UNIT 4:POSTING JOURNAL ENTRIES

Key unit competence: To be able to post journal entries

Introductory activity 4

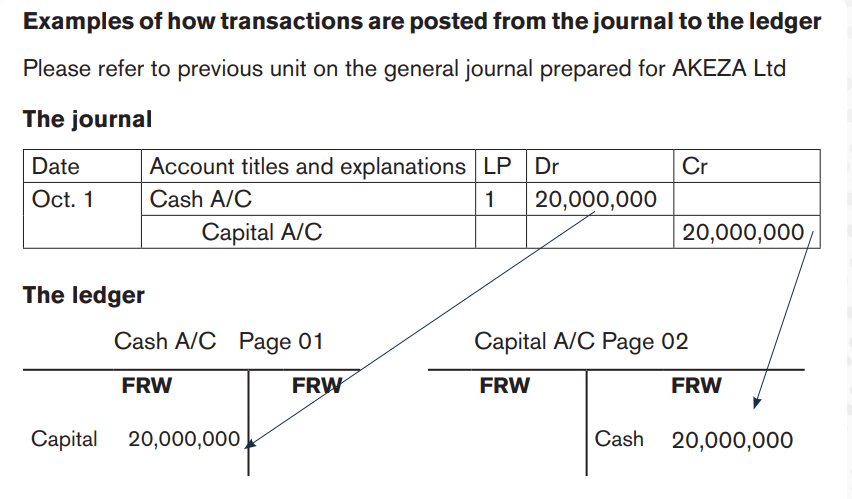

Figure 4.1: Posting journal entries

4.1 Meaning, types, and format of ledgers

Explain the terms “posting” and “ledger”.

Activity 3.8

In unit 1 you leant that business transactions are recorded in the books of

account in two stages: (i) Journalizing, and (ii) Posting into the ledger. You have

learnt the first stage of journalizing various transactions in Unit 3. In this unit

you will learn about the second stage i.e. posting in the ledger. This involves

posting journal entries into various accounts in the ledger, and balancing off theaccounts.

4.1.1 Meaning of ledger

A business may use many accounts in recording its transactions. Each account

is placed on a separate page in a bound or loose-leaf book, or on a separate

card in a tray of cards. If the accounts are kept in a book, the book is called

the ledger. Actually as used in accounting, the word ledger means a group of

accounts or place of storage of accounts. Transactions are posted from the

journal to the ledger. Posting simply means transferring journal entries to the

ledger accounts. An account was earlier defined as an accounting record of

increases and decreases in a specific asset, liability, or owner’s equity, revenues

and expenses. Ledger accounts summarize all transactions listed in the booksof prime entry.

4.1.2 Types of ledgers

Ledgers are broadly categorized under (i) General Ledgers and (ii) Subsidiary

Ledgers

General Ledger

The general ledger is also referred to as nominal ledger and it is the main ledger

of an organization. Whenever we use the term ledger, we are referring to the

general ledger, unless we specify otherwise. It is supposed to contain all the

ledger accounts of an organization used to update each account. In case there

are too many accounts in the organization, it is only the control accounts that

should appear in the general or main ledger and others are recorded in the

subsidiary ledgers. In manual accounting system, the general ledger is a big

bound book with hard covers. Each page in the book represents an account.

As observed above, the general ledger is supposed to contain all accounts of

the organization. However, for easy of recording and retrieval of accounts, the

general ledger is separated into subsidiary ledgers which are explained below.

Subsidiary ledgers

In order to avoid crowding of the general or main ledger with all accounts,

subsidiary ledgers are created. Subsidiary ledgers are subdivisions of the

general ledger. It is only the major accounts called control accounts that appear

in the general ledger. Details of the general ledger accounts can be seen in the

subsidiary ledgers.

Types of subsidiary ledgers are (i) Debtors or sales ledger and (ii) Creditors orpurchase ledger.

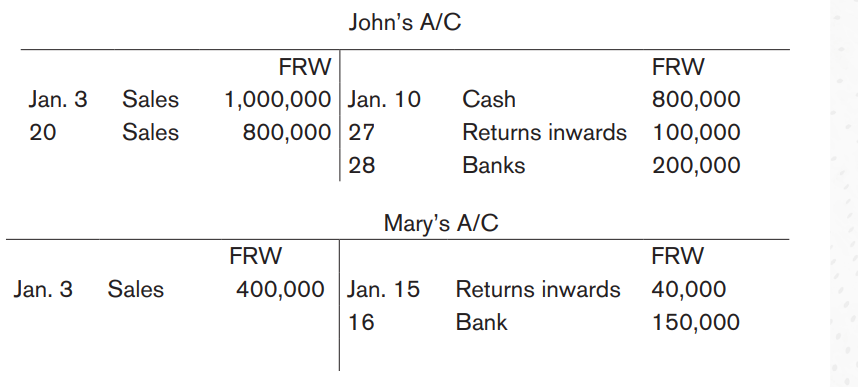

Debtors’ subsidiary ledger (Sales ledger)

It is often difficult to show each and every debtor’s account and its transactions

in the general ledger. To overcome this problem, a debtor’s subsidiary ledger is

prepared. This subsidiary ledger shows the position of each debtor’s account.

The total of individual debtor’s account balances in the debtors or sales

subsidiary ledger should reconcile with the balance of debtors control account

in the general ledger.

Creditors’ subsidiary ledger (Purchases ledger)

The creditor’s subsidiary ledger shows the details of each creditor’s account.

It is not possible to show this in the general ledger. The total of individual

creditors’ account balances in the creditors’ or purchase subsidiary ledger

should reconcile with the creditors control account in the general ledger.

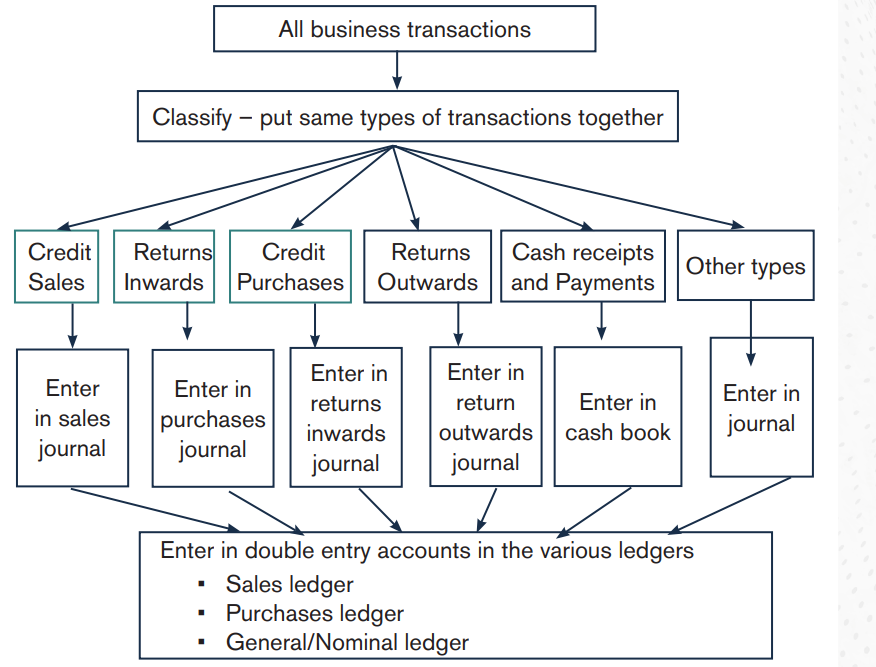

The following diagram illustrates how transactions fall in the books of original

entry earlier discussed in the previous unit and then how the books of original

entry feed those transactions into ledgersA diagram of books commonly used

4.1.3 Format of the ledger account

A ledger account can be written in two ways.

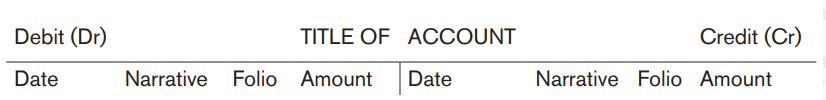

Format 1 T – Account Format

Organizations with manual accounting systems use T – Account format of the

ledger account. The simple T- account form used in accounting textbooks is

often very useful for illustration purposes. However, in practice, the account

forms used in ledgers are much more structured. The T – Account format

necessitates balancing off or closing the ledger account at the end of the period

because it has no running balance. This format is shown below.

In this account the date will show the opening period of the asset, liability,

capital, revenue or expense i.e. the balance brought forward. It will also show

the date when a transaction took place.

The detail column (also called the particulars column) shows the nature of the

transaction and reference to the corresponding account. The Folio Column for

purpose of detailed recording shows the reference number of the corresponding

account. The amount column shows the amount of the asset, liability, capital,

revenue or expense.

The left side of the account is called the debit side and the right side is called

the credit side. All assets and expenses are shown or recorded on the debit

side while all the liabilities, capital and revenues are recorded on the credit side.

Each type of asset, liability, revenue and expense must have its own account

whereby all transactions affecting then are recorded in this account. For the

double entry to be reflected in the accounts, every debit entry must have a

corresponding credit entry. The transactions affecting these accounts are

posted in the account as debit entry and credit entry to complete the double

entry.

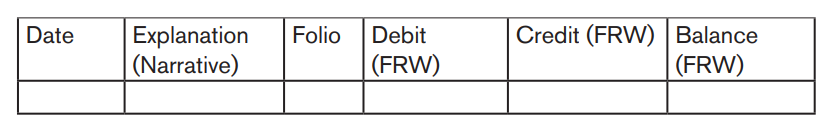

Format 2 With a running balance

Most computerized accounting systems use this format. Whenever s debit

or credit is entered, the balance automatically adjusts. This format does not

necessitate balancing off or closing the ledger account. This format is shownbelow.

Application activity 4.1

1. From which of the following a ledger account is prepared

a) Transactions

b) Journal

c) Events

d) None of above

2. The process of transferring of items from journal to their respective

ledger accounts is called as.

a) Entry

b) Arithmetic

c) Balancing

d) Posting

3. The left hand side of the ledger account is referred to as.

a) Footing

b) Credit side

c) Debit side

d) Balance

4. Ledger is a principle book that contains

a) Real accounts only

b) Personal accounts only

c) All accountsd) Nominal accounts only

4.2 Posting entries to the ledger

Activity 4.2

Refer to Entrepreneurship Subject and answer the following

question.

Mr. Mugabo commenced a business on 1 January 2021. All expenses

were paid by cheque and any cash received was banked daily. The

following is a summary of the transactions, which took place during the

first year of trading:

a) On 1 January 2021, Mr. Mugabo commenced business with

FRW5,000 which he lodged to the business bank account

b) During the period, total purchases amounted to FRW4,000

and payments made to suppliers were FRW3,550. On 31

December, 2021 FRW450 was still due to suppliers in respect

of these purchases

c) Sales for the year totaled FRWF9,000 all on credit. Amounts

received from customers 101during the year were FRW8,100.

On 31 December, 2021, FRW900 was still owing from

customers

d) Mr. Mugabo purchased a van in December costingFRW2,500

e) Administration Expenses were FRW2,300 for the year

Required: Write up the ledger accounts for Mr. Mugabo

Activity 4.2

Transferring journal entries to the ledger accounts is called posting. This phase

of the recording process accumulates the effects of journalized transactions

into the individual accounts. The aim of this section is to make you understandhow the posting is done. Do not forget your knowledge of double entry.

The above diagram shows the posting from the journal to the ledger. In the ledger

account, before putting the figure, the title of the second account necessary

for the completion of the double entry is inserted. Eg. In the cash account,

capital is mentioned before the figure and likewise in the capital account, cash

is mentioned before the figure.

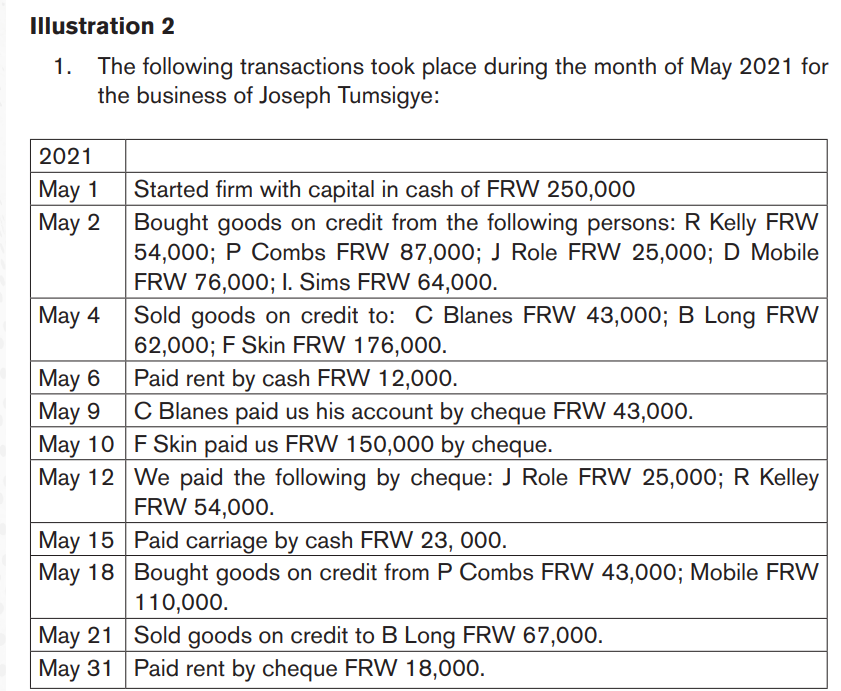

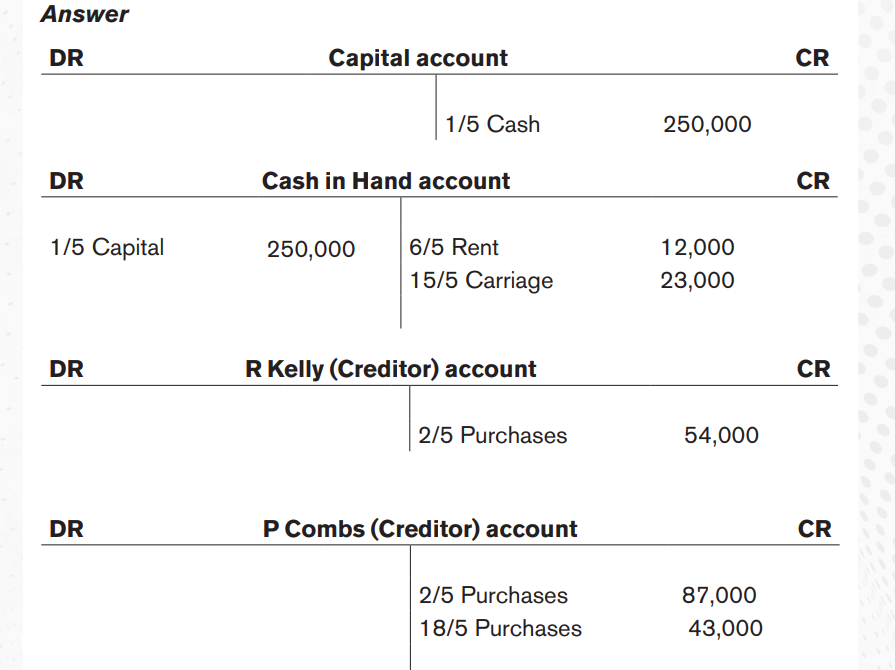

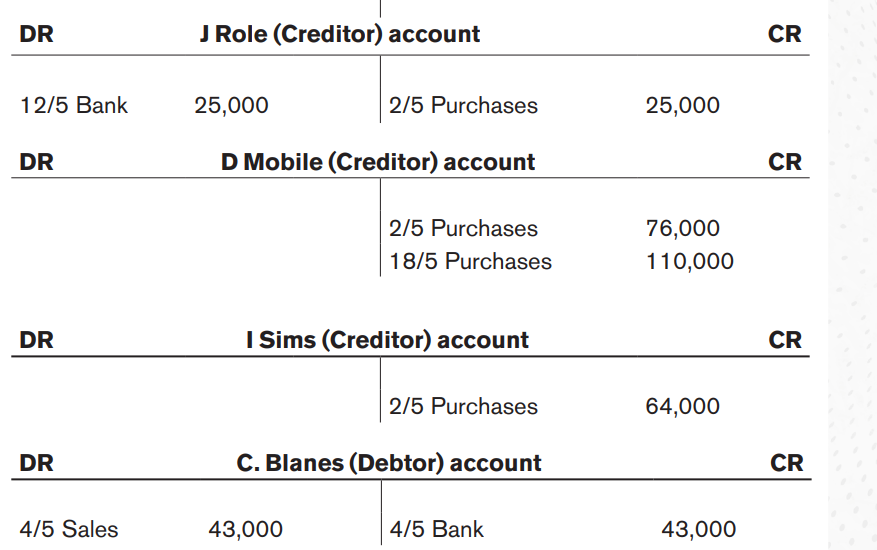

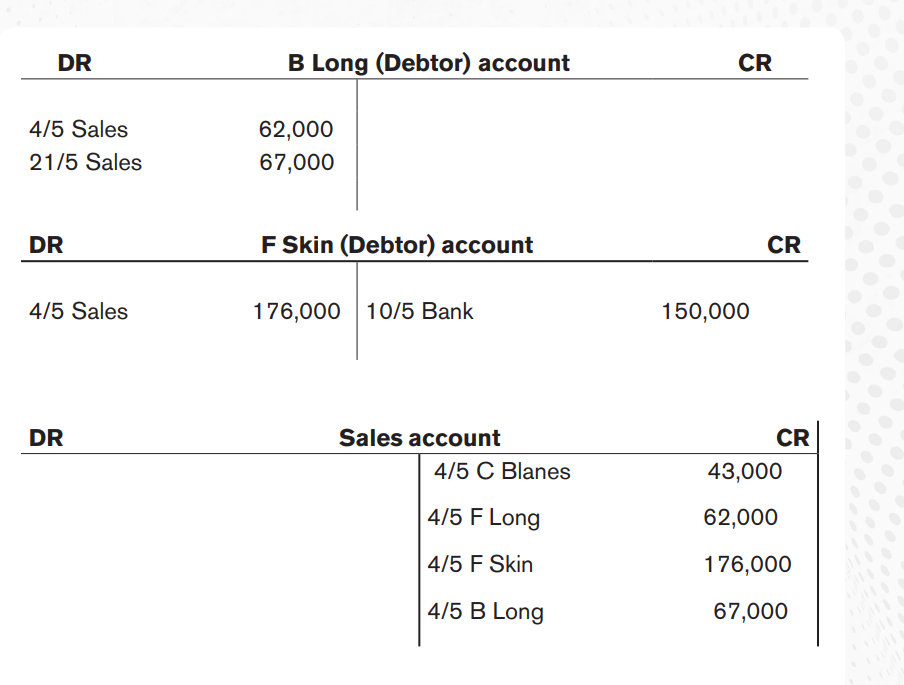

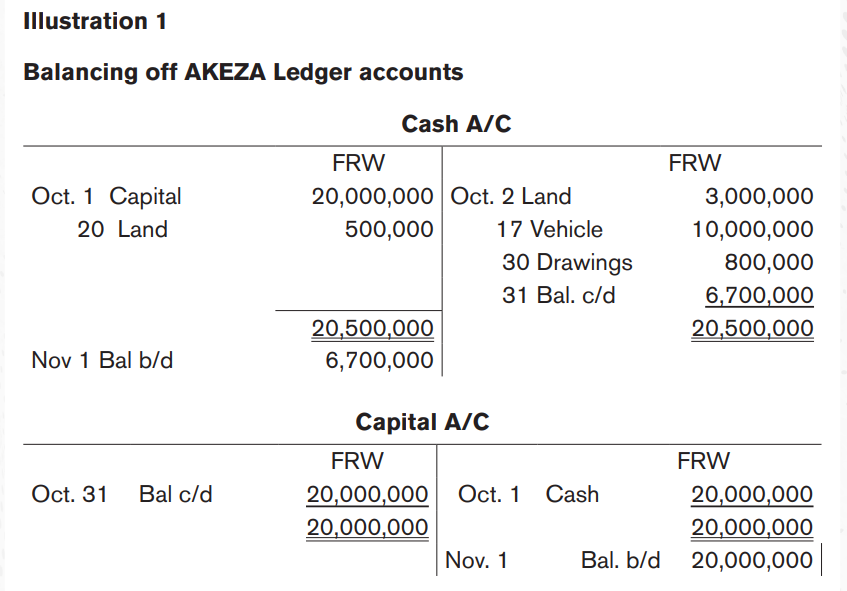

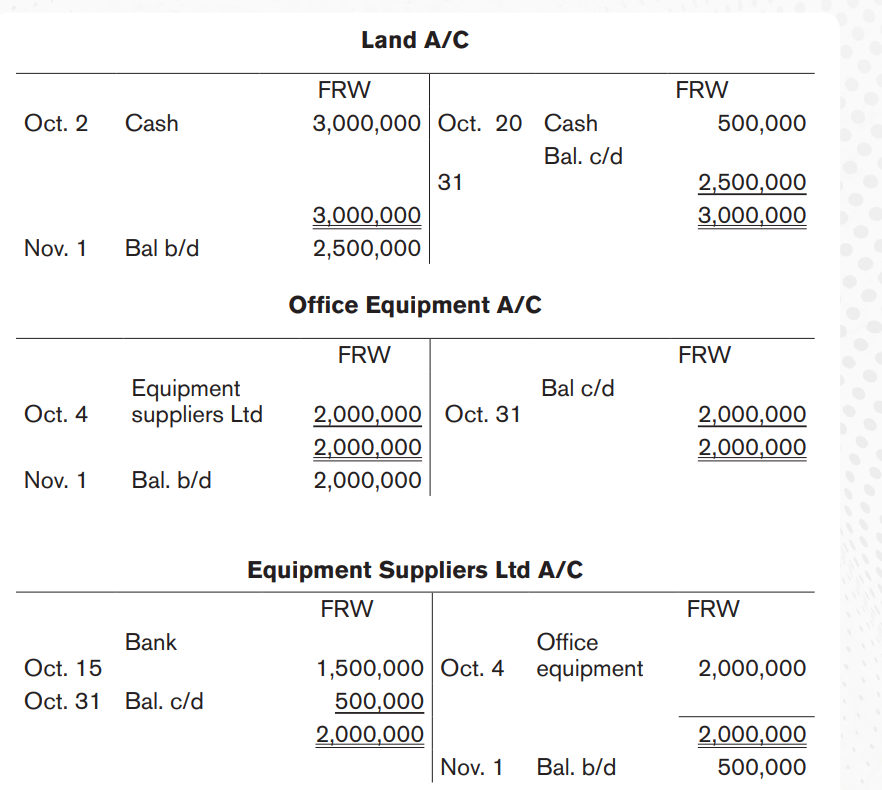

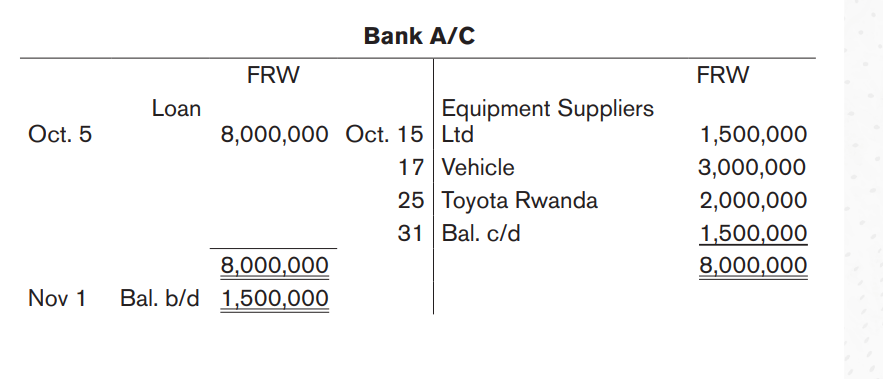

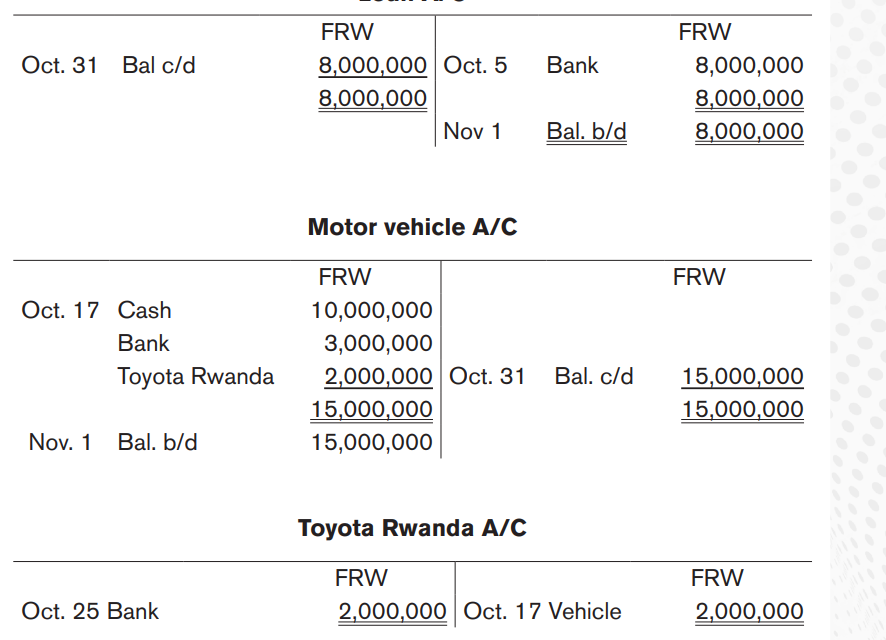

Illustration 1

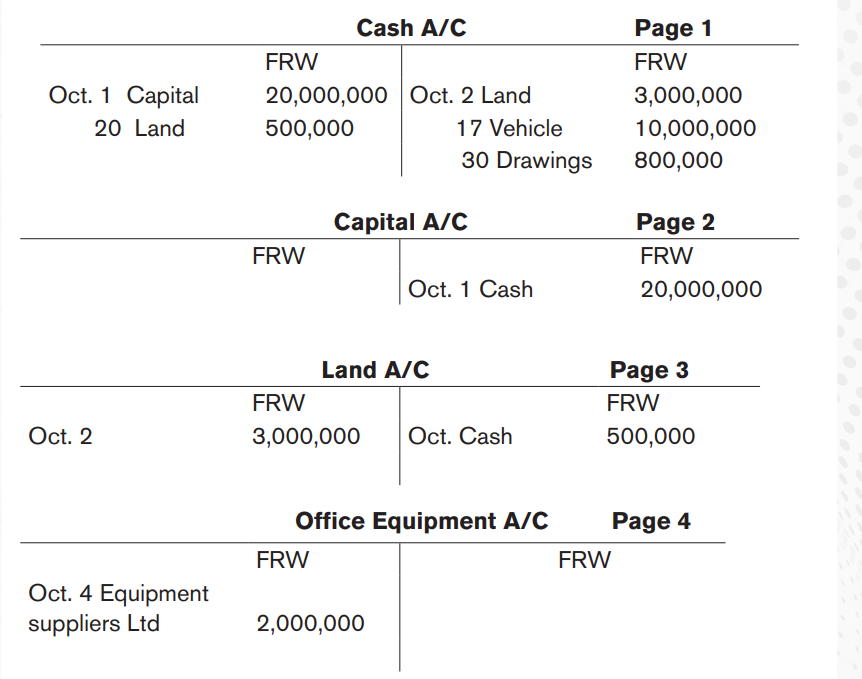

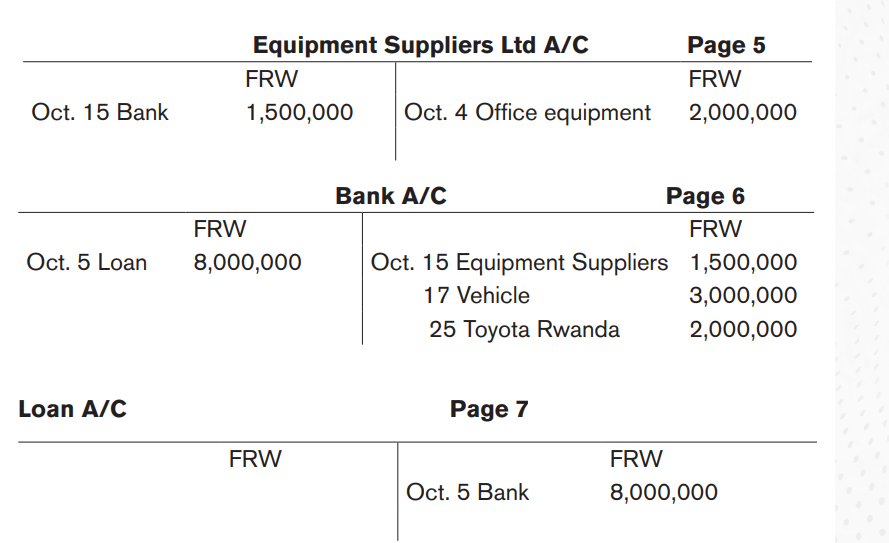

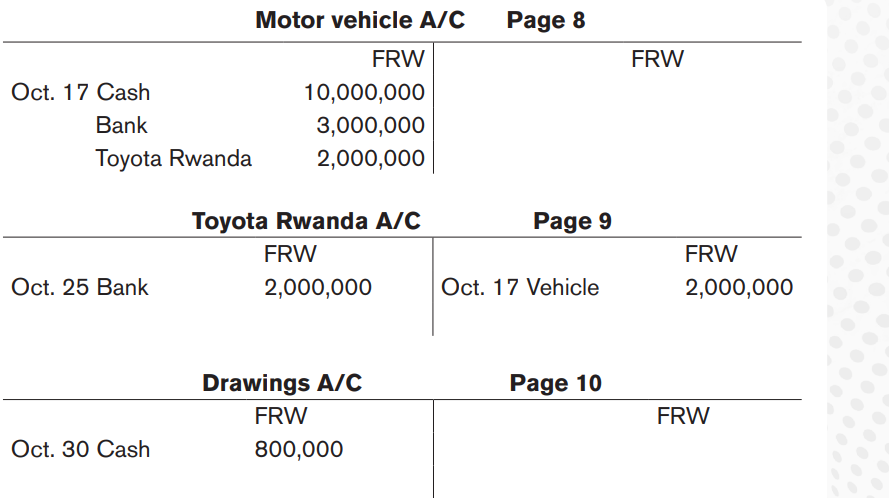

Let now complete posting all the transactions recorded in AKEZA Ltd’s generaljournal into its ledger (Refer to general journal prepared by AKEZA in unit 3)

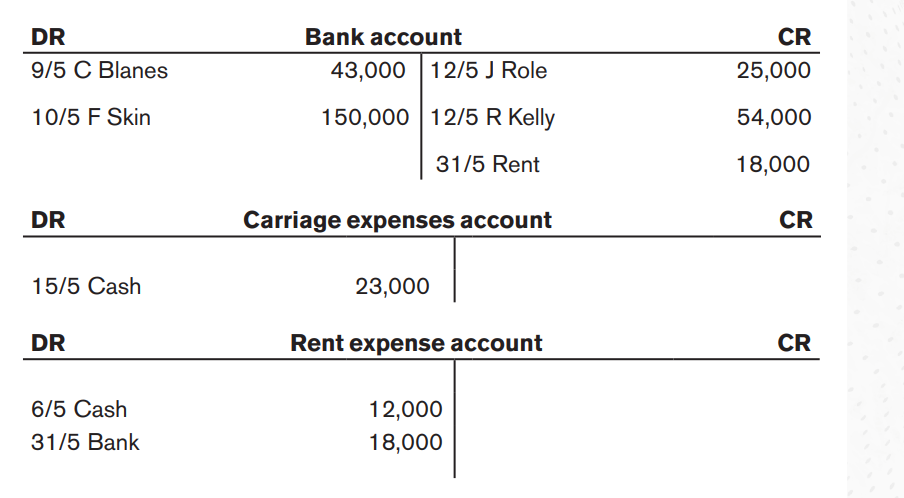

AKEZA Ltd’s Ledger accounts

Required: Record the above transactions in the appropriate accounts.

Application activity 4.2

Refer to unit 3 in application activity 3.2 and post entries from AKANYANA

Ltd general journal into ledgers.

4.3 The sales journal and sales ledger

What uses would the seller have for the copies of the sales invoice?

Activity 4.3

What uses would the seller have for the copies of the sales invoice?

n unit 3, you learnt that, rather than having only one book of original entry and

one ledger, most businesses use a set journals and a set of ledgers. In this

section, you will learn more about sales journal also called Sales day book and

sales ledger. You will also learn how cash and credit sales are entered in these

books.

4.3.1 Cash sales

As you have already learnt, when goods are paid for immediately, they are

described as “cash sales”, even where the payment has been made by cheque

or transfer of funds from the customer’s bank account into the seller’s bank

account. For accounting purposes, in such cases we do not need to know the

names of and addresses of neither customers nor what has been sold to themand, as a result, there is no need to enter such sales in the sales journal.

Credit card payments

When customers pay immediately by credit card, so far as recording details of

the customer is concerned, this is treated as if it were a payment made by cash.

No record is required for accounting purposes concerning the contact details

of the customer. However, it is still a credit transaction and it does result in a

debtor being created – the credit card company. The double entry would be a

credit to the sales account and a debit to the credit card company’s account in

the sales ledger.

4.3.2 Credit sales

In all but the smallest business, most sales are made on credit. In fact, the sales

of many businesses consist entirely of credit sales. For each credit sale, the

selling business gives or sends a document to the buyer showing full details of

the goods sold and prices of the goods. As you leant in unit 3, this document is

an invoice. It is known to the buyer as a purchase invoice and to the seller as a

sales invoice. The seller keeps one or more copies of each sales invoice for his

own use.

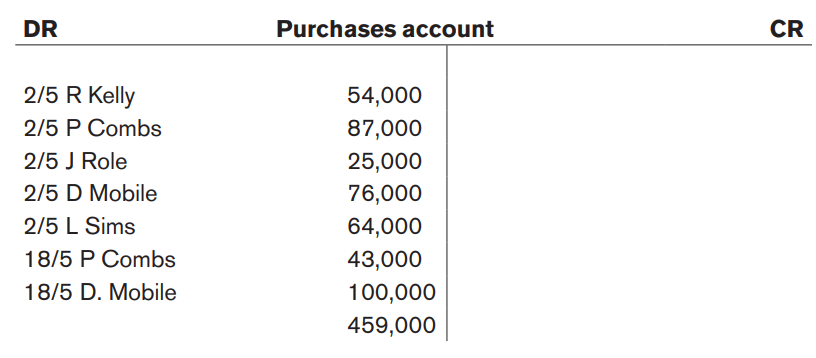

4.3.3 Making entries in the sales journal

Sales journal also called a Sales Day Book. It records all the sales invoices

issued by the firm during a particular period. The format is as follows (withsimple records of invoice)

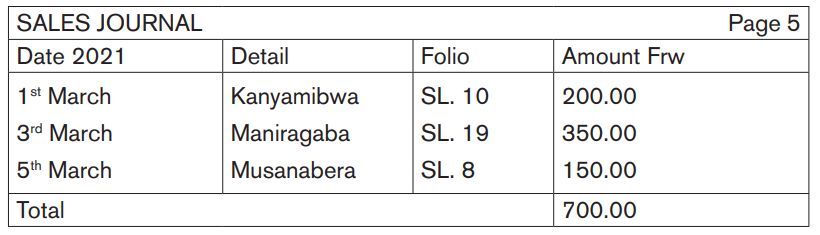

4.3.4 Posting credit sales to the sales ledger

Instead of having one ledger for all accounts, we now have a separate sales

ledger for credit sale transactions. It was described in section 4.1.

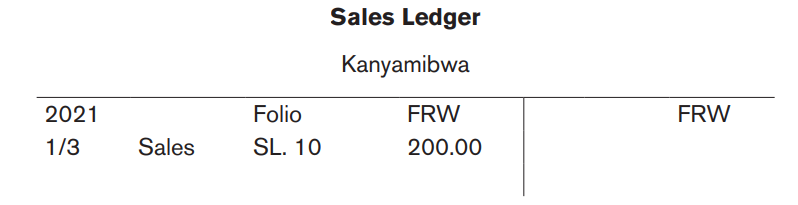

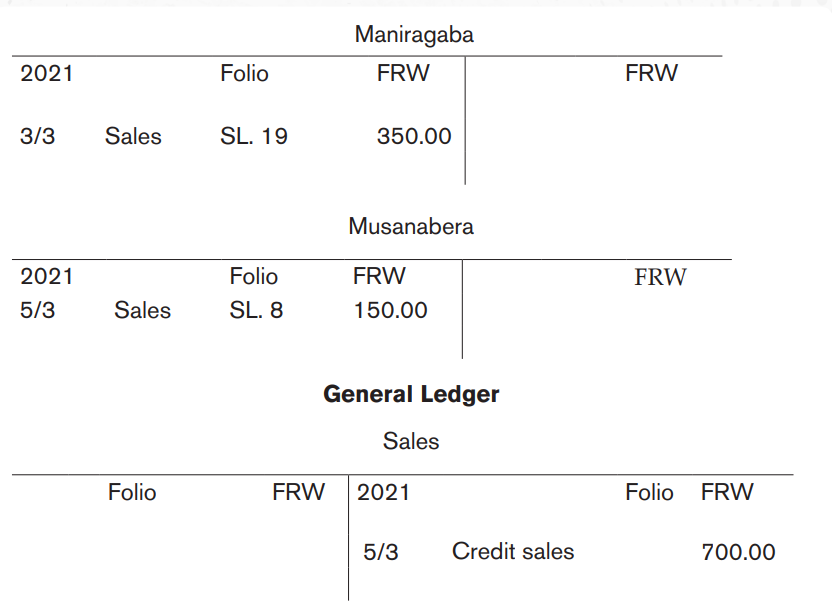

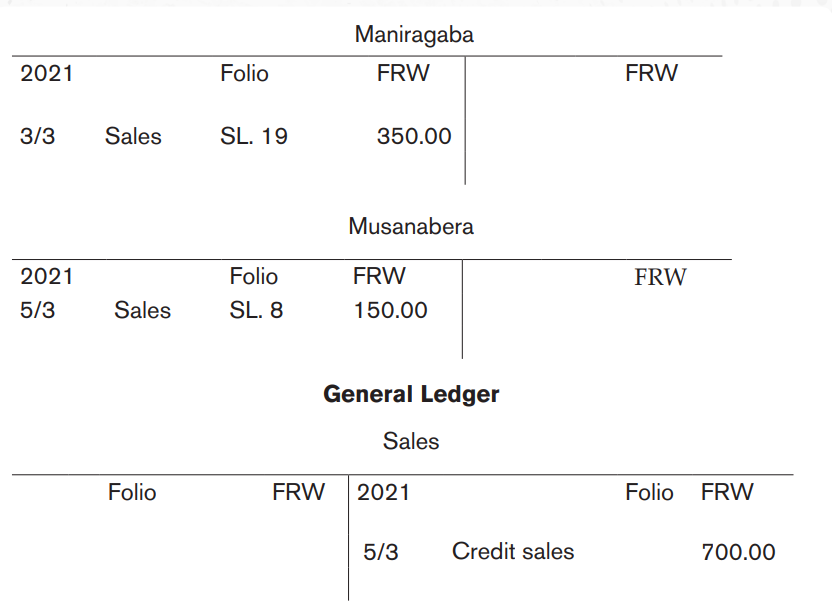

1. The credit sales are now posted, one by one, to the debit side of each

customer’s account in the sales ledger.

2. At the end of each period, the total of the credit sales is posted to thecredit of sales account in the general ledger

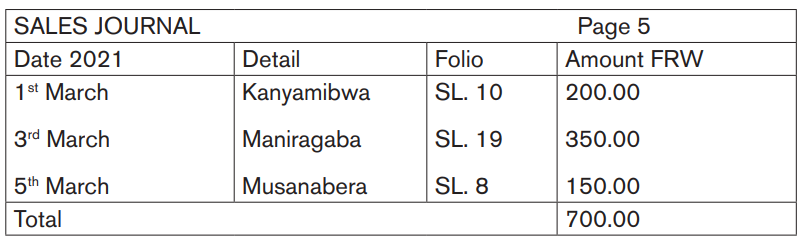

Example 1

The sales journal in 4.3.3 is now shown again. This time, posting is made to the

sales ledger and the general ledger. Notice the completion of the folio columnswith reference to numbers

The individual entries in the sales journal are posted to the debit side of the

debtor’s accounts in the sales ledger and the total is posted on the credit sideof the sales account in the general ledger

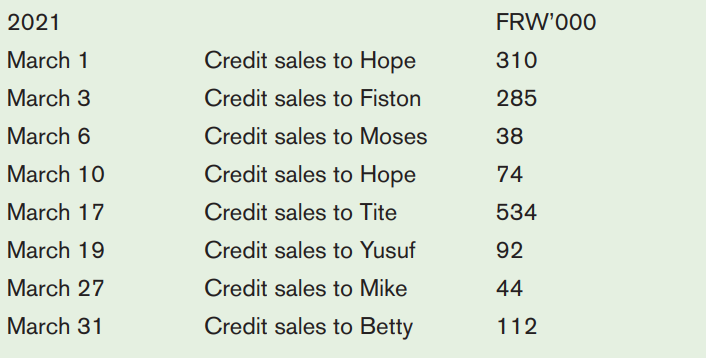

Application activity 4.3

You are to enter the sales journal from the following details. Post the items

to the relevant accounts in the sales ledger and then show the transfer tothe sales account in the general ledger.

4.4 The purchases journal and purchases ledger

Activity 4.3

Think back to what you learnt about the list of items contained in the sales

journal (sales day book). What do you think is the list of items recorded

in the purchases journal (purchases day book)?

In this section, you will continue your look at the journals and ledgers by looking in

more detail at the purchases journal (or purchases day book) and the purchases

ledger. Having already looked at the sales side of transactions in section 4.3,

you are now going to look at them from the side of purchases. Much of what

you will learn in this section is almost identical to what you lean in section 4.3.

This should not come as a surprise. After all, you are looking once more at how

transactions are processed in journals and ledgers and the process ought to

be similar as you move from the sales side to the purchases side of similar

transactions. If it weren’t, accounting would be a far more complex subject thanit is.

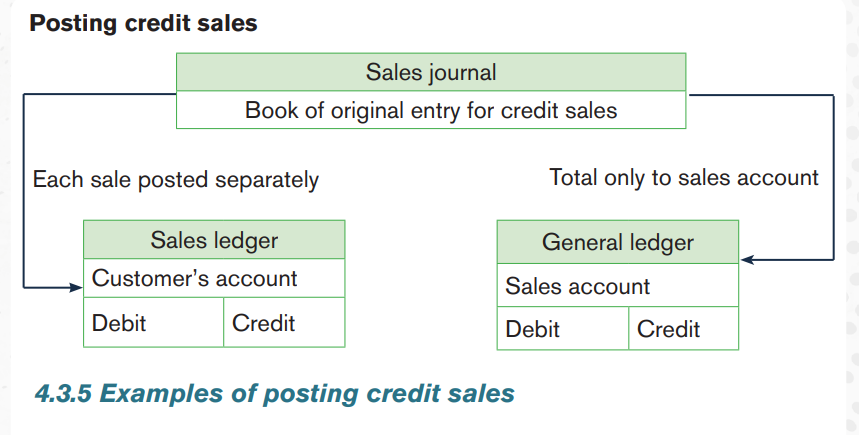

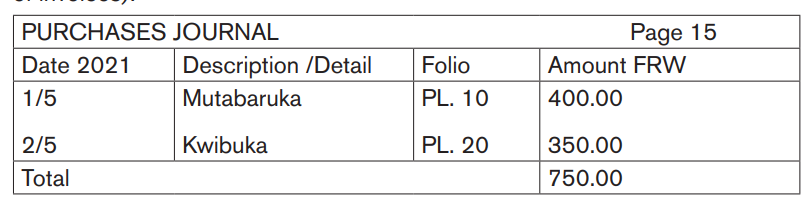

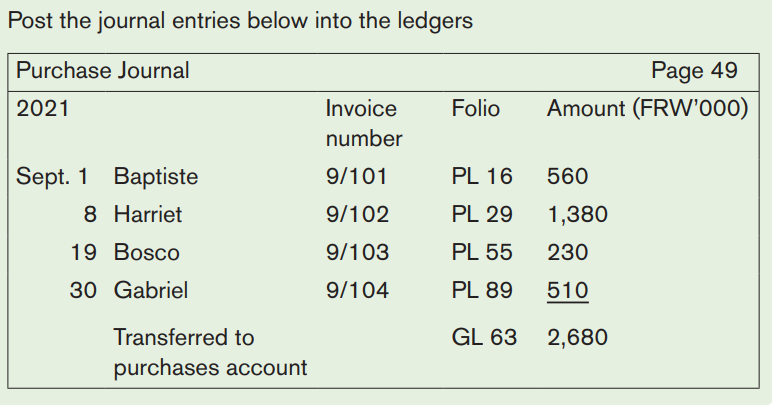

4.4.1 Making entries in the purchases journal

From the purchases invoices of goods bought on credit, the purchaser enters

the details in the purchase journal (purchases day book). There is no need

to show details of goods bought in purchases journal. This can be found by

looking at the invoices themselves. It has the following format (including recordsof invoices).

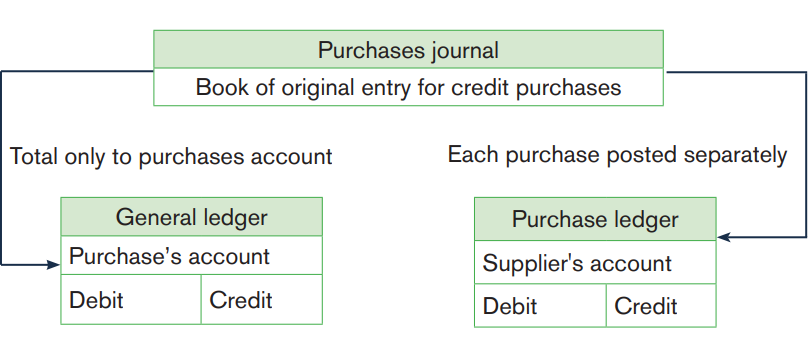

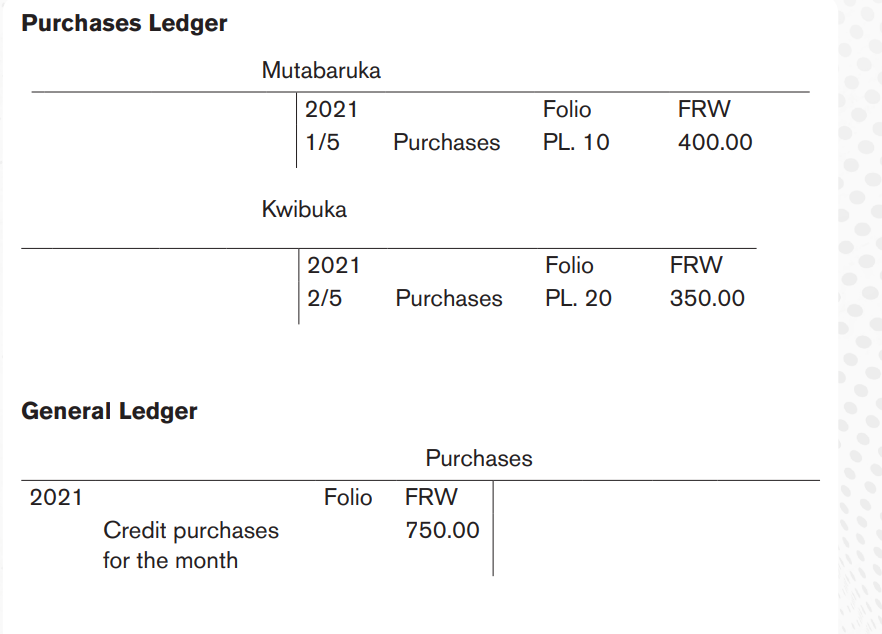

4.4.2 Posting credit purchases to the purchase ledger

We now have a separate purchases ledger. The double entry is as follows:

a) The credit purchases are posted one by one, to the credit of each

supplier’s account in the purchases ledger.

b) At the end of each period the total of the credit purchases is posted to

the debit of purchases account in the general ledger.Posting credit purchases

4.4.3 Examples of posting credit purchases

Example 1

The purchases journal shown in 4.4.1 is now shown again but, this time, posting

is made to the purchases ledger and general ledger. Note the completion of thefolio columns indicating that the posting had been completed

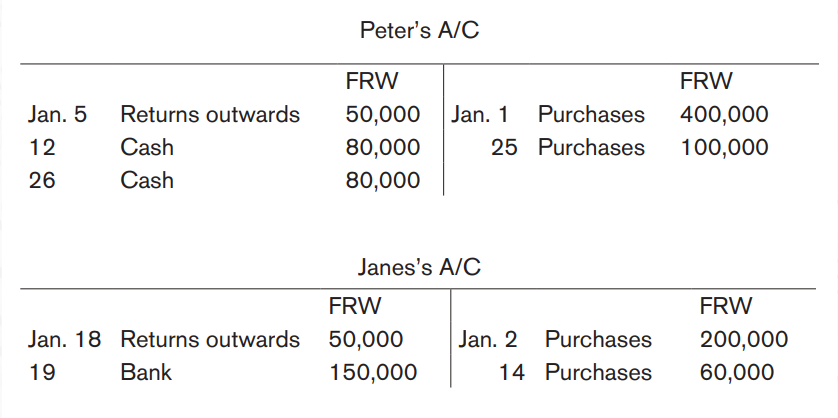

Example 2

Referring to AKANYANA Ltd’s general ledgers accounts in application activity4.2, the following is AKANYANA purchases ledger.

Application activity 4.4

4.5 Balancing off (closing) Accounts

Activity 4.5

1. What is the purpose of balancing off accounts?

2. Explain the process of balancing off accounts.

At the end of specific period most often a month, all ledger accounts are closed

or balanced off. The purpose of doing this is to obtain the net balances on each

account at the end of the month. After the accounts have been closed, a trial

balance can be extracted.

Procedure for balancing off accounts

1. Draw two lines below each side of an account. The upper line should be

single and the bottom lines should be double. Remember to leave one

blank line between the last figure and the first line closing the account.

This blank line is where the balance carried forward (c/f) or carried down

(c/d) will be put.

2. Add up all the figures on both the debit and credit sides without inserting

the totals. Having ascertained the side with the greater total, that total is

put on both sides of the account.

3. Determine the difference by which the two sides were not previously

agreeing and insert it on the deficient side and call that difference the

balance carried down or carried forward. You should remember that the

difference you obtain i.e. the balance carried down is put on the blank

line which you had reserved.

4. In order to complete the double entry recording of the balances, the

balance brought down or brought forward is put on the opposite side

of the account below the totals. The date to be indicated is the opening

date of the following month.

Note: Bal. c/f and bal. c/d mean the same thing and are used interchangeably.

They mean balanced at the end of the period. Likewise, bal. b/f and bal. b/d

are used interchangeably and mean the opening balances. With the above

knowledge, we are now ready to close or balance off the ledger accounts forAKEZA Ltd as presented in section 4.2.

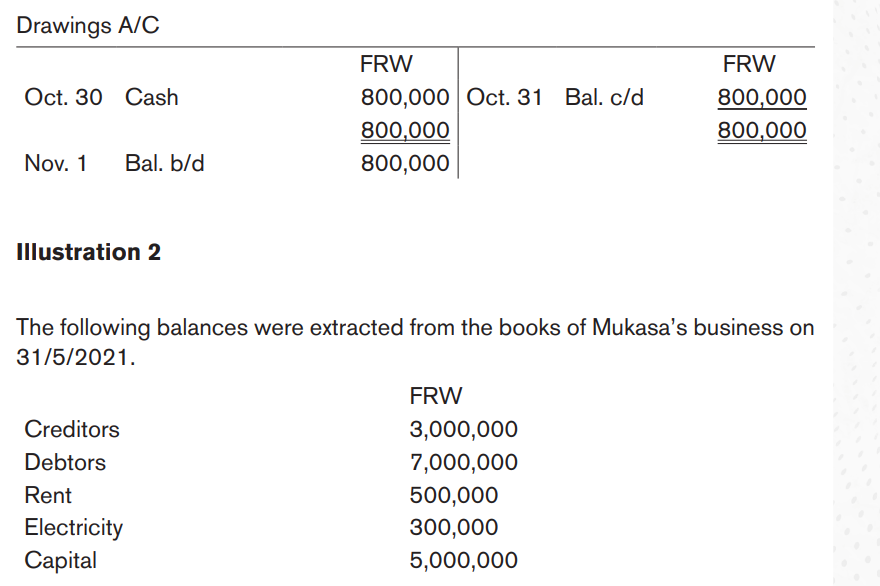

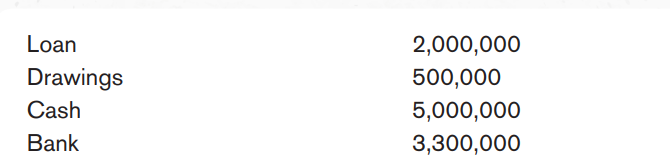

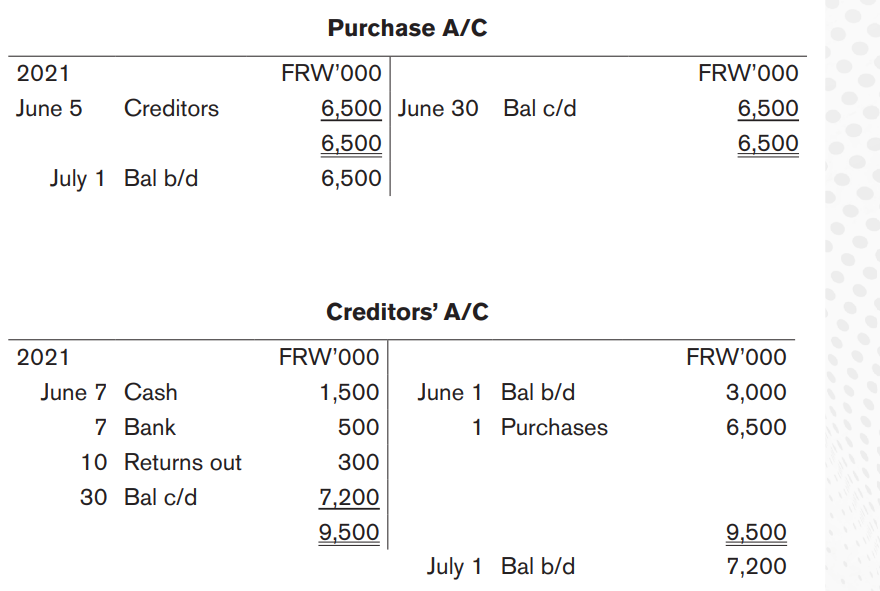

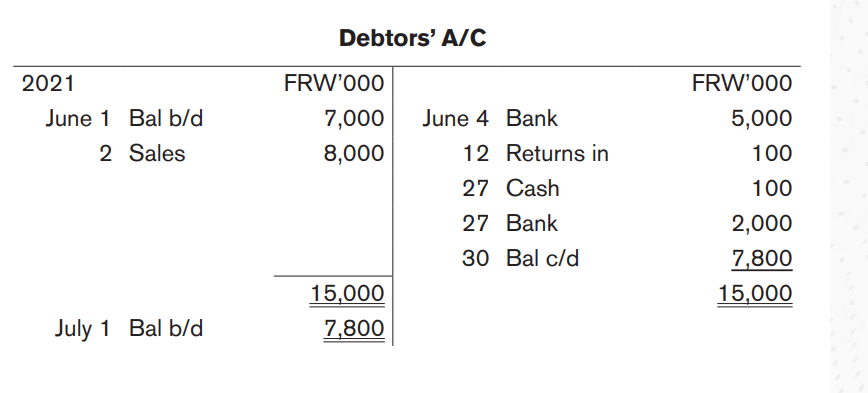

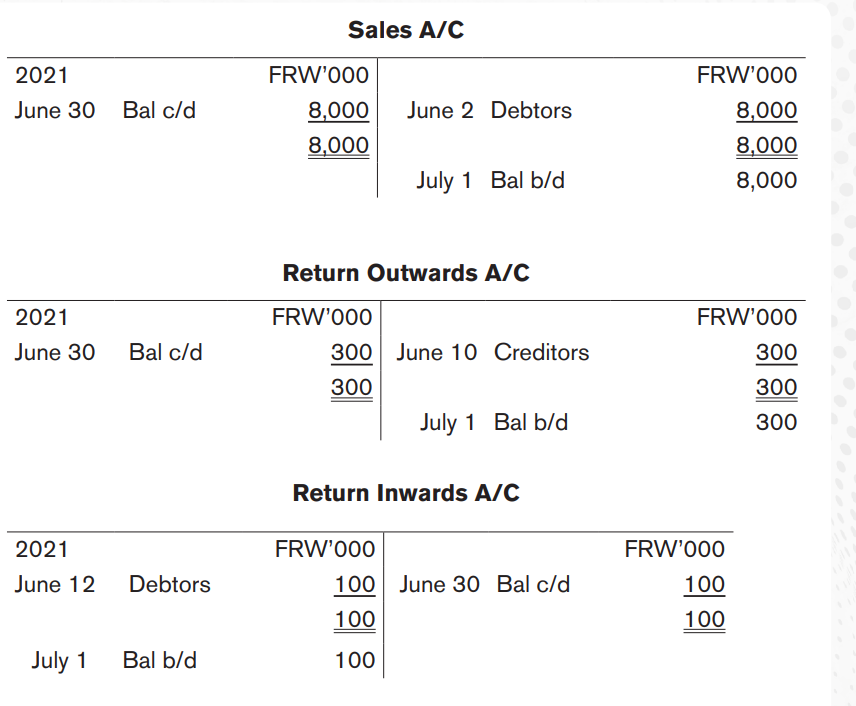

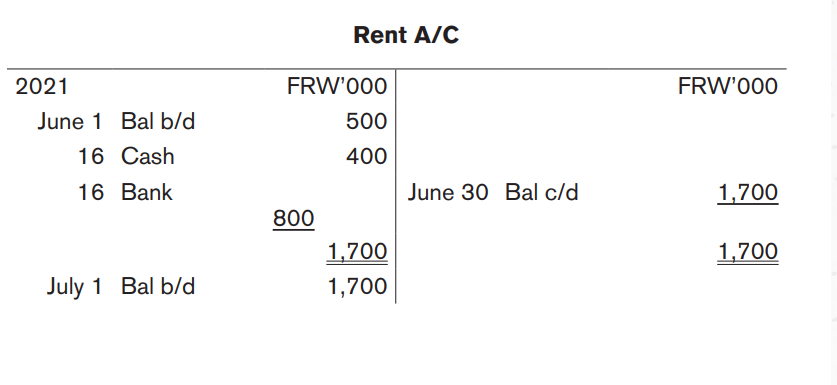

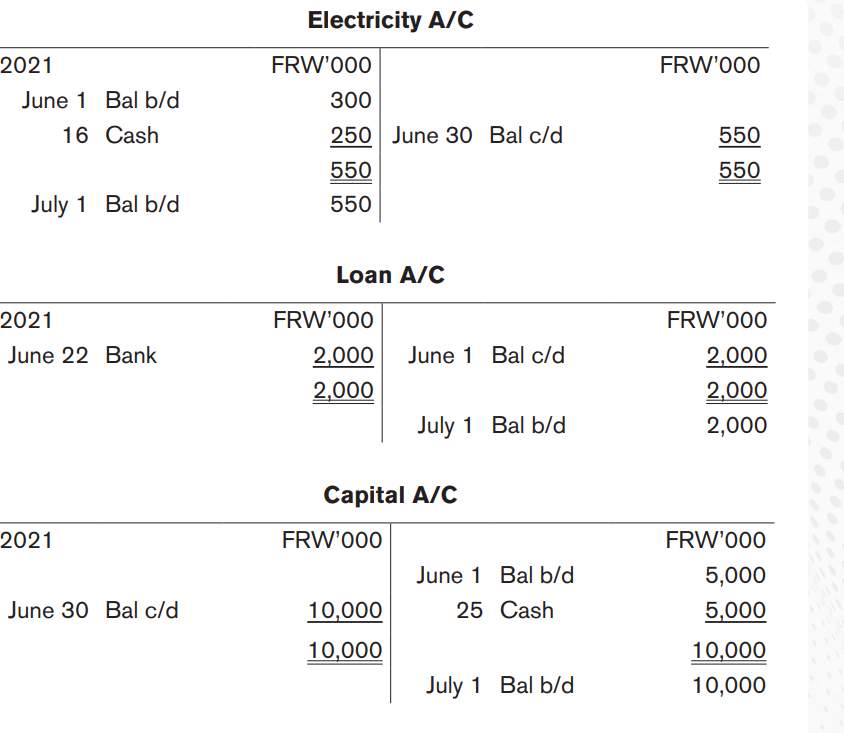

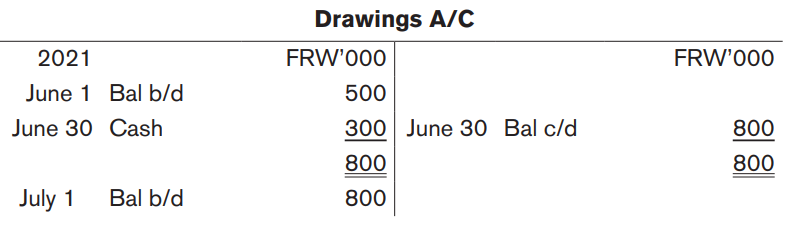

Loan A/C

During the month of June 2021, the following transactions occurred.

June

1

Bought goods on credit for FRW 6,500,000

2 Sold goods on credit for FRW 8,000,000

4 Received a cheque of FRW 5,000,000 from a debtor and banked it.

7 Paid creditors FRW 1,500,000 cash and FRW 500,000 by cheque

10 Rejected and returned goods worth FRW 300,000 to a creditor

12 A debtor rejected and returned goods worth FRW 1,00,000

14 Banked FRW 1,500,000 cash

16 Paid rent cash FRW 400,000 and FRW 800,000 by cheques and

electricity FRW 250,000 cash

20 Withdrew FRW 1,000,000 from the bank and put into the cash box for

payment of cash expenses

22 Paid FRW 2,000,000 by cheque in respect of retiring the loan

25 Fearing the consequences of the land bill, he sold the land inherited

form his father for FRW 10,000,000 cash. He used FRW 5,000,000

for his marriage ceremonies and the rest of the money he put into his

business

27 Received cash of FRW 100,000 and a cheque FRW 2,000,000 from

a debtor and banked both cash and cheque

30 Used business cash of FRW 300,000 for a social evening with his

friends at a club.

Required: Prepare Mukasa’s ledger accounts and extract balances on30/6/2021 (Ignore subsidiary ledgers)

Answer

Mukasa’s Ledger

Application activity 4.5

Refer to application activity 4.2, post the entries and balance off AKANYANA

Ltd ledger accounts.

End of unit assessment

You are required to enter the following transactions in the ledgers and

balance off the accounts

2010

Jan. 01 Started business with $ 20 000 capital, which was deposited

in the bank

Jan. 03 Paid rent for premises by cheque $ 1 000

Jan. 04 Bought goods on credit from PPP for $ 580 and KAN for $

2 400

Jan. 04 Purchased motor van for $ 5 000 paying by cheque

Jan. 05 Cash sales of $ 1 000

Jan. 10 Paid motor expenses in bank $ 75

Jan. 12 Paid wages in cash at bank $ 120

Jan. 17 Bought goods on credit from PPP $ 670

Jan. 18 Returned goods to PPP $ 70

Jan. 20 Sold goods for $ 800, payment being received as a cheque,

which was banked immediately

Jan. 24 Paid insurance by cheque $ 220Jan. 31 Paid wages in cash $ 135 and electricity by cheque $ 78