UNIT 3:JOUNALIZING FINANCIAL TRANSACTION

Key unit competence: To be able to journalize financial transactions

Introductory activity

Peter MUGABONAKE is a sole trader in Muhanga, selling construction

materials. During the year 2021, he had made a number of transactions

and thought he had earned a good profit but did not know how much.

This is because he was not aware of sales realized during the period and

purchases made. He also had neither idea on other income nor expenditure

for the same period. Besides, it was very hard for him to know what to

plan for the forthcoming year. He advised himself to go for deep checking

on invoices for the period, but failed because some disappeared! Due to

that critical situation, he was late to declare and pay tax and consequently

charged and paid penalties. What was a mistake Peter MUGABONAKE

did? What is your advice to him? What do you think as a sustainable

answer to avoid that mistake from happening again?

In principle, transactions must be recorded daily into the books or the accounting

system. For each transaction, there must be a document that describes the

business transaction. This unit describes first the double entry bookkeeping

system and later the books of original entry used before posting transactionsinto ledgers which will be covered under unit 4.

3.1. Double-Entry Bookkeeping System

Activity 3.1

Suppose that you are hired as a book keeper of a given shop in your locality.

You are required to identify a suitable bookkeeping system that will help to

produce good financial reports and explain your choice.

3.1.1 Meaning of Double Entry Bookkeeping System

It is a recording system in which there is dual recording of transactions. Under

a double entry bookkeeping system, a transaction must be recorded twice ie. in

two accounts or books. The principle or the rule of the double entry states that

for every debit entry there must be a corresponding credit entry and for every

credit entry there must be a corresponding debit entry. For each transaction total

debits must equal total credits. Double entry is very important in accounting.

Failure to conform to the rule of double entry will mean that accounts including

the balance sheet will not balance.

Debit and credit

Under double entry system accounts are debited and credited. It is important at

this time to understand what these words mean. Debit and credit are means of

either increasing or decreasing an account. They replace plus or minus used in

arithmetic. Depending on the nature or type of an account, debiting or crediting

could mean either increasing or decreasing it.

An Account

An account is a record in a summarized form and in chronological order of

transactions that took place in an organization. It is a heading under which

related transaction are brought together i.e. different transactions are classified

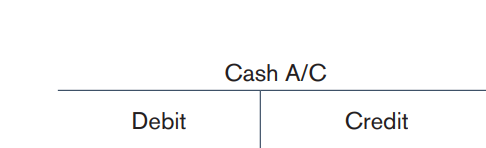

into their respective accounts.In manual accounting systems, accounts are recorded in “T” form.

Eg:

It is conventional that the left hand side of an account is the debit side while the

right hand side is the credit side. The words debit and credit may not have to

be reflected in the account because it is common knowledge that the left hand

side is debit and the right hand side is credit.

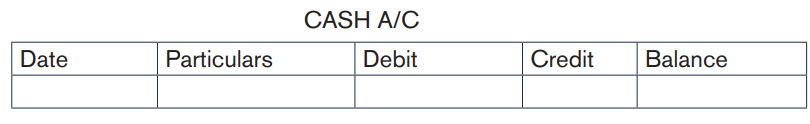

In the computerized accounting system, an account is written with a runningbalance as shown below:

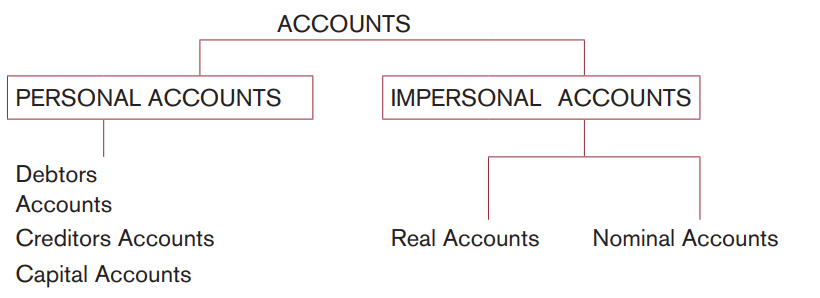

Classification of Accounts

Accounts in the ledger are mainly classified into two categories namely:

a) Personal accounts

b) Impersonal accounts

These accounts will be opened according to the requirements of the business.Below is an illustration to show the classification of accounts

They are explained as below:

Personal Accounts

These are accounts, which have names of business, persons or firms. They

mainly fall under debtors’ accounts, creditors’ accounts, drawings and capital

accounts.

a) Debtors’ accounts: These records the accounts of person or organization

to whom the business has sold goods on credit or to who the business

has extended another credit.

b) Creditors’ accounts: These record the accounts of persons or

organizations from whom the business has bought goods on credit or

from whom a business has taken another credit.

c) Drawings account: Drawings is a term used whenever the business

owner reduces: the business resources for his personal/ private use.

Drawings reduce business funds and therefore the drawings account is

treated as a reduction in capital. It is debited whenever a drawing is made.

At the end of financial period all entries of drawings are added up and the

total debited on the capital account. This implies that the capital account

(owner’s resources in the business) is reduced to the extent of drawings.

In addition, when the owner takes out some of the goods for his own use;this debits drawings account and credits purchases account.

d) Capital Account: This account will record the transactions of the

business and the proprietor/ owner. Thus any amount invested by the

proprietor is recorded in this account.

Impersonal Accounts

a) Real Accounts: These are accounts which record tangible items i.e.

physical items or things which we can see, touch or feel. They are

mainly assets accounts like Land, machinery, motor vehicles, cash,

stock, etc.

b) Nominal Accounts: These are accounts which record intangible

items i.e. they record things which we cannot see physically, touch or

feel. They are either expenses or incomes accounts. Eg. Rent, Salaries,

interests received, discount received, sales, purchases, etc

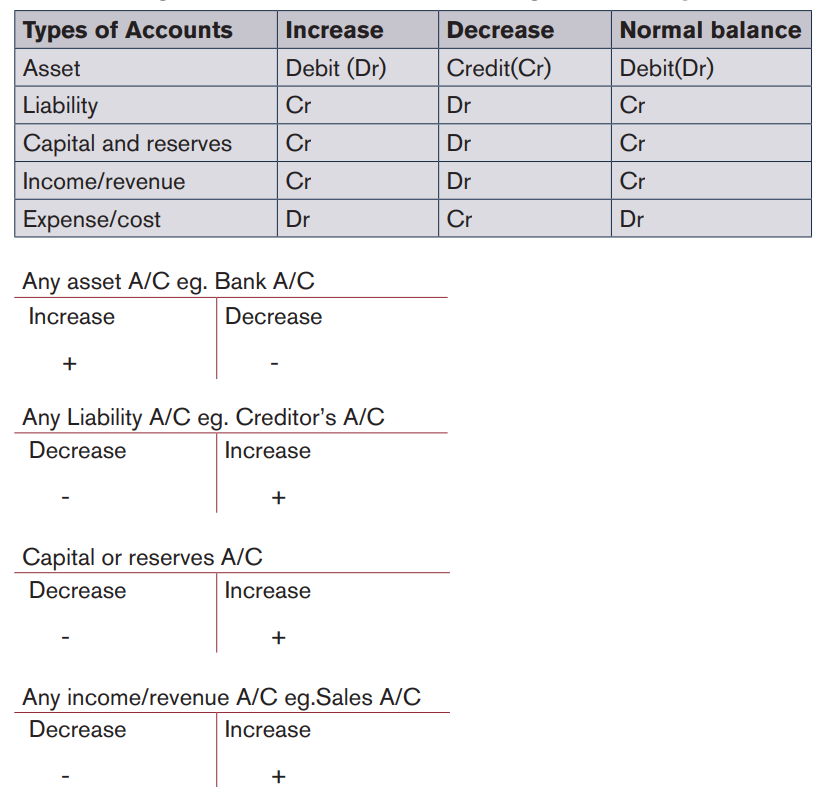

The following table is useful in understanding double entry

Accounts and Double entry

A classification of accounts enables us to establish rules for making double

entry. When completing double entry three points should be considered:

a) What two accounts are affected?

b) What types of accounts are they?

c) Which account is to be debited and which account is to be credited?

Nature of ledger balances

Debit balances: These may be classified as assets, expenses or losses

Credit balances: These are classified as liabilities, incomes and gains.

Determination of the accounts affected and Description of the impact

on the accounts (increases or decreases)

Example

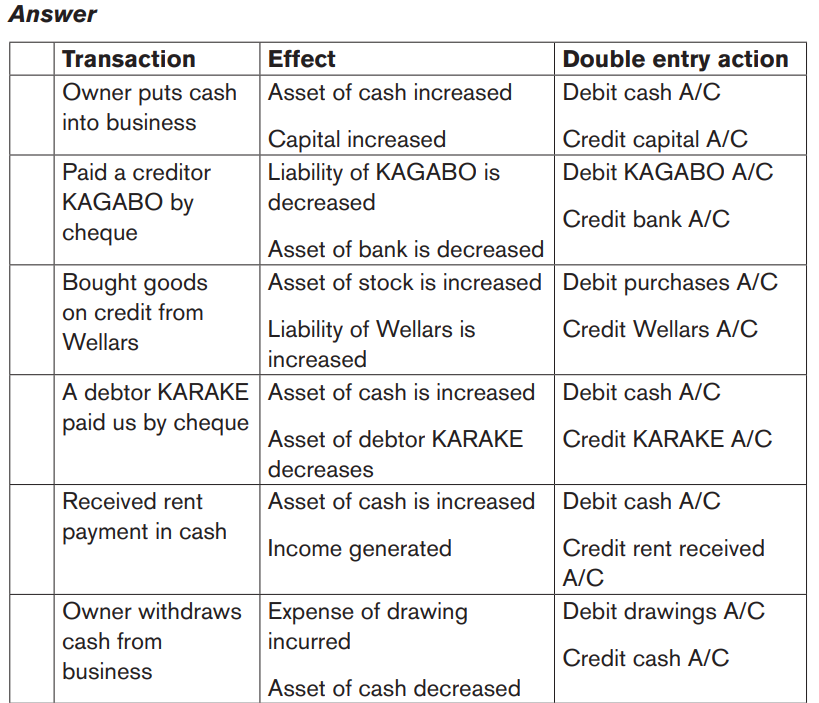

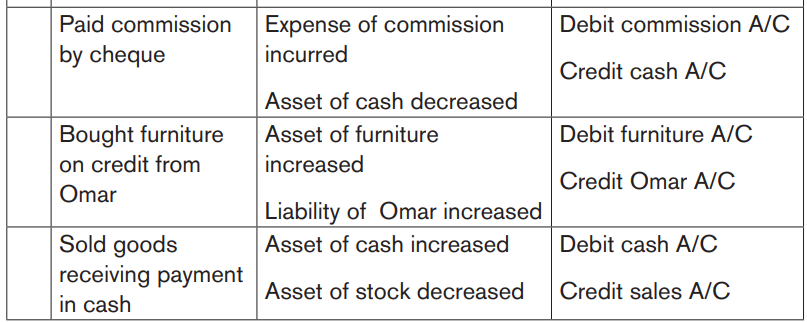

Identify the accounts affected by the following transactions and show action to

take when recording the accounts in the double entry system.

1. Owner puts cash into business

2. Paid creditor KAGABO by cheque

3. Bought goods on credit from Wellars

4. A debtor KARAKE paid us in cash

5. Received rent payment in cash

6. Owner withdraws cash from business for personal use

7. Paid commission by cheque

8. Bought furniture on credit from Omar

9. Sold goods receiving cash payment10. Bought goods paying in cash

11. Sold goods on credit to KARAKE

12. Some of the goods bought from Omar were returned back to him for

default reasons

13. KARAKE returned to us some of the goods bought, as they were inexcess of his order.

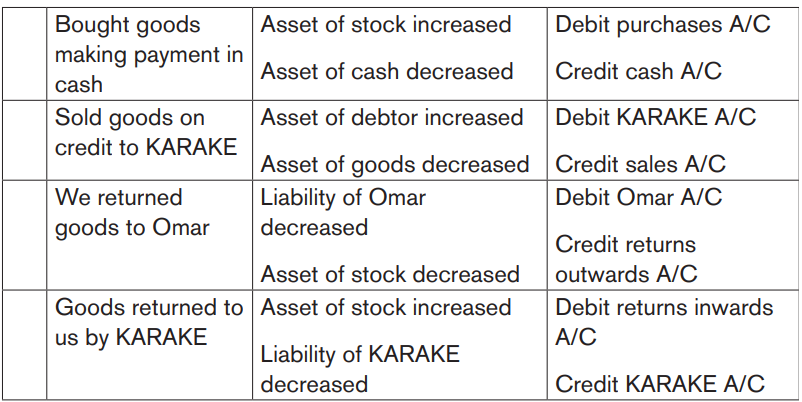

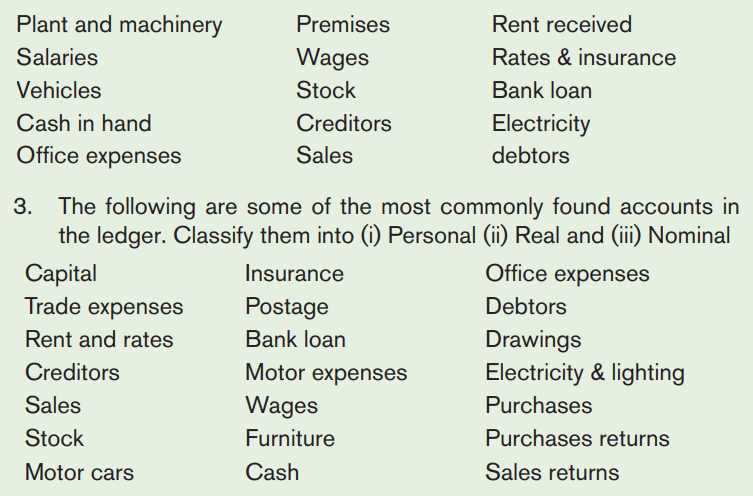

Application activity 5.1

1. Write short notes on the following:

a) Personal account

b) Real account

c) Nominal account.

2. From the following names of ledger accounts in the books of a

trader, rule columns headed assets, liabilities, Gains and expensesin each column place the right items.

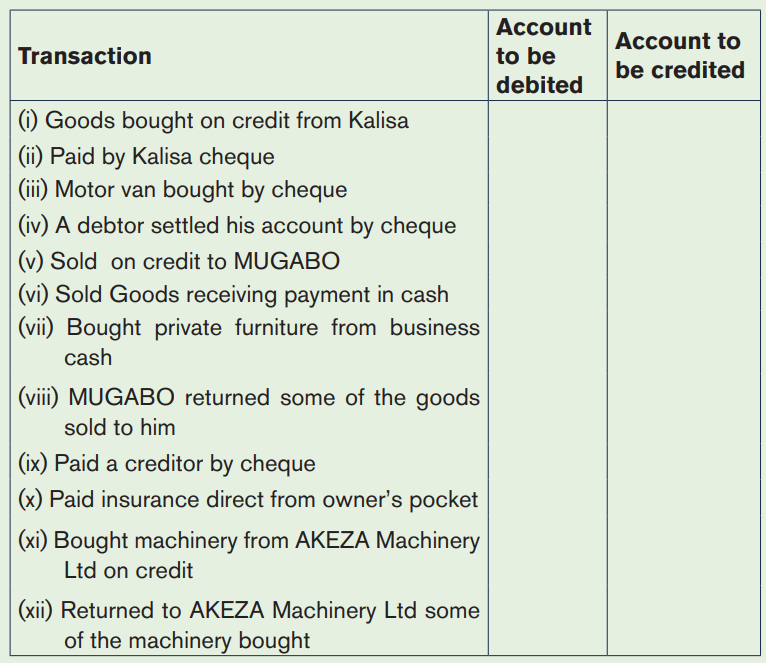

4. Complete the following table, identify the accounts affected by

each transaction, and state whether the account is to be debited orcredited.

3.2 General Journal

Activity 3.2

Referring to the knowledge gained from entrepreneurship O Level describe

the general journal and give its format.

Activity 3.2

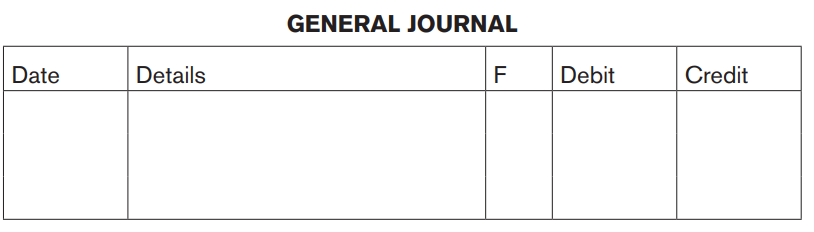

This is the book of original entry also known as journal proper or principal

journal, which is used to record items of a non-routine nature which cannot be

recorded in other book of prime entry. Unlike the subsidiary books, transactions

in the general journal are entered on a double entry basis and in order of theiroccurrence. It is ruled with columns for date, details, folio and debit and credit

amount columns and each transaction recorded therein is a true reflection of

how such a transaction will appear in the ledger. A debit entry in the journal is

still a debit entry in the ledger and likewise, a credit entry in the journal will be

a credit entry in the ledger for accounts concerned. Even though the journal

is operated on double entry lines like the ledger, it means subsidiary to the

ledger. Whatever is entered in the journal has to be transferred to the ledger for

permanent record.An illustration of a general journal format is as shown:

A journal entry must have a narration which is a brief explanation of what has

taken place. The narration gives some reason why one account has to be

debited while the other is credited and also some reference as the origin of the

transaction.

Notes:

Details/Account title: the name of the account involved in the transaction is

entered in this column plus a narration or explanation of the transaction.

Folio: this column shows the reference where the account can be found in the

ledger especially the page number of the account in the ledger. At times instead

of using folio, LP standing ledger page is used. In real World, this column is

largely referred to as reference.

Date: Dates at which transactions occurred are entered into this column.

Use of a general journal

The general journal serves many useful purposes such as the recording of:

– Opening balances at the beginning of a financial period

– Purchase or sale on credit of non-trading items like non-current assets.

– Correction of errors made during the recording of transaction, balancing

and closing accounts in the ledger.

– Transfer of amounts from one account to another in the ledger

– Adjustments in accounts in respect of items relating to succeeding and

preceding periods not connected with the present accounting period,

which have not been taken into account.

– Adjustments at the close of the period(e.g depreciation, bad debts,

interest on capital)

– Closing accounts of a business at the end of its financial period.

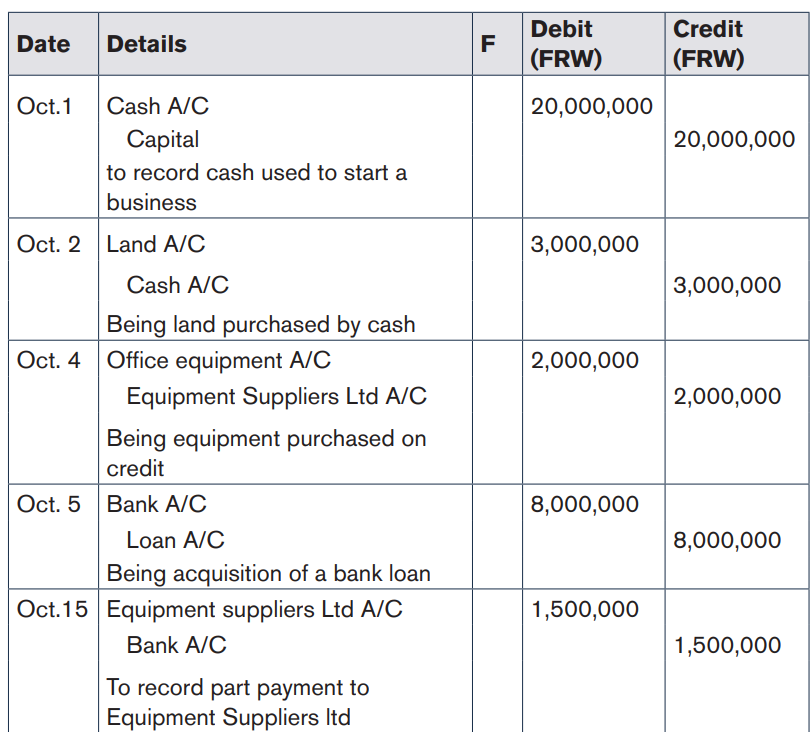

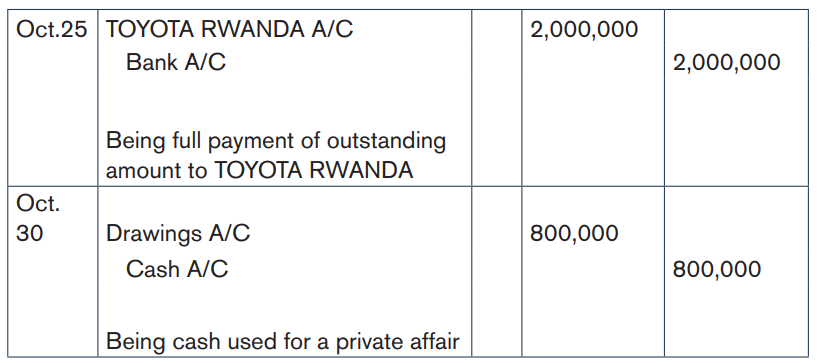

Preparation of the General Journal

Illustration

The following transactions are for AKEZA LTD for the month of October 2021.

Enter them into a general journal.

Oct. 1 Started business with FRW 20,000,000 cash

Oct. 2 Purchase land for the business at FRW 3,000,000 by cash

Oct.4 Purchased office equipment on credit from Equipment Suppliers Ltd at

FRW 2,000,000

Oct. 5 Obtained bank loan of FRW 8,000,000 it was deposited to a bank A/C

Oct.15: Made part payment of FRW 1,500,000 to Equipment Suppliers Ltd by

cheque.

Oct. 17: Bought motor vehicle from TOYOTA RWANDA at a cost of FRW

15,000,000

Made cash payment of FRW 10,000,000, paid FRW 3,000,000 by cheque and

promised to pay balance later

Oct. 20: Sold a portion of land that was fully un-utilized for cash FRW 500,000

Oct. 25: Fully settled the balance of FRW 2,000,000 by cheque due to TOYOTA

RWANDA for the motor vehicle

Oct. 30: FRW 800,000 business cash was used to entertain relatives fromupcountry

Record of opening balances

The journal proper is used to record the opening balances of assets, liabilities

and capital before they are posted to the respective ledger accounts. Where

capital is not known at the start of the period and where assets and liabilities

are given the opening journal helps to ascertain that capital. The double entry

system establishes a balancing concept in accounting (i.e. total debits should

always equal to total credits). Therefore, Assets= Liabilities + Capital as assets

are debits whereas liabilities and capital are credits. The journal is thus debited

with assets items and credited with liabilities items. The amount needed to strike

the balance on the credit side is capital

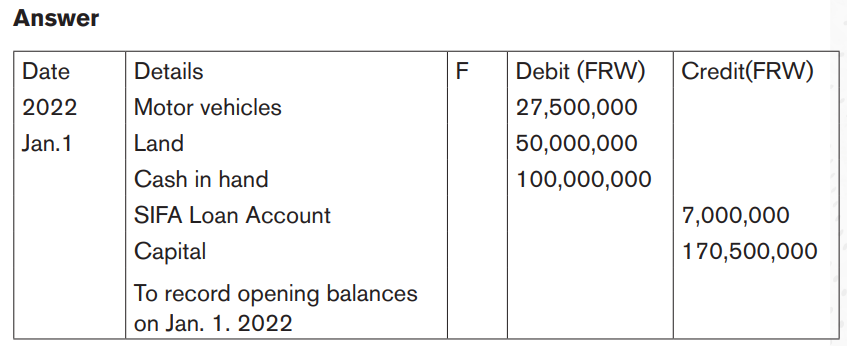

Example 1

Miss KEZA, commenced business on January 2022 with a Toyota pick-up van

valued at FRW 27,500,000; land at FRW 50,000,000 and cash in hand FRW

100,000,000. She also owed FRW 7,000,000 to her sister SIFA for money lent.You are required to record an opening entry for Miss KEZA

Assets= Liabilities + Capital

Assets: 27,500,000 + 50,000,000 + 100,000,000 = 177,500,000

Liability = 7,000,000

Capital = Asset - liability

Capital = 175,000,000 - 7,000,000 = FRW 170,500,000

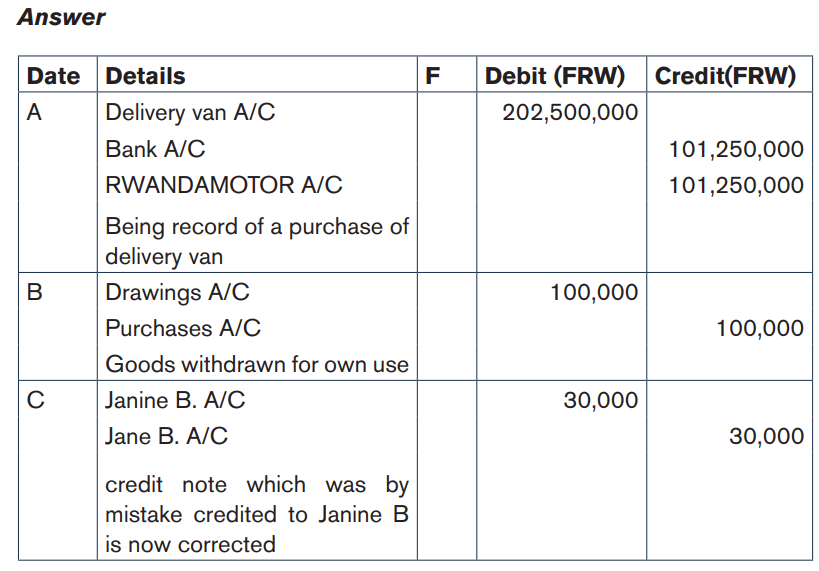

Example 2

Pass entries in the general journal to record the following transactions:

a) Purchase a delivery van worth FRW 202,500,000 from

RWANDAMOTOR paying half amount by cheque

b) Took out of stock of goods valued at FRW 100,000 for own use.

c) A credit note issued to Jane B. for FRW 30,000 was posted to the

credit of Janine B.

d) The bank statement indicated bank charges of FRW 15,000 which I

had not yet recorded in the books.

e) An invoice received for a credit purchase of furniture for FRW 800,000debited to purchases account

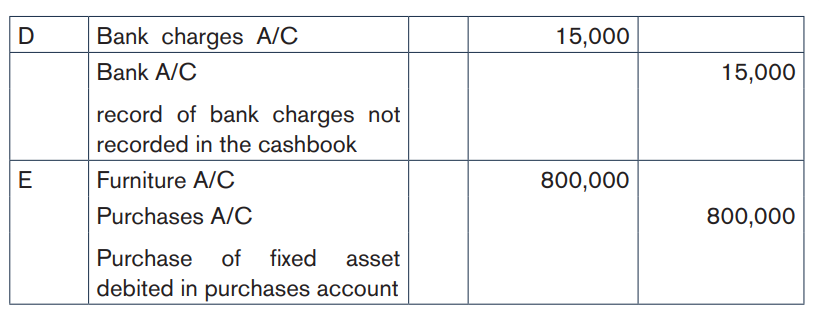

3.2.1 Journal entries for VAT

What is VAT?

Value Added Tax (VAT) is a tax charged on the supply of goods and services in

Rwanda. The concept underlying VAT is that the tax is paid by ultimate consumer

of the goods or services but that everyone in the supply of chain must account

for and settle up the net amount of VAT they have received in the VAT tax period

usually one month. If they have received more in VAT than they have paid out in

VAT, they must send the difference to Rwanda Revenue Authority. If they have

paid out more than they have received, they will be reimbursed the difference

(known as VAT refund). The rate of VAT in Rwanda is 18%. The following exhibitshows, through an example, how the system works

In the above example,

1. A manufacturer sells a table to a retailer for FRW 100 plus VAT of FRW

18

2. The retailer pays the manufacturer FRW 118 for the table

3. The VAT on that sale (FRW 18) is sent by the manufacturer to Rwanda

revenue Authority (RRA)

4. The retailer sells the goods to customer (i.e. the consumer) for FRW 120

plus VAT of FRW 22.

5. The customer pays FRW 142 to the retailer for table.

6. The amount of VAT paid for the goods by retailer to the manufacturer

(FRW 18)is deducted from the VAT received by the retailer from the

customer (FRW 22) and the difference of FRW 4 is then sent to RRA.

Only the ultimate consumer has actually paid VAT. Unfortunately, everyone in

the chain has to send the VAT charged at the step when they were in the role

of seller. In theory, the amount received in stages by Rwanda Revenue Authority

will equal the amount of VAT paid by the ultimate consumer in the final stage of

supply chain.

VAT paid on inputs (purchases) is called input VAT or VAT deductible while

VAT received from sales is known as output VAT or VAT collectible

The VAT Account

All registered business must account for VAT on all the taxable supplies they

make and all the taxable goods and services they receive. They must also keep

a summary (called a VAT Account) on the totals of input tax for each VAT tax

period. All these records must be kept up to date.

Journal entries for VAT

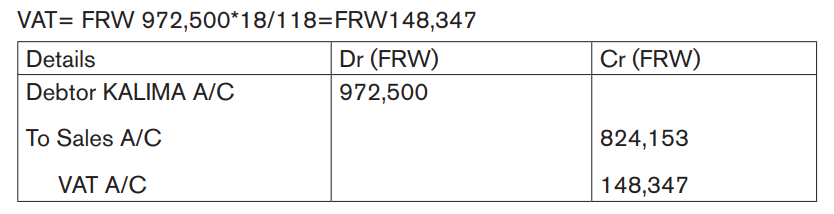

Example 1

A construction materials Shop (NYACOM) situated in Nyarugenge District

sold materials of construction to Mr KALIMA of MUHANGA District valued at

FRW 972,500 VAT included according to the information on the invoice No

075/C.M/2021 sent by NYACOM to Mr KALIMA.

Required: Calculate the VAT charged and record the transaction in generaljournal of NYACOM.

Answer:

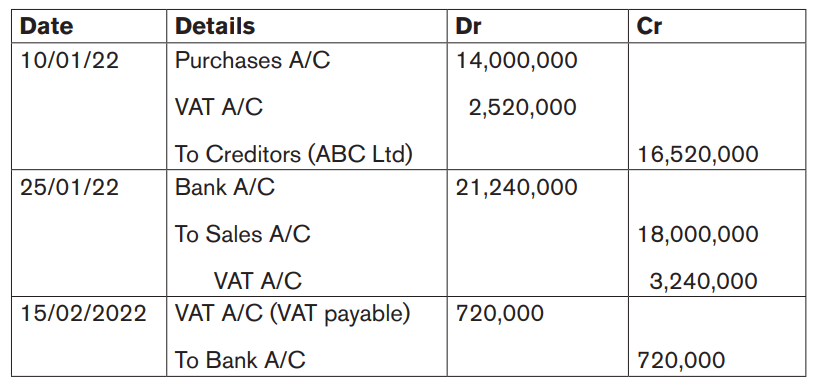

Example 2

The following transactions have been made by MGK Ltd. You are required to

journalize them.

a) 10/1/2022 Bought goods for FRW 16,520,000 inclusive of VAT on

credit to ABC Ltd.

b) 25/1/2022 Sold all the goods bought on 10/1 for FRW 18,000,000

before tax by cheque.

c) 15/2/2022 Declared and paid the VAT to Rwanda Revenue Authority

(RRA) by cheque.

Note: the VAT rate being 18%.

Answer:

a) VAT= 16,520,000x18/118= 2,520,000

Net amount from VAT= 16,520,000- 2,520,000 = 14,000,000

b) Net amount = 18,000,000

Add: VAT 18%= 3,240,000

Amount with VAT 21,240,000

c) VAT payable = VAT collectible- VAT deductable= 3,240,000 - 2,520,000 = 720,000

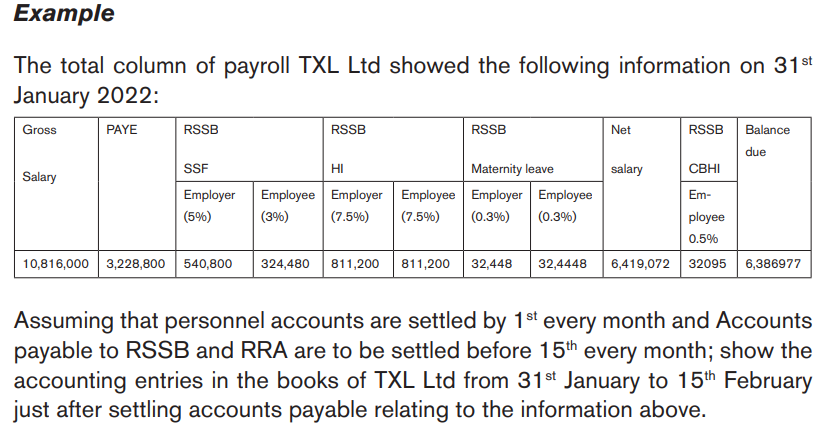

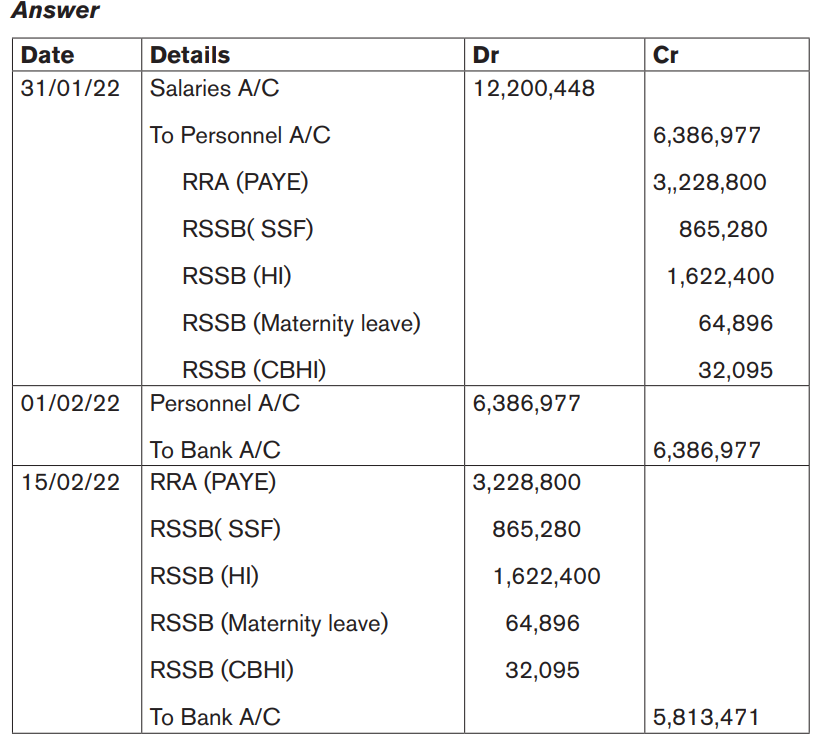

3.2.2 Journal entries for payroll information

Salaries and wages usually form a substantial part of a business's expenditure,

especially in service organisations. However, salaries and wages expenditure

does not arise in the same way as other cash and credit purchases.

The entries in the accounting system that are made in respect of salaries and

wages are known as payroll transactions.

To understand payroll transactions, you need to have a basic understanding

of the main statutory and voluntary transactions which are processed through

payroll.

Gross pay:

Gross pay is the total amount that the employer owes the employee before any

deductions have been made.

Statutory deductions:

Income tax and employees' social security contributions are known

as statutory deductions from gross pay, because the law (statute) requires

employers to make these deductions from individuals' salaries.

Employees pay their income tax under the income tax system. This means that

each time an employee is paid by their employer, the income tax for that period

(eg monthly) is deducted from their wages by the employer. At regular intervals

the employer then pays the income tax over to the tax collecting authority on the

employees' behalf.

Employees must also pay employees' social security contributions to the tax

authorities. Social security contributions are just another form of tax, calculated

differently from income tax. An individual employee's social security contributions

are deducted from the employee's wages and paid over to the tax authorities,

together with the employee's income tax.

Voluntary deductions

An employee may choose to have other (voluntary) deductions made from gross

pay. These items can only be deducted from an employee's gross salary if the

employer has the employee's written permission to do so.

For example, if an employee chooses to make pension contributions, this money

is deducted from gross pay and transferred to a pension administrator to provide

a pension for the employee on retirement.

Other voluntary deductions include the repayment of a loan from the business

(for example, to repay a season ticket loan for travel to work).

Net pay

Once all deductions have been made, the amount paid to the employee is called

net pay. It is sometimes referred to as 'take home pay'.

Employer's social security contribution (statutory)

The employer is also required to pay an additional amount of social security

contributions for each employee, known as the employer's social security

contributions. This is yet another form of tax, but the difference is that it is only

suffered by the employer. There is no deduction from the employee's gross

pay for the employer's social security contributions. Employer's social security

contributions are paid by the employer to the tax authorities.

Employer's pension contribution (voluntary)

The employer may make a voluntary contribution to the employee's pension.

Again, this is in addition to the gross pay. Therefore, it increases the 'total cost'

of employing individuals. However, it is not deducted from the gross pay.

Accounting for Payroll transactions

Payroll is accounted for using the double entry bookkeeping rules that we are

familiar with. The following example is a simple illustration of recording payroll

transaction in the context of Rwanda. Note that the example includes RSSB

maternity leave contribution which was not talked about in the above deductions,however it is a common statutory deduction in Rwanda.

3.2.3 Types of discounts

Discounts can be defined as follows:

A trade discount is a reduction in the listed price of goods, given by a

wholesaler or a manufacturer to a retailer. It is often given in return for bulk

purchase orders.

A cash(settlement) discount is a reduction in amount payable in return for

payment in cash, or within an agreed period.

Examples are given below

i) Trade discount

It is discount that you receive from the seller at the time of buying goods

(may be because of buying higher quantity or due to your business relations

with the seller etc) and the same is deducted or adjusted in the invoice. The

supplier’s invoice states the actual amount payable, net of trade discount.

E.g: Gross sales: FRW 700,000

Trade discount: 5%

Calculation:

Gross sales 700,000

Trade discount (5%) 35,000

Net sales 665,000

Accounting treatment of trade discounts

Trade discounts are not recorded in the accounting books. The net amount of

invoice will be used in recording the goods purchased or sold.

In the books of supplier:

Dr: Debtor A/C 665,000

Cr: Sales A/C 665,000

In the books of debtor

Dr: Purchases A/C 665,000Cr: Suppliers A/C 665,000

ii) Cash discount

It is a reduction allowed to a customer who pays before the end of credit period.

A credit period is a length of time that a customer is allowed to delay payment.

The customer qualifies for the cash discount only when he pays before the end

the credit period but within agreed period of time.

Note: cash discount is always recorded in the books of accounts.

Cash discount is in two types: Discount allowed and discount received.

Discounts allowed: they occur when the company accepts the payment

from a customer of a lesser amount than the amount due because he paid

promptly. It is treated as an expense because it reduces the amount charged to

the customer.

Dr: Discount allowed A/C

Cr: Debtors A/C

At the end of the accounting period, the balance on the discount allowed

account is transferred to the debit of the profit and loss account as an expense.

Besides when it is received from the supplier, it is called discount received

and it is treated as an income because it reduces the obligation toward the

supplier and it is recorded as under:

Dr: Suppliers A/C

Cr: Discount received A/C

Example 1

Albert has sold goods to William on credit for FRW 5,000,000.it is then agreed

that if William pays within 20 days of his purchase, he can receive 10% as

discount. If William performed payment within 20 days, show the journal entries

for both parties.

Answer:

a) In the books of Albert (seller)

Dr: Cash A/C 4,500,000

Discount allowed 500,000Cr: Debtors (William) A/C 5,000,000

b) In the books of William (buyer)

Dr: Suppliers (Albert) A/C 5,000,000

Cr: Cash A/C 4,500,000

Discount received A/C 500,000

Example 2

On 20th January 2022, Denis purchased from Alfred 1000 units of item at FRW

5300 each. As Denis is a regular customer, Alfred has to offer 2% discount for

bulk purchase and 5% discount for immediate payment.

Determine how much has invoiced to Denis and show the accounting entriesfor both parties.

Answer:

Calculations: Total sales: 1000x5300 = 5,300,000

Less trade discount (2%) 106,000

5,194,000

Less cash discount (5%) 259,700

Net cash paid by Denis 4,934,300

Journal entries

a) In the books of Alfred ( the seller)

Dr: Cash A/C 4,934,300

Discount allowed A/C 259700

Cr: Sales A/C 5,194,000

b) In the books of Denis ( Customer)

Dr: Purchases A/C 5,194,000

Cr: Cash A/C 4,934,300Discount received A/C 259700

Application activity 3.2

Enter the following transaction into the general journal properly showing

the double entry. The transactions are for AKANYANA Ltd for the month of

January 2022

Jan.1 Bought goods on credit from Peter for FRW 400,000

2 Bought goods on credit from Jane for FRW 200,000

3 Sold goods to John on credit for FRW 1,000,000

4 Sold goods to Mary on credit for FRW 400,000

5 Returned goods worth FRW 50,000 to peter because they were defective

10 Received part payment of FRW 800,000 cash from John for goods

taken on credit

12 Made part payment to Peter FRW 80,000 cash

14 Purchased goods for FRW 60,000 on credit from Jane

15 Mary rejected and returned goods worth FRW 40,000

16 Received a cheque of FRW 150,000 from Mary as part for payment for

goods taken on credit

17 Paid rent cash FRW 100,000

18 Returned goods worth FRW 50,000 to Jane because they were

defective

17 Paid rent cash FRW 100,000

18 Returned goods worth FRW 50,000 to Jane because they were

defective

19 Paid Jane FRW 150,000 by cheque

20 Sold goods to John on credit for FRW 800,000

22 Bought goods for FRW 100,000 paying cash

23 Sold goods cash FRW 500,000

24 Sold goods for FRW 4,000,000 receiving payment by cheque

immediately.

25 Purchased goods for FRW 100,000 from Peter

26 Paid Peter FRW 80,000 cash

27 John rejected and returned goods worth 100,000

28 Received a cheque of FRW 200,000 from John for goods sold to him

on credit

29 Paid for electricity FRW 50,000 by cheque and FRW 100,000 cash

30 Paid rent FRW 60,000 by cheque31 Paid salaries FRW 150,000 cash and FRW 160,000 by cheque

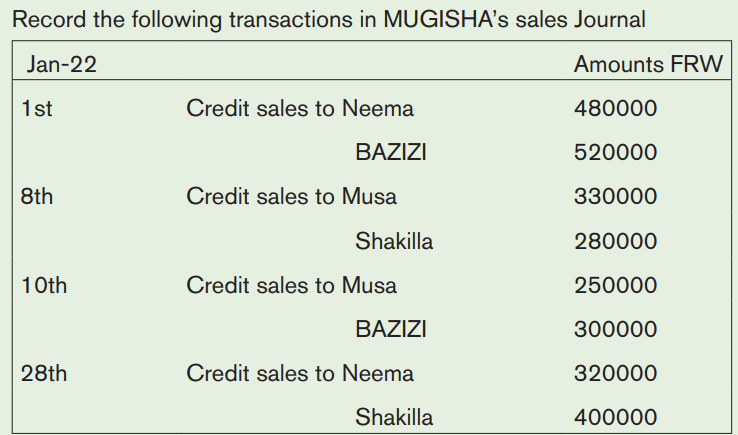

3.3 Sales Journal

Activity 3.3

Describe the books of original entry which records credit sales of goods

Sales day book/Sales Journal

This is the book of original entry in which daily credit sales are recorded from

copies of invoices issued to debtors before posting to the ledger. Each credit

sale is recorded in chronological order in the sales daybook, the personal

account of the customer in the ledger is debited with the amount of sale. At the

end of the week or month or any other posting period, the sales journal is totaled

to ascertain the total credit sales for the period. This total is then credited to the

sales account in the ledger, thus completing the double. If the posting is done

accurately, the sum of individual amounts to the individual customers’ accounts

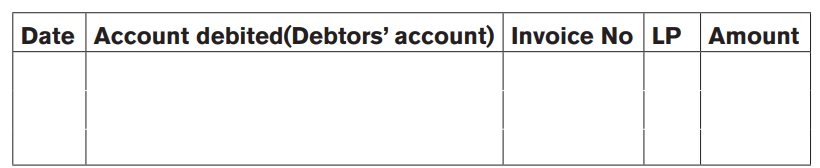

in the ledger should agree with the amount of credit sales.Format of Sales Journal or Sales Daybook

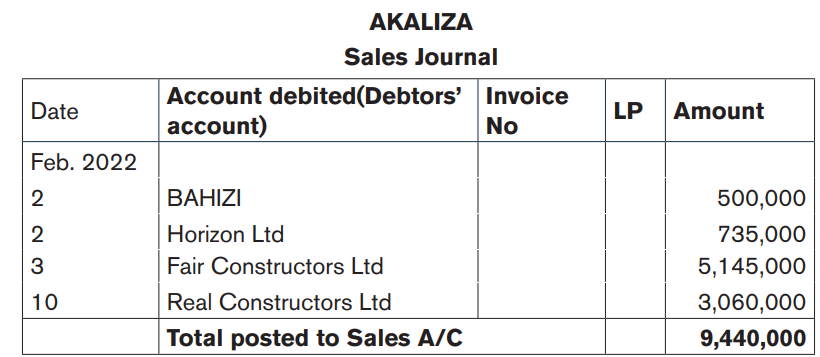

Example 1

The following credit transactions took place in the firm of AKALIZA during the

month of February 2022.

Feb. 2 Sold 50 sacks of Cement at FRW 10,000 each on credit to BAHIZI

Feb. 2 Sold 70 sacks of cement at FRW 10,500 each on credit to Horizon Ltd

Feb 3 Sold 500 sacks of cement at FRW 10,500 each on credit to Fair

Constructors Ltd less a 2% trade discount.

Feb 10 Sold 600 sacks of cement at 10,200 each on credit to Real Constructors

Ltd, receiving half the amount in cash.Answer

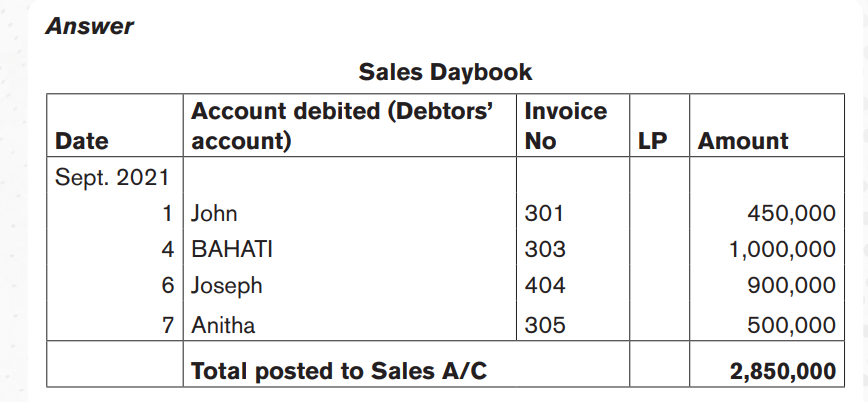

Example 2

A company sold goods to the following people on credit during the month of

September 2021:

Sept. 1 John for FRW 450,000 Invoice No 301

4 BAHATI for FRW 1,000,000 Invoice No 303

6 Joseph for FRW 900,000 Invoice No 4047 Anitha for FRW 500,000 Invoice No305

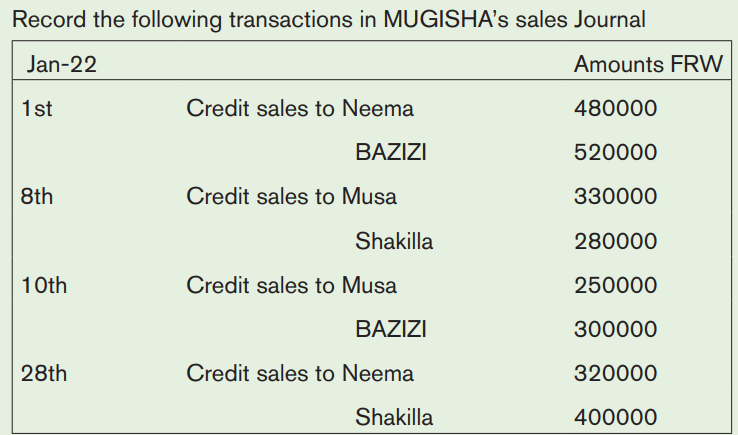

Application activity 3.3

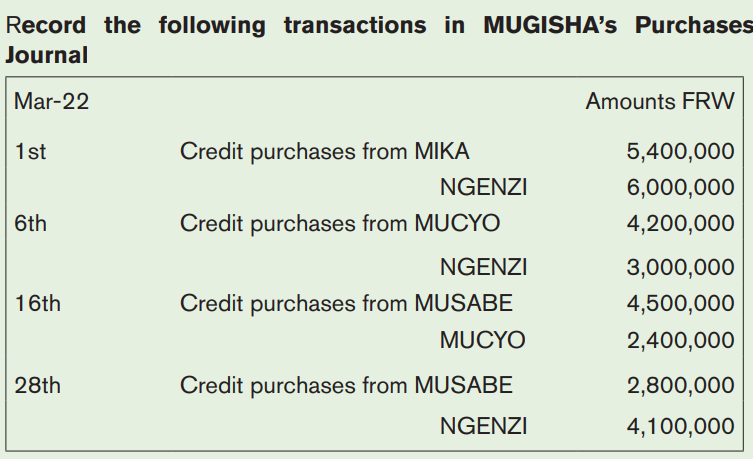

3.4 Purchases day book/ Purchases Journal

Activity 3.4

Referring to the competences acquired from senior two, describe the use

of purchases journal.

This subsidiary book contains day-to-day records, in chronological order, of

information on purchases. As each credit purchase is recorded from the invoice

into the purchases day book, the personal account of the credit supplier in the

ledger is credited. At the end of the month or other posting period, the total in

the purchases day book representing total credit purchases for that period, is

ascertained and posted to the purchases account in the ledger to record the

credit purchases in the ledger and also to complete the double entry. This debit

total extracted from the purchases day book should agree with the sum of the

individual amounts credited to the individual creditors’ accounts in the ledger. In

the details column of the purchases account in the ledger, the word “totals” is

used to indicate that it is a summary total posted and in the folio column, PDB isused to show that the total was extracted from the purchases day book.

Format of Purchases Journal

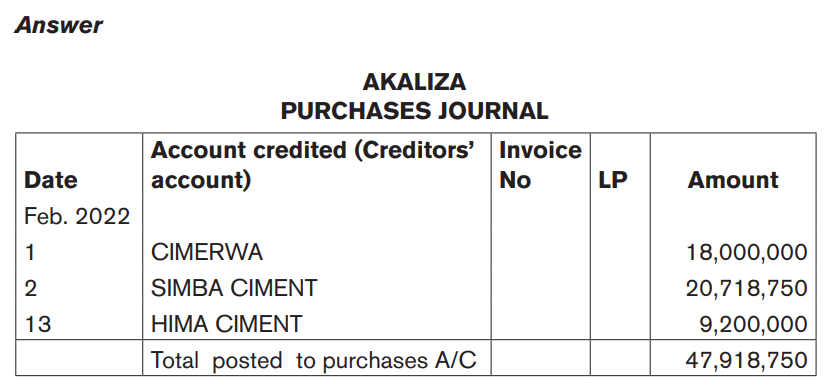

Example1

During the month of February 2022 AKALIZA had the following transactions in

its business:

February 1 Purchased 2000 sacks of cement at FRW 9,000 each on credit

from CIMERWA.

2 Bought 2,500 sacks of cement at FRW 8,500 each on credit from SIMBAcement less 2.5% trade discount

13 bought 1000 sacks of cement at FRW 9,200 each from HIMA cement on

credit.

Enter the above transactions in a purchases day book.

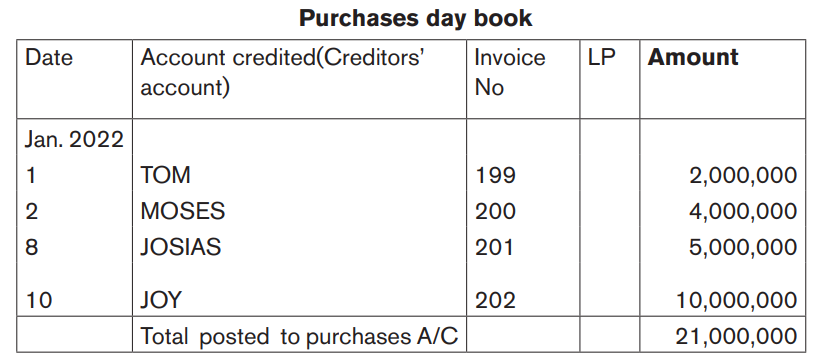

Example 2

Record the following transactions into the purchase journal

Jan. 1 Bought goods on credit from Tom for FRW 2,000,000 Invoice No 199

2 Bought goods on credit from Moses for FRW 4,000,000 Invoice No 200

8 Bought goods on credit from Josias for FRW 5,000,000 Invoice No 201

10 Bought goods on credit from Joy for FRW 10,000,000 Invoice No 202Answer

Application activity 3.4

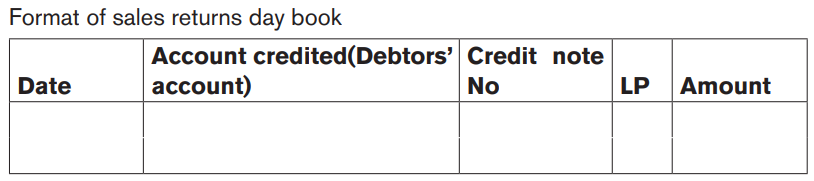

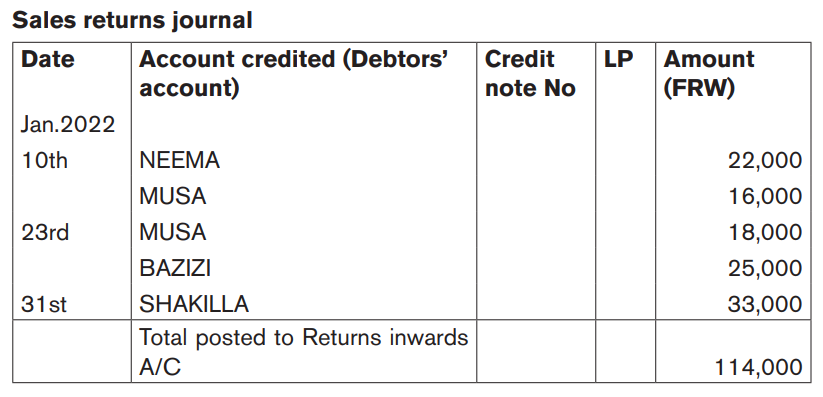

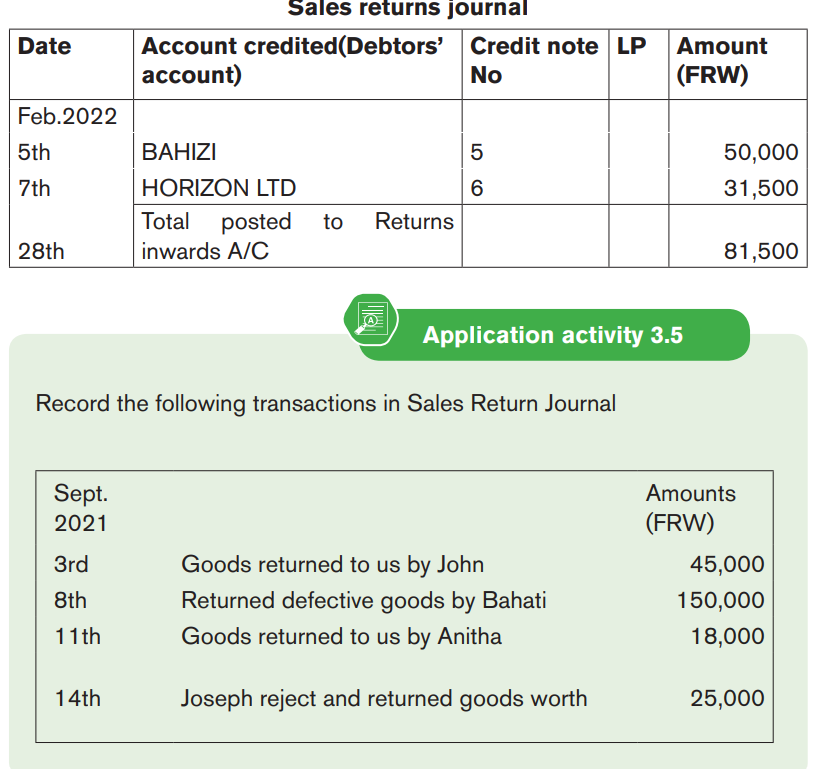

3.5 Sales Returns/Returns Inwards Journal

Activity 3.5

List as many reasons as you can think of why (a) retail customers and (b)

trade customers may return goods to the seller

This book is used to record credit note issued for goods returned to the seller

his/her credit customer. The individual items are recorded in the sales returns

day book as credit notes issued, and are immediately posted to the credit of

the personal accounts of the customers concerned in the ledger. At the end of

the posting period, the total in the sales returns Journal representing total sales

returns is debited to the sales returns inwards account in the ledger to completethe double entry and to record the sales returns in the ledger

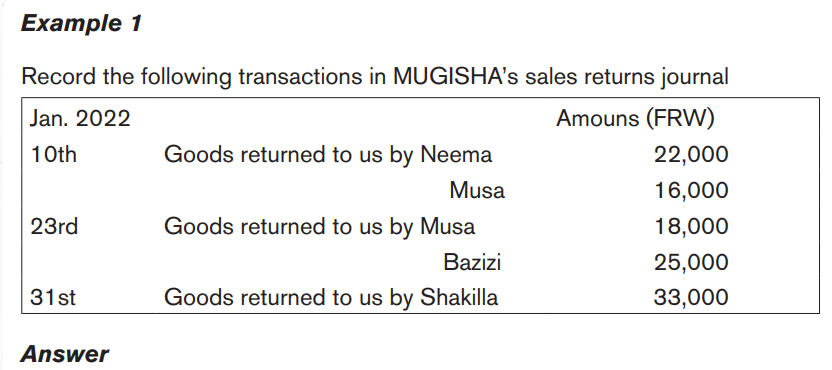

Example 2

Record in a suitable book of prime entry the following transactions which took

place in the firm of AKALIZA for the month of February 2022

Feb. 5 BAHIZI returned 5 sacks of Cement worth FRW 10,000each sold to him

on 2nd February, credit note No 005 issued.

7 Horizon Ltd returned 3 defective sacks which they had bought on credit forFRW 10,500 each, credit note No 006 issued.

Answer

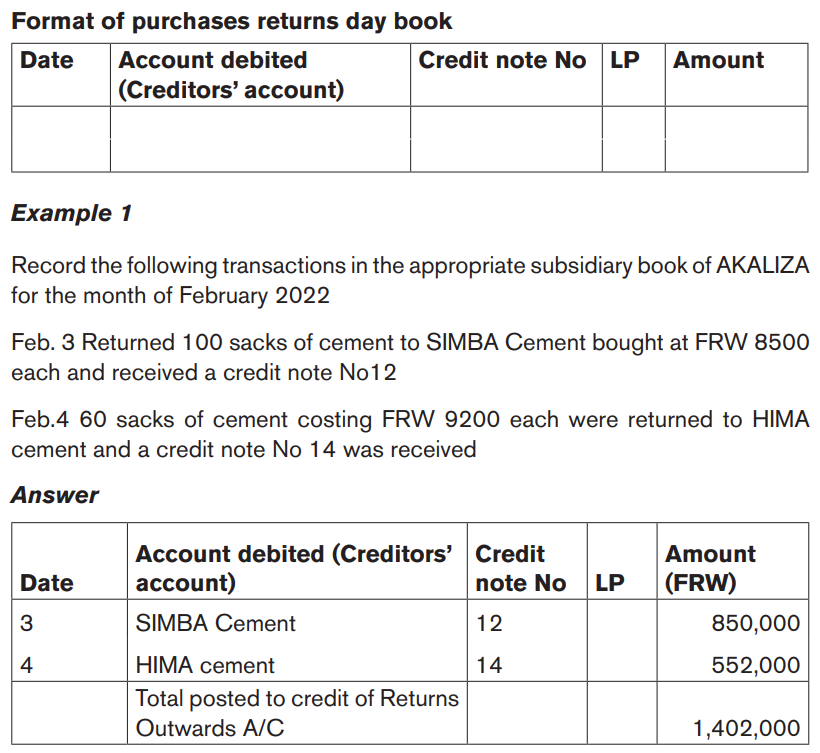

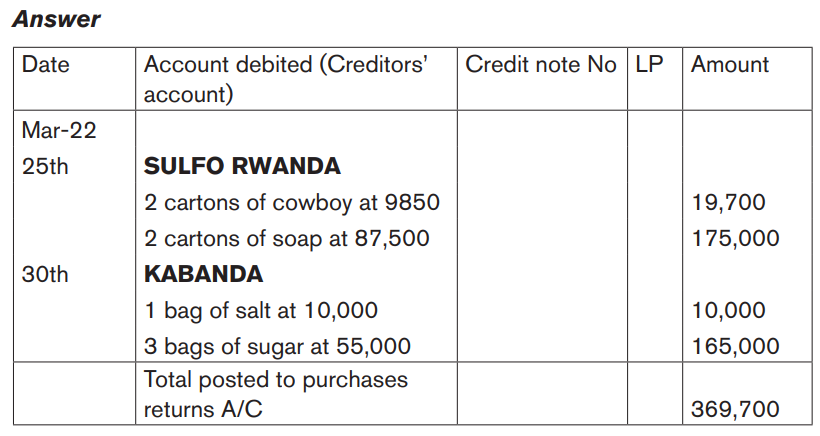

3.6 Purchases Returns/Returns outwards Journal

Activity 3.6

Suppose that your company needs to keep the separate books of prime

entry according to its transactions. Discuss the book of original entry underwhich credit notes received from your suppliers will be recorded.

Activity 3.6

This book is used to record particulars of all credit notes received from suppliers

in respect of goods returned by the buyer to the seller. Goods purchased

may be returned if they do not conform to the order as to quality, if they were

damaged in transit and credit is claimed from each supplier. Individual credit

notes received for goods returned are recorded in the returns journal in a similar

to purchases. At the end of the period, the purchases returns journal is totaled

to ascertain the total credit notes received for the period. This is then credited to

the returns outwards account in the ledger. If the goods returned were subject

to a trade discount, the necessary adjustment should be made when preparingthe returns advice claim for dispatch to the supplier

Example 2

The following are MUYIZERE’s transactions which he carried out in the month

of March 2022. Prepare his purchases returns day book.

1st March Bought goods from SULFO RWANDA 8 Cartons of Soap at FRW

87,500

5th March Bought goods from Omar 7 cartons of Naomi at FRW 8,700; cartons

of OMO at FRW 7,500

10th March Bought goods from 30 boxes of biscuits at FRW 2,500

20th March Bought goods from KABANDA 5 bags of sugar at FRW 55,000

25th March Returned to SULFO RWANDA 2 cartons of cowboy at FRW 9850

as damaged and 2 cartons of soap at FRW 87,500

30th March returned to KABANDA 3 bags of sugar at FRW 55,000 as damagedand 1 bag of salt at FRW 10,000.

Application activity 3.6

KAMUZINZI is a sole trader in Kigali, the following are transactions he

made during the month of June 2021.

June 1st Credit purchases from: Bertin FRW 2,500,000; Mathew FRW

14,500,000 Andrew FRW 35,000,000

4th Credit sales to: David FRW 41,000,000; Zouzu FRW 34,000,000;

Blaise FRW 27,000,000

10th Credit purchases from: Thomas FRW 14,700,000; Bertin FRW

10,000,000; Mathew FRW 19,000,000

12th Goods returned to Bertin FRW 3,500,000; Mathew FRW 5,000,000

15th Goods returned by Zouzu FRW 2,500,000; Blaise FRW 3,000,000

20th Credit purchases from: Thomas FRW 18,600,000; Bertin FRW

25,000,000; Mathew FRW 8,000,000

22nd Credit sales to: Zouzu FRW 15,000,000; David FRW 22,000,000

25th Goods returned to: Thomas FRW 2,000,000; Mathew FRW 1,500,000

30th Zouzu returned goods worth FRW 1,800,000You are required to prepare his returns outwards day book

3.7 Cash Book

Activity 3.6

KARUMUGABO a sole trader in your locality had numerous cash

transactions in his business, and needs to keep a separate book under

which cash and cheque transactions will be recorded, he asks you as

professional accountant to design a book that will help him to respond tohis need.

3.7.1 Nature and purpose of a cash book

Most of the numerous transactions of a trader involve the receiving and paying

of cash. There are many slogans displayed prominently in shop as “Pay Cash

Today, for Credit Come Tomorrow”. The commonest book of accounts is the

cashbook, which contains all records of payments and receipts of cash. Cash

here means bank notes, coins, money orders, credit transfers, cheques or other

form of monetary payment or receipt acceptable in settlement of business debts.

The cash book is said to be both a book of original entry and ledger. Thus, its

full name is cashbook ledger. It is a book of original entry because any receipt

or payment of cash is first recorded in this book before being posted to another

ledger account. It is important to note therefore that there is no subsidiary book

for cash transactions other than the cashbook, and credit transaction must not

be recorded in the cash book.

The cashbook is a ledger account because for every debit or credit entry made

in it, there must be a corresponding credit or debit entry in other accounts in the

ledger. Further, once a record is made in the cashbook, it is permanently kept

therein. The double entry rule applicable to recording entries in the cash bookis debit receipts and credit payments, which is consistent with the double entry

principle of debiting the account that is receiving value and crediting the one

giving value.

In brief, a business that keeps record of a cash book as an original book of entry

need not post separate bank and cash accounts into the ledger, as the cashbook serves the entire purpose.

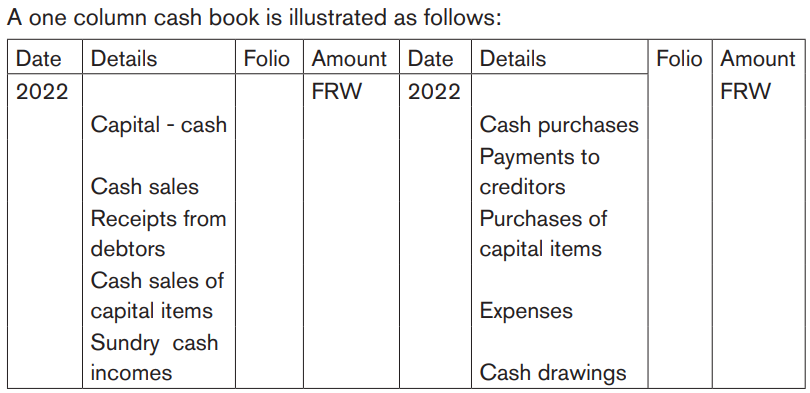

3.7.2 Types of Cash Book

i) One-column Cash Book

One-column cash book is the simplest version of a cash book being a mere

ledger ruling with debit and credit columns and columns for dates, details, folio

and amounts as shown. On the debit side are entered all cash receipts and on

credit side the cash payments. This is a typical cash account for businesseswhich do not use and accept cheques.

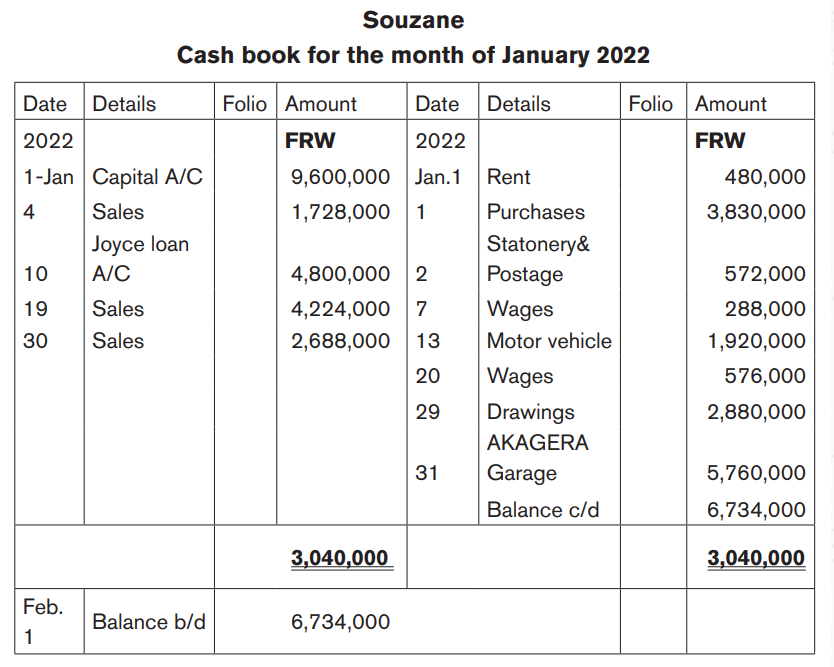

Example

From the following transactions during the month of January, write Souzane’s one

column cash book. She started business on 1st January 2022 having transferred

FRW 9,600,000 from his private bank account to the business office.

January 1st Paid FRW 480,000 for rent for the month and made purchase of

FRW 3,830,000.

2nd Paid FRW 380,000 for stationery and FRW 192,000 for stamps

4th Cash sales FRW 1,728,000

7th Paid FRW 288,000 in respect of wages to assistant.

10th Borrowed FRW 4,800,000 from Joyce, a friend.

13th Bought a used Pick-up for FRW 9,216,000 from AKAGERA Garage

against FRW 1,920,000 deposit

19th Cash sales FRW 4,224,000

20th Paid wages for two weeks, FRW 576,000

23rd Bought FRW 6,240,000 goods from ABC Wholesalers Ltd. on credit

29th Drew FRW 2,880,000 for private use

30th Cash sales FRW 2,688,00031st Paid another FRW 5,760,000 off pick-up account.

Answer

ii) Two-column Cash Book

A two column cash book has two amount columns on each side of the book. On

the debit side, one column represents cash receipts, while the other represents

bank receipts. Similarly, the cash and bank columns appear on the credit side

to represent their respective payments.

The cash book is balanced by comparing totals of each account column on

either side in the same way the ledger accounts are balanced off.

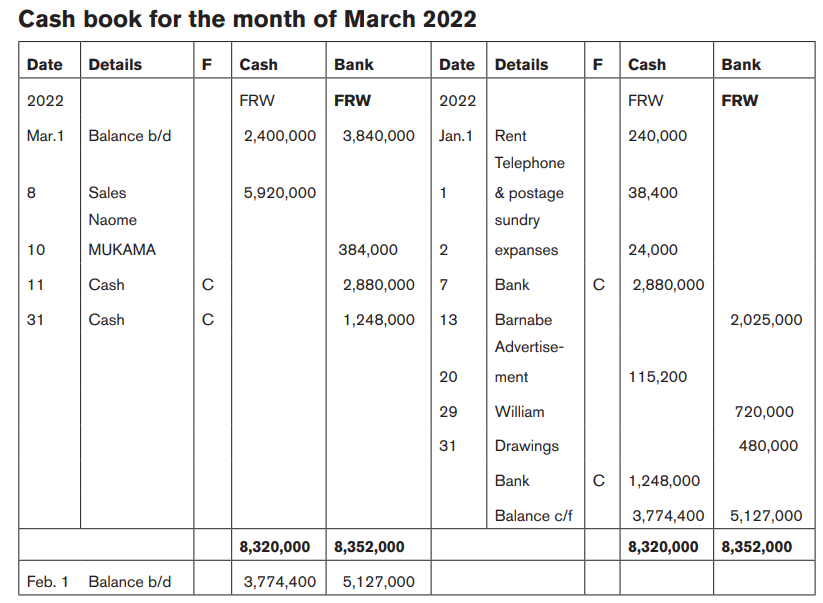

Example

The following transactions were extracted from the books of KAGABO for the

period of March 2022.

March 1st balance brought forward

Cash FRW 2,400,000

Bank FRW 3,840,000

March 1st Paid rent cash FRW 240000

2 Made payments for telephone and postage by cash FRW 38,400

4 Paid cash for sundry expenses FRW 24000

8 Sold goods and was paid by cash FRW 5,920,000

10 Received payment by cheque from Naome MUKAMA FRW 384,000

11 Deposited cash in bank FRW 2,880,000

13 Payment by cheque was made to Barnabe FRW 2,025,000

20 Paid for advertisement in cash FRW 115,200

29 Sent cheque to William FRW 720,000

31 Drew a cheque for own use FRW 480,000

31 Paid FRW 1,248,000 cash into bank

Required: Show the above transactions in a two column cash book, balance itoff and bring down the balances.

Answer

KAGABO

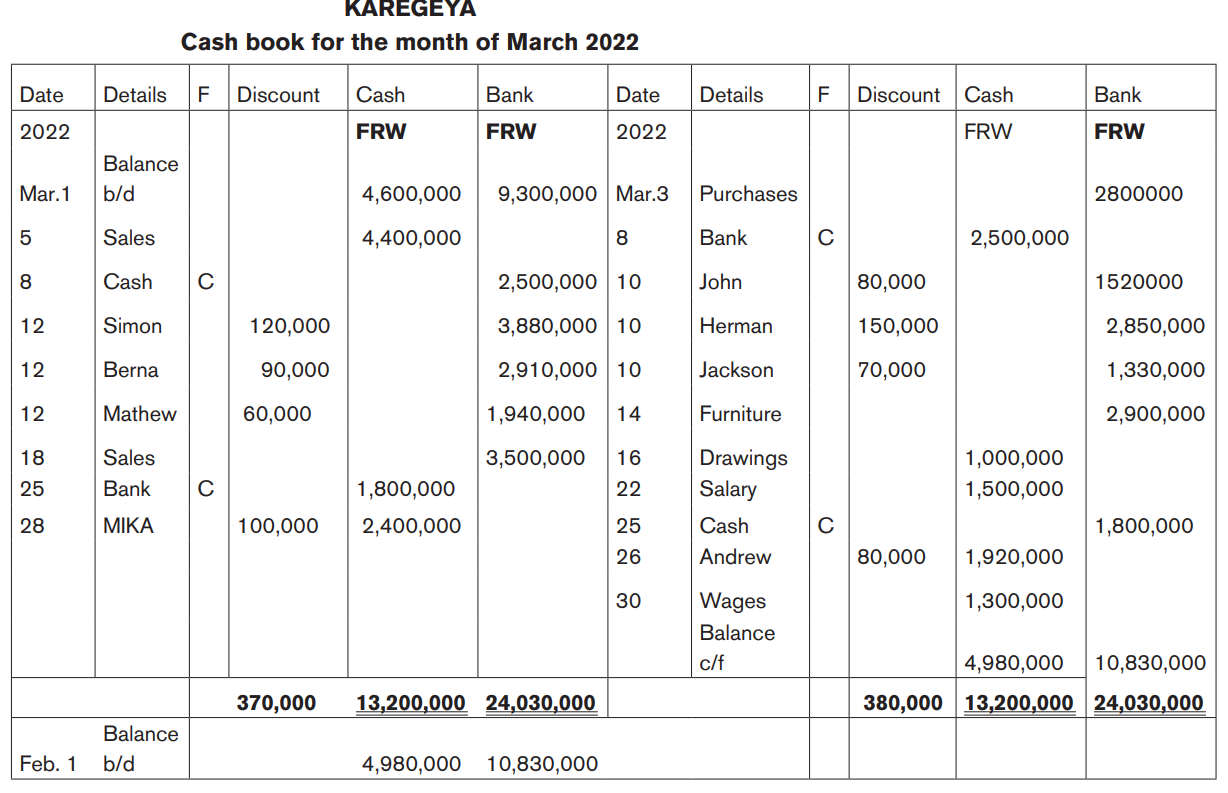

iii) Three column Cash book

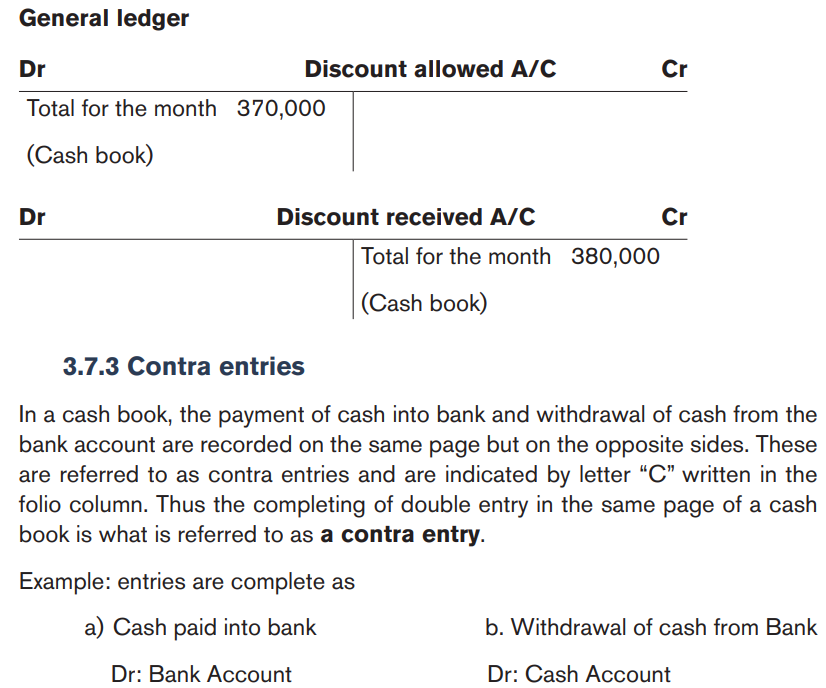

A three column cash book has an additional column on the debit side, to

record discounts allowed and on the credit side the additional column records

discounts received.

Every debit entry made in the cash book for discount allowed has a corresponding

credit entry in the debtor’s ledger, in the account of debtor being allowed the

cash discount. Similarly, every credit entry of discount received made in the cash

book, has a corresponding debit entry in the creditor’s ledger in the account of

the creditor from whom discount is received.

At the end of accounting period, amounts in the discount column are separately

added up for each column. Note that the discount columns, unlike the cash

and bank columns are not balance off. Each discount column shows the actual

totals. The totals are then posted into the general ledger in the respectivediscount accounts

The total of discount allowed column is posted on the debit side of discount

allowed account. Likewise the total of the discount received columns are posted

on the credit side of the discount received account.

It is important for you to understand the alternative method whereby a three

column cash book is used. In this case, each individual discount entry is made

in the general ledger, in the concerned account, instead of posting of posting in

it only total amounts.

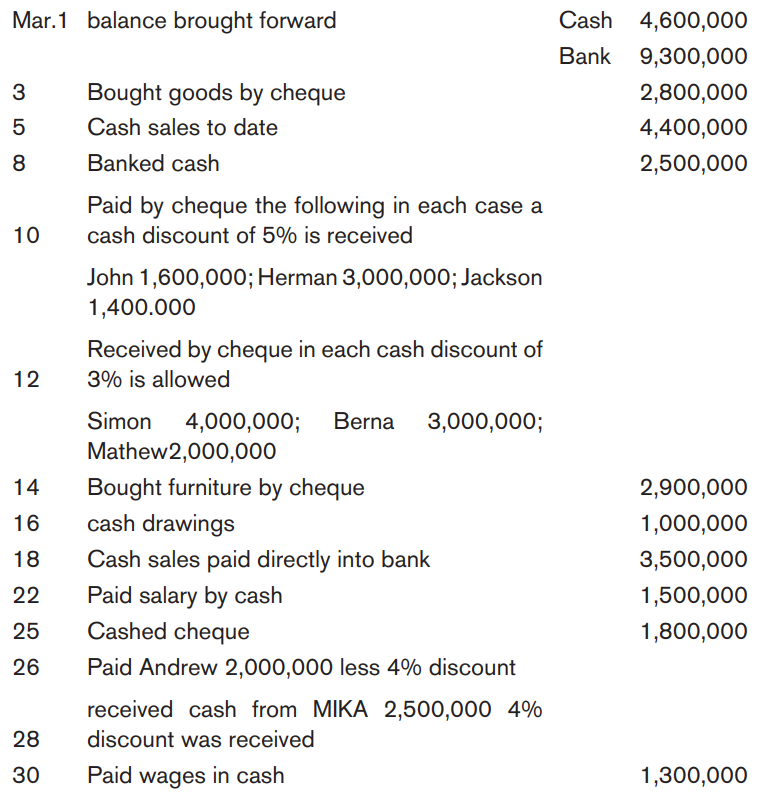

Example

Write up a three column cash book for KAREGEYA for details given below,

balance off at the end of the month and show the discounts accounts in thegeneral ledger in March 2022

Note: Cheques drawn for own use must not be treated as a contra since this

is for personal use and not for office use; hence the debit entry is made in the

“Drawings Account”. A contra is also defined as the balance of an account that

represents a deduction from another account e.g. provision for depreciation,bad debts, reserves, etc.

Application activity 3.7

From the following transactions enter the relevant transactions inthe cash book and open up the ledger for discount accounts

3.8 Petty Cash Book

Activity 3.8

BAHIZI is a Wholesaler in Nyarugenge Matheus, selling electronic items

import from CHINA. In order to avoid holding big amount of money in his

office, he uses cheques in all business transactions, including receipts and

payments. Few days later, he failed to handle small expenses which normally

require the use of cash other than cheques. In your groups, discuss the

simple way may be used to handle those small expenditure.

3.8.1 Petty cash

The cheque has become a very important means of settling business accounts,

such that most payment requiring large sum of money are made by cheque.

Nevertheless, there are certain accounts that require small amounts for

settlement. Expenses for the kitchen, cleaning, postage etc. are settled by small

amounts of money which usually are not done by cheque. Sometimes, items

like stationery, travelling expenses, small ledger accounts, advance to casual

workers, etc. are required urgently and the procedure for preparing a cheque for

the purpose is rather long. The alternative is to keep in the office to meet minor

and urgent expenses is called petty cash, float or imprest. The clerk in charge of

handling petty cash payments is known as a petty cashier

3.8.2 Petty cash voucher

This is a specially designed form used by a petty cashier. It states the nature of

payment the amount, date, the authority for the payment and the person to be

paid to. It also acts as evidence for receipt of such cash as the recipient must

sign it immediately after receiving the cash. It should be numbered serially. Petty

cash vouchers are used as source of information for recording the petty cash

book, which records petty transactions.

3.8.3 The petty cash book

This is the book of account in which petty cash transactions are recorded. The

petty cashier is provided with a strong cash box in which the petty cash is kept

and locked in a drawer. The patty cashier also keeps payment vouchers which

serve as source documents for information to be recorded in the petty cash

book. The vouchers state the date for payment brief details of the nature of

payment, the amount of payment, the recipient of the money, the authority for

payment, payments analysis etc.

Each recipient of petty cash fund must fill in and sign a petty cash voucher

which is the checked and approved by the accountant before cash is paid out.

The petty cashier must retain the payment voucher as evidence of the payment.

At all times, the total of amount appearing in the payment vouchers and the

balance of cash in hand in the cash box should add up to the original amount of

money given to the petty cashier as petty cash.

The petty cash book is a book of original entry and an account for petty cash

transactions. Petty cash transactions are first recorded in this book before being

posted to the ledger. It forms a separate ledger book.

The petty cash book is ruled in columns. The debit side has got columns for

date, folio, details and amount, while the credit or payment side has got columns

for date, details, folio, a total amounts column, plus analysis columns in which

various petty cash payments are analyzed such as sundry expense, stationery

and postage, telephone and telegrams etc. the debit side records the amount of

money received as petty cash plus any petty cash in hand brought forward from

previous period. The credit side records payments made out of petty cash and

each day’s payment is analysed in the relevant column. The daily total is posted

to the total payments column. At the end of the period, the amounts in the

analysis columns are added. The sum of the analysis column totals should agree

with the sum of the totals column. The difference between the sum of the total

payments column and the amount received column on the debit side represents

the balance of petty cash in hand carried forward to the next period. There is an

automatic check of the petty cash book as horizontal totals and vertical totals

must agree. The following example illustrates the ruling and preparation of the

petty cash book.

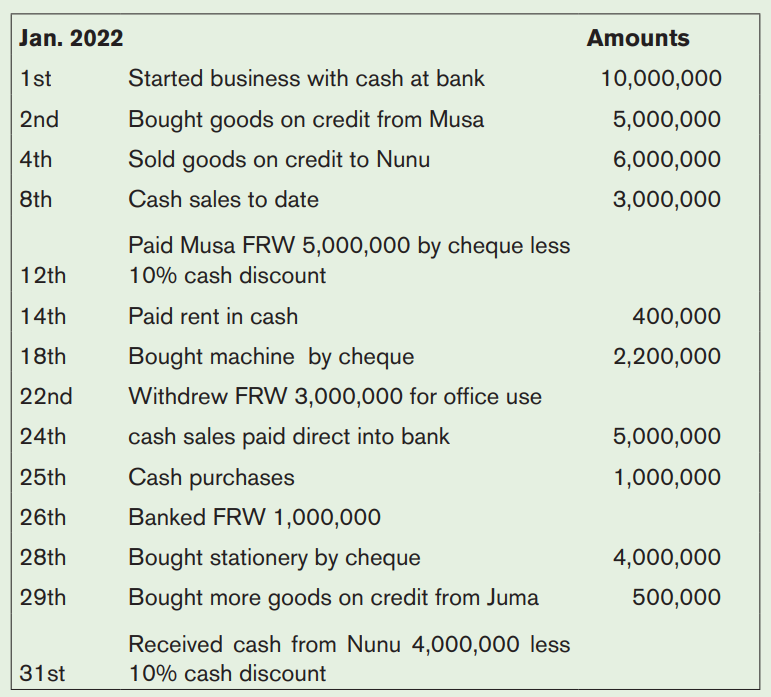

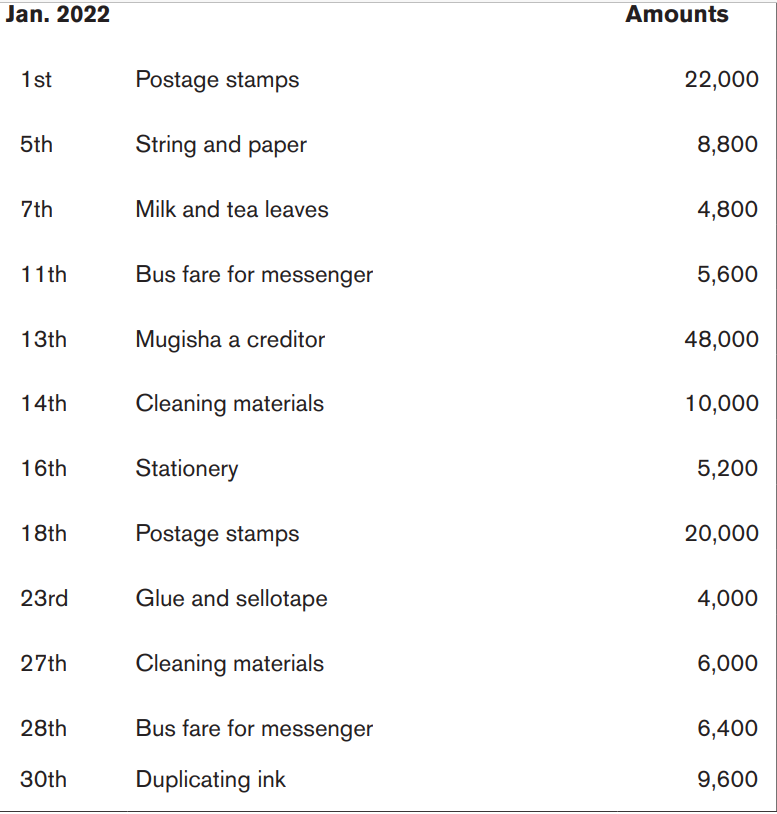

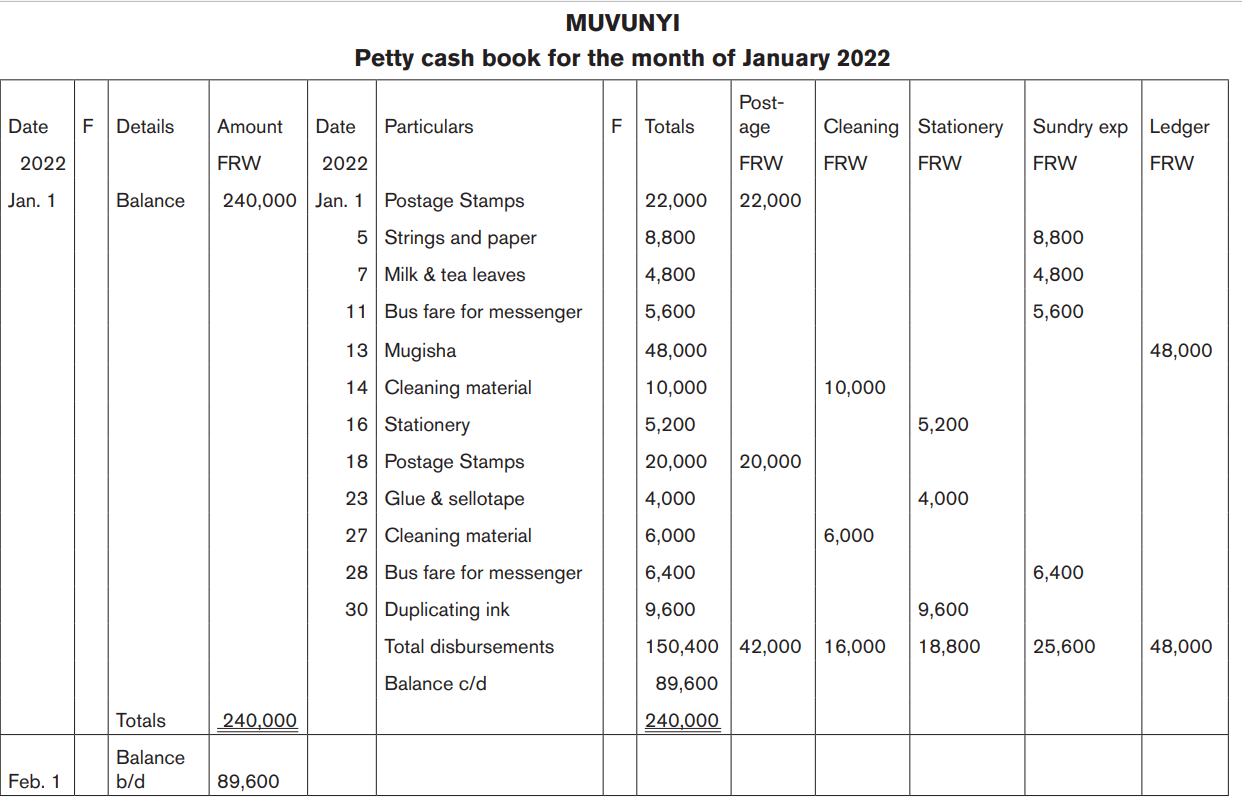

MUVUNYI keeps a petty cash book. On 1st January 2022 his petty cash was

given as FRW 240,000 and he made the following payments in the course ofthe month

Required:

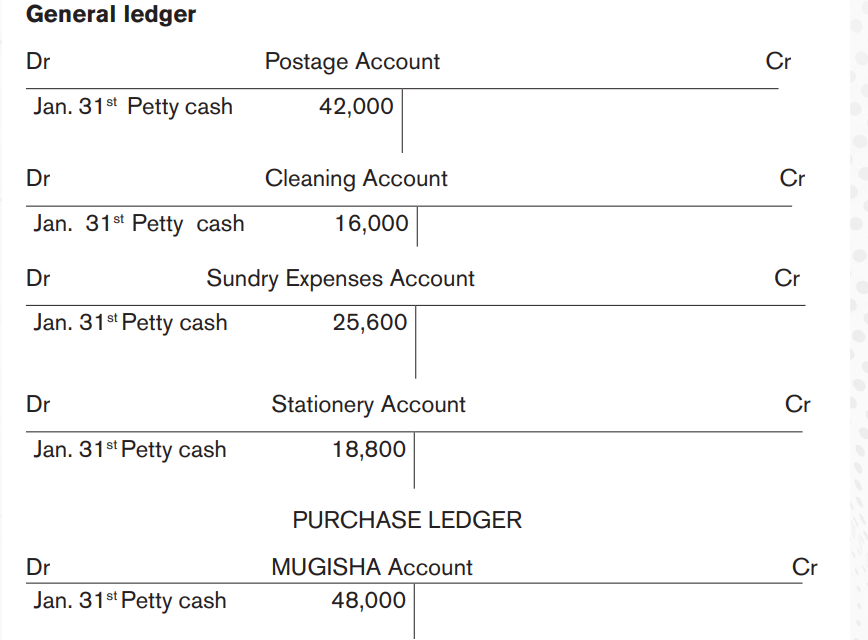

a) Enter the above transactions in a suitable ruled petty cash book for the

month of January and show the balance of petty cash in hand on 31st

January 2022. Use appropriate analysis columns.b) Post total columns to their relevant ledger accounts

3.8.4 The Imprest System

This is the modern system of keeping petty cash. Under the imprest system, a

petty cashier is provided with a fixed sum of money at the beginning of a given

period out of which petty cash payments are made. At the end of each balancing

period, the petty cashier is given a sum of money equal to the payments or

disbursements made during the period.

Features of the Imprest System

a) At any time, the sum of the petty cash in hand plus disbursements

as shown by the payment vouchers should always equal the original

amount given to the petty cashier

b) The amount of money to the cashier to restore the imprest is the total

of the payment vouchers or disbursements. This amount plus the

petty cash in hand automatically restores the initial imprest. The act

of restoring the imprest is also called reimbursement, or renewing the

float, as imprest is also called sometimes.

c) Total disbursements are equal to the cash or cheque debited in thepetty cash book to restore the imprest.

d) Double entry is exercised between the petty cash book, the cash book

and nominal expenditures.

1) Petty cash advance:

Dr: Petty cash A/C

Cr: Cash A/C

2) Monthly Payments:

Dr: Nominal A/C

Cr: Petty cash A/C

3) Reimbursement:

Dr: Petty cash A/C

Cr: Cash A/C

Advantages of the Imprest System

1. It makes it easy to verify the arithmetical accuracy of the cash book by

using the horizontal and vertical analysis column totals; cross- casting.

2. The petty cashier is always accountable for the imprest amount

3. The system facilitates good internal control as at any given time the petty

cashier’s cash in hand plus the amount paid as shown by the payment

vouchers must always add up to the imprest amount.

4. Deficiencies are limited at any time to the balance of imprest cash not

yet spent.

5. Usage of the system allows for sound cash management.

Advantages of Using Petty Cash System

1. It allows the recording of cash items in the cash book to be more objective

yet tidy. The petty cash items, involves small amounts, which can cause

a lot of entries in the cash book that would make it hard to manage,

especially in a busy business environment.

2. The use of this system allows limited cash to be in the business premises.

This ensures that only a limited amount may be lost in case of theft, as the

bulk of it will have been banked.

3. It facilitates day to day activities to run smoothly since urgent issues

requiring small cash amounts can be handled quickly instead of waiting

for long process of approving and signing cheques for various payments.

4. It creates flexibility in the organization’s cash management.

5. It saves time because the small cash payments are delegated to the petty

cashier while the accountant concentrates on other major issues in the

business entity.

6. It helps to control the flow of expenditure easily, especially cash

expenditure.

Amounts in the analysis columns for payments are posted to their respective

ledger accounts to complete the double entry. The balance in the petty cash

book appears in the trial balance as an asset and in the balance sheet among

current assets, proving further that the petty cash book is both a book of original

entry and a ledger book.

Example 2:

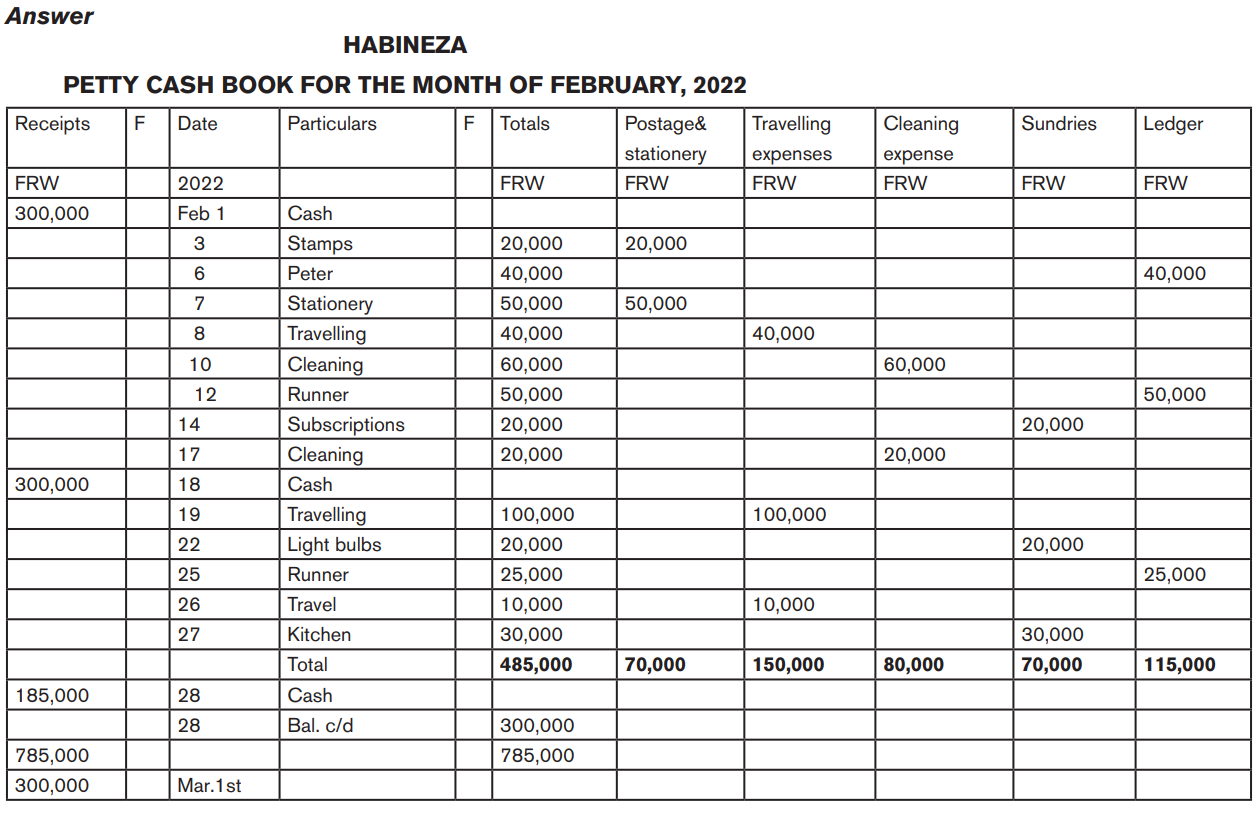

HABINEZA maintains a petty cash book on the imprest system. The imprest

being FRW300,000. The following transactions took place in February 2022.

Feb.1st Received imprest from the cashier of FRW 300,000

3 Bought postage stamps of FRW 20,000

7 Bought stationery FRW50,000

8 Paid travelling allowance FRW 40,000

10 Paid window cleaning expenses FRW 60,000

12 Paid Runner’s account in the purchases ledger FRW 50,000

14 Paid subscriptions for trade association FRW 20,000

17 Paid office cleaning expenses FRW 20,000

18 Received FRW 300,000 from the cashier

19 Paid for travelling expenses FRW 100,000

22 Bought electric light bulbs FRW 20,000

25 Paid Runner’s account in the purchases ledger FRW 25,000

26 Paid travelling expenses FRW 10,000

27 Paid for sugar, tea and milk FRW 30,000Required:

Enter the transactions into a petty cash book under the analysis column: Postage

and stationery, travelling expenses, sundries and a ledger column. Balance the

cash book showing the reimbursement required to restore the imprest and thebalance brought forward at 1st March 2022

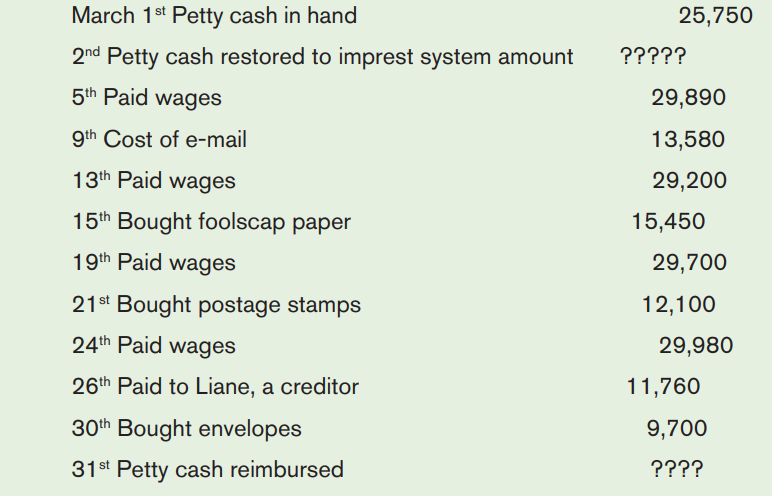

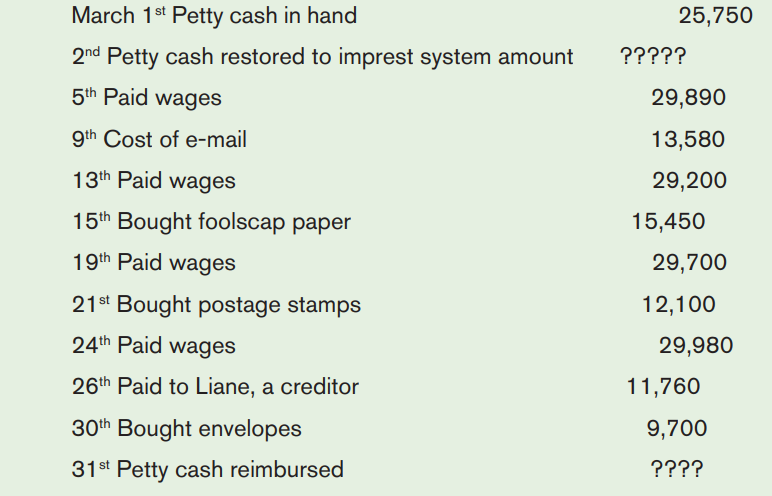

Application activity 3.8

- 1. State the advantages of using imprest system of petty cash

- 2. Mark NDUWAYEZU is a sole trader in a business know as MANDU

- Traders Ltd. He keeps his petty cash on an imprest system, amount

- being FRW 200,000. The following are the petty cash transactions

- for the month of March 2022.

Required:

1. Write up the petty cash book to record the above transactions,

showing the entries restoring the petty cash imprest amount

2. Post relevant entries into the ledger.

Notes : your analysis columns should show:

a) Wages

b) Postage and telegrams

c) Stationery

d) Ledger

End of unit assessment

MUGISHA commenced a stationery business on 1st January, 2022 with his

salary savings of FRW 50,000,000 which he was keeping with BANK OF

KIGALI. He transformed his personal account into a business account and

there after the salary had to be channeled to his account with I&M Bank.

He also took his sister as his assistant in the business and she was to be

paid a salary of FRW 500,000 per month.

During the month of January, he carried out the following transactions:

Jan. 1 He withdrew FRW 10,000,000 for use in day-to-day operations of

the business.

Jan. 2 Bought stationery worth FRW 15,000,000 from KBG Stationers

on credit, and also transferred his furniture worth FRW 10,000,000 from

home for use in the business.

Jan. 3 Bought further stock of stationery at FRW 18,000,000 and paid by

cheque. He also paid FRW 1,500,000 for transporting the stationery to the

place of work paying cash.

Jan. 5 Cash sales were FRW 8,000,000. He also sold stationery to Lycée

de Kigali at FRW 14,000,000 on credit.

Jan. 7 Paid KBG Stationers FRW 9,000,000 by cheque for stationery

previously bought, and returned some spoilt stationery worth FRW 700,000

on the same day.

Jan. 10 Bought Stationery at worth FRW 20,000,000 from Kigali Stationary

LTD on account.

Jan. 13 Lycée de Kigali paid FRW 6,000,000 by cheque and returned

some items worth FRW 800,000 which had not been ordered for.

Jan.20 Sold books worth FRW 23,000,000 to FAWE Girls School on

condition that payment is made before the end of the month.

Jan. 25 Paid salary to his assistant by cheque.Required: To record the above transactions into the books of original entry