UNIT 5: THE TAXATION OF INVESTMENT INCOME

Key unit competence: To be able to use and interpret the taxation of investment income

Introductory activity

Looking at the situation above in photos and talk about the activities

carried out there.

In Rwanda everybody especially business people discussing about tax.

This is because of wondering why you and businesses need to pay

taxes. In Rwanda, there are ruling bodies from the village, sector, district,

provincial and national levels. These bodies comprise: Legislature (who

make laws), Executives (who enforce laws) and Judiciary (who exercise

laws). The salaries that public servants receive to do their jobs come

from taxes. Paying taxes is considered as civic duty, doing so is also a

requirement of the law.

Paying your taxes is requirement of the law. If you do not pay your taxes, the

government agency that oversees taxes (the Rwanda Revenue Authority

or RRA) will require you to pay your taxes or else face penalties, such asfines or going to jail.

The Taxes have many forms depend on the tax base and taxpayer. When you

work at a job to make money, you pay income taxes. Depending on how much

money you earn.

When you buy things at a store, you also usually pay sales tax, which is a

percentage of the cost of the item charged by the store. If you own property,

you also pay property taxes on the value of your property.

As a business to be or referring to your community, what taxes can be paid

to investment?

With examples from your community or Rwandan community at large, why doyou think people and business need to pay tax on investment?

5.1. Legislative features or components of investment income

Activity 5.1

In Rwandan economy taxes are the most important source of government

revenue.

Taxes differ from other sources of revenue in that they are compulsory levies

and are not paid in exchange for some specific thing, but for welfare of

taxpayers as a whole.

The Taxes have many forms depending on the tax base and taxpayer. When

you generate income, you pay income taxes depending on how much money

you earn. If you own property, you also pay property taxes on the value of your

property.

As a business to be or referring to your community, look at income an individualmay receive from investments and identify the elements this tax can have?

Investment income tax: Includes payments of interest, dividends, service fees,

royalties, and rent which has not been taxed as business income in accordancewith law No 016/2018.

5.1.1. Legislative features

Investment income includes all payments in cash or in kind in the form of interest,

dividends or royalties. In the majority of cases, this will already have been paidas a withholding tax, but must still be declared, and then claimed back.

a) Financial interest

According to Article 40 of Law 16/2018, financial income includes:

i. Income from loans;

ii. Income from deposits;

iii. Income from guarantees;

iv. Income from government securities, income from bonds, negotiable

securities issued by the Government, securities issued by public and

private companies, as well as income from cash negotiable securities.

According to Article 60 of Law 16/2018, interest income is subject to a

withholding tax of 15% on the value exclusive of VAT.

However:

– The interest income derived from the Treasury bond with a maturity period

of three years and above, the withholding tax is 5%.

– Interests on deposits in financial institutions for more than one year is

exempted;

– Interests on deposits/ savings made in Rwanda national investment trust

(RNIT Iterambere Fund) is also exempted

– Interests on loans granted by a foreign development financial institution

exempted from income tax under applicable law in the country of origin is

also exempted;

– Interests paid by banks operating in Rwanda to banks or other foreign

financial institutions is also exempted.

b) Dividend income

According to Article 41 of Law 16/2018, Dividend income is the payment of

profits to shareholders, and is derived from the owing of shares in any societies.

Because the profits of Rwandan resident companies suffer corporate income

tax, the only further tax that may be payable by a Rwandan taxpayer on dividends

received from a Rwandan company is withholding tax. This is applied on the

outstanding balance of profit after taxation.

Like interest income, dividend income is also subject to a withholding tax of

15%. However, for shares that are listed at the Rwanda stock exchange andowned by a taxpayer from East Africa, it is subject to a withholding tax of 5%.

c) Royalties

Royalty income as per article 42 of law 16/2018, royalty income includes:

i. All payments of any kind received as a prize for the use of, or the right

to use, any copyright of literacy, craftsmanship or scientific work

including cinematograph films, films, or tapes used for radio or television

broadcasting;

ii. Any payment received from using a trademark, design or model, computer

application and invention patent;

iii. The price of using, or of the right to use industrial, commercial or scientific

equipment or for using information concerning industrial, commercial or

scientific knowledge;

iv. Payments from natural resource use.

The royalty income is taxed at a rate of 15% flat

Declaration period

Finance income, capital gain on shares, dividend income and royalty income are

declared within 15 days after the month of withholding. For example if the month

of withholding is April 2022, the tax should be declared and paid not later than

15th May 2022

d) Rental income

Rental income includes income from the rental of machinery and other equipment,

including agriculture and livestock equipment. For the purpose of this lesson,rental income includes rent of machinery and other equipment only.

Application activity 5.1

1. Compare dividend and royalties as components of investment income2. What kind of rental income is included in investment income?

5.2. Exemption from investment income

Activity 5.2

Paying taxes is requirement of the law. If you do not pay your taxes, the

government agency that oversees taxes (the Rwanda Revenue Authority or

RRA) will require you to pay your taxes or else face penalties, such as fines

or going to jail. But there are some of incomes which are not chargeable to

income tax on the individual.

• In Rwanda, not all goods and services pay taxes.

• Do you agree with this statement? Support your choice.

• Can you give some examples of goods and services you think should

not pay taxes in Rwanda?

Exemption income is any income which is not chargeable to income tax on

the individual.

1. Income accruing from savings in collective investment schemes and

employees’ shares scheme within a company are exempted from income tax.

2. Income earned by an agriculturalist or a pastoralist on agricultural or

livestock activities is exempt if the turnover from agricultural or livestock

activities do not exceed twelve million Rwanda francs (FRW 12,000,000)

in a tax period. In case the turnover exceeds twelve million Rwandan

francs (FRW 12,000,000), the latter amount is excluded from the taxable

income.

3. Capital gain from the sale or transfer of shares on the capital market and

capital gain from the sale or transfer of units of the collective investment

schemes, is exempted from capital gain tax.

4) Interest income is exempted from the withholding tax:

• Interests on deposits in financial institutions for at least a period of one

year;

• interests on loans granted by a foreign development financial institution

exempted from income tax under applicable law in the country of origin;

• interests paid by banks operating in Rwanda to banks or other foreign

financial institutions;

Application activity 5.2

Through the examples of Rwandan community, describe the exemptions oninvestment income

5.3. Computation of tax on investment income

Activity 5.3

• Do you think it is important for businesses to know how to compute

the amount of tax they are supposed to pay? Give reasons.

5.3.1. Financial interest:

Example:

Muhirwa has a current account with Mountain Bank ltd. Mountain Bank ltd pays

him a gross interest of FRW 55,000 on his savings. As the source of this income,

Mountain Bank ltd must declare and pay withholding tax on this interest of:

FRW 55,000 × 15%= FRW 8,250

This FRW 8,250 is declared and paid to RRA by Mountain Bank ltd. Therefore,

the net amount that is transmitted by Mountain Bank ltd to Muhirwa is:FRW 55,000- FRW 8,250= FRW 46,750

FRW 8,250 withholding tax was withheld by Mountain Bank ltd on behalf

of Muhirwa. Therefore, Muhirwa can claim back this amount in income taxdeclarations.

5.3.2. Dividend income

Example one:

BCM ltd pays a gross dividend of FRW 100,000 to its shareholder, MUKUNZI.

As the source of this income, BCM Ltd must declare and pay withholding taxon this dividend of:

FRW 100,000 × 15% = FRW 15,000

This FRW 15,000 is declared and paid to RRA by BCM Ltd. Therefore, the net

amount that is transmitted by BCM Ltd to MUKUNZI is:

FRW 100,000 – FRW 15,000 = FRW 85,000

FRW 15,000 withholding tax was withheld by BCM Ltd on behalf of MUKUNZI.

Therefore, MUKUNZI can claim back this amount in Income Tax declarations.

Example two:

HIMBAZA owns shares in MUHABURA limited a private company that is listed at

Rwanda Stock Exchange (RSE). During the year ended, he received a dividend

income of FRW 1,000,000

Dividend income: 1,000,000 x100/95 (since shares are listed at RSE the WHTtax is 5%) 1,052,632 x 5%=52,632

5.3.3. Royalties:

Example:

In order to promote your sales, XY Enterprise decides to use the mark of Inyange

for a period of one year. In exchange XY Enterprise pays to Inyange Industriestwenty-four million (FRW 24,000,000).

a) How do you call this type of income?b) Calculate the related tax if any.

Possible Answer

a) The term named for that income is Investment income/ royalty incomeb) Tax to be paid = FRW 24,000,000 × 15% = FRW 3,600,000

Application activity 5.3

1. MUKUNZI received FRW 10,000 from his saving from the bank.

Determine the gross amount to be included in his taxable income.

2. Modern Ltd company has received ten million (FRW 10,000,000) for

allowing Millenium company to use its brand of soft drinks for twoyears. Calculate tax to be paid .

5.4. Rental income from machinery and equipment

Activity 5.4

Basing on your knowledge on civic education, standards in business and

other knowledge related to taxes, answer the following questions:

1. What do you understand by “machinery”?

2. What do you understand by “equipment”?

3. If people have Machinery and equipment for rent, do you think they

have an obligation to pay their taxes? Give reasons to support your response.

4. If your response is yes in 3 above, mention some of the responsibilitiesyou think taxpayers should have.

5.4.1. Rental income from machinery and equipment

Article 43 of law 16/2018 states that all revenues derived from rent of machinery

and other equipment including agriculture and livestock equipment in Rwanda,

are included in taxable income, reduced by:

1) Ten percent (10%) of gross revenue as deemed expense

2) Depreciation expenses

3) Interests paid on loans if the asset was financed by the loan

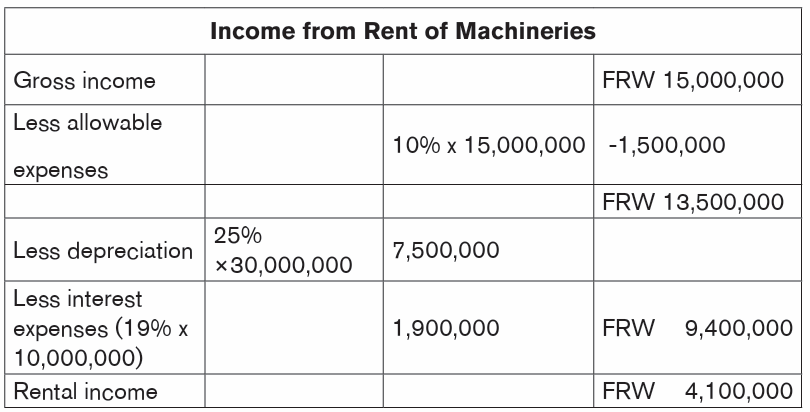

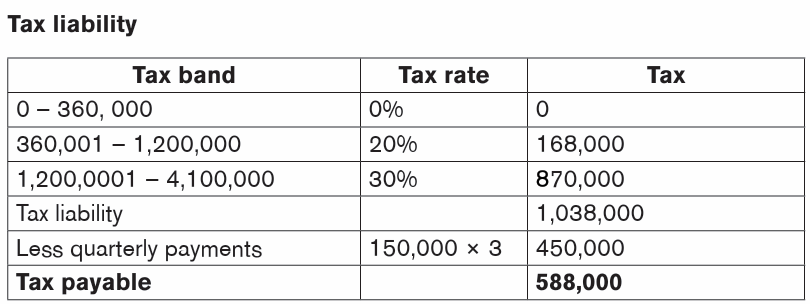

1. Example:

Mizero owns machineries which he rents to various entrepreneurs. During the

year ended 31/12/2021, he received a gross income of FRW 15,000,000.

The machineries were purchased at a cost of FRW 30,000,000 of which FRW

10,000,000 was a loan from the bank and he pays an interest rate of 19%

annually. Mizero pays a quarterly installment of FRW 150,000 on the rentalincome.

Required: Compute his taxable incomeSolution:

Since Mizero is an individual, tax liability is calculated using PIT formula.

If Mizero is a company, then apply corporate rate of 30% for companies, which

are exempt from rental income tax.

Application activity 5.4

HIRWA owns some heavy industrial machinery which cost him FRW

20,000,000. He has rented the machinery out this year for FRW 2,400,000.

HIRWA borrowed money to buy the machinery and has paid interest of FRW

100,000 this year. The relevant tax depreciation rate is 5% on cost.Calculate his taxable rental income.

5.5. Capital gains tax on shares

Activity 5.5

In Rwanda, the taxes have many forms depend on the tax base and taxpayer.

When you work at a job to make money, you pay income tax. Depending on

how much money you earn.

When you buy things at a store, you also usually pay sales tax, which is a

percentage of the cost of the item charged by the store. If you own shares

and immovable property used for business purpose, you also pay tax referring

to the income you earn.

Basing on your knowledge on civic education, standards in business andother knowledge related to taxes, what tax can be paid on income from shares.

5.5.1. Capital Gains Tax

According to Article 36 of Law 16/2018, capital gain tax is charged on the

sale or transfer of shares. The capital gain on sale or transfer of shares is the

difference between the acquisition value of shares and their selling price ortransfer price.

5.5.2. Who must register for Capital Gains Tax?

The tax on profit from the sale of shares is withheld, declared and paid by thecompany whose shares were sold.

5.5.3. Tax rate of Capital Gains Tax

Article 37 of the same Law provides that capital gain tax is taxed at a rate

of 5%, applied to the profit from the sale of shares, where profit equals sale

price minus purchase price. i.e the difference between the acquisition price andselling prices.

5.5.4. Tax periods and deadlines of Capital Gains

Capital Gains tax must be declared and paid by the 15th of the month after the

transaction was made. The tax is paid by the entity disposing of the shares

(having recovered this tax from the seller of the shares).

Sale of shares on the capital markets, and the sale of units in collective investment

schemes, are exempted from this tax. This exemption only applies to secondarymarket transactions for listed shares and securities.

5.5.5. Computation of capital gain tax

Example:

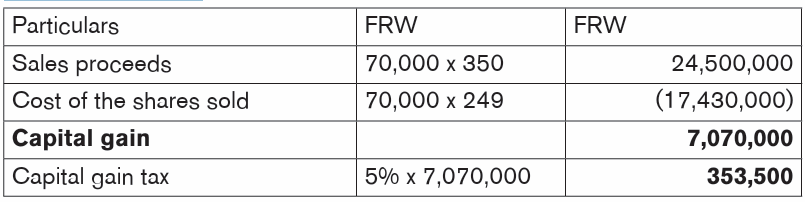

Madam KANAKUZE purchased 150,000 shares from Bank of Kigali at FRW

249 per share, a private limited company in 2012. In 2021, KANAKUZE sold

70,000 shares to Mark at FRW 350 per share.Compute the capital gain and the capital gain tax

Possible Answer:

5.5.6. Withholding and Declaration of Capital Gain Tax

According to Article 38 of the Law 16/2018, the capital gain tax on the sale or

transfer of shares shall be withheld by the company within which the transaction

occurred. This company shall declare and pay the capital gain tax to the Tax

Administration within fifteen (15) days following the month in which the sale or

transfer of shares occurred.

However, Article 39 of the same Law stipulates that capital gain from the sale or

transfer of shares on the capital market and capital gain from the sale or transferof units of the collective investment schemes, is exempted from capital gain tax.

Application activity 5.5

KANYARUTOKI owned 900,000 shares at Mobile Telephone Network (MTN)

Rwanda, a private company. The share was purchased in 2015 at a price of

FRW 180 per share. In 2021, he transferred 350,000 shares to MANZI. The

market price of the shares at the date of the transfer is FRW 200 per share.Required: Compute his capital gain and the capital gain tax.

5.6. Capital gains tax on immovable property

Activity 5.6

In Rwanda we have many businesses ensuring economic development of

country. Some of those businesses are purchasing and selling immovable

properties. The Taxes have many forms depending on the tax base and

taxpayer.

Basing on your knowledge related to taxes, what tax can be paid on incomeof immovable property.

5.6.1. Capital gains tax on immovable property

Capital gains tax on immovable business property is paid at a rate of 30% of

the selling value of the property (net of selling expenses and any unrelieved

tax base) and can be declared as income as part of an individual’s income tax

assessment, or by a company as part of their corporate income tax. Alternatively,

it can be declared separately. The capital gains tax is usual due by 31 March

following the end of the tax period of the disposal; however, if a company uses

a tax period that is not 31 December, the tax will be due by the last day of thethird month following the end of the tax period.

5.6.2. Declaration of Capital Gains Tax:

Capital gains, refers to the sale or transfer of commercial immovable property,

or profit from the sale of shares.

If a taxpayer receives taxable capital gains, and is registered for Income Tax, the

taxpayer must declare these as income within the Income Tax declarations.

If a taxpayer receives taxable capital gains and is not registered for Income Tax,

nor required to register for Income Tax, the taxpayer must register and declare

Capital Gains Tax at RRA offices.

The only domestic tax type which cannot be declared online is Capital Gains

Tax. This can only be declared with the help of RRA staff at RRA offices.

5.6.3. Exemption of Capital Gains Tax

1. A registered investor shall not pay capital gains tax. However, income

derived from the sale of a commercial immovable property shall be

included in the taxable income of the investor.

2. Capital gain on shares that are listed in Rwanda stock exchange and they

are under secondary market3. Capital gain on shares that are under a collective investment scheme

5.6.4. The penalties and fines

for Capital Gains Tax are similar to other domestic taxes.

This includes penalties and fines for:

• Late declaration

• Late payment

• Declaring less than the correct tax due

• Paying less than the tax due declared. There are no additional penalties

or fines specifically applicable to Capital Gains Tax. The only difference

compared to other domestic taxes is that as Capital Gains Tax is

declared and paid on a case-by-case basis, there is no need to submit

regular Capital Gains Tax declarations if no taxable capital gain hasbeen received.

Example:

SEMUHUNGU purchase house in 2010 of FRW 40,000,000, SEMUHUNGU

who is not registered as investor, sold this house in 2020 FRW 50,000,000 to

KAYUKI. Compute taxable liability of SEMUHUNGU after sales.

Answer:

Taxable income for SEMUHUNGU is:

FRW 50,000,000 - 40,000,000 = FRW 10,000,000Tax liability: FRW 10,000,000 × 30% = FRW 3,000,000

Application activity 5.6

1. What will happen when taxpayer receives taxable capital gains but

registered in income tax?2. What about penalties and fines for not paying capital gains tax?

End of unit assessment 5

1) Article 35 on law 16/2018 states that investment income includes

any payment in cash or in kind in the form of the following types of

income?

A. Interest, Dividends, Trading and Rent

B. Interest, Dividends, Royalties and Rent

C. Dividends, Royalties, Trading and Rent

D. Interest, Employment, Royalties and Rent

2) Which of the following types of income is chargeable to income tax

on immovable business property?

A. Pension payments from the state social security system

B. Income accruing to employee share schemes

C. Capital gain tax

D. Capital gains from secondary market transactions in listed

securities

3) SEBANANI has a current account with KIVU Bank ltd. KIVU Bank

ltd pays him a gross interest of FRW 100,000 on his savings. As the

source of this income, KIVU Bank ltd must declare and pay tax on

this interest. Calculate taxable income

A. FRW 100,000

B. FRW 5,000

C. FRW 15,000

D. FRW 30,000

4) MUKAMANA owns some IT equipment which she let out for FRW

2,500,000 this year. It had cost her FRW 11,500,000, and the

relevant tax depreciation rate is 10% on cost. MUKAMANA had

to borrow money to fund the purchase of the equipment and pays

interest of FRW 100,000 each year. MUKAMANA’s taxable rental

income for the year will be:

A. FRW 2,500,000

B. FRW 11,500,000

C. FRW 1,000,000D. FRW 100,000