Topic outline

UNIT 1: INTRODUCTION TO RWANDAN TAX SYSTEM

Key unit competence: Describe various Rwandan tax system legislation

Introductory activity: A case study

Every year around, before and after June 15, everybody especially business

people will be discussing about tax changes in the national budget. This is

because tax reforms and new taxes introduced are announced on that day.

However, have you ever wondered why you and businesses need to paytaxes?

In Rwanda, there are arms of the government (ruling bodies) from the Village,

Cell, Sector, and District, Provincial and National levels. These bodies

comprise: legislature (who make laws), executives (who enforce laws) and

judiciary (who exercise laws). Paying taxes is a civic duty, although doing sois also a requirement of the law.

Taxes take many forms too. When you work at a job to make money, you

pay income taxes. Depending on how much money you earn, a certain

percentage (part) of the money you make is withheld (kept out of your paycheck and sent to the government).

– When you buy things at a store, you also usually pay sales tax, which

is a percentage of the cost of the item charged by the store. If you own

property, you also pay property taxes on the value of your property.

If you do not pay your taxes, the government agency that oversees taxes the

Rwanda Revenue Authority (RRA) - will require you to pay your taxes or elseface penalties, such as fines or going to jail.

The money you pay in taxes goes to many places. In addition to paying the

salaries of government workers, your tax also helps to support common

resources, such as police and fire fighters.– Tax money helps to ensure the roads you travel on are safe and well

maintained. Taxes fund health facilities such as health centers and

hospitals, education, public libraries, parks and ensuring security in the

country and many other public utilities. Taxes are also used to fund many

types of government programs that help the poor and less fortunate, aswell as many schools!

Each year as the “Tax Day” rolls in, adults of all ages and businesses must

report their income to the RRA, using special tax forms. There are many laws

that set forth complicated rules about how much tax is owed and what kinds

of special expenses can be used (“written off”) to lower the amount of taxes

you need to pay

For the average worker, tax money has been withheld from pay checks

throughout the year. On “tax day,” each worker reports his or her income andexpenses to the RRA.

Employers also report to the RRA how much they paid each worker. The RRA

compares all these numbers to make sure that each person pays the correct

amount of taxes.

If you have not had enough tax money withheld from your checks throughout

the year to cover the amount of tax you owe, you will have to send more money

(“pay in”) to the government. If, however, too much tax money was withheld from

your pay checks, you will receive a check (get a “refund”) from the government.

Referring to the passage answer the following questions:– What are the major changes expected by people especially business

people on June 15, every year?– What makes the business people so anxious to know the changes

mentioned above in question1?– Why do you think it is important for businesses to pay taxes to thegovernment?

– How do the following benefit from taxes?

i. Entrepreneur.

ii. Government.

iii. Society.

– Identify and briefly explain at least two types of taxes paid in Rwanda?

– What happens to businesses or people who do not pay taxes?

– What is the difference between tax and taxation?

1.1. Meaning of taxation, tax and duty

Activity 1.1

Q1. Assume, your parents have restaurant in Kigali city; -help them to

understand that compulsory imposed to them and its contribution for public

purposes.

Q2. What do you think is the purpose of taxation?

1.1.1. Meaning of a taxation

1.1.2. Tax

Taxation is a term for when a taxing authority, usually a government, levies or

imposes a tax. The term “taxation” applies to all types of involuntary levies, from

income to capital gains to estate taxes. Thus, taxation is a system being used by

Government to serve general public interest.

Taxation is a system of raising money or revenues by the government from

individuals/business and companies by law through taxes.

A tax is generally referred to as a compulsory levy imposed by the government

upon assessment. Tax is fees charged (levied) by government on product,

income or activity. Tax is also defined as a compulsory levy or charge by the

state to its citizens and non-citizens that are usually payable in monetary form.

The collected fund is then used to fund different public expenditure programs.

The main types of taxes are direct tax and indirect tax.

1.1.3. Duty

In general, duty refers to the tax imposed on goods when they are transported

across international borders. In simple terms, it is the tax that is levied on import

and export of goods. The government uses this duty to raise its revenues,

safeguard domestic industries, and regulate movement of goods.

Application activity 1.1

1. What do you think for the meaning of taxation?

2. In your own words, explain why the institution called “Rwanda

Revenue Authority (RRA) “has been given the mandate of collecting

tax.1.2. Current legislation relating to taxation and tax periods

Activity 1.2

Referring to the activities in the previous lesson 1.1, do you think it is

important to know taxation for business operations, what is the final resting

place of a tax or the person or company that actually pays the tax?

1.2.1. Current legislation relating to taxation

The basis of taxation in Rwanda is derived from article 164 of the constitution

of Rwanda (2003), which states “No taxation can be imposed, modified orremoved except by law”.

It also states: “No exemption from or reduction in tax may be granted unlessauthorized by law”.

Thus, laws are required to impose taxes, or to exempt a person or a transactionfrom tax.

This is put into action by income tax law as organic law. Further ministerial

orders and commissioner general rules assist in the implementation of the lawonce approved, these are gazette (published) and become law.

The taxation background in Rwanda is very dynamic. This is evidenced by

different changes introduced in tax legislation:

– Taxations in Rwanda dates way back in 1912 when property tax was

introduced.

– After independence, taxes were formally introduced in Rwanda by the law

of the 2nd June 1964 concerning Profit tax.

– Recently in April 2018, Law Nº 016/2018 of 13/04/2018 establishing Taxes

on income repealed the law no 16/2005 of 18/08/2005 was introduced.

– Customs and excise duties were also introduced by the law of 17th July 1968.

– The East African Community Customs Management act 2004.

– Law Nº 34/2015 of 30/06/2015 establishing the infrastructure development

levy on imported goods.

– Law Nº 19/2017 of 28th/04/2017 establishing the levy on imported goods

financing African Union activities.

– Law Nº 35/2015 of 30th/06/2015 establishing the levy on petrol and gas

oil for road maintenance.

– In 2001 VAT law was introduced requiring taxpayers to start paying Value

Added Tax.

– The current VAT law is Law 40/2016 of 15th/10/2016 modifying and

complementing Law Nº 37/2012 of 09th/11/2012.

– Law Nº 75/2018 of 07th/09/2018, law determining the sources of revenue

and property of decentralized entities.

– Law Nº 025/2019 of 13th/09/2019 establishing the Excise Duty.

– Law Nº 29/2012 of 27th/07/2012 establishing tax on gaming activities.

– Law Nº 55/2013 of 02th/08/2013 on minerals tax.

– Law Nº 14/2009 of 30th/06/2009 determining motor vehicle registration fees.

All the above laws are related either to direct taxes or indirect taxes. Besides

Law No 026/2019 of 18th/09/2019 on Tax procedures, the main law on directtaxation in Rwanda is law 016th/2018 of 13th/04/2018.

1.2.2. Types of taxes, their advantages and disadvantages

There are two main types of taxes, direct tax and indirect tax

a) A Direct tax is a tax on the income or wealth of a person. It is recovered

generally from that person under previously enacted legislation; anexample would be income tax.

Advantages of direct tax

– Cheap to collect

– Convenient to pay because they are spread over a long period

– Direct taxes are flexible and are easily increased and decreased

– They are simple to understand

– Most direct taxes are progressive since the rich people pay taxes at higher

rate than the rates at which the poor people pay.

– Direct taxes are very effective at redistributing national income among thepopulation.

Disadvantages of direct tax

– In the developing countries with high levels of unemployment income are

very low and so the revenue that is generated from direct taxes is always

very low.

– Costs of assessment and collection are high when the tax payers are

scattered in different locations.

– It is difficult to measure the taxable capacity of the people to determine

how much income tax they have to pay. This leads to either over taxation or

under taxation.

– Direct taxes are easy to evade as people cannot conceal their income.

Others get income from many sources and are not resident in a single place.

This makes assessment and collection very complicated as a consequence,people evade the taxes.

b) An indirect tax is a tax on production, exchange or consumption of

goods or services. It is charged at the time a taxable operation is carriedout. This is the case for VAT and excise duty.

Advantages of indirect tax – Convenient to pay as they are paid together with the price of commodities

in installment.

– There is less tax evasion since they are included in the price of commodities.

– Indirect taxes cover a wide range of taxable items and therefore raise more revenue.

– A tool to control the production and the consumption of harmful goods like

cigarettes, alcohol, etc…

– Tool to protect domestic industries against competition from foreign

producers and dumping.

– Indirect taxes are the most important sources of government revenues

since they are based on consumption of goods and services and yet the

consumer has got full control and decision power to spend or not.

Disadvantages of indirect tax

– Indirect taxes are regressive in nature and therefore don’t satisfy the

principle of equity since the rich and the poor pay the same amount of taxes

on the same essential goods consumed.

– Indirect taxes are inflationary in nature as they increase prices of goods and

services hence increasing costs of production, costs of living, therefore

leading to demand for higher wages.– Being consumption tax, indirect taxes are unavoidable.

1.2.3. Tax period

There is no way somebody can understand the concept of tax period without

making the difference between tax period itself, fiscal year and budget year.

Fiscal Year is a period of twelve (12) months that begins on January 1 and endson December 31 the same year.

1. Tax period for individuals

Budget year is a period of twelve (12) months that begins on July 1 and ends onJune 30 of the following year.

“Tax period” means the period of time at the end of which the tax liability accrues.

In some documentation, tax period is referred as fiscal year.

A tax period is the period for which tax is calculated and paid.

An individual, whether they are in business or employed, will calculate their tax

in relation to the calendar year (from 1 January to 31st December) is known asthe tax period.

2. Tax period for companies

The default tax period for a company is also the calendar year. However;

companies may apply in writing to the minister of finance to use a different

12 – month period, under the following conditions:

– The company is required to prepare its accounts under Generally Accepted

Accounting Principles (GAAP); and

– The company presents a sound reason for using an alternative tax period

(for example, aligning their accounting date with a head office or parent

company)

Once a company has been granted approval to change the date, it must

approach the Rwanda Revenue Authority (RRA) so that they configure the new

dates in their tax system. Failure to do so may result in penalties.

All in all, the tax period may be different from the fiscal year depending on the

type of tax:

– For CIT, tax period is always annual.

– For PIT, tax period is annual.

– For PAYE, tax period is monthly but may be quarterly on request,

– For VAT, tax period is monthly but may be quarterly on request for those

who have a turnover which is less than FRW 200,000,000.

– For excise duty, tax period is every 10 days starting with the beginning of each month.Application activity 1.2

– Using examples differentiate direct taxes from indirect taxes.

– The government of Rwanda introduced the local industry promotion

named as “Made in Rwanda”. Explain how the government could usethe taxes in order to protect domestic industries.

1.3. The Residence and the Permanent Establishment (PE)

Activity1.3

Analyze the photos above and answer the questions that follow.

1. What is the residence?2. Discuss on the permanent establishment.

1.3.1. Meaning of residence

A person or a company’s residence position determines their liability to pay

Rwandan tax, especially on overseas income source.

An individual is considered to be a resident in Rwanda if he/she fulfils one of the

following conditions:

– He/she has a permanent residence in Rwanda

– He/she has a habitual abode in Rwanda

– He/she is a Rwandan representing Rwanda abroad

– An individual, who stays in Rwanda for more than 183 days in 12-month

period, either continuously or intermittently, is considered to be a resident

in Rwanda for the tax period in which the 12-month period has ended.

A person other than a natural person may be also considered as a resident in

Rwanda during a tax period if:

– It is a company established under Rwandan law

– It has a place of effective management in Rwanda

– It is a Rwanda Government company.

If any entity has a business in Rwanda, its effective management is determinedby looking at factors such as:

– The day-to-day control and management

– Where shareholder’s meeting is held

– Where the accounting records are kept

– The residence of the main shareholders and directors

– The existence of a business in Rwanda carried on through technologicalmeans (eg a trading website)

1.3.2. The impact of residence

A Rwandan resident person is generally liable to Rwandan income tax on their

worldwide taxable income. Whereas non-resident persons are only liable to

income tax on income generated in Rwanda the same principle applies to

Rwandan resident companies. They are liable to Rwandan corporate income

tax on their worldwide profits, whereas a non-resident company is only liable

to Rwanda corporate income tax on a profit generated through Rwandanpermanent establishments.

1.3.3. The Permanent Establishment (PE)

The Permanent Establishment (PE) definition.

Permanent establishment is defined by the law n° 026/2019 of 18/09/2019

on tax procedures, chapter one called general provisions in article 3 as a fixed

place of business through which an income generating business wholly orpartially conducted.

a) Activities considered permanent establishments

The following are considered permanent establishments according to Rwandan

law:

– A place of management

– A branch

– A factory or workshop

– A mine, an oil or any other place for an exploitation of natural resources

– A site set of construction, construction site, or a place where supervision or

assembly work are carried out – A place for the provision of services, including consulting services, carried

on by a person, with the support of employees or other personnel, for morethan 90 days in a 12 –month period either continuously or intermittently.

b) Activities not considered permanent establishments

The following shall not be deemed to be operations through permanent

establishments:

– The use of facility solely for the purpose of storage or display of goods or

merchandise belonging to the enterprise

– The maintenance of goods belonging to the enterprise for the purpose of

display or storage

– Maintenance of stock of goods for the purpose of processing

– Maintenance of fixed place of business solely for the purpose of purchasinggoods for the enterprise

Maintenance of a fixed place of business solely for the purpose of carrying on

for enterprises any other activities.

Application activity 1.3

– Explain the determinants the residence of natural persons– Describe the activities considered permanent establishments

1.4. List the rights and obligations of the taxpayer accordingto Rwandan tax system

Activity 1.4

Kabera and her mother want to start a shop in Musanze district of selling clothes

in Musanze shop. Her mother is suggesting that before starting they should

meet all taxpayer requirements but Kabera doesn’t understand why he should

do that. He wants to start without wasting time. Help Kabera to understand the

five (5) requirements that any taxpayer needs to start a shop.

1.4.1. The rights of the taxpayer according to Rwandan tax system

i. The right to be informed, assisted and heard

Taxpayer is entitled to have up-to-date information on the operation of the taxsystem and the way in which their tax is assessed.

ii. The right of appeal

The right of appeal against any decision of the tax authorities applies to all

taxpayers and to almost all decisions made by the tax authorities, whether

as regards the application of the law or of administrative ruling, provided thetaxpayer is directly concerned.

iii. The right to pay no more than the correct amount of tax

Taxpayers should pay no more tax than is required by the tax legislation, takinginto account their person circumstances and income.

iv. The rights to confidentiality and secrecy

Another basic taxpayers’ right is that the information available to the tax authorities

in the records of a taxpayer is confidential and will only be used for the purposes

specified in tax legislation. Tax legislation usually imposes very heavy penalties

on tax officials who misuse confidential information. The confidentiality rules that

apply to tax authorities are far stricter than those applying to other governmentdepartments.

1.4.2. The obligations of the taxpayer according to Rwandan tax system

i. Relevant legislation

Taxpayer obligations are mainly governed by law No 026/2019 on Tax procedures.

ii. Registration of a business

Articles 11 and 12 of law 026/2019 specify that an individual must register

with the Rwandan Revenue Authority within seven days (7days) of setting

up a business or company, or starting to generate taxable income. The tax

administration will then issue the taxpayer with the tax identification number

(TIN), which they will use when communicating with the tax authorities and

submitting their tax returns. In particular, the taxpayer should quote their TIN onall returns and backing documentation submitted to the tax administration.

iii. Record-keeping

Taxpayers are obliged to keep records to support the information contained

within their tax declaration.

This rule applies to:

– All companies

– Individuals engaged in business, professional or vocational occupations,

except where their turnover is less than FRW 1,200,000 per tax period

The types of records that are required to be kept depend on the size of the

business. All businesses (except individuals exempted under the rule above) are

required to keep the following books and records:

– Calculations of tax liability

– Documentation of withholding taxes charged

– Documentation showing the obligation to file declaration of a tax withheld,

such as the residence details of the recipient of a payment subject to

withholding tax.

In addition to this, businesses with turnover in excess of FRW 20,000,000 per

year are obliged to keep the following records:

– Business assets and liabilities

– Daily records of income and expenditures

– Purchases and sales of goods and services related to the business

– Records of closing trading stock

Lastly, companies only are required to follow a double entry bookkeeping system

and to accompany their tax declaration with a full set of accounts prepared tothe date of the tax period.

The records must be kept for a period of ten years (10years) following the endof the tax period. They must be at the taxpayer’s premises.

iv. Tax declarations

Articles 13 and 50 of law 16/2018 deal with tax declarations for individual and

companies respectively.

Taxpayers must usually file tax declaration to the tax administration by 31 March

following the end of tax period (this is the case of profit tax using tax period from

1st January to 31st December). The tax declaration for taxpayers in business

will include the accounts (a balance sheet, profit and loss account and other

notes prepared under local GAAP), and other documents as required by tax

administration. Individuals can be exempted from filling a tax declaration if theironly income is employment income that has suffered withholding tax.

1.5. Categories of direct and indirect tax

Activity 1.5

Purity has got an individual business besides being a shareholder in Purity

Manufacturing Co which is a foreign investor installed here in Rwanda,

Gasabo District, Remera sector from January 2018, produce the Juice

for local market and export. Base on facilities created by Government of

Rwanda and international leaving standard, The board of directors appoints

Mrs Kayitesi as Managing director of the company. Her benefit in contract

is FRW 45,000,000. The Managing director is provided with furnished

accommodation and a fueled car. Outline four Categories of taxationaccording to the Rwanda tax system legislation

1.5.1. Direct taxes

In general, direct taxes are levied on profit and income.

a) Personal Income Tax

Personal tax on income is levied on income received by an individual. It may

comprise the following elements:

– Employment;

– Business activities;

– Investment;

– Capital gain;

– Use, sale, lease or free transfer of an immovable property allocated to the business;

– Use, sale, lease or free transfer of movable property allocated to the business.

The following income types are liable to income tax. They can be broadly

categorized as employment income, business activity income, investment

income and capital gain.

For Rwanda resident individuals, the source of income is worldwide while for

non-resident, only income arising in Rwanda is subject to tax. Broadly, amongthe sources of income, we may consider:

– Income generated from performing services (including employment)

– Activities of a craft person, singer, artist or player

– Sports, cultural or leisure activities

– Income of Rwanda permanent establishment

– Income from the use, lease and disposal of movable assets by Rwandan business

– Sale, lease and free transfer of immovable Rwandan business assets

– Farming, fishing and forestry

– Usufruct (right of use of asset) and other rights attached to Rwandan

Business assets

– Income from investment in share (i.e., dividends)

– Sales or transfer of shares and debentures (capital gains tax)

– Change of partnership profit into shares, such that a partner’s interest increases

– Distributions of partnership profits to partners

– Income from lending and deposits(interest)

– Transfer, sales and lease of intellectual property

– Other income generating activities that are not classified as exempt

According to Rwanda legislation, all income types raised are subject to tax.

They can be categorized as follow:

• Personal Income Tax (PIT)

PIT real regime

PIT flat

PIT lump sum

Rates of income tax for vehicles transporting persons

Rates of income tax for vehicles transporting goods

Pay As You Earn (PAYE)

Investment income tax

Interest income

Dividend incomeRoyalty income

• Capital gain

• Rental income (here ignore housing which is decentralized)

• Tax on minerals

• Taxes on gaming activities

• Different types of withholding taxes

• Quarterly payment

b) Corporate Income Tax (CIT)

Rwandan resident companies, if not exempt bodies, pay corporate income tax

on all of their taxable income sources. The principles of what is taxable, and

which expenses are tax deductible, are similar to those for Personal Income Tax

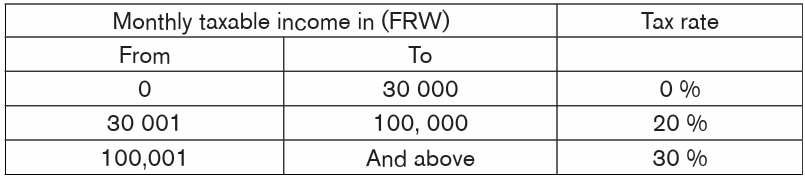

(PIT) but different tax rates are applied. For CIT, a fixed rate of 30 % is applied

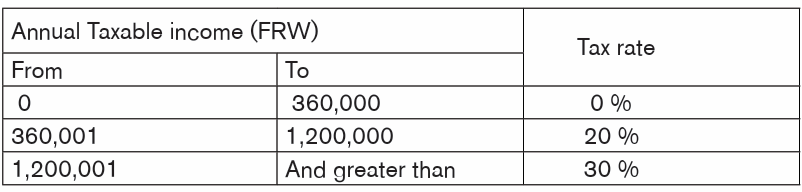

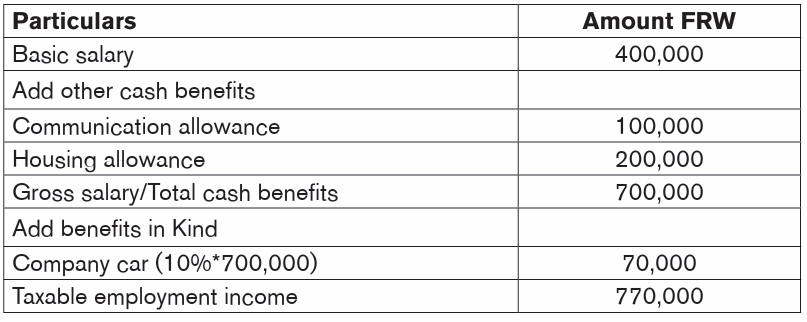

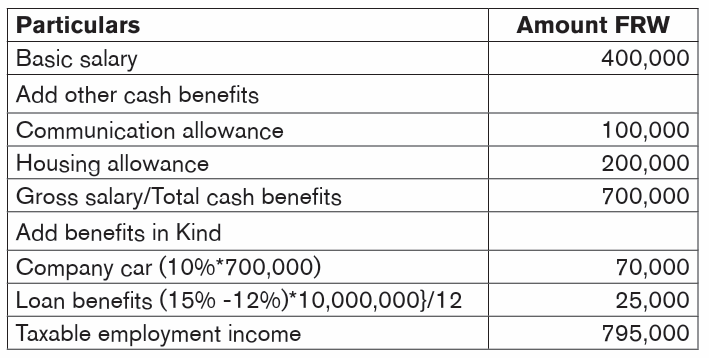

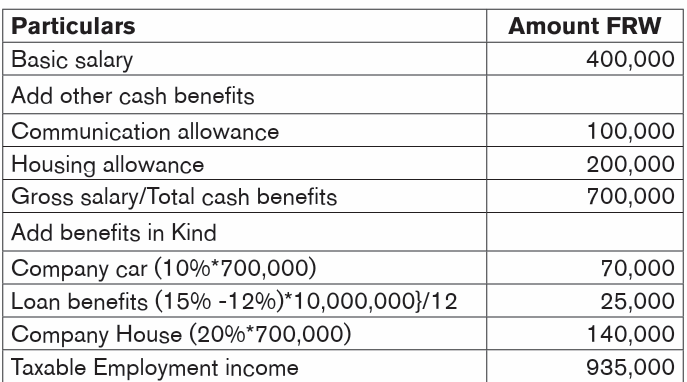

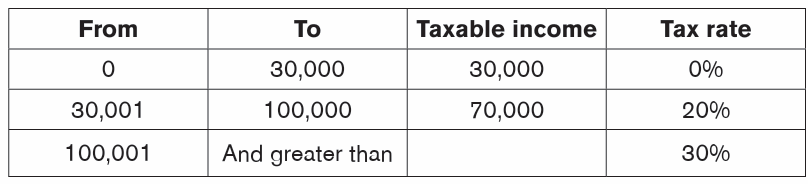

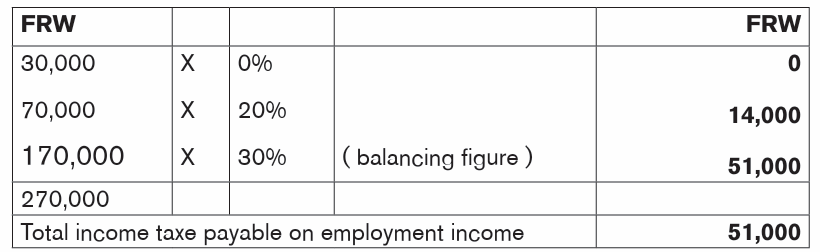

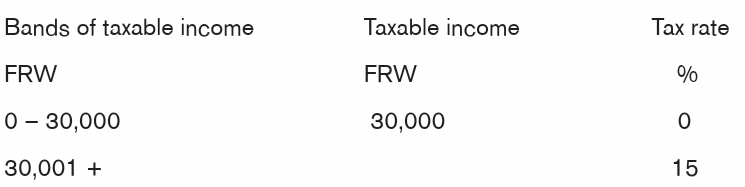

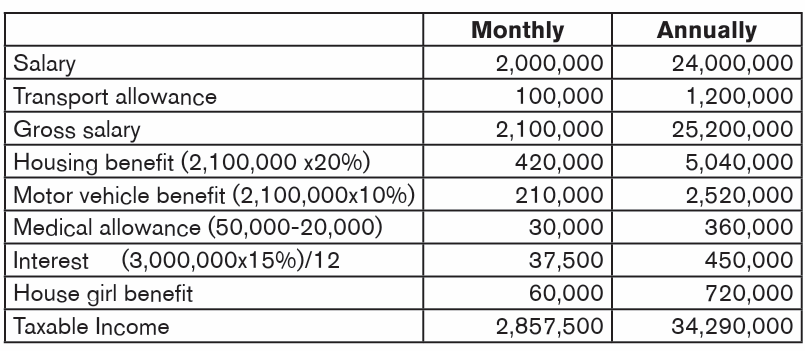

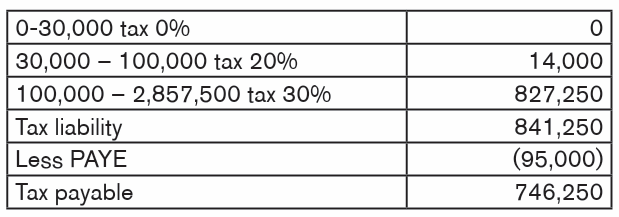

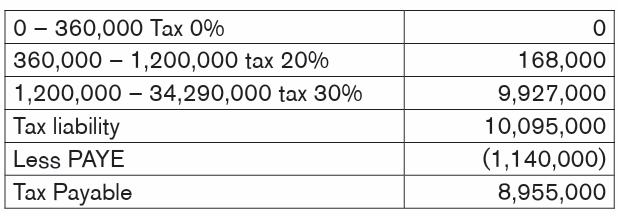

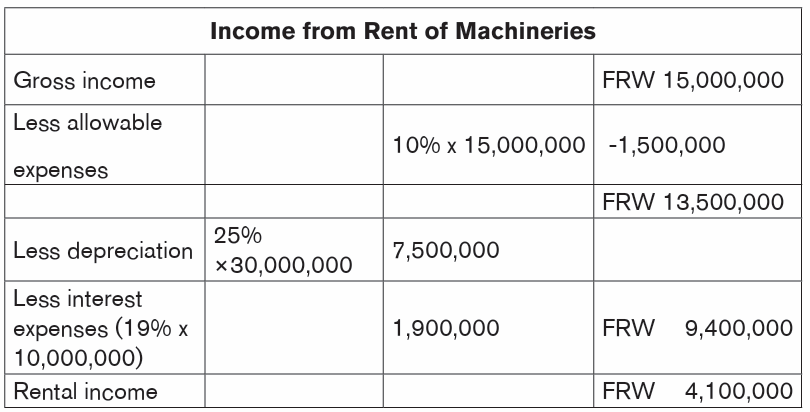

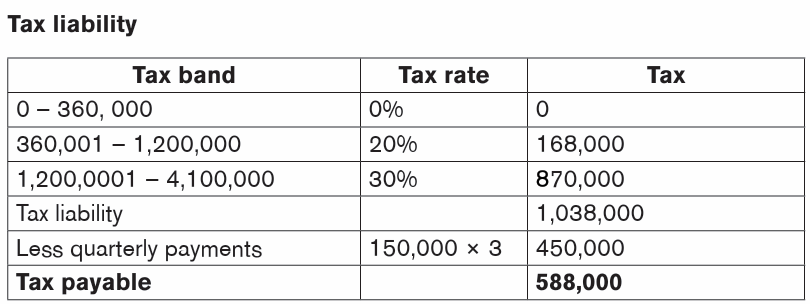

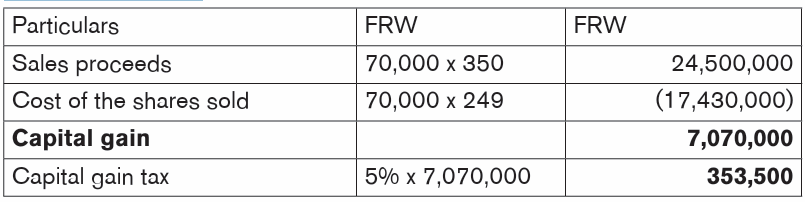

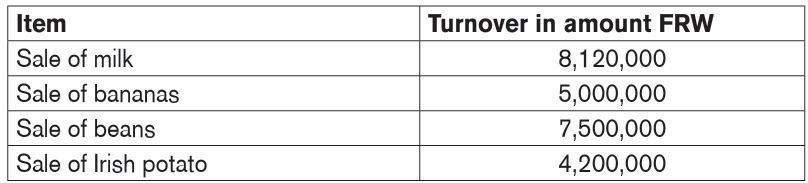

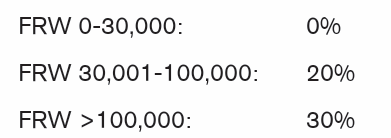

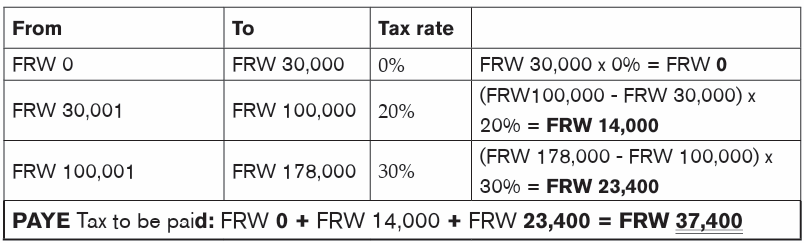

on the nearest thousand profits while for PIT we use the following progressivetax rate:

1.5.2. Indirect taxes

In general, indirect taxes are applied on consumption of goods and services.

a) VAT

– VAT is an acronym for the term Value Added Tax

– It is an indirect tax on “taxable supplies” made by a “taxable person”

– Subject to all taxable goods and services– Two tax rates in force:

Standard rate of 18%

Zero rate (0%)

A taxpayer must register for VAT if his turnover is above FRW 20,000,000

for any twelve-month period or above FRW 5,000,000 for three consecutive

quarters. In addition, any taxpayer may choose to register voluntarily for VAT if

he doesn’t meet the threshold.

b) Excise tax– Excise tax is imposed on specified goods /service produced locally or

imported to be consumed in the country.

– Excise tax was established in Rwanda in 1960 and is levied on locally

produced beers, lemonades, mineral water, juices, liquors, wines, fuel,

vehicles, powdered milk, as well as on cigarettes, etc… and their imported

counterparts if appearing on the list published in the consumption tax law.– Excise tax is also levied on telephone communication since year 2007.

Application activity 1.5

1. Explain the following fiscal terms:

– Personal income tax

– Corporate income tax

– Withholding tax2. Outline main Source of income liable to personal income tax

1.6. Definition of terminologies used in taxation

Activity 1.6

Analyze the following scenario and answer questions that follow: Marc is

a prominent trader in one of the growing centres of Eastern Province. He

normally buys his goods from the neighbouring country of Uganda. In the

previous budget, the minister announced that in order for the government

to be able to fund its activities such as providing free education, road

construction, all people will pay a certain amount of money to the government

but charged on the goods sold and bought in form of taxes. Marc realized

that this might reduce his profits. Therefore, he decided that in order to

continue getting the same profits, he would:

– Decisions 1 pay some boys to get for him some goods from Uganda by

crossing the river without going to customs to pay taxes.

– Decision 2 for goods on which he would pay taxes, he would increase

the prices charged to the customers.

– Decision 3 or stop buying some of the goods on which the tax had

been increased.

Questions:

Q1. From the scenario, what do you think is the meaning of the following:

– Tax.

– Taxation.

– Tax avoidance.

– Tax evasion.

– Tax shifting.

Q2. From the decisions Ruth made, which of them is:

– Tax avoidance.

– Tax evasion.

– Tax shifting.

Q3. Among the three actions, which one (s) do you think he can be penalized

for? And why?

1.6.1. Terminologies used in taxation

Tax burden: Tax burden this is the effect of a tax on the taxpayers.

Tax incidence: Tax incidence (or incidence of tax) is an economic term for

understanding the division of a tax burden between stakeholders, such as

buyers and sellers or producers and consumers.

A tax incidence is effectively the burden that a party, either an individual or

business, ultimately bears, even if they’re not the ones directly paying a tax. For

example, a sales tax on clothing would be paid directly by consumers at the timeof purchase.

Tax impact: The impact of a tax is the first point of contact with the taxpayers.

The term impact is used to express the immediate result of or original imposition

of the tax. The impact of a tax is on the person on whom it is imposed first. Thus,the person who is Habile to pay the tax to the government bears its impact.

Tax base: Tax base refers to the items /activities or value on which tax can be

imposed to raise tax revenue or activities/incomes covered by the tax system inan economy.

The tax base is the total amount of income, property, assets, consumption,

transactions, or other economic activity subject to taxation by a tax authority. A

narrow tax base is inefficient. A broad tax base reduces tax administration costsand allows more revenue to be raised at lower rates.

Taxable capacity: Taxable Capacity refers to the maximum capacity that a

country can contribute by the way of taxation both in ordinary and extra ordinary

circumstances. In other words, it refers to the maximum capacity of the people

of a country to bear the burden of taxation without much hardship.

Determinants of Taxable CapacityThe taxable capacity of a country is determined by a number of factors. The

main factors are:

1. Size of income and wealth: generally, the larger wealth and income of the

country, greater is its taxable capacity. Hence rich nations have a higher

taxable capacity than poor nations.

2. Stability and Growth of income: basically, if the economy operates

smoothly and progresses well, and ensures a stable and growing

income, the taxable capacity of the community will be higher. But it

here is fluctuations with serious ups and downs, and especially during a

depression, taxable capacity will obviously be lower.

3. Standard of living of the people the standard of living determines

the consumption pattern and habit of the community. A community

accustomed to greater needs as satisfaction on account of living, cannot

bear great sacrifice in paying taxes, hence its taxable capacity will be

less. But if the standard of living is low, there is a greater surplus available

for taxation, so that taxable capacity will be high.

4. Price level: if the price level is reasonably low and stable, a high income

means greater taxable capacity. But, if prices are rising fast, a very high

income may also pose a low capacity in real terms.

5. Characteristics of the tax system: a multiple tax system has a greater

advantage of enlarging the overall taxable capacity than a single tax

system.

6. Nature and purpose public expenditure: public expenditure is largely for

developmental schemes the productivity power of the country improves

and order is very essential for improving taxable capacity enlarges.

Further taxation intended for financing capital formation is therefore quite

justified as it raises the taxable capacity in effect.

7. Political condition: Generally, when people appreciate the government,

they will be willing to undergo many hardships and bear heavier taxes to in

order to enable the government to undertake welfare measures beneficial

to the common people, hence the taxable potential automatically expands.

Tax evasion: Tax evasion occurs when a person or business illegally avoids

paying their tax liability, which is a criminal charge that’s subject to penalties

and fines.

Tax avoidance: Tax avoidance is where the taxpayer carries out his or her

business in such a way that he will be required to pay less tax by exploiting the

loopholes in the tax law/system. Tax avoidance is when an individual or company

legally exploits the tax system to reduce tax liabilities, such as, establishing an

offshore company in a tax haven. It means paying as little tax as possible while

still staying on the right side of the law.

Tax exemption: Tax exemption is exoneration from paying tax granted by Tax

Administration. A tax exemption is the right to exclude all or some income from

taxation by governments.

Tax shifting: Tax shifting this is the transfer of either part or the whole amount

of the tax imposed on a tax payer to another party. It is the transfer of the tax

burden to another party. This is mainly with indirect taxes where the producers

or sellers usually shift the burden to the consumers by increasing prices of

commodities on which they are charged.

Backward shifting occurs when the price of the article taxed remains the same

but the cost of the tax is borne by those engaged in producing it.

Taxpayer: Taxpayer is any person who is subject to tax according to the taxlaws of Rwanda.

Budget year: Budget year is a period of twelve (12) months that begins on July

1 and ends on June 30 of the following year.

Tax Administration: In Rwanda, Tax administration is represented by Rwanda

Revenue Authority.

Fiscal Year: Fiscal Year is a period of twelve (12) months that begins on

January 1 and ends on December 31.

Authorized officer

Authorized officer as an officer of the tax administration empowered by the

competent organ to conduct audit, investigations, negotiate with the taxpayer,

make adjustments, prepares and issues tax assessment notices of assessment,

drafts affidavits and who is responsible for any other act necessary to ensure the

enforcement of the law on tax procedures and other laws in relation to collection

of tax, and who is issued with means of identification to possess such powers.

1.6.2. Characteristics of a Tax.

The definitions point out four main characteristics:

– There is no quid-pro- quo in tax:

Tax is not levied for a return for a specific service rendered by government to

taxpayers. An individual cannot ask for any special benefit from the government

in return for the tax paid.

– It is a compulsory contribution:

It is imposed by the government on individuals, households, or companies.

Because of its compulsory nature, those who do not pay it are reliable to being

punished but it is to be paid by those who come under its jurisdiction.

– It involves a sacrifice:

It is a payment by taxpayers which is used to benefit all the citizens whereby the

government uses the collected revenues to establish infrastructures such as

hospitals, schools as well as other public utility services.

– It is paid out of total wealth:

Meaning tax is computed based on a certain specific percentage of the totalincome.

Application activity 1.6

– Differentiate tax incidence from tax impact

– Discus the characteristics of tax- With examples, differentiate Tax avoidance and Tax evasion

1.7. The canons/principles of taxation

Activity 1.7

Analyze the Photos below and answer the questions that follow.

Refer to the picture above and state the Canons / Principles of Taxation

1.7.1. The Canons / Principles of Taxation

Canon of Equity

The principle aims at providing economic and social justice to the people.

According to this principle, every person should pay tax to the government

according to his ability and not the same amount. The rich class people

should pay higher taxes to the government, because without the protection of

government authorities (Police, Defense, etc.) they could not have earned and

enjoyed their income. Adam Smith argued that the taxes should be proportional

to income, i.e., citizens should pay the taxes in proportion to the revenue which

they respectively enjoy under the protection of the state.

The progressive rates of taxation are adopted in most countries to satisfy thisprinciple.

Canon of Certainty

According to Adam Smith, the tax which an individual has to pay should be

certain, not arbitrary. The taxpayer should know in advance how much tax he

has to pay, at what time he has to pay the tax, and in what form the tax is to be

paid to the government.

In other words, every tax should satisfy the canon of certainty. At the same time

a good tax system also ensures that the state/government also be certain aboutthe amount of revenue and the time when it is expected to flow to the treasury.

Canon of Convenience

The mode and timing of tax payment should be as far as possible, convenient

to the tax payers. By this principle, Adam smith means that the tax should be

levied at the time and the manner which is most convenient for the contributor

to pay it. Every tax ought to be levied at the time or the manner in which it is

more convenient for the taxpayer to pay. E.g.; payment of VAT, the consumer is

convenient because one pays it when he/she buys the goods and at the timewhich he has the means to buy.

This principle lay down that both the time and manner of payment should be

convenient to the taxpayer. In the Words of Adam Smith: “Every tax ought to be

levied at the time or in the manner in which it is most likely to be convenient forthe contributor to pay it”.

Canon of Economy

Tax system should be economical for the state to collect the tax, i.e. the cost of

collection should not exceed the amount of tax to be received. The tax should

also be economical to the taxpayer i.e. the tax payer should have sufficient money

left with him after payment of tax. A very heavy tax will discourage savings andinvestment and thus adversely affect the productivity of the economy.

The canon of economy implies that the expenses of collection of taxes should

not be excessive. This principles state that the cost of tax collection should be

lower than the amount of tax collected. Every tax should satisfy the economy intwo ways.

Canon of Productivity

The principle of productivity indicates that a tax when levied should produce

sufficient revenue to the government. A system that generates small revenue for

the government is normally discouraged. This is a good principle to follow in adeveloping economy.

Canon of Elasticity

According to this principle, every tax imposed by the government should be

elastic in nature. In other words, the income from tax should be capable of

increasing or decreasing according to the requirement of the country. For

example, if the government needs more income at time of crisis, the tax shouldbe capable of yielding more income through increase in its rate.

Canon of Flexibility

It should be easily possible for the authorities to revise the tax structure both

with respect to its coverage and rates, to suit the changing requirements of

the economy. With changing time and conditions, the tax system needs to be

changed without much difficulty. The tax system must be flexible and not rigid.

Canon of Simplicity

Canon of simplicity implies that the tax system should be fairly simple, plain and

intelligible to the tax payer. It should not be complicated; if it is complicated and

difficult to understand, then it will lead to oppression and corruption.

Canon of Diversity

This principles state that the government should collect taxes from different

sources rather than concentrating on a single source of tax. It is not advisable for

the government to depend upon a single source of tax, it may result in inequity

to the certain section of the society; uncertainty for the government to raise

funds. The government should collect revenue from its citizens by levying directand indirect taxes. Variety in taxation is desirable from the point of view of equity.

Application activity 1.7

1. Why is it important to have principles of taxation?

2. Referring to the principles (characteristics) of a good taxation system you

know, briefly explain why each is important to the taxpayer and tax authority (RRA).

3. In your community, you have probably heard people and business people

complaining about the taxes they pay or charged to different or similar items.Identify any 5 things you have heard normally people complain about.

1.8. The importance of tax and the Classification of taxes

Activity 1.8

Analyse the Photos below and answer the questions that follow.

1. With examples from your community or Rwandan community at large,

why do you think people and business enterprises need to pay taxes

to the government?

2. The Government of Rwanda had introduced the local industry

promotion named as Made in Rwanda. Explain how the Governmentcould use the taxes in order to protect domestic industries.

1.8.1. Importance of paying taxes

a) Importance of paying taxes to the government

– Source of government revenue.

Taxes are the main source of government

revenue to finance its public expenditure. Thus, taxes enable the government

to pay its workers, construct roads, maintain security, and provide health

care, education among others.

– Taxes benefit the Rwandan government to meet its objectives and goals

such constructing affordable houses to the citizens which helps improve

the standards of living.

– Taxes help the government to finance its policies especially on poverty

alleviation through programs such as “GIRINKA”, “VUP”, and “UBUDEHE”

among others.

– Taxes enable the government to regulate the prices of goods and services

in the country hence ensuring a low cost of living and maintaining the

standards of living of the citizens.– Taxes enable the government to maintain a balance between the poor

and rich. The government uses the taxes from business people to provide

services needed by the poor, which otherwise the rich could not provide– Taxes enable the government to promote its policy industrialization through

reducing products from other countries that would otherwise out compete

the home industries.– Taxes enable the government to ensure that the citizens have enough

products. This can be through taxes charged to reduce products moving

out of the country or removing taxes on goods needed in the country. This

helps maintain a high standard of living.

b) Importance of paying taxes to Society– There are reduced rates of poverty among the community due to a

significantly equal distribution of income through various activities and

projects set by the government.– Improved wellbeing among the vulnerable and elderly as they benefit from

the different government programs financed through taxes. – Reduced infant mortality rates and increased life expectancy due to

improved access to health facilities and services. – Increase in the percentage of the population that completes secondary

and TVET education, reducing the literacy levels, improving on the peoples’

skills through programs such as 12YBE.

• Increased community/social solidarity, general happiness, life

satisfaction, and a significant more trust among the community members

and for public institutions.– Taxes are charged on some products to discourage their production and

usage hence controlling over-exploitation of resources as well as protecting

the environment which is vital for the existence of the society.

1.8.2. Classification of taxes

Taxes can be classified in the following ways:

a) According to its nature

• Personal, poll or capitation tax: It is a tax of a fixed amount on individuals

residing within a specified territory, without regard to their property,

occupation or business. Ex. Community tax (basic)

• Property- imposed on property, real or personal, in proportion to its

value, or in accordance with some reasonable method or apportionment.

Ex. Real estate Tax

b) According to who bears the burden of the tax?

• Direct- the tax is imposed on the person who also bears the burden

thereof Ex. Income tax, corporate tax etc.

• Indirect –imposed on the taxpayer who shifts the burden of the tax to

another, Ex. VAT

c) According to the method of determination of amount of tax

• Specific –imposed and based on a physical unit of measurement as

by head number, weight, length or volume. Example: fermented liquors, cigars.

• Ad Valorem of a fixed proportion of the value of the property with respect

to which the tax is assessed. Ex, Real estate tax, excises tax on cars.

d) According to purpose

• General, fiscal, or revenue - imposed for the general purpose of

supporting the government. Example: Income tax, percentage tax.

• Special or regulatory - imposed for a special purpose, to achieve

some social or economic objective. Ex. Protective tariffs or custom

duties on imported goods intended to protect local industries.

e) According to scope or authority imposing the tax

• Centralized - imposed by the national government ex; CIT, PIT

• Decentralized - imposed by municipal corporations or local

Governments ex. property tax, rental tax and other fees

f) According to graduated scale of rates.

• Progressive taxes: a tax is progressive if the tax rate increases as the

income increases. Example: Pay As You Earn (PAYE), the rate increases

as the income increases where from FRW 0 - 30,000 the rate is 0%,

from 30,001 - 100,000 the rate become 20% and from FRW 100,001

and above the rate become 30%.

• Regressive taxes: a tax is regressive if the tax rate reduces with the

increase in levels of income. As income increase the tax rate decreases.

Example, a person earning FRW 100,000 = pays 10% of his income

and a person earning FRW 200,000 = pays 5%.

• Proportional taxes: proportional taxes are also called flat taxes.

The tax rate is constant for all levels of income. People of low income

and people of high income pay taxes at the same rate. Example:Value

Added Tax (VAT), the rate is fixed to 18% irrespective the taxable value.

This means that the even if the rate is fixed but the taxpayer pays thedifferent amount depends on his/her taxable value.

All tax payers irrespective of their income levels pay 20% of their income as a

tax. This does not mean that they pay the same amount but rather they pay thesame rate.

Application activity 1.8

– By giving specific examples from your community, how does your society

benefit from taxes?– What do you think would happen in the country if taxes were not paid?

Source of Taxable Income

According to Article 5 of Law 16/2018, income taxable in Rwanda includes the

following activities performed in Rwanda by any person and activities performed

abroad by a resident of Rwanda:

i. Services and employment;

ii. Activities of a crafts person, singer, artist and a player;

iii. Sports, cultural and leisure activities;

iv. Activities carried on by a non-resident through a permanent establishment

in Rwanda;

v. Use, sale, lease and free transfer of business movable assets;

vi. Sale, lease and free transfer of immovable assets allocated to the business;

vii. Crop farming, animal farming, fishing and forestry activities;

viii. Usufruct and other rights attached to immovable assets and their sale if

such rights are allocated to the business;

ix. investments in shares of companies;

x. Direct or indirect sale or transfer of shares or debentures;

xi. Change of profits into shares that increases the capital of partners;

xii. Distribution of profits among partners;

xiii. Lending, deposits and other similar income generating activities;

xiv. transfer, sale and lease of intellectual property;xv. Any other income generating activities.

Skills Lab 1

Through internet or after a field visit to RRA office, students are required toprepare a written report on taxes administered in Rwanda.

End of unit assessment 1

Q1. It is said that “tax is the free money to central or local authorities from

taxpayers” do you agree with this statement. Justify your answer

Q2. Describe any four characteristics of a good tax.

Q3. Discuss the classification of taxes

Q4. Which one of the following circumstances would be the minister permit

a tax period other than 31 December?

p) Claude Karera, an individual in business, whose trade is seasonal;

he is very busy at the time when the tax return is required to be filed

q) Musoni ltd, a small enterprise not required to prepare accounts

under GAAP

r) AB Ltd, a large company preparing its accounts under GAAP, which

wishes to prepare accounts to 30 June for commercial reasons

s) CD LTD, a large company preparing its accounts under GAAP, which

wishes to prepare accounts to 30 June in order to delay its tax liabilities

Q5. Which two of the following individuals would be treated as resident in

Rwanda in the tax period 2019?

– Solange Mukandanga, an individual whose habitual abode in Rwanda

but who is currently travelling around the world and will be away for

the whole of 2019

– Harry James, UK citizen who been seconded to Rwanda by his

employer for the period 1 September 2019 to 30 April 2020 – he is

staying in hotels while in Rwanda, and he has never visited Rwanda

prior to his secondment– Sophie smith, a colleague of Harry James, who was seconded to

Rwanda for the periods 1 December 2018 to 31 January 2019 and

15 April 2019 to 31 august 2019, but has now returned to the UK (her

usual home)

– Hank Azarea, a US citizen who owns a hotel as a business in Rwanda

but has only visited Rwanda for two weeks in 2019; he does not have

a Rwandan home

a. 1 and 2

b. 1 and 3

c. 2 and 3d. 3 and 4

Q6. Which of the following tax principle require to have multiple taxes in

order to ha have a good tax system?

A. Simplicity

B. Economy

C. Convenience

D. Diversity

Q7. According to …… principle, a good tax system should yield enough

revenue for the government activity

A. Economy

B. Productivity

C. Equity

D. Simplicity

Q8. Tax evasion is illegal while tax avoidance is legal

A. True

B. False

Q9. Which of the following does not explain a resident individual?

A. An individual with permanent resident is Rwanda

B. An individual with habitual abode in Rwanda

C. A Rwandan ambassador in USA

D. A foreigner who has stayed in Rwanda for 167 days

Q10. Which of the following is considered as a permanent establishment

as per the Rwandan tax Law?

i. A factory or a workshop;

ii. A mine, a quarry or any other place for an exploitation of natural resources;

iii. Maintains a stock of goods or merchandise belonging to him/her solely for the purpose of storage;

iv. A site set for construction, construction site or a place where supervision or assembly works are carried out;

v. Maintains a stock of goods or merchandise belonging to him/her solely for the purpose of processing by another person;

A. I and II

B. I, ii, iii

C. I, ii, iv

D. All the above

Q11. A tax which increases as the income increases is

A. Progressive tax

B. Proportion tax

C. Regressive tax

D. Digressive tax

Q12. Which of the following is not a source of income for tax in Rwanda

A. Activities of a crafts person, singer, artist and a player;

B. Sports, cultural and leisure activities;

C. Activities carried on by a non-resident through a permanent establishment in Rwanda;

D. Loan and grants

Q13. Which of the following taxes is classified as a direct tax

A. Capital Gain tax

B. VAT

C. Import duty

D. Excise tax

Q14. All duties are taxes but not all taxes are duty

A. TrueB. False

UNIT 2: LAWS RELATED TO BUSINESS ACTIVITIES

Key unit competence: To be able to identify laws related to business activities

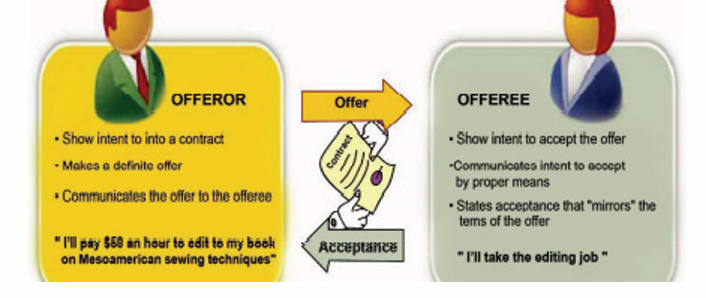

Introductory activity: A case study

Looking at the situation above in photo and talk about the activities carried out there.

In Rwanda today we have many businesses having different organization

according to their activities. These organizations may be public or private.

As a result of liberal economy Rwanda is currently adopting, any legal

entity or person is allowed to carry out business activities. For instance, a

business organization can be a company which is traditionally a business

organization, a cooperative or individual him/ herself. These kind of

business activities need order, standards, right protection in order to

clear some disputes that may happen. What is the solution to thesechallenges in business?

2.1. Law and Business Law

Activity 2.1

A community made up of people who concerned to pursue their own self

interest, needs regulation because there are situations where everyone

pursues their own self-interest, everyone will be worse off than they would

have been if they acted differently.

Through the situation at school and in your home community, what cangovern relationships between individuals and their society?

2.1.1. Meaning of law

The word “law” is difficult to define, particularly as it is used in different ways.

It contains, however, the concepts of orderliness, universality and objectivity.

Nonetheless, one may define it as a set of binding rules established and enforced

by competent authorities in order to govern relationships between persons in

a given community. The binding aspect of a legal rule is very meaningful as it

differentiates it from other norms such as moral rules, ethical or religious rules

which are deprived of immediate sanctions once they are violated.

Law is defined as a body of enforceable rules governing relationships between

individuals and their society (Miller & Jentz, 2008).

Law is a social phenomenon; as the roman maxim says, there is no society

without rules: “Ubisocietasibi jus”. In the middle Age, law was considered to

have been dictated by Divine Will, and revealed to wise men. This was known as

natural law deriving from God and transcending personal will of any individual.

From the time of ancient Greek empire to the contemporary world, law has been

and remains a human phenomenon.

Philosophers, writers and politicians have always demonstrated the importance

of legal norms meant to regulate relationships within communities. However, the

way it is perceived, its interpretation and its sources have undergone several

mutations.

The term” law” can be defined in different ways by different scholars. More

commonly, when people speak of law, they refer to the rules themselves. The

law says that you” must ...”, a phrase we use and hear. This is the sense in whichthe law will be generally used.

Therefore, the law can be defined as follows: Law is a set of principles;

rules and standards of conduct that have general application to the society,

have been developed by an authority for that society and for which the violation

imposes a sanction.

2.1.2. Business law

This covers business related activities like law of insurance, law of bankruptcy,

agency relationship, sale of goods, negotiable instruments, company law,

carriage law, banking law and labour law.

Business law is a section of code that is involved in protecting liberties and

rights, maintaining orders, resolving disputes, and establishing standards for the

business concerns and their dealings with government agencies and individuals.

Application activity 2.1

a) What do you understand by law?

b) Explain what you understand by law governing relationships. Mention

your opinion.

c) Why do you think that law is set of principles; rules and standards of conduct?d) Do you think law is necessary in society?

2.2. Important terms used in law

Activity 2.2

Looking at the photo above, think about the activities being carried out. Then

discuss some terms used during these activities.

2.2.1. Claimant/Plaintiff:

This is the person who sues another in a court of law. Or a plaintiff is the person

or entity initiating a lawsuit by filing a complaint in a court of law.

2.2.2. Defendant:

This is the one against whom a law suit is brought.

2.2.3. Appellant:

A person who appeals to a higher court against a decision of a lower court and

requests that that decision be set aside.

2.2.4. Law suit:

Accusation in the court of law

2.2.5. Remedy:

This is the relief given to the innocent party to enforce a right or to compensate

for violation of a right.

2.2.6. Counsel:

Legal advice given in a case; also means a lawyer or attorney in a case.

2.2.7. Damages:

Money that a defendant pays to the plaintiff in a civil case if the plaintiff has won

the case.

2.2.8. Fine:

Money paid by the defendant to the public or government

Application activity 2.2

Discussion in groups on the meaning of the following terms used in law:

Plaintiff: this is the person who sues another in a court of law. Or a plaintiff is

the person or entity initiating a lawsuit by filing a complaint in a court of law.

Defendant: this is the one against whom a law suit is brought.

Appellant: a person appealing to a higher court against a decision made by a

lower court, seeking reversal of that decision.

Damages: money that a defendant pays to the plaintiff in a civil case if the

plaintiff has won the case.

Fine: Money paid by the defendant to the public or government

2.3. Importance of business law in business operations

Activity 2.3

One of the most frequently debated topics is business. Business is the effort

of individuals to produce and sell, for a profit, the goods and services that

satisfy society’s needs. The goals of the business will vary based on the type

of business and the business strategy being used. The money raised from

business supports the government and allows it to fund in public expenditures.

As a business to be or referring to business activities in your community, what

are benefit of law in the businesses?

With examples from your community or Rwandan community at large, why doyou think people and business enterprises need law?

Business law refers to a set of laws that govern the dealings regarding commercial

matters, namely business organizations. It encompasses all laws that guide on

how to set up a business and then how to run it. This includes all the laws that

govern on how to set up, start, manage, run, close or sell a business. It includes

contracts, laws of corporations, other business organizations, commercial

papers, income tax, secured transactions, intellectual properties, and othertransactions and dealings related to the business.

2.3.1. The prime purpose of business law

The prime purpose of business law is to maintain order, resolve disputes,

establish generally accepted standards, protect rights and liberties when it

comes to business and its relation to other businesses, government authorities,and the customers.

2.3.2. The importance of business law

– Set of standards: Earlier, the customer had to suffer a lot due to the

absence of a proper law that could safeguard their interests and money

invested in a particular business. As there was no such law regarding

maintenance of order, rights, and liabilities, etc., the business owners made

their own standards and made the customers suffer just because of the

greed to make more money. With the establishment of business law, many

standards have been established which have to be followed by businesses.

– Maintain Equilibrium: This creates a sense of satisfaction among

customers. In the absence of the law, different countries had different laws

regarding the business dealings which made it difficult for the customersas well as the seller to establish a deal. But now every country has the same

standards, and the deal between buyer and seller is easily established. This

brings ease in business dealings and transactions all across the globe.

– Decrease chances of frauds: Business law helps the owners themselves

to get aware of the laws against other businesses and individuals. It also

helps the individuals, to be aware of the rights against the businesses so

that they can use them in case they fall prey to the frauds and misery of the

business.

– Presence of Ethical conduct: With the help of business law, business

owners may make better decisions, and also know when to seek legal help.

Every business has to maintain an ethical conduct but most businesses, in

the greed to earn more profits; do not follow such conducts. Business law

makes it mandatory for all the businesses to maintain an ethical conductwhich in turn pleases the buyers and they form a good image of the business.

Application activity 2.3

1. Determine why the business law is important to business.

2. Identify how the business law protects people from harmful business practices

2.4. Laws related to businessToday in Rwanda we have many businesses having different organization

according to their activities. In Rwanda, there are arms of the government

(ruling bodies) from the village, sector, district, provincial and national levels.

These bodies comprise: Legislature (who make laws), Executives (who

enforce laws) and Judiciary (exercise laws).

With examples from your community or Rwandan community at large, why doyou think people and business need different laws to govern their activities?

2.4.1. Land act:

An Act to provide for the tenure, ownership and management of land, to amend

and consolidate the law relating to tenure, ownership and management of land;

and to provide for other related or incidental matters.

2.4.2. Food and drugs law:

The Food and Drug Act prohibited interstate commerce in misbranded and

adulterated foods, drinks, and drugs. While it has since been repealed, new

laws regulate a wide range of consumer products. This Law establishes

Rwanda Food and Drugs Authority and determines its mission, organizationand functioning.

2.4.3. Consumer protection law:

Consumer protection laws offer an important part of a reliable market economy.

While “buyer beware” was once the motto of the free market, these regulationshelp keep sellers honest, with no threat of unpleasant surprises.

2.4.4. National environmental law:

This Law determines modalities for protecting, conserving and promoting the

environment against climate change. Environmental law refers to a variety ofprotections which share the goal of protecting the environment.

Application activity 2.4

Discuss on the role of laws related to business in Rwanda

2.5. Legal institutions related to businesses in Rwanda

Activity 2.5

In Rwanda today we are living in society where there are many government

institutions whose mandate is to accelerate Rwanda’s economic development,

introduced to facilitate the wellbeing of the society as well as the business.

As a business to be or referring to business activities in your community,which government institutions do you think businesses need?

2.5.1. Commercial Courts:

The commercial court system, established in 2008, is made up of three

commercial courts based in the three major urban areas in Rwanda, that is:Kigali, Musanze and Huye and the Commercial High Court located in Kigali.

These courts were introduced to handle commercial matters in order to deal

with a big backlog of commercial cases, speed up the resolution of businessdisputes and thus play a part in the promotion of investment in the country.

2.5.2. Rwanda Revenue Authority (RRA):

The Rwanda Revenue Authority is a government revenue collection agency

established by the Parliament of Rwanda. The RRA is charged with enforcing,assessing, collecting, and accounting for the various taxes imposed in Rwanda.

2.5.3. Rwanda Development Boards (RDB):

Rwanda Development Board (RDB) is a government institution whose mandate

is to accelerate Rwanda’s economic development by enabling private sectorgrowth.

The Rwanda Development Board is under the supervision of the Office of

the President and is governed by a Board of Directors made up of global

entrepreneurs and experts.

RDB was established in 2008 out of a merger of 8 Government institutions,

primarily to create a One Stop Shop for business and investments. RDB has

been built with global expertise and modelled on international best practice.

Currently, RDB’s key services are; Investment Promotion, Export & Special

Economic Zone (SEZ) Development, Investment Deals Negotiation, Tourism

and Conservation, Skills Development and One Stop Center services (business

and investment registration, visa facilitation, tax incentives management, etc.)

RDB is here to provide support throughout the entire investment journey and

to ensure that Rwanda remains one of the best places to do business in Africaand the World.

2.5.4. Rwanda Utilities Regulatory Authority (RURA):

Rwanda Utilities Regulatory Authority (RURA) was initially created by the Law

n° 39/2001 of 13 September 2001 with the mission to regulate certain public

utilities, namely: telecommunications network and/or Telecommunications

services, electricity, water, removal of waste products from residential or

business premises, extraction and distribution of gas and transport of goodsand persons.

2.5.5. Food and Drug Authority (FDA):

The FDAR Department protects and promotes human and veterinary public

health through conducting assessment and evaluations of application dossiers

for processed foods/ drinks, food additives, food supplements, both human

and veterinary medicines, vaccines and other biologics, medicated cosmetics,

medical devices, chemicals and pesticides, and tobacco and tobacco products.

The FDAR Department also recommends for registration and/or marketing

authorization (MA) to products that comply with Rwanda FDA regulatoryrequirements for registration.

2.5.6. Rwanda Standards Boards (RSB):

Rwanda Standards Board (RSB) is a public institution established by Rwanda

Government Legislation N° 50/2013 of 28/06/2013 determining the mission,

organization and functioning of the Rwanda Standards Board to undertake all

activities pertaining to the development of Standards, Conformity Assessment

and Metrology services in the country.

It is the only body with powers to define and possess national standards. Public

services and public or private firms must present their standards to RSB for

adoption at national level. RSB is governed by the Board of Directors composed

of major stakeholders from government, industry and academic institutions, aswell as consumer associations.

Application activity 2.5

Discuss the role of institutions governing business in Rwanda.

2.6. Business registration according to forms of business

Activity 2.6

Registering a business can be one of the best ways you can expand your

business and help ensure its success. Rwanda has the fewest procedures

and fastest processes to register and start a business.

Search and share the information of registering some businesses in Rwanda.

As a business to be in your community and in Rwanda at large, what kind ofbusiness do you think need to be registered.

2.6.1. Registering a sole trade business or Individual

Enterprises:

Business registration operates as a single point integrated service. Once you

complete your business registration, you have also completed tax registration

with the Rwanda Revenue Authority, employer registration with the Social

Security Fund of Rwanda and notification of business activities to the National

Institute of Statistics of Rwanda. This integrated registration is achieved through

the filling of a consolidated application form covering all the information required

for registration and notification with the relevant agencies.

Business Registration is concluded by the issuance of a business registration

certificate which has a unique enterprise code that acts as a unique identifier of

the business in relation to any public agency. The Enterprise/Company code is

also the Tax Identification Number (TIN).

The business registration services cover all businesses determined by the

Company Law No 07/2009 of 27/04/2009 and/or the Ministerial Order N°02/09/MINICOM of 08/05/2009.

2.6.2. Registering a company:

Rwanda has the fewest procedures and fastest processes to register and start

a business. Below are the steps followed to register a business in Rwanda.

You can register your business online at http://org.rdb.rw/ or at the Office of

the Registrar General which is a department within the Rwanda Development

Board located in Kigali, the capital city (see links below for full address).

What are some of the important documents needed before I can register my

business in Rwanda?

Domestic Company Registration

• Copy of ID/Passport

• Complete two copies of Memorandum of Association Art 14

(downloaded on our website here).

Opening a branch/ Foreign company

• Power of attorney to present the company in Rwanda. (Notarized)

• A duly authenticated copy of the memorandum Articles of Association.

(Notarized)

• Certificate of Registration/Incorporation issued by the registration

authority in the country of incorporation. (Notarized)

• Notarized resolution from the authorized agency authorizing to open a

branch.

• Passport copies of the shareholders/directors.

• List of directors residing in Rwanda (at least One)

2.6.3. Registering a partnership:

A partnership company is a type of business where two or more individuals

pool together their resources to achieve a common goal through business. This

type of business is usually helpful when an individual does not have enough

resources to start a venture.

You can register your partnership business online at http://org.rdb.rw/ or at the

Office of the Registrar General which is located in Kigali.

2.6.4. Registering a cooperative:

Registration of a Cooperative is the action or process of registering a cooperative

by attributing a registration number or of being registered in registration book

for Cooperatives.

When, How and where to register a Cooperative?

A cooperative is registered when it fulfils all legal requirements. The exercise is

done online by the applicant him/herself through the Cooperative Management

Information System (CMIS) (to be soon open).

Requirements for a cooperative to be granted legal personality:

– to have Internal regulations

– to define its domain of activity and objectives;

– to have the required number of founder members;

– to have a certificate issued by the Sector in which it will operate indicating

that the cooperative meets the requirements;

– to have a business plan indicating

a) the intended business model;

b) a clear outline of the economic and social benefits the cooperative

provides to its members

c) an action plan for at least the first three (3) years;

d) to present its working capital to finance its activities.

Detailed steps to register a Cooperative:

1. Cooperative applies for legal personality through the CMIS

2. Sector Cooperative Officer (SCO) assesses the application and may

decide to visit the cooperative. The sector has 5 days to approve the

application.

3. Once approved, the application is moved to the district. The District

Cooperative Officer (DCO) assesses (review) and approves or rejects.

He / She has to approve or reject the application the application.

4. After district approval, the application is moved to RCA.

5. RCA requests approval from BNR in case of SACCO’s application

6. If RCA approves, legal personality is granted within two (2) working days.7. If application is rejected, it is sent back with comments for rectification.

Requirements for membership in a primary cooperative:

A person who wishes to be a member of a primary cooperative must:

1. be at least sixteen (16) years of age;

2. Submit a written application for membership;

3. Not be engaged, either directly or indirectly, in any business likely to

jeopardize that of the cooperative he or she intends to join;

4. Pay his or her share in accordance with the bylaws of the cooperative;

5. Be committed to work with the cooperative in all or part of its operationsas provided for under the bylaws;

Application activity 2.6

1. How can register a business in Rwanda?2. Registering a business is one way of ensuring its success. Discuss?

2.7. Benefits of registering a business

Activity 2.7

In Rwanda we have many businesses ensure economic development of

country. One of those businesses are registered and another one is not

registered.

Look at the situation of business at home and around the country then shows

if registering business is necessary or not.

As a business to be or referring to business activities in your community, whydo you think businesses need to be registered?

2.7.1. Reputation from customer

Registering your business gives your potential customers confidence that they

are dealing with a reputable organization. Building reputation especially from

customers and clients if you’ve never done business before is very difficult.

2.7.2. You get legal liability protection

When you register your business as Limited Liability Company, you are a different

entity from your company. If you incorporate, you will not be held personally

responsible for certain accidents and other liabilities.

If you obtained loan and you defaulted in payment, your bank will not seize

your property except the company asset because you are protected from such

incidence.

2.7.3. Branding and Legitimacy

To prove that you have a legitimate business, legally in Rwanda, you will be

required to provide proof of business registration. A registered business helps

in building reputation with your suppliers, customers, and employees.

2.7.4. Loan facility

When your company is registered, accessing loan becomes very easy compare

to personal loan application. With your documents, you are going to have to

prove that you’re actually a business. This gives credibility and trust and also

ensures confidence. Your investors or lenders will see that they are dealing

with a company and will be willing to do lend you money if other terms andconditions are made.

2.7.5. Create employment

A registered business can employ full-time employees and pay them salariesand other benefits.

Application activity 2.7

Discuss on the benefice of registering business in Rwanda.

2.8. Consequences of not registering a business

Activity 2.8

In Rwanda we have many businesses ensure economic development of

country. One of those businesses are registered and another one is not

registered.

As a business to be or referring to business activities in your community,show consequences of not registering business.

2.8.1. Pay Fines and Penalties

If business fails to comply with business license requirements and you operate

your business without a valid license, you should expect to have to pay a fine orpenalty.

2.8.2. Lawsuits