UNIT 6 :TAXATION OF INDIVIDUAL BUSINESS PROFITS

Key unit competence: To be able to apply and compute the taxation ofindividual business profits (PIT).

Introductory activity

Observe the picture above and make an analysis of what is happening

The criteria for determining what is taxable and non-taxable business income,

as well as what expenses may and cannot be deducted from turnover for tax

purposes, are relatively similar for sole traders, partnerships, and corporations,and are all covered in this unit.

6.1. Definition of the concept

Activity 6.1

Because business owners and entrepreneurs work at the top of a company,

their ability to make financial decisions can make a company more profitable

and achieve financial success. However, it all starts with funding. But here,

too, you can perform well in your company and the income tax law exemptsyou from income tax. Brainstorming.

Certain forms of business profits are tax-free; however, the majority of commercialactivities are taxable.

a) What is a business?

In Rwandan tax law, there is no definition of a business. It might be viewed as a

liberal trade, career, or profession.

A liberal profession is defined in Article 3 of the income tax law No. 16/2018 as:

“a profession exercised on the basis of special skills, in an independent manner,in offering services to clients”.

Business is an integrated set of activities and assets that is capable of being

conducted and managed for the purpose of providing a return in the form ofdividends, members or participants.

The following considerations should be in establishing whether a trade is being

carried on, according to case law from other jurisdictions:

• The subject matter – are the goods being sold normally held as trading stock?

• The length of the period of ownership – the shorter this is, the more

likely activity will be treated as a trade.

• The frequency of similar transactions – a single transaction is unlikely

to be treated as a trade whereas multiple similar transactions suggest trading.

• Supplementary work and marketing activities.

• The existence of a profit motive.

Meaning of business Profit

Article 19 of section 3 of Law 16/2018 provides guidelines on the computation

of business profits. According to Article 19 of Law 16/2018 business profits are

determined as the income from all business activities reduced by all business

expenses. Business profit also includes proceeds of sale of any business asset

and proceeds from asset sharing received during the tax period. Business profits

are determined per tax period on the basis of the profit or loss account drawn

up in accordance with Generally Accepted Accounting Principles, subject to

the provisions of this Law. The Tax Administration may use any other accounting

method or other source of information in accordance with the law, to ensure the

accuracy of the taxpayer’s profit.

Tax exemption for profit on agricultural and livestock activities

Article 21 of Law 16/2018 also provides that income earned by an agriculturalist

or a pastoralist on agricultural or livestock activities is exempt if the turnover

from agricultural or livestock activities do not exceed twelve million Rwanda

francs (FRW 12,000,000) in a tax period. In case the turnover exceeds twelve

million Rwandan francs (FRW 12,000,000), the latter amount is excluded from

the taxable income.

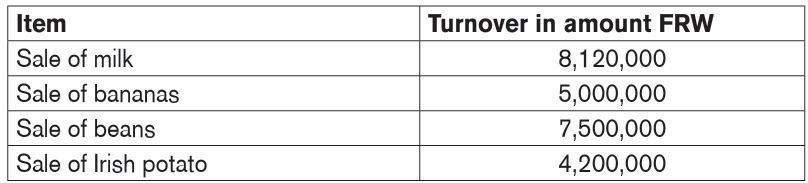

E.g., Jaden owns a farm in Bugesera where he practices agriculture and livestock

farming.During the year ended 31/12/2018 he received the following incomes

Required: Compute his taxable income and tax liability

Answer:

Taxable income 24,820,000 – 12,000,000 = 12,820,000

Tax Liability since the turnover is below 50,000,000, Jaden can opt to be taxed

in the lump sum regime. And since the turnover is above 20,000,000FRW, thetax rate will be 3%Tax liability 3% x 12,820,000 = 384,60

Application activity 6.1

Mutunzi Gashumba owns a piece of land reserved for agricultural and

livestock activities then during the year 2020 he sold 20 tons of beans which

brought him a total income of FRW 15,870,350.Required: Compute his taxable income.

6.2. The taxation of small businesses

Activity 6.2

Small and medium-sized enterprises (SMEs) make a significant contribution

to the economy in terms of employment, innovation and growth. This applies

to both industrialized and developing countries. Small and medium-sized

enterprises, or SMEs, are playing an increasingly important role in the global

economy, particularly in job creation. Micro and small businesses are a

response to the needs of people, communities and society. Brainstorm on theimportant contributions of small businesses to economic development

Small businesses and micro-enterprises have a simplified method for calculating

the income tax due. They are, however, allowed to opt-out of the simplifiedmethod and use the ‘real regime’

6.2.1. Micro-enterprises – “Flat tax” regime

A micro-enterprise is one whose business activities generate turnover equal

to or less than twelve million Rwandan francs (FRW 12,000,000) per tax period.

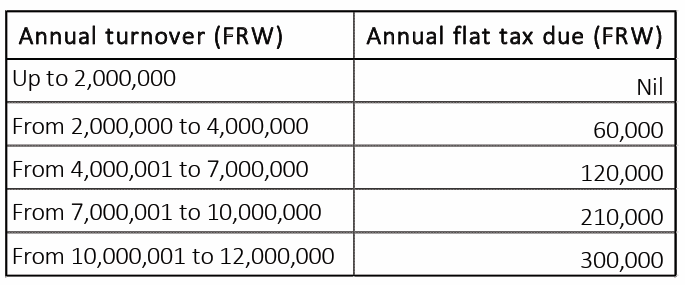

A micro-enterprise pays a flat tax. Turnover, rounded down to the nearest onethousand figure (FRW 1,000), is used to determine the flat tax due as below:

6.2.2. Small businesses – “Turnover” regime

A small business is one whose business activities result in a turnover ranging

between twelve million and one Rwandan francs (FRW 12,000,001) and twenty

million Rwandan francs (FRW 20,000,000) per tax period;

A turnover tax, commonly known as the “lump sum” regime, is the default tax

structure for small businesses. The year’s income tax due is based on 3% oftotal turnover, with no deductions for expenses or asset allowances.

Any small business may choose to opt-out of the turnover tax and into the ‘real

regime’ (i.e., taxation of trading profit as adjusted for tax purposes, as discussed

later in this chapter); this necessitates the preparation of financial statements

in compliance with local GAAP. They must notify the tax administration of their

decision, which is then irrevocable for three years from the date of making thisnotification.

If a small firm chooses not to pay the turnover tax, it may apply to the finance

minister for a simplified method of accounting to calculate income taxable profit

(Ministerial Order 5/19/10/TC dated 29/04/2019). Only daily cash and credit

sales and purchases, as well as a record of all cash transactions, are needed oftaxpayers. Full GAAP accounting is no longer required.

Keep in mind that, in the case of agricultural and livestock activities, only the

excess (taxable) turnover is considered for calculating the tax due under eitherthe flat tax or turnover tax regimes.

6.2.3. Liberal professions

The turnover tax and flat tax systems do not apply to businesses carrying on

liberal professions; they must use the real regime.

Small and medium-sized enterprises (SMEs) make a significant contribution

to the economy in terms of employment, innovation and growth. This applies

to both industrialized and developing countries. Small and medium-sized

enterprises, or SMEs, are playing an increasingly important role in the global

economy, particularly in job creation. Micro and small businesses are a response

to the needs of people, communities and society. Brainstorm on the importantcontributions of small businesses to economic development

Application activity 6.2

Calculate the amount of flat tax or turnover tax that the following businesses

would pay, assuming that they had not opted out of the small business regime.

If a flat tax or turnover tax is not applicable, state why.

a) Clement Gatete, a clothing manufacturer with an annual turnover of

FRW 18,000,000 and expenses of FRW 4,000,000 per tax year.

b) Henriette Uwiragiye, a lawyer with an annual turnover of FRW

15,000,000 per tax year.

c) Dutembere Plc, a company specializing in the tourist industry, with a

turnover of FRW 25,000,000 and expenses of FRW 6,000,000 per tax year.

d) Claude Mukamire, a crop farmer with an annual turnover of FRW17,000,000.

6.3. Adjustment of profit for tax

Activity 6.3

The starting point in determining whether an item of income is business

income is to determine whether the activity giving rise to the income is properly

characterized as a business. With this in mind, what is adjusted profit for tax

purposes?

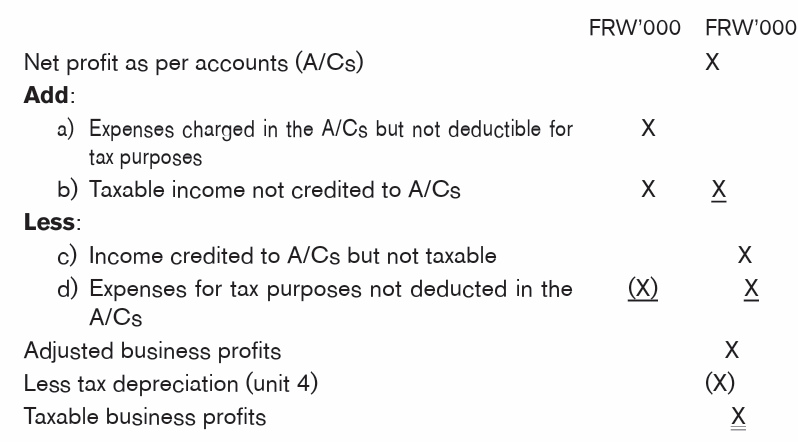

For those businesses within the real regime, the amount of tax is determined by

taxable profits. The taxable profit is the profit on which the tax is imposed.

This is not the same as accounting profits; these must be adjusted for tax rules.

Accounting standards frequently clash with tax legislation. The taxable business

profit is calculated by making multiple adjustments to the accounting net profitfigure in order to bring the profit into compliance with tax laws.

6.3.1. The need to adjust profits

The Rwanda Revenue Authority (RRA) will normally accept profits that are

determined in accordance with accounting principles provided that there is no

conflict between the accounting principles and tax legislation. However, there

is often a conflict, and the accounting profits may require several adjustments

to be made to them in order to determine the taxable profits. Taxable profits are

required to be determined in accordance with the requirements of tax legislation.

Expenses that are allowed for tax purposes do not require any adjustment if

accounts have already been prepared to reflect such expenses.

Some expenses which are charged in the accounts are not recognized as

expenses for tax purposes. Expenses that are not allowed for the purposes

of taxation should be added back to the net profit figure. Most expenses are

specifically non-deductible per the requirements of tax legislation while other

expenses are non-deductible because they do not meet the general criteria for

allowing them as expenses for tax purposes. Similarly, some income which is

credited to the profits is not taxable as business receipts or is entirely exemptfrom income tax.

6.3.2. Computation of taxable business profits

6.3.3. General rule for the deduction of expenses

Article 25 of the Income Tax Law No. 16/2018 sets out the conditions for an

expense to be deductible for tax purposes.

Expenses must fulfil the following conditions:

They are incurred directly for the purpose of the business and are directly

attributable to the income generated.

ii. They represent a real expense incurred, and the taxpayer can substantiatethe expense with a proper purchase document or receipt.

iii. The expense results in a decrease in the net assets of the business:

either cash has actually been spent in the period, or an invoice exists tosubstantiate any accrued expenses.

iv. They relate to activities carried out in the tax period in which they were

incurred (i.e they are deductible on the accrual basis). An expense incurred

in a tax period must be claimed in that tax period – it cannot be deductedin a later year.

If expenses that do not meet all of these criteria have been charged to the profit

and loss account, they must be added back in arriving at taxable profits. There

are also some specific expenses that are not deductible from trading incomeand must be disallowed.

6.3.4. Expenses that are not deductible from taxable income

(Disallowed expenses)

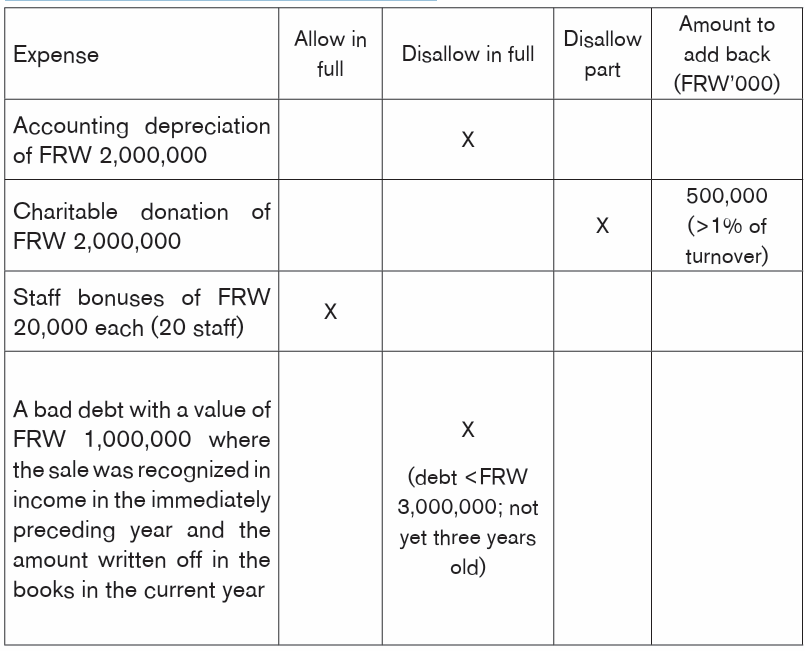

According to Article 26 of the income tax law No. 16/2018, the following

categories of expenditure are not eligible for tax relief and must be excludedfrom the calculation of taxable trade profits:

i. Dividends paid by a company, or profits paid out of a business to its owner;

ii. Reserve allowances, savings, and other special-purpose funds, unlessotherwise provided for by income tax law No. 16/2018;

iii. Fines and similar penalties;

iv. Donations, except if they total less than 1% of turnover and are made to

non-profit making organizations (for example charities); if total donations

to non-profit-making entities exceed 1% of turnover, the amount in excessof 1% of turnover is disallowed.

v. Tax paid, including Rwandan income tax, overseas income tax, andrecoverable Value Added Tax (VAT);

vi. Personal expenses of the business owner;

vii. Entertaining expenses, except for expenses on general sporting activitiesfor all employees;

viii. Twenty percent (20%) of expenses paid on business overheads that have

both business and private elements which are not practically separable,such as telephone, water, electricity, and fuel;

ix. Management fees, technical services fees, and royalties paid to non

resident persons, where they exceed two percent (2%) of the turnover

of the taxpayer – where such fees exceed 2% of turnover, the excess isdisallowed;

x. Board sitting allowances, and any other amounts that should be taxed asemployment, where tax has not been deducted under PAYE

xi. Interest arising from loans between related persons either paid or due on

a total loan that is greater than four (4) times the amount of equity. This

equity should not include provisions or reserves according to the balance

sheet, which is drawn up in accordance with the Generally AcceptedAccounting Principles.

The provisions under item (xi) above do not apply to commercial banks, financialinstitutions, and insurance companies.

Application Example

Categorize the following expenses as either allowable or disallowable in the tax

computation for Gasabo Ltd, a Rwandan corporate business with turnover of

FRW 150,000,000 in the tax period. If an expense is partially disallowed, statethe amount would be added back to profit.

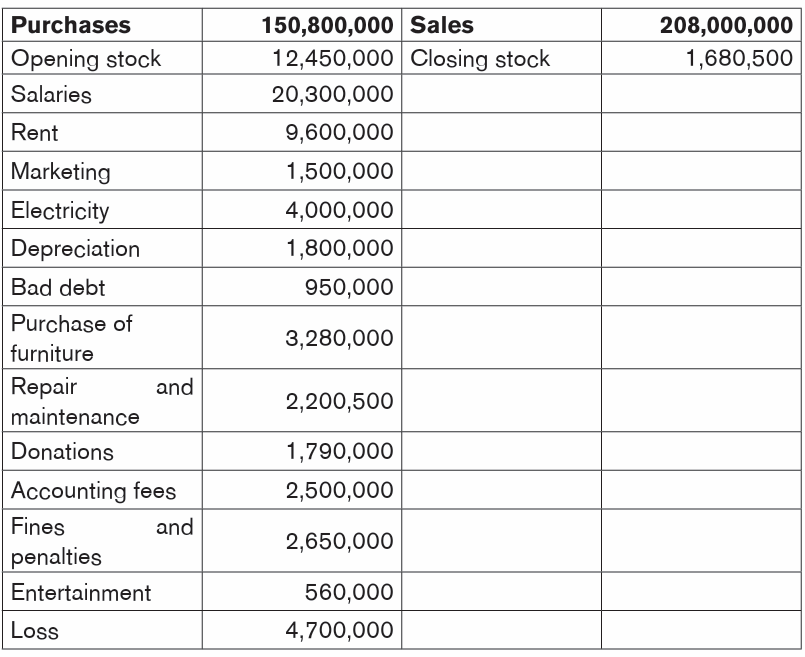

Illustration 1: on computation of taxable and tax payable for individual

Mbonimpa is a medium business man in Kakiru. During the year ended

31/12/2021, he reported a loss of 4,700,000FRW. He provides the followinginformation in support of this figure.

Additional Information

i.Mbonimpa lives in a flat above his shop. 30% of the rent and Electricity

relates to the flat.

ii. During the year ended Mbonimpa took goods costing 800,000FRW to his

home. The goods had a selling price of 1,600,000FRW.

iii. 300,000FRW of the bad debt expenses relates to debtor that has been

declared bankrupt by the court. The remaining amount is a provision that

was made at the end of the period.

iv. iThe donation was made to a charitable organisation

v. The fines and penalties relates to failure to withhold and paying taxes on time.

vi. Allowable capital allowance for tax purpose is 3,520,500FRW

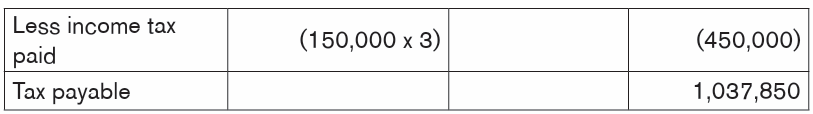

vii. Mbonimpa pays 150,000 every quarter to Rwandan revenue authority asincome tax

Required

i. Compute the taxable income, the tax liability and tax payable of Mbonimpa

for the year ended 31/12/2021ii. When should Mbonimpa declare and pay taxes.

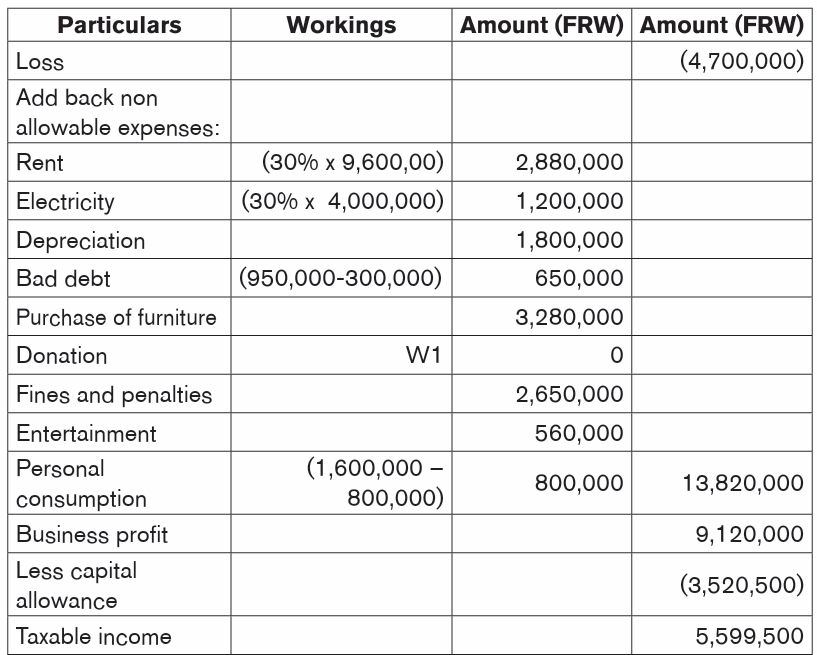

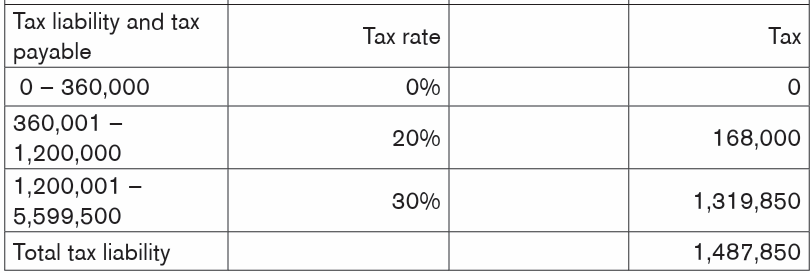

Answer:

i. Computation of taxable income of Mbonimpa for the year ended31/12/2021

Figures in Rwandan Francs

Workings

W1 Allowable donation 1% x 208,000,000 = 2,080,000

Donation made during the period 1,790,000

Since the donation was made to allowable charitable organisation and it isbelow one 1% of the turnover, it is all allowed

ii. Nzaboninka should make his declaration by 31/03/2018

Illustration2: Computation of taxable income and tax payable for individual

With examples differentiate between deductible and non-deductible expenses

for income tax purposes

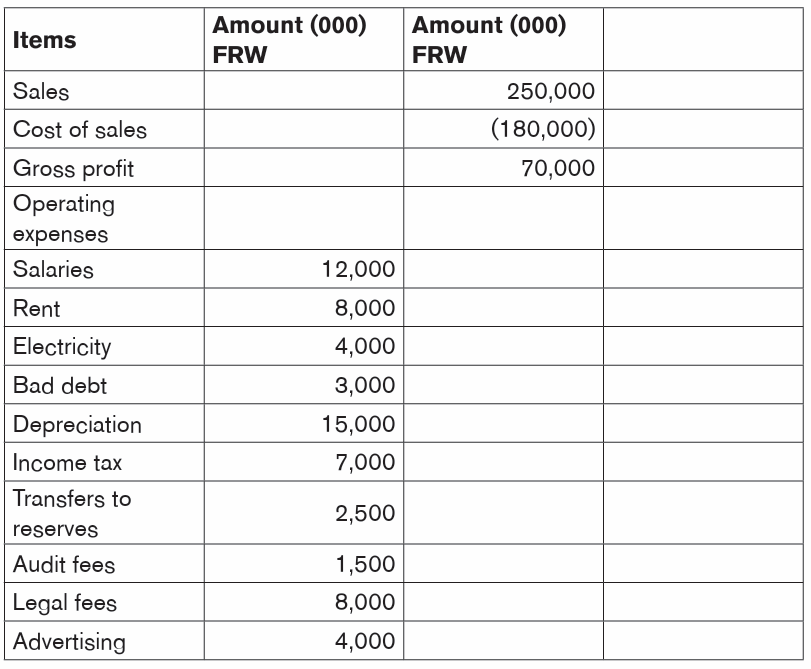

a) Nzamurambaho owns a supermarket in Kigali town. He submitted the

following information to RRA for the income tax assessment purpose forthe year ended 31/12/2021

Relevant information

i. FRW4,000,000 related to salaries accrued and not considered in the

income statement

ii. 40% of the rent will expire in 2017

iii. Of the bad debt FRW1,000,000 relates to the customer that was declared

bankrupt at the end of the year

iv. Capital allowances have been agreed by the tax administrators as FRW4,500,000

v. Legal fees relate to settling the divorce case

vi. Of the repair and maintenance, FRW3,000,000 was used to partition an

office of the internal auditor.

vii. The donation was made to church

viii. Communication is the money loaded on the mobile phone ofNzamurambaho He uses it for both private and business

Required: Compute the taxable income and tax liability ofNzamurambaho

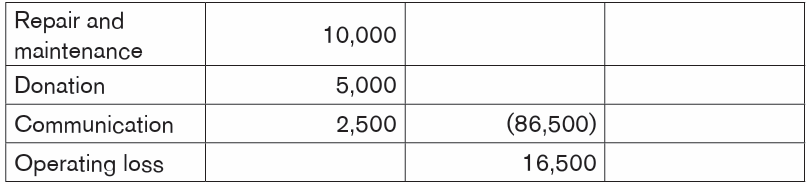

Answer:

Computation of taxable income and tax payable of Nzamurambaho for the yearended 31/12/2021

Application activity 6.3

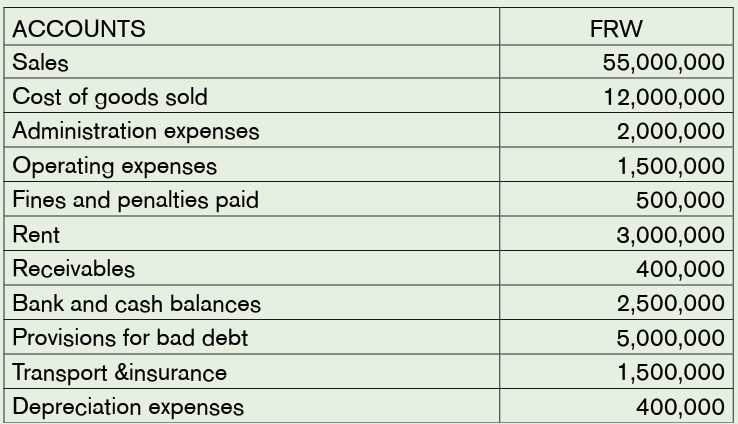

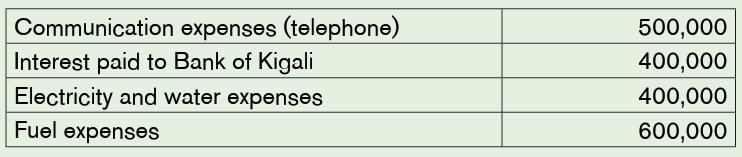

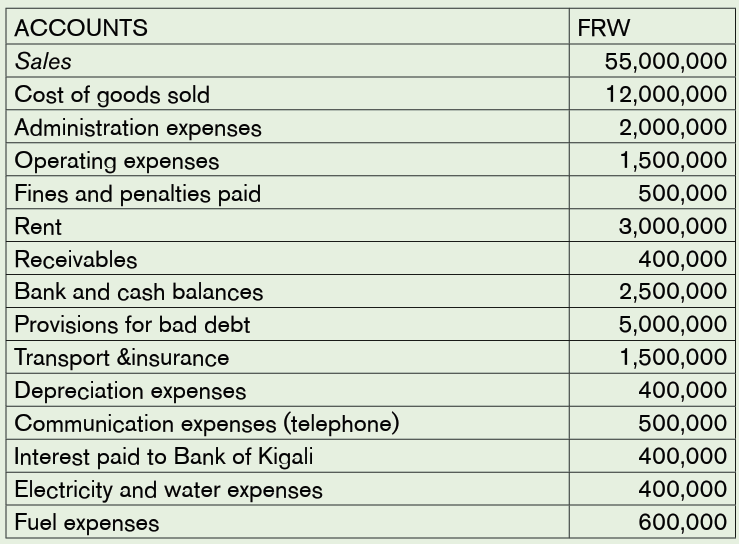

The management of DUHAHE Ltd presented the following information fordifferent accounts for the year ended 31st, December 2020:

Additional information:

• 25% of the rent is to be considered as personal expenses for

Mr.Kagabo, one of the directors of the company.

• Overheads expenses (Telephone & Electricity), because the shop

and the family’s residence were in the same building, it was difficult

to separate such expenses.• Investment allowance, allowable for the year is FRW 1,500,000

Required:

a) Calculate the profit for the company for the year ended 31st Dec 2020.

b) Determine the adjusted taxable income for the year ended 31st Dec 2020.

The management of DUHAHE Ltd presented the following information fordifferent accounts for the year ended 31st, December 2020:

6.4. Capital and revenue expenditure

Activity 6.4

Since you’ve covered some lessons in general ledger, you need to distinguishbetween capital expenditures and revenue expenditures.

Expenditure that is capital in nature (i.eg; a fixed asset) does not qualify for

tax relief in the period it is incurred. While revenue expenditures are those

expenditures of the government that do not lead to the creation of fixed assets.

The government spends money under various accounting heads, such as paying

interest on loans, salaries, pensions, subsidies, spending on different ministriesand departments, etc.

Law regulating capital and revenue expenditure.

The third requirement of Article 25 (income tax law no. 16/2018) stipulates

that an expense must diminish the business’s net assets in order to qualify for

tax relief. This implies that it must be revenue rather than capital in nature. The

following are the primary factors to consider when calculating taxable profits:

i. Expenditure incurred on the acquisition or improvement of fixed

assets, including any associated legal and professional fees, cannot be

deducted unless the asset cost is less than FRW 500,000. Items costing

FRW 500,000 or less may be deducted immediately.

ii. Accounting depreciation of fixed assets and losses on the disposal of

fixed assets are non-deductible expenses.

iii. Accounting profits on disposals of fixed assets are not taxable income.

The proceeds on the sale of an asset will be charged to income tax (orcapital gains tax).

When expenditure is made once and for all with a view to bringing into existence

an asset or advantage for the enduring benefit of a business, that expenditure

will reasonably be treated as capital expenditure.

Problems arise when dealing with repairs and renewals. Repair is restoration by

renewal or replacement of subsidiary parts of the whole. For example, replacing

a chimney in a factory would be a replacement of a part of an asset (the building),

and therefore is revenue expenditure and will qualify for immediate tax relief, but

if the asset itself was a chimney (for example at a power station), replacing it

would be capital, and therefore considered a fixed asset - this would not bedeductible immediately but would qualify for tax depreciation.

When an asset is purchased that requires significant investment before it can

be utilized in commerce, this investment is typically capital - for example, makinga ship seaworthy before it can be used.

However, expenditure on newly purchased assets to repair natural wear andtear, on the other hand, represents revenue and is allowed.

Application activity 6.4

Which TWO of the following items would be considered capital, and therefore

not deductible from business profits?

1. Repair of a large piece of machinery following a breakdown – the

repair cost FRW 600,000

2. A computer upgrade costing FRW 300,000

3. A building extension costing FRW 15,000,000

4. The purchase of a second-hand delivery van costing FRW 1,000,000

a) 1 and 3

b) 2 and 3

c) 3 and 4d) 1 and 4

6.5. Transactions in foreign currencies

Activity 6.5

Brainstorm what is a foreign currency and what foreign currency transaction is.

Gains or losses on translation of assets are reflected as part of taxable income.

6.5.1. How exchange differences arise

The conversion of the values of assets and liabilities held in a foreign currency

may be required while preparing accounts (and taxable income) in Rwandan

francs. Here are some examples:

i. A sale to an overseas customer (where invoiced in a currency other than

Rwandan francs) which is an outstanding debtor at the end of the tax period

ii. Any asset, such as stock or a machine, that was purchased in a currency

other than the Rwandan franciii. An outstanding creditor that will be repaid in a foreign currency

The item must be re-translated using the closing exchange rate if the exchange rate

at the time of the original transaction differs from the exchange rate at the end of

the tax period. There will be an exchange gain or loss as a result of this. The relevantexchange rates to use will be those published by the National Bank of Rwanda.

6.5.2. Tax treatment of exchange differences

If the accounts were prepared in accordance with GAAP, the differences would

have already been estimated and accounted for in the period’s profit or loss.

There will be no need to modify profits because taxing exchange gains and

deducting exchange losses as part of taxable company income is proper. If

these entries aren’t made in the books, an adjustment to taxable income will bemade to reflect the entire exchange discrepancies.

Application Example

Robert Kamanzi, a Rwandan resident exporter of goods, makes a sale to Jacob

Walton, a US customer, on 14 September 2021. Kamanzi agrees with Jacob

that he will pay for the goods in US dollars ($). Kamanzi invoices for a total of

$2,300. Payment terms are agreed at 60 days, and Jacob had not settled theinvoice by 30 September 2021.

Relevant exchange rates are as follows (FRW per USD):

14th September 2021: 994.8804 / 30th September 2021: 997.5315

Calculate the exchange difference that would be taxable or deductible for Kamanzi.

Solution

At the date of the sale, the original invoice was worth ($2,300 x

994.8804) = FRW 2,288,225. The Rwandan franc has strengthened,

and so if Jacob were to have paid the invoice on 31st September, it would

now be worth ($2,300 x 997.5315) = FRW 2,294,322. The exchange

gain of FRW 6,097 will be treated as part of taxable business income.Conversely, any exchange losses are a deductible business expense.

Application activity 6.5

Jackson Habimana, a sole trader, has purchased some goods from a Finnish

supplier and has received an invoice for € 5,000. He has not settled this

invoice at the end of the tax period.

Relevant exchange rates are as follows (FRW per €):

Date of purchase: 1,020.85

End of tax period: 1,051.25

Complete the following sentence:

Jackson will record an exchange (gain/loss) of FRW __________ in the taxyear, and this will be treated as (taxable income/a deductible expense).

6.6. Long-term contracts and stock

Activity 6.6

Accrual accounting is commonly used as the basic financial reporting system

for businesses. The idea behind the system is to reconcile the costs with the

income for specific activities, so that a true picture of the profitability of the

activities can be obtained. The results of accrual accounting are manifested

in the balance sheet, income statement, and a variety of other historical

business reports. The cost and revenue information required to perform all

optimizations is different than that required for accrual accounting, and the

requirements for tax analysis are in turn different.

Answer the following questions based on the above scenario:

1. What is the definition of a long-term contract?2. Discuss the accrual concept.

Long-term contracts must be taxed according to the accruals concept. Losses

on long-term contracts are treated in a special way. Stock must be appropriatelyvalued and accounted for in arriving at taxable profits.

6.6.1. What is a long-term contract?

A long-term contract is a contract for manufacture, installation, construction,

or “Long term contract” means a contract for work, manufacture, installation

of construction, the performance of related services, which is not completed

in the tax period in which work under the contract commenced, or other thana contract estimated to be completed within the twelve months as of the date

on which work under the contract commenced. The timing of inclusion in and

deduction from business profit relating to a long-term contract is accounted for

on the basis of the percentage of the contract completed during any tax period.

The percentage of completion is determined by comparing the total expenses

allocated to the contract and incurred before the end of the tax period with

the estimated total contract expenses including any variations of fluctuations orcomparing the value of the work certified and the contract price.

Percentage of completion = expenses of the work certified

Estimated contract cost: A loss in tax period in which a long-term contract

is completed may be carried back and offset against previously taxed business

profit from that contract to the extent it cannot be absorbed by business profitin the tax period of completion

Example:

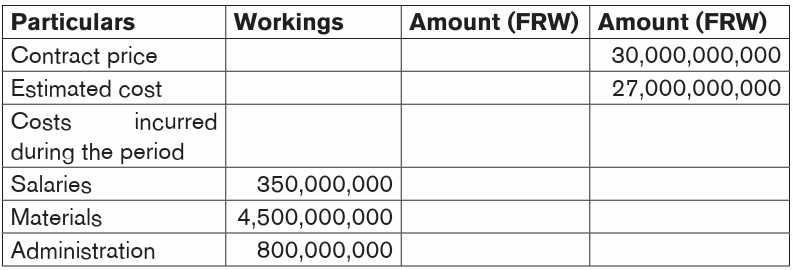

On 1st/1/2021 Akandi Limited started the construction of road from Nyagatare

to Kayonza. The agreed contract price was FRW 30,000,000,000. The cost

accountant of Akandi Limited estimated a cost of FRW 27,000,000,000 to

the complete the road. By 31st/12/2021, the road was only complete up to

Kabarore and the following costs were incurred up to that point: salaries and

wages FRW 350,000,000, Materials FRW 4,500,000,000, Administration and

General Expenses FRW 800,000,000 and other miscellaneous expenses FRW

200,000,000.Required:

a) Compute the Taxable income for Akandi limited for the year ended

31st/12/2021.b) Differentiate between accounting period and period of accounts

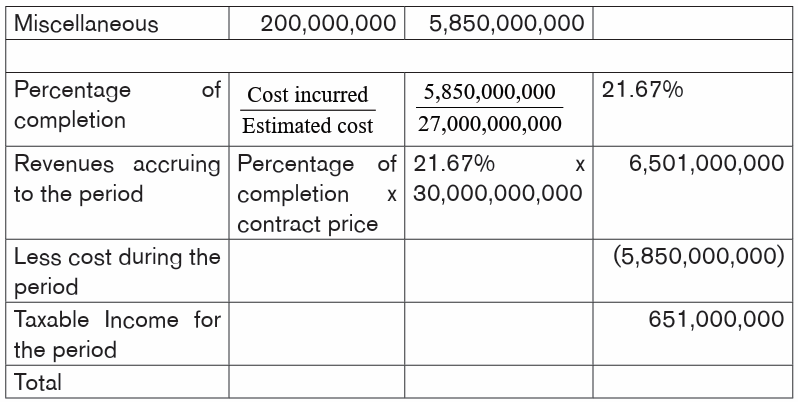

Solution:Computation of taxable income for Akandi Limited for the year ended 31/12/2021

Example: If a contract with an agreed price of FRW 2,000,000 is estimated

to cost FRW 1,500,000 to fulfil, there is an estimated overall profit of FRW

500,000. If, at the end of the tax period, the contract is still in progress and thecosts incurred to date total FRW 1,050,000:

i. The percentage complete is estimated at (FRW1,050,000/FRW1,500,000) = 70%

ii. Hence the income that should be reflected in business profits will be (70%

x FRW 2,000,000) = FRW 1,400,000.

iii. The amount of profit to tax in the current tax period will be FRW 350,000

(FRW 1,400,000 –FRW 1,050,000) or (70% x (FRW 2,000,000 – FRW

1,500,000)). If this is not the amount of profit that has been recognized inthe accounts, an appropriate adjustment must be made.

6.6.2. Losses on long-term contracts

If in the subsequent period where a long-term contract is completed, there are

unexpected costs incurred by the business in order to complete the contract,

this may result in a loss being incurred, whereas in previous tax periods the

taxpayer may have paid income tax based on anticipated contract profits.

This loss will reduce the taxable profit of the subsequent period (as the expenses

recognized in the profit and loss account will be higher than the associated

income). If a loss cannot be offset by other profits in the period in which the

contract is concluded, the excess loss might be ‘carried back’ and used forprofits already recognized on that contract.

6.6.3. Stock

The majority of retail and manufacturing companies will maintain a level of trading

stock. As you may recall from your accounting studies, cost of sales identifies

closing stock as a company asset that is ‘matched’ with sales revenue when the

item is sold using the accruals concept.

The same principle applies to taxable income: a stock tax deduction is only

available after the accompanying income is recognized. Closing stock is valued

at the lower cost and market price on the last day of the tax period, according

to Article 27 of the income tax law No. 16/2018.This means that stock losses

would be recognized right away, however, gains (profits) would not be recorded

until the asset was sold. However, before the taxpayer may claim compensation,

the RRA must inspect the stock and agree on the loss to expense. Losses

cannot be expensed without RRA clearance.

If the trader provides a service rather than commodities, the work in progressmay be valued at cost at the conclusion of the tax period.

Application activity 6.6

Which TWO of the following statements are TRUE in relation to the taxation

of long-term contracts and stock?

1) The tax treatment of long-term contracts generally follows GAAP.

2) Income to be taxed will depend on the amount invoiced to a customer

in the year.

3) The percentage of a contract that was completed during the year will

determine the level of profit to be taxed.

4) Stock is always valued for tax purposes at its market value at the end

of the tax period.

a) 1 and 4 b) 2 and 3c) 1 and 3 d) 2 and 4

6.7. Bad debts

Activity 6.7

In the determination of business profit, a deduction is allowed for bad debts if

the following conditions are fulfilled:• if an amount corresponding to the debt was previously included in

the income of the taxpayer;

• if the debt is written off in the books of accounts of the taxpayer; and

• if the taxpayer has taken all possible steps in pursuing payment and

has shown concrete proofs that the debtor is insolvent

But there is an exception: bad debts recovered are added back to taxable profit.

Given the above statements, you are required to prepare a presentation on

the following questions:

a) What is a bad debt?

b) Any simple example of bad debt?

c) What causes bad debts?

d) What are the effects of bad debts?e) Why bad debts recovered are added back to taxable profit?

Bad debts: These are amounts outstanding in the personal accounts of debtorswhich have proved will not be paid.

Bad debt is an expense that a business incurs once the repayment of credit

previously extended to a customer is estimated to be uncollectible and is thusrecorded as a charge off.

Bad debts will usually be charged as an expense to the profit and loss account.

They represent income that has been recognized but will never be received bythe seller.

To be eligible for tax relief for bad debt, the seller must meet all of the following

requirements:

i. The amount has previously been included in the taxable income of the

taxpayer;

ii. The debt has been written off in the books of accounts of the taxpayer;

iii. The taxpayer has taken all reasonable steps to recover the debt and thedebtor has been declared insolvent by a court decision.

However, for an individual whose debt is less than three million Rwandan francs

(FRW 3,000,000) in addition to the conditions referred to in points 1° and 2°

above, the taxpayer must provide proof that he has taken all reasonable steps

over a period of three (3) years to recover the debt.

Thus, no court insolvency decision needs to have been made for such debts,

but there will be a significant delay between the debt becoming bad and the taxrelief becoming available.

If the aforementioned requirements are not completed, the bad debt will not

be eligible for tax relief. As a result, if the bad debt is charged to the profit and

loss account, it must be put back into the calculation of taxable profit before a

deduction can be taken in a later tax period provided the circumstances are met.

Note that licensed financial institutions and leasing businesses are exempt

from meeting the aforementioned standards and may deduct any rise in theirmandatory reserves for non-performing loans.

Any provisions made for doubtful debts, whether general or specific in nature,

are not allowable expenses. They fail to satisfy neither the above conditions nor

the general conditions for deductibility set out in lesson 6.3.3. A reduction in a

provision may be subtracted from the accounting profit; on the other hand, anincrease in a provision must be added back in the adjustment of profit.

Application activity 6.7

Nancy Keza, a business owner, is owed the sum of FRW 2,700,000 by Kelly

Umuhoza, a customer. The original sale was recorded in Nancy’s books on

31st July 2018, with credit terms of 60 days, and declared as part of business

profits in Nancy’s tax declaration for that year. Nancy has been trying to

recover this amount from Kelly since then. She wrote the debt off as a bad

debt in the 2020 accounts. Nancy has regularly tried to contact Kelly and has

employed debt collectors, but has as yet been unsuccessful in recovering themoney.

What is the correct treatment of this debt in Nancy’s tax declaration for the

tax period to 31st December 2021?

a) Add back a disallowed expense of FRW 2,700,000

b) Deduct bad debt relief of FRW 2,700,000c) Do nothing

6.8. Transfer pricing

Activity 6.8

Businesses rely on transfer pricing to ensure transaction prices between

related parties are comparable to fair market value. This process, conducted in

accordance with Organization for Economic Co-operation and Development

(OECD) guidelines, requires that the governing entity of this transaction

choose a pricing methodology that provides the best estimate of that fairmarket value. Why do countries choose a transfer pricing methods?

Adjustments to taxable income and deductible expenses may be required whentransactions between related parties are not at arm’s length.

6.8.1. Transfer pricing principles

Multinational groups of companies will typically trade with each other in goods

and services. The price at which such transactions occur is called the transfer

price. While the trading of goods between Rwanda and other countries is

governed by Article VII of GATT (the General Agreement on Tariffs and Trade),

and must not take place at an artificial or contrived value, this rule does not apply

to the transfer price for services. An overseas parent company could therefore

charge management fees, and manipulate the transfer price so that profits

arise in a country where the rates of taxation are lower so that the overalltax liability of the group is minimized.

The transfer pricing rules mean that the purchase price of goods and services

paid for by Rwandan businesses to related parties should not exceed the amountthat would have been paid to an independent third party.

6.8.2. Definition of related persons

Article 3 of the income tax law No. 16/2018 defines related persons as “any

person who acts, or is likely to act, in accordance with the directives, opinion

or wishes of another person when such directives, opinion or wishes arecommunicated or not communicated to them”.

The following are specifically deemed related persons:

i. An individual and their spouse, lineal ancestors, and descendants until at

least the third degree

ii. A person who participates directly or indirectly in the management, control

or capital of the other person,

iii. A third person who participates directly or indirectly in the management,

control or capital, or both control and capital, of another person (for

example two companies that are controlled by the same parent company

are related),

iv. Any of the above persons who participate directly or indirectly in the

management, control or capital of an enterprise

A common example of related persons is a company and its shareholders and

directors; the shareholders meet the definition in (ii) above as persons who

participate in the capital of the company (which is a legal person in its own

right), and the directors participate in management.

6.8.3. Impact of transfer pricing rules

Related persons must retain documents that justify that the prices charged on

transactions between themselves were carried out on an arm’s-length basis.

If a taxpayer fails to retain such documentation, the tax administration has the

power to adjust taxable profits accordingly. For example, if the price paid for a

management service by a Rwandan business to its overseas parent company

was above an arm’s-length price, the tax administration would increase taxable

income by the difference between the actual price and the arm’s-length price.

Arm’s length prices

If a person enters into a controlled transaction, he or she must determine the

price and margin resulting from the transaction, in a manner that complies with

the arm’s length principle. In determining whether the result of a controlledtransaction complies with the arm’s length Principe

Methods of determining arm’s length pricesComparable uncontrolled price method

The comparable uncontrolled price method consists in comparing the price

charged on property, goods or services transferred or supplied in a controlled

transaction to the price charged on property, goods or services transferred or

supplied in a comparable uncontrolled transaction and done in comparable

circumstances.

Resale price method

The resale price method begins with the price at which a product that has been

purchased from a related person is resold to an independent person

Cost plus method

The cost-plus method begins with the costs incurred by the supplier of property,

goods or services in a controlled transaction. An appropriate cost-plus markup

is added to the costs incurred to make an appropriate profit, taking into account

the functions performed and the market conditions. The result is considered as

an arm’s length price of the original controlled transaction

Transactional net margin method

The transactional net margin method consists of comparing the net profit margin

related to the appropriate base such as costs, sales or assets that a person

achieves in a controlled transaction with the net profit margin achieved in a

comparable uncontrolled transaction.

Transactional profit split method

The transactional profit. If it is possible to determine arm’s length profits for some

of the functions performed by related persons in connection with the transaction

using one of the approved transfer pricing methods, the transactional profit split

method is applied based on the common residual profit that results once such

functions are so remunerated.

6.8.4. Thin capitalisation

Internationally, most tax jurisdictions (including Rwanda) provide that taxable

income may be reduced by amounts paid as interest on loans to related parties.

By contrast, most do not provide tax relief for distributions to owners made

to shareholders by way of dividends. As a result, multinational enterprises are

motivated to finance their foreign subsidiary companies through loans rather

than share capital. When the subsidiary is financed heavily by debt finance, itstaxable profits would be substantially reduced by interest payments.

To prevent huge reductions of taxable profits by way of interest deductions, thin

capitalization rules apply. These rules limit the amount of interest that would be

allowed as a deduction when computing taxable business profits. This is done

by not allowing as an expense the amount of interest paid on related party loanswhen the company’s debt to equity ratio exceeds a certain limit.

In Rwanda, this limit is a ratio of four to one: where debt is more than four times

equity (share capital on the balance sheet), a company is said to be “thinly

capitalized” and interest payable on loans to related persons will not be giventax relief (and must therefore be added back).

Example

YC Plc, a Rwandan company, has the following capital structure:

Share capital FRW 50,000,000

Reserves FRW 150,000,000

Debt FRW 300,000,000

(of which FRW 100,000,000 is an intra-group loan)

The company is thinly capitalized, as debt (FRW 300,000,000) is six times the

equity shares capital (FRW 50,000,000).

The implications of this are that the interest on the intra-group loan would bedisallowed in full.

Application activity 6.8

Take for example, the case of Business A being headquartered in Country

A, and has a subsidiary in Country B. It makes widgets in Country B which

it exports back to its parent in Country A. Let us assume that Country A has

a corporate tax rate of, say 15%, and Country B has a corporate tax rate of say 35%.

Business B makes 500,000 widgets, at a unit cost of 1 franc. It decides it

needs a gross profit of a further 1 franc, and so decides to sell the widgets at

2 francs each back to its own business in Country A.Required: Demonstrate the transfer pricing process in this case.

End of unit assessment 6

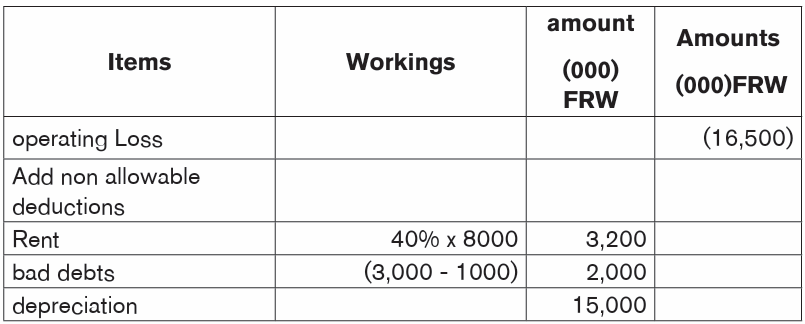

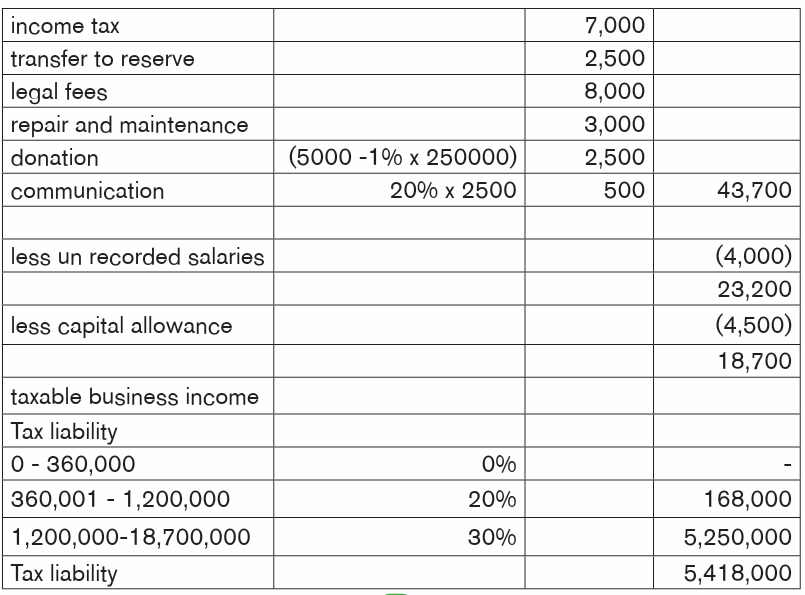

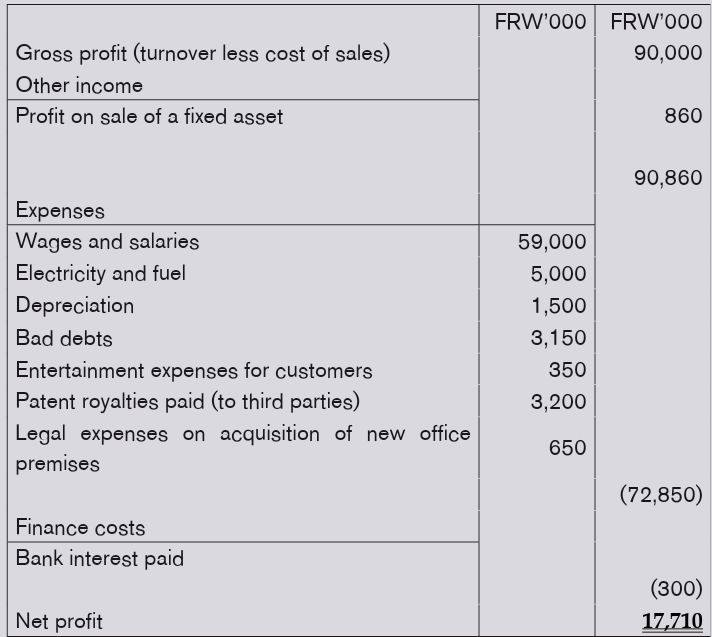

Q1. Here is the statement of profit or loss of Diane, sole trader, for the taxperiod ended 31 Dec.

Additional information

Salaries include FRW 15,000,000 paid to Diane to cover her personal expenses.

Electricity costs include the cost of lighting and heating Diane’s home

(where she regularly carried on her business before acquiring a purpose

built office during the year).

The bad debt cost was written off due to the court insolvency of a customer

during the year; this income was recorded in the accounts in the immediately

preceding tax period, and Diane spent considerable effort attempting to

recover the debt prior to the insolvency.

Compute the adjusted taxable trade profit (before tax depreciation). Youshould start with the net profit figure of FRW 17,710,000.