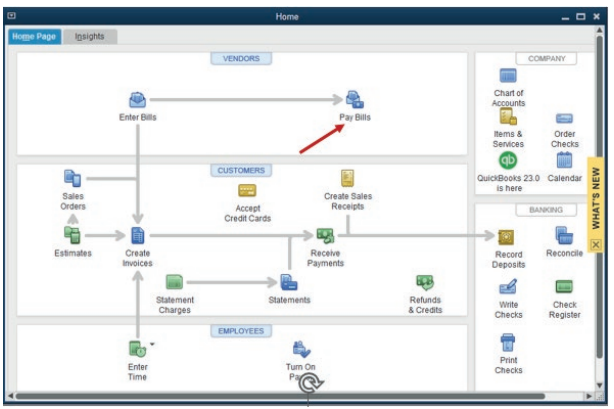

3.2.3. Pay the bill for received items

The business uses to purchase goods or services from different vendors. Being

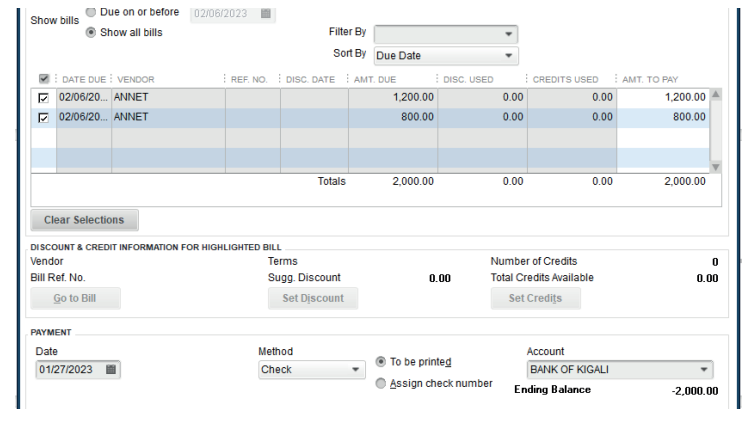

either credit purchase or cash, the transaction is concluded when the paymentis over. For the above-mentioned case, the bill as paid as follow:

Figure 3.8. Starting Bill Payment process

Annet’s bill will automatically appear, but any total amount will be available on

the bill until all bills are selected. Here under, bills are no selected and Payselected bill is inactive.

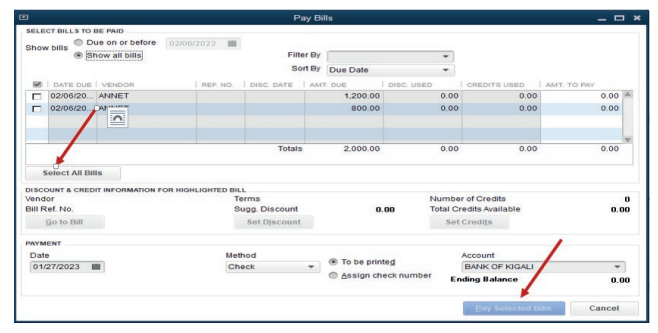

Figure 3.9. Selection of items to be paid

This is Annet’s bill after selecting all bills:

Figure 3.10 Selection of all Bill to be paid

The total amount to pay is 2,000 FRW. There is no discount and the payment

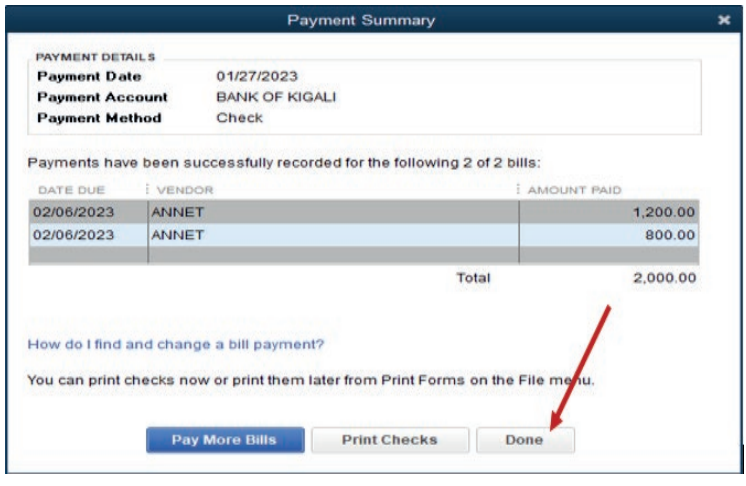

mode is by cheque. It is time to click on Pay selected Bills. A proof of paymentappears as follow:

Figure 3.11. Proof of Payment

Click on Print checks if it is necessary to give a hard copy cheque to payee orClick on done for ending the process.

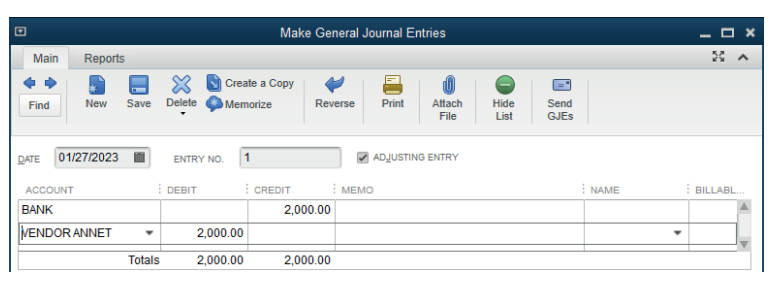

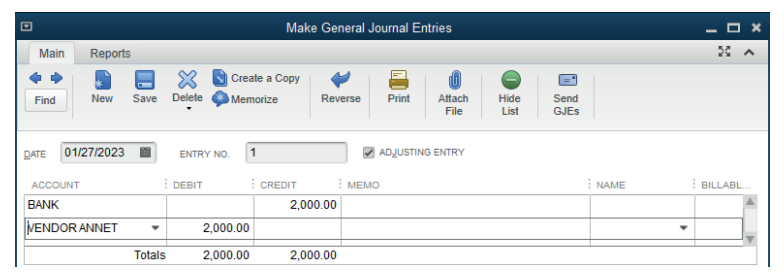

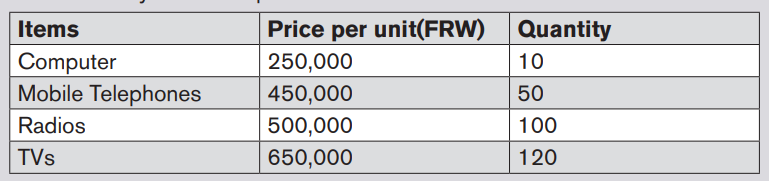

3.2.4. Recording the bills payment

If the payment to the vendor should be done either by cash, bank or cards.

To record the payment, the general journal is used by debiting the vendor’saccount and crediting the source of payment. (Cash, card or bank account.)

3.2.4. Recording the bills payment

If the payment to the vendor should be done either by cash, bank or cards.

To record the payment, the general journal is used by debiting the vendor’saccount and crediting the source of payment. (Cash, card or bank account.)

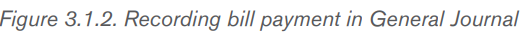

End of Unit Assessment

1. Differentiate:

a) Vendor from a customer

b) Order from invoice

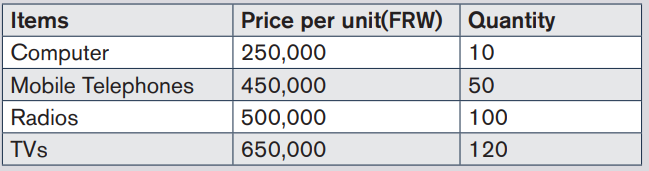

2. Mrs. Alex, the owner of BEST ELECTRONIC Ltd stated the business inJanuary 2020. He purchases the items bellow:

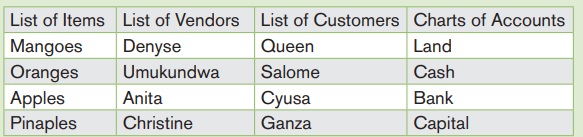

SAMSUNG 250 is Alexis’ supplier of computer and telephones while RWIZA

Ltd supplies Computers and TVs. Vision 2050 is a customer of both Radios

and TVs. You are hired as an accountant of BEST ALECTRONCS and the

company uses QuickBooks in preparation of its reports.

Required:

1) Create the list of items

2) Enter the vendors

3) Prepare the bills for received items4) Record the payments to the vendors

UNIT4: SALES AND RECEIVABLES

Key unit competence: Apply the rules of cash, cheques, credit

sales and account receivable transactionsin QUICKBOOKS

Introductory Activity

The management committee of MUTARA ENTERPRISE is experiencing a

low level of return on its investment. It decided to use QuickBooks software

especially while dealing with sales of its products. MUTARA ENTERPRISE

customers are allowed to pay by all means (Cash, cheque and cards). Some

other customers use to pay after a certain period as they buy on credit.

NTAGANDA is the accountant and wants you to assist him in recording both

(credit and cash/bank), sale transactions.

Show him the way appropriate record of credit and cash/bank transaction in

QuickBooks to improve the company current situation and start to get a highlevel of return on investment.

4.1 Credit sales transactions

Learning Activity 3.2.

DUFATANYE SOTRE is engaged in sales of fruit and vegetables in KIMISAGARA

market. The customers in the morning purchase on credit for paying in the

evening after selling.

• Advise the DUFATANYE SOTRE on the ways of recording its daily

sales

• If they DUFATANYE SOTRE needs to use QuickBooks in recording,explain to its accountant the steps of creating a sales invoice

The term “credit sales” refers to a transfer of ownership of goods and services

to a customer in which the amount owed will be paid at a later date. In other

words, credit sales are those purchases made by the customers who do notrender payment in full at the time of purchase.

Credit sales are a type of sales in which companies sell goods to the customer

on credit based on the credibility of customers. It gives the customer time to

make the payment after selling the purchased goods and does not require them

to invest their own money into a business. It helps small businesses, especially

those that do not have enough capital. At the same, it helps big companies also

because it attracts customers.

A credit sales transaction affects two accounts: Debtor (account receivables)

which is debited as it is a current asset and the sales account which is creditedas it is an income.

4.1.1. Record a credit sale

In QuickBooks, a credit sales transaction is recorded as here under:

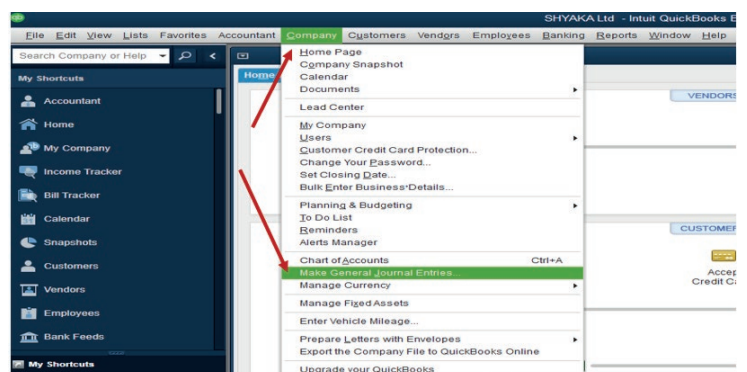

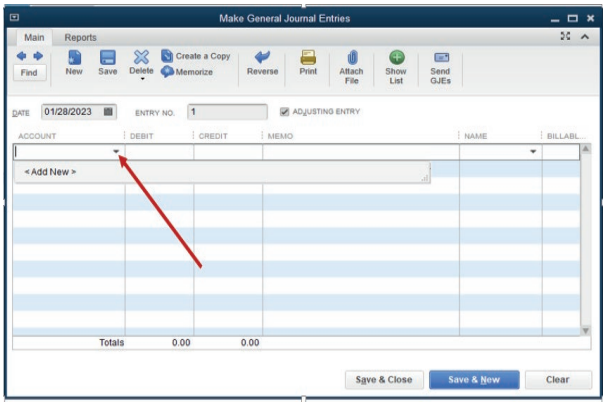

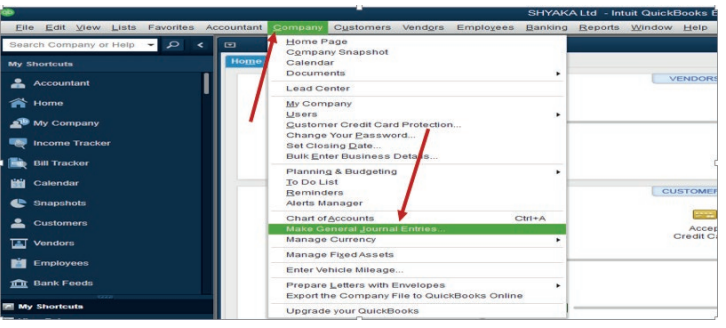

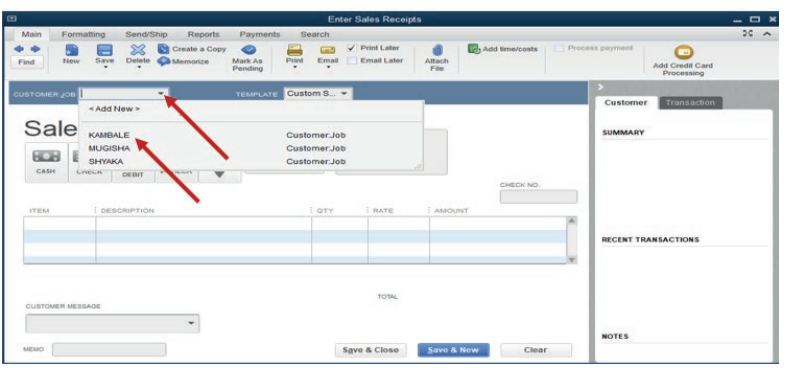

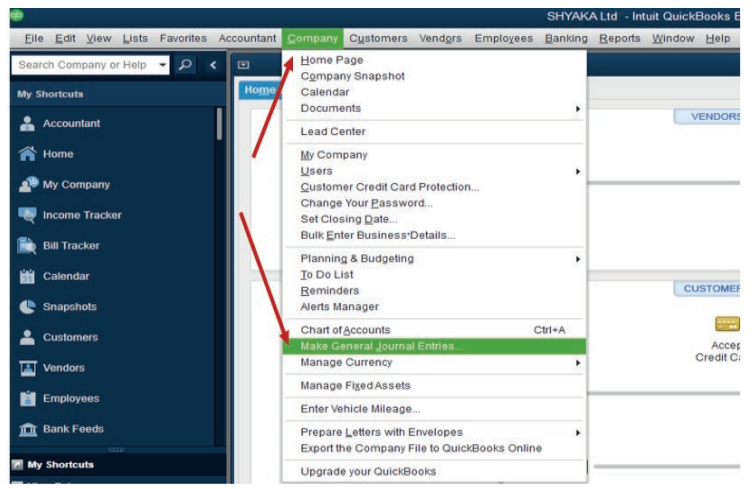

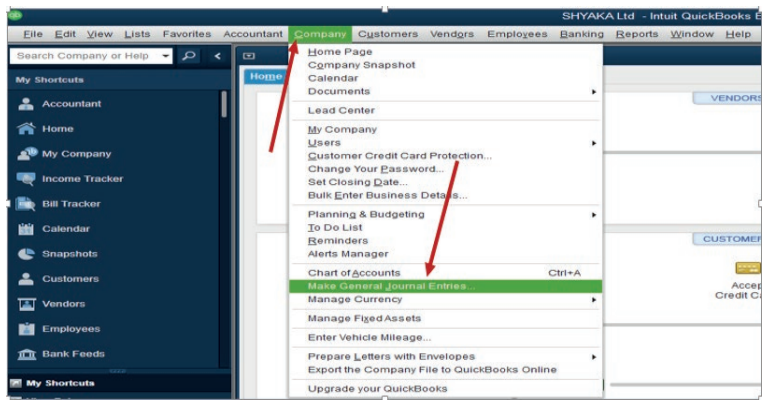

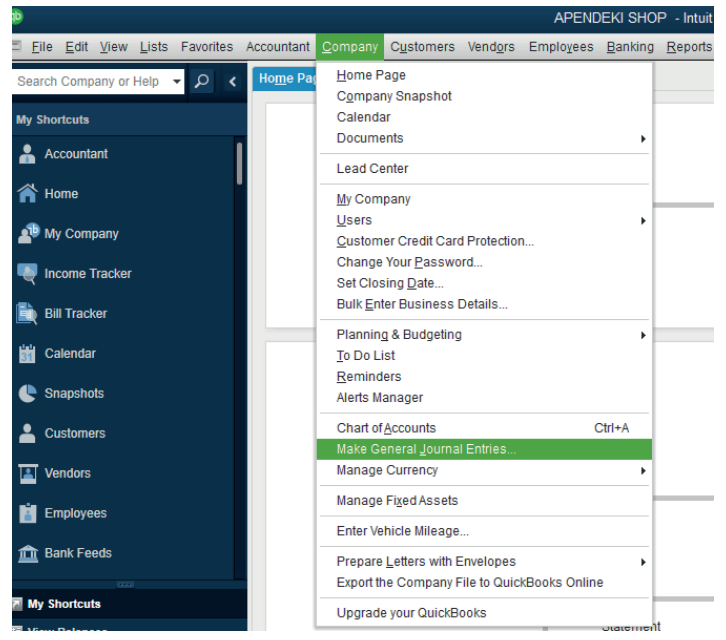

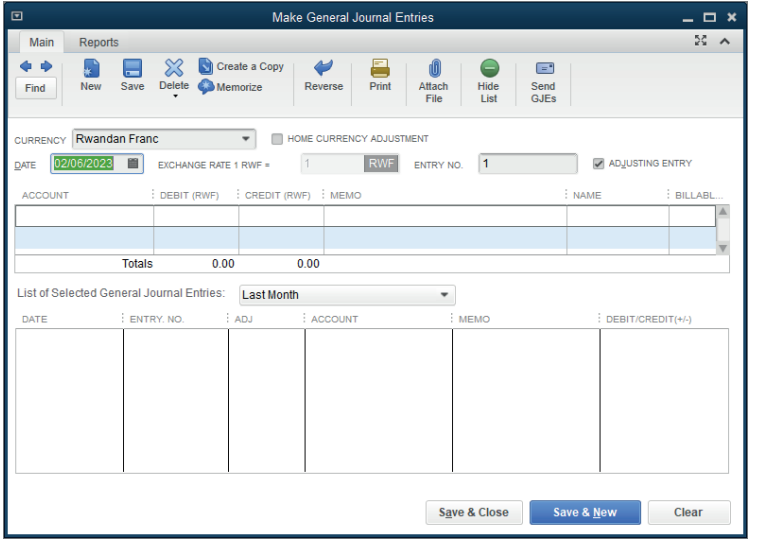

Step 1. Click on company menu on QuickBooks home page, then select MakeGeneral Journal Entries

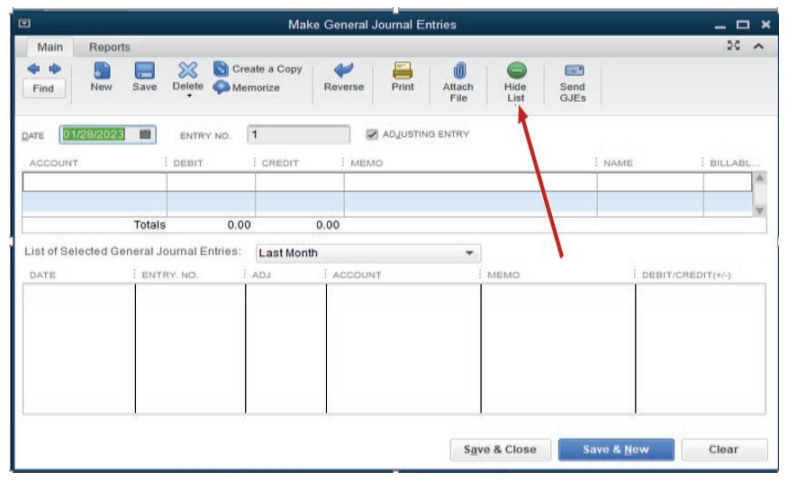

Figure 4.1 General Journal Entries selection

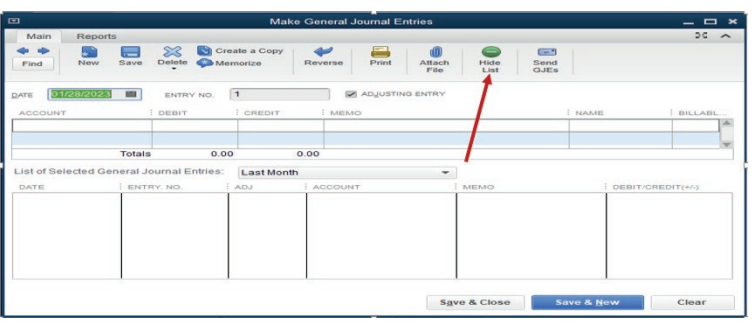

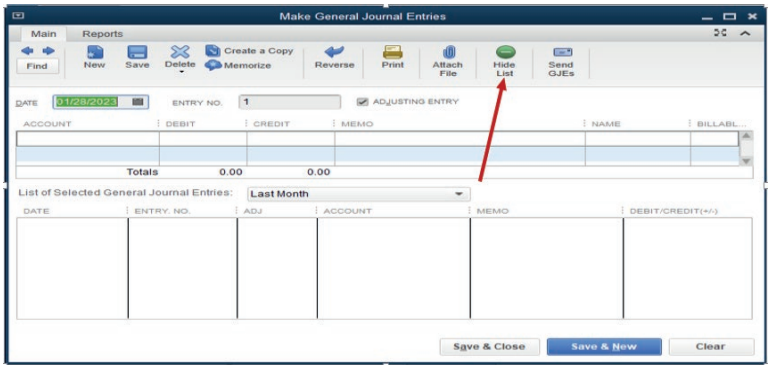

Step2. Complete the general journal

Figure 4.2 Option of hiding list of selected General Journal Entries

The first part of the window is for double entry and the bottom part shows the

number of transactions concluded. For having a clear space for recording, the

bottom part should be hidden by clicking Hide List

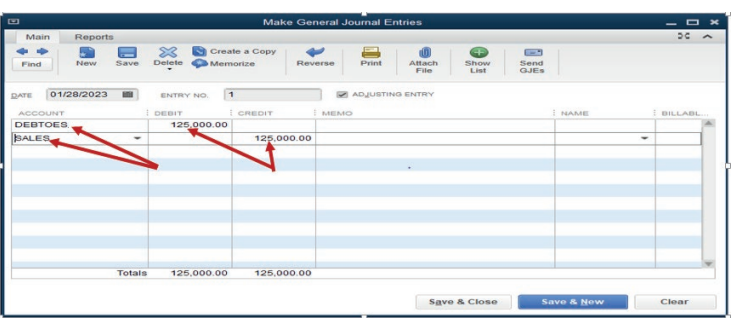

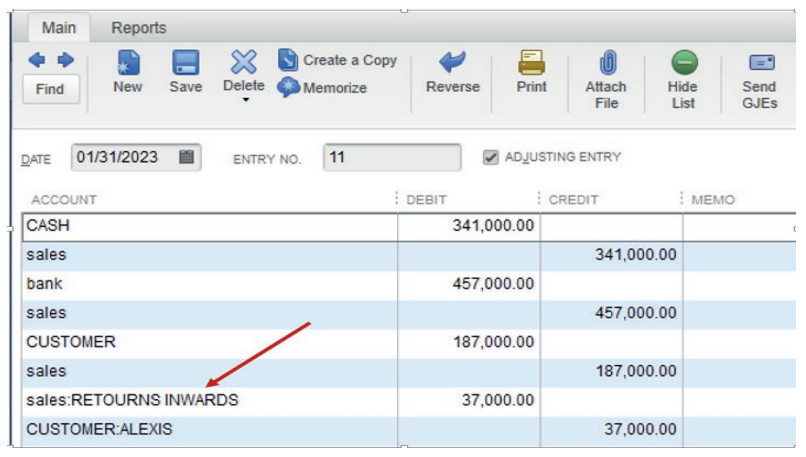

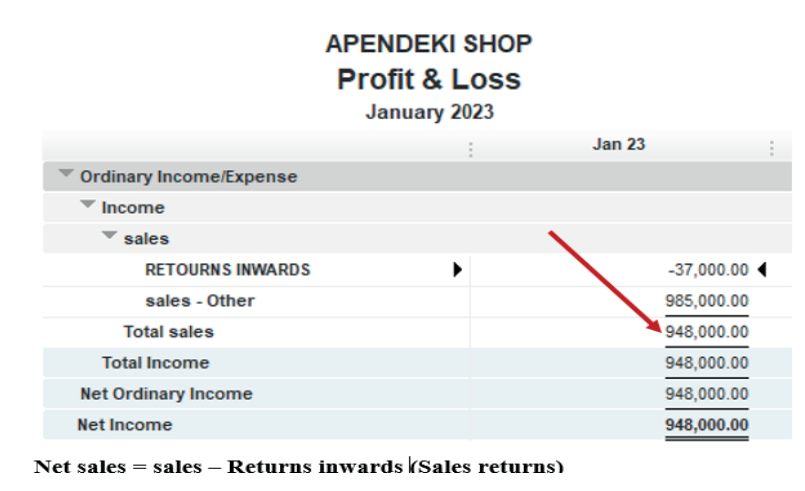

Example: SHYAKA Ltd started its business activities in January 2022. During

January the sales transactions concluded with all of its debtors is valued at

FRW 125,000. To record this transaction in the general journal, of course the

debtors and sales account are already created in the chart of account. If not

QuickBooks gives an option to add new account while recording.

Debit debtors: 125,000Credit sales: 125,000

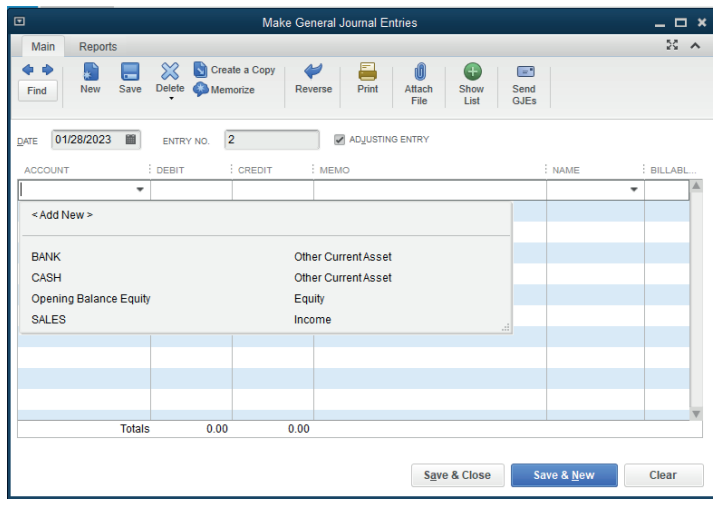

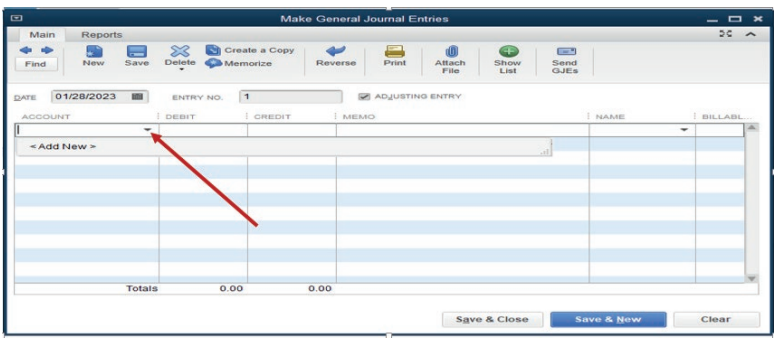

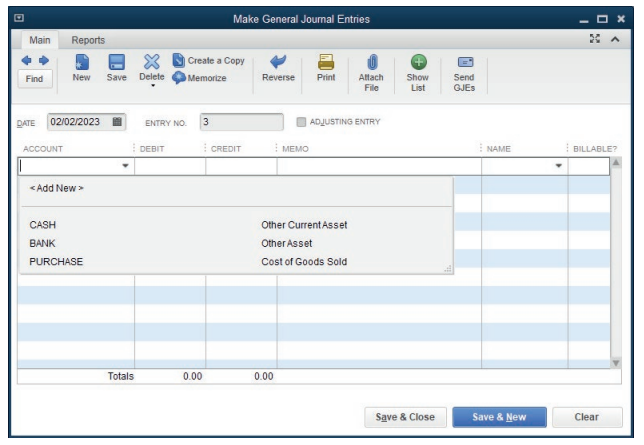

Figure 4.3 Empty General Journal Entries

As there is no debtors and sales accounts created in chart of account, we

can add them by the normal way of account creation, account type, continue,

account name then Save&Close or Save&New. Through this, a debtor

account is created and debited with FRW 125,000. Sales account is createdand credited with the equivalent amount.

Figure 4.4 .Records of credit sales

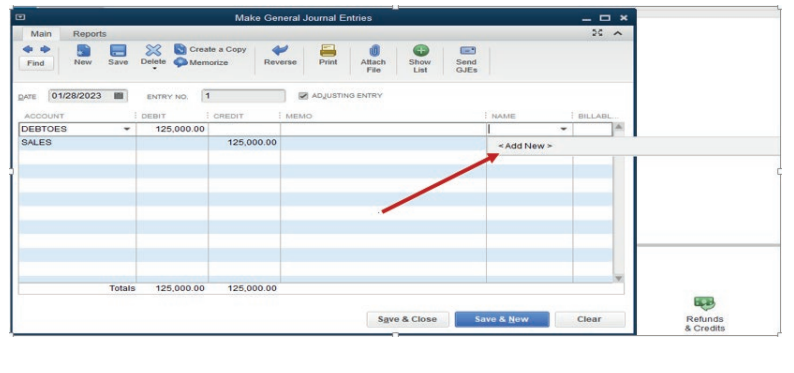

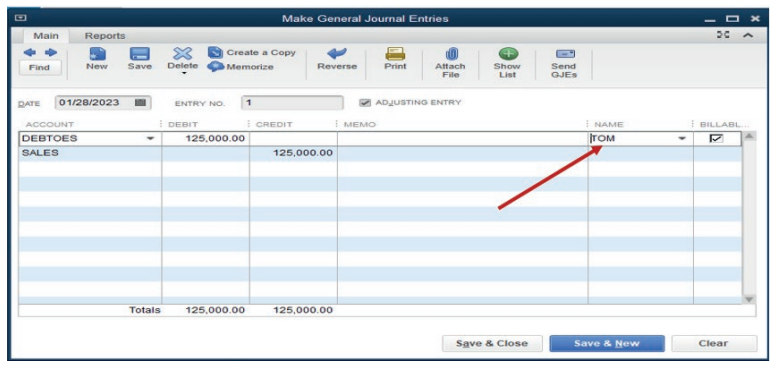

In case there is specific customer name, it can be added on the name columnfor clarifying who is the debtor.

Figure 4.5 created Field for adding customer name

If we click on Add New QuickBooks provides field to add customer name.

Figure 4.6 recording a sale transaction

A sale transaction is recorded, then Save &Close

4.1.2. Creating a sales (customer) invoice

A Customer invoice is an accounting document sent by seller of goods/services

to a buyer. It records services rendered, items provided, the amount owed by

the customer, and how they can make payment.

Invoices create legally binding agreements between business and buyers,

especially for larger purchases. This type of customer invoice is created based

on a sales order, which includes order lines and item numbers.

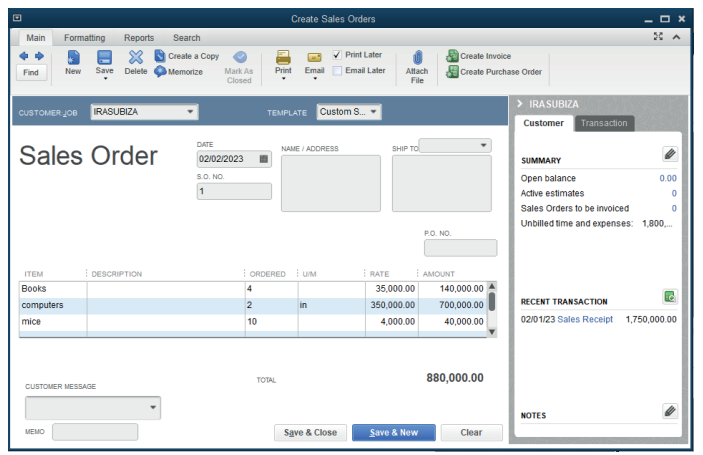

Sales order

This is a document hold by the business from its customer ordering the business

to supply determined goods or services.

For our case, the cooperative has on order from a customer KAMBALE whoordered two items: Beans and sorghum.

Figure 3.13 Sales order Document

It is a responsibility of the business to create an invoice to its customer for

detailing goods or services that the customer ordered, the business is to deliver

(or delivered) for getting customer know exactly how much she/he owes the

business. The invoice is created through this process by starting on QuickBooks

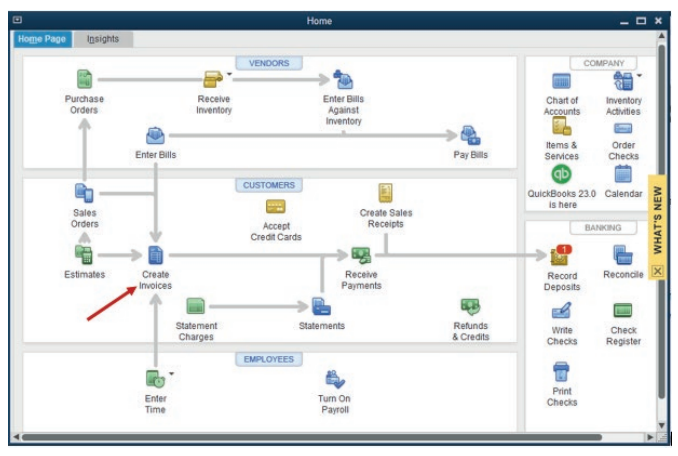

home page,Click on Create Invoice

Figure 3.14 icon used in invoice creation

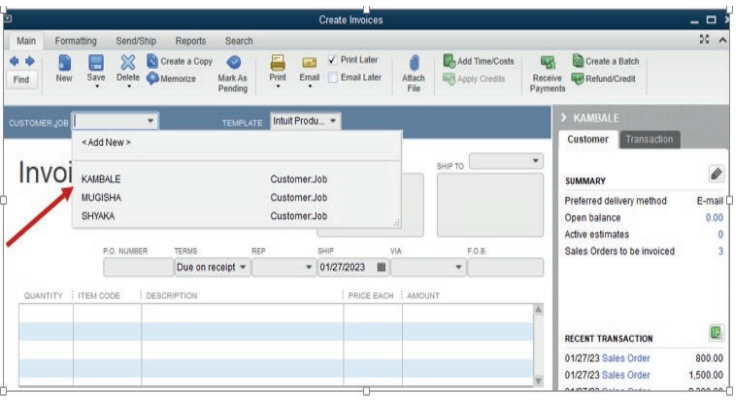

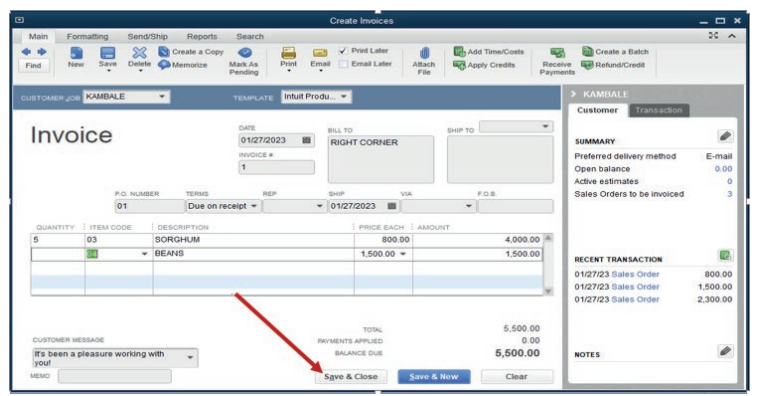

Then a customer invoice window appears as below:

Figure 3.15 list of invoices created

The invoice goes to customer KAMBALE. So, the user selects KAMBALE from

the list of customers. The invoice consists the following:

The invoice number

Terms of payment

Date and details of goods supplied.Click Save &Close.

Figure 3.16 Saving an invoice created

Application Activity 4.1.

1. Define a transaction

2. What is a credit sales?

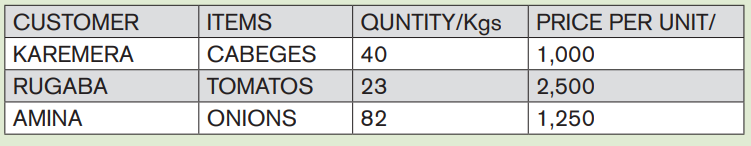

3. Record the transaction below and display the sales invoice to thecustomer KAREMERA

Learning Activity 4.2.

The financial success of a business depends on selling goods or services

to customers, or clients. The more goods or services sold, the more income

the business makes. There are a number of different ways that customers

pay for goods and services sold to them. Sometimes payment is received

immediately and sometimes payment is received later. In the trading

Industry, customers or clients pay for goods and services and the like. These

transactions require the use of cash. Cash means the form of payment the

customer uses such as notes and coins, checks, debit or credit cards and

cheques.

1. Discuss the cash transaction effects on business account2. How this transaction is recorded in QuickBooks?

4.2. Cash/ cheque sales transactions

A cash sale is a business transaction in which the buyer pays for goods or

services at the time of the purchase. In a cash sale, payment is immediate. How

the buyer pays doesn’t matter, as long as there is a transfer of monies. It can

be: Cash: The buyer counts the bills and coins and hands it over to the seller. It

can be the cheque or payment cards for transferring money from the customer

account to the seller’s account.

A cash sales transaction affects two accounts: Cash /bank which is debited asit is a current asset and the sales account which is credited as it is an income.

4.2.1. Record a cash sale

In QuickBooks, a cash sales transaction is recorded as here under:

Step 1. Click on company menu on QuickBooks home page, then select MakeGeneral Journal Entries.

Figure 4.10 Make General Journal Entries

Step2. Complete the general journal

Figure 4.11. General journal to use for recording

The first part of the window is for double entry and the bottom part shows the

number of transactions concluded. For having a clear field for recording, thebottom part should be hidden by clicking Hide List

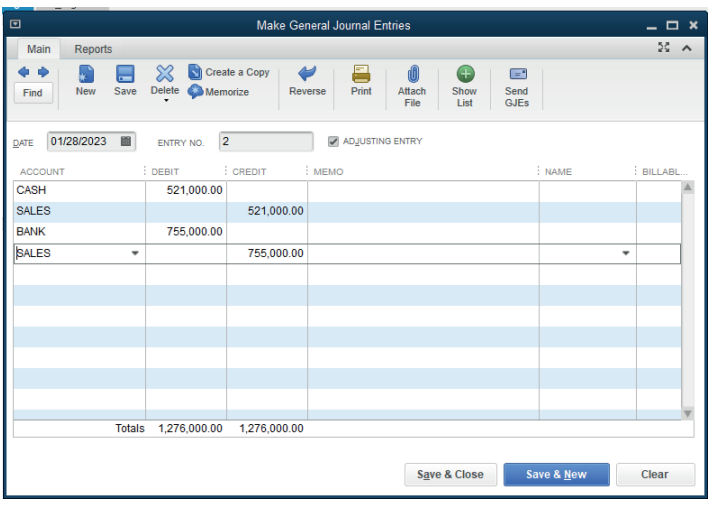

Example:

SHYAKA Ltd started its business activities in January 2022. During January the

cash and cheques sales transactions concluded with all of its clients are valued

at FRW 521,000 and FRW 755,000 respectively.

To record this transaction in the general journal, of course the cash, bank and

sales account are already created in the chart of account. If not QuickBooks

gives an option to add new account while recording. Here all the accounts arecreated in chart of account.

Figure 4.12.Option to record a sales by cheque and by cash

The next step is to debit the account to be debited and credit the account to be

credited respecting the rule of double entry. It means:

Debit Cash account 521,000

Credit Sales account 521000

Debit Bank account 775,000Credit Sales account 755,000

Figure 4.13. Sales by cash and by cheque record

A sale transaction is recorded, then Save &Close

4.2.2. Receiving the payment

This occurs when a payment is received from a customer for goods or services

supplied. The customer who received the invoice has the option to sign a cheque

and send it to the business. He can also deposit cash on business account and

submit the bank deposit slip to the business or pay cash in hand to the business

premises.

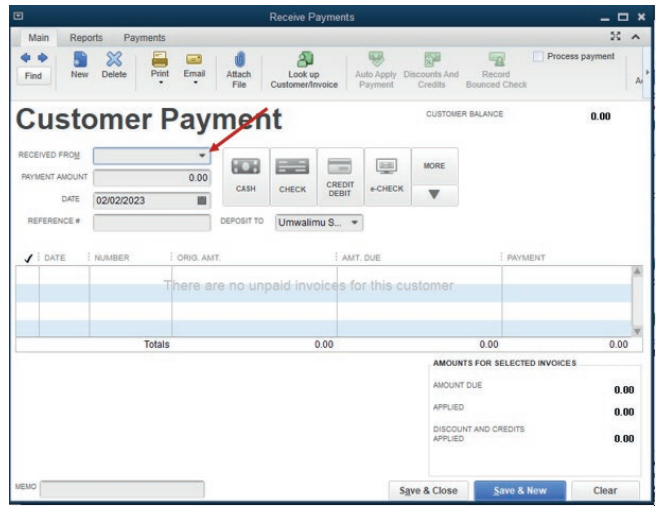

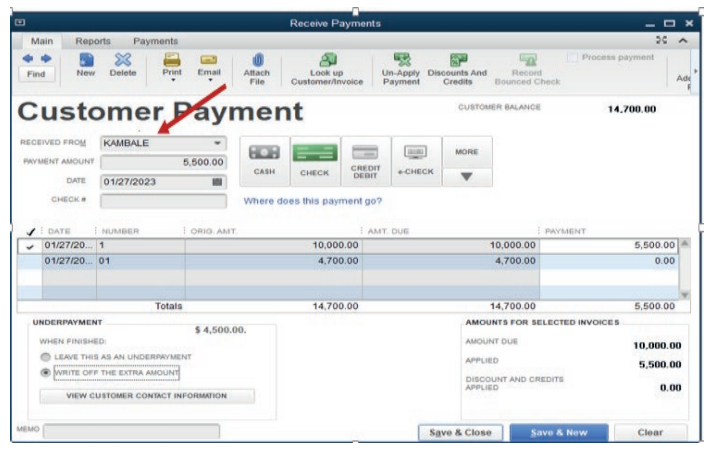

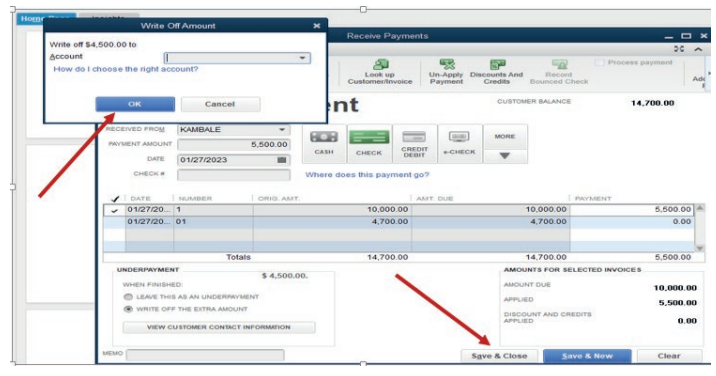

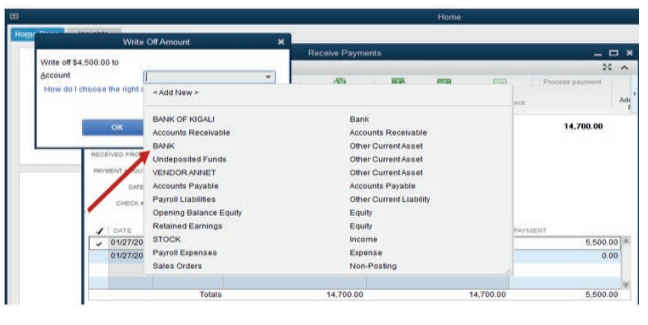

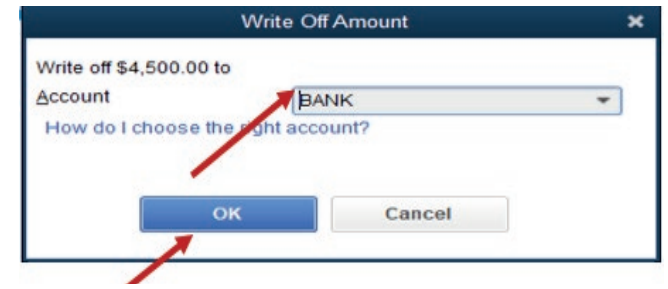

For our case, KAMBALE paid by cheque. To process this in QuickBooks, click

on Receiving Payment on QuickBooks home page for getting the followingwindow.

Figure 3.17 Selecting customer paid

This gives the option to enter the customer’s name where the payment is from,

the amount to receive, and after this, check whether the amount is equivalentwith the invoice. If yes, Click on Save & close

Figure 3.18. save a payment of customers

Save & close leads to the step of confirming the account to which the paymentgoes.

Figure 3.19. Selection of receiving account

Select the account from the list

Figure 3.20 Confirmation of receiving Account

Because the payment is done by cheque, the account is Bank. Then OK.

Figure 3.21. The receiving account is Bank

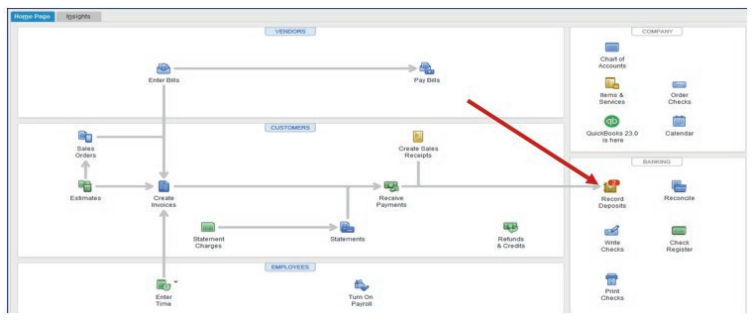

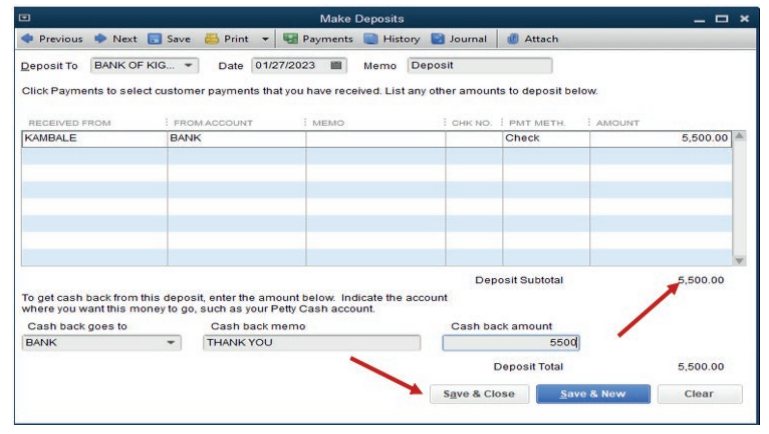

4.2.3. Recording the payment

Cash or cheque payment from customers must be recorded in business books

accounts. QuickBooks recognizes any unrecorded payment and the notificationis shown on its home page as below:

Figure 3.22. QuickBooks Home Page deposit notification

Once we click on notification, the below window showing the date, type of

transaction, payment method, the names of customer who is paying and totalamount paid appears. Click Save & Close

Figure 3.23. Cash Deposit slip

4.2.4. Sales receipt

A sales receipt is a transaction record that the seller issues at the time of sale

to verify the provided product or service and the amount the buyer paid. It is a

proof of payment. It is written by the selling business to its customer when the

payment against goods or services provided is over.

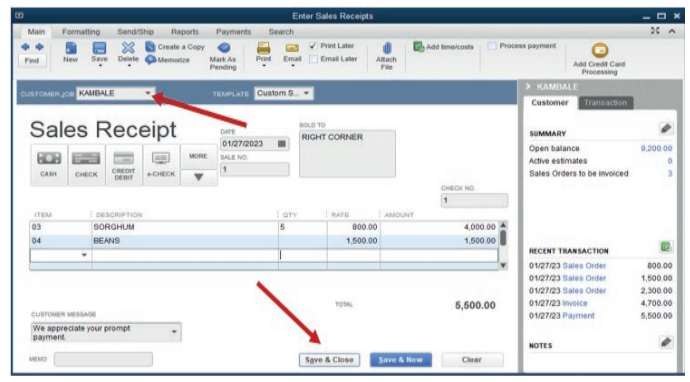

In QuickBooks, a sales receipt is created as following:

Clicking on Create Sales Receipt tool on QuickBooks home page and gettingthe below window:

Figure 3.24. creation of sales receipt

From this, KAMBALE is a customer to whom a receipt belongs. So the user

has to add the items and quantity that the customer is paying for, customer

message if necessary, cheque number… Once the below window appears andthere is an exact amount as is per invoice, click save & close

Figure 3.25. selection of the concerned customer

Application Activity 4.2.

1. Make a clear difference between sales and cash transactions

2. During the month of December 2022, B2C Co. Ltd concluded the

following sales transactions:

Sales on credit to; Teddy: FRW45, 740, Moise: FRW 347,600, Allen: FRW

245,000

Required:

• Record the abov e transactions in the journal of B2C Co. Ltd• Prepare the sales receipt.

End of Unit Assessment

1. Differentiate:

a) Vendor from a customer

b) Order from invoice

2. Mrs. Alex, the owner of BEST ELECTRONIC Ltd stated the business inJanuary 2020. He purchases the items below:

SAMSUNG 250 is Alexis’ supplier of computer and telephones while

RWIZA Ltd supplies Computers and TVs. Vision 2050 is a customer

of both Radios and TVs. You are hired as an accountant of BEST

ALECTRONCS and the company uses QuickBooks in preparation ofits reports.

Required:

3. Create the list of items

4. Enter the vendors and customers

5. Prepare the bills for received items

6. Record the payments to the vendors

7. Prepare the order on behalf of customer, invoice and receive payment8. Record the payment from the customer

UNIT5: PURCHASES AND PAYABLES

Key unit competence: Apply the rules of cash, cheques, credit

sales and account receivable transactionsin QUICKBOOKS

Introductory Activity

Mr. MUGISHA has a shoes shop. He uses to purchase from different suppliers

on credit basis and then pay after selling.

1. Explain the credit purchase

2. Advise him on process of recording transaction be recorded inQuickBooks?

5.1. Credit purchase transactions

Learning Activity 5.1.

DUFATANYE SOTRE is engaged in sales of fruit and vegetables in

KIMISAGARA market. The customers in the morning purchase on credit for

paying in the evening after selling.

• Advise the DUFATANYE SOTRE on the ways of recording its daily sales

• If DUFATANYE SOTRE needs to use QuickBooks in recording, explainto its accountant the steps of creating a sales invoice

The term “credit purchase” refers to a situation where a buyer or a customer

conclude a purchase of goods or service from the supplier and promises to pay

on future date. It is a purchase transaction on the side of the buying entity but asales transaction on the side of the seller.

When goods or services are bought by a business on account or on credit

for reselling later, we can then say that Credit Purchases have taken place in

accounting. As with purchases, credit purchases can be used to by goods and

services however these are on credit or on the account.

Due to the credit purchase, an account receivable and an account payable are

then created. The account payable is the current liability for the buyer, and they

will pay the supplier at an agreed later date. The buyer should record it as a

Credit Purchase.

From the viewpoint of the supplier, they should record it as an account receivable,

it will be considered a current asset and it should be recorded in AccountsReceivable Subsidiary Ledger.

5.1.1. Record a credit purchase

A credit purchase transaction starts with the purchase order. A purchase order

is a document written buy the buyer to the seller just ordering him/her to supply

ordered good or services. A supplier who receives a order from the buyer try

to deliver goods or services which can be paid either directly or in future date.In QuickBooks, a credit purchase transaction is recorded as here under:

Step 1. Click on company menu on QuickBooks home page, then select MakeGeneral Journal Entries.

Step2. Complete the general journal

The first part of the window is for double entry and the bottom part shows the

number of transactions concluded. For having a clear space for recording, thebottom part should be hidden by clicking Hide List

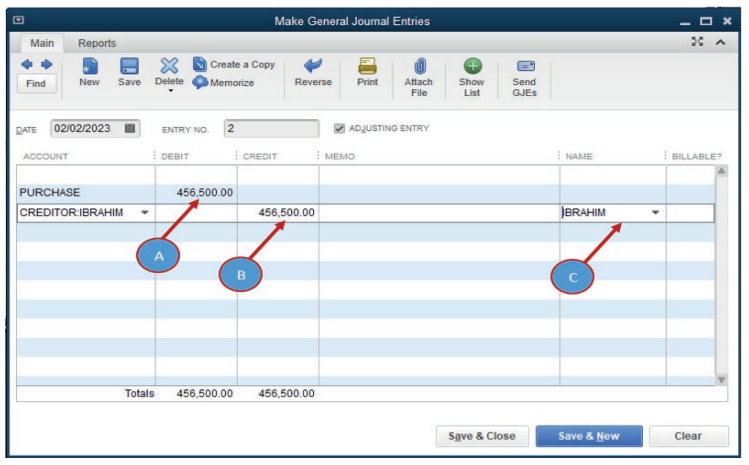

Example: SHYAKA Ltd started its business activities in January 2022. During

January the purchase transactions concluded with all of its creditors is valued

at FRW 456,500. To record this transaction in the general journal, of course the

creditors and purchase account are already created in the chart of account. Ifnot QuickBooks gives an option to add new account while recording.

Debit purchase account: 456,500Credit creditors account: 456,500

As there is no debtors and sales accounts created in chart of account, we

can add them by the normal way of account creation, account type, continue,

account name then Save&Close or Save&New. Through this, a debtor

account is created and debited with FRW 125,000. Sales account is createdand credited with the equivalent amount.

A. A debited account (purchase)

B. A credited account (Creditor)C. Name of supplier

In case there is specific customer name, it can be added on the name column

for clarifying who is the debtor.A purchase transaction is recorded, then Save &Close

5.1.2. Purchase invoice

A purchase invoice is an invoice used to record the purchase of goods or

services by a company. The purchase invoice will include the same information

as a regular invoice, but it will also list the terms of the purchase agreement and

any discounts that were negotiated.

An invoice is issued by the seller (or vendor) upon completion of the terms as

outlined in the purchase order. An invoice includes the previously agreed uponprice that the buyer should pay now that the order has been completed.

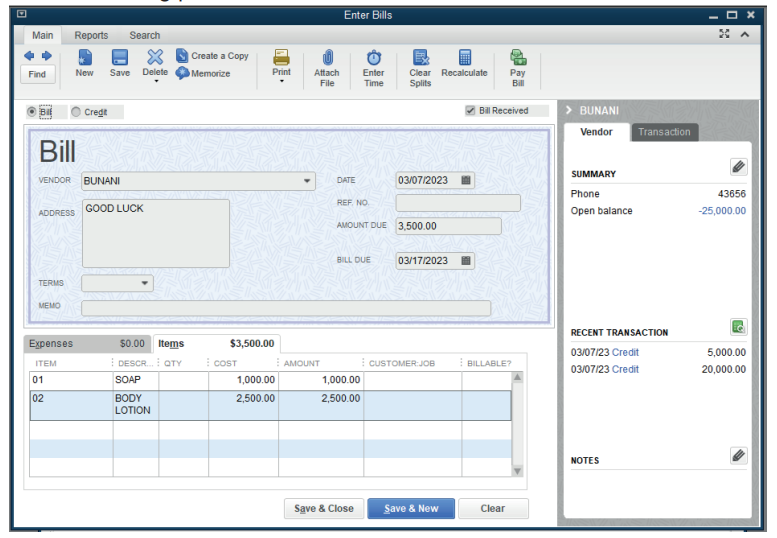

In QuickBooks, if goods or services are received by the company from the

vendor, an invoice is checked for ensuring the conformity with order and paid

later. The following is the purchase invoice from vendor that details the itemsreceived for being paid.

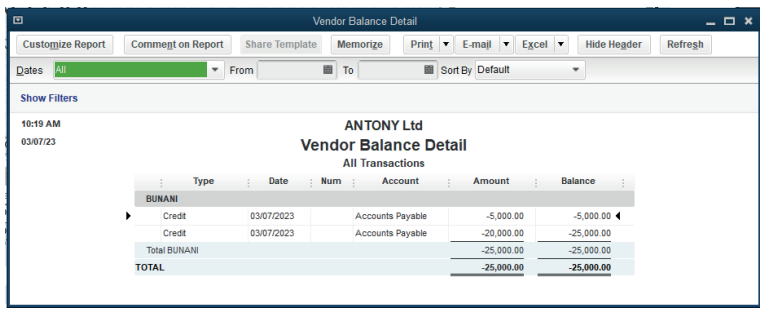

This is a purchase invoice entered in the QuickBooks for being paid.

The company keeps the purchase invoice valued at 25,000FRW to be paid to

ANTONY Ltd for soaps and body lotion purchased on credit.

Application Activity 5.1.

1. Define a credit purchase transaction

2. What are the account affected by any business credit purchase

transaction?

3. MUGEMANA, a sole trader in Bushenge market purchased goods

valued at 743,980FRW on credit from supplier GATO.Record this transaction in his general journal.

5.2. Cash/ Cheque purchase transactions

Learning Activity 5.2.

JACKY SHOP uses to purchase goods and services and pays directly for

keeping its current assets free from liabilities.

• Is there advantages of purchasing by cash? Explain to Jacky.• Advise her to the recording of cash purchase.

A cash purchase transaction is a transaction where there is an immediate

payment of cash for the purchase of goods or services.

The common definition of a cash transaction is an immediate payment for

the goods or services bought. However, the term can have diverse meanings

because some time cheques or payment cards are used to pay goods orservices and it is always considered as a cash transaction.

5.2.1. Record a cash purchase

A cash purchase transaction affects two accounts: Cash /bank which is debited

as it is an increase in current asset and the sales account which is credited as

it is an income.

In QuickBooks, a cash purchase transaction is recorded as here under:

Step 1. Click on company menu on QuickBooks home page, then select MakeGeneral Journal Entries

Step2. Complete the general journal

The first part of the window is for double entry and the bottom part shows the

number of transactions concluded. For having a clear field for recording, thebottom part should be hidden by clicking. Hide List

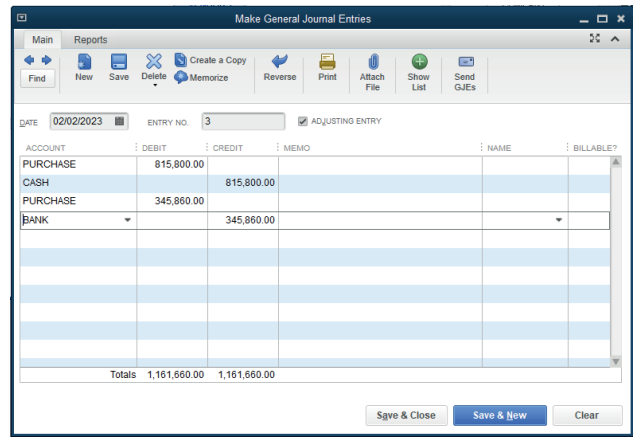

Example: SHYAKA Ltd started its business activities in January 2022. During

January the cash and cheques purchase transactions concluded with all of itssuppliers are valued at FRW 815,800 and FRW 345,860 respectively.

To record this transaction in the general journal, of course the cash, bank and

purchase account are already created in the chart of account. If not QuickBooks

gives an option to add new account while recording. Here all the accounts arecreated in chart of account.

The next step is to debit the account to be debited and credit the account to be

credited respecting the rule of double entry. It means:

Debit Purchase account: 815,800

Credit Cash account: 815,800

Debit Purchase account: 345,860Credit Sales account: 345,860

A purchase transaction is recorded, then Save & Close

5.2.2. Paying the bill

The following steps will be followed for paying vendor bill:

1. Go to the Vendors menu, then select Pay Bills.

2. Select the correct accounts payable account from the dropdown.

3. Select the checkboxes of the bills you want to pay from the table.

Note: To unmark or mark all the bills in the list, select Clear

Selections or Select All Bills.

4. Set any discount or credit that you want to apply to the bills.

• Discount - Select this if your vendor gave you a discount for this

transaction.

• Credit - Select this if you received a credit from your vendor, and you

used it to reduce your total bill amount.

5. Enter the date you paid the bill.

6. Select the payment method:

• Check Select Assign check number if you plan to manually write

the check. Select To be Printed to print the check or add it to the

list of checks to print.

• Credit Card - You can use credit cards to pay bills, then print a

payment stub.

• Online Bill Payment - You can directly pay your vendor bills in

QuickBooks. It also records your payment automatically so your

reports are accurate.

• Online Bank Payment - The payment processor will print and

mail a check to the employee. You can select Include reference

number if you want the bill or credit reference number to be sent

along with your name and account number.

• Cash, Debit or ATM card, Pay pal, or EFT - You can select Check,

then Assign check number even when you’re not paying with an

actual check. Enter the type of payment in the check number field or

leave it blank.

7. Select Pay Selected Bills.

8. Select Done, or select Pay More Bills if you have other bills you needto pay.

Application Activity 5.2.

1. Define a cash purchase

2. List the steps followed in recording a cash purchase

3. Mr. Gashugi purchased goods valued at 2,00,500 FRW by cash.

He also paid 134,550 FRW by cheque for services rendered to him.Record the transaction in QuickBooks and display it.

5.3. Cash/ Cheque purchase transactions and paymentprocesses

Learning Activity 5.3.

Rurangwa is a sole trader who uses to purchase goods and services from

different suppliers. It is his policy to pay directly when goods are deliveredto his company. Discuss the importance of his policy.

A cash transaction refers to a transaction which involves an immediate outflow of

cash towards the purchase of any goods, services, or assets. Cash transaction

can be consumer-oriented or business-oriented. A cash transaction stands

in contrast to other modes of payment, such as credit transactions in

a business involving bills receivable. Similarly, a cash transaction is also differentfrom credit card transactions.

5.3.1. Recording the payment

In QuickBooks, the payment is done either by cheque or credit card. The

accounting entry for this transaction is as follow:

Debit: the vendor (Creditor)Credit: the bank or credit card

Cash or cheque purchase has the advantages below:

• Convenience for small purchases and tipping

• Lower transaction costs

• Negotiating power

• Buyer anonymity

• Budgeting and debt avoidance

• Preparing for emergencies

5.3.2. Payment receipt

This is a document kept by the company from the vendor as a proof of payment.

A copy of it is kept by the vendor. A payment receipt, also known as a receipt of

payment, is a document issued from a business to its customer when they have

received payment for provided goods or services.

This can apply either to partial or full payments, showing a clear record of how

much money has been received and what is still owed. Cash payment receipts

are useful documents both for the buyer and seller. Buyers can see where they

stand with payment, viewing a clear record of what they have paid for. Sellers

can verify the date and other details of a purchase, using this information to

create more detailed financial statements later. In the case of partial payments,receipts are also helpful as they serve as reminders for outstanding balances.

Application Activity 5.3.

1. What is a cash transaction?2. List the importance of cash os cheque purchase transaction

End of Unit Assessment

1. Make a clear difference between credit purchase and cash purchase

transactions

2. During the month of December 2022, B2C Co. Ltd concluded the

following Purchase transactions:

Purchase on credit to; Meddy: FRW 74,450, Modeste: FRW 645,000,

Arsine: FRW 245,000, Cash purchase: 357,450

Required:

• Record these transactions in the journal of B2C Co. Ltd• Prepare the sales receipt.

UNIT6: FINDING AND CORRECTING OMISSION AND MISSTATEMENTS

Key unit competence: Correct errors in the account balancesusing QUICKBOOKS

Introductory Activity

Mr NGOGA Frank is an accountant in ABC Ltd. During the month of November

2022, he recorded and posted the following transactions:

• Purchase of goods valued at 34,000 Frw by cash and he debited both

purchase and cash account.

• Taking goods worth 12,500 Frw for his own use and no entry has been

made

• The company sold the unused part of its land, the accountant debited

land and credited sales account.

• Cash banked FRw. 390 had been credited to the bank column and

debited to the cash column in the cashbook.

• Cash drawings of FRw. 400 had been credited to the bank column of

the cashbook.

In preparation of final report, some imbalances occurred.

a) For each case, show whether the transaction is posted correctly

b) What do you think is the causes of the imbalance?c) How can this be solved?

Recording transactions, posting to the various accounts and extraction of list of

account balances, it is possible for errors to be committed. Such errors may or

may not affect the totals of the list of account balances. Recall that if the totals

of the list of account balances equal, then this shows arithmetical accuracy in

recording and posting of transactions.

Now it should be said, this does not mean non-existence of errors. It is possible

for some errors not to affect the totals being equal for the list of account

balances. Some errors can affect too the total of list of account balances. For

those errors that affect the trial balance, quick books detect them before endingthe recording process.

6.1. The errors that do not affect the trial balance: Error ofomission, Error of Commission, Error of principle

Learning Activity 6.1.

After all transactions have been posted from the journal to the ledger, it is a

good practice to prepare a trial balance. A trial balance is simply a listing of the

ledger accounts along with their respective debit or credit balances for self check to determine that debits equal credits.

Do you agree with the statement that if the debit side of trial balance is equal

to the credit side of trial balance, there is no error committed in postingtransactions? Discuss your answer.

In Accounting, errors refer to the common mistakes made while recording

or posting accounting entries. These discrepancies are not fraudulent and

generally unintentional. Errors that do not affect the List of account balances

(trial balance) are the ones that totals of the list of account balances equal each

other.

However, on taking a close check on the balances and transactions posted,

errors may have been made and therefore the balances shown on the list of

account balances may be incorrect. Quick books cannot detect such errors.The following errors will not affect the totals of list of account balances

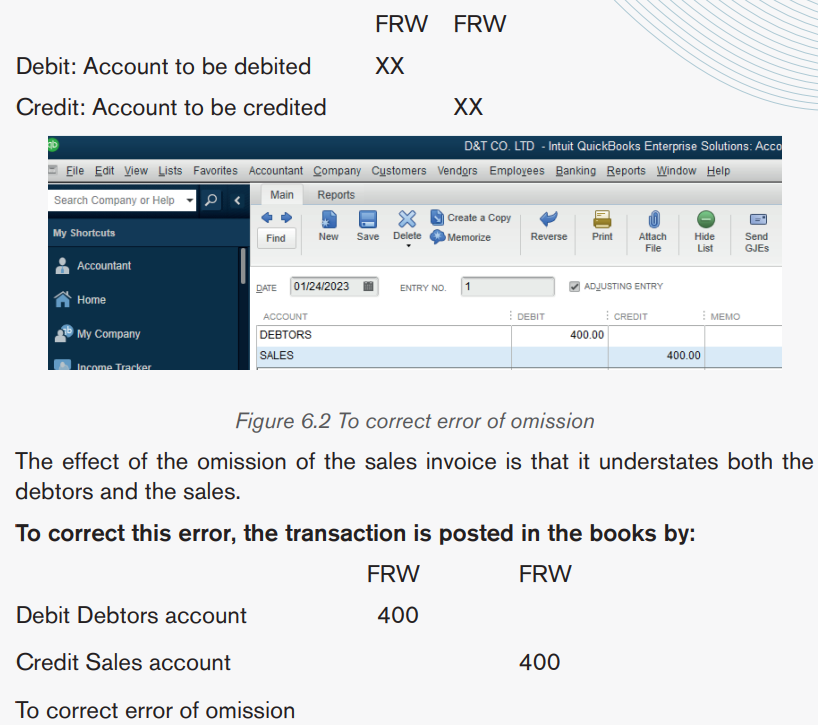

6.1.1. Error of omission

Here, a transaction is completely omitted from the accounts and therefore the

double entry is not made.

For example, a sales invoice of Frw 400 is not posted in the sales journal

therefore no entry is made in the debtor’s account and the sales account. That

is both debit of Frw 400 in debtor’s account and credit of Frw 400 in the salesaccount.

Figure 6.1. Error of omission. No entry is made.

6.1.2. Error of Commission

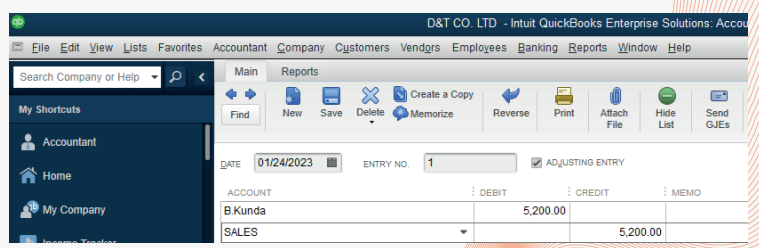

This error occurs when a transaction is posted to a wrong account but the

account is of the correct class of account. Example: A credit sale to B. Kundwa

is posted to B. Kunda’s account for an amount of Frw 5200. Instead of a debit

to B. Kundwa account it is made to B. Kunda’s account and the corresponding

credit in the sales account is correct.

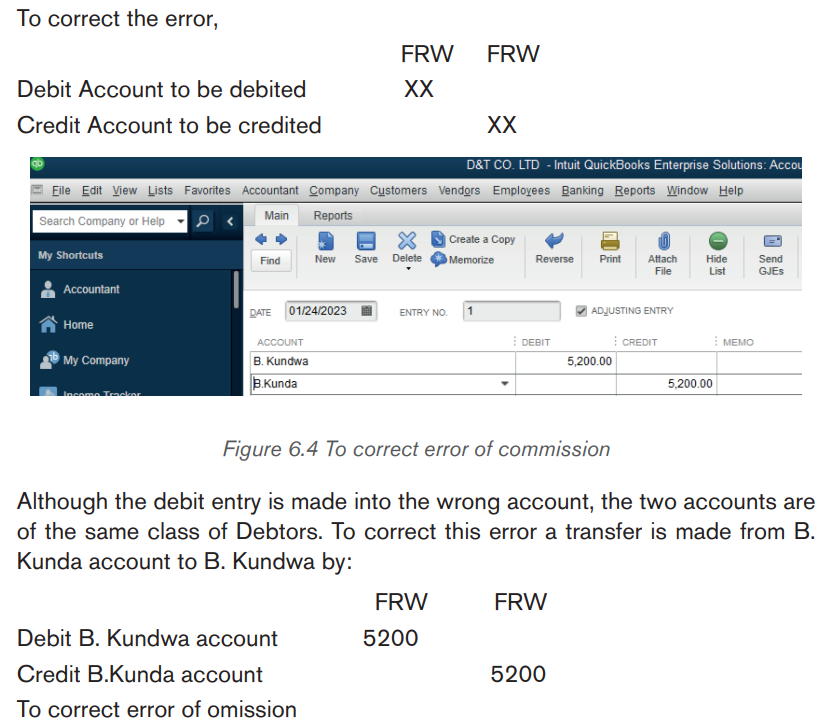

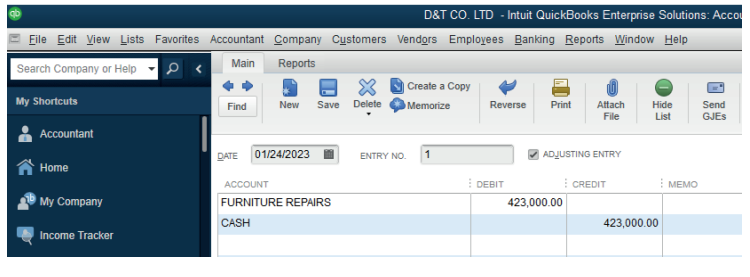

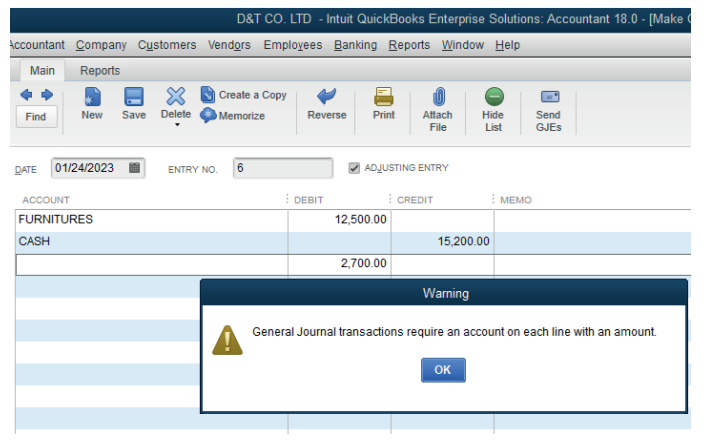

6.1.3. Error of principle

This type of error occurs when a transaction is posted to the wrong class of

account. For example, Furniture purchased for FRw 423,000 cash is debited

to the Furniture repairs account instead of debiting Furniture account, and thecredit entry in the cashbook is correct.

Figure 6.5: Error of principle

The furniture is a non-current asset, and a furniture repair is an expense.

Therefore a capital expenditure has been posted as revenue expenditure.

To correct such an error, the amount in the wrong class of account has to beremoved and transferred to the right class of account.

Figure 6.6 To correct the error of principle

Application Activity 6.1.

1. Explain;

a) Error of omission

b) Error of commission

c) Error of principle

2. The information bellow is from the books of Nelly. You are required to

record them in the journal of Nelly by correcting the errors committed.

a) Cash sales worth 29,000 FRW has never been recorded

b) Cash Payment of stationary has been recorded correcting in cash

and debited in salary account: 10,000 Frw

c) Furniture purchased for FRw 423,000 cash is debited to the

Furniture repairs account instead of debiting Furniture account, andthe credit entry in the cashbook is correct.

6.2.The errors that do not affect the trial balance: Completereversal, Error of Original entry, Compensating Errors

Learning Activity 6.2.

It is human nature to commit some errors especially in recording financial

transactions. This causes the imbalance in some list of account and requiresadjustment. Suggest some of such errors

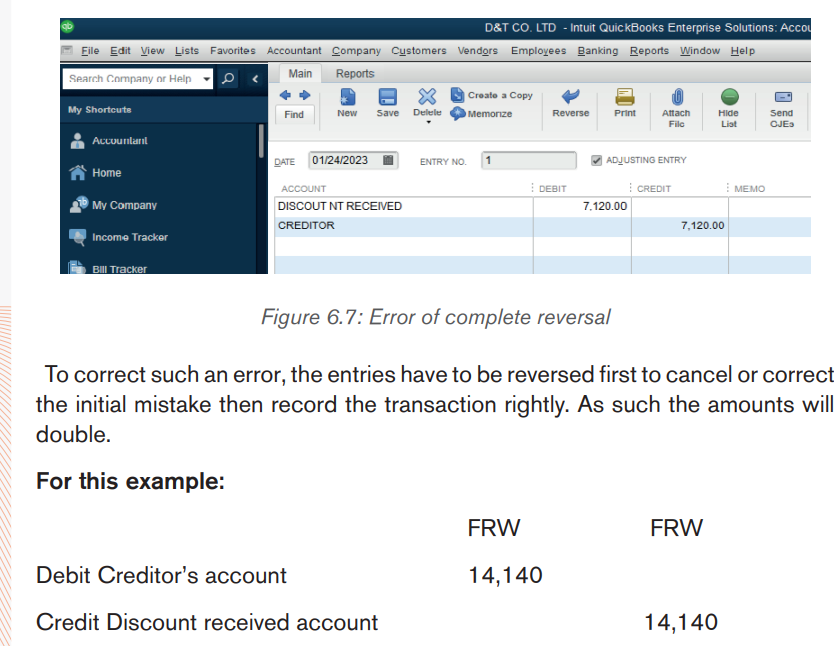

6.2.1. Complete reversal

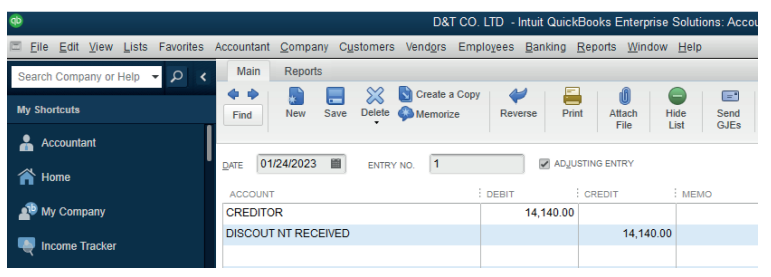

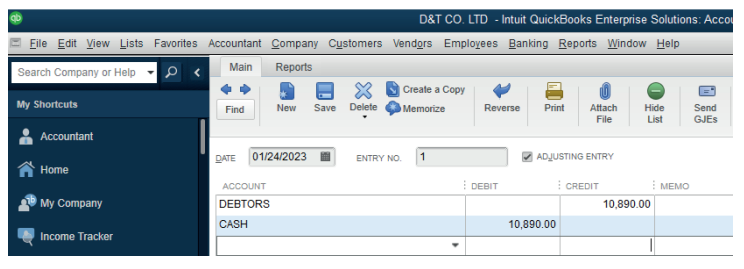

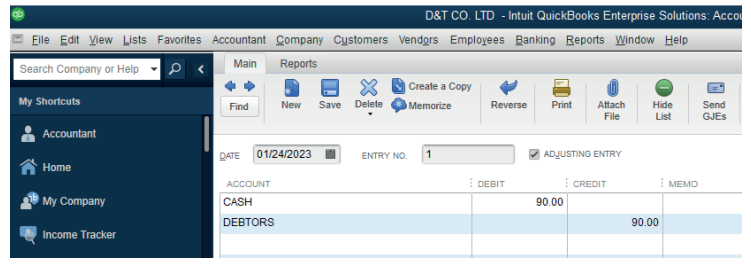

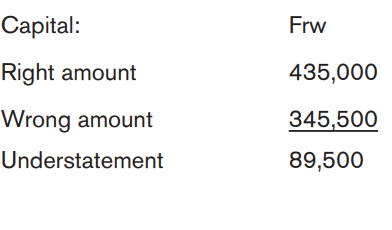

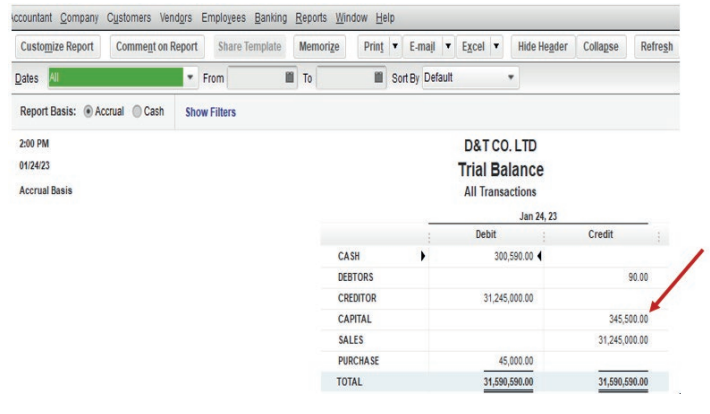

A transaction is posted to the correct accounts but to the wrong sides of the